Apple részvény vásárlása Magyarországon

Listed on the NASDAQ stock exchange, Apple is now a trillion-dollar company, so it’s no wonder that buying Apple stock is popular among investors. If you want to own Apple shares, you need to use a Hungarian stockbroker that provides access to the US markets.

In this article , we will explain how to buy Apple shares online in Hungary. We will not only tell you what you need to consider before investing in Apple, but we will also review the best stock brokers available in Hungary and show you step by step how to buy shares today.

Don’t worry if you don’t have time to read the entire guide. You can follow the quick steps below and buying Apple stock won’t take you more than 10 minutes! As we demonstrated above, buying Apple on the eToro platform is not only safe, but it also takes no more than a few minutes.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. [stocks_table id=”17″] However, you should also make sure that the broker you choose is regulated and offers competitive fees. To help you, below you will find the best Hungarian brokers we have selected, with whom it is most advantageous to buy Apple shares. This is because you don’t need to buy a whole Apple share (at the time of writing, it’s priced at just over $190). Instead, eToro allows you to invest in fractions, so you can invest as little as $50. In addition to allowing you to buy shares, eToro also offers stock CFD trading and is considered one of the best CFD brokers. This means you can short Apple stock and use leverage of up to 1:5 to make a larger trade. eToro is well known for its social copy trading tools, which really set this platform apart from other standard trading platforms. As a social broker, eToro allows you to connect with other users while using the CopyTrader tool to copy the entire portfolio of top traders. You can make a deposit using a credit card or bank transfer. You must meet the minimum deposit of $200. Since eToro converts all deposits into dollars, you will have to pay a 0.5% conversion fee. This has the advantage that you can easily invest in Hungarian or international companies. When it comes to security, you should know that eToro is licensed by ASIC and CySEC. If you are an investor who likes to buy and sell stocks on the go, eToro also offers a fully-featured investment app. Opening an account on the eToro platform only takes a few minutes. Its trading platform is also relatively easy to use and web-based.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Pepperstone is currently one of the best brokers, where you can buy Apple shares , among other things. More than 1,200 instruments are available on the platform in the form of CFDs, so the assets themselves do not become the property of traders. Interested parties can choose from commodities, stocks, indices and cryptocurrencies, among others. Pepperstone also places great emphasis on proper education, which is why it offers useful tutorials that help novice traders navigate the maze of trading. And the reports shared on the platform offer useful information for all traders, regardless of their experience level. Pepperstone was launched back in 2010 and was dreamed up by experienced traders who wanted to bring a new lease of life to the world of online trading. We can say that they succeeded, as traders speak highly of the platform both among themselves and online. Pepperstone offers traders favorable commissions and there are no hidden fees, you only pay for withdrawals. Pepperstone is open to both new and experienced traders, and its educational materials help anyone learn the basics of trading.

A lakossági befektetők 74,6%-a pénzt veszít, amikor spread fogadásokkal és CFD-kkel kereskedik ennél a szolgáltatónál. Offering over 5,000 instruments, XTB is one of the best online brokers on the market today. However, the platform does not only offer investors tradable instruments: it also offers over 30 hours of educational material, providing traders with valuable and important information. The platform also allows users to open a demo account, with which they can try out different trading strategies. The demo account offers the opportunity to trade with fictitious money. The trading process is very simple, all you need is an XTB account. After registration, you can try out your trading strategies without even risking your own money. This allows you to gain valuable experience while significantly reducing the amount of training money. To trade, all you have to do is find an asset you like, then specify the price and how much you want to buy. You can specify a target price, above which you absolutely do not want to buy, or you can buy at the current market price – in the latter case, the transaction is immediate, while in the former, it only takes place when the asset reaches the specified price. The broker is licensed and regulated by the Financial Conduct Authority ( FCA ). At the time of writing, the platform has 720,000 users, with a massive 104,000 user growth in Q1 2023. The company has offices worldwide, including in Dubai, Spain, Poland, the United Kingdom, Germany, and France. There are no minimum deposit limits on the XTB website, and users can make deposits using dozens of options. In addition to bank transfers, bank and credit card payment methods, XTB also supports e-wallets. For example, PayPal, PayU, Neteller, Skrill, Paydoo or Paysafe can help you with your payments. Electronic payments usually take a few minutes, while bank transactions can take several business days. In most cases, you can deposit to XTB for free, but some e-wallets may charge a commission of 1.5-2%. If the deposit currency is different from the account currency, XTB may charge a conversion fee. Withdrawals are free for amounts over 100 euros, and a 30% fee applies for amounts below this.

A lakossági befektetők 78%-a veszteséget könyvel el CFD-kereskedés során ezzel a szolgáltatóval. As CFDs are derivatives, you never actually own the underlying shares, you can only speculate on the direction of price movements. This means that you can not only trade with the margin, but also take long (sell) and short (buy) positions. Additionally, you can trade buy and sell Apple CFDs with zero spread on Libertex! This is the difference between the buy and sell price, which is one way the broker gets paid for its services. Libertex instead charges a low commission on buys and sells, currently only 0.207%. You also get a dividend adjustment when using CFDs.

A lakossági befektetői számlák 85%-a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. AvaTrade also offers a wide range of trading accounts, including CFD trading accounts, spread betting accounts, options trading accounts, and Islamic swap-free accounts. Professional accounts are also available for serious traders. You can trade with AvaTrade from a variety of platforms, including the popular MetaTrader 4 and MetaTrader 5 trading platforms. The broker also has a lot of research and educational material available on its website.

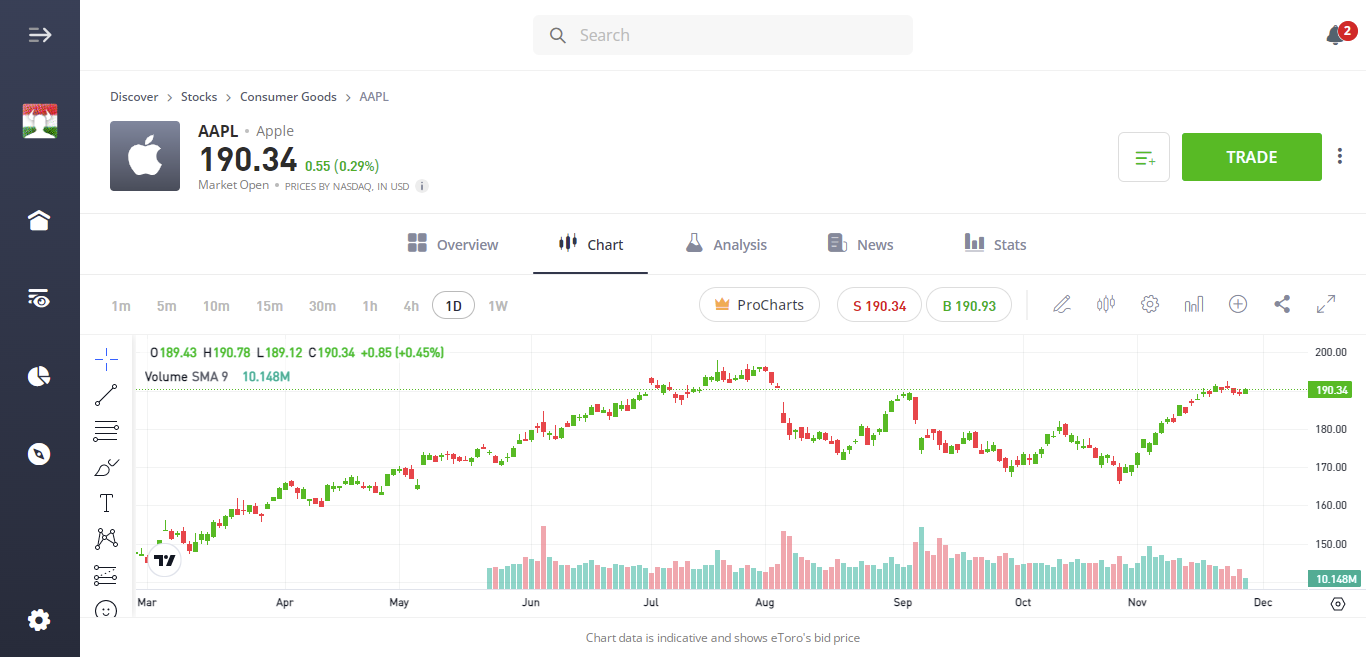

A lakossági befektetői számlák 71% -a pénzt veszít az ezen az oldalon végzett CFD-kereskedés során. You may have already decided that you want to buy Apple shares, but we recommend that you conduct independent research first. This will ensure that you are fully aware of the risks and benefits of owning Apple shares. Below, we present some basic facts about the tech giant so you can get an idea of where to start. Although Apple is considered a new-age technology innovator, the company actually went public in 1980. Apple chose the technology-oriented NASDAQ stock exchange over the NYSE, and its shares were originally priced at $22. At the time of writing, those same shares are worth about $134! This marks an “all-time high” for Apple stock, meaning the company has never been worth more than that. However, it’s important to note that Apple has done four stock splits since going public in 1980. That makes a huge difference when determining how much growth the company has achieved. This includes the 7:1 split in 2014, and the 2:1 splits in 1987, 2000, and 2005. To put it simply, if you had bought 1,000 Apple shares in 1980, you would now own 56,000 shares. This would have originally cost you $22,000 (22 x $1,000 shares). However, it is also important to look at the shorter-term picture. Smart investors would have likely bought Apple shares in March 2020, when Apple’s share price was significantly lower. This was due to the broader impact of the coronavirus pandemic. For example, while Apple shares were trading at $82 in January 2020, just two months later the same shares were worth just $53. This represents a significant two-month decline. However, the stock not only recovered these losses by the end of June 2020, but has been steadily rising ever since. So, if you had invested in Apple shares in March 2020, you would have made a profit of over 150% at today’s prices. Unlike other Big Tech companies listed on NASDAQ (namely Amazon , Google, Facebook, and Netflix), Apple actually pays dividends. This allows it to combine its ever-increasing stock price with regular income payments. Although dividends are paid four times a year, Apple stock has a relatively low dividend yield. It is true that at the time of writing this is below 1%, which is not even worth writing about. However, as described above, this has been offset by the unprecedented capital gains that investors have enjoyed over the past decades. Opponents of Apple as a viable long-term investment argue that revenue growth from its core product, the iPhone, is slowing somewhat. However, let’s not forget that Apple has the largest cash reserves not only in the United States but also globally. That’s actually $192 billion. Amazon and Facebook, while not to be outdone, have a fraction of that, at $49 billion and $60 billion, respectively. Crucially, such a large free cash position is beneficial for two reasons. First, the company is not facing any problems related to the COVID-19 pandemic. Whether it is a decline in sales or a supply chain, Apple shareholders have nothing to worry about. Second, the almost $200 billion in reserves allows Apple to continue its diversification efforts. This means introducing new, innovative products and services, as well as making acquisitions. The latter includes the recent purchase of NextVR, a virtual reality company specializing in sports events. For new investors, Apple often refers to its core iPhone lineup. While that’s still a real source of revenue for Apple, the company is increasingly devoting resources to developing its services division. In 2019 alone, Apple launched four new services in global markets, and growth looks strong. This includes a streaming TV service, game streaming, news subscriptions, and even a credit card. Crucially, Apple’s services revenue grew 16% in 2019 – accounting for almost a fifth of its total revenue. As mentioned above, this level of free cash flow position provides Apple with the opportunity to further increase its exposure to the services space. Very few companies escaped the broader stock market crash that occurred in March 2020. Investor concerns about the effects of COVID-19 saw many major companies lose between 20% and 50% of their value in just a few weeks. As mentioned earlier, Apple shares fell 30% during that period. However, by early June 2020, Apple had recovered from these losses. This was very positive for shareholders. Apple shares not only returned to their pre-March 2020 levels in two and a half months, but their growth trajectory continued. Once you have completed your independent research on Apple shares, the next step is to open an account with your chosen Hungarian broker. Regardless of which platform you choose to register with, the process is largely the same. For example, you will need to provide some personal information, make a deposit, and then purchase Apple shares. To see how seamless the process is, below we present the steps for investing in stocks using our recommended broker available in Hungary, eToro.

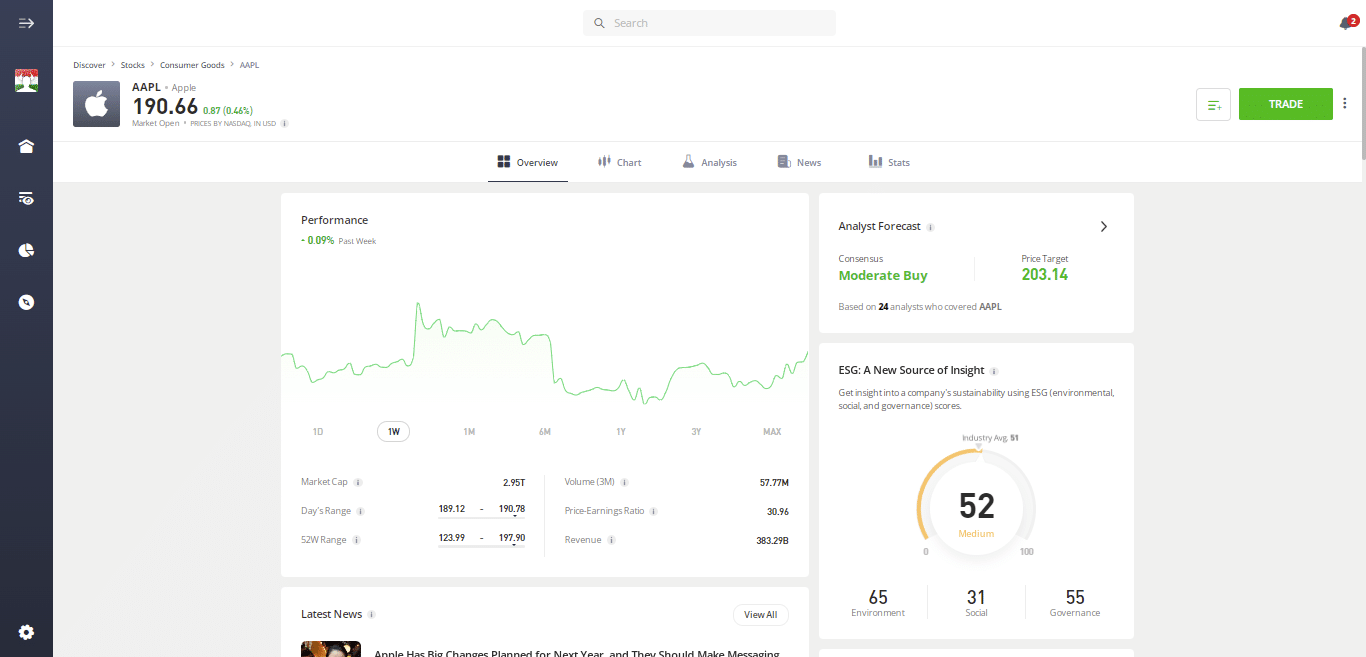

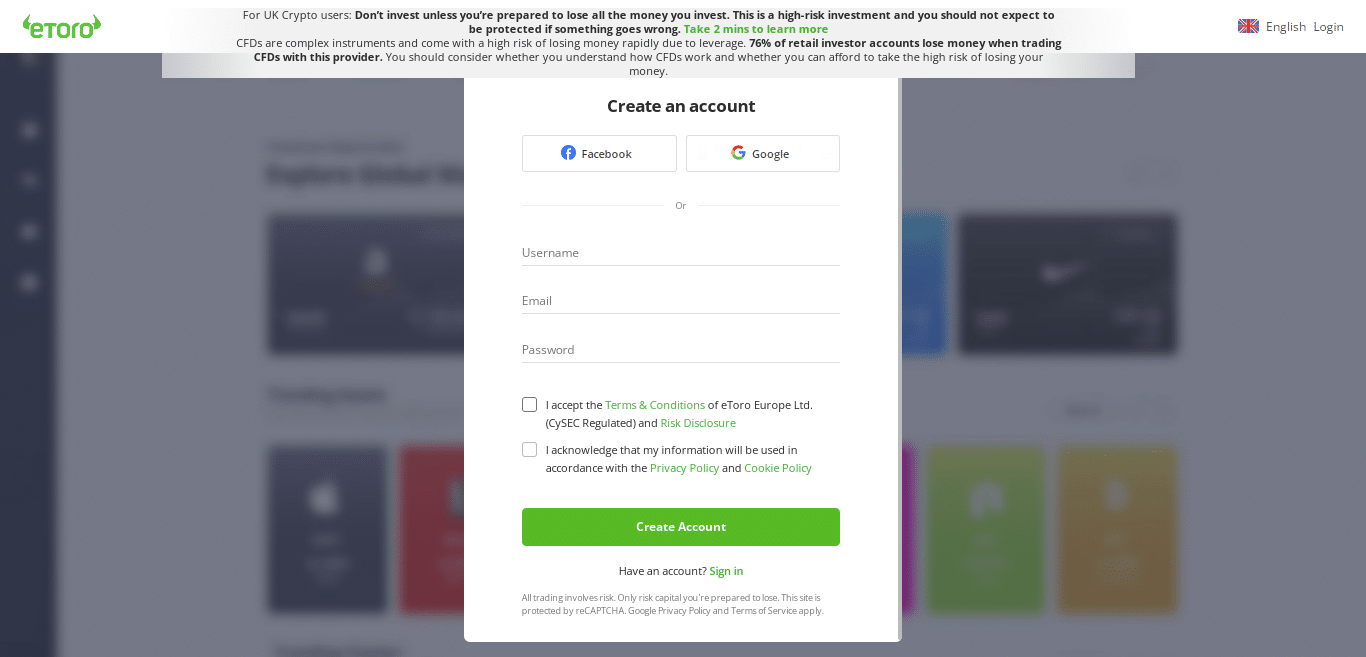

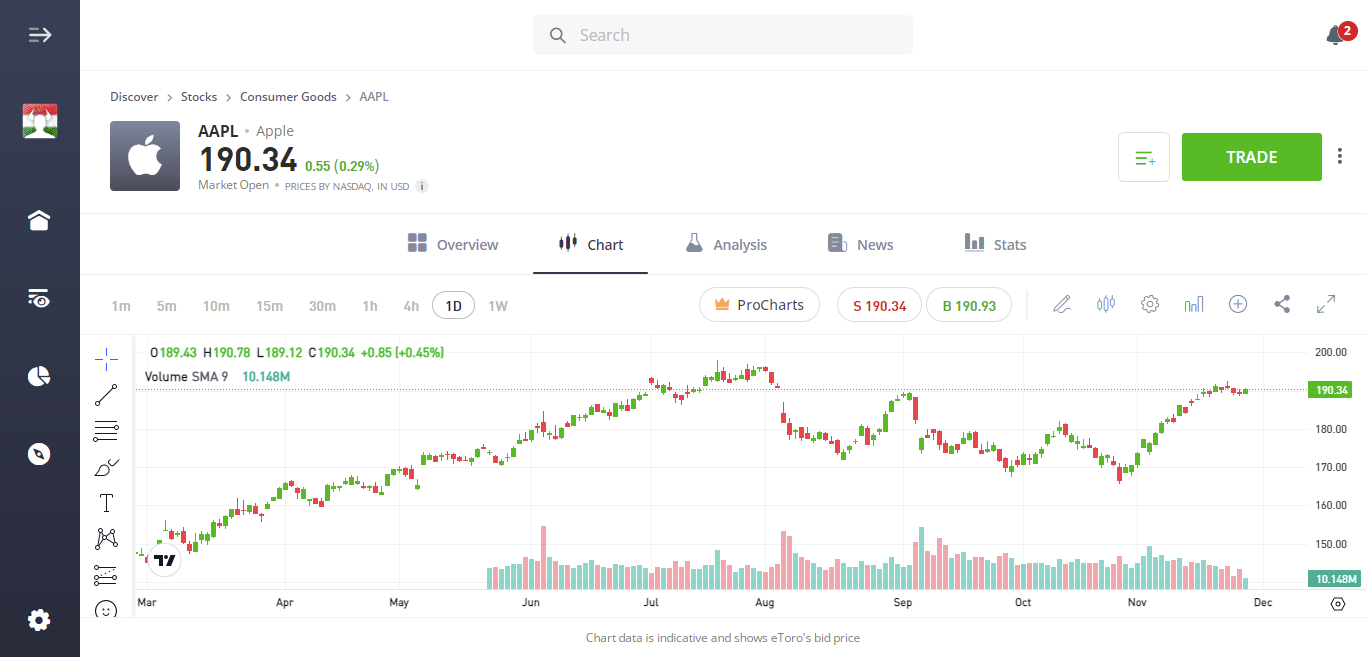

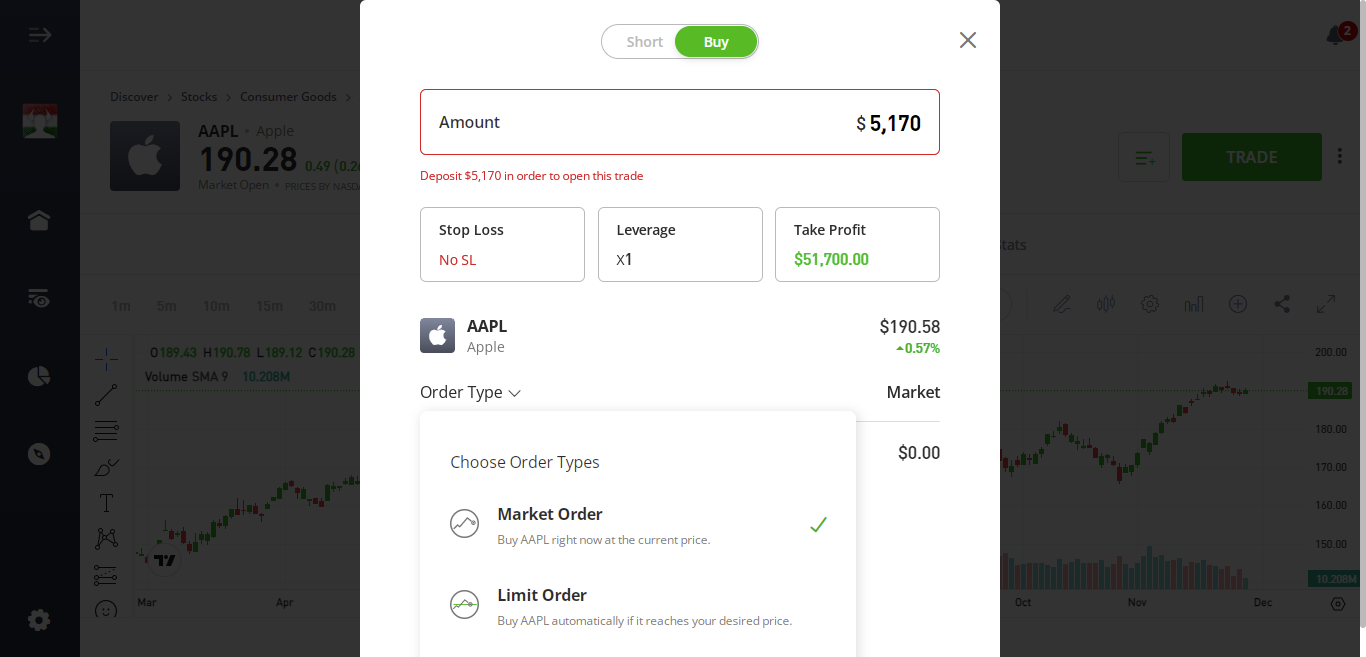

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. First, you need to visit the eToro website and select account registration. After that, you need to provide the following personal information: Although eToro allows you to deposit up to €2,000 instantly, it is best to verify your identity first. This will ensure that any deposit restrictions are lifted and you can withdraw funds without delay. To do this, you will need to upload some documents to confirm your details. Once you have uploaded the above documents, you will need to deposit funds into your account. The deposit must be at least $200 and you will be charged a 0.5% conversion fee. eToro accepts the following payment methods: Apart from bank account transfers, all deposits made using other payment methods will be credited to your account immediately. Once you have funded your eToro brokerage account, the next step is to buy Apple stock. First, type “Apple” into the search box at the top of the page. Click on the result that appears. Then click on the “Trade” button.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. You will then see an order field. If the current market price of Apple is right for you, all you have to do is enter the amount you want to invest. You don’t have to buy a whole share. Instead, you can invest from as little as $50. Click the “Open Trade” button to complete your Apple stock purchase. Note: If you are purchasing Apple stock outside of normal market hours (9:30 a.m. to 5:00 p.m. Eastern Time), click “Set order.” Your Apple stock purchase will be executed when the markets open. It’s no surprise that Apple stock is often considered one of the best stocks available in 2026. With a market cap of over $1.6 trillion, there’s no telling how much further this tech giant can grow. Considering its cash reserves are just under $200 billion, Apple has all the tools it needs to continue pursuing its diversification and acquisition goals. This is important for Apple shareholders because it reduces the risk of overexposure to the core iPhone division. Apple’s services – such as TV and game streaming subscriptions – are growing year after year. If you want to start investing in the financial markets today, popular regulated broker eToro offers you the opportunity to buy Apple shares for as little as $50. Simply click the link below to get started!

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Péter a Tradingplatforms írója, elemzője és befektetője aki Győrben él. Tapasztalt piaci elemző, aki aktívan kereskedik, és több mint 10 éves tapasztalattal rendelkezik a pénzügyi piacokon. Szakterülete a napon belüli kereskedés és a hosszú távú befektetés különböző eszközosztályokban. Péter érdeklődése és elkötelezettsége a pénzügyi piacok bonyolultságainak megértése iránt már fiatalon kibontakozott, és élete során ez vált a pénzügyi piacok mélyebb megértésének elkötelezett elérésévé. Pter jártas a Forex és a részvénybefektetések bonyolult világában, és éles észrevételeivel tűnik ki. Szenvedélye, mellyel a pénzügyi piacok összetettségeit megfejti, mind a kereskedési, mind az írói területen nyilvánvaló. Munkáiban Péter megosztja tudását, és bonyolult pénzügyi fogalmakat tesz hozzáférhetővé a szélesebb közönség számára. Újabban a kriptovaluta piacok is érdeklik. FIGYELMEZTETÉS: Az ezen az oldalon található tartalom nem tekinthető befektetési tanácsadásnak, nem vagyunk felhatalmazva befektetési tanácsadás nyújtására. Ezen a weboldalon semmi sem minősül egy adott kereskedési stratégia vagy befektetési döntés jóváhagyásának vagy ajánlásának. A weboldalon található információk általános jellegűek, ezért az információkat az Ön céljainak, pénzügyi helyzetének és igényeinek fényében kell mérlegelnie. A befektetés spekulatív jellegű. Befektetéskor a tőkéje kockázatnak van kitéve. Ez az oldal nem használható olyan joghatóságokban, ahol a leírt kereskedés vagy befektetések tiltottak, és csak olyan személyek és olyan módon használhatják, ahogyan az jogilag megengedett. Előfordulhat, hogy az Ön befektetése nem felel meg a befektetői védelem feltételeinek az Ön lakóhelye szerinti országban, ezért kérjük, végezze el saját kutatásátt, vagy szükség esetén kérjen tanácsot. Ezt a weboldalt ingyenesen használhatja, de előfordulhat, hogy jutalékot kapunk az általunk bemutatott vállalatoktól. A weboldal további használatával elfogadja az általános szerződési feltételeinket és az adatvédelmi szabályzatunkat. Cégjegyzékszám: 103525 © tradingplatforms.com Minden jog fenntartva 2023

Buying Apple shares in Hungary – detailed guide

Step 1: Find a brokerage firm that offers Apple shares

1. eToro – A leading broker offering social trading without commissions

Advantages:

Disadvantages:

2. Pepperstone – One of the best choices for buying Apple shares

Advantages:

Disadvantages:

3. XTB – CFD trading on Apple shares with ease

However, the company offers much more than that, in addition to a huge selection, it also makes some ETFs and stocks available commission-free, up to €100,000 per month. The commission for amounts larger than that is 0.2%. That is why we think XTB could be one of the best choices when buying Apple shares.

XTB payment methods and fees

Advantages:

Disadvantages:

4. Libertex – Buy Apple shares with zero spread!

Advantages:

Disadvantages:

5. AvaTrade – Buy Apple shares without commission

AvaTrade is a CFD broker regulated in six different jurisdictions worldwide. Not only can you buy Apple shares using CFDs, but you can also trade over 1,250 markets covering stocks, cryptocurrencies , indices, forex and other instruments, all commission-free.

Advantages:

Disadvantages:

Step 2: Apple stock analysis and research

Apple stock price history

Apple stock dividend information

Buying Apple shares – is it worth it?

Huge cash reserves

The services division remains key for Apple shareholders

Speed of recovery from COVID-19-related losses

Step 3: Open an account and make a deposit

Step 4: Buy Apple stock

Apple stock buying conclusion

eToro – Buy Apple shares

LIZARD

What was the price of Apple stock when the company went public?

How much does it cost to buy Apple stock in Hungary?

Does Apple pay a dividend?

Will I have to pay a currency conversion fee when buying Apple shares on the eToro platform in Hungary?

How many Apple shares can I buy at the minimum?

Varga Péter

Pénzügyi szakértő

Varga Péter

Pénzügyi szakértő