O que é Negociação de CFD e Como se Tornar um “CFD Trader” em 2022

You’re probably not unfamiliar with the term CFD Trading – and maybe you’re thinking about becoming a CFD trader right now!

Although many beginning investors initially learn to buy company shares, contracts for difference (CFDs) are an increasingly popular type of investment.

With online CFDs, investors do not purchase shares directly. Instead, they purchase a contract from their broker that allows them to speculate on fluctuations in the value of the company as well as the stock.

There are several advantages of trading CFDs in Portugal compared to buying shares directly. In this guide, we will cover everything you need to know about online CFD trading in Portugal and reveal the best CFD trading platform in 2021.

CFD Trading Portugal Tutorial – Step by Step Guide

Want to trade CFDs on financial markets? Let us explain how to start your Libertex journey:

- 1 – Open a CFD trading account in Portugal (we recommend Libertex)

- 2 – Fund your account.

- 3 – Open a CFD trade.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

What is CFD Trading and what are CFDs in practice?

What is CFD Trading and what are CFDs in practice?

CFD trading is a form of trading derivative instruments (CFDs).

This means that instead of investing directly in a financial asset, trading is done through a contract based on the value of the respective asset.

For example, instead of buying or selling shares directly, you buy and sell a contract, the value of which depends on the underlying price of the share.

CFD trading may seem complicated for beginners, but it is actually quite simple. In most cases, CFD trading works like buying shares directly. If the share price rises by 5%, the value of your CFD contract will also rise by 5%.

However, there are some specific advantages to trading CFDs online. We will cover these advantages throughout this article, but one of the most important aspects is the possibility of trading almost all financial instruments available with CFDs.

You can trade stocks, for example, as well as Forex, commodities, cryptocurrencies, exchange-traded funds (ETFs), bonds and more.

CFD Trading Example – CFD Simulation

Let’s look at an example to see how CFD trading works in Portugal. Let’s say you want to buy Royal Mail shares, trading at 181 per share. You can visit your CFD broker and buy CFDs for Royal Mail shares worth 181 per contract.

If Royal Mail’s share price rises to 190p, the value of its CFD contracts will also rise to 190p. If you choose to sell your contracts at this price, you will receive a 9.5% profit – exactly the same as the profit you would have made if you had purchased Royal Mail shares directly.

What a CFD “Trader” Can Trade with CFDs

As already mentioned, it is possible to trade various financial instruments on CFDs in addition to shares.

CFDs are extremely flexible, so they can be used to trade any type of financial instrument. Some popular types of CFDs in Portugal include:

- Stock CFDs.

- CFDs em Forex.

- CFDs on commodities (e.g. gold, silver and oil).

- Cryptocurrency CFDs.

- CFDs em ETFs.

- CFDs on securities.

Although these are the most common types of CFDs available from major brokers in Portugal, it would be possible to trade CFDs on less common types of financial assets.

For example, CFDs that track the value of real estate or even pieces of art.

On any of these assets, the value of the CFD directly follows the price of the underlying asset. For example, imagine you start your CFD trading on Bitcoin. If the value of Bitcoin rises by 2%, the value of your Bitcoin CFD will also rise by 2%.

The same applies to Forex, commodities, indices and any other asset that trades on CFDs.

Reasons to be a CFD “Trader”

Since it is possible to buy shares and other assets directly, what reasons justify the use of CFDs? There are several particular advantages that make CFD trading so popular.

Indirect Ownership

The main benefit of CFDs is that you do not need to take ownership of the underlying asset. This may not seem very important if you only trade stocks – in most cases, stock certificates are stored digitally in a stock trading account, requiring no effort on your part to buy or sell.

But what if you want to trade currency pairs or essential commodities like oil? To buy oil directly, you need to find transportation to physical oil barrels and storage facilities.

Forex trading requires converting one currency to another, which often involves navigating the complex legality and taxation regulations associated with foreign currencies.

When trading CFDs, you don’t have to worry about any of these issues.

You only buy a contract, not a barrel of oil or a foreign currency – the potential to profit from the price movements of the respective asset is the same.

Leverage on CFDs

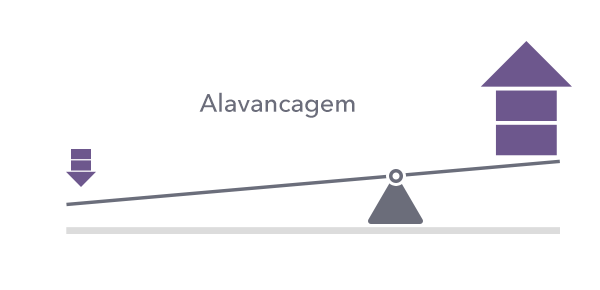

Perhaps the main reason CFDs are so popular among stock traders is the ability to trade with leverage. With leverage, the trader essentially uses money borrowed from his broker to increase the volume of his position.

Let’s say you want to buy AstraZeneca shares, currently selling at €8.60. If you have €100 in your trading account, you can only buy 11 CFD contracts.

However, with leverage, you can invest more money than you have available in your CFD trading account.

For example, if you use 1:10 leverage in your trading, you could buy 110 contracts of AstraZeneca shares (a total cost of €946) with just €100 in your constant.

The benefit of using leverage is the potential multiplication of your profits should the value of Astra Zeneca shares increase.

For every 1% increase in the price of the underlying asset, the price of your CFD position – leveraged 1:10 – increases by 10%. Therefore, with leverage, you can multiply your returns on successful trades.

Additionally, because you need less money to invest in each position, you can diversify your trades without adding more money to your account.

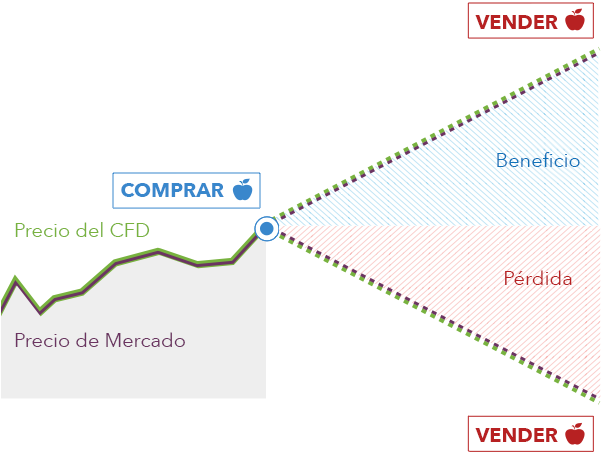

Make Money with CFD Trading in Both Directions

Another big advantage of trading CFDs in Portugal is the possibility of profiting even when asset prices fall. You can open a short sell order for your CFD contracts instead of buying.

If the Facebook share price, for example, falls by 5%, the value of your CFD position increases by 5%.

Fractional Investment

Another benefit of stock trading is through CFDs, especially if you invest in expensive stocks like Amazon. With stock CFDs, you can invest any amount you want – you are not forced to buy entire shares.

Therefore, although the value of each Amazon share is over €3,400, most CFD brokers allow investment of any amount, such as £50 in each investment

CFD Trading Fees in Portugal

Although applying commissions is a common practice among stockbrokers, most of the best CFD brokers in Portugal are completely commission-free.

This means that when trading CFDs in Portugal, you do not need to pay a fixed fee of several euros for each open trade.

However, trading CFDs is not completely free. CFD trading platforms typically charge a spread that can range from less than 0.1% to more than 0.5%.

The spread is the difference between the buy and sell price of each contract for difference (CFDs), so it is built into your trades. The good news is that for most traders, spreads of around 0.1% per share on CFD trading are still much more cost-effective compared to commissions.

CFD Trading Risks

Trading CFDs online carries many of the same risks associated with other types of trading. There is always the possibility of devaluation of the underlying asset being traded, which would also result in the devaluation of your invested CFD contracts.

In this situation, you can choose to sell your contracts and take the loss, or keep your position open in the hope that the value will rise again.

If you trade with leverage, trading CFDs is no more risky than trading assets directly. However, when trading leveraged CFDs in Portugal, the risks increase substantially.

We should point out that leverage also multiplies your losses. If you trade CFDs with a leverage of 1:10, and if the value of the underlying asset falls by 1%, the value of your CFD position will fall by 10%.

Most brokers require a minimum account balance equal to the value of your positions, so you may need to add money to your CFD trading account to keep your leveraged position open.

Alternatively, other brokers automatically sell any position at a loss.

Another thing to keep in mind is that since leverage requires borrowing money from the broker, this comes with interest rates. You will have to pay the broker for each day your leveraged CFD position remains open – swap fees.

If the price increase doesn’t occur as quickly as you expected, interest rates could end up being higher than your profit.

Best CFD Trading Trading Strategies for 2021

There are several different approaches you can take to trading CFDs. But regardless of your goals or trading style, it’s important to approach each negotiation with a clear plan.

To help you get started, let’s explore some of the most popular strategies for day trading CFDs:

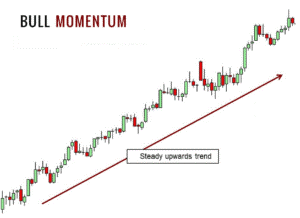

Momentum Trading

Momentum trading is one of the simplest CFD trading strategies for beginners. Simply identify a stock or other asset that shows a rapid increase in value with high volume. As long as more traders come in to trade the asset, its price will continue to rise for some time.

When the momentum starts to dissipate, sell your position and collect your profits. Remember that it is better to sell too early and make some profit, than to sell too late and end up losing what you could have gained.

Momentum in value is often triggered by company news and announcements, so you can identify potential opportunities by following market news.

Breakout Trading

Breakouts are another popular target for traders. To find these breaking points, it is necessary to first identify the areas of resistance that the respective stock has not yet managed to overcome.

When the stock price finally breaks above this resistance level, it is likely to continue rising.

The key to this type of strategy is to avoid being fooled by false breakouts. A true breakout must break the resistance level with strong trading volume.

It is also possible to use technical analysis tools to identify other factors, such as momentum (trend), that indicate continuous growth in the value of the asset.

Scalping (Escalpelamento)

Scalping is a CFD trading strategy that involves immense focus and patience. With scalping, the objective is to profit from small, brief movements in the asset’s price that occur routinely throughout the day.

You can look for small bursts of momentum or increases in trading volume. Typically, scalping trades are opened and closed in just a few minutes.

Scalping is particularly suitable for CFD traders because it is possible to apply leverage to trades. The price movements involved in this strategy are usually just a fraction of a percentage point.

However, with leverage of 1:10, that same price fluctuation represents profits equivalent to several percentage points.

Tips for Being a Successful CFD Trader

Trading CFDs can be very profitable, but it is important not to forget the risks involved in this type of trading.

Let’s explore five CFD trading tips you can use to decrease your risk exposure and increase your profits.

Get started with a CFD Trading Demo Account

One of the best things you can do when starting your journey into the world of CFD trading is to open a free demo account.

Most brokers in Portugal provide this type of CFD trading platform, which allows you to buy and sell CFDs as you would in any real CFD trading account – but without committing your real money to your trades.

A demo account is a fantastic tool to familiarize yourself with CFD trading and learn how to develop a strategy for your future real CFD trading account.

It is important to look at the demo account as if it were a real trading account, with real money, to effectively practice good risk management practices.

Various Positions

As most CFD brokers do not charge commissions on their trades, there is no disadvantage to placing multiple buy and sell orders.

Instead of executing your trade with one bulky order, you can mitigate risk by buying and selling in multiple orders.

The advantage of cautiously entering multiple positions is that if the asset’s price drops after your first purchase, you can buy more at a lower price.

By selling, you can make some profits by keeping your position open in some CFD contracts to earn a higher yield if the price continues to rise.

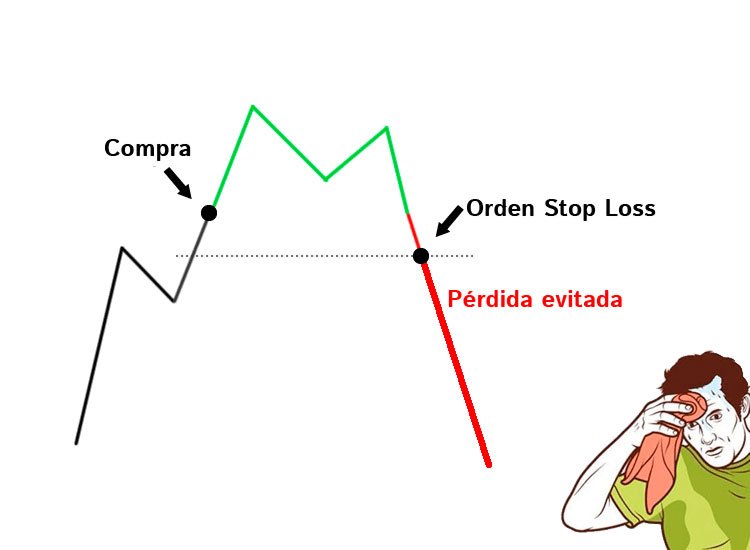

Use Ordens de Stop Loss

A stop loss is a stop loss order. It corresponds to a price lower than the current market price of your CFD contract, at which the broker must sell your position. Stop loss orders are essential for good risk management. When you set a stop loss, nothing happens immediately.

If the value of your position decreases significantly, your broker will automatically sell your position to limit your loss.

On the other hand, you can also use stop loss orders to secure some profit. Simply set your stop loss at an amount above your CFD purchase price. This limit will be called “ take profit .”

Use CFD Technical Analysis Tools

Technical analysis is an essential toolbox for analyzing the value of stocks, Forex currency pairs and other assets. This type of analysis considers the asset’s price history in the past to predict its movement in the future.

While you shouldn’t rely solely on a single technical indicator, using multiple indicators and price charts together can help in developing trading strategies and identifying potentially profitable CFD trades.

Diversify your CFD Portfolio

One of the main benefits of CFD trading is the ability to open more positions without adding more money to your account.

Regardless of whether you trade fractional shares or use leverage, trading CFDs is not very expensive.

You can use this feature to your advantage by diversifying your portfolio. You can invest in CFDs on shares of companies from different market sectors – for example, buy oil stocks, blue chip stocks and pharmaceutical stocks.

Or trade stock CFDs and Forex CFDs to diversify your portfolio across various classes of financial instruments. The more diversified your portfolio, the more protected you will be if the value of a particular company or market sector declines substantially.

Best CFD Trading Platforms in Portugal

To start your journey into the world of CFD trading in Portugal, you need to open an account on a CFD trading platform.

There are many brokers to select from and they vary greatly in terms of cost, amount of CFDs available and number of trading tools included.

Therefore, to make your choice easier, we have highlighted four of our favorite brokers operating in Portugal.

1 – Libertex – CFD Broker with Zero Spreads

However, with Libertex, traders only pay a small commission for buying and selling and overnight position fees.

This means you can trade with zero spread on over 213 financial instruments with CFDs, from cryptocurrencies, stocks, currencies, indices, commodities and more! It is also possible to use the MetaTrader 4 trading platform which allows automated trading.

Operating your Libertex account is extremely simple. The broker is also regulated by CySEC, providing security and peace of mind to its traders.

Pros:

- Regulated by CySEC

- Low minimum deposit amount.

- Analysis and news in real time on the platform.

- Zero spreads!.

- More than 213 global markets.

- Access to MetaTrader 4.

Contras:

- Smaller market selection compared to the competition.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2 - Quantum A – Best Global CDF Trading Platform with Artificial Intelligence

Quantum AI is a unique trading platform that uses artificial intelligence to help you make better trades. It scans the markets and reads thousands of different prices per second, which a person cannot do. All this information is collected to provide recommendations on good CFD trading opportunities.

The Quantum AI platform allows you to trade stocks, commodities, cryptocurrencies, forex and other financial instruments like CFDs. It is a partner with 15 regulated partners, where Quantum AI works as an automated trading software.

Opening an account for Quantum AI trading is done in a few simple steps, where your first deposit must be at least €220. You can choose to make the deposit via bank transfer or use credit and debit cards.

You do not pay any fees when making any transaction. The platform also does not charge commissions, which means it is completely free!

You can easily download the Quantum AI app on your mobile phone if you have an iPhone or Android device. Otherwise, you can use the platform directly in one of your computer's browsers, such as Safari and Google Chrome. Quantum

AI can be a very good option for beginners who want to learn the different CFD markets and for established traders who don't have as much time to do all the research before trading

Pros:

- Many CFD instruments.

- No commission and no transaction fees.

- It is software for regulated brokers.

- Available as an app on your cell phone.

- Easy to register and deposit.

- Customer support open 24 hours a day every day.

- Get recommendations on which CFD instruments to buy.

- Fast payments.

Contras:

- Payments can only be made by bank transfer and cards.

71% of retail investor accounts lose money when trading CFDs with this provider.

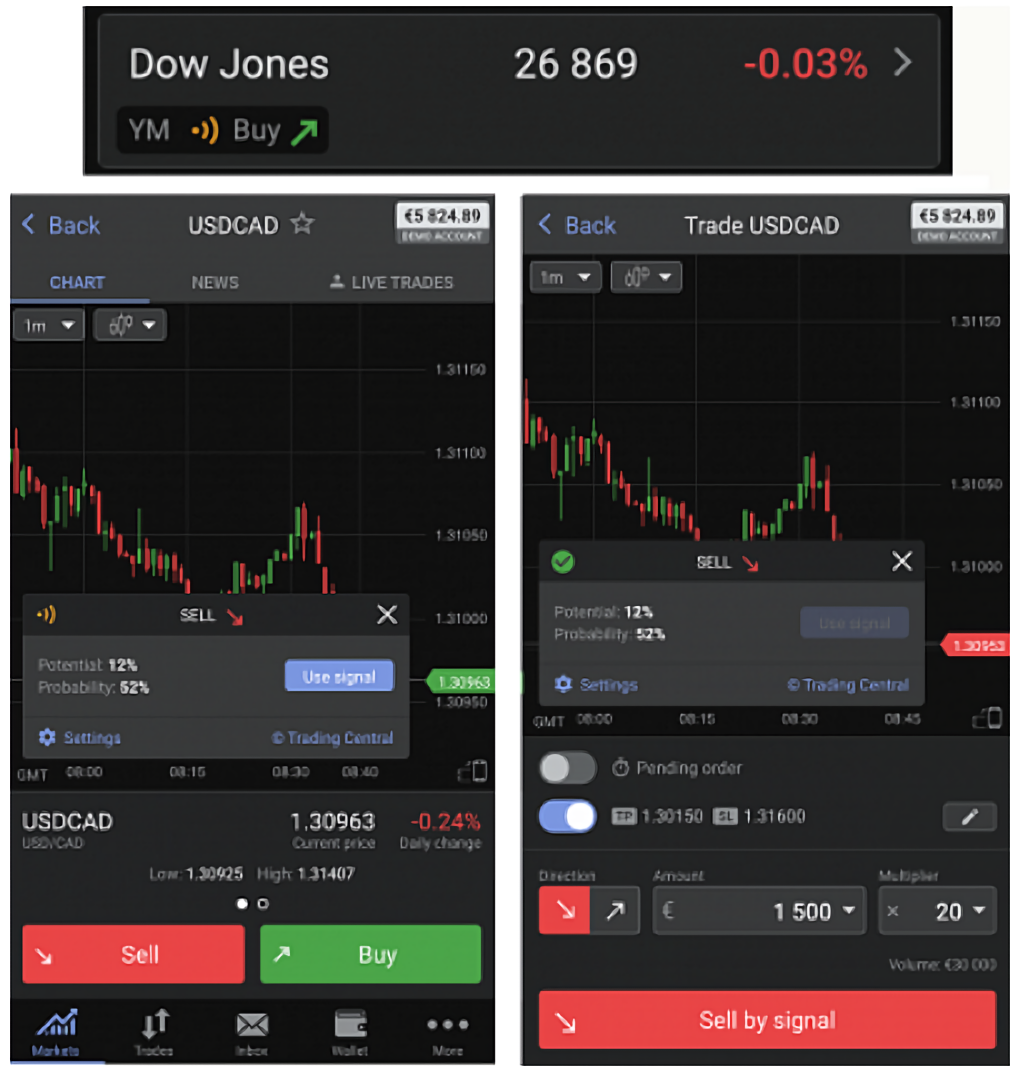

3 - Capital.com – CFD Broker 3,000+ Markets

Its users can trade CFDs on more than 3,000 markets, including stocks, indices, currencies, commodities and cryptocurrencies. The number of cryptocurrencies available for trading is particularly incredible.

One of the best features of Capital.com is the offering of no commissions for opening or closing trades, as well as zero commissions for deposits and withdrawals!

The broker's web platform is easy to use, but you can also use MetaTrader 4 or TradingView.

Opening an account is extremely simple, in just a few minutes, with a minimum deposit of €20!

Pros:

- 100% commission-free trading.

- Regulated by the FCA and CySEC.

- More than 3,000 global markets.

- No fees for deposits and withdrawals.

- Low and competitive spreads.

- Several trading platforms are available.

Contras:

- There are no investment accounts available yet.

71.2% of individual investors lose money trading CFDs on this site . .

4 - AvaTrade – Corretora de CFDs com Vários Tipos de Conta

Com o AvaTrade, é possível negociar com uma variedade de tipos de contas diferentes, incluindo contas CFD Trading, Options Trading e contas islâmicas Swap Free.

A corretora também é regulamentada globalmente, proporcionando tranquilidade e segurança aos fundos de seus clientes.

Com a AvaTrade, é possível negociar CFDs em mais de 1250 mercados globais de ações, commodities, índices, moedas, criptomoedas e muito mais. É possível negociar todos esses tipos de CFDs, totalmente sem comissões, apenas com spreads e swaps.

Você também pode acessar uma variedade de ferramentas educacionais e de pesquisa, incluindo artigos, vídeos e um blog. Além disso, se você tiver alguma dúvida, a AvaTrade oferece suporte ao cliente em mais de 14 idiomas diferentes de segunda a sexta-feira.

Prós:

- Acesso a mais de 1.250 mercados globais.

- Regulado em seis jurisdições diferentes.

- Ampla seleção de tipos de contas.

- 0% de comissão apenas com spreads e swaps.

- Taxas de depósito e retirada zero.

Contras:

- Taxas de inatividade.

71% dos investidores individuais perdem dinheiro negociando CFDs neste site.

Tutorial de Negociação CFD em Portugal – Guia Passo a Passo

Quer negociar CFDs online? Deixe-nos explicar como começar a sua jornada no Libertex.

Passo 1: Abra um Conta de Negociação de CFD em Portugal

Para abrir uma conta no Libertex, basta visitar a página inicial do site da corretora e clicar em “Join Now”.

O corretor solicita um novo nome de usuário e senha para sua conta. Em seguida, você deve inserir alguns dados pessoais, como seu nome, data de nascimento, endereço de e-mail e número de telefone.

O Libertex também exige a verificação de sua identidade para garantir a conformidade com os regulamentos relevantes. Você precisa fazer o upload de uma cópia do seu cartão de cidadão, carteira de motorista ou passaporte, com uma cópia de uma conta de luz ou extrato bancário emitido nos últimos 3 meses.

SPasso 2: Financie Sua Conta

Depois de configurar sua conta, você precisa depositar alguns fundos. O Libertex exige um depósito mínimo de € 200, que você pode fazer usando os seguintes métodos de pagamento:

- Cartão de débito.

- Cartão de crédito.

- Transferência bancária.

- Transferência Eletrônica de Fundos.

Passo 3: Abra um Negociação de CFDs

Agora você está pronto para abrir sua primeira negociação de CFD. Insira o nome de qualquer ação, moeda, ETF ou criptomoeda na barra de pesquisa do Libertex ou navegue pelos ativos disponíveis em seu painel.

Quando você encontrar o ativo que deseja negociar, clique em “Negociar” para abrir um novo formulário de pedido.

No formulário de pedido, insira o valor que deseja investir. Você também pode definir um stop loss ou obter lucro para controlar o risco associado à sua negociação.

Se você deseja aplicar alavancagem à sua negociação, também pode definir esta opção nesta janela.

Quando seu pedido estiver configurado, clique em “Negociar” para abrir sua posição de CFD.

Conclusão - Guia de Negociação de CFD Português

A Negociação de CFD é uma forma cada vez mais popular de negociação para comprar ações, Forex, Criptomoedas e uma variedade de outros instrumentos financeiros..

Com os CDFs, você não é obrigado a se apropriar do ativo subjacente e pode multiplicar o tamanho de sua posição por meio de alavancagem. Além disso, a maioria dos melhores corretores de CFD em Portugal não cobra comissões pela negociação.

Você está pronto para começar a negociar CFDs? Abra sua conta Libertex hoje para aproveitar a negociação no mercado financeiro em comissões!

Libertex – O Melhor Corretor de CFD com Spreads

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.