Obchodní robot recenze – zkušenosti s obchodními roboty: nejlepší robot roku 2026

Trading robots (sometimes also called “Forex Robot”) are automated advisors designed to increase the probability of a positive return on investment.

These are machines programmed with computer algorithms that can advise us, manage money, and invest for us autonomously and at any time.

These trading robots are tasked with managing investment portfolios using specific orders you enter and through reliable platforms.

In this sense, they do all the work for us. Automated management is an innovative element and is increasingly common in the world of finance.

Therefore, in this guide, we will explain trading robots and show you what they are for, how to get the most out of them, and how to choose the right one.

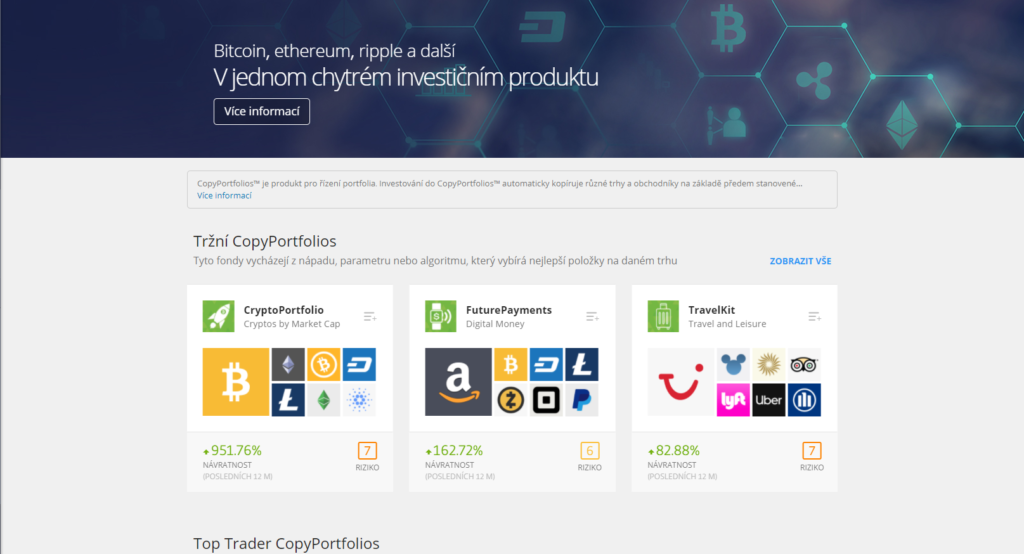

Alternative to a trading robot – trade with the eToro Copy Trading feature

Follow these 4 steps below to start trading on eToro, where you can find a large selection of financial assets such as cryptocurrencies and forex.

[/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

Trading robots: best robot of the year 2026

The trading robots in the following paragraph are among the best on the market. We have tried and tested each of them.

What is an automatic trading robot?

You are probably wondering what trading robots are actually about.

In short, these are new types of tools that use the latest technology and artificial intelligence for trading.

This robot will take care of investing for us and can do it 24 hours a day, 7 days a week without the slightest problem.

This software program works through specific instructions to automatically execute and place trades in the financial market.

This is possible thanks to algorithmic trading, which involves codes and a computer program that determines what the trading robot should do, depending on each specific situation.

For example, a forex robot can be programmed to buy or sell a certain amount of a currency or forex pair at a certain time: when currency X rises, when pair Y falls, or at a certain time of day every day.

It works on the same principle as, for example, a forex broker, but it stands out in that it is under the control of artificial intelligence.

Trading robots perform operations for us without emotions and other human psychological factors associated with trading.

These robots can be programmed and targeted to follow specific strategies, and can also be adapted to all types of investment profiles and goals.

Types of trading robots

Trading robots are characterized by two key factors: first, the types of assets they trade, and second, the proprietary strategy that the trader adapts (for example, "buy and hold" robots or robots based on signals, DCA, or arbitrage).

Regarding the first option, in this guide we highlight the two most popular types of trading robots:

1. Forex Robot

Forex trading robots specialize in MetaTrader 4 and MetaTrader 5 through pre-established strategies and rules for making currency trading decisions.

Thus, the Forex robot automatically enters and exits positions and trades with currency pairs. The Forex robot can completely scan the market in milliseconds and is effective at finding opportunities that humans would not see.

This is a major key point to making money in a volatile and extremely fast market like forex .

A forex robot can apply strategies based on candlestick charts, technical analysis, support and resistance levels or other indicators. This pattern is programmed and the robot then continues on its own. So a sell order can be programmed when the GBP/USD forex pair reaches a certain resistance level, and the robot will always follow these instructions.

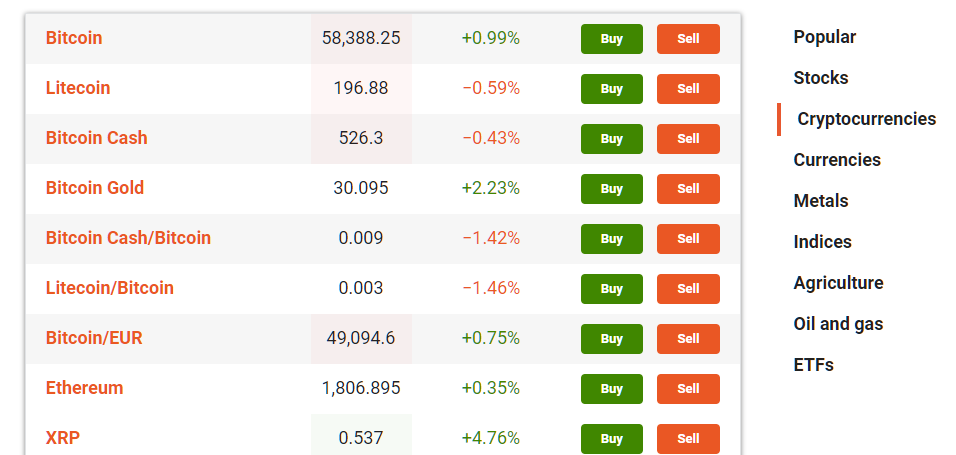

2. Cryptocurrency Trading Robot

Cryptocurrency trading robots specializing in cryptocurrencies are similar to forex trading robots, but their goal is to generate returns from buying Bitcoin or other cryptocurrencies .

Like forex robots, other trading robots work very well in fast-moving or highly volatile markets.

In this case, cryptocurrency trading robots monitor the cryptocurrency asset market and trade according to the settings specified by the client.

They can be set based on the volume of cryptocurrencies in trading, orders, sales, price, and how the market is changing.

Trading robot experience - how do they work?

After we have covered the main types, it is time to explain in detail how trading robots actually work.

Trading robots function as software that offers features that include:

- Opening of investment operations

- Open Position Management

- Closing of investment operations

- Generating signals for you as a trader

- Regular repetition of operations

- Automatic operation 24 hours a day

With manual trading, you, as an investor, can set your rules, place trades, monitor their performance, and buy or sell as you see fit.

This entails the need to sacrifice your time - both in front of a computer or smartphone and the need to make decisions at the right time.

Trading bots can help you ease this effort and use algorithms to make many of the decisions for you - especially those that can be automated.

For example, if you know you want to invest €100 in the EUR/USD pair every month, a trading robot can do it for you .

You can then focus on other investments or other ways of earning - e.g. buying shares or an affiliate program, or Amazon shares.

What is the best trading robot of the year 2026?

In this section, we analyze the best trading robots available based on factors such as their profitability, profit rate, advantages, disadvantages, and availability.

Bitcoin Era

The Bitcoin Era robot helps its clients make money every day using advanced algorithms. Getting started is easy with a quick registration and verification process that allows you to start trading in less than 30 minutes.

Advantages:

Disadvantages:

Riskujete ztrátu vašich peněz.

Bitcoin UP

Advantages:

Disadvantages:

Riskujete ztrátu vašich peněz.

Bitcoin Profit

It automatically trades cryptocurrency for you , so you don't have to do it yourself. Its sophisticated programming technology processes large amounts of data on the cryptocurrency market to make it possible to buy and sell.

Advantages:

Disadvantages:

Bitcoin Revolution

The Bitcoin Revolution cryptocurrency robot is an automated trading software that was launched in 2017. It is free and you can get started with just $250. The developers have proven their commitment to offering traders a safe and easy way to invest in the popular cryptocurrency Bitcoin.

Advantages:

Disadvantages:

Riskujete ztrátu vašich peněz.

Best brokers for cryptocurrency and forex trading

If you are looking for a platform with automated trading options where you can trade on your own, below are some good options that can serve as a replacement for a trading robot.

There are hundreds of different brokers, but we have put together a summary of the best in terms of security, financial assets, customer support, fees and many other factors.

1. eToro

- Overall best platform

It offers thousands of different assets for you to trade and invest in, including stocks, indices , cryptocurrencies , forex , ETFs , and many more.

It is highly regulated by the FCA, which means you can trade and invest completely safely.

Copy Trading and Social Trading features allow you to automate your trading by copying the portfolios of other successful traders.

The Copy Trader feature seems much more effective than standalone automated systems and robots, and you also have more control over your own trading.

At the same time, you will learn from others and be part of the decision-making process.

The platform is available on mobile devices and computers, meaning you can trade from anywhere in the world at any time.

Getting started is very easy and your account will be active within minutes. It offers a wide range of payment options, including debit and credit cards, PayPal and more.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

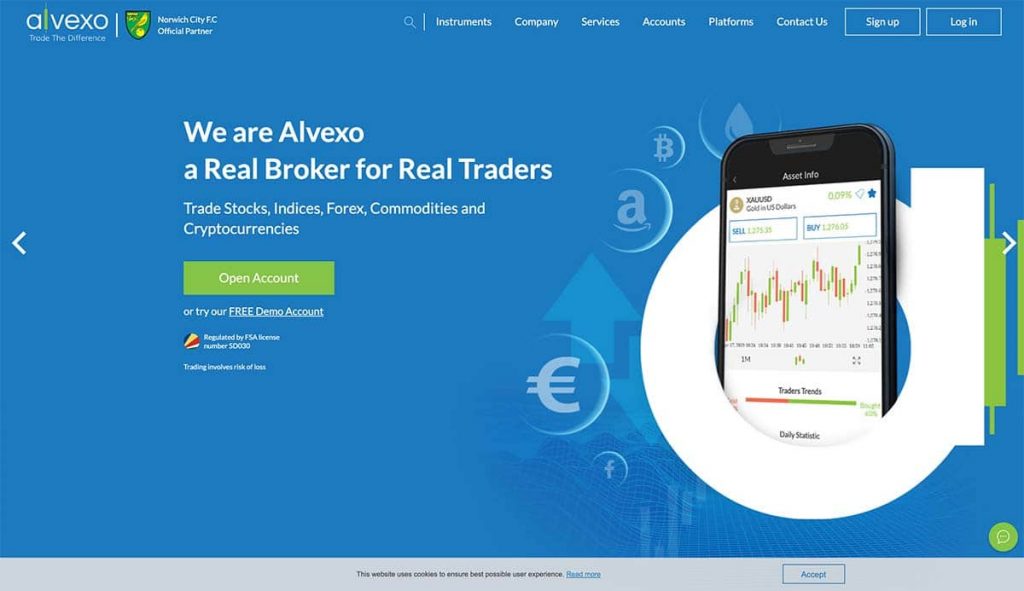

2. Alvexo – a platform that allows you to buy cryptocurrencies and trade forex

Alvexo is a broker that focuses on CFD trading , i.e. Alvexo broker. This abbreviation refers to an investment instrument called Contract for Difference. Investors do not trade the assets themselves, but enter into contracts to pay the difference between the current value and the value at the time of the contract .

It is not a tool that helps to acquire assets into ownership, but it allows speculation and earnings based on the development of the price of a specific asset. Therefore, the investor can also use the decline in the price of the asset to make his earnings. Alvexo trading offers many options.

This trading method is not allowed in all countries of the world, but the good news is that Czech investors can legally use this platform. The platform is supervised by the Cyprus Securities and Exchange Commission (CySEC) , so it has the ability to operate throughout the European Union.

Users can benefit from the platform's goal of supporting user education and using world-class technologies that help with effective investing in several ways. These include the platform and applications, access to global financial markets, analytical tools, and a quality trading tool.

As part of the Alvexo review, we found that the platform offers, in addition to the Alvexo WebTrader online environment and mobile applications, a connection to the MT4 platform with all the tools, as well as additional services that help investors make the right decisions. These include market signals, news, webinars, analyses, e-books and its own financial television. 24/7 user support is also a must.

The platform has different approaches to the spreads it charges, as well as to commissions. These vary depending on the user's account type and also on the category of the asset the investor is entering. For the Gold and Elite account types, commissions are in most cases zero. The amount of pips varies between 0.1 and 2.9.

Pros

[/blade]

[/blade]

Riskujete svůj kapitál. In total, you will find around 200 different instruments here. Libertex has its own software that can be used on both mobile and desktop devices, as well as MT4 and MT5. Here you can take advantage of integrated robots and trading signals that can copy automated strategies or trades. The Libertex app offers the chance to trade whenever and wherever you want. Libertex is very user-friendly both on the app and on your computer. You can rest easy with negative balance protection. The platform is regulated by CySEC and FCA, which means you can trade without worrying about security. Libertex’s fees are very low, starting at 0.006%, and best of all – you don’t pay any spreads.

Disadvantages

3. Libertex

Advantages

Disadvantages

73,77 % účtů drobných investorů ztrácí peníze při obchodování CFD s tímto poskytovatelem.

4. AvaTrade

- The perfect broker when you don't have time

AvaTrade is an online forex and CFD trading platform that also offers automated trading and copy trading.

This is the perfect way to trade if you don't have time or if you are entering the market with no experience. With the auto trading feature, you can follow other successful traders with proven results.

The AvaTrade broker is especially useful for those of you looking for an app with forex trading news .

That's because you can set up real-time notifications when something new is published on the site. The app also comes with market statistics and analysis, which is great for creating your own short-term trading strategies.

When it comes to instruments, AvaTrade gives you access to thousands of financial assets to choose from.

In addition to stocks, indices , cryptocurrencies , forex , ETFs , and bonds, you will also have access to a wide range of forex pairs. This includes major pairs as well as minor and exotic ones.

Spreads are highly competitive.

For example, take the EUR/USD pair, which comes with a minimum spread of 0.9 pips.

As for the trading platform itself, you can choose from MetaTrader 4 and MetaTrader 5 or the AvaTradeGO software.

This gives you the ideal opportunity to choose the software that best suits your specific needs.

Advantages

Disadvantages

71 % účtů drobných investorů přichází o peníze při obchodování s CFD s tímto poskytovatelem.

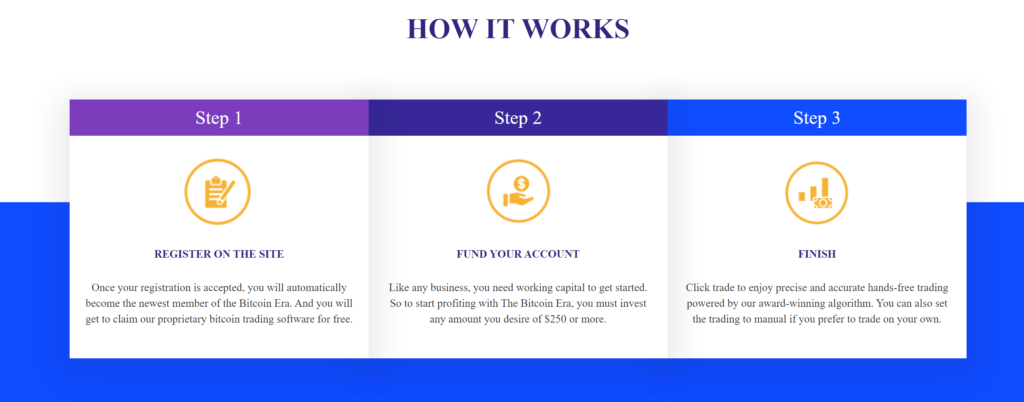

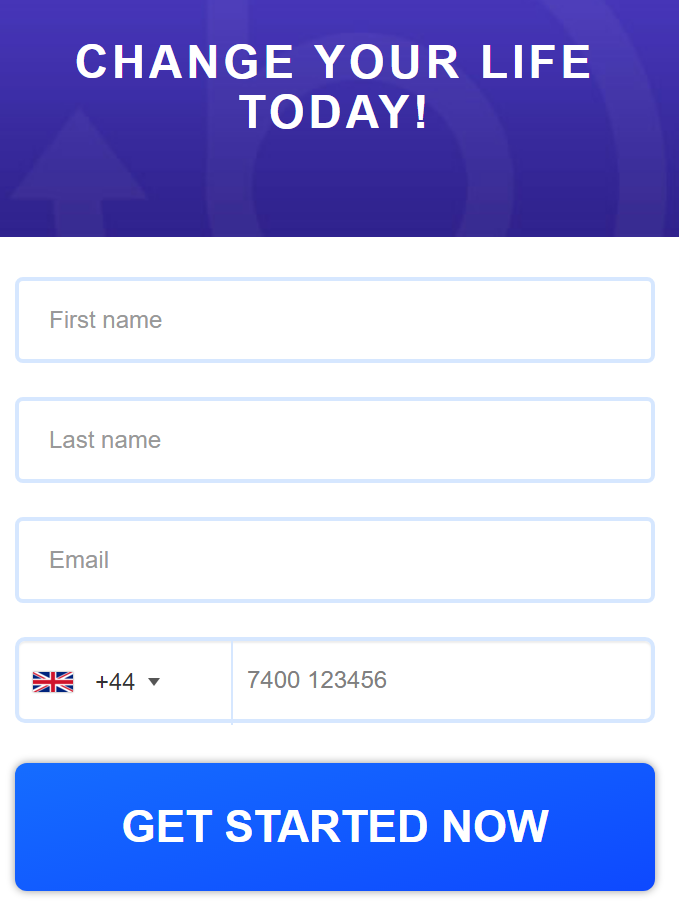

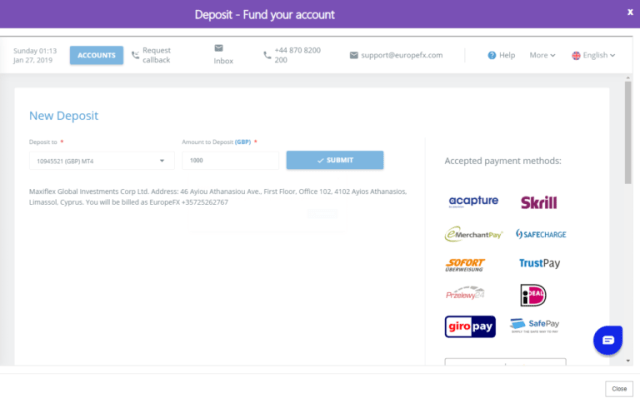

Trading robot – how to open an account?

To open an account with a trading robot, go to the Bitcoin Era website or one of the others. To create an account, there is a quick form on the same main page. Fill in your details and click “Register Now”. You will need an email, phone number and other personal information. You will see a message congratulating you on your registration and a button to start trading. You will see a dashboard where you can invest. First, you need to make an initial deposit. Enter the amount. The minimum is €250 for your trade bot to start trading. You have several payment methods available – credit cards, debit cards, Plus and other options. It is important to check whether the third-party broker platform you will be using the robot on is regulated. All reputable brokers and platforms are regulated today, which increases the safety of trading and investing. Different regulatory bodies can be, for example, FCA or CySEC, but also many others. On the Sirix platform, you will have all the potential of a trading platform with cutting-edge trading technology, where your trade bot can operate by giving it the instructions you prefer from pre-designed options or those you customize yourself. Your trading bot will take care of the rest of the trading. You just need to choose how you want to invest and set the stop-loss or take-profit parameters and leverage that match your personal strategy.

Riskujete ztrátu vašich peněz.Step 1: register with a trading robot

Step 2: Go to your dashboard and make your first deposit

Step 3: Check your platforms

Step 4: enter the platform and start automated trading

Trading robot – how to trade successfully

The basis of success is choosing the right trading robot , which is an aid in making money and successful trading.

However, this is not an easy task, as most trading robots claim to offer better services than others.

In the following section, we have therefore looked at key aspects that will help you choose the best trading robot.

#1 - Choosing the right currency and market

No forex robot offers the most advantageous features across all market types or ranges.

To have the best results, choose the right currency pairs for the risk and associated volatility.

It is equally important to adjust the level of leverage in such markets that can be volatile, which is similar to how CFD brokers operate. The size and percentage of money invested will of course affect this distribution.

#2 - Profit Factor

The profit factor is a key statistic. It answers the question of whether a trading robot will make money or not.

This factor represents the relationship between earnings and the associated risk. A robot can be profitable, but if you always risk all the money in your account, it may not be ideal.

This factor is calculated from gross profit (sum of winning trades) divided by gross loss (sum of losing trades). Ideally, you should get a result greater than 1. But the higher, the better.

#3 - Risk-reward ratio

This ratio indicates the robot's tolerance for risk.

A trading robot with, for example, a take-profit of 5 pips and a stop-loss of 40 pips has a ratio of 8:1. This means that it needs a success rate equal to or greater than 90% to make a profit. Higher ratios, such as 12:1, indicate very risky strategies.

However, there is a greater risk that if the success rate decreases, the trading robot will quickly lose money.

Take this ratio into account and adjust your stop-loss and take-profit margins accordingly.

Trading Robot Experience - Is It A Scam?

Usually not. Trading robots have been around since the early 2000s, so some are as old as MetaTrader 4, which is what most of them run on.

Right now, due to their popularity, there are a lot of brokers, platforms, software, and algorithms, and most claim to be the best trading robots .

If you are interested in using a trading robot or investing through it, you should look at its trajectory, how long it has been on the market, opinions and experiences about it, or whether it is a tested or proven system.

Sadly, there are scammers on the market, but if you do your research before signing up, you should be able to make a safe choice.

Important : Generally, if it sounds too good to be true, it probably is, so in these cases it is important to evaluate the robot's usage, price, profit promise, and other factors. Reviews from other users can also help in this regard.

Trading Robot – how to choose?

Just like when choosing an advisor or trading platform, your profile will be crucial in determining which trading robot and software will best suit your needs .

In the sections below, we will provide you with some key factors you should look at when making your choice.

Opinions and trajectories

A key aspect is to look at which trading robots have been tested or analyzed by independent websites. The opinions of other traders are always valuable, especially considering that automated trading always carries some risk. The trajectory that the best trading robots have is marked by their profits over the past months or years.

Demo account availability

It is a good idea to test the robot before using it with real money. Your savings are at stake, so it is better to learn how the robot works and get used to its controls. Although demo accounts of a trading robot do not always represent a 100% real environment, they are a great way to test, experiment and get to know the robot.

Style and your investor profile

In this third factor, aspects such as your ability to understand forex technical analysis come into play .

Here you also take into account whether, for example, you prefer a robot that you can calibrate or adjust frequently, over a robot that takes care of everything and you have a free hand with. You are also interested in the type of signals that a profitable trading bot can provide you. Finally, you have to decide whether it will take care of 100% of your investments, or only a part and you will take care of the rest manually.

If you decide that a trading robot can benefit you in your investing, it is important to consider the reality of this virtual software. Trading robots can be a great help for those who want to trade, for example, cryptocurrencies. Investing online is a fast and dynamic way of trading, not for the faint of heart – thanks to trading robots, even new and novice investors can make money from it. If you have decided, we recommend that you start with Bitcoin Era, one of the robots that can provide medium and long-term profitability, significant profits, and also combine cryptocurrencies. However, if you want to be in control of your own trading and investments, eToro is a highly recommended choice. You can choose from thousands of different instruments, including forex and cryptocurrency. If you want to learn more and automate your trading, you can make good use of the Copy Trading and Social Trading features.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.Conclusion: which trading robot is the best?

eToro – Trade with Copy Trading and Social Trading features

Trading robot – frequently asked questions

Trading robot – what are its advantages?

Does a trading robot really work?

Is a trading robot profitable?

What is the profitability of a good trading robot?