Como investir em Petróleo em Portugal – Guia completa

If you’re looking to get into this market action, this beginner’s guide on how to invest in oil with CFDs will definitely help!

In a step-by-step process, we show you how to invest in crude oil with the best brokers, the best strategies for trading oil market volatility, the best oil companies to invest in, among others.

How to Invest in Oil on Libertex

The section below outlines a step-by-step process on how to invest in oil with the Libertex software. It is our platform of choice because it is regulated by the FCA, CySEC and ASIC and offers commission-free trading:

- Open an account (we recommend Libertex )

- Send your Identification Document

- Deposit funds into your Wallet

- Choose your petroleum product and invest!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

How to invest in Oil in Portugal

If you are wondering how to invest in oil with little money in Portugal, then follow these quick steps:

- Choose an oil broker. We recommend Libertex , which is authorised and regulated by the UK FCA and offers a wide range of oil-related products, including crude oil, oil stocks and oil ETFs.

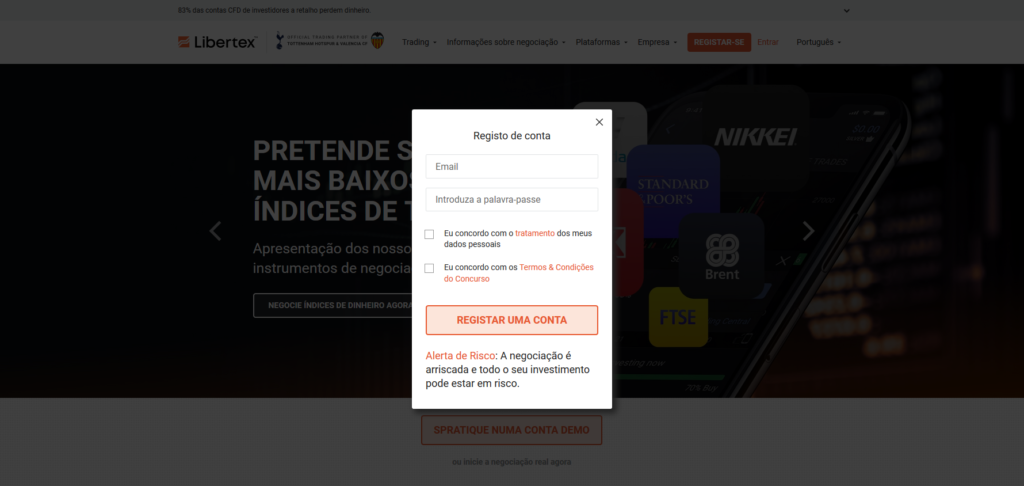

- Open an account . Opening an account with Libertex is simple and can be done in minutes. Fill in a few personal details and you’re ready to go.

- Deposit funds. The minimum first deposit is just $20 and can be made via bank transfer, debit/credit card or via e-wallets.

- Oil investing! Now you are ready to invest in oil on the stock market. Find your market and start trading!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Step 1: Choose a Broker to invest in oil

One of the most important parts to consider when investing in oil (apart from the oil price on the stock exchange, of course) is making sure you are using the right trading platform .

After all, your platform is your gateway to investing in the oil market and therefore needs to be secure, reliable and easy to use.

Below, we discuss some of the best oil trading platform providers to choose from.

1. Libertex – Best Trading Software for Investing in Oil with Zero Spreads

The broker is licensed and regulated by the Cyprus Securities and Exchange Commission, providing traders with great peace of mind when depositing and withdrawing funds.

The platform offered by Libertex is unique in that the broker does not charge any spreads. The spread is the difference between the buying and selling price and is often limited by the broker.

With Libertex you can trade over 213 CFD financial instruments, including commodities such as oil, as well as stocks, indices, currencies and all with zero spreads and low commissions!

Libertex also provides the possibility to trade oil on margin using CFDs. With CFDs, you can control a larger position with a smaller deposit.

Margin requirements vary depending on whether you are a professional or retail client.

Libertex trading software is web-based and feature-rich. They also offer the world’s most popular MetaTrader 4 platform.

An account at Libertex can be opened easily and in just a few minutes.

The minimum deposit is just €100 and can be made via bank transfer, credit/debit cards and e-wallets such as Neteller and Skrill. You can also access excellent customer support from Monday to Friday, from 8:00 to 20:00, via live chat, WhatsApp or Telegram.

Pros:

Cons:

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

2. Crypto.com: 0% commission broker for investing in oil

This is a top-notch oil trading platform that, despite specializing in cryptocurrencies, also allows its investors the freedom to invest in respected stocks and ETFs. In addition, you will have the possibility to invest in CFDs of these stocks. On Tesla, you will also have access to charts of the price assessment of the ETF and other stocks, for example. It is excellent for beginner investors!

Pros:

Cons:

71% of retail investor accounts lose money when trading CFDs on this website.

Step 2: Choose a Way to Invest in Oil

Now that you have chosen the right oil investment platform, it is time to decide which oil investment you are going to make. There are also a few options to choose from!

Oil CFDs, Futures and Options

As mentioned above, there are a wide variety of ways to speculate on the price of oil. Some methods are relatively easy and some are quite complex, as you will see below.

CFD Oil

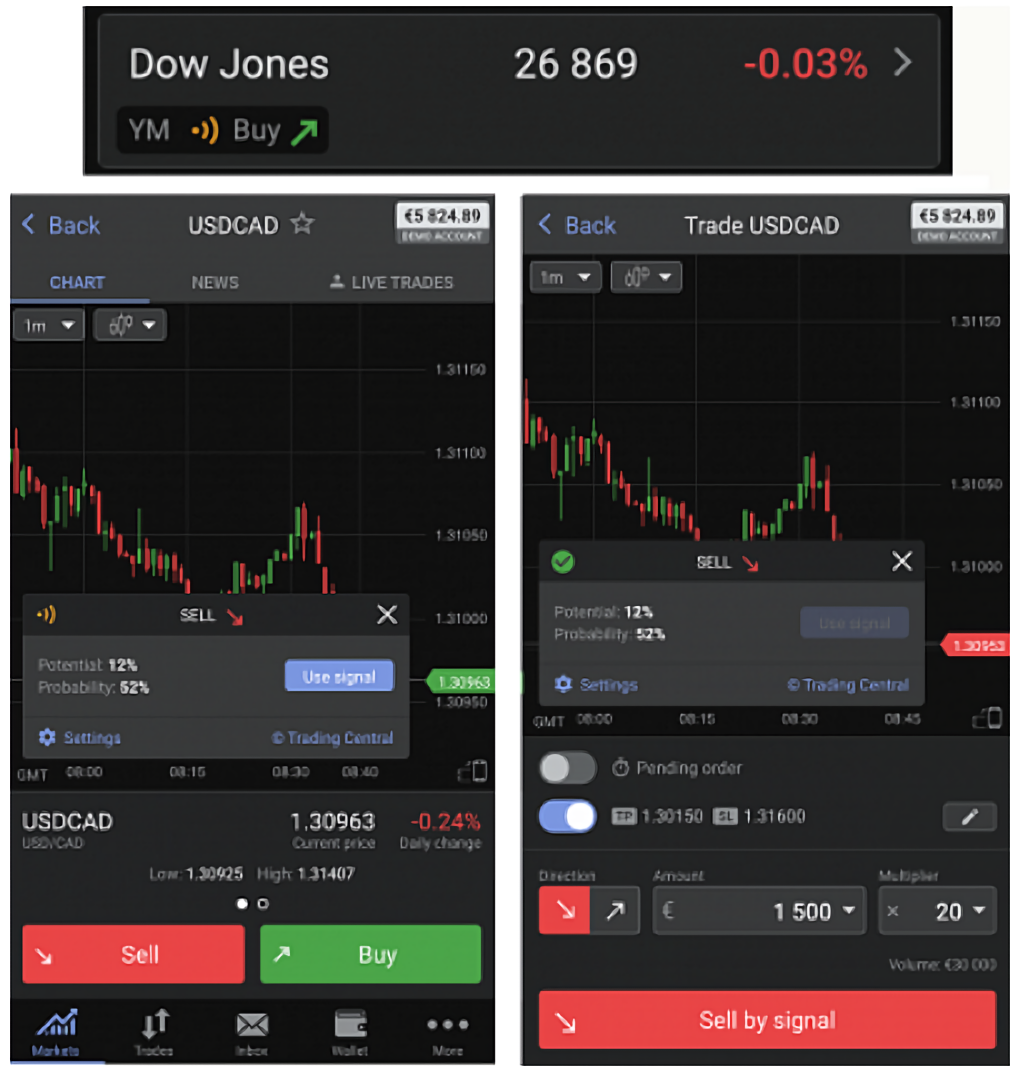

One of the easiest ways to invest in oil is by using a CFD broker, such as Libertex and Crypto.com. With CFDs, you are simply speculating on the rise or fall of the market price and do not actually own the underlying asset.

All you need to do is press the buy button if you think the market will go up or press the sell button if you think the market will go down. This is just one of the benefits of CFDs – you can trade long and short and profit from both rising and falling markets.

Another benefit of trading oil CFDs is that you can use leverage to control a larger position using a small deposit.

The image above, taken from the Libertex platform, shows a $1,000 investment in oil giving you $10,000 exposure. This means you have leveraged your position by 10 times your investment!

With a CFD broker, you will also be able to set stop-loss orders to minimize any losses if the market moves against you, as well as take profit orders to lock in any gains if the market moves in your favor.

Oil Futures

Oil futures are contracts to trade a certain number of barrels of oil at a fixed price, on a fixed date in the future. When trading futures, each contract has an expiration date that is usually one month, but can also be three months.

These contracts are typically traded through a futures exchange such as the New York Mercantile Exchange (NYMEX) and are primarily used by trading companies to lock in the price of the barrels of oil they want to buy.

However, the leverage is not as high as what CFD brokers offer.

Oil Options

An oil options contract gives you the right, but not the obligation, to buy or sell a fixed quantity of oil at a fixed price on a fixed date in the future. The two types of options available are called "calls" and "puts."

If you believed the price of oil would go up, then you would buy a call option. If you believed the price of oil would go down, then you would buy a put option.

Oil options contracts are also affected by time lapse and volatility, making options trading one of the most complex forms of oil investing.

Stocks and ETFs to invest in Oil

While some investors may choose to invest in oil using CFDs, Futures or Options directly, another popular way is by investing in oil stocks, oil ETFs or mutual funds.

After all, companies that drill for oil would likely do well when oil prices rise.

Energy companies offer investors direct exposure to the oil market, with some other benefits.

Some of the biggest energy giants like Exxon Mobil, BP and Shell pay very good dividends on stock purchases.

This means that the investor can potentially profit from the capital gains derived from the share price, as well as any income payments from the stock's dividend payments, which typically occur every quarter.

With Libertex trading software, you can even buy oil stocks 100% commission-free, as shown below.

Oil ETFs are also another way to gain exposure to the oil market or the energy sector as a whole.

For example, the United States Oil Fund is one of the most popular oil ETF trading products available. The goal of this fund is to gain exposure to the American oil market without having to buy any futures contracts.

There are other oil ETFs that act more like a mutual fund where they invest in a basket of different oil stocks. For example, the Energy Select Sector SPDR gives investors exposure to the top companies in the US energy market.

The fund's largest holdings include Exxon Mobil, Chevron, ConocoPhillips and 23 other energy companies.

Libertex trading software offers you a full range of oil companies to invest in.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Step 3: Research to Invest in Oil CFDs

Now that you know more about the different ways to start trading oil, it would also be smart to learn as much as possible about this market. This is important to find out where the opportunities are, but also to know what the risks are.

Make sure to explore the sections below to gain knowledge on all aspects of oil investing!

Different Types of Oil

When learning how to trade crude oil online, it is important to understand the different types of oil blends that exist. The two most commonly traded are WTI crude oil and Brent crude oil.

WTI (West Texas Intermediate) crude oil is a blend of oil that is processed in the United States and traded on the New York Mercantile Exchange (NYMEX). This type of oil is extracted from oil reserves in Texas, Louisiana and North Dakota and then piped to Oklahoma.

Brent crude oil is extracted from the North Sea and piped to Scotland. It is traded on the Intercontinental Exchange (ICE) and is used as a benchmark for oil prices in Europe, Africa and the Middle East.

Oil Price - Oil Price on the Stock Exchange

Oil blends such as WTI and Brent are priced in US dollars. When you look at the price of oil, you are essentially looking at the price of a barrel in US dollars. For example, at the time of writing, the price of WTI crude oil is $63.10 per barrel.

When learning how to invest in crude oil, it will be helpful to be able to predict future price fluctuations. The price of oil is affected by many different factors, such as:

- OPEC production . The Organization of the Petroleum Exporting Countries (OPEC) is made up of 14 oil-rich countries led by Saudi Arabia. They meet every month to discuss how much oil they will produce and sell on the open market. If they cut supply, prices usually go up, and vice versa.

- Geopolitics. The oil market is highly politicized due to tensions that could erupt in the Middle East. Even the coronavirus pandemic has raised concerns about the price of oil, as barrels of oil were stored in the Americas during the lockdown, leading to a build-up of stocks and a drop in the price of oil.

- The US Dollar. Since both WTI and Brent crude oil prices are denominated in US dollars, any large movements in the currency could have an impact on the price per barrel.

Should You Invest in Oil Now? - Oil Investment Analysis

Since the nearly 90% drop in oil prices during the coronavirus pandemic and subsequent 500% recovery, many investors are questioning whether oil is now a good investment.

According to JP Morgan analysts, commodities have entered a new super cycle as prices soared across agriculture, metals and energy. Only four super cycles have developed over the past 100 years, with the last peaking in 2008.

Many analysts are now calling for higher oil prices in the long term, citing a number of reasons, including increased demand for oil due to:

- A successful rollout of the coronavirus vaccine will increase international travel and mobility.

- Central Bank stimulus that is likely to increase infrastructure and manufacturing industry spending.

- Energy companies are shifting to renewable energy, which means less oil will be extracted overall, driving up the price of current supply.

If oil prices could come anywhere close to the highs reached in 2018, at ~$77, this would mark a 60% increase in the price of oil from where it opened at the start of 2021. A move towards the previous 2018 highs, at ~$113, would mark a 130% increase in prices.

Oil has a reasonable level of volatility as it is affected by global demand and geopolitical factors, and as such it is also important to be aware of some of the risks of investing in oil.

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Risks of Investing in Oil and Trading Oil with CFDs

When thinking about how to trade oil in Portugal, it is also important to think about the risks involved, as the market presents a high degree of volatility. Some risks include:

- Economic risk. Markets can be affected by supply or demand shocks that may result from weather patterns, geopolitical tensions and unforeseen events. For example, when demand for oil came to a sudden halt during the pandemic, oil prices fell to 30-year lows.

- Company risk. If you are choosing oil companies to invest in, then there are company news announcements that could hurt the stock price. A scandal, accounting mismanagement or negative earnings could leave some investors footing the bill.

- Political risks. Geopolitical tensions can cause large fluctuations in oil prices. Much of the oil comes from the Middle East, where tensions can easily flare between different countries, causing disruptions to supply routes.

- Climate change risks. More and more oil companies are moving away from underground drilling to find more environmentally friendly energy sources. Many companies are also losing big investors as mutual funds shy away from energy companies that leave a large environmental footprint.

Oil Trading Strategies

There are a variety of strategies that investors can use to capitalize on the volatility of the oil market. Many of the strategies will depend on your chosen investment style, such as whether you prefer short-term or long-term investing. Let’s take a look at a few:

Oil investing using basic principles

Longer-term investors tend to look at the fundamental picture of what could happen over many months or years. These types of investors are more likely to focus on investing in oil companies rather than buying oil directly.

Since energy companies tend to pay high dividends, it is a great strategy that combines different income streams – the rising stock price and income from quarterly dividends.

Oil trading using technical analysis

Shorter-term investors, such as day traders, may choose to speculate on the direction of oil market prices using CFDs, as they provide the opportunity to profit from both rising and falling markets using leverage.

In this case, most traders would study price charts and technical analysis indicators to help identify short-term turning points in the market. Although it is a highly specialized skill, oil day trading is popular due to the volatility of the market.

Oil Trading using CopyPortfolios

A much newer way to capitalize on the market is to use the Libertex CopyPortfolio functionality. These are ready-made investment portfolios managed internally by the Libertex Investment Committee.

They are also super simple to access and can offer a good level of diversification.

For example, on the Libertex platform, there is a GoldenEnergy Copyportfolio. This is a portfolio that includes investments in the energy, oil, gold and mining sectors.

You can easily see the different investments in the portfolio and choose to invest with just one click!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.

Step 4: How to Oil Trade on Libertex

The section below outlines a step-by-step process on how to trade oil on the Libertex trading software. It is our platform of choice because it is regulated by the FCA, CySEC and ASIA and offers commission-free trading!

Step 1: Open a Day Trader Account

We would like to emphasize again that Libertex is an authorized and regulated broker by the FCA.

This means that it is legally obliged to verify the accounts of all its users – to comply with the rules imposed against money laundering.

Don’t worry, the process can be completed in just a few minutes – as Libertex uses automated verification technology .

It is important to note that you will need to download the Crypto.com app. This is the only way to easily access all the day trading resources and tools presented.

Step 2: Download Libertex for smartphone

Once you have opened your account, you will need to download the Libertex app. You will be redirected to the Google Play or Apple Store by clicking on the respective link.

Once the download is complete, install the app and proceed to log in using your credentials.

Step 3: Trade on Libertex with oil trading

Once you have access to your portfolio, you need to choose the currency pairs you want to invest in. You will quickly have access to a huge range of pairs to trade in the CFD market with oil trading, always with 0 commissions and the best access to charts and technical analysis.

This requires an initial deposit of $200 , but you can invest as little as $25 . Available payment methods, with instant processing, include debit and credit cards, Paypal, Skrill, and Neteller.

In this beginner’s guide to How to Trade Oil in Portugal, we look at some of the best platforms for oil investing, the different types of products available to invest in, and how to do it. Whether you are trading oil directly through CFDs, oil stocks or oil ETFs, many analysts are very optimistic about the future of the oil market. In fact, JP Morgan believes we are now in a super commodity trading cycle – only the fifth in the past 100 years. To capitalize on this trend, it’s essential to have access to the right broker and platform. For us, Libertex has a number of options, as it is highly regulated and offers 100% commission-free trading. You can open an account in a matter of minutes and see for yourself!

85% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com este provedor.How to Trade Oil CFDs in Portugal – Conclusion

Libertex – Best Broker to Invest in Oil in Portugal

FAQ: Frequently Asked Questions

Is oil a good investment?

How do I decide which oil companies to invest in?

How to oil invest with little money?

What are the risks of learning how to do crude oil investing?

Can you profit from falling oil prices?