Melhores Defi Plataformas de Trading em Portugal 2026 para comprar Defi Crypto

DeFi platforms are clearly growing in terms of adoption and popularity. This is because, through DeFi crypto technology, it is possible to create decentralized software and platforms, whether in the financial sector or not. In this review, find out what DeFi crypto is and the best DeFi crypto platform, so that you are several steps ahead in your investment.

Not only will you learn about the best DeFi platforms on the market to invest in, but you will also understand the DeFi crypto meaning and how it could impact the future of how we carry out transactions or make online payments. All based on the DeFi crypto value and analysis by Trading Platform experts !

[fin_table id=”20″]

List of Defi Crypto Trading Platforms 2026

Fortunately, there are multiple defi platforms that allow you to invest in different ways in the main defi crypto. So, now find out which defi platforms stood out the most in our tests:

- Libertex – Invest in Bitcoin CFDs and other cryptocurrencies

- Crypto.com – Platform that does not have defi, but allows you to invest in defi coins

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Best Altcoin Trading Platforms Reviewed

Next, learn in more detail how to best invest in defi coins and defi tokens, but within licensed and completely legal brokers. These are the best platforms, with defi tokens, that you can take advantage of:

1. Libertex – Best CFD Trading App with Crypto Defi Staking

Despite having a greater focus on cryptocurrency CFDs, the reality is that the Libertex broker also allows you to invest in a list of defi cryptocurrencies. Therefore, you will have greater exposure to this fundamental and market that promises to be revolutionary. This is the best entry into the defi blockchain that you can find on the market.

Libertex Commissions

Rate

Amount

Stock Trading Fee

0.034% commission on shares.

Forex Trading Fee

0.008% commission on GBP/USD.

Cryptocurrency Trading Fee

1.23% commission on Bitcoin.

Inactivity rate

$5 per month after 180 days of inactivity

Withdrawal fee

Free

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% Commission Exchange for Crypto Defi Wallet

Although it is possible to buy crypto defi coin with crypto com defi wallet earn, the truth is that defi crypto.com is more focused on investing in its cryptocurrency CFDs . Thus, with crypto com defi wallet, it is possible not only to invest in real cryptocurrencies in this sector, but also to diversify with cryptocurrency CFDs, always with total security that only one of the best defi platforms could provide.

Rate

Amount

Stock Trading Fee

From 5%

Forex Trading Fee

0.9 pip spread on EUR/USD

Cryptocurrency Trading Fee

From 0.25% on OTC market

Inactivity rate

$50 per quarter after 3 months of inactivity + $100 after 1 year of inactivity

Withdrawal fee

Free

Pros:

Cons:

Defi crypto what is it?

First and foremost, defi crypto coins are an acronym for “decentralized finance.” The term is used to describe a variety of financial applications implemented on cryptocurrency or blockchain that aim to disrupt financial intermediaries. Hence the enormous value of defi platforms or defi crypto platforms these days.

This is all inspired by blockchain, the technology behind the digital currency bitcoin , a system that allows multiple entities to keep a copy of a record of a transaction, so that it is not controlled by a single party. The reason this is important is that human gatekeepers and centralized systems can slow down and complicate transactions, giving users less direct control over their money. So defi crypto price uses blockchain to enable more complex financial transactions than simple transfers with a “middle man.”

Your capital is at risk.

How can I trade DeFi cryptocurrencies? And its defi crypto value?

If you are interested in investing in DeFi - defi crypto news - and want to know where to buy DeFi cryptos, there are several ways to do so. The simplest way to gain exposure to DeFi, which only provides a general overview of the technology, is to buy ETH and other coins that use DeFi technology, within DeFi platforms. In the case of DeFi-powered coins, you gain exposure to almost the entire defi wallet crypto industry.

To earn interest directly on your cryptocurrency holdings, you can deposit them directly into a DeFi trading platform. Depositing funds for longer periods of time can result in higher interest rates, and the interest rate paid on your deposit can be fixed or variable depending on the market.

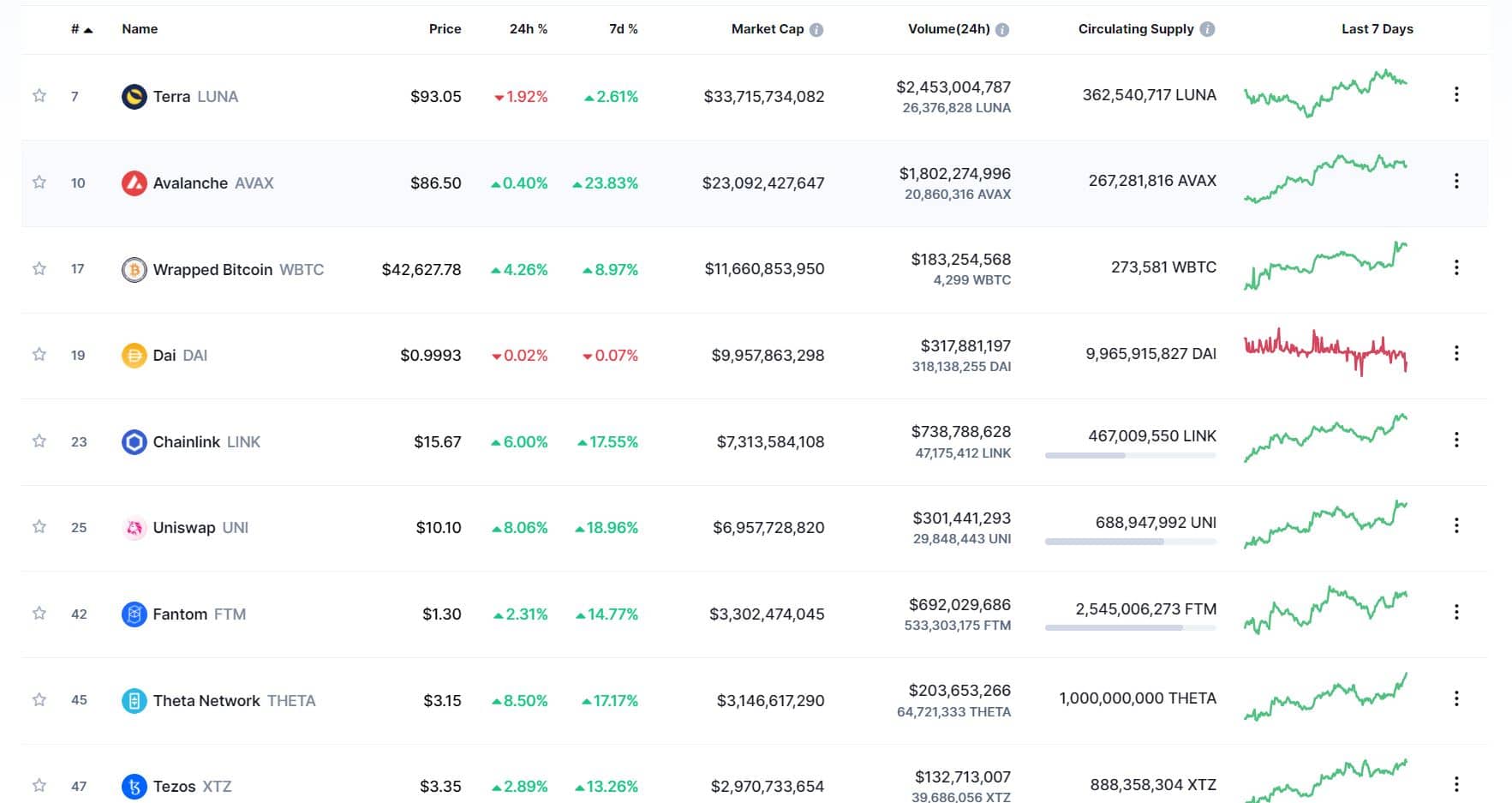

Defi crypto list by market cap

Uniswap

Uniswap is one of the leading cryptocurrency exchanges that uses the ERC20 DeFi token as its trading platform. This exchange uses an automated liquidity protocol and uses a cryptocurrency trading system called Automated Liquidity Protocol. Uniswap is a blockchain-based platform developed in 2018 that uses Ether blockchain technology, making it compatible with any other ERC20 token and cryptocurrency wallet service.

Chainlink

Certainly one of the best defi platforms, the Chainlink oracle network is a leading DeFi oracle network that allows off-chain data to be merged into smart contracts . There are currently approximately 419 million LINK tokens available, which represents approximately 41% of the total supply.

DAI

A stablecoin based on the Ethereum blockchain produced by MakerDAO and Maker Protocol, DAI is pegged to the fiat currency USD and is developed by MakerDAO and Maker Protocol. As such, DAI represents the first DeFi crypto of its kind.

Compound

By storing digital assets in one of the many supported liquidity pools, users can earn interest on their digital assets through Compound , a DeFi trading platform. Depositing cryptocurrencies into a Compound token pool earns users cTokens.

0x

This is a P2P (peer-to-peer) exchange for ERC20 DeFi tokens on the Ethereum blockchain using the 0x protocol powered by the DeFi protocol. Users can trade ERC20 tokens without relying on traditional cryptocurrency exchanges using this infrastructure protocol.

Risks of Trading DeFi Cryptocurrencies

By now knowing what defi crypto is, you will have a better understanding of what to expect when trading defi cryptocurrencies. However, be aware that, as they are decentralized networks, there will be no entities or organizations that can protect you. Therefore, you will need to have full control over the entire network and what you will be investing in. Only then will you be able to get the most out of defi platforms.

Your capital is at risk.

Light Defi Crypto Trading Strategy

Here are some strategies you can follow when buying defi cryptocurrencies:

HODL (Hold On for Dear Life!)

HODL, hold the investment for a long time, if you believe in it. This is the concept of HODL. Investors have at their disposal a variety of strategies, including HODLing.

It’s probably a good strategy for beginners if they’re not obsessive about their investments, like day-trading. Hodlers hold their cryptocurrencies in the hope that the price will increase in the near future, rather than relying on short-term price movements as their investment strategy.

Buy and Sell Government Tokens

Invest in government-backed DeFi tokens. Additionally, one can buy or sell governance tokens , in addition to hodling, to invest in DeFi applications. A token can be traded in three ways:

- DeFi Degen.

- Rules based

- Momentum based.

- Rules-Based DeFi Trading

The rules-based approach is the opposite of DeFi degen. A trader uses this system to determine when to enter and exit. For example. A rule could be to buy the moment the price breaks 50% of the listing price and sell the moment the price falls 30% from the peak.

Momentum-Based DeFi Trading Strategy

The DeFi degen strategy is a hybrid of the rules-based strategy and the DeFi degen strategy. In this case, the price must drop slightly to justify the sale. Otherwise, the rules-based approach applies. Despite this, DeFi offers a whole new world of financial products. How can you take advantage of it? Here are some tips.

Interest on Lending Protocol - Earning Passive Income from DeFi Exchanges

Three different investment strategies will be explored - the third is to leverage one of the most famous tools in the DeFi-verse - lending protocols. Investing in defi platforms to earn dividends.

In the DeFi ecosystem, AMMs are essential to enable digital assets to be traded permissionlessly and automatically using liquidity pools instead of a traditional marketplace where buyers and sellers interact.

Advantages of Cash Farming

Know that yield gains can be achieved using one of the many DeFi protocols. There are different risks and rewards associated with different protocols. A user well-versed in these platforms can move intelligently between them to maximize rewards.

This is a system that allows farmers to continuously farm and reinvest their profits to earn rewards forever. This drastically reduces the overall token velocity as a significant amount of tokens are stored as “stakes”.

Is DeFi trading legal?

Of course, yes. However, you should be fully aware that this is a new market and concept, and therefore must be fully mastered before you can enter it and make the best decisions.

Your capital is at risk.

How to Get Started with a DeFi Crypto Trading Platform

Find out now how, among the best defi platforms, you can make the most of these defi investments:

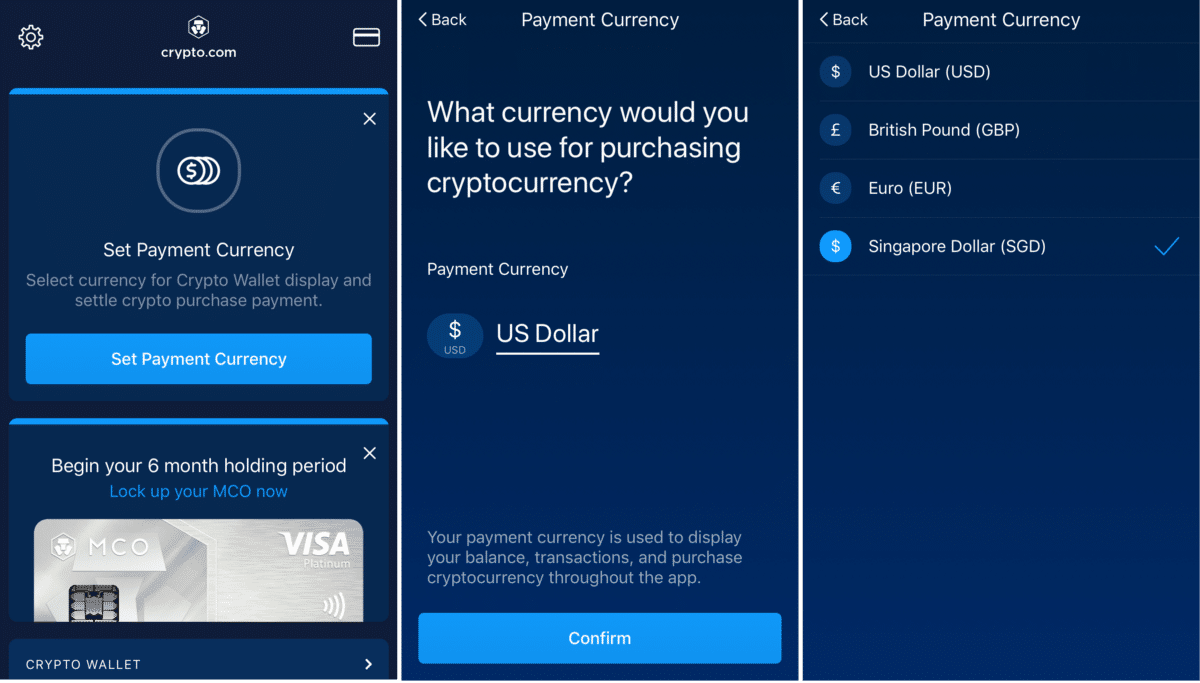

Step 1: Open an account on the Crypto.com app

We would like to point out again that Crypto.com is an authorized and regulated broker by the FCA. This means that it is legally obliged to verify the accounts of all its users – to comply with the rules imposed against money laundering.

Don’t worry, the process can be completed in just a few minutes – as Crypto.com uses automated verification technology.

It is important to note that you will need to download the Crypto.com app. This is the only way to easily access all the trading resources and tools presented.

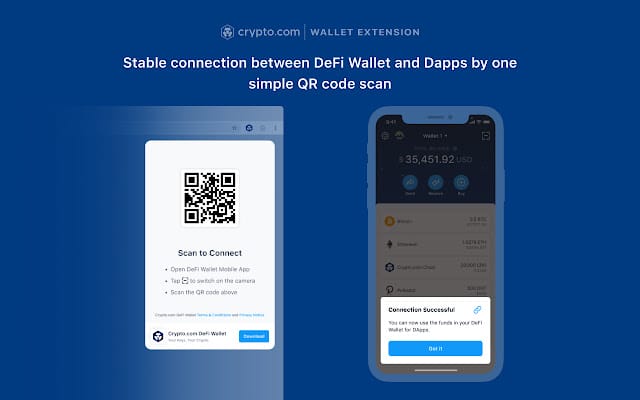

Step 2: Download Crypto Wallet to Smartphone

Once you have opened your account, you will need to download the Crypto.com wallet app . You will be redirected to the Google Play or Apple Store by clicking on the respective link.

Once the download is complete, install the app and proceed to log in using your credentials.

Step 3: Add Defi Cryptocurrencies to Wallet

Once you have access to your wallet, you need to transfer your defi cryptocurrencies . If you don't have any BTC at this stage, you can buy it directly from the broker's app.

This requires an initial deposit of $200, but you can invest as little as $25. Available payment methods, with instant processing, include debit and credit cards, Paypal, Skrill, and Neteller.

Step 4: Sell/Buy defi tokens

In the future – whether it’s weeks, months or years – you’ll want to convert your defi cryptocurrencies back into real money. This platform allows you to do this with just one click. In addition, you won’t have any problems activating tools like stop loss or optimized trading with this licensed broker.

Once you confirm the sale, the funds will be deposited into your Crypto.com account . After conversion, you can withdraw the funds directly to your debit/credit card, e-wallet, or bank account. Just be careful about the limits for each transaction.

Your capital is at risk.

Our Verdict on DeFi Trading

As you can see, there are multiple defi platforms that provide all the ingredients for you to take advantage of this decentralized market. Certainly, eliminating the “middle man” will be a concept to be explored in the coming years, so investing in crypto defi, from its early years, could be an investment opportunity worth considering.

Crypto.com – The Best Cryptocurrency DeFi Trading App

Your capital is at risk.

FAQ: Frequently Asked Questions about DeFi

What is the difference between defi vs bitcoin?

Are there defi crypto taxes to be considered?

What are the best defi platforms at the moment?

Are there limits on trading defi tokens?

Are there better defi cryptocurrencies on the market than others?