Melhores Fundos de Investimento Portugal em 2026

If you are interested in investing in the financial markets, but do not have the necessary knowledge to trade independently – you should consider one of the best investment funds.

With this option, your chosen fund will determine which assets to buy and sell, meaning you can enjoy passive income. Investment funds come in a variety of forms – from ETFs and mutual funds , to investment trusts and index funds.

In this guide, we’ll cover the best investment funds available to residents in Portugal, in 2026 . We cover a variety of fund types – and explain the process of investing from the comfort of your own home.

8 Best Investment Funds

The following list provides a summary of the best investment funds in Portugal that meet our requirements. You can find more information about each fund throughout this article.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Securities Investment Funds

On the one hand, the availability of thousands of profitable investment funds for investors in Portugal is fantastic.

This ensures that there is a suitable fund for any type of investor . However, it can be extremely difficult to “separate the wheat from the chaff”.

With that in mind, you can find in this article our best choices of investment funds available in Portugal.

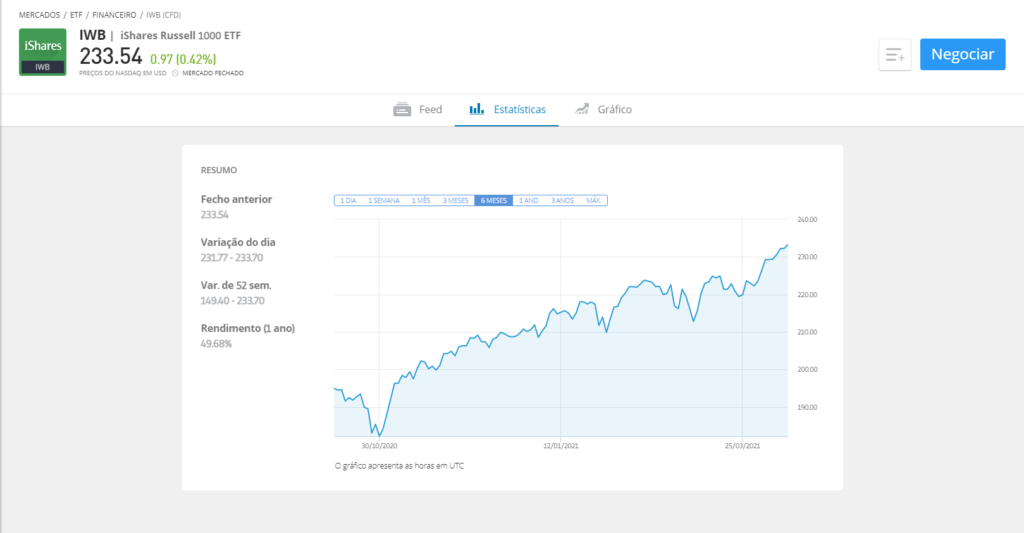

iShares Russell 1000 ETF – Investing in US Stocks

The iShares Russell 1000 ETF is an extraordinary option to enter the US economy.

In fact, this particular investment fund gives you instant access to 843 individual stocks .

This means you can obtain a large and diversified portfolio of stocks with a single investment.

The iShares investment fund manager aims to select U.S.-based companies that appear to be undervalued. This includes large- and mid-cap stocks across a variety of sectors. In terms of big names, the fund currently holds 2.76% in Berkshire Hathaway and 2.27% in Johnson and Johnson. Additionally, the fund includes companies such as Walt Disney, Intel, Verizon, and JPMorgan Chase & Co.

Although this investment fund is based in the US and focuses entirely on American companies – investing in Portugal couldn’t be simpler. In fact, by using an FCA -regulated broker such as Libertex, you can invest without any commissions, trading charges or recurring fees. Additionally, the aforementioned platform requires a minimum investment of just $50 – around €40.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

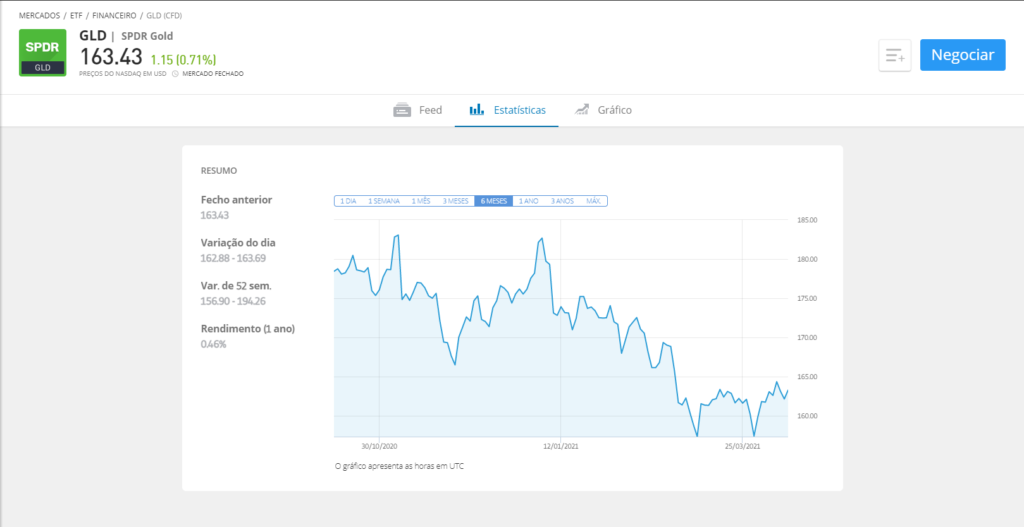

SPDR Gold ETF – Invest in Gold Commission-Free

As the name suggests, this investment fund is entirely focused on gold. You should consider this store of value if you foresee unfavorable economic conditions in the near future. Investors often turn to assets like gold whenever market uncertainty increases. This is evident from the fantastic performance of gold prices this year.

In fact, the SPDR Gold ETF is up 25.99% over the past 12 months. This investment fund is also extremely affordable – a minimum investment of just $50 is required on Libertex. This way, you’ll be investing in the future value of gold without having to worry about storage facilities or delivery services.

Instead, the ETF provider – SPDR – is physically backed by the asset, making the investment process simple and easy. Opting to go the ETF route also results in extremely affordable fees. Again, there are no commissions or recurring fees if you use a broker like Libertex, and you can close your position at any time.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Best Mutual Funds in Portugal

Our top two picks, listed above, are both tradeable through ETFs. This means that the broker is responsible for tracking and monitoring a specific market – such as the Russell 1000 or gold. Mutual funds, on the other hand, are significantly different. This is because the fund manager personally decides which assets to buy and sell – and when.

In other words, although the fund manager focuses on FTSE 100 stocks, he or she may decide to remove a certain number of constituents if he or she believes that these companies do not add any value to his or her investors. This is something that ETFs cannot do. In any case, you can find our top picks for mutual funds available in Portugal in the following section.

MI Chelverton UK Equity Growth Fund – Best Investment Fund for Investing in Small Stocks in Portugal

While most investors focus on large-cap stocks listed on the London Stock Exchange, others seek exposure to emerging companies. Such companies are typically found on the Alternative Investment Market (AIM) – the UK’s secondary stock exchange.

This particular market has a much higher risk/reward ratio than established blue-chip stocks, as AIM-listed companies have yet to prove the effectiveness of their business model. Or, they may be established companies that simply have a lower market valuation. Either way, if you are looking to invest some capital in smaller UK companies – a mutual fund such as the MI Chelverton UK Equity Growth Fund is a good idea.

The investment fund in question personally determines which stocks deserve a place in the fund. The experienced fund manager also determines the best times to buy or sell. The MI Chelverton UK Equity Growth fund was launched in 2014, with over £722 million in assets as of August 2020.

Led by James Baker and Edward Booth, its portfolio contains 127 individual stocks. The constituent companies operate across a range of sectors – with a strong focus on technology, healthcare, support services and consumer goods. Some of the top companies included include Future, Clingen, SDL, Premier Foods, Gamesys and dotDigital.

Other mutual funds to consider include:

- BlackRock Fund: This mutual fund focuses on large -cap UK companies. This fund may be more suitable for investors looking to take lower risks – as the fund consists of established companies with superior market valuations.

- ASI Global Smaller Companies: This is another mutual fund that encompasses emerging companies in the UK. The fund has performed exceptionally well since its inception, so it may be beneficial to diversify by investing in this fund and another, such as MI Chelverton UK Equity Growth, to balance risk levels.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Best Investment Fund for Beginners

Arguably, all investment funds are suitable for beginners, as they do not require active, autonomous trading. Instead, the process of buying and selling assets is carried out entirely by the fund provider.

That said, certain investment funds are more suitable for beginners, as they include assets that are easy to understand. Typically, the asset class focuses on shares of large companies with a long history of positive market performance, including globally known brands.

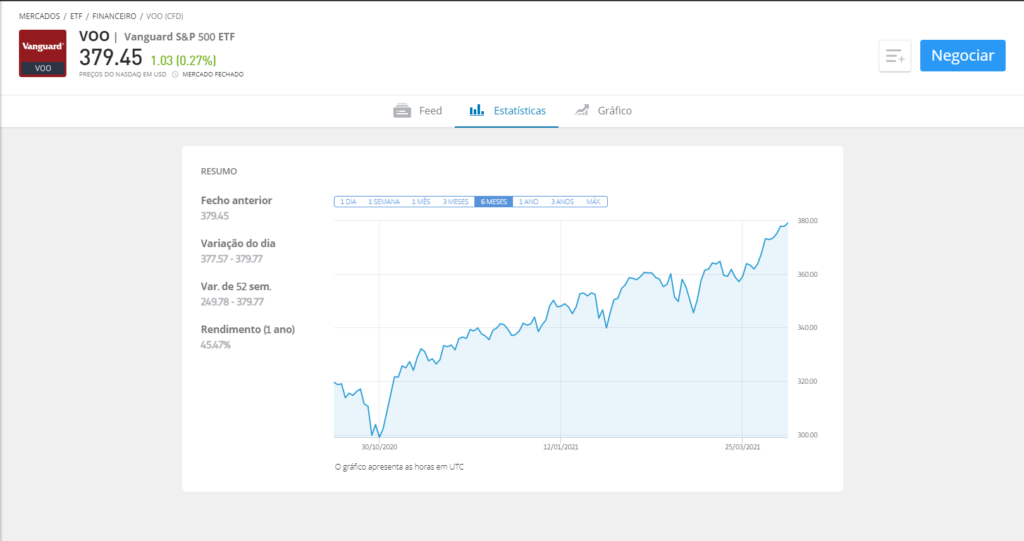

S&P 500 Index – Best Long-Term Investment Fund

Even if you’ve never traded anything in the financial markets, chances are you’ve heard of the S&P 500 index. For those unfamiliar, the S&P 500 is a stock market index based on American companies. It tracks the progress of the 500 largest companies in the United States – from the New York Stock Exchange (NYSE) and the NASDAQ index. These include big-name companies such as IBM, Google, Twitter, Disney, Berkshire Haway, Verizon, Apple, Amazon, and many more.

Since its launch in 1926, the S&P 500 index has delivered an average return on investment of around 10% per year – time-weighted. Therefore, in terms of the best investments for beginners, it is recommended to consider this index and learn how to invest in the S&P 500 in Portugal . The main advantage is that this index is rebalanced regularly, to ensure that the index accurately reflects the values of the major US stock exchanges. To achieve this goal, the S&P 500 focuses on market capitalization.

This means that the largest US stocks by market value contribute a high percentage to the index. In terms of exposure, there are many investment funds in Portugal that track the S&P 500. In our opinion, the easiest and most cost-effective way to invest is through ETFs. Leading the way is Vanguard – with its ETF on the S&P 500 hosted by Libertex.

This means that you can invest as little as $50 without paying any additional commissions or fees. It should also be noted that – like most ETFs – Vanguard allows you to earn dividends. The profits will be transferred to your investment account every three months. By reinvesting these dividends back into the S&P 500 index, you have the chance to quickly multiply your money.

To ensure you can find an S&P 500 investment fund that meets your needs, the following list provides other viable options:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Best Exchange Traded Investment Funds

We’ve already covered some of the best mutual funds offered in the form of ETFs. To recap – these include the Vanguard S&P 500 Index, SPDR Gold ETF, and iShares Russell 1000 ETF. However, there are other ETFs that you should consider.

Including:

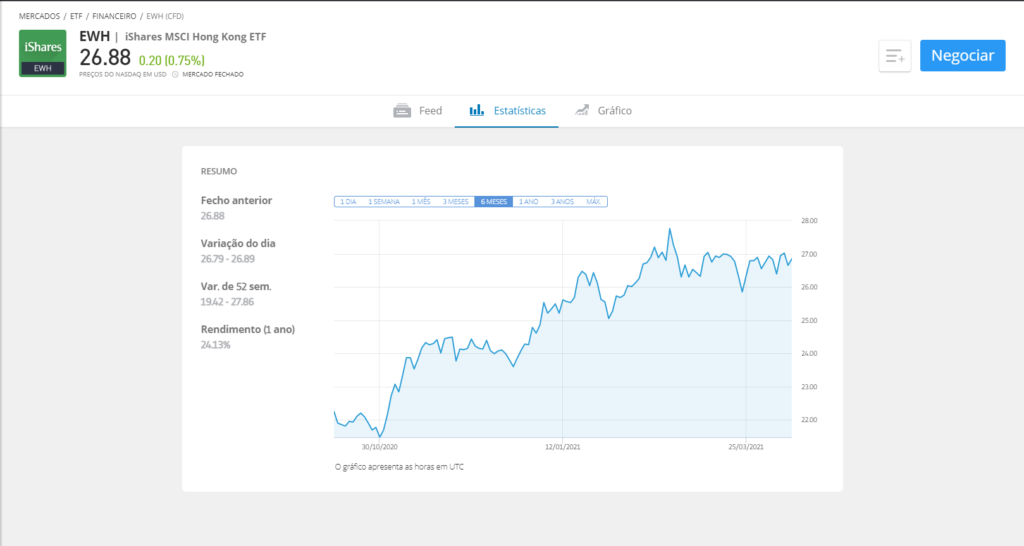

iShares MSCI Hong Kong ETF – Hong Kong Equity Investment Fund

If you’re the type of investor who wants to gain access to the growing markets of Asia, you should consider the iShare MSCI Hong Kong ETF. As its name suggests, this investment fund focuses on the Hong Kong markets. Specifically, the fund contains 41 individual stocks listed on the Hong Kong stock exchange.

Although the portfolio is reasonably weighted, only two of the companies account for more than 36%. These consist of AIA Group (23.95%) and Hong Kong Exchanges and Clearing (12.14%).

Of the remaining names, the fund includes names such as Sun Hung Kai Properties, Techtronic Industries, and CK Hutchinson. Crucially, this ETF once again highlights the ease of investing in international companies from the comfort of your own home. Simply make a minimum deposit of $50 and you’re ready to invest – you’ll have access to a range of stocks from 41 Hong Kong companies!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

iShares FTSE China 25 Index ETF – Investing in China Stocks

Another ETF to consider for investing in overseas markets is the China 25 Index. Backed by renowned fund manager iShares, you can gain access to 25 major Chinese companies.

This fund includes companies such as Tencent Holdings, Meituan Dianping, China Construction Bank, Alibaba, and China Mobile. Representing one of the most powerful and fastest growing economies in the world, this investment fund is definitely worth considering.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Best Ethical Investment Funds in Portugal

When investing in this type of investment fund, there are some ethical codes that play an important role. For example, this type of fund may avoid certain industries and sectors – such as gambling, alcohol, tobacco or defense.

In some cases, an ethical investment fund focuses entirely on companies involved in areas that benefit society. For example, it might include a company that focuses on developing clean, sustainable energy.

In any case, the following section presents our top picks for ethical investment funds available in Portugal.

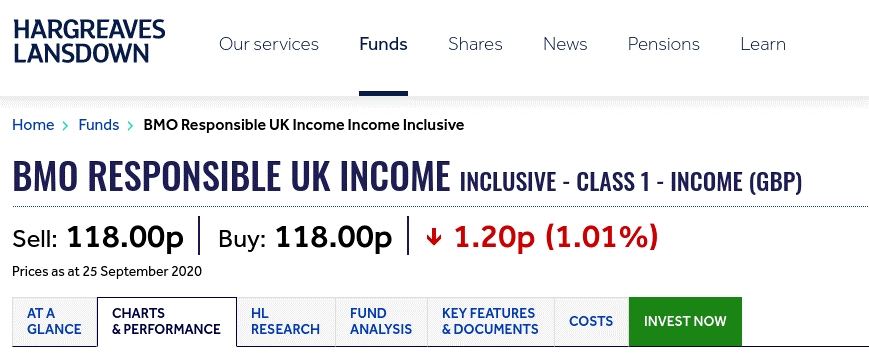

BMO Responsible UK Income 2 Inc – The Best Ethical Investment Fund for Investing in UK Small and Medium-Sized Companies

This investment fund is a UK-based option focused on shares of British companies. The main feature of this fund is that each share must comply with a variety of ethical standards, and they must exclusively belong to small or medium-sized companies. In terms of performance, the fund has outperformed the FTSE All-Share index in 4 of the last 5 years.

When investing directly with this fund provider, you need to invest at least £500,000. For this reason, it is recommended to use an intermediary broker. For example, Hargreaves Lansdown only requires an investment of £100, or a minimum direct debit of £25 per month. In terms of fees, this fund costs around 0.91% per year.

Jupiter Responsible Income – Invest in Great UK Companies Actively Managing Social Responsibilities

This investment fund focuses on companies that actively manage their social and environmental responsibilities. The portfolio contains 45 stocks in total – with companies such as GlaxoSmithKline, RELX, Vodaphone, Teso, and Aviva leading the way.

Again, using Hargreaves Lansdown requires a minimum deposit of just £100 or £25 per month. The recurring rate is 0.93% with no upfront fees.

What are Investment Funds in Portugal?

Investment funds allow you to invest money in the financial markets passively. You do not need any prior experience or knowledge of how the markets work – the fund manager and provider makes all investment decisions. Your selected investment fund buys and sells shares, bonds and other assets on your behalf.

This particular investment scenario encompasses a number of different asset classes. For example, mutual funds may use ETFs such as REITs (Real Estate Investment and Management Companies), mutual funds that include real estate funds, investment trusts , money market funds or index funds. The main aspect of each of the funds mentioned above is that they provide full access to a range of stocks with just one investment.

For example, let’s say you invest in a fund focused on small UK companies. By investing just a few hundred euros, your portfolio could consist of 200+ small -cap companies listed on AIM (the alternative investment market). Similarly, by investing in a fund that tracks the FTSE 100 index, you would be buying a range of shares from 100 large companies.

Em termos fundamentais, os fundos de investimento são operados e geridos por instituições financeiras de grande escala. Alguns dos maiores nomes neste espaço incluem a iShare, SDPR e Vanguard. O seu dinheiro será acumulado ao capital de milhares de outros investidores – o que significa que o fundo possui, frequentemente, biliões de euros sob gestão.

Como Funcionam os Fundos de Investimento?

Quer opte por um ETF, fundo mutualista ou sociedade de investimento (trust) – o processo de investimento é maioritariamente igual. Para ajudar a clarificar, vamos analisar um exemplo e conferir como funcionam os melhores fundos de investimento.

- Você investe £10.000 num fundo de investimento mutualista

- O gestor do fundo foca-se em ações de grandes empresas no Reino Unido

- No total, o fundo de investimento compra ações em 150 empresas listadas na Bolsa de Valores de Londres.

- Teoricamente, você é proprietário de uma pequena porção de cada ação comprada pelo fundo – com base na quantia que investiu

- Por exemplo, se o fundo possuir 4% do seu portefólio em ações do HSBC, o seu investimento de £10.000 consiste em ações do HSBC no valor de £400.

Em relação a rendimentos monetários, a maioria dos fundos de investimento em Portugal paga dividendos. Esse valor é equivalente a uma parte de quaisquer dividendos de ações ou taxas de juro de obrigações que o fundo recebeu em nome dos seus investidores. A sua parte será tipicamente distribuída a cada 3 meses, mas alguns fundos podem pagar a cada 6 ou 12 meses.

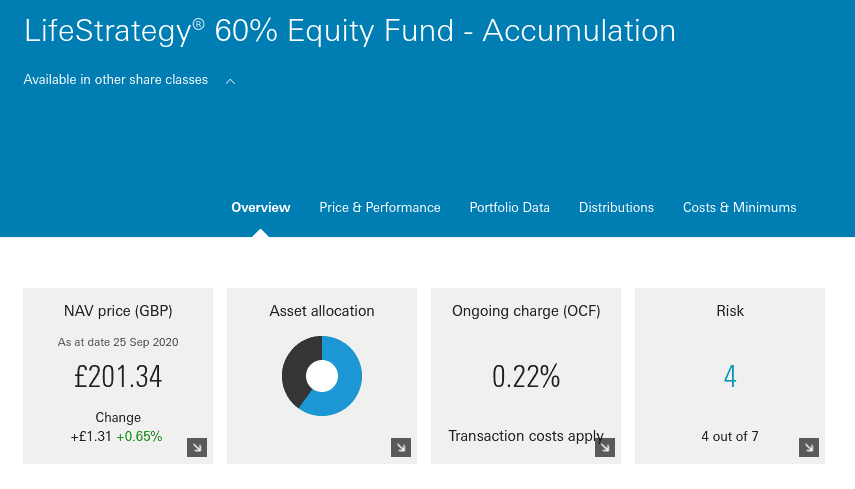

Para além de dividendos normais, também pode aumentar o seu capital mediante o aumento do valor patrimonial líquido (NAV) do seu investimento. Por exemplo, se investir no fundo FTSE 100 e o valor do índice aumentar em 10%, o seu investimento no fundo deverá aumentar de forma semelhante.

Tipos de Fundos de Investimento Portugal

Como já abordámos no início deste artigo, existem vários tipos de fundos de investimento. A maioria opera de forma similar, na medida em que pode investir em conjuntos de ativos de forma completamente passiva. O fundo efetua qualquer compra de ativos em nome dos seus investidores, e determina os melhores momentos para vender.

Com essa informação, existem algumas pequenas diferenças entre cada tipo de fundo de investimento, incluídas na seguinte lista:

- Fundos mutualistas (mutual funds): Este tipo de investimento determina quais os ativos a serem comprados e quando. O gestor do fundo tem flexibilidade para selecionar os ativos em que pretende investir, pois não se encontram vinculados a qualquer mercado específico. Uma vez que este tipo de fundo é gerido ativamente, as taxas são relativamente mais elevadas, comparativamente a ETFs.

- ETFs (Fundos Negociados em Bolsa): Este fundo de investimento acompanha um mercado específico. Por exemplo, se o objetivo for acompanhar o índice NASDAQ 100, o ETF irá replicar exatamente a bolsa NASDAQ. Os ETFs são tipicamente a opção mais económica, devido à sua gestão passiva.

- Sociedades de Investimento (Investment Trusts): As sociedades de investimento (trusts) são semelhantes aos fundos mutualistas. O seu capital é ativamente gerido pelo fundo – o que significa que o gestor do fundo toma todas as decisões de investimento. As sociedades de investimento não estão vinculadas a mercados específicos, o que providencia imensa flexibilidade.

- Fundo de Índice (Index Fund): Como o próprio nome sugere, os fundos de índices acompanham um índice específico no mercado de ações, tais como o FTSE 100 ou Dow Jones. O fundo compra ações em todas as empresas que constituem o respetivo índice, com o mesmo sistema de ponderação.

Alguns dos melhores tipos de fundos de investimento disponíveis para investidores em Portugal incluem:

- Fundos de Índices

- Fundos Mutualistas

- Fundos Tracker (ETFs)

- Fundos Vanguard

- Fundos do Mercado Monetário

- Fundos de Renda Fixa

- Fundos de Investimento Éticos

- Sociedades de Investimento (trusts)

- Fundos Imobiliários

- Sociedades de Investimento e Gestão Imobiliária

- Fundos de Ouro

- Fundos de Tecnologia

- Fundos de Retorno Absoluto

Sociedades (trusts) vs. Fundos de Investimento

As sociedades de investimento, ou trusts, são um ramo do espectro mais amplo de fundos de investimento. São populares em Portugal, devido ao seu desempenho geralmente mais elevado, comparativamente a fundos mutualistas, durante a última década.

Uma das principais diferenças entre sociedades e fundos de investimento reside na capacidade de as sociedades emprestarem dinheiro. Conhecido como gearing (“alavancagem”), garante à sociedade investimento um poder de compra bastante superior. Em retorno, conseguem investir mais dinheiro do que possuem no seu capital funcional.

Benefícios de Investir nos Melhores Fundos de Investimento

Existem vários benefícios associados ao investimento em fundos, comparativamente a ações tradicionais ou obrigações.

Os benefícios incluem:

- Não Necessita de Experiência: O processo de selecionar ações ou obrigações pode ser difícil e complexo. É necessário ter conhecimento adequado e competências de análise técnica e fundamental, sendo capaz de ler e interpretar relatórios pertinentes às empresas. Por essa razão, imensos iniciantes optam por investir em fundos de investimento em Portugal, uma vez que não necessitam de experiência prévia ou conhecimento sobre o funcionamento dos mercados financeiros.

- Rendimento Passivo: Após injetar o seu dinheiro num fundo de investimento, pode relaxar e permitir que o gestor do fundo compre e venda ativos em seu nome. É uma modalidade de investimento extraordinária para obter lucros passivos, pois irá provavelmente receber um pagamento em dividendos a cada três meses.

- Quantia de Investimento Reduzida: Atualmente, é possível investir em fundos com uma pequena quantia de capital. Na maioria dos casos, pode começar com apenas algumas centenas de euros. A Libertex permite aos seus utilizadores investirem em ETFs com apenas $50 (cerca de €40), enquanto a Hargreaves Lansdown requer uma quantia de investimento mínima de £100.

- Taxas Reduzidas: A maioria dos melhores fundos de investimento para 2026 cobra uma taxa recorrente menor do que 1% por ano. Algumas destas taxas aproximam-se dos 0% – especialmente em ETFs e fundos de índices. Mesmo na extremidade superior da escala, as taxas aplicadas são extremamente benéficas, considerando que pode investir de forma passiva.

- Diversificação: A diversificação permite-lhe reduzir a sua exposição geral ao risco, investindo em vários ativos pertencentes a múltiplas indústrias e mercados. Alcançar este objetivo como investidor autónomo pode ser dispendioso e consumir demasiado tempo. Este não é o caso com fundos de investimento, uma vez que consegue obter acesso a centenas (ou milhares) de ativos com uma única injeção de capital.

- Facilidade de Acesso a Mercados: Obter acesso a alguns mercados financeiros pode ser difícil para a maioria dos investidores casuais em Portugal. Ações listadas em mercados emergentes são um ótimo exemplo dessa dificuldade. Fundos de investimento, por outro lado, possuem frequentemente biliões de euros sob gestão. Isso significa que nenhum mercado é inacessível. Como tal, os fundos de investimento oferecem um atalho para um determinado ativo ou setor específico aos quais pretenda ganhar acesso.

Como escolher os Melhores Fundos Investimento em 2026

Com tantos fundos de investimento atrativos para escolher, saber por onde começar pode ser complicado. O aspeto mais importante é que o fundo deve conseguir satisfazer os seus objetivos de investimento a longo prazo. Por exemplo, pretende aumentar o seu capital durante várias décadas, com o objetivo de poupar para a sua reforma, ou procura acesso a um mercado específico, como obrigações no estrangeiro ou títulos dos EUA?

De qualquer forma, a lista seguinte apresenta algumas características que deve procurar ao selecionar um fundo de investimento que satisfaça as suas necessidades.

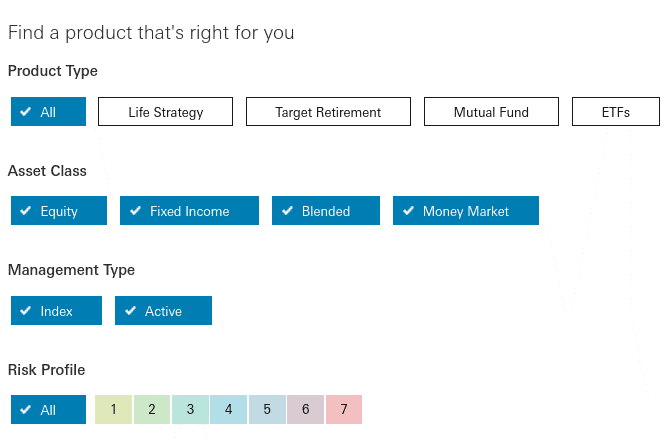

- Tipo de Fundo: Primeiro, é necessário explorar os tipos de fundos providenciados pelo gestor/corretora. Podem consistir em ETFs, fundos mutualistas, sociedades de investimento (trusts), ou fundos de índices.

- Objetivos: O foco do fundo está direcionado para que ativo ou mercado? Isso pode incluir tudo, desde ações de grandes empresas (large-cap) dos EUA a obrigações emitidas nos mercados emergentes.

- Histórico de Retornos: Analise as percentagens de retorno geradas pelo fundo de investimento ao longo dos últimos anos. Compare esses retornos com os resultados de outros fundos na indústria e do mercado em geral.

- Taxas Recorrentes: A maioria dos fundos possui taxas recorrentes – expressas em percentagem. Embora a maioria dos fundos aplique uma taxa menor do que 1% por ano, outros podem ser bastante mais dispendiosos. Para além disso, procure por taxas iniciais e de desempenho.

- Investimento Mínimo: Analise a quantia mínima de investimento exigida pelo gestor do fundo. Se essa quantia for demasiado elevada, é possível encontrar um mínimo menor em corretoras intermediárias.

- Risco: Líderes na área de gestão de fundos de investimento, como a Vanguard, providenciam uma classificação dos riscos envolvidos em cada um dos seus produtos. Essa informação permite-lhe avaliar a quantidade de risco que corre ao investir no fundo.

- Frequência de Dividendos: Deve saber com que frequência são distribuídos os seus dividendos relacionados com o desempenho do fundo de investimento. Tipicamente, quaisquer dividendos são pagos a cada três meses, mas outros fundos podem apresentar modalidades bianuais ou anuais.

Como pode conferir, pela lista acima, existem imensas características que deve considerar antes de selecionar qualquer fundo de investimento. Por essa razão, é recomendado explorar alguns dos melhores fundos de investimento, que explorámos convenientemente neste artigo – todos esses fundos estão disponíveis para investidores em Portugal.

Melhores Corretoras com Fundos de Investimento em Portugal

Caso pretenda investir num fundo de investimento, é necessário encontrar uma corretora fidedigna online, regulamentada pela FCA. Embora alguns dos gestores de fundos permitam o investimento direto através dos seus websites, irá encontrar frequentemente taxas associadas, e valores mínimos de investimento mais elevados. Por essa razão, sugerimos a utilização de plataformas intermediárias.

Na nossa opinião, estas são as melhores corretoras com fundos de investimento disponíveis para residentes em Portugal.

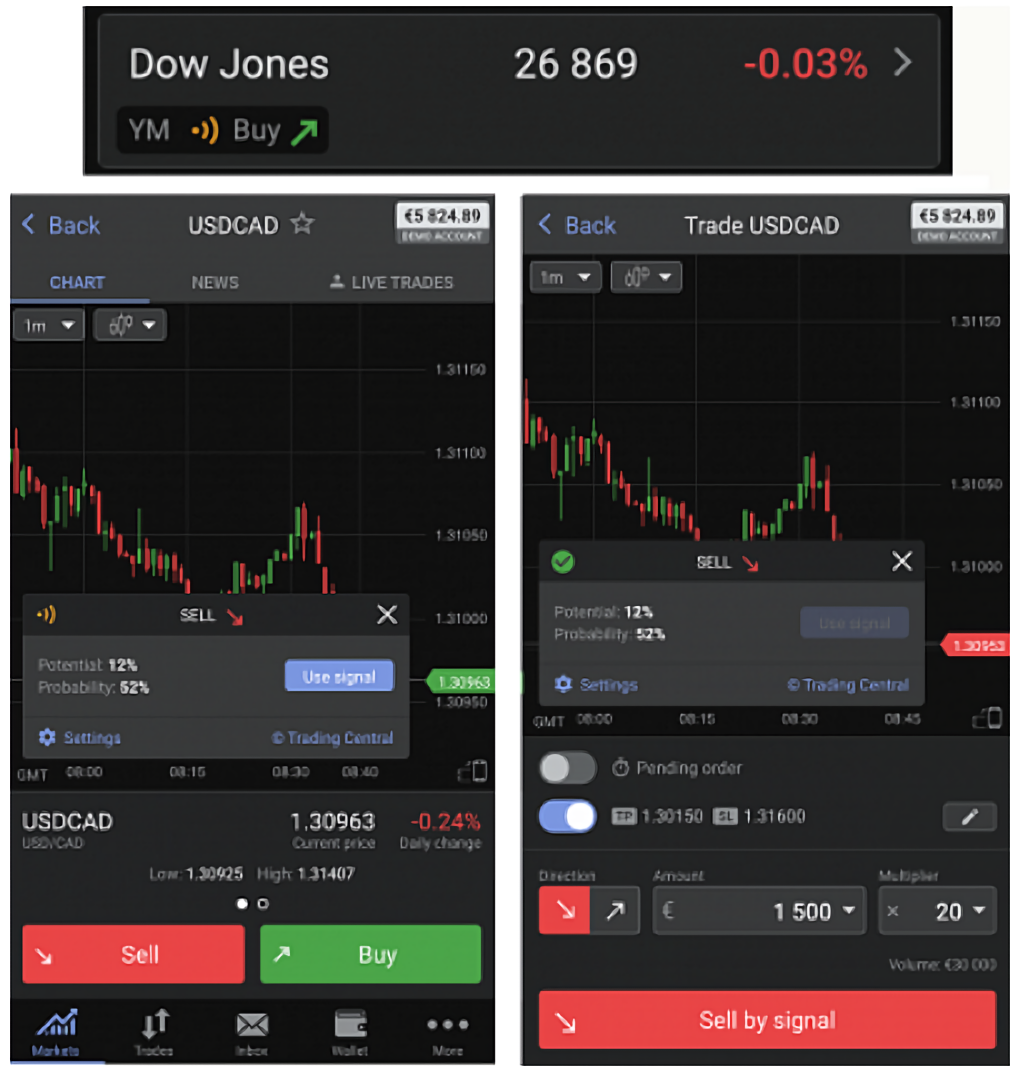

1. Libertex – Investir em fundos de investimento de forma fácil e regulada

A corretora é autorizada e regulamentada pela Comissão de Valores Mobiliários e Câmbio do Chipre (CySEC – Cyprus Securities and Exchange Commission), providenciando segurança e paz de espírito aos seus traders.

Libertex’s trading platform is unique, allowing investors to trade over 213 financial instruments via CFDs, covering currencies, stocks, commodities, indices and cryptocurrencies.

The broker also offers its traders a range of different trading platforms, including the most popular platform worldwide – MetaTrader 4.

However, they also offer their own proprietary and customized trading platform with useful features such as sentiment indicators, and real-time news and analysis.

You can easily open your Libertex account in just a few minutes.

You can make your minimum initial deposit of just €100 via your debit/credit card, bank transfer and e-wallets such as Skrill and Neteller.

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% Commission Broker for Investment Funds

This is a top-notch ETF trading platform that, despite specializing in cryptocurrencies, also allows its investors the freedom to invest in respected stocks and ETFs. In addition, you will have the possibility of investing in CFDs of these stocks. At Tesla, you will also have access to charts of the ETF's price assessment, for example. It is excellent for beginner investors!

Pros:

Cons:

71% of retail investors lose money when trading CFDs on this website

How to Invest Today in the Best Investment Funds in Portugal

Do you want to make a profit from your capital with an investment fund, but don't know where to start? Follow the step-by-step instructions outlined below to invest in any fund from the comfort of your home.

The following guide is based on the best broker for investment funds, in our opinion – Libertex – which allows you to invest without commissions or recurring fees. You can, of course, use any other broker.

Step 1: Open an account with Libertex

We would like to emphasize again that Libertex is an authorized and regulated broker by the FCA.

This means that it is legally obliged to verify the accounts of all its users – to comply with the rules imposed against money laundering.

Don’t worry, the process can be completed in just a few minutes – as Libertex uses automated verification technology .

It is important to note that you will need to download the Crypto.com app. This is the only way to easily access all the trading resources and tools presented.

Step 2: Download Libertex for smartphone

Once you have opened your account, you will need to download the Libertex app. You will be redirected to the Google Play or Apple Store by clicking on the respective link.

Once the download is complete, install the app and proceed to log in using your credentials.

Step 3: Trade Investment Funds on Libertex

Once you have access to your portfolio, you need to choose the currency pairs you want to invest in. You will quickly have access to a huge range of pairs to trade in the investment fund market, always with 0 commissions and the best access to charts and technical analysis.

This requires an initial deposit of $200 , but you can invest as little as $25 . Available payment methods, with instant processing, include debit and credit cards, Paypal, Skrill, and Neteller.

Investment funds continue to grow in popularity among Portuguese investors, as they are a completely passive form of income. All you need to do is select a fund, invest an amount equal to or greater than the minimum amount required by the broker and you’re ready to go – just sit back and watch your money work for you. In addition to growing your capital as the fund’s net asset value increases, you can also earn in the form of dividends. This is your share of stock dividends or bond interest received by the fund manager – typically distributed every three months. If you want to start investing in funds today, the process rarely takes more than 10 minutes when using Libertex. You can deposit funds instantly with this FCA-regulated broker and invest in any fund for as little as $50. The best advantage of using Libertex for this investment is that you don’t have to pay any commissions or recurring fees.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.Conclusion

Libertex – Invest in the Best Investment Funds with 0% Commissions

FAQ: Frequently Asked Questions

What is a mutual fund?

Do mutual funds pay dividends?

What do you need to do to sell a mutual fund?

How much do investment funds cost?

What is the best investment fund provider?