eToro recenze 2026 – Poplatky, funkce, výhody a zápory

Are you an investor from the Czech Republic and are you interested in investing directly from the comfort of your home? If you answered yes, continue reading this eToro review, where we will reveal and compare experiences, fees and other important factors that affect the outcome of your investment .

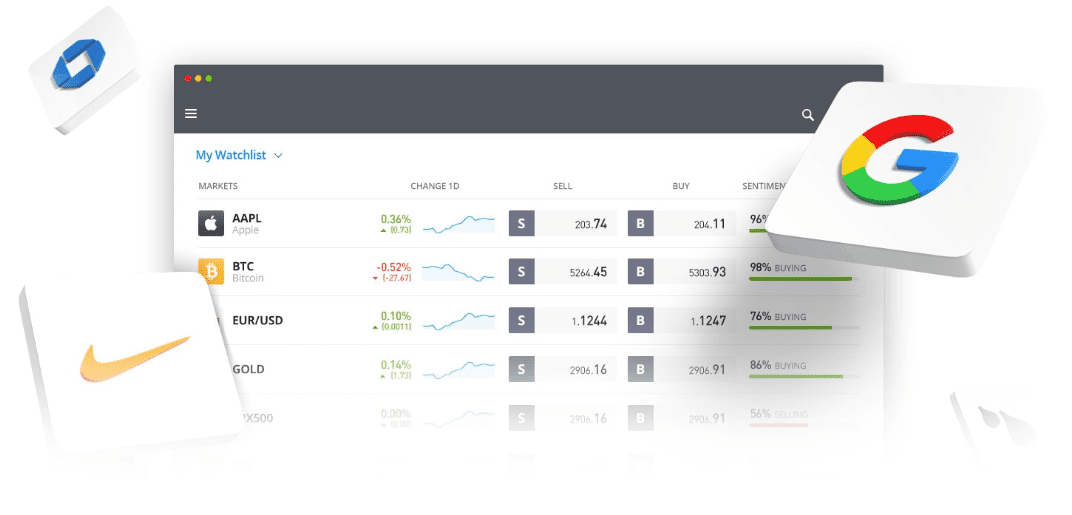

This multi-asset platform is very popular with beginning investors – opening an account and depositing money is easy, and you can buy shares in a few minutes.

But is eToro the right choice for you?

In this detailed eToro review, we will discuss important factors including the types of tradable stocks, various fees and commissions, trading tools, payment options, usability, regulation, and other aspects.

How to start trading on eToro?

If you like eToro and want to start trading stocks right now, below are 4 easy steps to start trading on eToro in 5 minutes:

[/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

What is eToro? - overview

In terms of traditional trading, there are stocks, ETFs and cryptocurrencies to choose from, while CFDs offer stocks, indices , bonds, metals, energies and more.

As a stock trading platform aimed at beginning investors, eToro ranks first in our experience.

You can easily set up a trading account in a few minutes and make a deposit using a credit card, e-wallet or bank transfer. Then you just have to choose how much you want to invest, which shares you want to buy and click on confirm the trade.

We should also mention copy trading and social trading , which are behind the surge in interest in these trading platforms . Thanks to these options, you can communicate with other investors in a similar spirit to Facebook and copy the trades of others.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

What stocks can be bought on eToro?

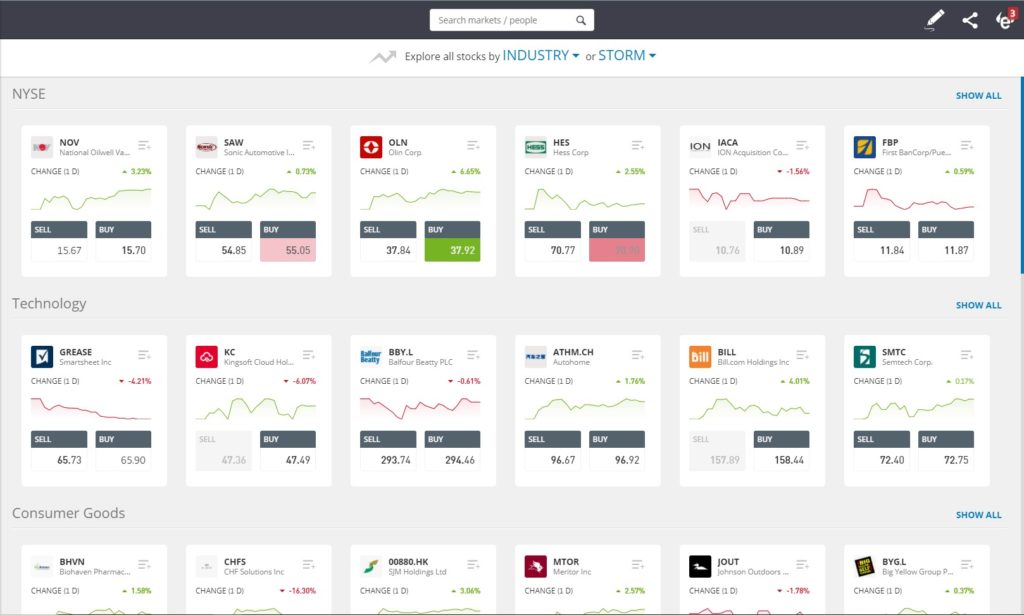

eToro offers over 1,700 stocks from various markets. It's a smaller selection than IG or Hargreaves Lansdown, but there's still plenty to choose from, including the best stocks of the year 2026.

For example, you can easily invest in shares of British companies such as BP, Royal Mail, Tesco or HSBC.

Furthermore, eToro can also help you with international diversification.

The main offering is from the US markets. You can choose from hundreds of well-known companies from the New York Stock Exchange (NYSE) and NASDAQ.

The international markets are then as follows:

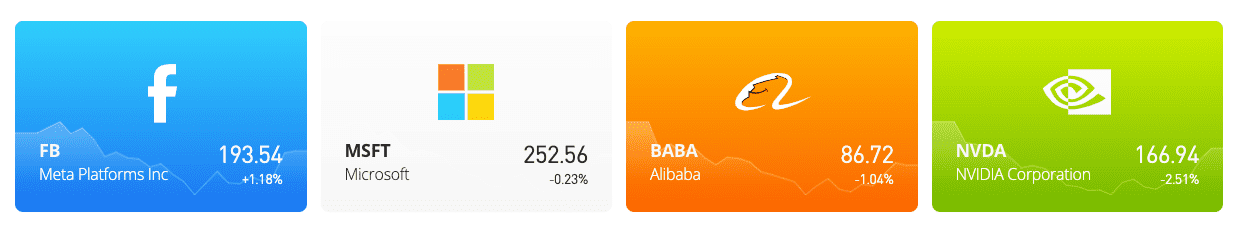

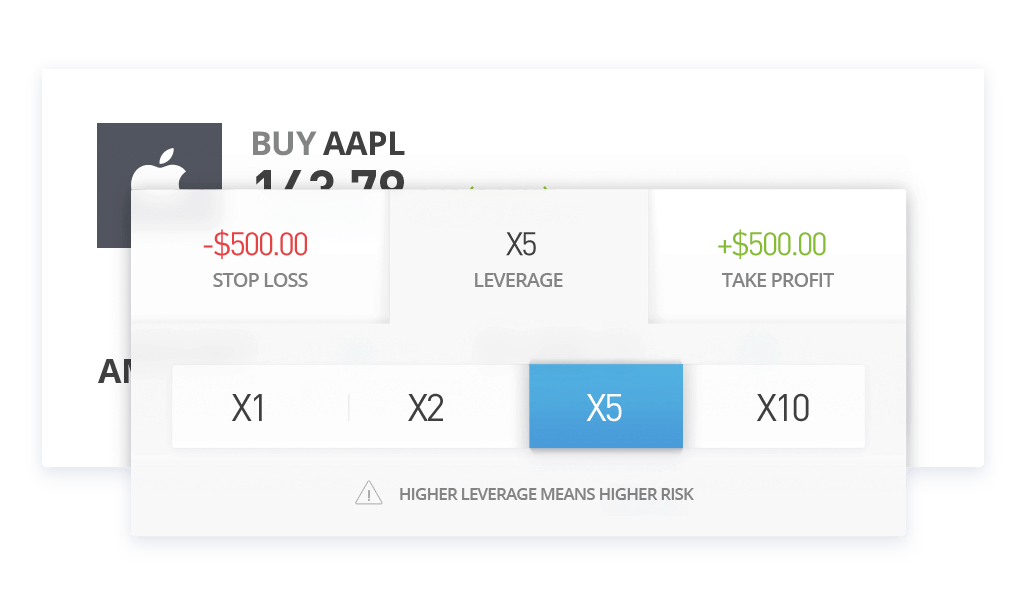

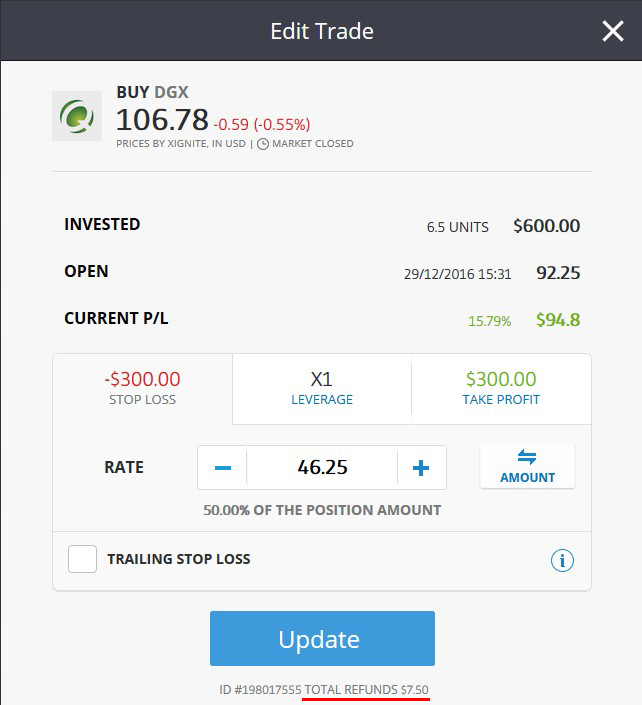

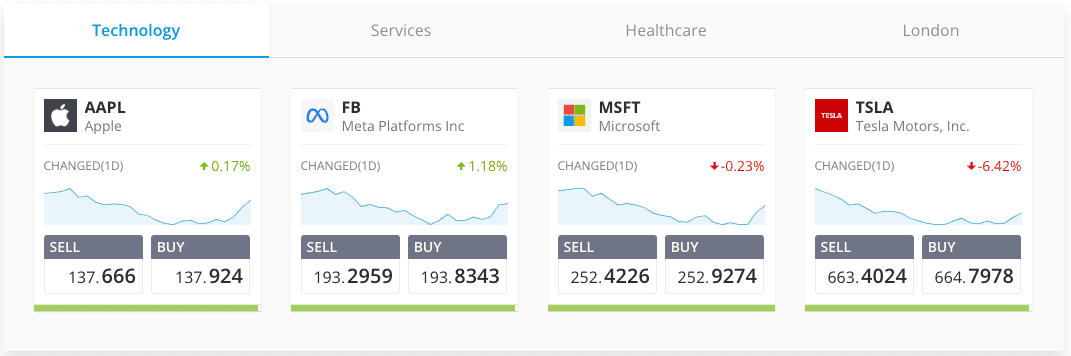

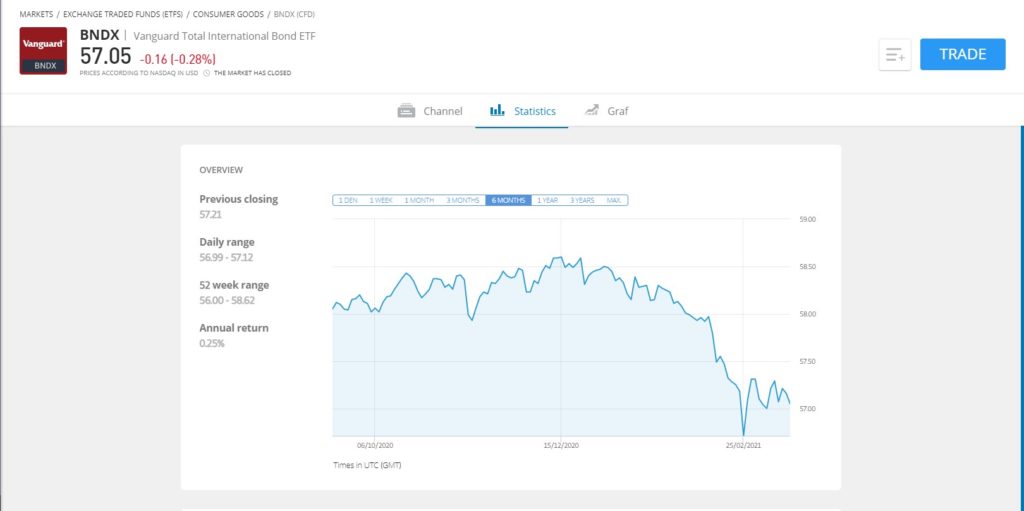

[/blade] You’ll find stocks like Apple , Amazon , Facebook , IBM, Ford Motors, Nike, Disney, and more. As for the specific types of stocks on offer, there’s technology, retail, banking, food, beverage, and even cannabis ! If you’re interested in passive income, there’s also dividend stocks. You can follow the development of your favorite stocks through watchlists. eToro is one of the few Czech brokers offering so-called “fractional shares”. As the name suggests, you can buy just a “fraction” of a share. This has several advantages. For example, imagine a situation where you want to add a few US stocks to your portfolio on eToro. American markets are denominated in dollars, and shares of some companies on the NYSE and NASDAQ can easily cost you hundreds and often even thousands of dollars. As an example, take a look at Amazon shares , which are worth $3,184 at the time of writing this eToro review. This stock would cost you around CZK 70,000. However, most investors don’t want to invest such a large sum in a single stock. First, it makes portfolio diversification more challenging, and you could also quickly exceed your planned investment budget. However, if you want to buy Amazon shares on eToro, you will need $50 , which is around CZK 1,100. In other words, if you invest CZK 1,100 in Amazon, you will own approximately 1.6% of one share. This fractional ownership applies to all of the more than 1,700 shares offered on eToro. If you want to use eToro to buy international stocks but can’t choose specific companies, consider investing in ETFs . This way, you invest in a package of different stocks within a single trade. After buying an ETF from eToro, you don’t have to do anything else and just wait for the right moment to sell. The ETF provider will handle the buying and selling of shares for you. In total, eToro offers 153 ETFs covering various market sectors. Specifically, you will find ETFs from the three largest providers in this financial market sector – Vanguard, iShares and SDPR. This allows you to invest in the most popular ETFs worldwide. For example, each of the aforementioned providers offers ETFs that track the performance of the S&P 500 index. The S&P 500 is the most traded index in the world and is comprised of the 500 largest US companies by market capitalization. With a single investment in the S&P 500 ETF, you can buy shares in 500 different companies with eToro. If you want to take your diversification to the next level, you can buy an ETF with exposure to bonds. For example, the Vanguard Total International Bond ETF contains over 6,000 bond instruments from different markets. Again, you get all of these assets by purchasing a single ETF. As for the minimum investment amount, you can buy ETFs on eToro for as little as $50 without fees . This is great news for Czech investors, as most online brokers require much more. If you wanted to buy directly from a provider like Vanguard, the minimum investment would be CZK 15,250. If you want to invest in different assets, eToro offers its users a wide range of options. Here’s a summary of what else you’ll find on the platform: It is worth mentioning that apart from stocks, ETFs and cryptoassets, all other asset classes are traded via CFDs (contracts for difference). This allows you to trade the future value of the underlying asset without actually owning it. This is particularly interesting for trading tangible assets such as gold , silver and oil . While you won’t own the underlying asset, CFDs at eToro have two key advantages that traditional ownership doesn’t offer – leverage and the ability to short sell. However, please note that CFDs are complex and high-risk instruments, and the risk is even greater when using leverage. Before you decide to invest your money in them, do your research to understand how they work. Leverage allows you to trade with more than you have in your account. eToro is subject to and complies with all regulations of the European Securities and Markets Authority (ESMA). As a result, leverage is capped for anyone living in Europe. For stocks it is 1:5, for gold it is 1:20 and for major currency pairs it is 1:30. For cryptocurrency trading you can have leverage up to 1:2 and for commodities it is 1:10 (except gold). If you don’t know how leverage works, it’s basically multiplying your investment. Let’s say you want to invest 2,500 CZK in gold. If the price of gold increases by 10%, your profit with a leverage of 1:20 would be increased to 5,000 CZK (you multiply 10% of 2,500 CZK by a leverage of 20). One of the most popular features of eToro is the short selling option. This gives you the ability to speculate on a price drop in a simple way . For example, let’s say you’ve done some in-depth research on HSBC shares and they’re extremely overvalued. While most investors would simply avoid the stock, more savvy investors will consider short-selling to profit from its decline. So if you place a sell order for CZK 15,000 and the stock drops by 20%, you will earn CZK 3,000. You can only trade via CFDs in this way.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. People often ask us if eToro pays dividends. In short, yes – when you invest in ETFs with eToro, you are entitled to exactly the dividend that the company decides to pay. In the case of stocks, the company transfers the dividend to eToro, which immediately adds it to your account balance. You can withdraw the money immediately or, even better, reinvest it in other assets, taking full advantage of compound interest. For ETFs , providers like Vanguard and iShares typically pay dividends every three months. Companies across the asset class pay dividends at different rates throughout the month, and it would be impractical to transfer each amount separately. Instead, the ETF pays you dividends in one lump sum for the entire quarter. The dividends are then credited to your eToro account and you can withdraw them immediately. One of the most important factors when choosing a broker for stock trading is the fee structure. EToro charges a 1% fee for buying or selling crypto assets on its platforms. There are no fees for ETF trades, and the broker covers the account for regulatory transaction fees when selling stocks. There is a $75 fee for partial and full account transfers. However, that’s not all, there are more fees to be aware of. Therefore, the following is a complete list of eToro fees that you need to be well aware of for long-term profitable investments. This applies to eToro’s entire stock offering, whether local or foreign. Such a generous offering deviates greatly from that of traditional local brokers, which is why eToro has already become a favorite among more than 12 million investors. For example, popular UK broker Hargreaves Lansdown charges an entry fee of £11.95. You pay this fee when you buy and then again when you sell. So if you buy Royal Mail shares for £50, the fee will be 23.9% of your entire investment! Below you can find a comparison of the fees you would pay to buy £1,000 worth of shares on eToro , IG and traditional companies like Hargreaves Lansdown. Below you will find the fees you would pay when opening a long position on a £1,000 stock CFD with eToro, Plus500 or MarketsX. There are a few additional fees to keep in mind when using eToro, including: In the world of stocks, spreads are the difference between the bid (buying price) and the ask (selling price). Understanding this principle is very important because it is an indirect cost of trading and affects the resulting ROI (return on investment). eToro does not have fixed spreads, so they will vary depending on the current market situation. This means that during the busiest trading periods, you will have practically the best conditions in terms of spreads. To give you a better idea of how much you’ll actually pay on the spread, the bid and ask prices for Royal Mail shares during standard trading hours were 174.24 and 174.80 pence respectively. This means the spread was around 0.32%. Considering you don’t pay any purchase fees , these are pretty great terms. eToro charges an inactivity fee of $10 per month for accounts that are inactive for more than one year. Withdrawal fee $5 Deposit fee 0 Inactivity fee 10 USD (More than a year) Account maintenance fee No As we can see above, eToro does not charge any fees directly for deposits . However, there is an indirect currency conversion cost to consider, as all eToro accounts are denominated in US dollars. If you deposit by credit card, e-wallet or bank transfer, you will be charged a currency conversion fee of 0.5%. For a deposit of CZK 10,000, this is CZK 50. Withdrawals are charged a fixed fee of $5, which is approximately CZK 110.

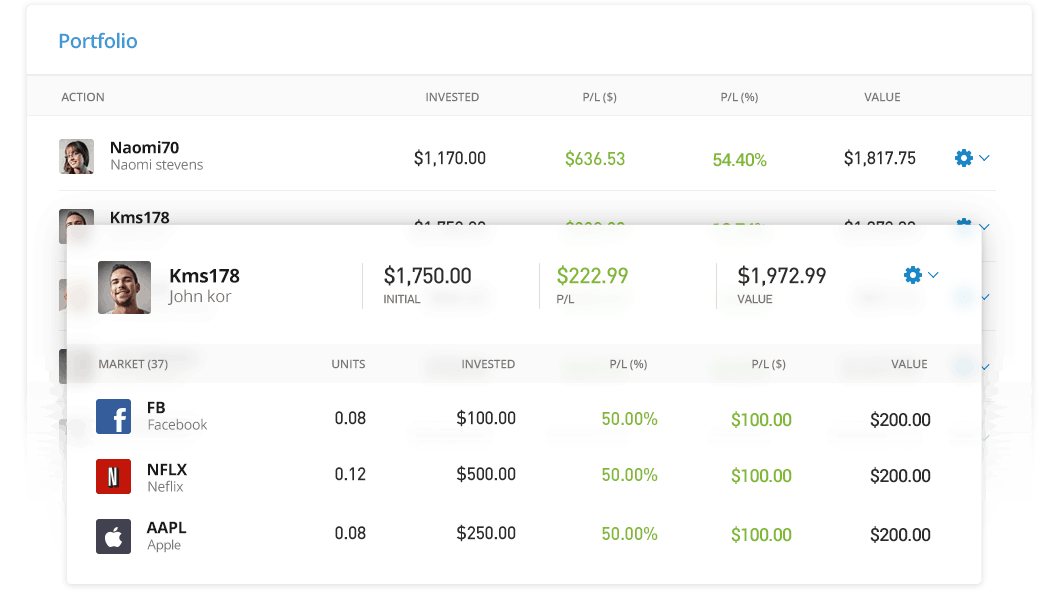

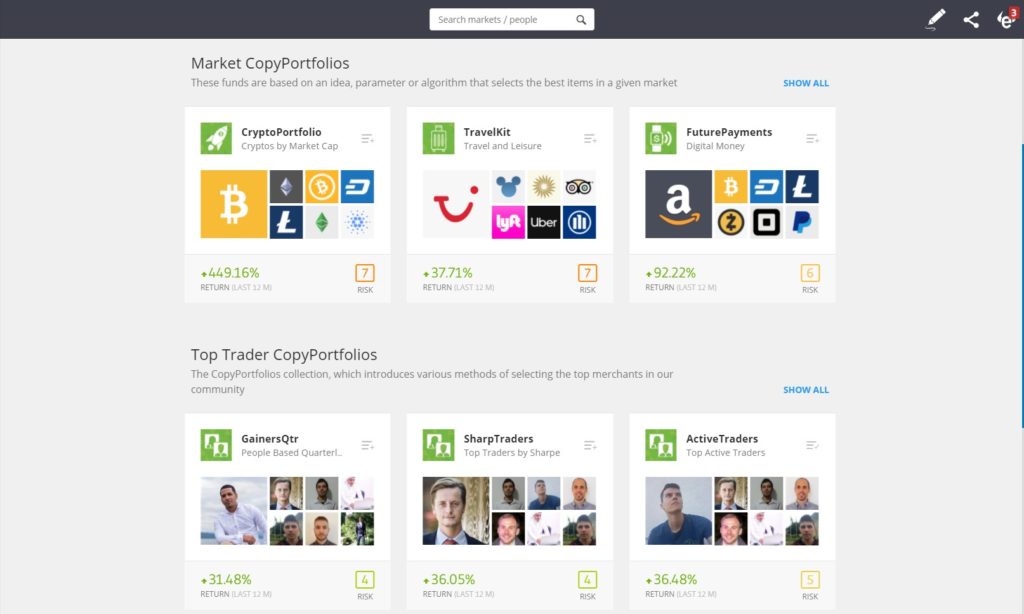

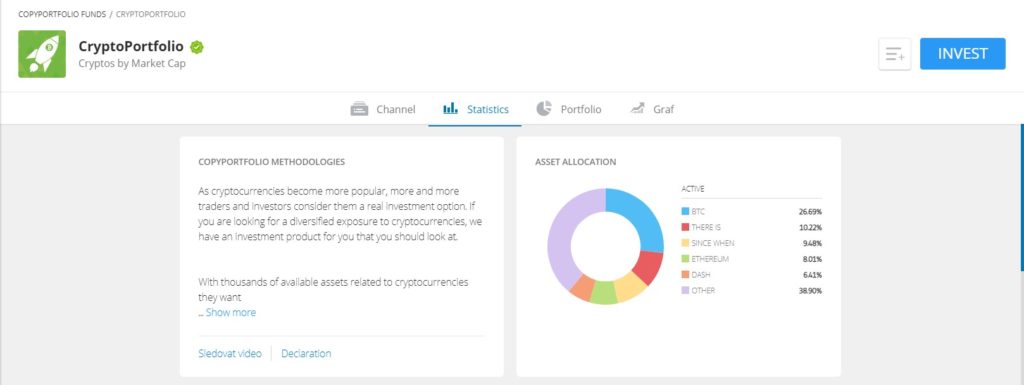

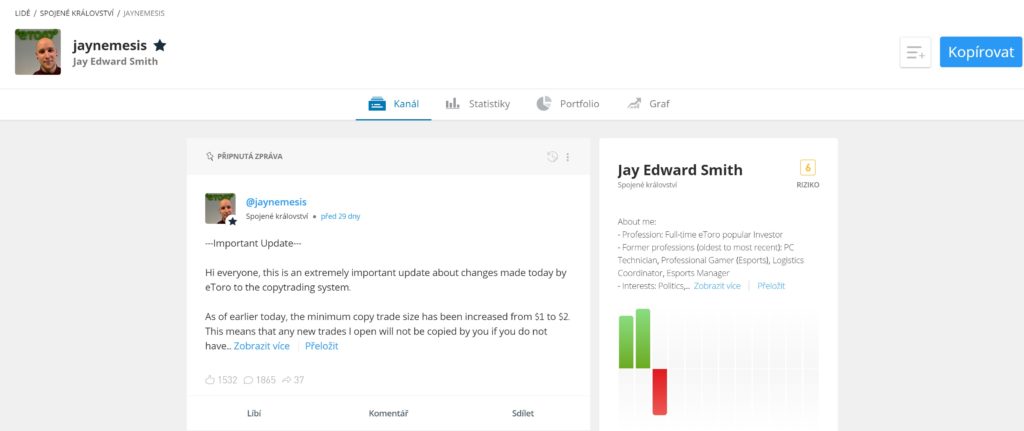

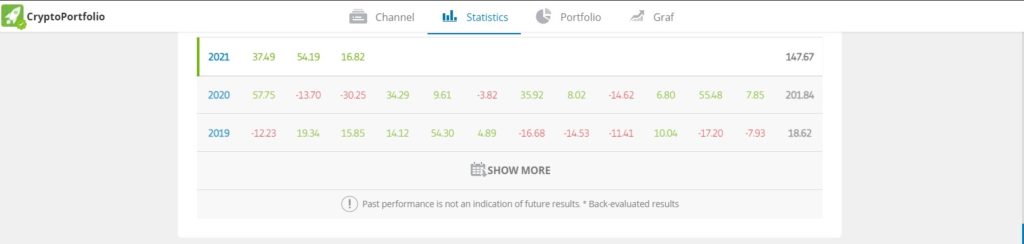

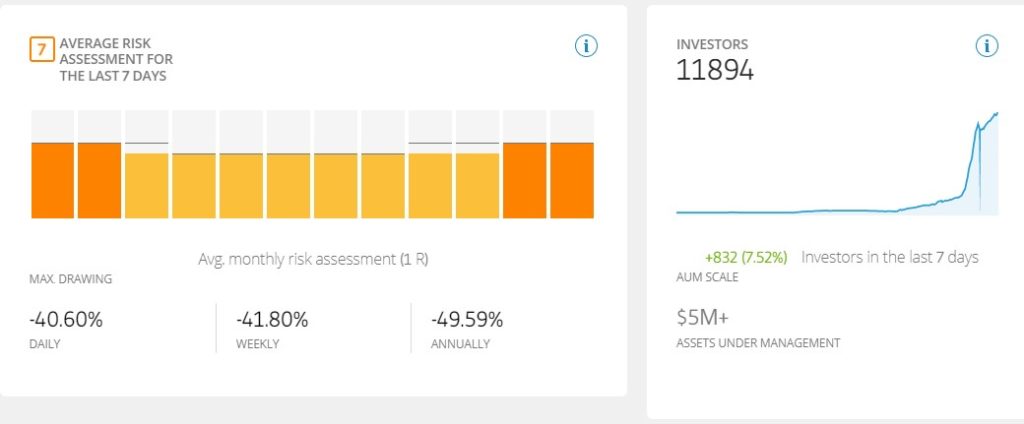

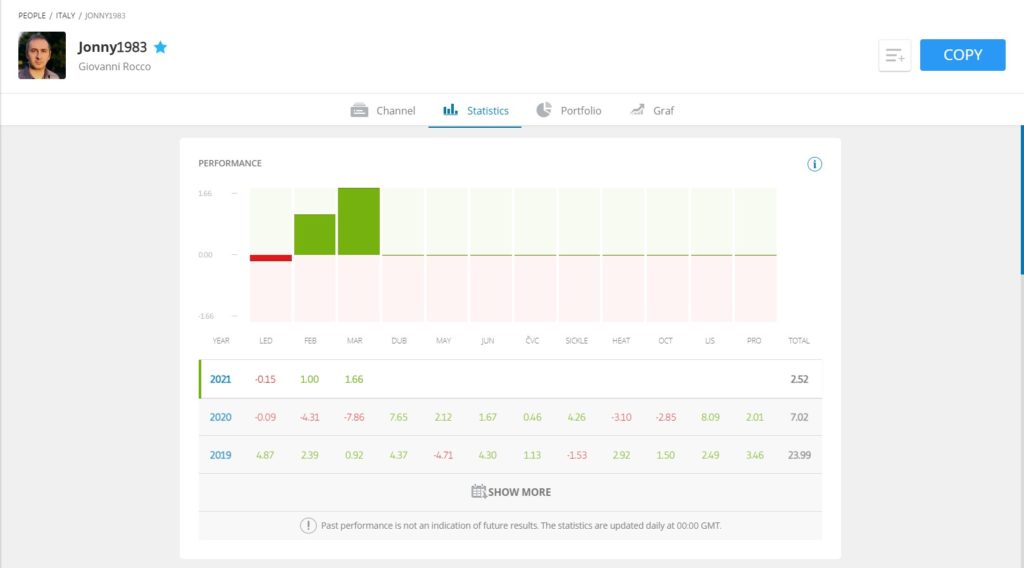

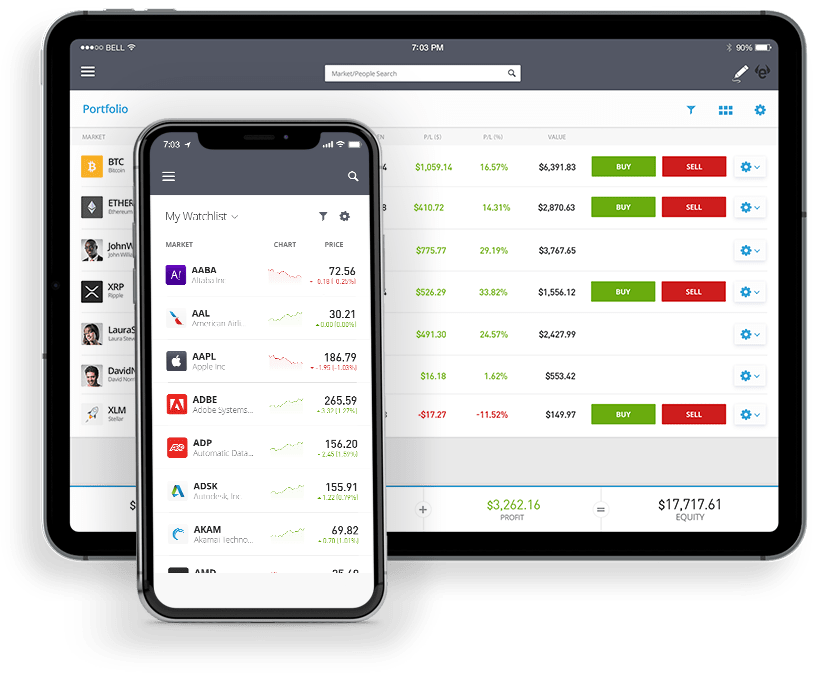

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. When it comes to buying and selling stocks on eToro, it’s a very simple process. You can search for investments in two ways. Although eToro is aimed at beginning investors, you still have plenty to choose from in terms of orders. Types of commands include: To sum it up, if you are going to buy stocks on eToro that you want to hold for several years, you will be more than happy with a market order. eToro is often referred to as a “social trading platform,” and for good reason. If you haven’t encountered this phenomenon before, it’s basically a social network , except for stocks and an investment environment. In other words, you can discuss your trading ideas and get investment recommendations from your peers in a public place. Let’s say a more experienced trader has issued an investment recommendation for the coming week on eToro. In that case, you can not only read the recommendation, but also react to it. This is especially useful if you are really just starting out and need to gain new experiences and perspectives. You can then add selected eToro users to your friends list, allowing you to follow their activities on the platform. While eToro is an excellent social trading platform, nothing can match the copytrading feature it offers. Thanks to this, you can search for your favorite investors on eToro and copy all their trading activities to the letter . You will copy not only the trader’s entire portfolio, but also their future investments. This allows you to invest in stocks without having to do your own research. So if you are just starting to learn how to invest in stocks, but would like to invest, you can use CopyTrader to do so. The best part is that you can invest the amount that suits you – after meeting the $200 minimum. There are no additional fees associated with copying trades and you can close positions whenever you want. You can even close individual orders directly in your portfolio, giving you 100% control over your money. At the time of writing, there are nearly 710,000 traders you can copy. Fortunately, there are a bunch of filters to help you choose the most suitable candidate to meet your long-term goals. To give you an idea of what to consider when choosing a trader, we have created this list: Finding a trader on eToro can be time-consuming, as you are choosing from thousands of potential options. With this in mind, we have selected the three best eToro copy traders for you. Rest assured, Jay Edward Smith, aka “Jaynemesis,” is one of the hottest copy traders on eToro in 2026. First, this trader has a return of over 68% this year. Given the circumstances created by COVID-19 and the fact that many stocks are still trading at pre-pandemic levels, this is an unprecedented performance. Even more impressively, apart from a 0.57% dip in September 2026, Jay Edward Smith has finished the previous 14 months in profit. In 2018, the trader brought followers a 52% appreciation. A closer look at his portfolio reveals that he invests in a diversified basket of stocks. You’ll find Microsoft, Etsy, UPS, Canadian Solar, and Beyond Meat. 95% of the portfolio is in stocks, but a smaller portion is also in Bitcoin and ETFs . Jay Edward Smith has also dabbled in indices and commodities in the past. His risk rating has increased to 5/10 from eToro’s 2/10 in April 2020. The trader currently has over 26,000 followers and over $5 million in assets under management. If the risk of 5/10 seems too high for you, take a closer look at a trader named Shamsher Malik. This UK trader specializing in fundamental analysis prefers safer investing. Specifically, he trades stocks and forex. He holds positions for an average of 2 weeks, which is consistent with following short-term trends. Although his risk rating is 3/10, his returns are not holding up at all. For example, in the first 10 months of 2020, he had a return of 12.32%. This is certainly a much smaller amount than Jay earned, but you also need to remember the risk-reward ratio. Of course, you should expect higher returns from riskier traders. However, Shamsher had a 32% appreciation in 2019. The drawdown is also very friendly, averaging 10.45% per year. If you’re interested in short-term swing trading, you might like up-and-coming trader Mantas Dabkevicius. He’s from Denmark and regularly buys and sells assets on eToro under the handle “Mantasdabk.” His average trade duration is 1.5 weeks. He places an average of 25 trades per week, making him very active. As for the assets of this eToro copy trader, 60% are stocks. He also has interests in commodities, currencies, cryptocurrencies , and ETFs. You can participate in the events of various markets completely passively, practically continuously. Regarding the evaluation of its history on the eToro platform, it dates back to December 2019. However, in the first month it earned 4.85% and for the year 2020 its evaluation was 55.62%. This represents 58.70% of his winning weeks since joining eToro. Based on his high returns, you might think he is a very risky trader, but his risk rating is actually 4/10, up from 6/10 in March 2020. eToro also provides more advanced tools for copying trades called CopyPortfolios. These are professionally managed portfolios using artificial intelligence and algorithmic trading. There are two types. Top Trader Portfolios are made up of the most successful traders on eToro, and Market Portfolios combine certain assets into one selected trading strategy. Regarding the first type of Top Trader Portfolios, one of the most popular on eToro is “GainerQtr”. In 2026 this portfolio earned a little less than 20%. The year before, the return was a little over 14%. The portfolio is well diversified, with 25% of it made up of 5 traders. The rest is divided among a large number of traders from different markets. This is a more sophisticated method of copying, but at the same time the disadvantage is the minimum deposit into CopyPortfolio of 5,000 USD (110,000 CZK). Nevertheless, it must be admitted that from a passive point of view this is the best available investment on eToro, because you do not have to deal with absolutely anything. No selection of suitable traders and portfolio rebalancing solutions. With Market Portfolios, you can target specific areas of the financial markets. One example is the “RemoteWork” portfolio. This is a portfolio that offers exposure to companies associated with working from home (remote work). This includes stocks like Twilio, Zoom, Shopify, Adobe, Salesforce, and more. This particular portfolio has been particularly successful since its launch in 2018. Over the past three years, its returns are 82% (2020 year-on-year), 41% (2019), and 49% (2018) – perfect numbers. Other areas of eToro Market Portfolios include renewable energy, self-driving cars, mobile payments, food and technology, and video games. Unlike Top Trader Portfolios, the minimum deposit is just $1,000 (CZK 22,000). However, the specific amount depends on the portfolio you choose, so check it out to be sure. In the area of research and analysis, eToro lags slightly behind. Although the TipRanks website is integrated into the eToro web platform , you won’t get much out of it. For example, you can’t view financial reports, detailed expert analysis, or financial statements. However, you can look at various analytical data associated with the selected stock. These include piles of charts linked to historical price and also the general consensus of leading hedge funds. As for the fundamental aspect, it’s the same song again – weakness. There is practically only information shared by other users of the platform. Therefore, it is better to search for source information externally on sources such as Yahoo Finance or Morningstar. In the investment app and web version of the platform, you can do the same things as in the main desktop version. Whether it’s buying and selling shares, checking the value of your portfolio, or depositing/withdrawing funds, you’ll find everything in its place. The big advantage of using the eToro mobile app is that you are not limited by a small screen. The app is completely optimized for mobile devices, so everything works without any problems. If you want to take your investing efforts to the next level, try out all the benefits of the eToro app. For example, you can find out the value of your shares with one click, wherever you are. You can also make last-minute investments without having to wait until you get to your computer at home. The same goes for closing positions. Waiting for long hours to get to your computer could end up costing you a lot. If you want to test your trading skills without risking your hard-earned money, open an eToro demo account. It comes with 100,000 virtual dollars and full access to the eToro trading platform, including the ability to copy trades. The demo account is a great learning opportunity.

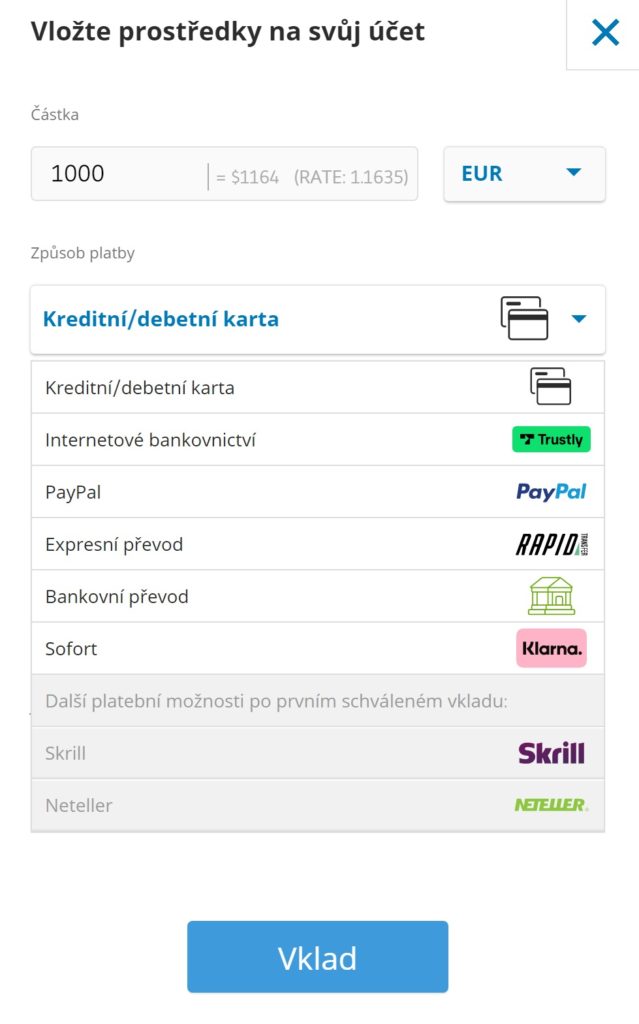

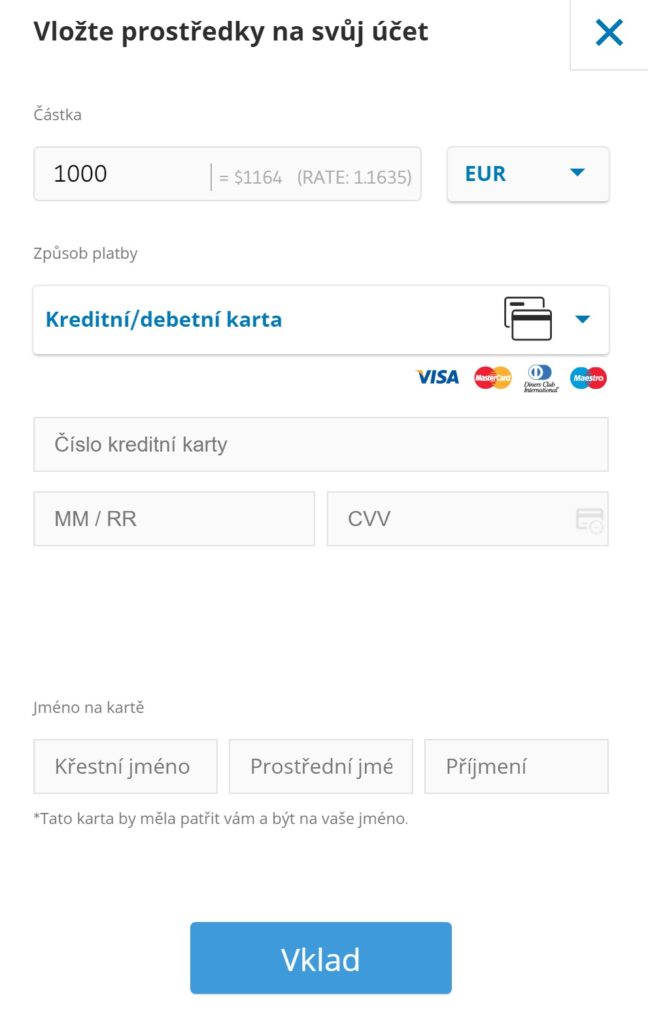

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. One of the biggest advantages of eToro is its wide range of payment options, which include:

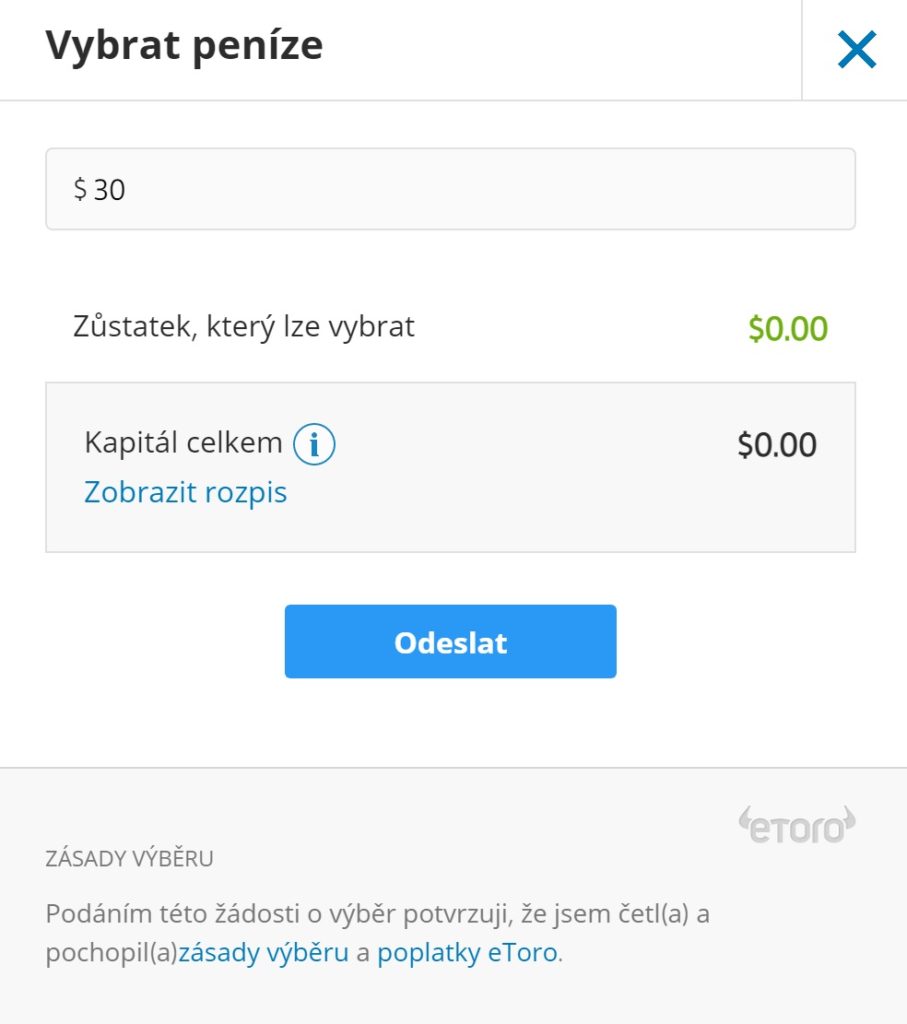

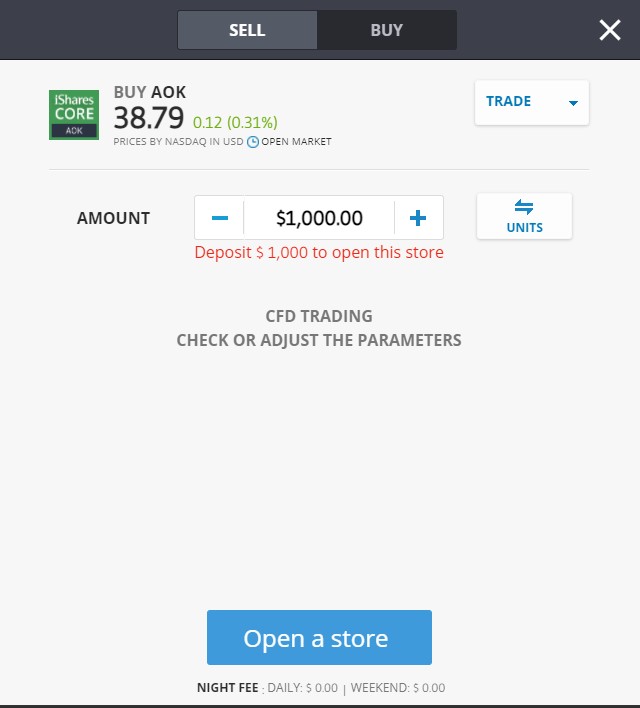

[/blade] The above payment methods offer great flexibility, as many traditional brokers do not offer such options. Take Degiro for example, where it can take several days to process a deposit. If you want to buy shares quickly, such delays will definitely not please you. However, when depositing with a debit/credit card or e-wallet on eToro, the deposit will be processed immediately and you can start investing. As for the restrictions, the minimum deposit is $200, which is equivalent to 4,400 CZK. You may have noticed that everything on eToro is denominated in US dollars. The trading platform has over 1,700 stocks from 17 international markets, and when you stick to a single currency, you don't have to worry about constantly changing exchange rates. As a result, eToro charges a 0.5% currency conversion fee on all deposits. So if you deposit in CZK, EUR, GBP or any currency other than USD, you will pay a smaller fee. For a deposit of CZK 10,000, this corresponds to CZK 50. As for withdrawals, again, it's not complicated. Just go to your account, select the withdrawal option and enter the amount. Due to anti-money laundering laws, you must withdraw the money to the same place where you originally deposited the money, at least up to the amount of the deposits made. To help you visualize this, let's say you deposited CZK 10,000 into your account with a payment card and want to withdraw CZK 12,000. In that case, you must send at least CZK 10,000 to the same card you used to make the deposit, and you can send the remaining CZK 2,000 elsewhere. The minimum withdrawal amount is $30 (approximately CZK 660). Each withdrawal is subject to a fixed fee of $5 regardless of the amount withdrawn. Each withdrawal is also subject to a 0.5% currency conversion fee. The current CZK/USD exchange rate at the time of withdrawal is used for the conversion. While the range of instruments and fees are certainly very important factors when choosing a broker, you should place even greater emphasis on how the broker is regulated. This factor will affect the broker's reliability and the safety of your funds. As for eToro, it holds three licenses: In addition to the aforementioned regulations, it is also important to consider that eToro has been in the stock trading business since 2007. That is a 14-year history. As we have already mentioned, the customer base includes over 12 million investors. Considering these factors, you don't have to worry about your funds with eToro. If you like eToro and want to start trading stocks, you can find the required steps below. First of all, you need to go to the eToro homepage and create an account. They will ask you for some personal information, which is common to most regulated platforms. They ask for your name, address, date of birth, and contact information. They will also ask for your social security number. eToro needs to verify that you are the real owner of the account. To do this, you will upload several documents. These include: Verification of your documents on eToro usually takes less than an hour, and you can make your first deposit in the meantime. Making a deposit is easy. Just choose a payment method (you can find the options above) and enter how much you want to deposit. The minimum deposit is $200 (approximately 4,400 CZK). Unless you choose a bank transfer, the deposit will be processed immediately. Once you have made your deposit, you can start buying stocks straight away. If you know which company you want to invest in, you can easily search for it in the search box at the top of the page. If you want to browse the entire stock library, click on the “Trader Markets” button and then “Stocks”. There is also the option to filter by sector. In our example, we want to buy Nike shares, so we enter the name in the search box and click “Trade.” Now all you have to do is enter the amount you want to invest. As we mentioned, you enter this amount in dollars. The minimum investment is 50 dollars, which is approximately 1,100 CZK. To confirm the order, simply click the “Open Trade” button if the markets are open, or the “Set Order” button if not. eToro advantages and disadvantages

Fractional Shares on eToro

ETFs

Other assets on eToro

eToro leverage

eToro short selling

eToro dividends

eToro fees and commissions

1. Fees for purchasing shares

2. Comparing fees when buying shares

eToro

IG

Hargreaves Lansdown

International stocks

1$

£0 or £10

£11.95 or 1% (min. £20 / max. £50)

3. Comparison of fees when buying stock CFDs

eToro

Plus500

MarketsX

S&P 500

£1.20

£1.05

£1.30

Europe 50

£1.35

£0.65

£1.25

Apple

£3.15

£4.45

£3.20

4. Additional fees

Spread

Inactivity fee

Deposit and withdrawal fees

eToro platform for buying shares

Command types

eToro Review: Stock Buying, Social Trading and Copytrading

Copying trades

Best traders on eToro to copy

Jay Edward Smith – Jaynemesis – top-rated trader with a 68% year-over-year return in 2026

Shamsher Malik – ShamsherMalik – low-risk stock and currency trader (55% year-over-year return 2026)

Mantas Dabkevicius – Mantasdabk – swing trader with great potential (55% year-on-year appreciation for 2026)

CopyPortfolios

Top Trader Portfolio

Market Portfolios

Charts, research and analysis on eToro

eToro mobile app

eToro demo account

Payment options on eToro

eToro withdrawals

Is eToro safe?

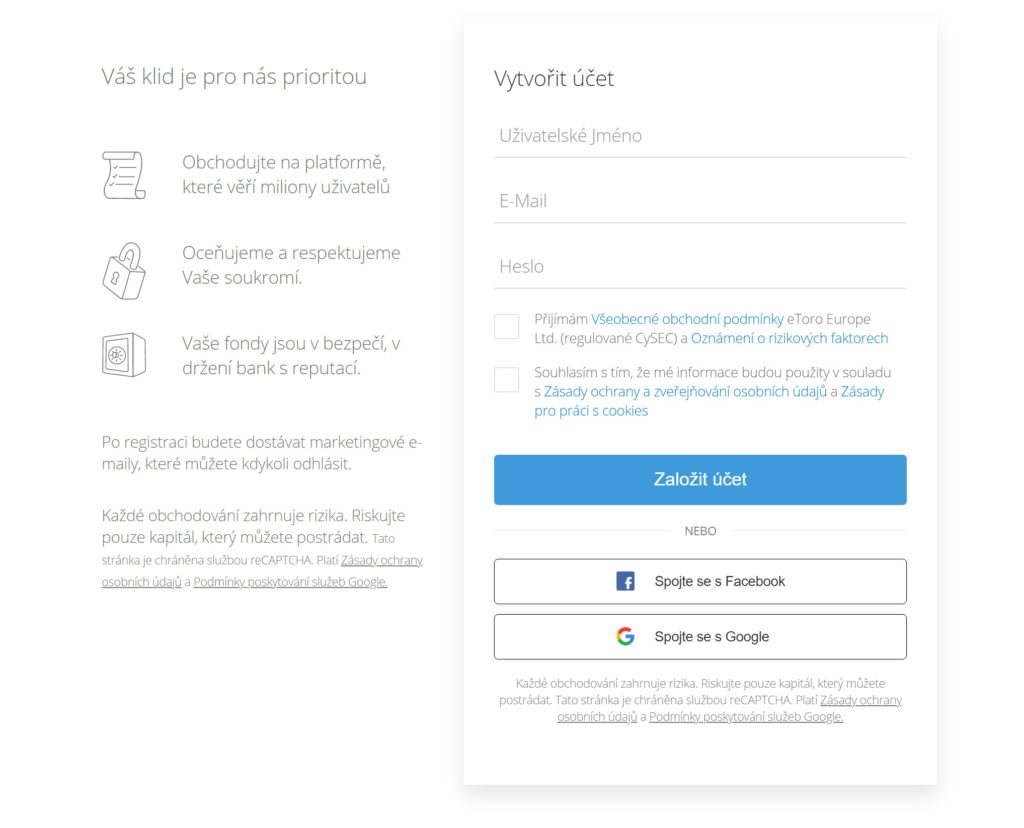

How to get started on eToro?

Step #1: Create an account

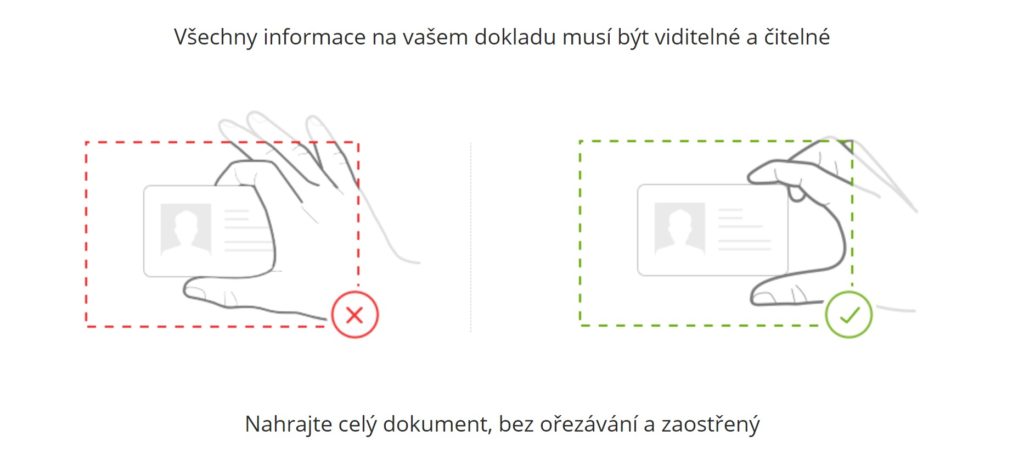

Step #2: Identity Verification

Step #3: Make a deposit

Step #4: Buying shares

Advantages:

Disadvantages:

eToro review for the Czech Republic

Of course, we are not the only ones who have written a review of eToro. Since it is one of the most popular brokers, there are many information resources dedicated to it on the Internet. If you look at other eToro reviews, you will find that most of them say the same thing as us – eToro is a quality platform for trading and investing.

It’s clear why eToro has become a favorite among over 12 million investors. There are no annual fees, and payment options include debit/credit cards, bank transfers, and e-wallets. If you are interested in more sophisticated strategies, eToro also offers leverage and short trading. This applies to over 1,700 stocks, indices, cryptocurrencies, bonds, currencies and commodities. All in all, eToro is a great solution for easy, safe and cost-effective stock investing. Interested in the eToro offer? Click the link below and create an account now!

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.Result

eToro – our most popular broker for the Czech Republic

FAQ

Does this eToro review tell me if I can actually make money on eToro?

What are eToro Czech Republic fees?

Does this eToro review rate the mentioned platform as a scam?

Where is eToro available?

According to the eToro review, is this platform suitable for beginners?

Is eToro really free?

What stocks can be bought on eToro?

What is the minimum deposit on eToro?

How to withdraw money from eToro?

Does eToro accept PayPal?