Melhores Corretoras Portugal – Melhores Corretoras Licenciadas

In this guide, we review the best Portugal brokers with high leverage available to traders from Portugal in 2026 .

If you are looking to trade online but don’t have access to a large amount of capital to make the process worthwhile – it might be worth considering one of the best brokers in Portugal with high leverage.

Open an account with XTB in 4 simple steps

Start trading with leverage at XTB

Are you looking for a quick list of the best brokers in Portugal right now? If so, check out the list below!

Best Brokers Portugal 2026

Best Brokers in Portugal Revealed

While your main priority may be to find the best trading platforms in Portugal that offer high leverage, you will also need to consider other key factors.

In particular, this should include the assets and markets that the best brokers in Portugal support, what fees and commissions they charge, and whether or not the platform offers a great user experience.

We’ve done the hard work for you by selecting four of the best high leverage brokers in Portugal right now.

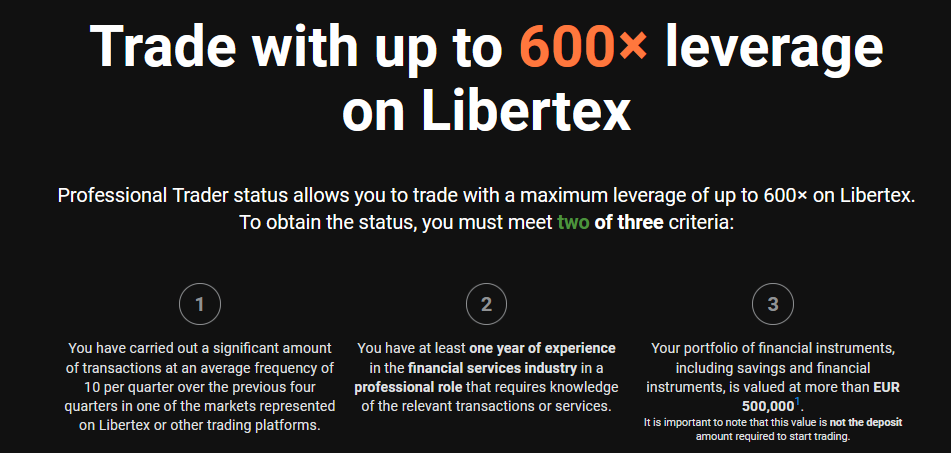

1. Libertex – One of the best Brokers in Portugal with ZERO Spread and 1:600 Leverage for Professional Clients

This means that in some ways, Libertex is not much different from an ECN broker. In terms of what you can trade, Libertex specialises in CFD instruments. This covers everything from hard metals, energies, stocks, indices and forex.

As a top CFD broker, this means that you will be able to obtain leverage. As for limits, this will ultimately depend on whether you are a retail trader or a professional client. If the latter, then you will be able to trade with leverage of up to 1:600.

This means that a balance of £1,000 would allow you to open a trade worth £600,000. If, however, you do not fall within the scope of a professional client, then you will be bound by the same limits we discussed in our Crypto.com review. This means that the maximum you can get is 1:30 on major currency pairs and less on other financial instruments.

When it comes to fees, we mentioned that Libertex is a zero spread broker. However, you will have to pay a trading commission when opening and closing positions. That said, this is often just a fraction above 0%, so all in all – trading fees are really competitive at this high spread broker.

If you want to get started with Libertex today, the platform requires an initial deposit of £100. However, you can fund your account from as little as £10, starting with your second deposit. This can be done using a debit/credit card, bank transfer, and various e-wallets. Finally, this two-decade-old broker is licensed by CySEC.

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: One of the best brokers in Portugal with 0% commission for cryptocurrencies

Unlike most of its competitors, at Crypto.com you will have the advantage of actually owning the cryptocurrencies. In other words, you can, whenever you want, using your Bitcoin wallet or others, make the transactions you want, since you will have your own chance. Another advantage is that here you will have detailed support, helping you at every stage of the process, even for beginner investors. Bitcoin has never been such an accessible investment, as with this licensed broker!

Crypto.com Fees

| Rate | Amount |

| Stock Trading Fee | From 5% |

| Forex Trading Fee | 0.9 pip spread on EUR/USD |

| Cryptocurrency Trading Fee | From 0.25% on OTC market |

| Inactivity rate | $50 per quarter after 3 months of inactivity + $100 after 1 year of inactivity |

| Withdrawal fee | Free |

Pros:

Cons:

Your capital is at risk.

Best Brokers Portugal: Fees and Leverage Comparison

If you are looking for an overview of the limits offered by the best Portugal forex brokers with high leverage that we have covered on this page – see the table below.

| Maximum Leverage (Retail) | Maximum Leverage (Professional) | Commission | Minimum Deposit | |

| Crypto.com | 1:30 | 1:500 | 0% | £20 |

| Libertex | 1:30 | 1:600 | 0%-0.5% | £100 |

Best High Leverage Brokers in Portugal - What You Need to Know

The online trading arena in Portugal is very heavily regulated. In turn, the FCA has certain protections in place for retail clients when it comes to leverage.

To ensure you know the rules and regulations that the best online brokers in Portugal need to adhere to, this section will explain everything there is to know about high leverage in Portugal.

What is Leverage at the best brokers in Portugal?

While most people reading this guide will already know what leverage is, others may be complete newbies. In its most basic form, leverage allows you to trade with more money than you have in your brokerage account. In effect, you are essentially borrowing the additional capital from your chosen trading platform.

Leverage can be viewed as a multiple (such as x2, x3) or a ratio (such as 1:2, 1:3), although most of the best brokers in Portugal opt for the latter. For example, let’s say you bet £100 on a forex trading position with leverage of 1:10. This in turn means you are trading with 10 times your stake. So in this example, you have turned a £100 bet into £1,000.

Here is a quick example of how this trade would work when using the best Portugal brokers with high leverage.

- You bet £100 on GBP/USD - opting for a buy order as you think the exchange rate will rise

- Apply leverage of 1:10

- A few hours later, your GBP/USD position is worth 4% more

- Happy with your profits, you close the transaction with a sell order.

- Without leverage, your 4% profit on a £100 bet would have only returned £4

- However, as you have applied leverage of 1:10, this £4 profit is increased to £40.

As you can see above, the best Portugal forex brokers with high leverage allow you to increase your potential profits - making them ideal if you don't have a large amount of trading capital at your disposal.

Leverage Limits at the Best Brokers in Portugal

As we have noted throughout this guide, the FCA is very strict when it comes to the leverage limits available to retail clients. For those who are not aware, having retail client status simply means that you are not a professional trader. Rather, you are a casual trader who bets modest amounts from the comfort of your own home.

If you feel this is right for you, then the maximum amount of leverage you will be able to obtain at your chosen FCA regulated broker will be as follows:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold and major indices

- 10:1 for non-gold commodities and non-major stock indices

- 5:1 for individual stocks and other benchmarks

You may notice that cryptocurrencies such as Bitcoin are not on the list above. Before January 2021, retail clients in Portugal could trade digital assets with a leverage of 1:2. However, the FCA has since banned crypto derivatives for retail clients in Portugal.

Again, if you are a retail client and want to get higher limits – you only have two options – which we will cover in the sections below.

Option 1: Open a Professional Client Trading Account

The best way to increase your access to the best brokers in Portugal with high leverage is to open an account as a professional client. Regardless of which broker you decide to use in Portugal – the requirements for doing so remain constant.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

In other words, it is necessary to fulfill at least two of the following three criteria:

- Have at least 1 year of experience in the financial services industry. This is a fairly broad requirement, although you will likely need to show the high leverage broker that you have worked in a professional role that required trading/investing skills.

- Over the past four years, you should have placed at least 10 trades per quarter . This does not have to be with the high leverage broker you want to sign up with. For example, if you have previously traded with IG but now want to open a professional account with Libertex, this is possible. Essentially, this is the easiest criterion to meet, as 10 trades per quarter is not a lot. In fact, it is essentially just 5 completed trades, as each trade requires both a buy and a sell order to open and close the position.

- You currently have a portfolio of assets worth at least 500,000 EURO (approximately £441,000). This may include investments, savings and other financial instruments – but not property.

As you can see above, becoming a professional client can be challenging. If you don’t have €500,000 in assets, then you will need to prove that you have worked in the financial services sector in a professional capacity and have traded on a semi-regular basis for the past 4 years.

If you can, then the best high leverage brokers in Portugal will ask you to submit documentation so that they can review your application.

Option 2: Use an Offshore Broker

If you cannot meet the requirements of a professional client, and you want even higher leverage than what the FCA rules allow, then your only other option is to use an offshore broker.

In simple terms, this means that the platform will not be authorised or regulated by the FCA and that it is not covered by the FSCS protection scheme. The latter protects you in the event of a broker going bust – up to £85,000.

Overnight Financing with Leverage at the best brokers in Portugal

Before you start a leveraged trading strategy, it's important to understand that there are certain fees involved. More specifically, you'll have to pay an "overnight financing fee" for each day you keep your leveraged position open.

After all, you’ll be trading with more money than you have in your account – which means you’ll be borrowing the balance from the broker in question. In turn, the broker will want a financial return on the capital they lend, which comes in the form of interest.

There is no standard interest rate on leveraged financial products, as it can vary from broker to broker and asset to asset. The key point is that leveraged trading is not suitable for long-term investments. This is because the overnight financing fee will continually eat into your potential earnings.

However, in terms of when the overnight funding rate comes into effect, this will again depend on the trading platform.

- At Libertex, for example, all leveraged positions incur a daily fee at 17:00 New York time, which corresponds to 22:00 in Portugal.

- Therefore, if you open a leveraged position at 23:00 on Monday, the first daily rate will be applied at 22:00 on Tuesday.

Now, knowing what a high leverage broker charges in terms of overnight financing is crucial. Even if you are a short-term trader, an excessively high interest rate could make trading unviable.

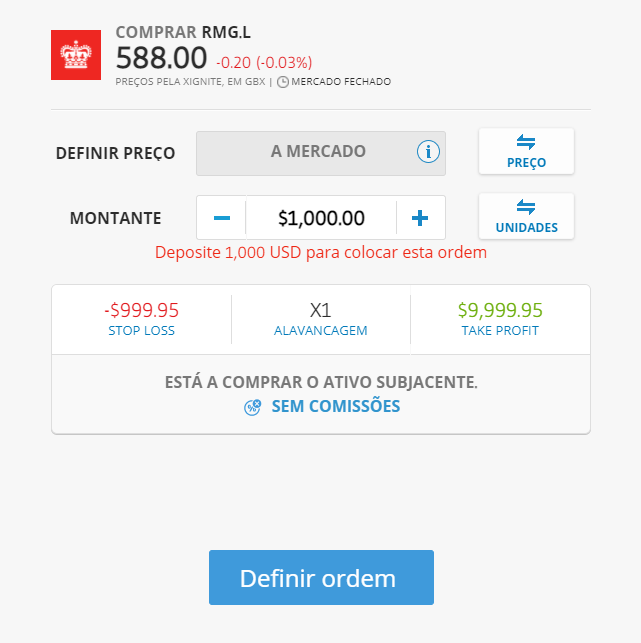

The good news is that Libertex clearly shows you what your overnight funding rate will be before you place your trade. In fact, the specific daily rate – which is shown in dollars and cents, is updated as you change the order box parameters.

For example:

- If you were trading $50 worth of Royal Mail shares with 1:5 leverage on Libertex, the daily overnight financing fee amounts to $0.04. If the position remains open over the weekend, you will pay an additional $0.13.

- If we increase the above bet from $50 to $500, the daily and weekend rate is now $0.44 and $1.32 respectively.

Em última análise, ao usar um corretor FCA transparente como o Libertex, para negociar com alavancagem, terá uma visão completa sobre as taxas de financiamento noturno que será obrigado a pagar.

Diferença entre Margem e Alavancagem nas melhores corretoras Portugal

Ao procurar as melhores corretoras Portugal, poderá ter a certeza de que se deparará com o termo "margem". Tanto a alavancagem como a margem são frequentemente utilizadas indistintamente, mas diferem ligeiramente.

Em termos simples:

- A alavancagem refere-se ao montante em que deseja aumentar a sua aposta. Por exemplo, a alavancagem de 1:5 vai transformar uma aposta de £100 em £500.

- A margem, no entanto, refere-se ao montante de capital que precisa de investir para obter o seu montante de alavancagem desejado. No exemplo acima, a sua margem é de £100, uma vez que tal é necessário para obter £500 em capital de negociação por 1:5

Compreender como o requisito de margem é realmente importante, ao usar as melhores corretoras Portugal – já que isto irá determinar o seu ponto de "liquidação".

Ser liquidado pelo seu corretor com alavancagem elevada significa que a plataforma irá fechar a sua transação, automaticamente, quando a mesma descer abaixo de certo montante.

- Mantendo o mesmo exemplo acima, a sua transação com alavancagem de 1:5 exigiu uma margem de £100 - o que corresponde a 20% da posição de £500.

- Assim sendo, se sua posição for na direção errada em mais de 20%, você será liquidado.

- Por sua vez, a alavancagem elevada do corretor forex escolhido por si vai manter a sua margem de £100 - o que significa que perderá toda a sua aposta

Em última análise, é por isso que deverá atuar com cautela ao aplicar elevados níveis de alavancagem sobre as suas posições de negociação. Fundamentalmente, é por isso que a FCA apresenta limites rigorosos para os clientes não profissionais.

Outras Considerações a Fazer ao Escolher um Corretor com Alavancagem Elevada

É crucial notar que nunca deverá registar-se num corretor online só porque ele oferece limites de alavancagem elevados. Pelo contrário, existem muitas outras métricas-chave que precisará de ter em conta, tais como:

- Que ativos é que as melhores corretoras Portugal com alavancagem elevada suportam?

- Quanto é que as melhores corretoras Portugal forex cobram em taxas e comissões?

- Se as melhores corretoras Portugal com alavancagem elevada estão regulamentado pela FCA ou por outro organismo financeiro de nível 1?

- Que métodos de pagamento é que as melhores corretoras Portugal forex com alavancagem elevada aceitam?

- Se as melhores corretoras Portugal com alavancagem elevada são adequadas para novatos?

As you can imagine, there are many things to consider when looking for the best brokers in Portugal that suit your needs. So, if you don’t have the time to research dozens of providers yourself, we’ve found that Libertex ticks all the right boxes in terms of ease of use, zero commissions, supported markets, and regulation.

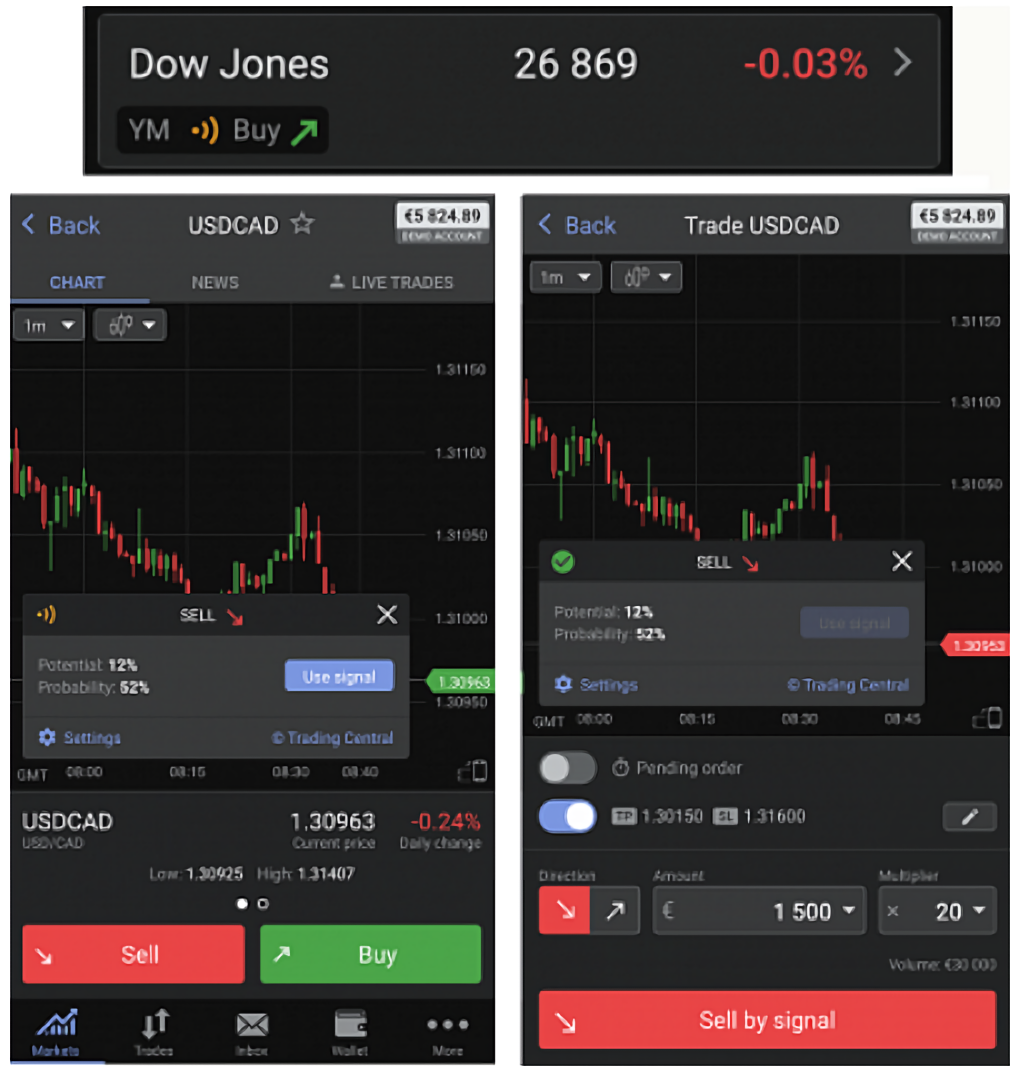

How to Get Started with One of the Best Brokers in Portugal with High Leverage

If you’re ready to start trading with the best high leverage brokers in Portugal and fully understand the risks involved, we’ll now walk you through the process with Libertex. This FCA-regulated broker will offer you leverage of up to 1:30 the moment you start setting up your account – which takes less than 10 minutes.

We emphasize again that Libertex is one of the best brokers in Portugal authorized and regulated by the FCA. This means that it is legally obliged to verify the accounts of all its users – to comply with the rules imposed against money laundering. Don’t worry, the process can be completed in just a few minutes – as Libertex uses automated verification technology . It is important to note that you will need to download the Crypto.com app. This is the only way to easily access all the trading resources and tools presented. Once you have opened your account, you will need to download the Crypto.com wallet app. You will be redirected to the Google Play or Apple Store by clicking on the respective link. Once the download is complete, install the app and proceed to log in using your credentials. Once you have access to your portfolio, you need to choose the currency pairs you want to invest in. You will quickly have access to a huge range of pairs to trade in the ETF market, always with 0 commissions and the best access to charts and technical analysis. This requires an initial deposit of $200 , but you can invest as little as $25 . Available payment methods, with instant processing, include debit and credit cards, Paypal, Skrill, and Neteller.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.Step 1: Open an account with Libertex

Step 2: Download Libertex for smartphone

Step 3: Trade on Libertex

If you live in Portugal and are looking for the best online brokers with high leverage – chances are you’ve hit a wall. That is, if you are a non-professional client and are looking for leverage limits above and beyond what the FCA allows, then luck is not on your side. Well, unless you can prove that you are a professional trader or you decide to use one of the best offshore brokers Portugal with high leverage. Taking all this into account, we found Libertex to be by far the best option we had. Not only can retail clients from Portugal get leverage of up to 1:30, but all tradable markets are commission-free. Getting started with this popular FCA-regulated platform takes just a few minutes, and you can deposit funds instantly using a Portuguese debit/credit card or ewallet!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.Conclusion

Libertex – Best High Leverage Broker Portugal with 0% Commission

FAQ: Frequently Asked Questions

What leverage can traders in Portugal get?

How can I get higher leverage limits in Portugal?

What are the best brokers in Portugal?

Which broker has the highest leverage?

What leverage rates do I need to consider?