Libertex recenze – Výhody, nevýhody, srovnání funkcí a poplatků

If you are looking to trade CFDs online – whether to gain access to more sophisticated markets or to take advantage of leverage, you should consider Libertex. Is Liberex CFD trading platform really the right one for you? The answer to this question is the subject of our comprehensive Libertex review today, where we will evaluate all its main aspects, such as tradable assets, fees, payment methods, tools, features and security.

This trading platform is regulated by CySEC and offers a wide range of asset classes tradable via CFDs – including stocks, indices, cryptocurrencies, ETFs and commodities. One of the main advantages of Libertex is the possibility of trading without spreads (the difference between the buying and selling price).

Libertex Review – Get Started with Libertex in 4 Easy Steps!

If you decide to trade with this broker after reading this review, you can start trading immediately by following the four simple steps listed below.

If you want to learn more about Libertex and all its features and services, keep reading! [/blade]

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Review – What is Libertex?

Launched in 1997, Libertex is a reputable online CFD trading platform that has now been in operation for over two decades. The provider claims to operate in 110 countries and has over 2.2 million clients, including a mix of retail day traders and professional investors.

Unlike many of its competitors, Libertex doesn’t offer an over-the-top service that focuses on thousands of financial instruments. Instead, the platform has chosen to specialize in a few specific asset classes, covering 213 markets. Liberex offers a solid selection of stocks, ETFs, forex , cryptocurrencies , commodities, and more to trade.

Every financial market can be traded with leverage on Libertex. If you are based in the Czech Republic and are a retail trader, you will be able to trade with leverage of up to 1:30. If you trade as a professional investor, you can get leverage of up to 1:600. This means that an account balance of 3,000 CZK will give you access to trading capital of 1,800,000 CZK.

As for the stock trading account itself – Libertex offers two options. For those of you who prefer a user-friendly trading interface without unnecessarily complex tools, the Libertex web platform may be more suitable. However, if you have a lot of experience with online trading and want to use technical indicators, graphical tools, customized screens, or even automated robots, then you can trade via the MT4 platform.

What stocks can you trade on Libertex?

First, it is important to note that you will not be “buying” stocks directly on Libertex. Instead, you will be trading stock CFDs . This means that you will be speculating on whether the price of a stock will go up or down in the short term.

The key point is that the CFD ( Contract for Difference) financial instrument you trade on Libertex is not backed by holding an actual share, and therefore you do not have a legal claim to the shares themselves. However, as you will see below, this financial instrument comes with many great benefits in the form of low trading fees, the ability to open both long and short positions, and the possibility of using leverage.

Libertex offers a total of 50 stock CFD markets. These focus on the major blue -chip stocks listed on the New York Stock Exchange and NASDAQ. For example, you can trade CFDs on stocks from companies such as Tesla, Facebook, Amazon and Apple. You can also trade stocks from the UK, European and Latin American markets.

Among stock CFDs, Libertex offers everything from technology and pharmaceutical stocks to shares of companies operating in the cannabis industry and retail.

Forex trading

Libertex is very well known in the online forex trading space . The platform offers most of the major and minor pairs – such as EUR/USD, GBP/USD, USD/JPY and USD/CAD. Although it is quite common for this online forex broker to offer the most popular trading pairs by default. As part of preparing this Libertex review, we appreciate that investors also have the opportunity to trade various exotic pairs.

These are forex pairs that contain at least one emerging currency. These include the Mexican peso, Singapore dollar, Turkish lira, South African rand, and others. These exotic currencies can be traded in pairs with major currencies such as the USD, EUR, or GBP.

Commodity trading

In addition to forex, you can also engage in commodity trading on Libertex. Tradable commodities are divided into three main categories: metals, energies, and agricultural products.

Here are the specific commodities you trade on Libertex:

- Metals : gold, silver, copper, platinum including platinum ETFs, palladium

- Energy : Brent crude oil, WTI crude oil, Henry Hub natural gas, heating oil, light sweet crude oil

- Agricultural products : coffee, cocoa, soybeans, wheat, corn, sugar

While most commodity brokers in the retail space in the Czech Republic focus only on the main oil, gas and gold markets - as can be seen from the list above, Libertex offers much more.

Trading indices

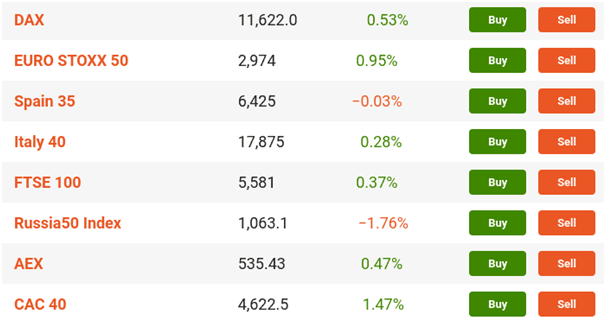

If you are also interested in accessing index trading, then you will appreciate that Libertex offers a large number of index markets.

The main index markets include:

- NASDAQ 100

- DOW JONES 30

- SP 500

- RUSSELL 2000

- FTSE 100

- CHINA 50

- HANG SEN

- NIKKEI 225

Rovněž získáte přístup k velkému počtu méně likvidních indexových akciových trhů, například:

- SPAIN 35

- ITALY 40

- RUSSIA 50

- ISRAEL 35

- CHILE INDEX

Obchodování s ETF

Libertex vám poskytuje přístup na 10 ETF obchodních trhů. Ve srovnání s ostatními CFD brokery se touto nabídkou Libertex vymyká. Většina ETF je podložena iShares, ale je zde také trh nabízený správci aktiv Vanguard a SPDR.

Poplatky & provize na Libertexu

Libertex se prezentuje jako broker nabízející nejlepší ceny obchodování na trhu, proto jsme v rámci vyhotovení této recenze prozkoumali, jaké poplatky vám budou při používání této obchodní platformy účtovány. Nezapomeňte si přečíst následující kapitolu, abyste se tak přesně dozvěděli, co vám bude na Libertexu účtováno.

Nulové spready

Co se poplatků týče, Libertex vyniká svou nabídkou nulových spreadů. To je něco, s čím jsme se na scéně CFD obchodování ještě nesetkali. Spready si totiž účtují platformy všech tvarů a velikostí. Pokud netušíte, co se pod pojmem “spread” skrývá, jedná se o rozdíl mezi kupní a prodejní cenou.

Například pokud spread činí 0,4 %, znamená to, že potřebujete zisk alespoň 0,4 %, abyste dosáhli vyrovnaného výsledku. Jinými slovy, při obchodování online spread způsobuje, že vždy začínáte obchodovat s mírnou ztrátou. Obchodování s nulovými spready, které Libertex umožňuje, pro vás tedy znamená vyšší potenciální obchodní zisky.

Obchodní provize

Jedna z věcí, která se nám při zhotovení recenze Libertexu nezamlouvá, je mlžení ohledně účtovaných provizí. Museli jsme hodně pátrat, abychom našli požadované informace. To se nám nelíbí, protože nejlepší weby pro online obchodování obvykle jasně uvádějí, jaké provize budete při obchodování platit.

Níže pro vás shrnujeme podstatné informace z naší recenze:

- Konkrétní provize, kterou zaplatíte, bude záviset na aktivu a trhu, se kterým chcete obchodovat.

- Cenově nejefektivnějším trhem je trh hlavních devizových párů, který s sebou přináší provizi ve výši pouhých 0,03 %.

- Trhy s vyšším rizikem, jako jsou digitální měny, mohou dosahovat až 2,5 %, což je opravdu vysoké procento.

- Více likvidní páry, jako například BTC/USD, však obvykle zůstanou pod hranicí 0,5 %.

- Pokud chcete obchodovat s CFD na akcie, budete platit komisi v rozmezí 0,1 % - 0,2 %.

Ačkoli nyní existuje několik CFD brokerů bez provize, kteří zprostředkovávají obchodování českým investorům, je důležité si uvědomit, že na místo provize vždy budete muset platit spready. Zatímco v případě Libertexu neplatíte žádné spready, za to vám ale budou účtovány provize. Proto musíte zvážit oba tyto obchodní náklady, abyste získali jasnou představu o tom, zda se vám obchodování na vámi vybrané platformě vyplatí.

Ostatní poplatky

Ačkoliv budou mít spready a provize největší dopad na vaši peněženku, před založením účtu u Libertexu je třeba zvážit několik dalších nákladů.

Mezi další náklady patří:

- Poplatek za obchodování přes noc: Jako každá obchodní stránka dostupná klientům v České republice, při CFD obchodování budete platit poplatky za financování přes noc neboli “swapové poplatky”. Jedná se o poplatky, které budete platit za každý den, kdy si ponecháte vaši pozici otevřenou. Je to proto, že CFD jsou finanční produkty využívající pákový efekt, a tak s sebou přináší úroky.

- Poplatek za nečinnost: Pokud máte zůstatek na účtu nižší než 10 000 USD a neuzavřete žádný obchod v období delším než 180 dnů, začnou vám být účtovány poplatky za nečinnost. Ty činí 10 USD měsíčně a poplatek bude odečítán každý měsíc, dokud neuskutečníte obchod, nebo nevyberete váš zůstatek.

Dobrou zprávou je, že naše recenze Libertexu nezjistila účtování poplatků za provedení vkladů finančních prostředků.

Platforma Libertex a obchodní nástroje

Jak jsme se krátce zmínili dříve, Libertex nabízí dvě obchodní platformy – MT4 (podle nás je to nejlepší MT4 broker) a rovněž provozuje vlastní webovou platformu.

MetaTrader 4 (MT4)

Jste-li zkušený obchodník, pak se budete dobře orientovat v tom, co je MT4 a v mnoha funkcích a nástrojích, které nabízí. Pro ty, kteří nevědí, jedná se o obchodní platformu poskytovanou třetí stranou. S touto platformou získáte přístup k mnoha technickým indikátorům a nástrojům pro kreslení grafů.

Můžete si plně přizpůsobit vaši obchodní obrazovku a v ideálním případě rovněž nainstalovat automatizovaného forexového robota. MT4 je přístupný přímo z webových stránek Libertexu, nebo si můžete stáhnout MT4 pro Mac. Chcete-li však platformu využít na maximum, měli byste zvážit stažení softwaru na vaše stolní zařízení.

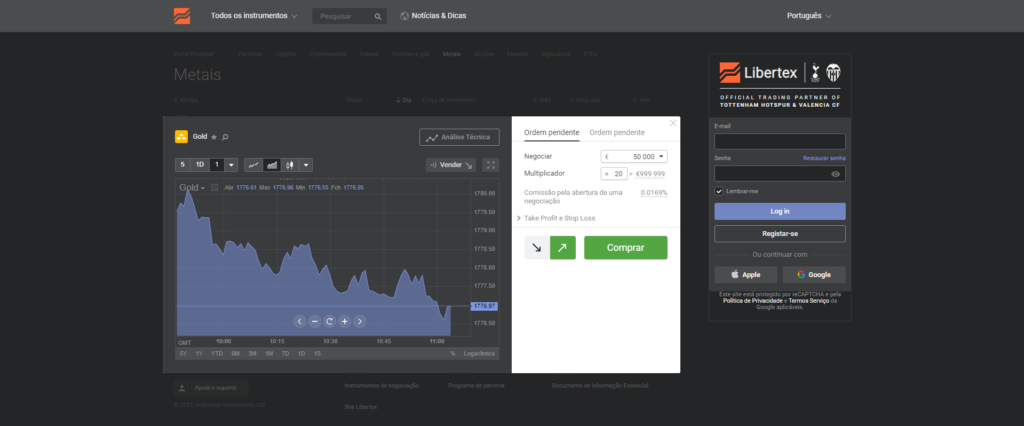

Webová obchodní platforma Libertex

Pokud s online obchodováním teprve začínáte, může pro vás MT4 být poněkud složitější. Začátečníkovi se může množství a složitost všech dostupných funkcí a nástrojů zdát zastrašující. Pokud je to váš případ, doporučujeme používat webovou obchodní platformu Libertex. Jedná se o online platformu navrženou a spravovanou samotným Libertexem.

Není třeba instalovat žádný software, protože ke všemu získáte přístup pomocí standardního webového prohlížeče. Webová obchodní platforma Libertex se snadno ovládá, a je tudíž ideální pro ty z vás, kteří s obchodováním nemají velké zkušenosti. Vámi zvolený trh můžete snadno najít pomocí funkce filtrování nebo jednoduše jeho zadáním do vyhledávání.

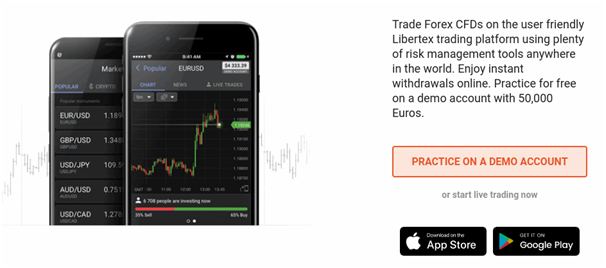

Libertex recenze – Mobilní Aplikace

Jako většina nejlépe hodnocených CFD brokerů nabízí i Libertex plnohodnotnou mobilní aplikaci pro obchodování s akciemi. Tato aplikace je k dispozici na zařízeních Android i iOS, a vy se tak neochudíte o špičkový obchodní zážitek, který vždy budete mít na dosah ruky.

You can find the Libertex app on the official website. You will then be redirected to the relevant Google Play or Apple Store to complete the download. It is also worth mentioning that you can access your Libertex account on the go using the MT4 app. All you need to do is install the MT4 app and log in using your regular login details.

Libertex demo account

One of the best features of Libertex is access to a demo account that you can use whenever you see fit. This tool is especially useful if you are just starting out with online trading. The demo account , which comes pre-set with a trading balance of EUR 50,000, allows you to trade in a safe environment and 100% risk-free.

The great thing about a demo account is that it simulates real trading conditions. It gives you an idea of how the financial markets work without risking real money.

However, the Libertex demo account is also useful for experienced traders, who can try out new trading strategies and systems. The demo account also allows you to try out a new forex or CFD robot on MT4 without risking any trading capital.

Research and analysis on Libertex

If you are looking for an online trading platform that provides a large amount of internal information materials, then Libertex will probably disappoint you. For example, although there is a news section on the website, articles and news are published only infrequently.

The website also lacks financial commentary. There is an economic calendar, but apart from that, you won't find many other sources of information.

In terms of technical analysis, Libertex provides all the necessary tools you need. This category includes a large number of technical indicators that are available on the Libertex web trading platform as well as on MT4.

Leverage on Libertex

Like most CFD trading sites, Libertex offers the ability to trade on all markets using leverage . Although the 1:600 leverage offer is very tempting, it is only available to professional traders. If you are a daily retail trader based in the Czech Republic or elsewhere in Europe, then you are limited by the limits set by the ESMA.

This means you can use a maximum leverage of 1:30 when trading major currency pairs. Minor and exotic forex pairs and gold are accessible with a leverage of 1:20. You can trade stocks with a leverage of 1:5 and cryptocurrencies with a leverage of 1:2.

Payments on Libertex

At Libertex, you can make deposits and withdrawals through a wide range of payment methods.

Supported payment methods include:

- Debit cards

- Credit cards

- Skrill

- Neteller

- IMMEDIATELY

- Giro Pay

- Trustly

- Bank transfer

- Neosurf

- Tele Ingreso

- And others

Remember that Libertex does not charge any fees for making a deposit – regardless of the payment method you choose. Apart from the traditional bank transfer, all of the above payment methods are processed instantly. This ensures that you can start trading immediately without any unnecessary waiting.

Conversely, the processing time for a withdrawal on Liberex depends on the payment method you choose. For example, payments via e-wallets such as Skrill and Neteller are the fastest, as Libertex usually processes them in less than 24 hours. Once this happens, the funds from your trading account will be credited to your e-wallet within seconds.

Additionally, all withdrawals made via e-wallet are free of charge. If you choose to withdraw via debit/credit card, the processing time can take from 1 to 5 days. In addition, you will be charged a small fee of 1 EUR. Bank transfers take 3-5 days to process and are subject to a fee of 0.5% (min. 2 EUR, max. 10 EUR).

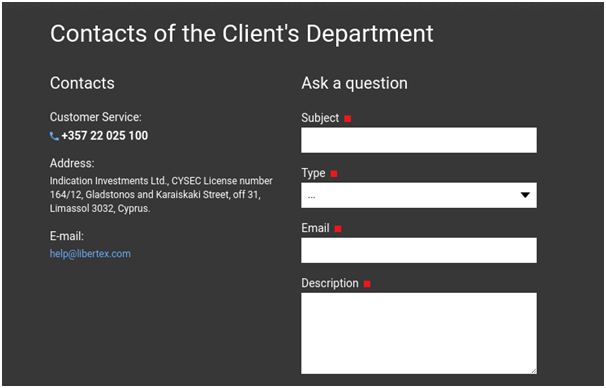

Customer service at Libertex

Libertex offers its clients a sophisticated support. The easiest way to speak to an advisor in real time is via live chat. There is also a Whatsapp number and a Facebook Messenger link that you can also use.

If you want to speak to a member of the Libertex team by phone, you can call the Cyprus phone number +357 22 025 100.

If you wish to contact Libertex via email, you can do so at [email protected].

The help and support section also contains a fairly detailed “Frequently Asked Questions” where you can find the answer to your question without having to contact Libertex directly yourself.

Libertex Review – Is Libertex Safe?

Libertex is fully licensed by the Cyprus Securities and Exchange Commission (CySEC). This in itself ensures that they have to adhere to a number of strict regulatory conditions. For example, all new account holders are required to verify their identity or they will not be able to make a withdrawal.

This ensures that you can trade in a fully secure environment. In addition, brokers regulated by CySEC must keep client funds in segregated bank accounts. When using Libertex, you will also benefit from the investor protection scheme. According to CySEC, you will be protected up to EUR 20,000 or 90% of your claim – whichever is lower.

Libertex Review – Advantages and Disadvantages of Libertex

Advantages:

Disadvantages:

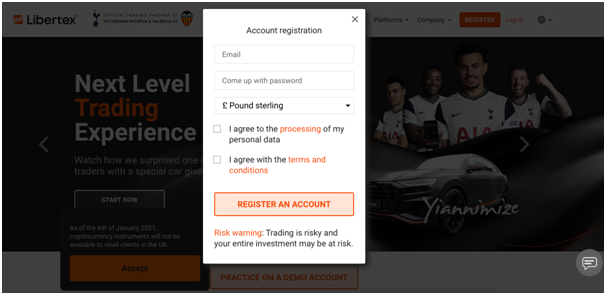

Join Libertex Today – Step by Step Guide

If you want to trade with a CySEC regulated broker and take advantage of zero spreads when trading CFDs on stocks, cryptocurrencies , indices , forex and more, then follow our step-by-step guide below.

Opening an account with Libertex is really easy. Just click on the “Register” button on the broker’s homepage and fill in some personal details. You will also fill out a short questionnaire so the broker can learn more about you. You will enter information about your job, trading experience, etc. As Libertex is regulated by CySEC, they must adhere to strict anti-money laundering regulations, which means they will need to verify your identity. Proof of identity can be easily uploaded via the client portal. You only need the following two documents: Identity verification is a simple process and you can complete it in just a few minutes! At Libertex, the minimum deposit is just €100. You can fund your account in a variety of ways without paying any fees. Supported deposit methods include: With Libertex you can trade CFDs on a wide range of markets including stocks , cryptocurrencies , indices , forex , commodities and more. The Libertex trading platform is easy to use and has a large number of interesting features. Once you have chosen the market you want to trade, you can easily open a trade ticket to buy or sell. You can then adjust your leverage, add a stop loss or take profit order , and also view a chart of the market you are trading. The broker also details the commission for the trade. Its amount is therefore clearly stated and transparent. In addition, you always trade with zero spreads.Step 1: Open an account

Step 2: Verify your identity

Step 3: Deposit funds

Step 4: Choose a market

Step 5: Trade!

Libertex, which was launched in 1997, has been around for a long time in the world of online CFD trading . It offers a relatively small number of markets – just 213 – but supports all the most traded asset classes. At Libertex you can deposit funds instantly – with no fees – and trade with zero spreads on all markets. We appreciate that you have the choice of MT4 or the Libertex web trader platform and you can also log in to your account via the mobile app. All in all, Libertex offers almost all the advantages in the online CFD trading space. If you want to open an account now, simply click on the link below! 85% of retail investor accounts lose money when trading CFDs with this provider.Libertex review – verdict

Libertex – The best CFD broker with low fees

Frequently asked questions

Is Libertex a scam?

Does Libertex offer leverage?

What is the minimum deposit on Libertex?

Does Libertex support MT4?

How much does Libertex charge?