- Összehasonlítás

- FőmenüÖsszehasonlítás

- Legjobb magyar brókercégek

- FőmenüLegjobb magyar brókercégek

- Alvexo vélemények

- AvaTrade vélemények

- Binance vélemények

- Coinbase vélemények

- eToro vélemények

- Libertex vélemények

- Kraken vélemények

- Plus500 vélemények

- Brókerek

- ETF Kereskedés

- FőmenüETF Kereskedés

- Legjobb ETF Magyarországon

- Kriptovaluta kereskedés

- FőmenüKriptovaluta kereskedés

- Altcoin vásárlás

- FőmenüAltcoin vásárlás

- Avalanche vásárlás

- Bitcoin BSC vásárlás

- Bitcoin Cash vásárlás

- Bitcoin ETF token vásárlás

- Bitcoin Minetrix vásárlás

- Cardano vásárlás

- Chainlink vásárlás

- CHIMPZ vásárlás

- Decentraland vásárlás

- Dogecoin vásárlás

- Ethereum vásárlás

- eTukTuk vásárlás

- IOTA vásárlás

- KAVA vásárlás

- Launchpad XYZ vásárlás

- Meme Kombat vásárlás

- Monero vásárlás

- Polkadot vásárlás

- Ripple vásárlás

- Safemoon vásárlás

- Scotty The AI vásárlás

- Smog token vásárlás

- Stellar Lumen vásárlás

- Terra Luna vásárlás

- TeslaCoin Vásárlás

- TG Casino vásárlás

- Tron vásárlás

- VeChain vásárlás

- Wall Street Memes vásárlás

- yPredict vásárlás

- Kripto vásárlás

- Kripto árfolyam előrejelzés

- Bitcoin kereskedési platform

- Robot kereskedes

- FőmenüRobot kereskedes

- Bitcoin robotok

- FőmenüBitcoin robotok

- Bitcoin 360 AI vélemények

- Bitcoin AI vélemények

- Bitcoin Circuit vélemények

- Bitcoin Dynamit vélemények

- Bitcoin Fast Profit vélemények

- Bitcoin Era vélemények

- Bitcoin Edge vélemények

- Bitcoin Evolution vélemények

- Bitcoin Freedom vélemények

- Bitcoin Loophole vélemények

- Bitcoin Method vélemények

- Bitcoin Motion vélemények

- Bitcoin Prime vélemények

- Bitcode Prime vélemények

- Bitcoin Pro vélemények

- Bitcoin Profit vélemények

- Bitcoin Revolution vélemények

- Bitcoin Smarter vélemények

- Bitcoin Sprint vélemények

- Bitcoin System vélemények

- Bitcoin Trader vélemények

- Bitcoin Thunderbolt vélemények

- Bitcoin Up vélemények

- Bitcoin XOX vélemények

- xBitcoin AI vélemények

- xBitcoin Capex Club vélemények

- Kripto robotok

- FőmenüKripto robotok

- BitIQ vélemények

- BitQT vélemények

- BitQL vélemények

- BITQs vélemények

- BitAi Method vélemények

- BitAlpha AI vélemények

- BitiCodes iPlex vélemények

- Bitcoineer vélemények

- Bit iPlex Codes vélemények

- Bitindex Prime vélemények

- Bitprime Gold vélemények

- BitProfit vélemények

- Bitsoft360 vélemények

- Chain Reaction vélemények

- CoinGPT vélemények

- eKrona vélemények

- Immediate Edge vélemények

- Immediate Granimator vélemények

- Immediate GP vélemények

- Quantum AI vélemények

- Quantum Pro 360 vélemények

- Quantum Prime Profit vélemények

- Robbo AI vélemények

- TeslaCoin vélemények

- Yuan Pay Group vélemények

- NFT Platformok

- Tőzsdei Kereskedés

- FőmenüTőzsdei Kereskedés

- Kereskedés

- Befektetés

- Nyersanyagok

- FőmenüNyersanyagok

- Aranykereskedés

- Olajkereskedés

- Legjobb tőzsdei kereskedési platform

- FőmenüLegjobb tőzsdei kereskedési platform

- Amazon részvény

- Apple részvény

- Gamestop részvény

- Meta részvény

- Moderna részvény

- NIO részvény

- Novavax részvény

- Pfizer részvény

- Tesla részvény

- Virgin Galactic részvény

- Szoftver

A legjobb kereskedési platformok kezdőknek 2026

Használja interaktív keresőnket, hogy megtalálja a legjobb magyar részvény, Forex, CFD, kripto, social vagy day trading platformot, amely megfelel az Ön igényeinek.

- Csak szabályozott brókereket mutatunk be

- Felfedjük a rejtett költségeket, jutalékokat és spreadeket

- Konzultáljon olyan brókerekkel, akiket jó ügyfélszolgálatra értékeltek.

Teljesen szabályozott

Szakértők által áttekintve

Biztonságos és megbízható

Átlátható díjak

Mobil verzió

Stock exchange platforms are the most important bridge between you and your chosen financial market. So, whether you are interested in stocks, forex, commodities or cryptocurrencies – you need to find a suitable free stock exchange platform site that suits your needs.

Here at TradingPlatforms.com, we strive to showcase the best trading platforms in 2026. This includes the best fees and commissions, the widest variety of asset classes, and of course, the most strictly regulated exchange platforms.

Read on to find out which exchange platforms stand out from the crowd!

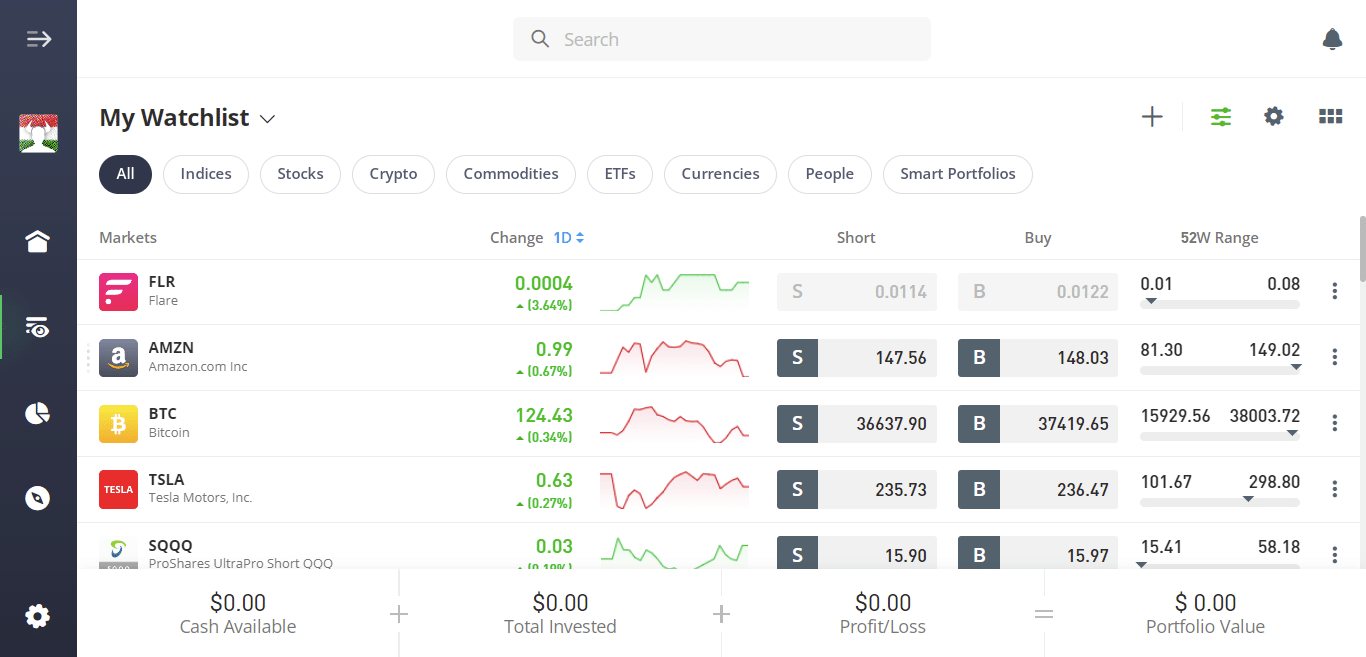

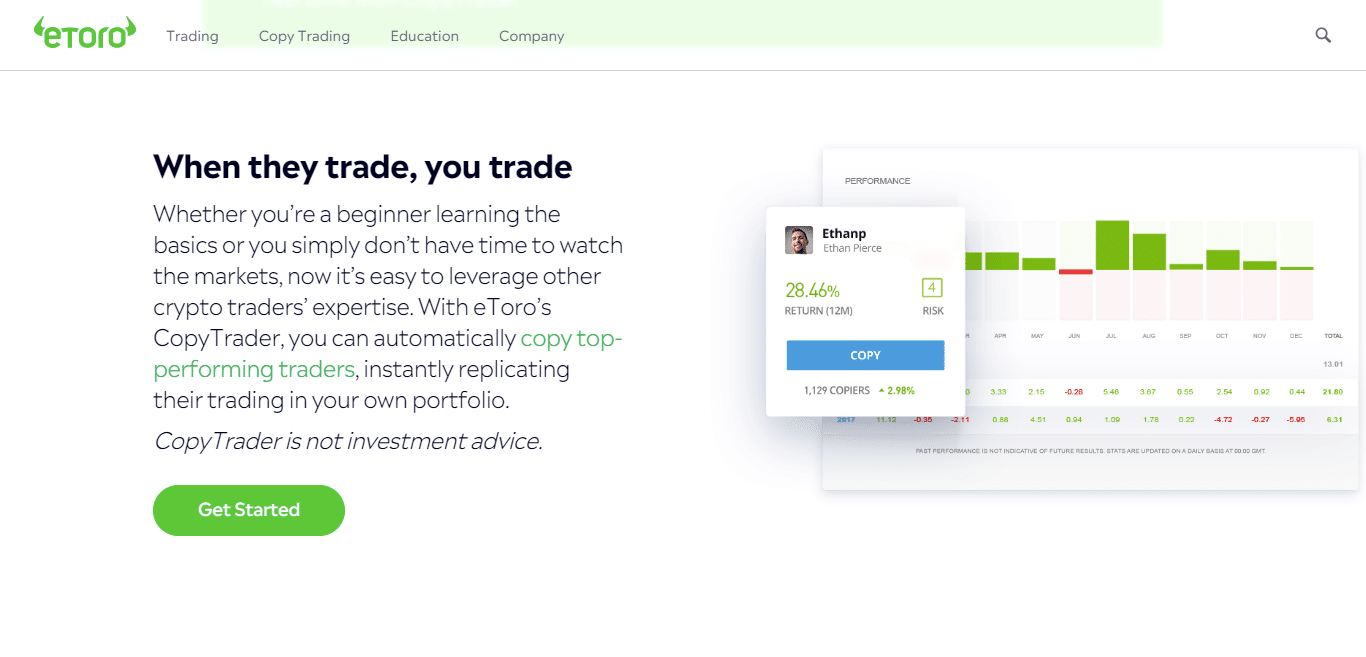

[stocks_table id=”17″] With hundreds of providers operating in the online space, choosing a free stock exchange platform that suits your needs is not an easy task. For example, the trading platform should not only have a good reputation and support your chosen financial market, but also offer competitive fees and excellent customer service. You should also consider the trading tools and features available, tutorials, and charting indicators. Below is a list of the best stock trading platform sites to look out for in 2026. Scroll down to read our full review of each free trading platform provider! After reviewing hundreds of online providers, we found that eToro is the best trading platform on the internet in 2026. Above all, this broker is a perfect choice because it supports small amounts. For example, the minimum deposit is just $200 and you can trade with just $25. When it comes to the assets available for trading, eToro offers a wide range of asset classes. This amounts to a total of 2,400 stocks across 17 different markets. For example, you can buy shares of companies based in the United States, Canada, the United Kingdom or Hong Kong, and you can also trade on a wide range of European exchanges. eToro also has over 250 ETFs and 30 cryptocurrencies available. If you’re looking to trade commodities, the platform has everything from gold to silver to oil and natural gas. Of course, eToro also offers plenty of forex trading options. There are no ongoing fees, making eToro a great exchange platform for those looking for a low-cost provider. Another reason why eToro takes the top spot on our list of the best stock trading platforms is that it offers passive investment tools. For example, with the CopyPortfolio feature, you can benefit from a professionally managed investment strategy. This means that the assets are bought and sold on your behalf by the eToro team. There are a variety of strategies to choose from, including those focused on technology stocks, cryptocurrencies, and even renewable energy. There’s also the eToro Copy Trading tool, where you can choose an experienced trader you like and then copy all of their ongoing trades. For example, if the trader allocates 3% of the portfolio to Apple shares and 2% to IBM, the same will happen to your portfolio. If we look at the basic terms, you can make a deposit on eToro using a credit card and bank transfer. The trading platform is regulated by CySEC (Cyprus) and ASIC (Australia), which shows that it takes client security seriously. For those living in the United States, eToro is registered with the FINRA regulator.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. With 400,000 traders joining Pepperstone, it is truly one of the best stock trading platforms. The company was founded in Melbourne in 2010 and opened its London office in 2015 to serve its European clients. Pepperstone is rightly proud to have won numerous awards over the years. It won the title of Best CFD Educational Tool at this year’s ADVFN International Financial Awards. It also took home the award for Best MT4 Broker at the 2023 Good Money Guide Awards. And the list goes on. Pepperstone offers a demo account, but it also has standard and Islamic accounts. It has 10 base currencies: AUD, USD, GBP, JPY, EUR, CAD, NZD, CHF, SGD, and HKD. Its trading fees are considered extremely low. Beginners or uncertain traders can absorb the necessary knowledge with the help of countless educational materials and webinars. If you have any problems, contact our multilingual (English, Russian, Vietnamese, Thai) customer service via live chat, phone or email. Since several international financial authorities supervise its operations, it can be considered extremely safe.

A lakossági befektetők 74,6%-a pénzt veszít, amikor spread fogadásokkal és CFD-kkel kereskedik ennél a szolgáltatónál. XTB is one of the best stock exchange platforms on the market today, offering its clients over 5,000 instruments. In addition to its wide range, XTB also entices investors with commission-free transactions, allowing them to buy a number of ETFs and stocks under these conditions, up to a monthly value of EUR 100,000. For amounts above this, the commission is 0.2%, with a minimum of EUR 10 per transaction . The site also offers over 30 hours of free educational material for investors. Investors can also open a demo account to try out different trading strategies. With a demo account, you can trade with “play money”. All you have to do is create an XTB demo account and then try out different trading strategies. What’s more, you can do this without risking your own money. This will not only give you valuable experience, but also save you from painful failures. Demo trading is very simple, you just need to find a stock you like, specify the conditions and how many shares you want to buy, and you’re done. You can buy at the current market price, or you can specify a target price – in the latter case, the transaction will only take place if the specified conditions are met. XTB is licensed and regulated by the Financial Conduct Authority (FCA). The platform has a growing customer base, with around 720,000 at the time of writing. It experienced massive growth in the first quarter of 2023, gaining a total of 104,000 new users. The company maintains offices in various parts of the world, such as Poland, France, Dubai, Spain, Germany, and the United Kingdom, and also provides access to various markets. There is no minimum deposit requirement for any of the XTB account types, and you can make deposits using a variety of payment options. In addition to debit and credit cards or bank transfers, the platform also supports e-wallets. In the latter case, you can choose from Paysafe, PayU, Skrill, Paydoo, PayPal, and Neteller. Electronic payments only take a few moments, while bank transfers can take up to several business days. Deposits are mostly free, with the exception of some e-wallets, which charge a commission of 1.5-2%. If the deposit currency and the account currency are different, a conversion fee may be charged. The withdrawal itself is free for amounts over 100 euros, but there is a 30% fee for smaller amounts.

A lakossági befektetők 78%-a veszteséget könyvel el CFD-kereskedés során ezzel a szolgáltatóval. Admirals also offers long opening hours so you can trade more, with lower costs and lower spreads. Registration is completely free and only requires your name and email address. Hundreds of commission-free stocks and stock CFDs await users on global exchanges. The system is compatible with MT4, MT5, and Invest MT5 accounts under certain conditions. Trading is possible from 100 euros and investing from 1 euro. Admirals has 16 local offices and multilingual customer service available via phone, email and live chat. Admirals can boast of being licensed by the world’s leading regulators in the UK, Estonia, Cyprus and Australia. Plus, deposits are insured. All client deposits are held separately from their own operating funds, offering extra protection in volatile markets. For beginners, it can be a great help to practice trading with a virtual deposit, which simply requires opening a free Admirals demo trading account. This requires no credit card or deposit, making it a completely stress-free practice. Admirals may also be one of the best stock exchange platforms because it offers the best possible trading conditions:

A lakossági befektetői számlák 74%-án veszteség keletkezik, amikor ennél a szolgáltatónál CFD-kkel kereskednek. As a result, you can take advantage of industry-leading quotes. Although Libertex charges commissions on both sides of the trade, these are often very low. In fact, commissions are often below 0.1% per trade. A prime example is the popular NZD/USD forex pair, which you can trade with a commission of just 0.012%. In terms of available markets, Libertex offers CFDs on stocks, commodities and currency pairs. As a CFD expert, you can apply leverage to any trade you choose. This is in line with European trading limits, meaning that leverage is limited to 1:30 for major forex trading pairs and lower for other instruments. On Libertex, every CFD market offers a buy or sell option. This allows you to profit from both rising and falling markets. Libertex offers two exchange platforms to choose from. You can trade on the Meta Trader 4 platform , as well as on a proprietary in-house platform. Both options are available online and via mobile apps. MT4 can also be downloaded to your desktop device – this is the solution you should choose if you want to install an automated robot. If you like what Libertex has to offer, you can open an account in minutes. The minimum deposit is just £100 and they accept bank/credit card payments, bank transfers or e-wallets. After the initial funding of your account, all future deposits are only a minimum of £10. When it comes to security, Libertex is regulated by CySEC, the leading EU license issuer. Furthermore, Libertex has been offering its online trading and financial services since 1997. This means that the provider has been in business for over two decades.

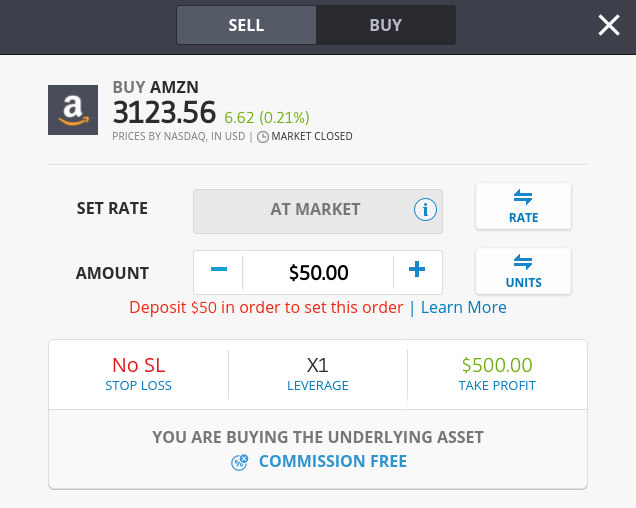

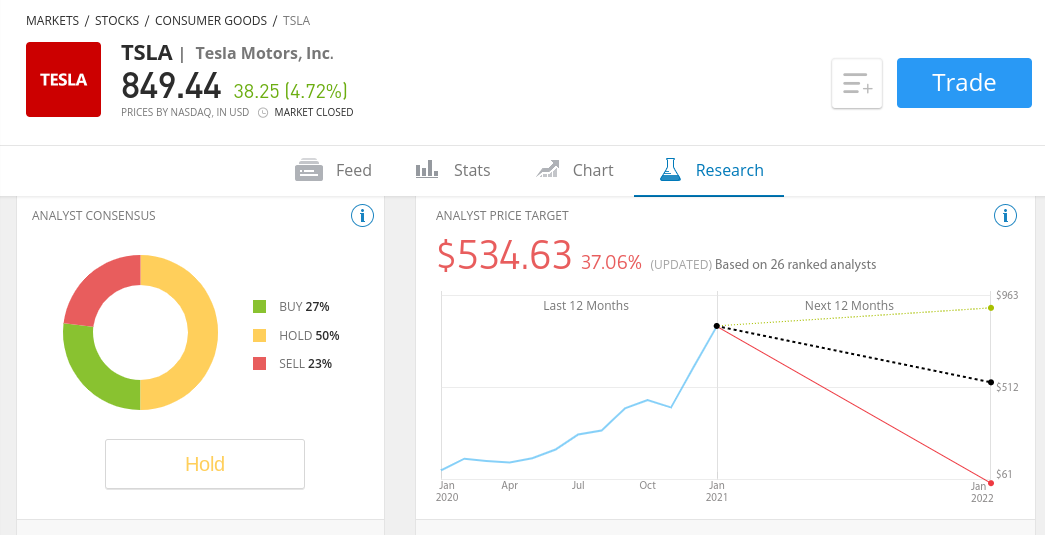

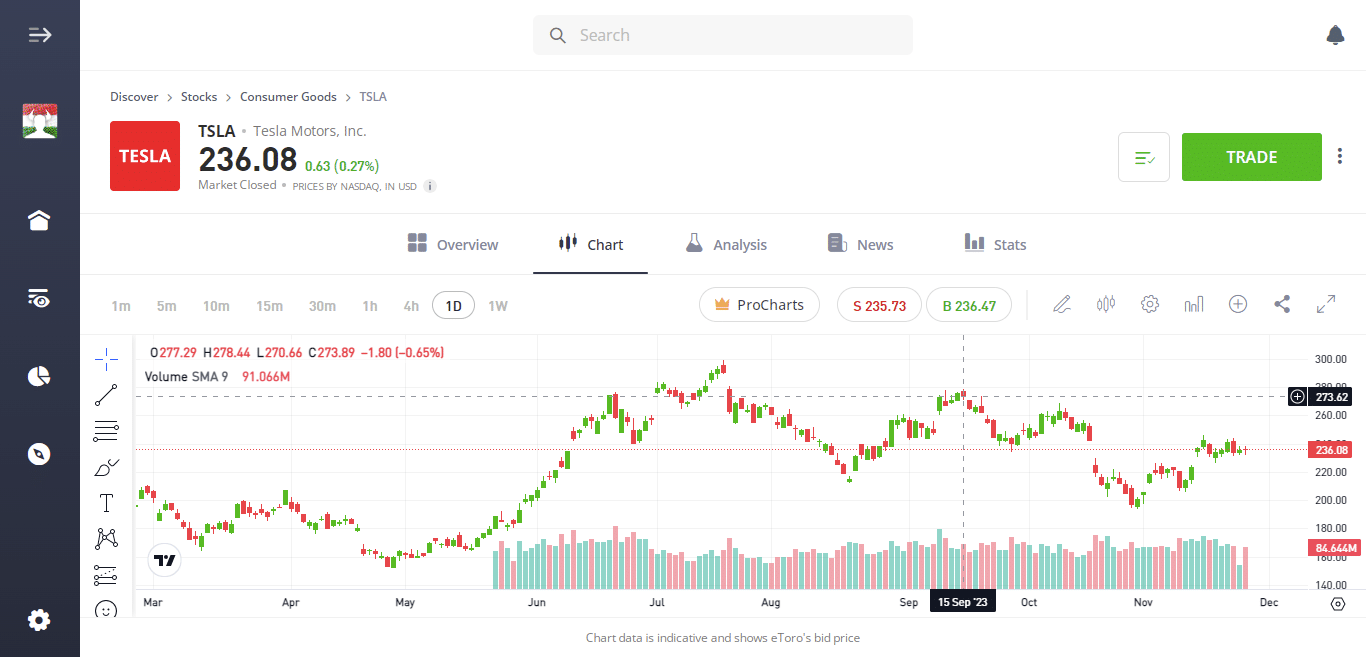

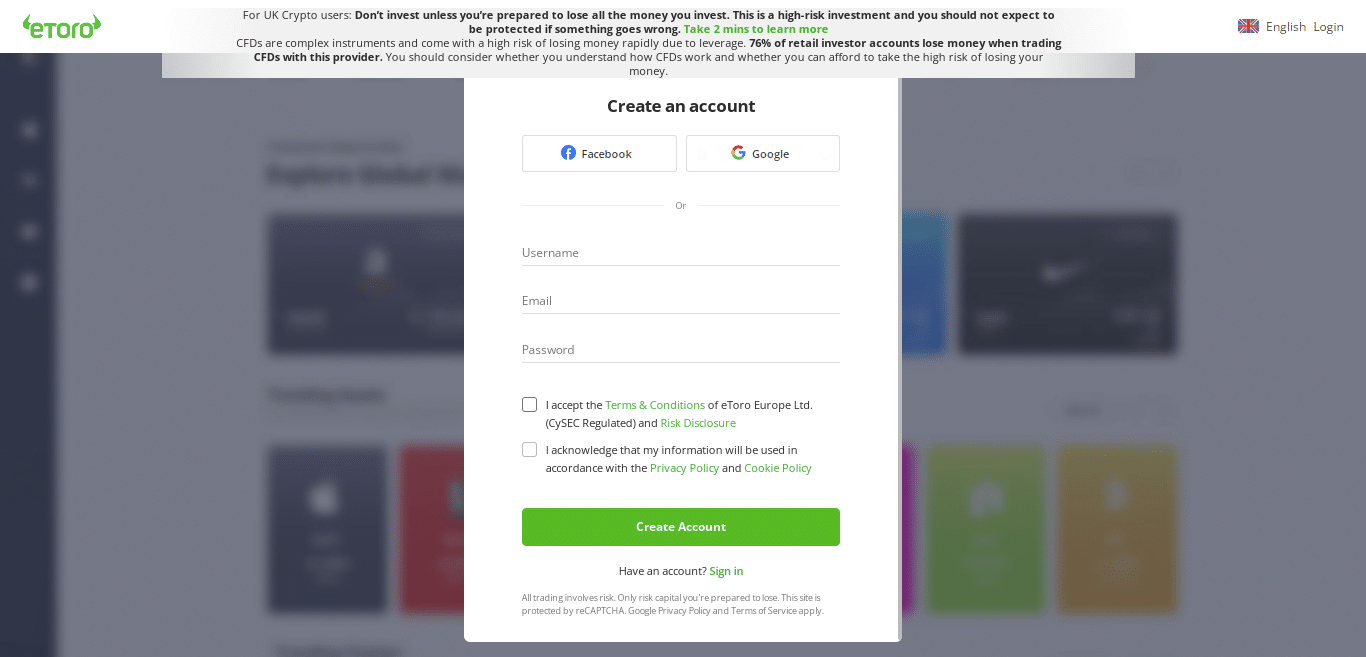

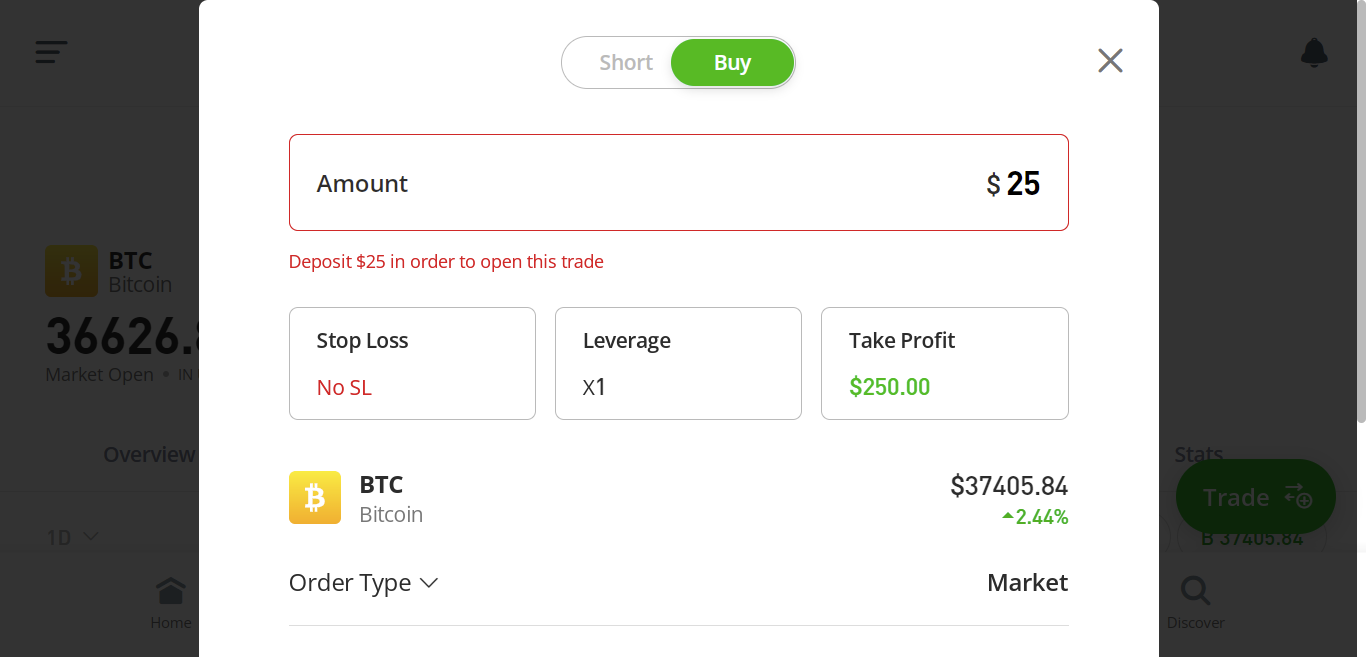

85% of retail investor accounts lose money when trading CFDs with this provider. There are so many trading platforms on the market that finding the right provider can be time-consuming. After all, you are about to invest your hard-earned money, so you need to be 100% sure that the stock exchange platform you choose is right for you and your financial goals. The good news is that finding the best stock exchange platform service in 2026 by checking off a “checklist” of the most important indicators shouldn’t be a problem. The most important factors you should consider are: While it is tempting to choose an exchange platform based on fees or supported markets, the safety of your money should be your top priority. Once again, this is because you are entrusting your own capital to the chosen platform. Therefore, check which financial institutions the provider is licensed by. The best online stock exchange platforms are regulated by FINRA and the SEC in the US. Other governing bodies include the FCA in the UK and ASIC in Australia. If you are wondering why you should stick to online stock exchange platforms licensed and regulated by the aforementioned bodies, consider the following benefits: Ultimately, choosing a trading platform that is not regulated – or one that is licensed in a dubious offshore location – means that your funds will be at risk. The online trading scene can be enjoyed by investors of all shapes and sizes. For example, while some of you may simply want to buy stocks, others may be interested in trading futures or options. With this in mind, you should check to see if the provider has offers in your chosen market. The best online stock exchange platform sites for beginners that we have presented today offer markets in the following main asset classes: By visiting our website, you can easily find out if a given exchange platform supports your preferred financial market. It goes without saying that the best stock exchange platform providers in the online space have truly competitive fees. In some cases, the platforms offer a simple, transparent pricing structure. However, we have also come across providers whose fee structures are confusing and overly complicated. This makes it difficult to say exactly how much you should pay. To make this easier, below we explain in more detail the main fees charged by exchange platforms: The most important fee you should look at is the platform’s trading commission. This can come in two different forms. For example, some stock trading platforms charge a flat fee. This means that you pay $15 for a share , for example, and another $15 when you request a withdrawal . In other cases, you may pay a variable fee. For example, the trading platform may charge 1% on all buy and sell positions. So, if you bought a stock for $500, the commission would be $5. Then, if you closed the stock position at $600, you would pay a commission of $6. However, if you read our article on the best online stock trading platforms for beginners, you will see that most of the selected providers allow for commission-free investing . This means that you can buy stocks, ETFs, and other asset class products without having to worry about commissions or fees. If you are a long-term investor who wants to hold stocks or funds for several years, you don’t need to pay too much attention to the spread. However, if you are a short-term trader who wants to buy and sell forex, commodities or cryptocurrencies – then the spread is crucial. For those who don’t know, this is the difference between the buy and sell price of your chosen instrument. There are cases where this is calculated as a percentage. However, when you are trading forex, the spread is expressed in “pips”. You may be surprised to learn that many brokers in the online space charge transaction fees when you deposit and/or withdraw money. Again, the amount you pay – if you have to pay at all – varies from platform to platform. Additionally, they may charge a flat fee or a percentage based on the amount deposited. In addition to commissions, spreads, and transaction fees, there are several other fees you should consider before signing up with your chosen trading platform provider. These include the following: Ultimately, understanding the fees of exchange platforms can be a daunting task, but it is crucial. If you are looking for a simple, basic trading platform where you can buy and sell assets – you may not be too interested in the other features the site offers. However, you should not ignore this, as there are many useful trading tools that you may be missing out on. These include the following: The ability to buy fractional shares is very important if you are a retail customer with a limited budget. After all, you may not want to pay more than $3,000 for a share of Amazon or more than $1,700 for a slice of Google. With that in mind, fractional shares allow you to buy a “part” of a stock. For example, the top-rated eToro exchange platform allows you to invest in any of its 2,400 stocks from as little as $50. This means that if you invested $50 in a $500 stock, you would own 10% of that stock. This is not only great for small investments, but also when building a diversified portfolio. Regardless of which trading platform you choose to trade on, you will need to place an “order” to execute your position. This is to let the broker know what you want to achieve with the trade. While all trading platforms offer “buy” and “sell” orders, there are other types of orders that you may need. For example, the best online trading platforms offer both “stop-loss” and “take-profit” orders. Both are essential for risk-averse trading. There is also the all-important “trailing stop-loss” order. With this order, you can hold a profitable position open on trading platforms like eToro until the price drops by a certain percentage. If you want to actively trade in the financial markets but don’t have the necessary experience or knowledge, you should look for a platform that offers a trader copy function. In its most basic form, you copy a trader 100% passively. For example, eToro is home to thousands of verified investors who have signed up for its trader copier program. You can review each trader’s profile – see key metrics such as past performance, average monthly return, risk rating, preferred asset class, and average trading duration. If you find someone you want to copy, all you need to do is reach the minimum of $200 per month. Once confirmed, every position executed by the trader will be reflected in your trading account. Of course, you can stop copying the trader at any time. If you are an experienced trader, you know that the MetaTrader (MT) series is extremely popular. For those who don’t know, both MT4 and MT5 are third- party exchange platforms that sit between you and your chosen broker site. Many traders choose a broker that provides access to these platforms, which have advanced tools. For example, both MT4 and MT5 offer the following: Not all exchange platforms support MT4 and/or MT5, so if this is important to you, you should check. Financial markets can and do move at an incredibly fast pace. That’s why it’s important to be properly informed when there are any key changes. With this in mind, it’s a good idea to choose a provider that offers alerts. For example, the best online trading platforms allow you to set up price alerts – which the provider can send on their app or via email. This has the added benefit of letting you know when an asset reaches a specific price target. For example, you want to manually trade the GBP/USD currency pair when the pair reaches 1.36. Additionally, the best exchange platforms allow you to set volatility alerts. This means you will be notified if there is a volatile upward or downward movement in one of your chosen assets. We believe that the best online stock exchange platforms in the online space take their services to the next level by offering comprehensive tutorials. This means that you can learn the basics of buying and selling financial instruments without having to rely on a third-party provider. Some of the most useful tutorials offered by top-rated trading platforms include: In addition to educational materials, the best online trading platform providers also offer a variety of market monitoring and analysis tools. As for the former, this can include real-time financial news, trading information, and market sentiment breakdowns. When it comes to analysis, the best online trading platforms offer advanced chart reading tools, such as technical indicators. If this is your first time trading online, make sure you choose a provider that offers a smooth user experience. While this is usually not an issue when using the provider’s main desktop website, end-to-end connectivity can be both good and bad when it comes to the app. After all, if you prefer mobile investing, you have to open buy and sell positions on a small screen. Therefore, it is vital to check how easy it is to navigate the app. This includes not only finding assets and monitoring the market, but also placing and closing orders, checking the value of your portfolio, and depositing/withdrawing funds. The good news is that in most cases, the best stock exchange platform providers design apps for both iOS and Android devices. In other words, the app is created by the team and, importantly, is optimized specifically for the operating system used. If the stock exchange platform also offers demo accounts, you can try it out without risking any money. To start buying and selling assets from the comfort of your home, you will need to fund your trading account. Therefore, it is very important to check what payment methods the provider accepts. In most cases, you can transfer money from your personal bank account. While some platforms allow instant payments, others require 1-2 business days to process the payment. Therefore, it is worth considering using an exchange platform that also offers debit/credit card payments – so that the deposit amount is almost always added to your account immediately. If you trade on the top-rated eToro exchange platform, you can make deposits using a credit card or bank transfer. There can be huge differences in the level of customer support offered by your chosen trading platform. For example, some providers only allow assistance via email or an online customer service ticket. It is best to avoid these sites as it often takes days to receive a response. Instead, stick to stock exchange platform providers that offer real-time customer support. The best way to get in touch is via live chat, although phone support is also popular. You should also check what days and hours the customer service is open. Most platforms do not provide support on weekends, as the vast majority of financial markets are closed. Support is usually provided on a 24/5 basis. So far in this guide, you have read about the best online trading platforms available online. We have also explained the many important indicators that you should consider before choosing a provider. Finally, we will walk you through the first steps required to start trading on an exchange platform. To do this, we decided to present the necessary steps on the website of the highly rated provider eToro, which offers trading in thousands of markets. Regardless of which trading platform you choose to register with, the process begins with opening an account. On eToro, this can be done in a matter of minutes. To do this, visit the eToro website and click on the “Start Trading” button. You will then be asked to provide your personal information – your full name, nationality, address and date of birth. The exchange platform staff will also need your email address and phone number. eToro is regulated by the UK Financial Conduct Authority. As such, you will be required to verify your identity for legal reasons before requesting a withdrawal. With this in mind, it is best to complete this verification quickly. All you need to do is upload a legible copy of the following two documents: It’s time to fund your newly created eToro trading account. Currently, you can choose from two convenient payment methods, including: The minimum deposit is 20 EUR/USD/GBP for all payment methods except for wire transfer, which has a minimum amount of 250 EUR. No deposit fees are charged. Now that you have funded your eToro account, it is time to find the instrument you want to trade. Once you know which market you are interested in, simply search for it. To see which assets are available, click on the “Trade” button. This will show you the asset classes you can trade – such as stocks, cryptocurrencies, ETFs , forex and commodities – as well as the markets that are rising, falling and volatile the most. Once you know which asset you want to trade, you need to place an order. In our example below, we want to trade Bitcoin. You can trade at live market prices, place orders, and add stop-loss and/or take-profit orders. When you are ready to send your order, click the “Send Order” button.

A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Overall, there are now hundreds of exchange platforms to choose from. With that in mind, you need to do a lot of research to find the provider that suits your needs. For example, while some of you may want to focus primarily on low fees, others may be looking for a platform that offers a specific market or asset class. All in all, we think eToro has everything you could want from an online trading platform. A lakossági befektetői számlák {etoroCFDrisk} %-a pénzt veszít, amikor CFD-kel kereskedik ezzel a szolgáltatóval. Péter a Tradingplatforms írója, elemzője és befektetője aki Győrben él. Tapasztalt piaci elemző, aki aktívan kereskedik, és több mint 10 éves tapasztalattal rendelkezik a pénzügyi piacokon. Szakterülete a napon belüli kereskedés és a hosszú távú befektetés különböző eszközosztályokban. Péter érdeklődése és elkötelezettsége a pénzügyi piacok bonyolultságainak megértése iránt már fiatalon kibontakozott, és élete során ez vált a pénzügyi piacok mélyebb megértésének elkötelezett elérésévé. Pter jártas a Forex és a részvénybefektetések bonyolult világában, és éles észrevételeivel tűnik ki. Szenvedélye, mellyel a pénzügyi piacok összetettségeit megfejti, mind a kereskedési, mind az írói területen nyilvánvaló. Munkáiban Péter megosztja tudását, és bonyolult pénzügyi fogalmakat tesz hozzáférhetővé a szélesebb közönség számára. Újabban a kriptovaluta piacok is érdeklik. FIGYELMEZTETÉS: Az ezen az oldalon található tartalom nem tekinthető befektetési tanácsadásnak, nem vagyunk felhatalmazva befektetési tanácsadás nyújtására. Ezen a weboldalon semmi sem minősül egy adott kereskedési stratégia vagy befektetési döntés jóváhagyásának vagy ajánlásának. A weboldalon található információk általános jellegűek, ezért az információkat az Ön céljainak, pénzügyi helyzetének és igényeinek fényében kell mérlegelnie. A befektetés spekulatív jellegű. Befektetéskor a tőkéje kockázatnak van kitéve. Ez az oldal nem használható olyan joghatóságokban, ahol a leírt kereskedés vagy befektetések tiltottak, és csak olyan személyek és olyan módon használhatják, ahogyan az jogilag megengedett. Előfordulhat, hogy az Ön befektetése nem felel meg a befektetői védelem feltételeinek az Ön lakóhelye szerinti országban, ezért kérjük, végezze el saját kutatásátt, vagy szükség esetén kérjen tanácsot. Ezt a weboldalt ingyenesen használhatja, de előfordulhat, hogy jutalékot kapunk az általunk bemutatott vállalatoktól. A weboldal további használatával elfogadja az általános szerződési feltételeinket és az adatvédelmi szabályzatunkat. Cégjegyzékszám: 103525 © tradingplatforms.com Minden jog fenntartva 2023

List of the best stock exchange platforms in 2026

Best stock exchange platforms – overview

1. eToro – The best trading platform in terms of features

Advantages:

Disadvantages:

2. Pepperstone – one of the best stock trading platforms with a demo account and competitive prices

Advantages

Disadvantages

3. XTB – one of the best trading platforms

Device

Selection

Cryptocurrency

25+ cryptocurrencies

Commodity

21 items

Share

1650+ shares

ETF

100+ ETFs

Forex

49 currency pairs

Index

42 global indices

XTB payment methods and fees

Advantages:

Disadvantages:

4. Admirals – Trade and invest in over 8,000 markets

Device

Selection

Cryptocurrency

Bitcoin, Dash, Ether, Litecoin, Monero CFD, etc.

Commodity products

CFDs on precious metals, energies and commodities

Share

3000+ stock CFDs and thousands of stocks

ETF

380+ ETF CFDs and hundreds of ETFs

Forex

80 currency pairs CFDs

Index

20 index CFDs (cash CFDs, index futures)

Bonds

US Treasury Bills and German BUND CFDs

Advantages

Disadvantages

5. Libertex – low-cost CFD exchange platform with ZERO spreads

Advantages:

Disadvantages:

Choosing the best stock exchange platform that suits you best

Choosing the Best Exchange Platform: Regulation

Choosing the Best Stock Trading Platform: Tools

Choosing the Best Stock Trading Platforms: Fees

Exchange platform fees: Trading commission

Exchange platform fees: Spread

Exchange platform fees: Transaction fees

Exchange platform fees: Other fees

Choosing the Best Stock Trading Platform: Trading Tools and Features

Fractional shares

Order types

Copy trading

MT4/MT5

Warnings

Choosing the Best Stock Market Platform: Education, Market Monitoring, and Analysis

Choosing the Best Stock Trading Platform: User Experience

Choosing the Best Stock Exchange Platform: Payment Methods

Choosing the Best Stock Trading Platform: Customer Service

Using the best stock exchange platform – first steps

Step 1: Open an account and upload your ID

Step 2: Confirm your identity

Step 3: Deposit

Step 4: Browse the available trading markets

Step 5: Open a deal

Best Stock Trading Platforms – Summary

LIZARD

Which is the best exchange platform?

How do I choose the best exchange?

What ID is required to register an account?

Varga Péter

Pénzügyi szakértő

Varga Péter

Pénzügyi szakértő