Libertex Vélemények 2026 – Előnyök és hátrányok feltárva

If you are looking to trade CFDs online – perhaps because you want access to more sophisticated markets or want to use leverage – you may want to consider Libertex. Read Libertex reviews!

This CySEC-regulated trading platform offers access to a wide range of CFD asset classes – including stocks, indices, cryptocurrencies , ETFs and commodities. One of the main attractions of Libertex is that you can trade without paying a spread.

Is Libertex the right CFD trading platform for you? That’s exactly what we want to find out in this Libertex review summary. We’ve gathered all the essential information about tradable assets, fees, payment methods, tools, features and security.

Once you know that you want to trade with this broker, it only takes four simple steps to start trading.

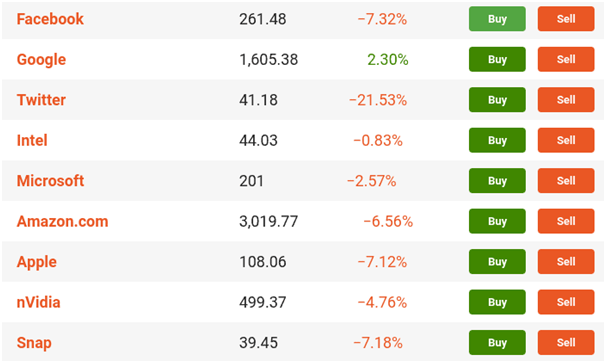

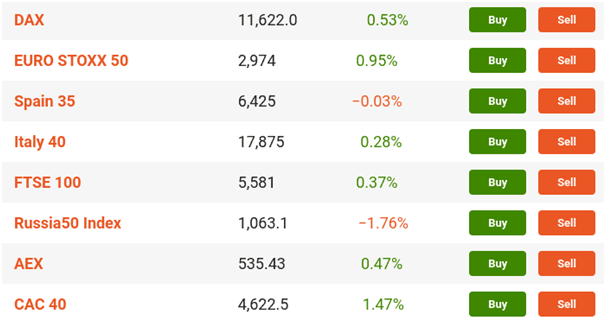

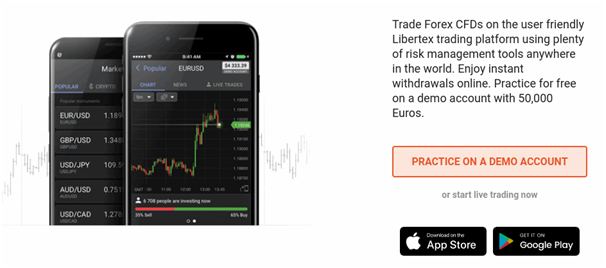

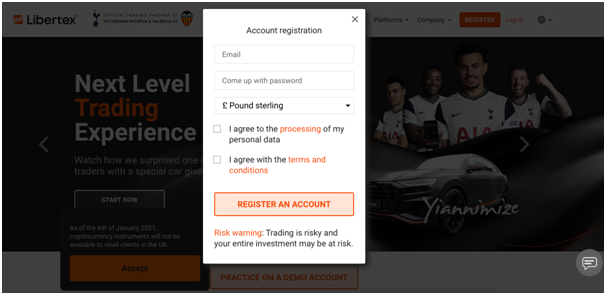

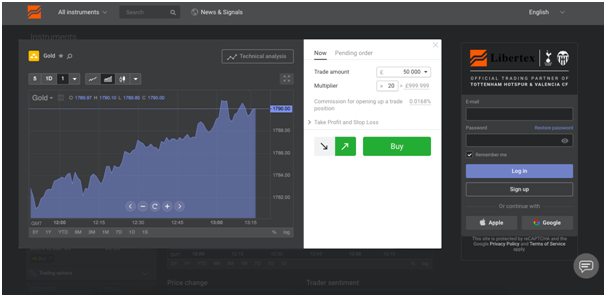

85% of retail investor accounts lose money when trading CFDs with this provider. Unlike many of its industry competitors, Libertex doesn’t offer an overwhelmingly broad range of services with thousands of financial instruments. Instead, the platform has decided to focus on a few niche asset classes – covering just 213 markets. This includes a decent selection of stocks, ETFs, forex , cryptocurrencies, commodities, etc. You can trade every financial instrument at Libertex with leverage. This is capped at 1:30 if you live in Hungary and are a retail client. If you are a professional trader, you can get leverage of up to 1:600. This means that a £100 account balance gives you access to £60,000 worth of trading capital. As for the stock trading account itself – Libertex offers two options. For those who are more interested in a user-friendly trading experience, free from the “chills” of advanced tools, the Libertex web trader is probably more suitable. However, if you already have a lot of experience in the online trading scene and want to use technical indicators, drawing tools, customized screens, and even automated robots – you can also trade via MT4 . Learn about Libertex reviews, FAQs by reading our Libertex review article! First of all, it is important to note that you cannot buy shares at Libertex. On the contrary, you will be trading share CFDs here. This means that you are trying to predict whether the price of a particular share will rise or fall in the short term. Crucially, the CFD instrument you trade with Libertex is not the stock itself, so you do not have any legal rights in the stock. However, as we will explain in more detail below, this comes with the added benefits of really low trading fees, buy and sell transactions and the use of leverage. Libertex offers a total of 50 stock CFD markets. These are mainly major blue-chip stocks listed on the New York Stock Exchange and NASDAQ. For example, you can trade Tesla , Facebook, Amazon and Apple stock CFDs. There are also a number of stocks available from the UK, European and Latin American markets. As for the sectors covered by Libertex stock CFDs, they include everything from cannabis stocks and technology stocks to pharmaceutical stocks and retail. Libertex is well-known in the online forex trading world. The platform offers most major and minor pairs – such as EUR/USD, GBP/USD, USD/JPY and USD/CAD. While it is industry standard for an online forex broker to offer the most popular trading pairs on the market, what we really like about Libertex is that you can also trade a variety of exotic pairs. These are simply forex pairs that include at least one emerging market currency. These include the Mexican peso, Singapore dollar, Turkish lira, South African rand, etc. These exotic currencies can be traded against major currencies such as the USD, EUR, or GBP. In addition to forex, you can also trade commodities with Libertex. This includes the three main energy categories, heavy metals, and agricultural products. Here are the specific commodities you can trade on the Libertex platform: While most commodity brokers in Hungary focus only on the main oil, gas and gold markets – as you can see from the above, Libertex offers more than that. If you also want to access the index trading scene, you will be happy to know that Libertex offers a wide range of such markets. The main index markets are: You can also get access to a number of less liquid stock market indices, such as: Libertex also offers access to 10 ETF trading markets in Hungary. This is quite a few options compared to what other CFD brokers offer. Most ETFs are supported by iShares, while there is also a market for Vanguard SPDR. Libertex claims to offer an industry-leading pricing structure, so we have taken a detailed look at the fees you will pay when trading on the platform. Be sure to read the following sections and make sure you know exactly what you will be paying when using Libertex. A standout feature in terms of pricing is the broker’s zero spread offer. This is something we haven’t seen before in the CFD trading market, as spreads are charged by platforms of all shapes and sizes. For those who don’t know, the spread charged by brokers is simply the difference between the bid and ask price. For example, if the spread is 0.4%, this means that you need to make at least 0.4% profit to break even on the trade. In other words, when you trade online, you always start the trade with a small loss due to the spread. So the fact that you can trade with zero spread at Libertex is good news for your potential profit. One of the main problems with Libertex is that the commission system it charges is not transparent enough. By this we mean that we had to do some serious searching to find the information we needed. This is not nice, as the best online trading sites typically publish the commissions they charge crystal clear. However, here’s the gist: Although there are now many commission-free CFD brokers serving traders in Hungary, it is important to note that you will always have to pay a spread. While Libertex does not have a spread, they do charge a commission. Therefore, when choosing a platform, you should consider both trading costs, as this is the only way to get a clear idea of whether a platform’s offer is competitive. While spreads and commissions have the biggest impact on a trader’s wallet, there are a number of other costs you should consider before joining Libertex. These include the following: The good news is that Libertex allows for free deposits. As we briefly mentioned earlier, Libertex offers two trading platforms – MT4 (in our opinion, it is the best MT4 broker) and its own proprietary web trader. MetaTrader 4 (MT4) If you are an experienced trader, you are familiar with MT4 and the many features and tools that the platform offers. For those who are not familiar, it is a third-party trading platform that sits between you and Libertex. On the platform, you have access to a wide range of technical indicators and charting tools. The trading screen is fully customizable and best of all, you can install automated forex robots. MT4 is available directly from the Libertex website, and you can download the MT4 Mac version. However, to get the most out of the platform, consider downloading the software to your desktop device. If you are a new trader, you may find MT4 a bit overwhelming. This is because the sheer volume and depth of the platform’s features and tools can be daunting for a beginner. If this is the case, we recommend using the Libertex web trader. This is an online platform designed and maintained by Libertex. You don’t need to install any software, as everything is accessible through your standard browser. The Libertex web trading platform offers a seamless and seamless experience in every way, perfect for those with little experience. You can easily find your chosen market by using the filters or simply searching. Like most CFD brokers in this space, Libertex offers a full-fledged stock trading app. The app works on both Android and iOS devices – so you can always have the perfect trading experience at your fingertips. The Libertex app is accessed securely from the website. You will then be redirected to the appropriate Google Play or Apple Store where you can complete the download. It is also worth noting that you can access your Libertex account on the go via the MT4 app. All you need to do is install the MT4 app and log in with your Libertex credentials. One of the best features of Libertex is that you can access the demo account service whenever you want. On the one hand, this is great if you are completely new to online trading. After all, the demo account – which comes with a pre-loaded “paper money” balance of €50,000 – allows you to trade in a 100% risk-free environment. It’s also great that the demo account service mirrors real trading conditions. This way, you can experience how the financial markets work before you jump into trading with real money. On the other hand, the Libertex demo account is also useful for experienced traders, as it allows them to try out new trading strategies and systems. Specifically, it allows you to try out a new forex or CFD robot via MT4 without risking your trading capital. If you are looking for an online trading platform that offers a lot of in-house research, Libertex will not be the right choice. Although there is a basic news section on the website, articles and opinions are only sporadically featured here. The website also lacks financial commentary. They offer an economic calendar, but very little else. When it comes to technical analysis, Libertex provides all the tools you could need. This includes a large number of technical indicators that are available on the Libertex web trading platform and MT4. Like most CFD trading sites, Libertex offers leverage on all markets. While you may find the 1:600 leverage offered by the platform attractive, this is only available to professional traders. If you are an everyday retail trader living in Hungary or Europe, the limits set by ESMA are the upper limit for leverage. This means that 1:30 leverage is the highest you can get when trading major forex pairs. For minor/exotic forex pairs and gold, the maximum leverage is 1:20. Stocks can be traded with 1:5 leverage and cryptocurrencies with 1:2 leverage. When it comes to making deposits and withdrawing money from Libertex, the broker supports a range of payment methods. These include the following: Please note that Libertex does not charge any fees for deposits, regardless of the payment method. Apart from traditional bank transfers, all of the payment methods listed above are processed instantly. This means you can start trading immediately and without delay. When it comes to withdrawing funds, the processing time at Libertex depends on the payment method used. For example, e-wallets such as Skrill and Neteller are the fastest, with Libertex typically processing these payments in less than 24 hours. Once this happens, the funds will be credited to the corresponding e-wallet within a few seconds. E-wallet withdrawals are also free. If you choose bank/credit card withdrawal, the processing time can take 1-5 days. There is a low fee of 1 euro. Bank transfer processing takes 3-5 days and incurs a 0.5% fee (min. 2, max. 10 euros). Libertex offers a number of channels for contact. The easiest way to speak to an advisor in real time is to use the live chat feature. There is also a Whatsapp number and Facebook Messenger link that you can use. If you would like to speak to a member of the Libertex team by phone, call them on +357 22 025 100 (Cyprus number). If you would like to reach Libertex by email, contact them at [email protected]. The help and customer service section also includes a fairly comprehensive FAQ section where you can find the answer to your question without having to contact Libertex. Libertex is fully licensed by the Cyprus Securities and Exchange Commission (CySEC). This in itself ensures that Libertex has to meet strict regulatory requirements. For example, all new account holders must verify their identity before any withdrawals can be made. This ensures that you can trade in a safe and secure environment. In addition, CySEC regulated brokers must keep client funds in bank accounts that are separate from their own. When using Libertex, you also benefit from the investor protection scheme. For CySEC regulated brokers – this is €20,000 or 90% of the claim amount – whichever is lower. If you are ready to trade with the CySEC-regulated Libertex broker and pay zero spreads when trading CFDs on stocks, cryptocurrencies, indices, forex, etc. , follow our detailed Libertex review guide below. Opening an account with Libertex is really easy. Just click on the “Register” button on the broker’s homepage and fill in some personal details. The broker also wants to know more about you, so you will also have to fill out a short questionnaire. This includes questions about your job, trading experience, etc. As Libertex is a CySEC regulated broker, you are required to adhere to strict anti-money laundering regulations and verify your identity. These documents can be easily uploaded via the client portal. You only need the following two documents: Authentication is a simple process, so you can start trading in just a few minutes! Libertex only requires a deposit of €100. You can fund your account free of charge in various ways, such as: With Libertex you can trade CFDs on a wide range of markets covering stocks, cryptocurrencies, indices, forex, commodities, etc. The Libertex trading platform is easy to use and has many interesting features. Once you have selected the market you wish to trade, you can simply open a buy or sell trading ticket. Here you can set leverage, add stop loss or take profit levels to your order, and view the chart of the market you are trading. This page also details the trading commission, which is clear and transparent, and includes the zero spread offer. Libertex, founded in 1997, has been providing CFD services for some time. It offers quite a few markets, only 213, although most of the most traded asset classes are available. You can deposit money into your account with the broker instantly and for free, and enjoy zero spreads on all markets. We like that you can choose between the MT4 or Libertex web trading platforms, and you can also access your account via the broker’s own mobile app. Overall, Libertex ticks most of the important boxes when it comes to CFD trading. If you would like to open an account now, simply click the link below!

85% of retail investor accounts lose money when trading CFDs with this provider. Péter a Tradingplatforms írója, elemzője és befektetője aki Győrben él. Tapasztalt piaci elemző, aki aktívan kereskedik, és több mint 10 éves tapasztalattal rendelkezik a pénzügyi piacokon. Szakterülete a napon belüli kereskedés és a hosszú távú befektetés különböző eszközosztályokban. Péter érdeklődése és elkötelezettsége a pénzügyi piacok bonyolultságainak megértése iránt már fiatalon kibontakozott, és élete során ez vált a pénzügyi piacok mélyebb megértésének elkötelezett elérésévé. Pter jártas a Forex és a részvénybefektetések bonyolult világában, és éles észrevételeivel tűnik ki. Szenvedélye, mellyel a pénzügyi piacok összetettségeit megfejti, mind a kereskedési, mind az írói területen nyilvánvaló. Munkáiban Péter megosztja tudását, és bonyolult pénzügyi fogalmakat tesz hozzáférhetővé a szélesebb közönség számára. Újabban a kriptovaluta piacok is érdeklik. FIGYELMEZTETÉS: Az ezen az oldalon található tartalom nem tekinthető befektetési tanácsadásnak, nem vagyunk felhatalmazva befektetési tanácsadás nyújtására. Ezen a weboldalon semmi sem minősül egy adott kereskedési stratégia vagy befektetési döntés jóváhagyásának vagy ajánlásának. A weboldalon található információk általános jellegűek, ezért az információkat az Ön céljainak, pénzügyi helyzetének és igényeinek fényében kell mérlegelnie. A befektetés spekulatív jellegű. Befektetéskor a tőkéje kockázatnak van kitéve. Ez az oldal nem használható olyan joghatóságokban, ahol a leírt kereskedés vagy befektetések tiltottak, és csak olyan személyek és olyan módon használhatják, ahogyan az jogilag megengedett. Előfordulhat, hogy az Ön befektetése nem felel meg a befektetői védelem feltételeinek az Ön lakóhelye szerinti országban, ezért kérjük, végezze el saját kutatásátt, vagy szükség esetén kérjen tanácsot. Ezt a weboldalt ingyenesen használhatja, de előfordulhat, hogy jutalékot kapunk az általunk bemutatott vállalatoktól. A weboldal további használatával elfogadja az általános szerződési feltételeinket és az adatvédelmi szabályzatunkat. Cégjegyzékszám: 103525 © tradingplatforms.com Minden jog fenntartva 2023

Start trading with Libertex in 4 easy steps!

What is Libertex?

Founded in 1997, Libertex is an online CFD trading platform with over two decades of experience. The provider says it operates in 110 countries and has over 2.2 million clients. This number includes both everyday retail clients and professional investors.

What stocks can be bought on Libertex?

Libertex Forex Trading

Libertex Review – Commodity Trading

Libertex Review – Index Trading

Libertex Review – ETF Trading

Libertex fees and commissions

Libertex Review – Zero Spreads

Libertex Review – Trading Commissions

Libertex Review – Other Fees You Should Consider

Libertex platform and trading tools

Libertex web trader

Libertex application

Libertex demo account

Libertex Review – Research and Analysis on Libertex

Libertex opinion – leverage

Depositing and withdrawing at Libertex

Libertex Review: Customer Service

Is Libertex safe?

Libertex Review – Pros and Cons

Advantages

Disadvantages

Join Libertex today – step by step guide

Step 1: Open an account

Step 2: Verify your ID document

Step 3: Deposit

Step 4: Market selection

Step 5: Trade!

Libertex Review – Summary

Libertex – leading CFD broker with low fees

Libertex Frequently Asked Questions – FAQ

”Is

”Does

”What

”Does

”How

Varga Péter

Pénzügyi szakértő

Varga Péter

Pénzügyi szakértő