Melhor Plataforma de Margin Trading em Portugal 2026 – Corretores de margem mais baratos revelados

Knowing the specifics of margin trading for your various investments is something to consider, as this standard will amplify the results of your trades. Whether it is Forex, cross or another strategy , the reality is that it is essential that you can fully master everything that this investment possibility can offer you.

Through our Trading Platforms website, specialized in investment tools, trading and reviews of the best brokers with margin trading, it will be possible not only to understand what margin is in trading, but also the level that you can request from the best platforms.

Best Margin Trading Platforms in Portugal

When analyzing the best platforms with margin trading, we concluded that these were the best in our test , highlighting margin and futures trading, as well as different leverage modes:

- Libertex – Invest in CFDs with margin trading

- Crypto.com – Crypto-focused margin trading app platform

Your capital is at risk.

[side_by_side_comparison id=”18″ type=”Crypto”]

Best margin trading platform crypto Reviewed

When analyzing in detail what margin trading is and how this investment option can be reflected in different investment strategies, these were the margin trading platforms that stood out the most:

1. Libertex – Best Margin Trading App and Low Cost

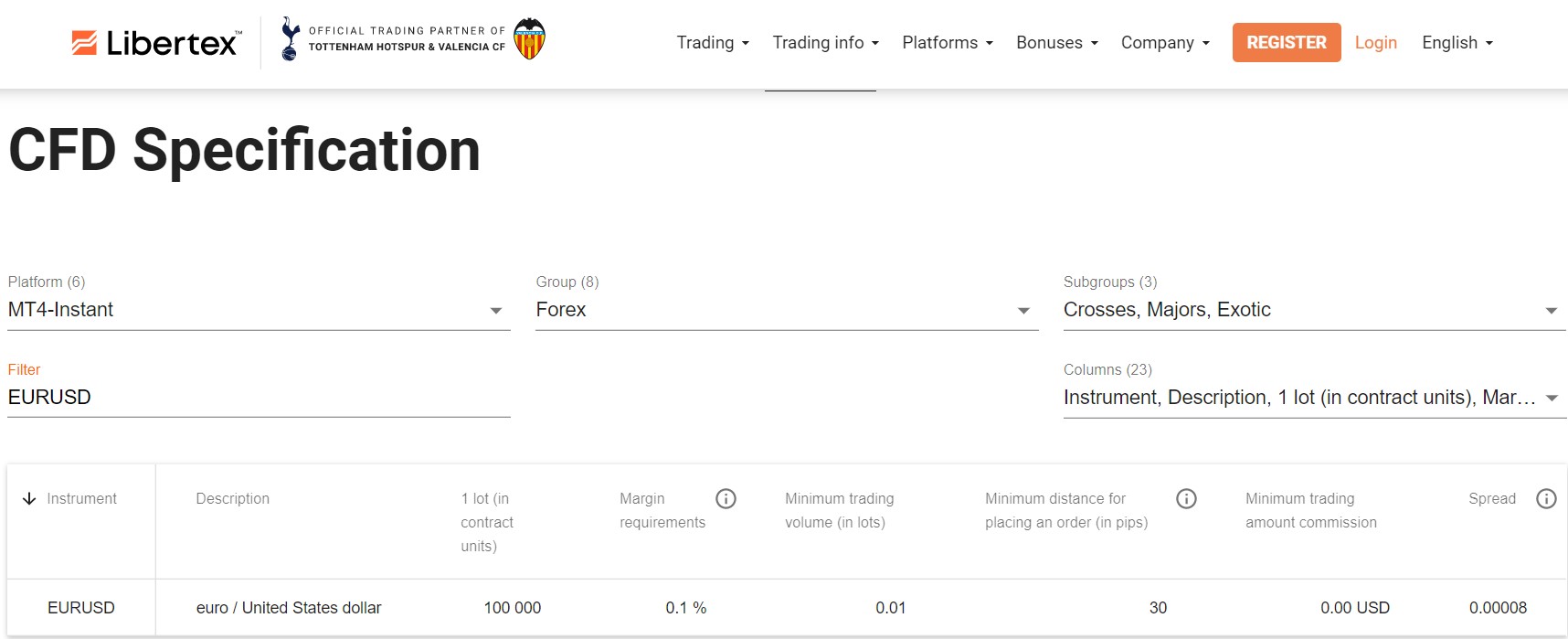

Libertex is completely different from other brokers, such as Crypto.com, as it specializes exclusively in CFD instruments , allowing margin trading whenever necessary. In other words, in most of its financial instruments it is entirely possible to leverage your trades, giving only a percentage of your investment as collateral.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% Commission Broker and Cryptocurrency Trading

Crypto.com, a broker launched in 2016 – even before the huge bull runs – is a highly reputable trading and investment solution for Bitcoin and other cryptocurrencies. If your profile is approved, you will have no difficulty in using its margin trading strategies to your own advantage, thus leveraging your positions, always with total transparency and low costs.

Your capital is at risk.

Comparison of Fees of the Best Platforms

To help you make the best decision possible, here are the rates you can expect from these top margin trading platforms:

| Platform | Trading Commission | Commissions without Trading | Margin Trading Commissions |

| Crypto.com | Commission ranging from 1 cent to 3 for each financial asset | Monthly costs for inactivity | Commission up to 2.5% under the requested margin |

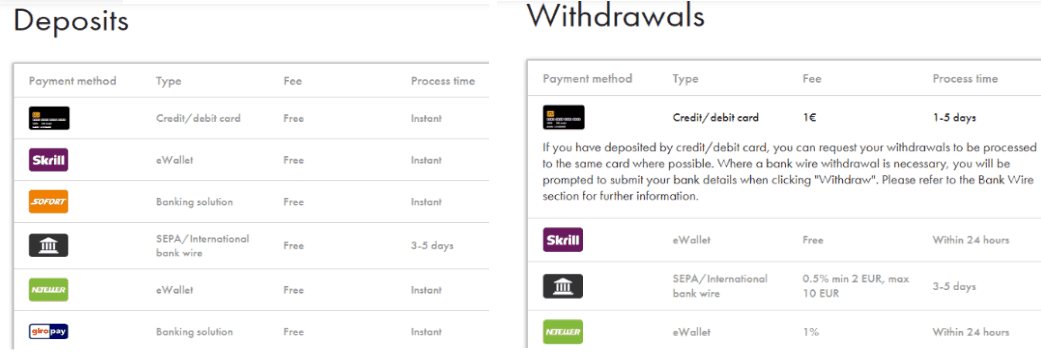

| Libertex | commissions from 0% to 0.46% | Withdrawal fee €1 to 1% | Overnight rate for CFDs (company rate + LIBOR) |

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

What is Margin Trading?

Now, margin trading is an efficient way to increase returns and amplify your portfolio. Whether you trade cryptocurrencies, stocks, ETFs, commodities, or currencies, you can increase the dollar value of your positions by borrowing money from your broker. For example, using 2:1 leverage (50% margin), you can open a $10,000 trading position with just $5,000 of your own funds.

How does Margin Trading work?

To take advantage of the benefits, you first need to open a margin-eligible account. After that, you can borrow funds from your broker (which is easily done using any of the brokers’ online platforms above ) and use the funding to buy virtually any asset.

Remember, though: If your position increases in value, the return will be much higher than a cash purchase. However, if the value of your holdings falls below the broker’s maintenance margin (usually 25% to 35% of the total position), the broker may issue a margin call and require you to deposit more money. Otherwise, the broker has the right to sell all of your holdings.

How to get started with the best Margin Trading account?

Now understand how, within one of the best saxo margin trading platforms that you can access, what are the actual steps to take to request your example, which can even be obtained within the free demo account:

1: Open a Libertex Account – Pay 0% Commissions

To create an account, Libertex will ask you to enter a series of personal information – such as your:

- Full name

- Household

- Date of birth

- Social Security Number

- Contact Details

You will also need to choose a username and a strong password. Confirm your email and validate your Libertex account registration to be able to trade with margin trading.

2: Send Identification Document

You can make a deposit of up to $2,000 without sending your ID to Libertex, but if you want to deposit more, you will have to verify your account, as Libertex is regulated by the Financial Conduct Authority CySEC .

You simply need to upload a copy of your ID card, passport or driving license, and proof of address. This could be a bank statement or a recent utility bill. Once you’ve uploaded the documents, Libertex should be able to validate them within a few minutes.

3: Deposit Funds to provide collateral

You will need to meet a minimum deposit amount of $200 at Libertex (around €165). Supported payment methods include debit/credit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill.

All Libertex deposits will be converted to US dollars at a rate of 0.5%. This will give you instant access to over a dozen financial markets – both in Portugal and abroad.

4: Buying Stocks and other assets with margin trading on Libertex

Once your Libertex account has been funded, you can then purchase your first share or other financial asset through the tool. With our example, you will be purchasing shares in the company BP . So, instead of investing the thousand euros that you will have available in your account, you can open a trade (after pre-approval from the broker) and request margin trading.

In most cases, this will be a 2:1 parameter, but it will all depend on your trader profile and even the questionnaires you have answered throughout the account validation process. Once you have this in mind, you can then proceed to place the order, guaranteeing a certain percentage that you will have available on your platform . All of this will need to be carefully assessed, as exposure is a fundamental factor when deciding whether or not to do margin trading.

Step 5: Take advantage of the Libertex brokerage

Understand all the risks of trading on margin and make the best decisions, using all the trading tools that Libertex is currently offering. By having this knowledge, it will be much easier to take advantage of the advantage that margin trading at Libertex offers. In addition, with total transparency, the broker will clearly indicate what your exposure and responsibilities are, whether in a short or long position. This is why it has always been considered a high-risk element for any type of investment.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Our verdict: The best platforms

There is no doubt that, with the growth of different platforms with margin trading, this investment leverage tool has grown in popularity. Now that you know a little more about how this tool works, but also its specificities and advantages, you should understand that total mastery of this trading tool is really necessary.

Since you will be investing or trading with money “borrowed” by the platform itself, you will be able to find out about the commissions, terms, obligations and your exposure . With our website, you will be absolutely sure that you will be investing and margin trading on platforms that are offering the best possible guarantees, as a way of maximizing your success in the different investment markets.

Libertex – Best Margin Trading Platform

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

FAQ: Frequently Asked Questions

Futures vs margin trading: which is the best option?

Are there risks in trading with margin?

Is it possible to do margin trading with leverage?