Mit jelent a copy trading? Hogyan fektessünk számlamásoló portfólióba?

If you are a novice investor and simply have no idea how the world of stocks and dividends works, you may want to consider an ETF or mutual fund. This is because the provider buys and sells stocks on your behalf. However, a somewhat new phenomenon has recently emerged that may be appealing – copy trading.

Would you like to know more about what copy trading is in a nutshell? Copy trading allows you to “copy” the trades of other investors on the platform you are using. This gives you the chance to make money on the stock markets without having to research which companies to invest in. Instead, the entire process is passive.

In this guide, we’ll explain the ins and outs of copy trading, how it works, and whether it’s suitable for your long-term investment goals.

As with most online investment solutions these days, the process of copy trading is actually relatively simple. Whether it’s crypto account copying or bitcoin account copying or anything else, the gist is the same:

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. In its simplest form, copy trading does exactly what the name suggests. It copies the trades of another investor. This allows you to actively trade the stock markets without having to know how things work. This also means that you benefit from the expertise of that trader, as every decision is made on your behalf. Best of all, the copied trader will be investing with their own capital – so you will be less reckless. It is important to note that the data account copying method is generally offered by a limited number of stock brokers. For example, it is widely accepted that the regulated eToro platform is the market leader in this segment. However, there are brokers that are also leaders in account copying, such as AvaSocial and its partner, FCA-regulated Pelican Trading, as well as Libertex with its MetaTrader 4 offering. Which is the best account copying platform? Find out! When copying traders from other traders, you need to make sure you have a great broker to help you find the best ones! A level of performance analysis is essential to making the right decision about who to copy. You also need to make sure that the account copy trading platform itself is easy to use and the fees are transparent. To save you some time, here are the top three copy trading platforms to get you started: We will discuss each of them in detail below. The level of detail in the analytics is truly impressive. You can view detailed statistics for all account copiers, analyze their past performance, overall profits and losses, and more importantly – feedback from other people who copy them. The best thing about eToro copy trading is that you can copy traders! There are no fees for buying or selling as the broker is compensated by the margin and any daily fees for each product. Fantastic! Deposits are also free, and you can access copy trading services across multiple platforms, including forex, cryptocurrencies , stocks, commodities, and more. If you’re serious about account copying, eToro is the place to be.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Through the app , you can interact, follow and copy other traders with the click of a button. The performance statistics are also great, helping you find the right trader to copy. It details monthly performance, trading activity, overall profit and markets visited.

A lakossági befektetői számlák 71% -a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. The platform is not as user-friendly as eToro or AvaSocial, but it does allow for algorithmic trading. Fortunately, there is good quality performance data available to review and analyze traders before choosing who to copy.

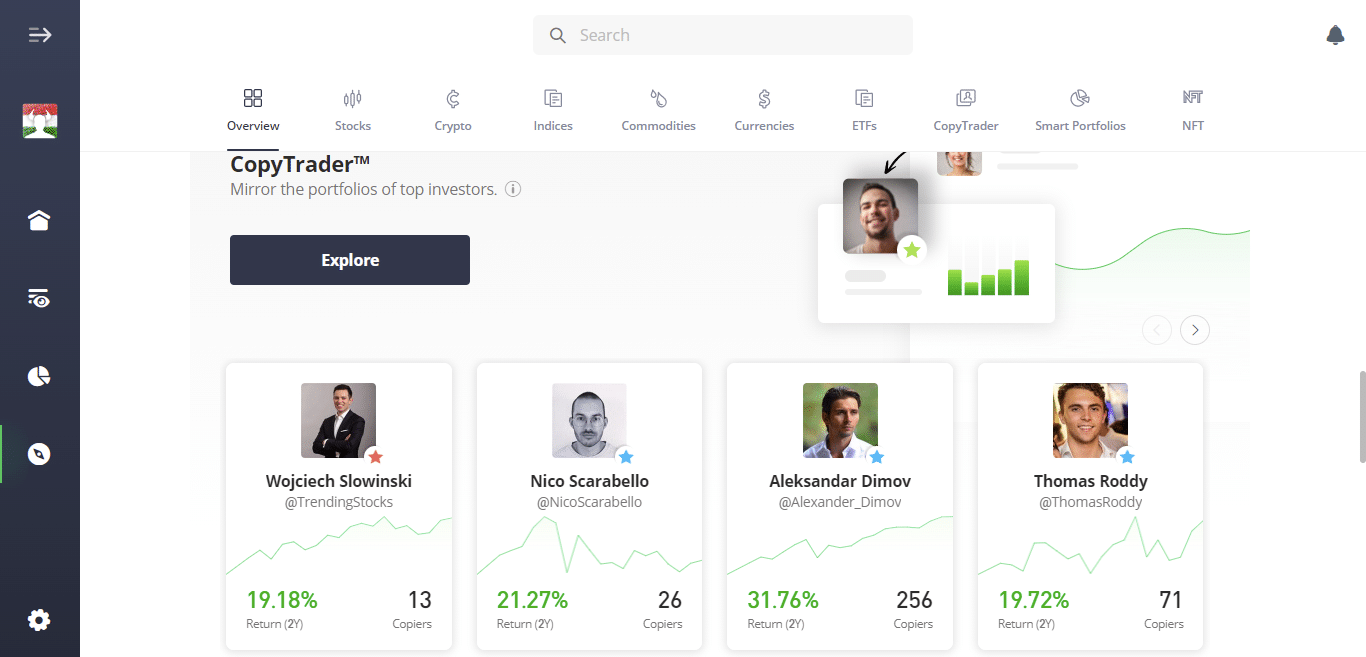

A lakossági befektetői számlák 85%-a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. As with most online investment solutions these days , the process of account copying is actually relatively simple. Whether it’s crypto account copying or Bitcoin account copying or anything else, the gist is the same. Below is the general process you should follow – with some helpful screenshots from the market-leading eToro account copier platform. However, the process remains largely the same regardless of which platform you choose. The first and perhaps most important part of the account copying process is choosing the investor you want to “follow.” That is, you need to carefully select an experienced investor that you want to copy completely. Ultimately, your profits and losses will be 100% dictated by the investor’s trading results. If you were to use eToro to copy your account, you would have access to over 12 million investors. This is one of the reasons why eToro copy trader reviews around the world are so positive. It goes without saying that the vast majority of these traders will not have the skills or proven experience to be worthy of copying. As a result, it is essential that you take full advantage of the filter options. You can use various filters such as location, market you want to copy, the amount the trader you want to copy has earned in the last twelve months, and much more. Once you set your filters and hit the “GO!” button, you will be presented with a comprehensive list of potential traders to copy!

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. AvaTrade has a unique trading copy offer from its partnership with FCA regulated firm Pelican Trading. With the AvaSocial app, you can interact, follow and copy the trades of other traders, known as data providers. You can view detailed statistics for each provider by clicking on their profile. There you will see a detailed breakdown of their performance history, frequency of trading activity, and how many followers and copiers they have.

A lakossági befektetői számlák 71% -a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. Libertex offers you access to copy functions through the popular MetaTrader 4 trading platform and the MetaTrader data section. This allows you to view the performance of other traders using the MetaTrader platform. The platform is a bit more complicated to use than eToro, which is very simple. You may have to pay to copy some of the data to your trading account!

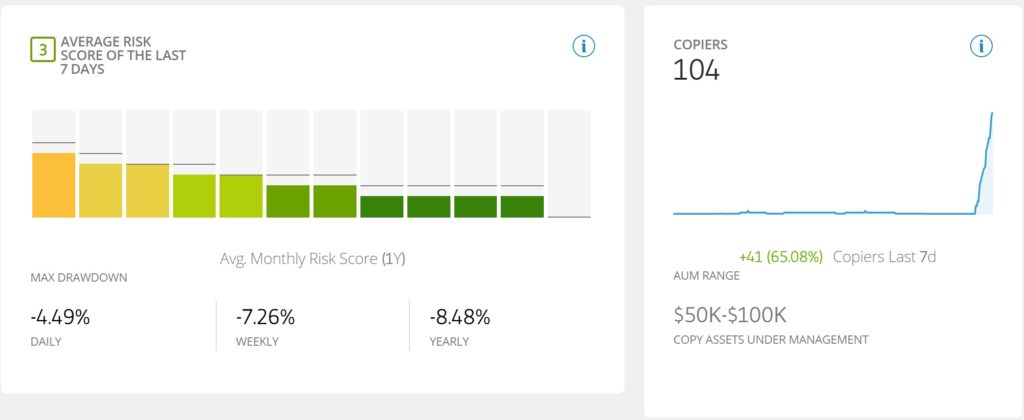

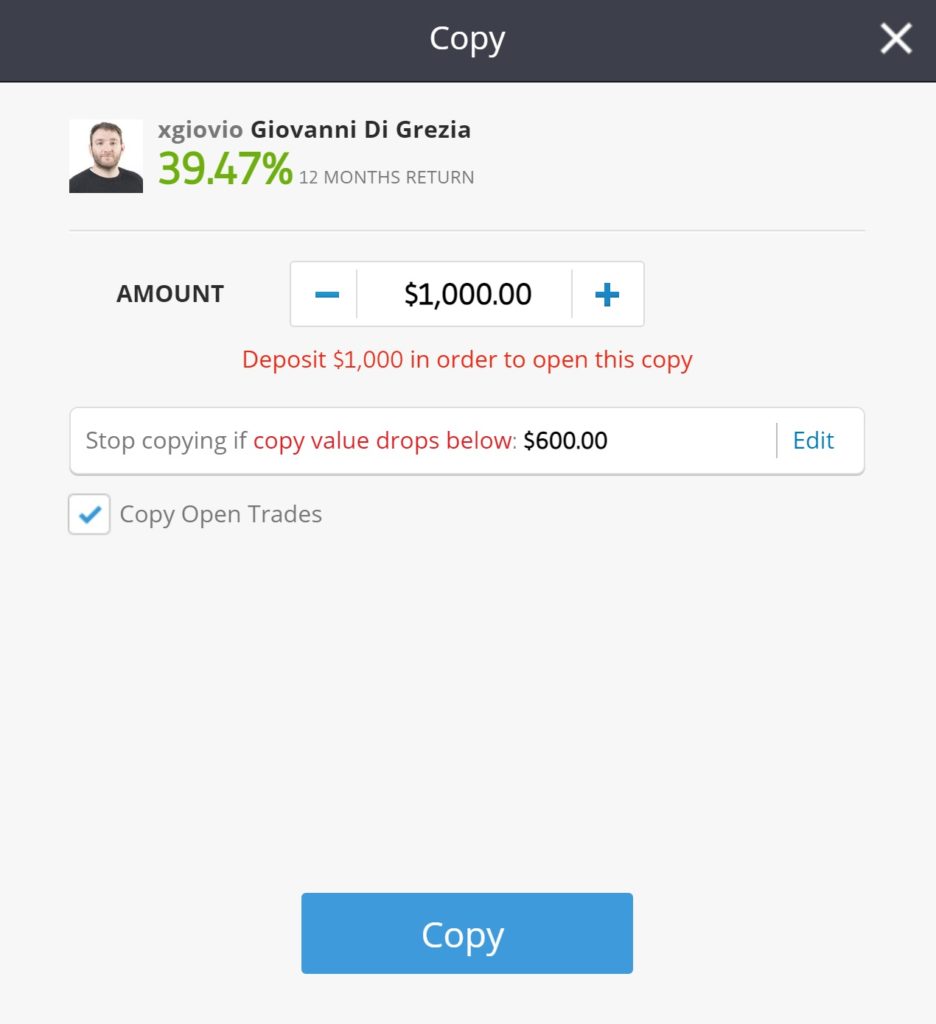

A lakossági befektetői számlák 85%-a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. This is where things get interesting, not least because a significant amount of information will be presented when you click on a particular trader profile. For example, you can view: Some argue that this is the most important indicator to analyze. Importantly, it provides complete details on how the trader has performed on the platform since they have been on it. You need to be careful here, especially when it comes to the timeframe. For example, while a trader may be 40% green, this may only be based on 3 months of trading. This indicates that the trader is taking significant risks. Instead, we recommend sticking with traders who have at least 12 months of experience. You can see how many people are currently copying the investor. If an investor has a large number of followers, it is usually a good sign. You can view the investor’s AUM (Assets Under Management). This number doesn’t play a big role in the selection process, but it’s interesting nonetheless. This set of statistics is useful because it allows you to see the investor’s mindset. For example, you get a full breakdown of what assets the trader likes to buy and sell. If you want to specialize solely in stocks and dividends, you should evaluate these statistics before investing your money. You can also view the average profit and loss for each trade. This number is also useful as it gives you an idea of what kind of profit the trader is generally targeting. It also highlights how much the trader is willing to be in the red before exiting a position. At the bottom of a trader’s profile, you can see some interesting averages. For example, you can see how many trades the trader typically makes per week. The higher the number, the more active the trader. Similarly, if this number is low, the investor is likely to favor a long-term “buy and hold” strategy. You can also view the average number of days an investor holds an open position. This again gives a clearer indication of whether the investor prefers a short-term or long-term strategy. eToro also assigns a risk rating to the investor, which is updated frequently. The risk rating can range from 1-10. The lower the number, the less risk the trader is taking. The level of risk you are comfortable with is ultimately a personal matter. Once you have chosen a trader whose profile you like, you need to decide how much you want to invest. There will always be a minimum investment threshold, which varies depending on the platform you choose. In the case of eToro, this is a minimum of $200 (approximately 60,000 Forints) per trading portfolio. As soon as you confirm the investment – the amount is taken from the broker account balance and placed in the trader’s portfolio. Once you invest, your personal stock and dividend portfolio will update accordingly. To explain this in the simplest way possible, it’s probably best to give a basic example. For simplicity, let’s assume that the investor’s portfolio looks like this: Although it is clearly visible that the total value of the portfolio is 1,000,000 Forints – this number is not really relevant. Instead, for the purposes of account copying, we are more concerned with the “weighting” of the portfolio. In layman’s terms, this means how much each stock contributes to the wider portfolio. This is because the personal stock portfolio reflects this similar weighting. For example: As you can see from the above, your portfolio now reflects that of your chosen investor – but by an amount proportional to the amount invested! Once your personal stock portfolio is copying your chosen trader, you don’t need to do anything else. However, it’s important to note that the investor is actively buying and selling stocks as long as they remain on the trading platform. In other words, if the investor decides to sell all of their BP shares, your BP shares will also be sold. Similarly, if investors decide to add Facebook shares to their portfolio, your portfolio will also contain Facebook shares. This is where things start to get a little confusing, as eToro copy traders often use additional funds to add more stocks to their portfolio. In this case, you have two options: When the investor deposits additional funds, you will receive a notification. In most cases, the investor will publicly announce that they intend to add additional funds, which gives you time to prepare. However, if you really want to copy the investor, you will need to deposit more money – proportionally. If you decide not to add more money to the copied trader’s portfolio, your position will be automatically adjusted. In other words, eToro will have to sell some of the shares you currently hold to make room for the new purchase. In this sense, you will still be copying the investor, but the ratio will not be 100% accurate. If you have read our detailed guide to ETFs and mutual funds, you should already have a good idea of how to copy trade and how to make money with a copy trade portfolio. If not, you will still make money the same way – if you bought the shares on a DIY basis. As such, you can make money in the form of capital gains and dividends. Top Tip: To mitigate the risk of being outbid by a copy trader, it may be worth diversifying across multiple investors. However, you should ensure that you reach the minimum investment of 60,000 HUF with each copy trader – if you use eToro. The fees you pay when using account copying depend on the platform you choose. Overall, account copier portfolios are an interesting alternative to other passive income sources such as ETFs and mutual funds. This is because you have to personally select an experienced trader whose work you like and analyze his profile. Moreover, and perhaps most importantly – you have much more control over the account copier portfolio. This is because you can adjust your portfolio as you wish. For example, if you agree with a trader’s 90% stock purchase, that doesn’t mean you want to be exposed to the technology sector. In that case, you can manually exit these positions and keep the rest of your portfolio active! Similarly, you can buy shares in any company you choose. Just make sure you understand the risks of account copying. Ultimately, just because your chosen investor has impeccable experience in stocks and dividends, it doesn’t mean that it will remain that way forever.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Péter a Tradingplatforms írója, elemzője és befektetője aki Győrben él. Tapasztalt piaci elemző, aki aktívan kereskedik, és több mint 10 éves tapasztalattal rendelkezik a pénzügyi piacokon. Szakterülete a napon belüli kereskedés és a hosszú távú befektetés különböző eszközosztályokban. Péter érdeklődése és elkötelezettsége a pénzügyi piacok bonyolultságainak megértése iránt már fiatalon kibontakozott, és élete során ez vált a pénzügyi piacok mélyebb megértésének elkötelezett elérésévé. Pter jártas a Forex és a részvénybefektetések bonyolult világában, és éles észrevételeivel tűnik ki. Szenvedélye, mellyel a pénzügyi piacok összetettségeit megfejti, mind a kereskedési, mind az írói területen nyilvánvaló. Munkáiban Péter megosztja tudását, és bonyolult pénzügyi fogalmakat tesz hozzáférhetővé a szélesebb közönség számára. Újabban a kriptovaluta piacok is érdeklik. FIGYELMEZTETÉS: Az ezen az oldalon található tartalom nem tekinthető befektetési tanácsadásnak, nem vagyunk felhatalmazva befektetési tanácsadás nyújtására. Ezen a weboldalon semmi sem minősül egy adott kereskedési stratégia vagy befektetési döntés jóváhagyásának vagy ajánlásának. A weboldalon található információk általános jellegűek, ezért az információkat az Ön céljainak, pénzügyi helyzetének és igényeinek fényében kell mérlegelnie. A befektetés spekulatív jellegű. Befektetéskor a tőkéje kockázatnak van kitéve. Ez az oldal nem használható olyan joghatóságokban, ahol a leírt kereskedés vagy befektetések tiltottak, és csak olyan személyek és olyan módon használhatják, ahogyan az jogilag megengedett. Előfordulhat, hogy az Ön befektetése nem felel meg a befektetői védelem feltételeinek az Ön lakóhelye szerinti országban, ezért kérjük, végezze el saját kutatásátt, vagy szükség esetén kérjen tanácsot. Ezt a weboldalt ingyenesen használhatja, de előfordulhat, hogy jutalékot kapunk az általunk bemutatott vállalatoktól. A weboldal további használatával elfogadja az általános szerződési feltételeinket és az adatvédelmi szabályzatunkat. Cégjegyzékszám: 103525 © tradingplatforms.com Minden jog fenntartva 2023

How does copy trading work?

What does copy trading mean ?

The three best copy trading platforms in Hungary

1. eToro – The best copy trading platform in every respect

Advantages:

Disadvantages:

2. AvaSocial – FCA regulated copytrade app

The AvaSocial account copy app is a partnership between globally regulated broker AvaTrade and FCA-regulated Pelican Trading. Together, they provide an account copy app available on Android and iOS devices.

Advantages:

Disadvantages:

3. Libertex – Access to MetaTrader data

Advantages:

Disadvantages:

How does copy trading work?

Step 1: Select the trader you want to copy

eToro account copying

AvaSocial account copywriter

Libertex account copying

Step 2: Analyze the performance of the trader you want to copy

Copy trading analysis – Performance

Copy trading analysis – Copiers and AUM

Copy trading analysis – Trading statistics

Copy trading analysis – Averages

Copy trading analysis – Risk classification

Step 3: Decide how much to invest in copy trading

Step 4: Copy trading with portfolio weighting

Step 5: Copy ongoing trades

Copy trading – Add more money

Copy trading – Automatic rebalancing

How to make money with account copying?

What trading copy fees should I know about?

Online Copy trading – Conclusion

eToro – the number one recommended broker

Trade Copy – FAQ

How can you make money with account copying?

Can I tell the copied trader what stocks to invest in?

How much does copy trading cost?

How long is my money tied up in a copy trading portfolio?

Varga Péter

Pénzügyi szakértő

Varga Péter

Pénzügyi szakértő