eToro vélemények 2026 – Díjak, jellemzők, előnyök és hátrányok feltárva

Do you live in Hungary and want to buy stocks from the comfort of your home? If so, you may have come across the eToro brokerage. Read our eToro reviews and learn more!

This multi-asset platform is popular with first-time traders as it allows you to open an account, make a deposit and buy shares without commission in minutes. But is eToro right for you? Read this eToro review to learn more.

In this eToro review, we’ll tell you everything you need to know about eToro. You’ll find information on the types of shares you can buy, fees and commissions, trading instruments, payment methods, ease of use, regulation, and more. Let’s see if eToro is the right broker for you.

[stocks_table id=”17″] If you like what eToro has to offer and would like to open a stock account today, here are the steps you need to take:

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. In the traditional ownership section, you can buy stocks, ETFs, and cryptocurrencies on eToro; the company also offers CFDs on stocks, indices, bonds, heavy metals, energies, and more. One of the most attractive features of eToro is its industry-leading pricing structure, as it is one of the few platforms that allows stock purchases. As a stock trading platform aimed at new investors, eToro is also suitable for those who have never bought stocks online before. This is because opening a trading account only takes a few minutes and you can simply deposit money using a debit card or bank transfer. You then simply need to select which shares you want to buy, how much you want to invest and then approve the transaction. We should also mention the social and copy trading features available on the eToro trading platform, which have contributed to eToro’s rapid popularity. They allow you to connect with other investors in a Facebook-like format and even copy other users’ trades, adding a new dimension to traditional trading.

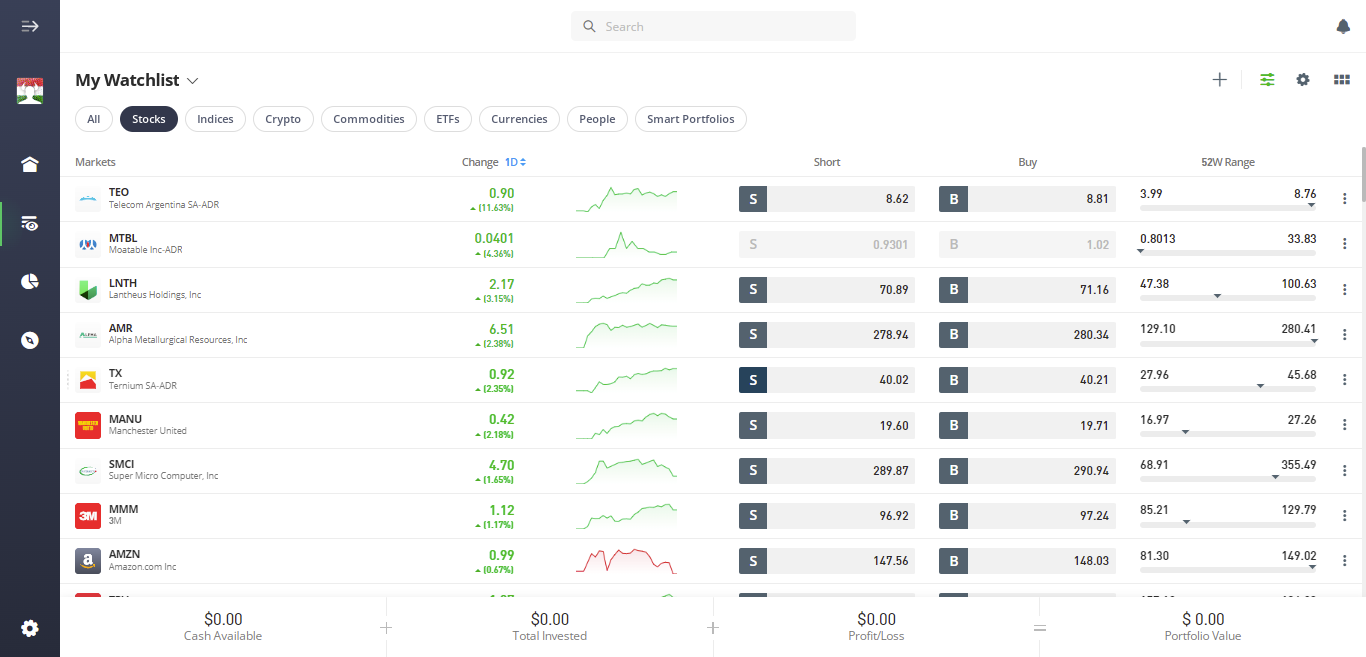

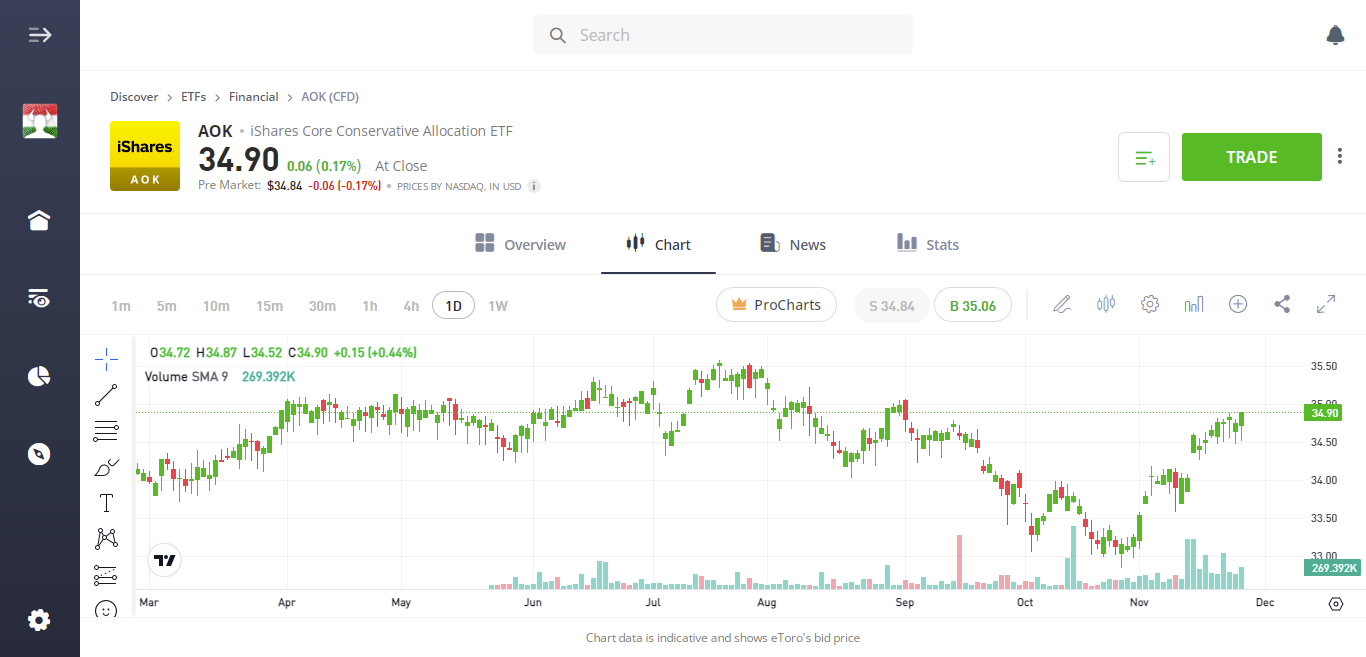

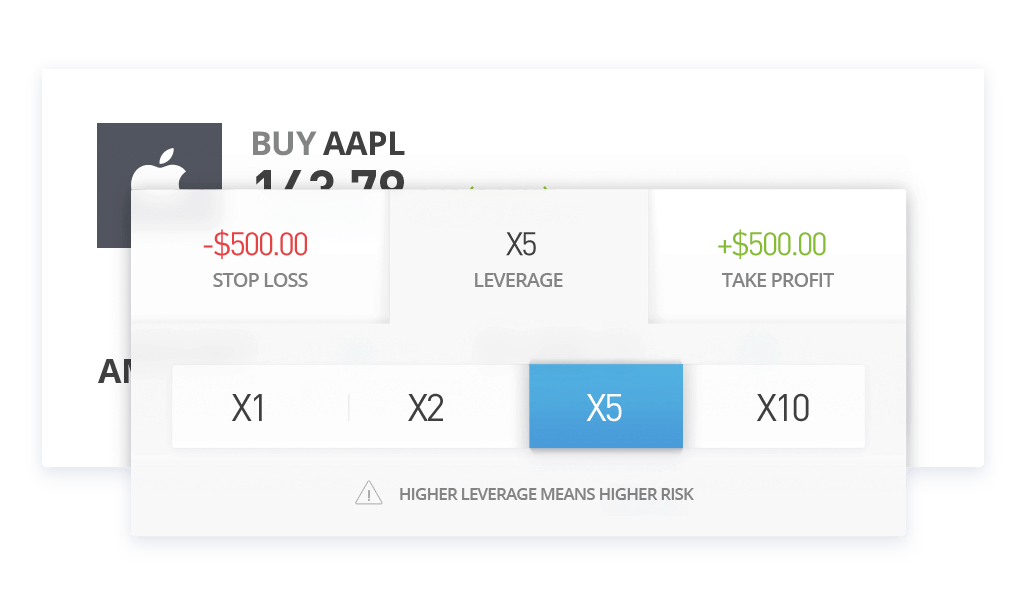

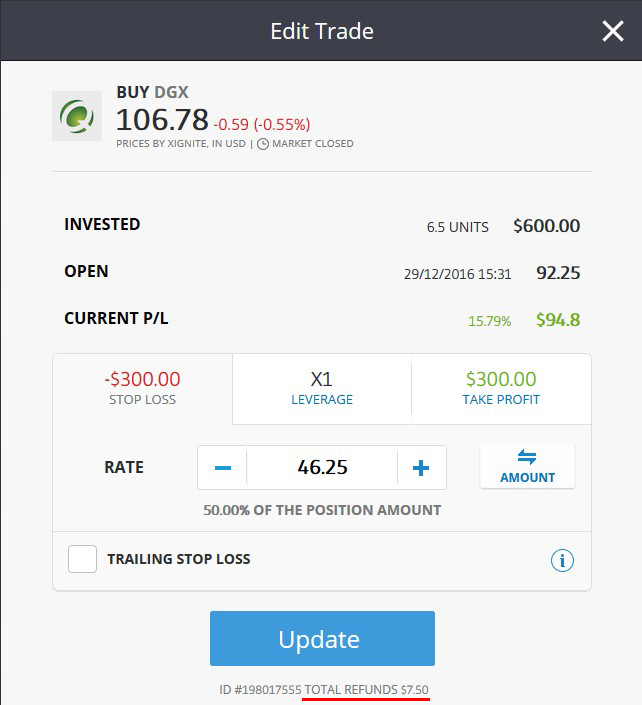

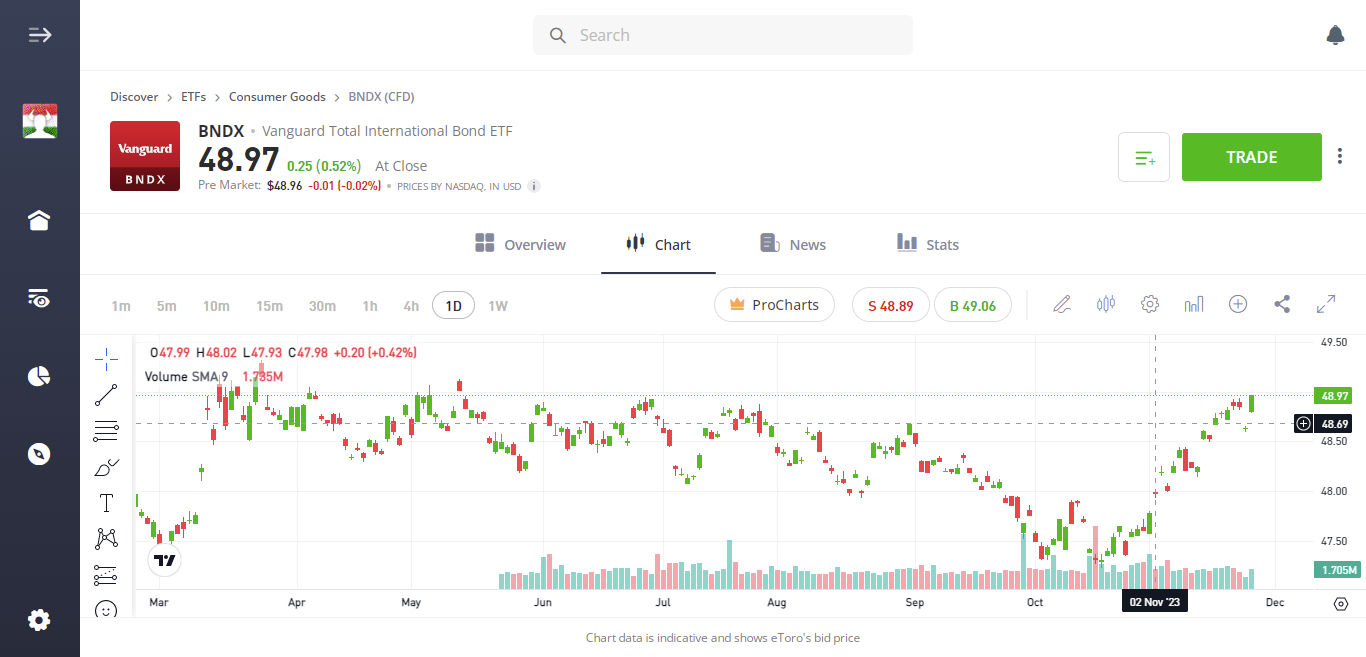

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. eToro offers stocks from over 1,700 companies across a variety of exchanges. While this is less than what brokers like IG or Hargreaves Lansdown offer, it still gives you a decent number of companies to choose from, including some of the best stocks of 2026 . For example, if you want to invest in UK companies like BP, Royal Mail, Tesco or HSBC, you can easily do so with eToro. Additionally, if you want to add other international stocks to your portfolio, eToro also offers a wide range of options. The focus is on US markets. Through the New York Stock Exchange (NYSE) and NASDAQ, eToro provides access to hundreds of well-known US companies. eToro provides access to the following international exchanges: This includes stocks such as Apple , Amazon , Facebook , IBM, Ford Motors, Nike, Disney, Palantir , etc. When it comes to the specific types of stocks you can buy, this includes technology stocks, retail stocks, banking stocks, food and beverage stocks, and even cannabis stocks ! There is also a wide selection of dividend-paying stocks on offer for those looking for a source of passive income. You can track your favorite stocks on eToro’s customizable watchlists. eToro is one of the few UK brokers that allows you to take advantage of ‘fractional ownership’. As the name suggests, this allows you to buy a ‘fraction’ of a share. This is extremely beneficial for a number of reasons. For example, let’s say you’re planning to add some US stocks to your eToro portfolio. Unlike the London Stock Exchange, which prices companies in pennies, US markets are denominated in dollars (as opposed to cents). As such, the stock prices of the most traded companies on the NYSE and NASDAQ can reach hundreds – and often thousands – of dollars. Take Amazon for example – at the time of writing this eToro review, the retail giant’s share price is $3,184. Converted into pounds and pence, this is roughly the equivalent of £2,400. Most of us wouldn’t want to spend that much money on a single stock. Not only would this prevent us from building a diversified stock portfolio, it could also be much more than you plan to invest. However, if you buy Amazon shares on eToro, you only need to invest a minimum of $50, or around £40. In other words, if you invested £40 in Amazon, you would own roughly 1.6% of a single share. This fractional ownership offer is available on over 1,700 stocks on the eToro platform. These allow you to invest in a basket of different stocks with a single investment. Once you invest in an eToro ETF, you don’t need to do anything else until you decide to cash out your investment. This is because the ETF provider buys and sells stocks on your behalf. There are a total of 153 ETFs on eToro across a variety of sectors. eToro primarily offers ETFs from the three largest providers in this segment of the financial sector – Vanguard, iShares and SDPR. This allows you to invest your money in the most popular ETFs worldwide. For example, all three of the above-mentioned providers offer ETFs that track the S&P 500. It is the world’s most traded stock index and tracks 500 large-cap companies listed in the United States. This means that if you invest in the eToro S&P 500 ETF, you are buying shares in 500 different companies with a single investment. If you want to take your diversification strategy to the next level, eToro also offers ETFs that give you access to bonds. For example, the Vanguard Total International Bond ETF contains over 6,000 bonds from different markets. Again, you can invest in an entire basket of assets with just one ETF trade. As for the minimum investment, ETFs can be purchased on eToro from as little as $50. This is important information for investors in Hungary, as most online brokers require a significantly higher amount. Furthermore, if you were to go to the ETF provider itself, companies like Vanguard require a minimum investment of £500. If you want to expand your diversification strategy across a wide range of asset classes, eToro has you covered. Here is a breakdown of what other instruments you can trade on the platform: It is important to note that apart from stocks, ETFs and cryptocurrencies, all other asset classes on eToro are traded via CFDs (Contracts for Difference). This means that you can trade the future value of a given asset without having to store or own it. This is particularly beneficial for exposure to hard assets such as gold, silver or oil. Although you don’t own the underlying asset, eToro CFDs provide two key benefits that traditional investing doesn’t offer – leverage and short selling. Remember that CFDs are complex instruments, and especially when leverage is used, they carry a high level of risk, so before trading with real money, make sure you delve into the subject and thoroughly understand how CFDs work. Leverage allows you to trade with more money than you have in your account. In the case of eToro, the broker complies with all regulations set by the European Securities and Markets Authority (ESMA). Thus, for those residing in Hungary (and throughout Europe), the upper limit of leverage is limited. This is 1:5 for stocks, 1:20 for gold, and 1:30 for major currency pairs. If you trade cryptocurrencies, the leverage can be 1:2, and for non-gold commodities, it can be 1:10. If you’re not familiar with how leverage works on eToro, think of it as essentially multiplying your stake by the factor you choose. For example, let’s say you’re investing in £100 worth of gold. If the price of gold has increased by 10% and you’ve used the maximum leverage of 1:20 – your £10 profit will grow to £200. One of the most popular features of eToro is the ability to short sell. Simply put, this allows you to speculate on an asset that is going down in value. For example, let’s say you do some in-depth research on HSBC shares. Based on the information you’ve gathered, you believe the shares are overvalued. While most eToro investors in Hungary simply avoid buying, astute traders aim to short HSBC shares to profit from falling prices. So, if you were to place a sell order for £500 on HSBC and the share price falls by 20% – your profit would be £100. To do this, you would need to trade the chosen instrument via CFDs.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. One of the most common questions is whether eToro pays dividends. The simple answer is yes – by investing in eToro stocks and ETFs, you will be entitled to dividends as and when the company distributes its dividends. In the case of stocks, the company transfers the dividend paid to eToro. The brokerage then adds this amount to your cash balance. You can then withdraw the money or, better yet, invest it in other assets. This is the best possible way to take advantage of compound interest. In the case of ETFs, providers like Vanguard and iShares typically pay quarterly. This is because the basket of assets makes dividend payments throughout the month – so making individual eToro payments would not be viable. Instead, the quarterly payout covers all dividends received by the ETF provider during that period. In short, ETF dividends appear in your eToro account and can be withdrawn immediately. One of the most important indicators you should look at before joining a UK broker is the fee structure. This does not only include transaction fees, as there may be other applicable fees as well. Therefore, below we provide a full breakdown of the fees you will pay on eToro (eToro fees). If you buy £1,000 worth of shares on eToro, IG or a traditional investment firm such as Hargreaves Lansdown – the fees you will pay are listed below. If you buy £1,000 worth of CFD shares on eToro or MarketsX – the fees you will pay are listed below. There are certain fees you should be aware of when using eToro. In the world of stocks, the spread is the difference between a company’s “bid” and “ask” price. It’s an important concept to understand because it’s the indirect trading fee that you need to factor into your overall return on investment (ROI). eToro does not have a specific structure for spreads as this varies depending on market conditions. In other words, if you trade during normal market hours, you can take advantage of the most competitive spreads. Here’s an example to give you an idea of how much you’ll pay: the bid and ask prices for Royal Mail shares at the time of writing (during normal UK trading hours) are 174.24p and 174.80p. This works out to a spread of around 0.32%. This is actually quite reasonable considering you don’t have to factor in stock trading fees. eToro charges a $10 monthly inactivity fee after one year of inactivity. eToro does not charge a separate deposit fee. However, there is an underlying currency conversion fee that you need to consider. This is because all account balances on eToro are denominated in US dollars. So, if you deposit into your eToro account using a debit card or bank transfer, you will be charged a 0.5% conversion fee. This means that a £1,000 deposit will cost you £5. When it comes to withdrawing funds, eToro charges a flat fee of just $5, which is around £4.

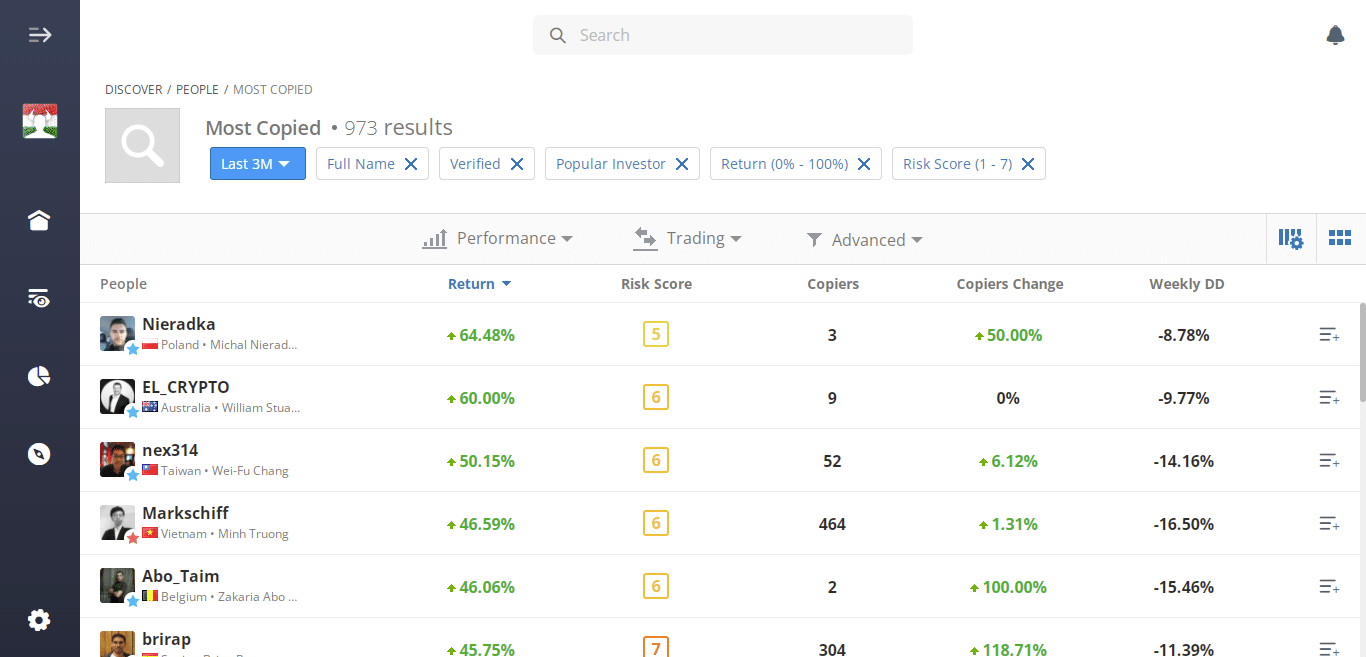

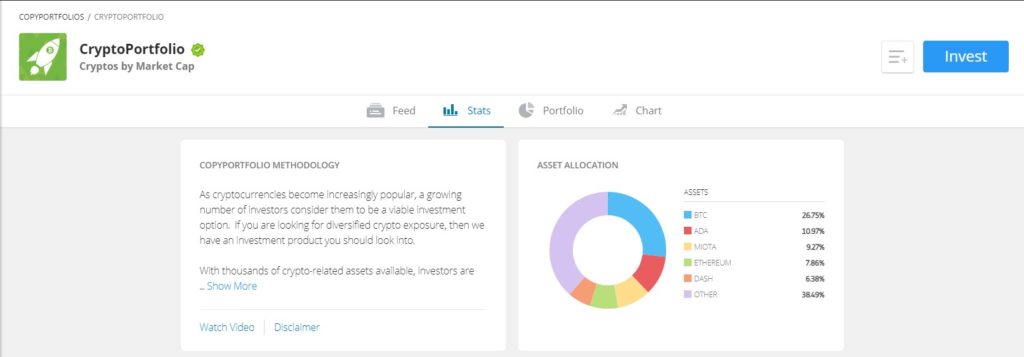

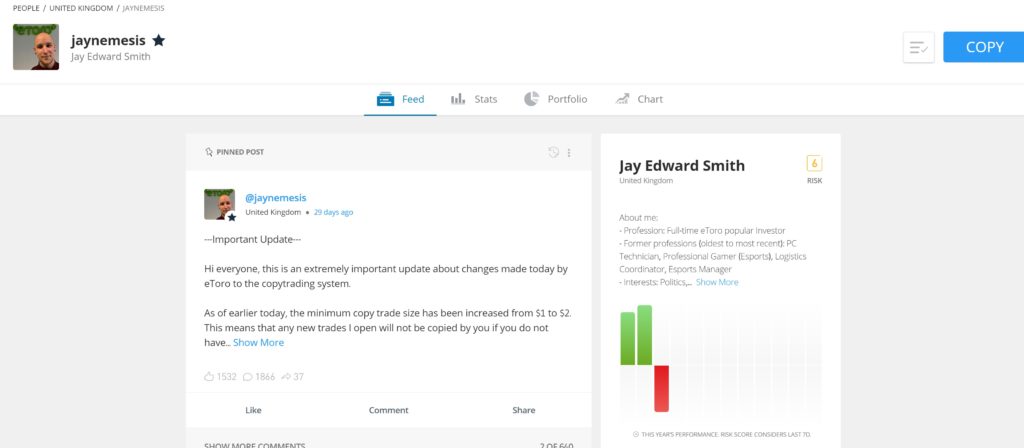

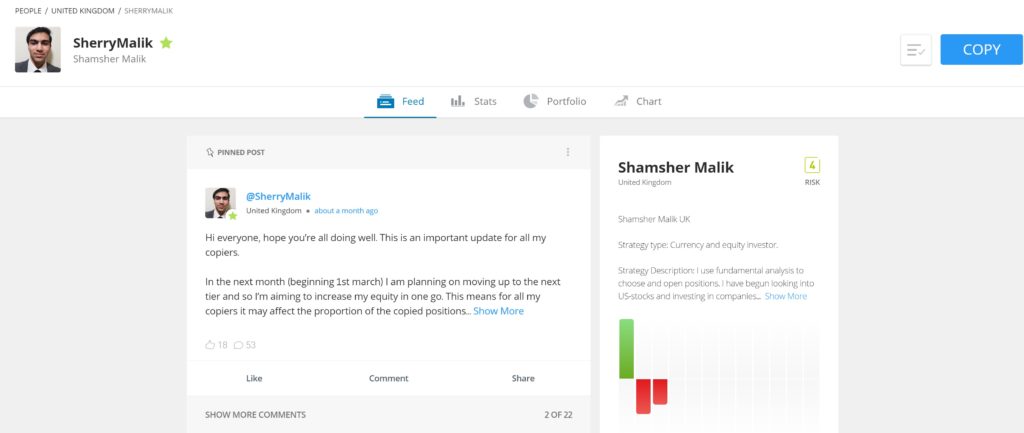

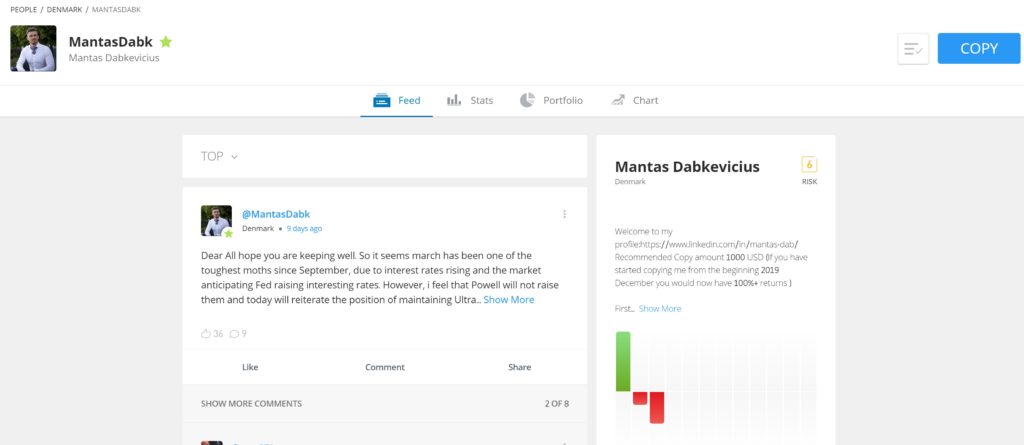

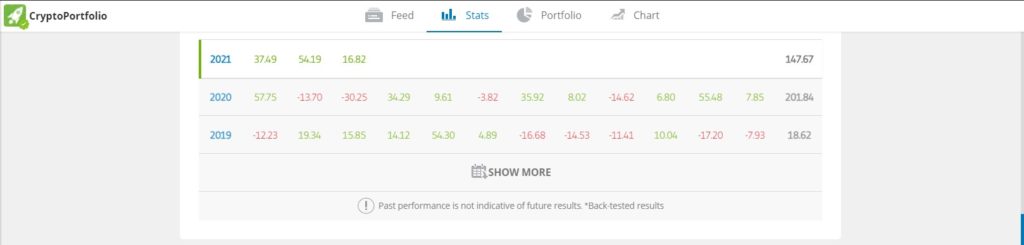

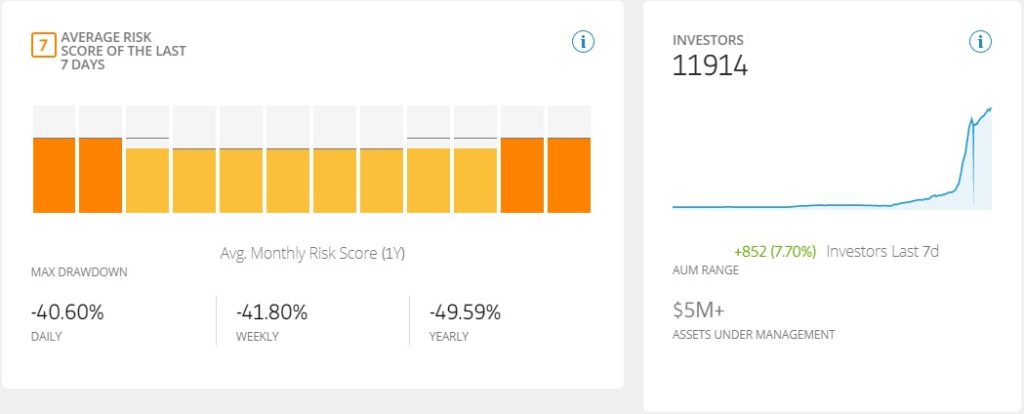

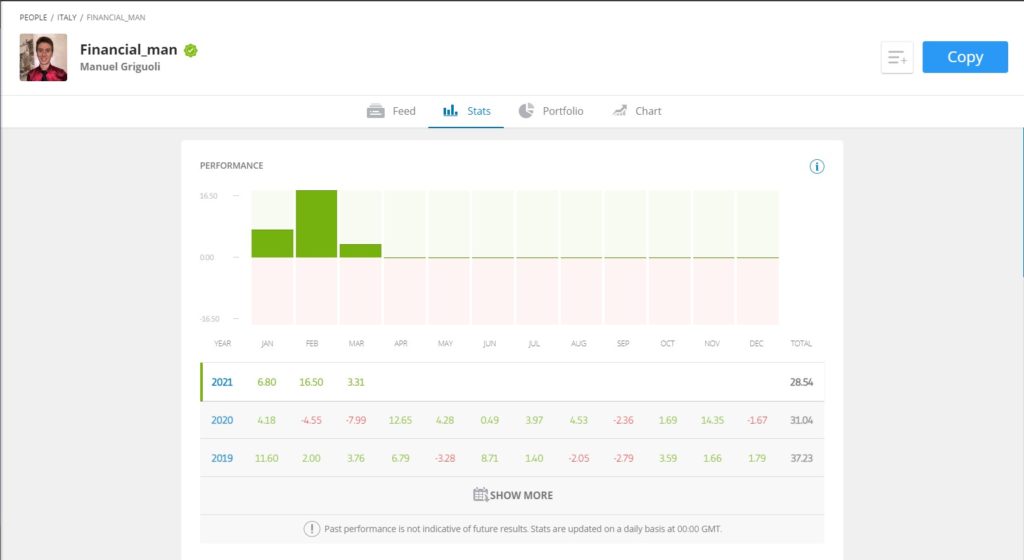

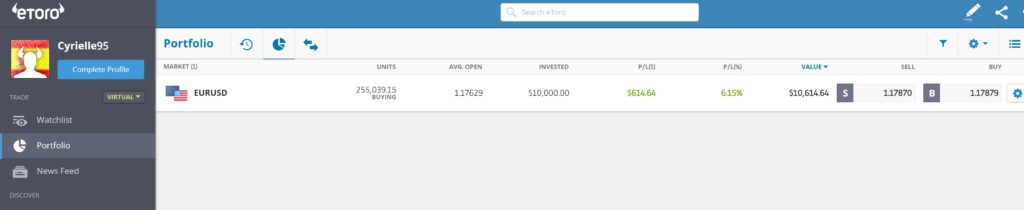

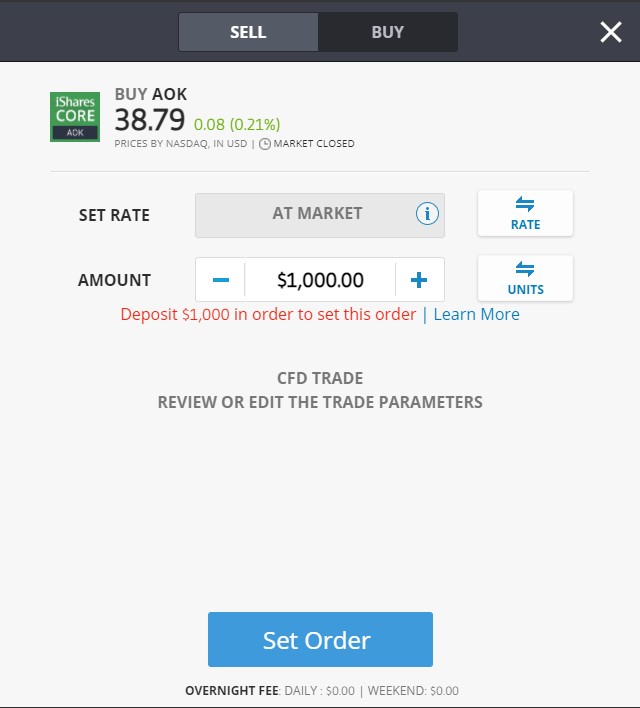

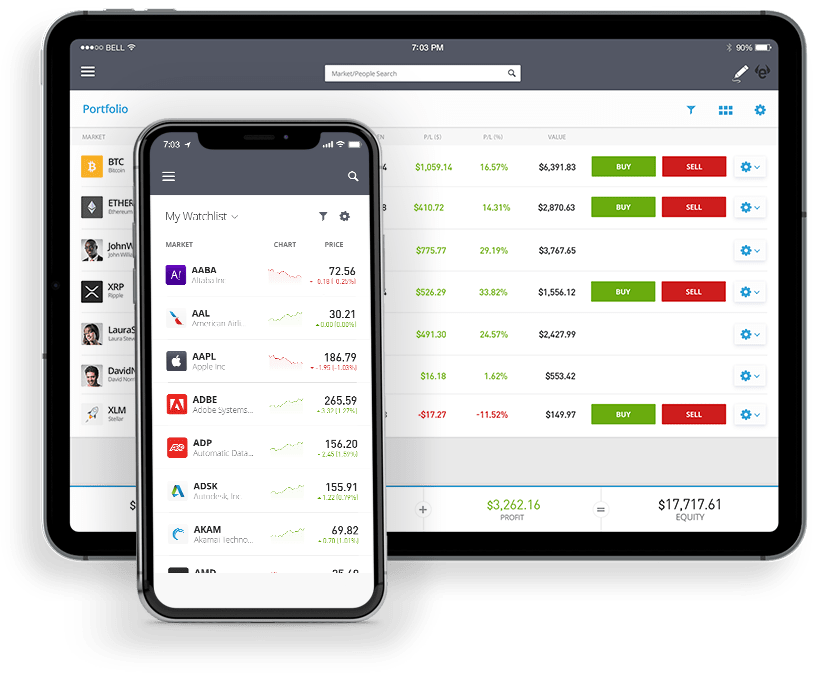

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. When it comes to buying and selling stocks on eToro, the process is extremely simple. You have two options to find your chosen investment. When trading, you still have a number of orders available to you. These include the following: However, if you want to buy shares on eToro and hold them for several years, a market order is probably appropriate. eToro is often referred to as a “community trading platform” – and for good reason. For those new to community trading, it works much like a social media platform, but it’s a space for investing in stocks. Here you can publicly discuss and share your trading ideas, and even get investment advice from your fellow eToro traders in a public setting. For example, let’s say an experienced investor on eToro posts some trading ideas for the coming week. You can not only view the announcement, but also post a response. This is especially useful if you are completely new to the investment arena and want to gain knowledge and skills as you go. You can then add selected eToro members to your “friends list,” which will allow you to follow the user’s activity on the platform. As great as social trading is on eToro, nothing quite beats the copy trading feature. As the name suggests, you can choose a popular trader on eToro and then copy their trades. You can copy the trader’s entire portfolio, as well as all of their future investments, This means that you can essentially invest in stocks without having to do any of the research that would otherwise be required. So if you are a beginner who is learning how to invest in stocks but at the same time wants to invest, you can do so using the eToro CopyTrader . The best part is that you can invest any amount you feel comfortable with – as long as you reach the $200 minimum. There are no additional fees for using the eToro copy trading feature, and you can exit your position at any time. In fact, you can manually cancel individual orders within a portfolio, giving you 100% control over your money. At the time of writing, there are almost 710,000 traders you can copy on eToro. Fortunately, the platform has a full range of filters so you can find a highly qualified trader who not only fits your long-term financial goals, but also consistently delivers profits. To get an idea of what types of considerations you should look for when choosing the best eToro traders to copy, check out the list below: Finding a trader to copy on eToro can be time-consuming. After all, there are thousands of potential investors to choose from. With this in mind, we have listed three below who are among the popular traders in current eToro review Hungarian opinions and foreign lists. Make no mistake – Jay Edward Smith, also known as “Jaynemesis,” is the most popular eToro trader of 2026 . First of all, the trader has achieved a slightly higher than 68% profit for 2020 (as of mid-October 2020). This is unprecedented given the widespread market uncertainty due to COVID-19, and the fact that many stocks are still worth less than their pre-pandemic levels. Even more impressive is that aside from a small 0.57% loss in September 2020 – Jay Edward Smith had closed the previous 14 months with a profit. In 2018, the trader returned just over 52% to investors, which is also a huge number. Taking a closer look at the trader’s portfolio, Jay Edwards Smith has a diversified basket of stocks. It includes everything from Microsoft and Etsy to UPS, Canadian Solar, and Beyond Meat. While 95% of the trader’s portfolio is made up of stocks, he also has a small allocation to Bitcoin and ETFs. Jay Edward Smith previously traded indices and commodities. However, the trader’s eToro risk rating is 5/10, which is higher than the 2/10 score in April 2020. Currently, this highly rated copy trader has over 26,000 followers and manages over $5 million in assets. If you are uncomfortable backing a trader with a risk rating of (5/10) like Jay Edward Smith, you might want to consider copying Shamsher Malik. This British trader specializes in fundamental analysis – he prefers a low-risk approach to investing. Most of the traders focus primarily on stocks and forex. Shamsher Malik holds a position for an average of 2 weeks, which shows that he likes to follow short-term trends. Although the trader has a low risk rating of 3/10 – his returns so far are impressive. For example, in the first 10 months of 2020 alone, Shamsher Malik has achieved a return of 12.32%. Of course, this is much lower than in the case of Jay Edward Smith. However, it is important to mention how the risk/reward ratio works. After all, the more risk the chosen copy trader takes, the more he can expect on the profit side. However, in 2019, the trader achieved even better returns, just over 32% for the year. Shamsher Malik’s drawdown percentage is also impressive – currently averaging 10.45% per year. If you’re interested in shorter-term swing trading, you might want to consider up-and-coming trader Mantas Dabkevicius. The eToro copy trader, known as “Mantasdabk,” based in Denmark, likes to buy and sell assets on a regular basis. In fact, his average trade duration is just a week and a half. Additionally, Mantasdabk opens almost 20 trades per week on average – so he is super active. In terms of asset classes, this eToro copy trader has a 60% exposure to stocks. He also trades everything else, including commodities, forex , cryptocurrencies, and ETFs. This ensures that you can trade 24 hours a day, 100% passively, on multiple markets. In terms of performance, Mantas Dabkevicius only joined the eToro platform traders in December 2019. The trader made 4.85% in his first month and has now recorded a profit of 55.62% so far in 2020. This represents 58.70% of profitable weeks since joining eToro. While such high returns may indicate that Mantasdabk is a high-risk trader, he actually has a very respectable risk score of 4/10. This is lower than his average risk score of 6/10 in March 2020 – which is good. eToro also offers more advanced copy trading tools, such as CopyPortfolios. These are professionally managed portfolios that leverage artificial intelligence and algorithmic trading, and come in two types. Top Trader Portfolios are created by eToro’s top performing traders, while Market Portfolios combine multiple assets under a selected market strategy. In the former category, one of the most popular Top Trader Portfolios available on the platform is “GainerQtr”. This CopyPortfolio is currently just shy of 20% gain in 2020. It achieved just over 14% in the previous year. The portfolio is well diversified, with just over 25% of its weighting being made up of 5 traders. The remainder is spread across a large number of traders from different target markets. While these are more advanced than the standard CopyTrader tool, you will need to invest at least $5,000 into a CopyPortfolio. On the other hand, this is the most passive investment option on eToro, as it handles everything for you. You don’t have to personally choose which investors to copy, nor do you have to worry about constantly rebalancing your portfolio. Market portfolios allow you to target a specific segment of the financial markets. One such example is the “RemoteWork” portfolio. As the name suggests, this provides exposure to companies associated with working from home. Examples include Twilio, Zoom, Shopify, Adobe, Salesforce, etc. This eToro Market Portfolio has performed exceptionally well on the platform since its launch in 2018. Over the past three years, it has achieved 82% (2020 so far), 41% (2019) and 49% (2018) – all extremely high results. Other niche sectors covered by the eToro Market Portfolios feature include renewable energy, autonomous vehicles, mobile payments, food and technology, and gambling. Unlike Top Trader portfolios – which require a minimum investment of $5,000 – some market portfolios are available from as little as $1,000. However, the specific amount depends on the portfolio you choose – you should definitely check this. eToro is a bit lacking when it comes to research and analysis. Although the eToro web platform has integrated its stock research page with the TipRanks platform, it does not provide a lot of information. For example, you can’t view earnings reports, published accounts, or detailed expert analysis. However, you can view a range of analytical data on the selected stock. This includes a number of charts and graphs showing the stock’s past price movements, as well as the general sentiment of leading hedge funds on the stock. As for basic news feeds, this is also a shortcoming of eToro. It is limited to “sharing” news by platform users. Therefore, we advise you to use external sources for your research, such as Yahoo Finance or Morningstar . Both the investment app and the mobile browser-based versions allow you to perform the same account operations as on the main desktop website. Whether it’s buying and selling shares, checking the value of your portfolio, or depositing and withdrawing funds (eToro withdraw) – you can do it all easily from your mobile phone. It is crucial that the trading experience is not hindered by the smaller screens of the eToro mobile app. This is because the app is fully optimized for mobile use – making the process of investing remotely seamless. If you are looking to take your investing to the next level – we recommend that you take full advantage of the possibilities offered by the eToro app. For example, you can check the value of your stock positions with the click of a button, no matter where you are. You can make last-minute investments – you don’t have to wait until you get home. This is true even when it comes to closing a losing position. After all, waiting hours to access your desktop tool can be extremely expensive. If you want to gain experience and practice trading on eToro before risking your own money, you can do so using the eToro demo account. This provides you with $100,000 worth of paper money to trade with and offers the full functionality of the eToro platform, including trade copying tools – making it a great way to get to know the platform.

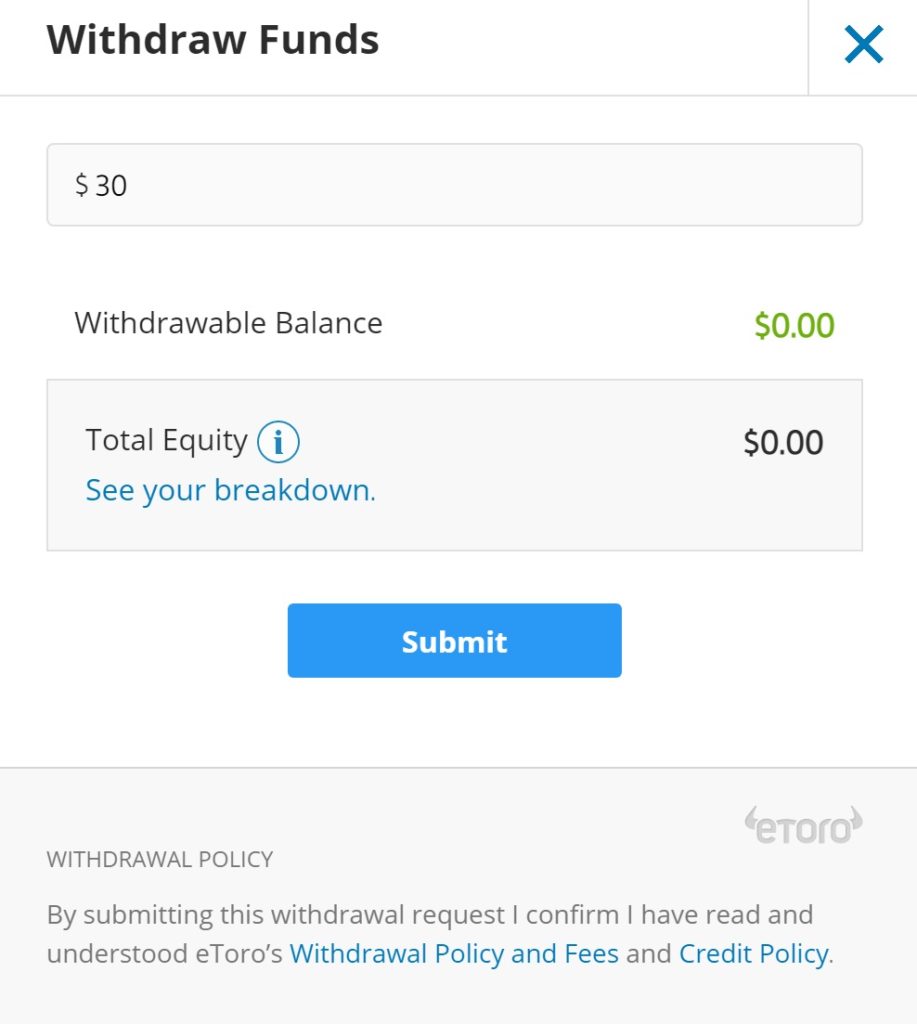

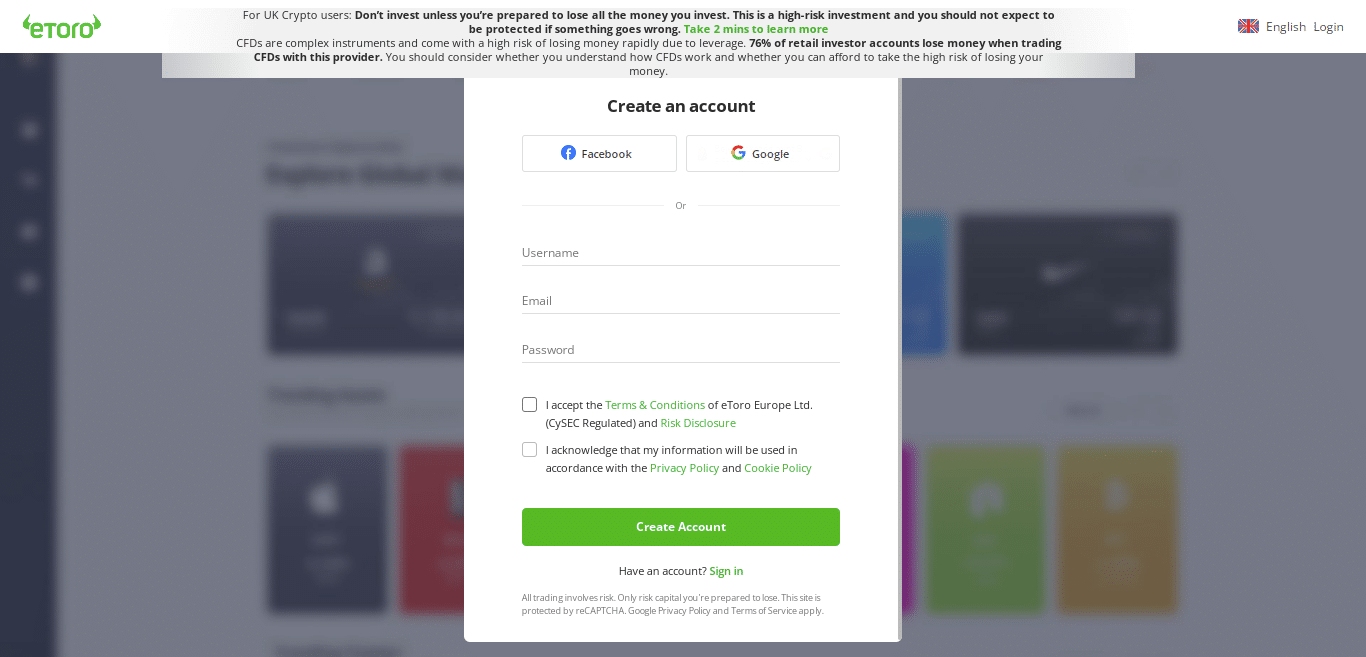

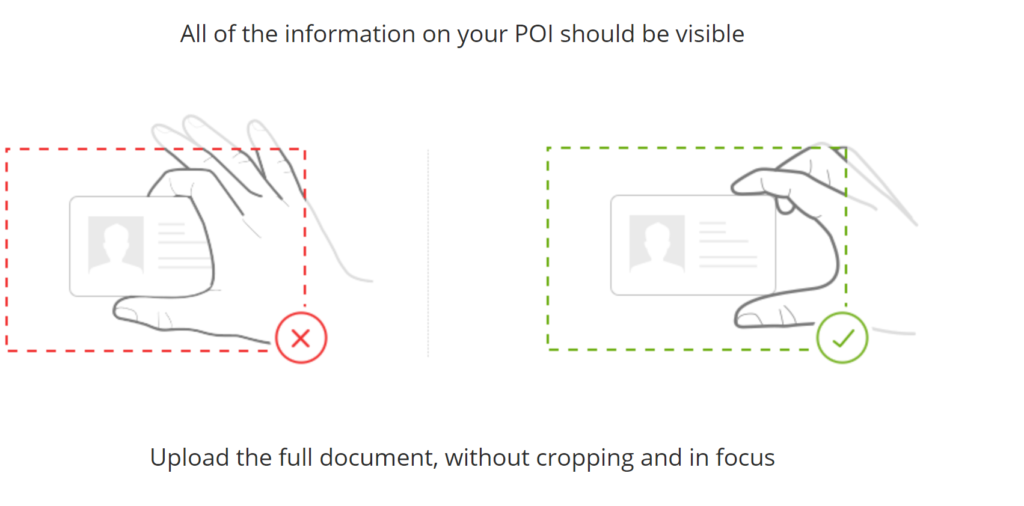

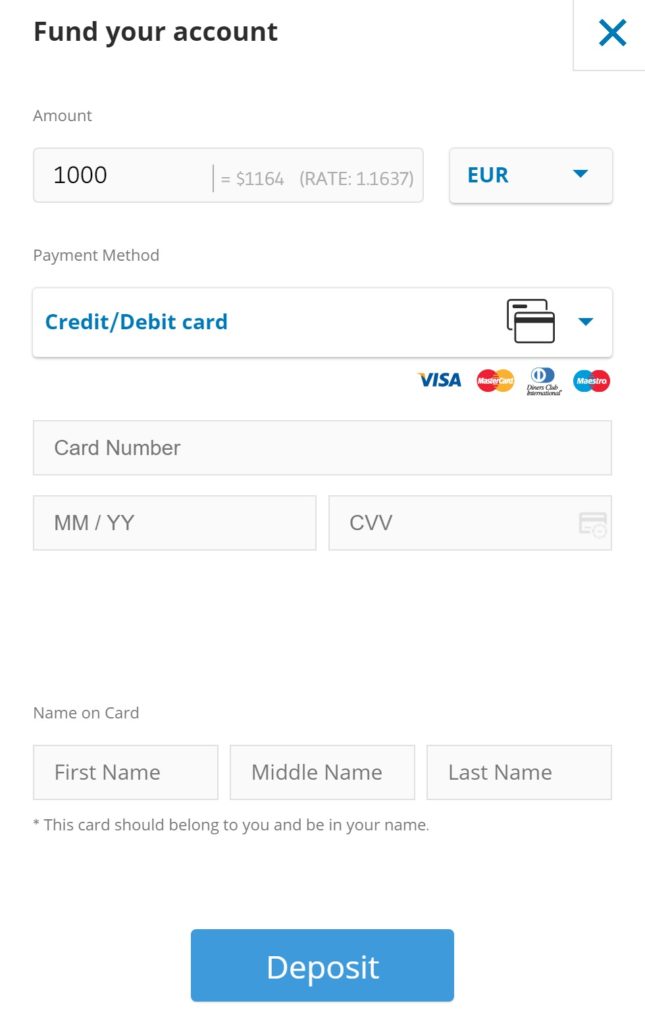

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. eToro offers two payment methods. These are: The above payment methods offer much more flexibility, as many traditional brokers in the UK only allow you to deposit funds via bank transfer. Degiro is a good example of this – the end-to-end deposit process can often take days. This can be frustrating if you want to buy shares immediately. However, with eToro, as long as you use a debit card to deposit – your money will be credited instantly, allowing you to start investing immediately. As for the minimum account amount, eToro requires a minimum deposit of $200, which is around £160. You’ve probably noticed that everything on eToro is denominated in US dollars. This is because the platform offers over 1,700 stocks across 17 international markets. By sticking to one currency, you don’t have to worry about constant exchange rate fluctuations. For this reason, eToro charges a 0.5% conversion fee on all your deposits. So, if you deposit in GBP, EUR, AUD or any other currency other than USD, you will have to pay a small fee. For example, if you deposit $1000 – the fee is $5. When it comes to withdrawing funds, the process is incredibly simple. Simply go to your account dashboard, select withdrawal and enter the amount you wish to withdraw. In accordance with UK anti-money laundering legislation, you must at least return the deposit amount to the source of your funding. Let’s say you deposit $500 with your bank card and withdraw $600. Of the amount in your withdrawal request, you must send at least $500 to the same bank card you previously used to make the deposit – while the remaining $100 can be sent to a different source. The minimum withdrawal amount from the platform is $30. All withdrawal requests are subject to a flat fee of $5 (eToro withdrawal fees) – this fee is independent of the amount. It should also be noted that eToro charges a 0.5% currency conversion fee on withdrawals. This is based on the GBP/USD exchange rate at the time of the withdrawal request. While the number of shares available for trading and the stock trading fees are extremely important indicators to look out for when choosing a broker, you should also check the regulatory status of the platform. This will ensure that you are using a reputable and trusted broker with whom your money is safe. Many people ask if eToro is legal. We will find the answer in the lines below. In the case of eToro, the platform is licensed by two regulatory authorities: In addition to its regulatory licenses, it is important to highlight that eToro has been active in the field of online stock trading since 2007. This represents over 14 years of proven activity. As we noted earlier, this includes a customer base that has now exceeded 12 million people. In summary, you don’t have to worry about your funds when they are with eToro. If you like what eToro has to offer and would like to open a stock account today, you can find the steps below. First , visit the eToro website and open an account. This will require some personal information. This includes your name, address, date of birth, and contact information. You will also need to provide your national social security number. eToro needs to verify that you are the real owner of your account. To do this, you will be asked to upload some supporting documents. These include the following: eToro usually verifies your documents within an hour. In the meantime, you can go ahead and fund your account. Depositing money to eToro is easy. You just need to choose which payment method you want to use (see above for a list of options) and then enter the amount you want to deposit. The minimum deposit is $200 (around £160). Unless you choose a bank transfer, your deposit will be credited to your account immediately. Once you have registered and logged into eToro and have made a deposit into your account, you can go ahead and buy shares. If you know which company you want to invest in, type it into the search box at the top of the page. To browse the eToro stock library, click on the “Market Trading” button, then “Stocks”. You can filter this by exchange or sector to find related stocks. In our example, we want to buy Nike shares, so we enter this in the search box and click the “Trade” button. Next, we just need to determine how much we want to invest. As we noted earlier, this must be in US dollars. You can invest a minimum of $50 in the stock of your choice, which is approximately £40. To complete an order for a stock, click the “Open Trade” button during market hours or the “Set Order” button if the relevant exchange is currently closed. Of course, we are not the only publication to review eToro. As one of the most popular stock brokers in the UK, it has been reviewed by a number of online sources. If you look at some other eToro reviews, you will see that most of them say similar things to us, so you know that eToro is indeed a quality platform for trading and investing. In summary, it’s clear why eToro has amassed over 12 million investors. There are also no annual fees to consider, and you can pay with your credit card or bank account. For those looking for more sophisticated trading, eToro also supports leverage and short selling. This is available for over 1,700 stocks, as well as indices, cryptocurrency trading , bonds, eToro forex and commodities trading. Overall, eToro is ideal if you want to invest in the stock markets in a safe and cost-effective way. Like what you read about eToro? Simply click the link below to register for an account today!

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Péter a Tradingplatforms írója, elemzője és befektetője aki Győrben él. Tapasztalt piaci elemző, aki aktívan kereskedik, és több mint 10 éves tapasztalattal rendelkezik a pénzügyi piacokon. Szakterülete a napon belüli kereskedés és a hosszú távú befektetés különböző eszközosztályokban. Péter érdeklődése és elkötelezettsége a pénzügyi piacok bonyolultságainak megértése iránt már fiatalon kibontakozott, és élete során ez vált a pénzügyi piacok mélyebb megértésének elkötelezett elérésévé. Pter jártas a Forex és a részvénybefektetések bonyolult világában, és éles észrevételeivel tűnik ki. Szenvedélye, mellyel a pénzügyi piacok összetettségeit megfejti, mind a kereskedési, mind az írói területen nyilvánvaló. Munkáiban Péter megosztja tudását, és bonyolult pénzügyi fogalmakat tesz hozzáférhetővé a szélesebb közönség számára. Újabban a kriptovaluta piacok is érdeklik. FIGYELMEZTETÉS: Az ezen az oldalon található tartalom nem tekinthető befektetési tanácsadásnak, nem vagyunk felhatalmazva befektetési tanácsadás nyújtására. Ezen a weboldalon semmi sem minősül egy adott kereskedési stratégia vagy befektetési döntés jóváhagyásának vagy ajánlásának. A weboldalon található információk általános jellegűek, ezért az információkat az Ön céljainak, pénzügyi helyzetének és igényeinek fényében kell mérlegelnie. A befektetés spekulatív jellegű. Befektetéskor a tőkéje kockázatnak van kitéve. Ez az oldal nem használható olyan joghatóságokban, ahol a leírt kereskedés vagy befektetések tiltottak, és csak olyan személyek és olyan módon használhatják, ahogyan az jogilag megengedett. Előfordulhat, hogy az Ön befektetése nem felel meg a befektetői védelem feltételeinek az Ön lakóhelye szerinti országban, ezért kérjük, végezze el saját kutatásátt, vagy szükség esetén kérjen tanácsot. Ezt a weboldalt ingyenesen használhatja, de előfordulhat, hogy jutalékot kapunk az általunk bemutatott vállalatoktól. A weboldal további használatával elfogadja az általános szerződési feltételeinket és az adatvédelmi szabályzatunkat. Cégjegyzékszám: 103525 © tradingplatforms.com Minden jog fenntartva 2023

eToro Reviews 2026 – Registration and Account Opening

What is eToro? – eToro Reviews

eToro stock – What stocks can be bought on eToro?

Fractional Shares on eToro

eToro ETFs

eToro Trading – Other Instruments at eToro

eToro Leverage

eToro Short Selling

eToro Dividends – What about dividend payments?

eToro Reviews – eToro Fees and Commissions

Buying £1,000 worth of shares on eToro vs. other UK brokers

eToro

IG

Hargreaves Lansdown

International stocks

1 pound

0 or £10

£11.95 or 1% (min. £20 / max. £50)

Buying £1,000 worth of CFDs on eToro for 1 week vs. other UK brokers

eToro

MarketsX

S&P 500

£1.20

£1.30

Europe 50

£1.35

£1.25£

Apple

£3.15

£3.20£

Other awards

Spread

Inactivity fee

Deposit fees, withdrawal fees

eToro Stocks, Share Dealing Platform

Share orders

eToro opinions, or full eToro review

Stock buying, social and copy trading

eToro Copy Trading

eToro trader copy – who to copy on eToro

eToro review – eToro copy

Jay Edward Smith – Jaynemesis – top rated trader with 68% return (2020 so far)

Shamsher Malik – ShamsherMalik – Low Risk Stock and Forex Trader (55% Profit in 2020 So Far)

Mantas Dabkevicius – Mantasdabk – emerging swing trader (55% profit so far in 2020)

Portfolio copying

Top Trader Portfolios

Market portfolios

Charts, research and analysis on eToro

eToro Reviews – Mobile Trader

eToro Demo Account

eToro deposit

eToro Withdrawals

Is eToro safe?

Using eToro – first steps

Step 1: Open an account

Step 2: Verify your identity

Step 3: Deposit

Step 4: Buy shares

eToro Review: Pros and Cons

Advantages

Disadvantages

eToro reviews Hungary

eToro Review – Summary

eToro – the number one recommended UK stockbroker

eToro Reviews – Frequently Asked Questions

Can you really make money on eToro?

What are the eToro fees in Hungary?

Is eToro legal?

Which countries is eToro available in?

Is eToro suitable for beginners?

Is eToro really free?

What stocks can be traded on the eToro platform?

What is the minimum deposit on the eToro platform?

eToro withdrawal: How to withdraw money from the eToro platform?

Does eToro accept Paypal?

Varga Péter

Pénzügyi szakértő

Varga Péter

Pénzügyi szakértő