Jak koupit akcie Apple (AAPL) v roce 2026

Nowadays, there is probably no one who does not know the company Apple . This is a term that already means something in today’s society. For many individuals, it is even an idol that they cannot let go of, and who would not have at least one product from this company, as if it were not there. Apple (AAPL) has been a member of the club of stocks with a market capitalization exceeding several trillion dollars for some time . It is therefore no surprise that many investors want to have at least one Apple share in their portfolio . However, for Czech investors, this means that if they want to buy these shares, they must find a broker who not only operates on the Czech market, but also allows them access to the markets in the USA.

In this guide, we will show you how easy it is to buy Apple shares online in the Czech Republic, along with reviews of the best Czech brokers who offer Apple shares, and we will tell you all the important information about Apple and its shares that every investor should know before investing in Apple shares.

How to Buy Apple Stock – A Step-by-Step Guide

If you don’t have time to read our entire guide, that’s okay. Just follow the steps below and you’ll be buying Apple shares in under 10 minutes!

As you can see, the entire process of buying Apple shares on eToro is not only safe, but it also only takes the investor a few minutes. [/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

[stocks_table id="24"]

Basic information about Apple

Apple is currently one of the most well-known and popular brands in the world.

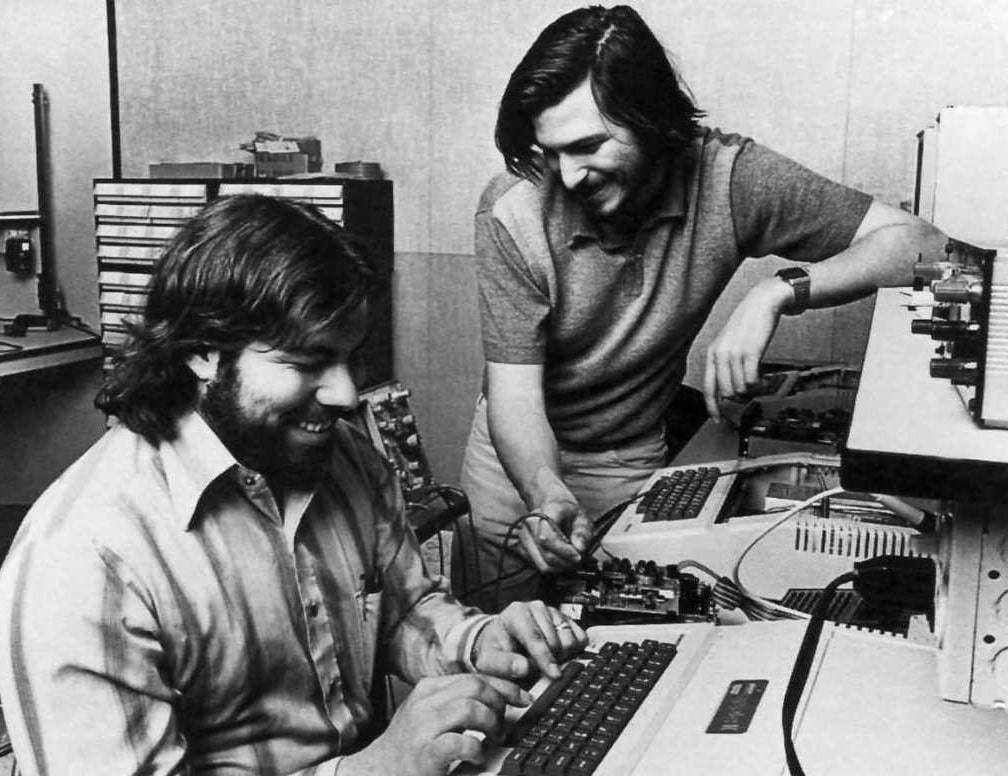

The beginning of the Apple story dates back to April 1, 1976, when Steven Wozniak, Ronald Wayne, and Steven Jobs founded a company called Apple Computer Company to develop and sell Wozniak's Apple I personal computer. However, it was not until the second computer, called Apple II, that it became the expected bestseller and one of the first mass-produced microcomputers.

Not long after, in 1980, the company went public, where it immediately achieved huge financial success. Apple was able to continue developing new technologies and bring its clients countless innovations that were the absolute best at the time. For example, the company developed computers with an innovative graphical user interface, such as the Macintosh from 1984, which is still very popular today. The unexpected success and high costs of Apple products resulted in a power struggle between the company's executives. Eventually, Wozniak decided to withdraw from Apple, saying that he would focus on other products, while Jobs resigned and founded NeXT, taking several Apple employees with him.

The big turnaround came in the 1990s, when the personal computer market began to develop massively. At that time, however, Apple began to lose market share significantly to the Microsoft Windows operating system. In 1990, just before the company went bankrupt, Apple decided to save the company by buying NeXT. It was also a good move to attract Jobs himself back to Apple and start writing a new and incredible history for the company.

Within the first few years, Jobs managed to turn Apple into a profitable company through various tactics. The most successful were the introduction of the iMac, iPod, iPhone and iPad. Thanks to great advertising campaigns such as "Think different", the opening of the Apple Store retail chain and countless acquisitions of many companies, Apple not only managed to become one of the absolute leaders in the industry, but also significantly expanded its product portfolio, which attracted several hundred thousand more users. It could be said that in just seven years, Jobs managed to turn Apple into an idol for many, without whom they can no longer imagine their lives.

In 1997, however, the whole world was shocked by the news of Steve Jobs' resignation, due to health reasons. Unfortunately, less than two months after his resignation, Steve Jobs died. Tim Cook replaced him as CEO. For Apple, this loss was huge, but not devastating. The company continues to surprise the general public with the innovations it releases and its attention to detail.

And since we started with the "BEST" of Apple, we'll end with them. Apple also became the first publicly traded American company to be valued at more than $1 trillion in 2018, $2 trillion in 2020, and $3 trillion in 2022. In June 2023, it was then valued at more than $3 trillion. In addition, the company has long enjoyed a high level of brand loyalty, a high following, and has long been ranked among the most valuable brands in the world.

Apple products and services

As mentioned above, Apple is currently enjoying huge interest. Therefore, it is not surprising that it wants to bring its loyal customers more and more new products, which should make their everyday lives a little easier. However, the company has already achieved a lot in its relatively short history, both in terms of products and services. In this section, we will introduce the most famous Apple products and services in more detail.

The chart below shows Apple's revenue by source. Apple's highest revenue comes from iPhone sales . However, iPhone revenue has been increasing every year, which is the case for all Apple products except the iPad, which has seen a slight decline in sales since 2021.

Mac (Macintosh)

The term "Mac" refers to a family of personal portable computers from Apple, which is now known

iPhone

The product that brings Apple the most revenue is the iPhone. This is a series of

Other Apple products

In addition to the above-mentioned products, Apple also offers its customers a range of

Services

Apple's services are the company's second-largest revenue source. In 2021, services revenue was $68.42 billion, and in 2022, it was more than $78 billion. These services include AppleCare+ extended warranties, iCloud+ cloud storage services, Apple Card credit card payment services and Apple Pay processing platform, and digital content services such as Apple Books, Apple Fitness+, Apple TV, iTunes Store, Apple Music, and Apple News+. However, most of these services were only launched in 2019.

Apple Stock - Basic Information

If you're interested in buying Apple shares, it's best to do at least a brief analysis first. This will ensure you fully understand the risks and rewards of owning these shares. To help you do that, we've put together some basic facts about the tech giant below.

Apple stock is one of the most popular and sought-after technology stocks on the market . Although Apple is often seen as the next-generation innovator in new-age technology, the company's stock has actually been publicly traded since 1980. Apple opted for the technology-oriented NASDAQ exchange instead of the NYSE, where its shares were listed under the symbol AAPL at a price of $22. At the time of writing (October 2023), the same shares are worth over $173. Apple shares are therefore within striking distance of their peak value of $195 per share. However, since its IPO, Apple shares have also undergone several stock splits that have made this stock more accessible to retail investors.

Individual splits of Apple shares

The company has already completed five stock splits since it went public, mainly because it was growing at a rapid pace, making its shares unaffordable for many investors.

The split itself is an act that consists of dividing one share into several pieces. At the same time, the price of the shares naturally and proportionally decreases. It is therefore more of a psychological effect, because only a handful of investors would be willing to buy one share for 5 thousand dollars. On the contrary, shares for 100 dollars are much more affordable. Simply put, thanks to the split, the shares of the company become more attractive, both for large and small investors.

| Date | Split |

| June 1987 | 2:1 |

| June 2000 | 2:1 |

| February 2005 | 2:1 |

| June 2014 | 7:1 |

| August 2020 | 4:1 |

Note: The company decides to split its shares 2:1, with the price of one share being $100. For an investor who already holds shares in the company, this means that instead of one share for $100, they will hold two shares for $50 after the split.

Apple's dividend history

Unlike other Big Tech companies listed on NASDAQ, such as Amazon , Google, Meta or Netflix, Apple pays dividends . This allows the investor to combine an ever-increasing share price (capital return) with regular dividend payments. Unfortunately, the dividend yield is very low in the long term and is more of a bonus that always pleases shareholders. The dividend yield currently reaches 0.6% per year. The good news is that dividends have been increasing for nine years in a row, although still only in the order of cents. For 2023, dividends per share amounted to USD 0.96. Apple shares simply belong to the so-called growth stocks, which are primarily about capital return.

Share buybacks

Buybacks, or share buybacks, are the process by which a company buys back its own shares from investors, thereby attempting to reduce the total number of shares outstanding.

For more than a decade, Apple has been successful in fulfilling its historically established share buyback plans. Since 2012, the company has spent over $573 billion on share buybacks, which is the absolute most among American companies. In the last nine months of this year alone, it has spent another $56 billion on buybacks. For the whole of 2022, the number was no less impressive, namely $64 billion. According to available information, the company wants to continue to carry out buybacks, in the amount of about $20 billion per quarter. Share buybacks have thus become both an essential part of Apple's business model and a method of capital deployment.

Note: Share buybacks have the same benefit to the investor as a dividend payment. Because the company reduces the supply of shares on the market, the investor can expect a higher return on capital.

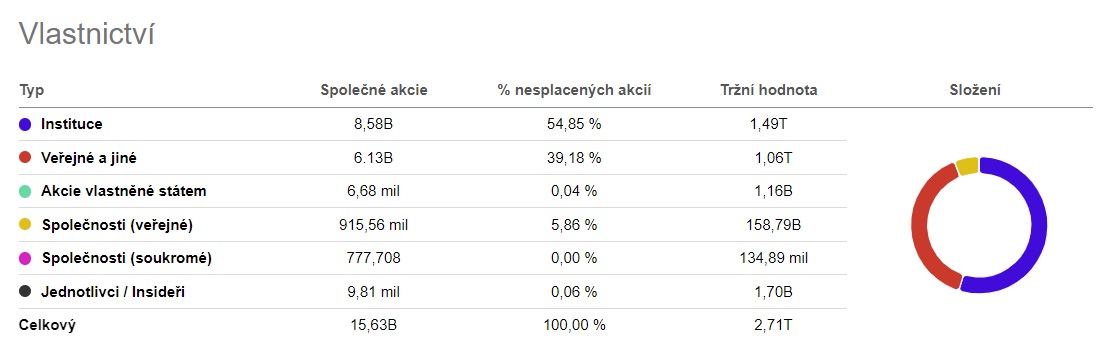

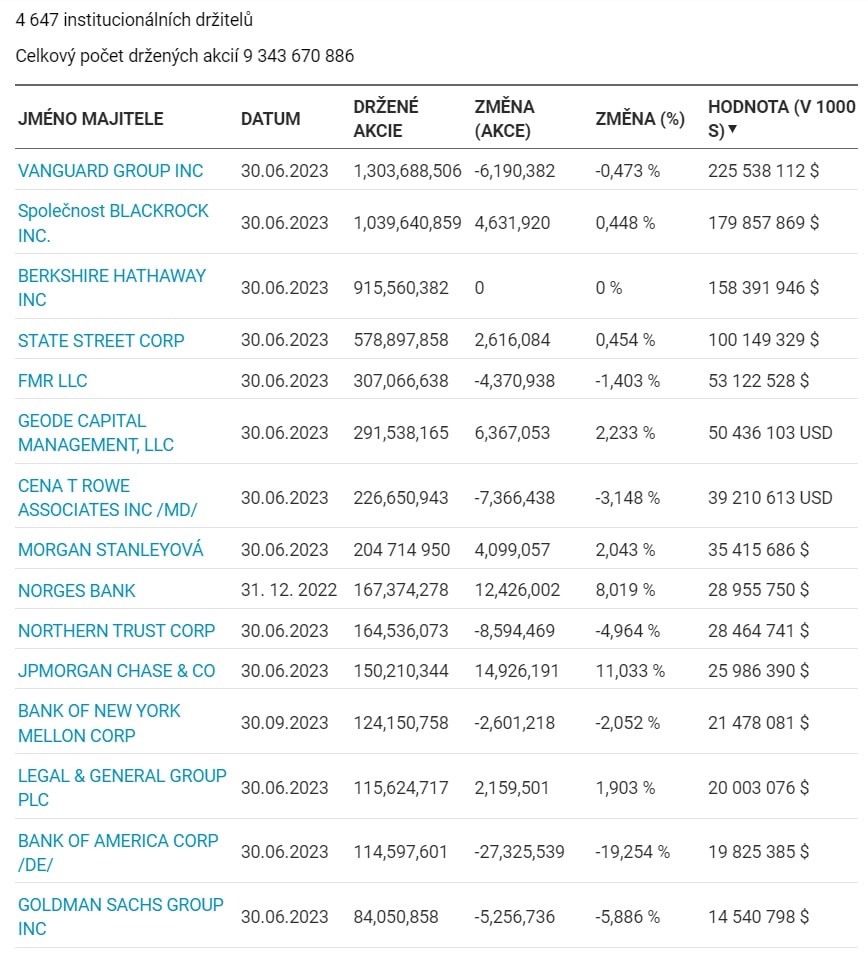

Who owns all the Apple shares?

As for the company's shareholder structure, it is distributed fairly evenly between private individuals and institutional investors. Institutional investors own almost 60%, while private investors own the rest. This distribution clearly demonstrates Apple's high popularity among private investors.

If we look at the specific names of the companies that own the most Apple shares, Vanguard holds the lead, followed by BlackRock and Berkshire Hathaway.

Apple stock price history

The history of Apple's share price began in 1980 (IPO), when Apple went public. At that time, the price of one share was $22. Apple's listing on the stock exchange caused a huge stir, as even then it was a very volatile stock, which could easily increase its price by 50% in one year, only to fall significantly again in the next few months.

Note: If you had bought 1,000 shares of Apple in 1980, you would now own 56,000 shares. Back then, the purchase would have cost you $22,000. Now, your investment would be worth almost $10 million.

However, Apple shares have experienced very dynamic development in the last few years. Although technology companies were already at the top of the profitability rankings before the Covid-19 pandemic, the lockdowns in 2020 multiplied everything even more. It must be said, however, that at the beginning there was a bit of panic in the market due to the unknown. Many people were working from home and the world was not really familiar with such a situation. This also had an impact on Apple shares themselves, which were trading at around USD 80 at the beginning of 2020, but their price fell by 35% to USD 53 during February and March.

However, over the next two years, the stock appreciated by an incredible 240% . The share price rose to over $180. Apple shares not only erased previous large losses, but also recorded huge profits. So if you took advantage of the opportunity resulting from cheap prices in March 2020, you would appreciate your money by almost 250%.

However, they have shown increased volatility since 2022. After the strong growth of previous years, a steep fall followed, during which the company's shares fell by almost 33%. This volatility was also caused by the presence of retail traders in the market, who became much more interested in investing, especially during the Covid period. However, it is important to remember that higher volatility places increased demands on risk management and also on investment psychology .

Apple shares have been weakening after creating their all-time high, ignoring the price levels of the broken all-time highs, and the market has thus not confirmed the so-called pullback that many investors and traders were waiting for. On the contrary, they are now trading in an aggressive downtrend, with the closest support being at $155 per share, where the most significant volume in the market consolidation is located. If this support were to be broken and the market continued to fall, only the levels formed by price lows could stop it in its fall, which may not be entirely correct support levels. In the event of a decline in Apple shares, investors should wait for some confirmation of renewed growth, either from technical analysis or based on quality fundamental stimuli.

Apple stock fundamentals

Apple has been one of the absolute leaders in its field for many years . Thanks to the fact that it constantly brings its customers new products that make their everyday lives easier, Apple has become an indispensable part of their lives for many. The same applies to its shares. Especially for small investors, owning an Apple share is an honor and at the same time a very nice boost to their investment portfolio. Apple is currently simply a term that promises, at least in the long term, interesting appreciation.

Apple shares are among the largest technology giants

Apple is simply the undisputed leader in the field of telecommunications and IT. Apple products are used by tens of millions of people around the world, with this number growing every year. At the same time, there are probably only a small handful of people who do not know Apple or its legendary founder Steve Jobs.

But Apple's uniqueness lies primarily in thinking about the overall concept of the company. Over its time, Apple has created an ecosystem of products that interact perfectly with each other, while placing great emphasis on not letting anyone else into this space. Thanks to this, the company has a very good overview and control over its applications and fees. It is therefore not surprising that this visionary approach has secured the company almost a quarter of the entire mobile phone market.

The potential and overall reach of Apple's products and services is also incredible. In addition, the company's high diversification in the IT industry and its immense popularity and appeal among the general public also boosts the price of its shares, which can therefore be at least an interesting investment in the long term.

The fundamentals of Apple stock

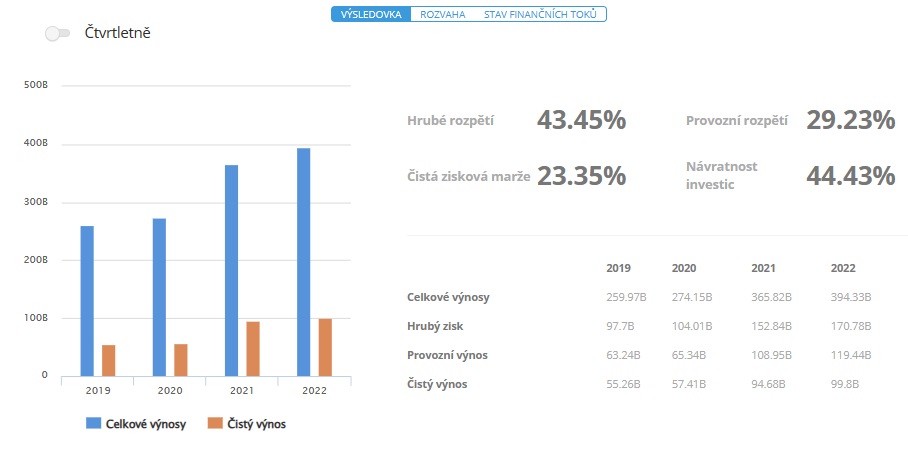

And now for some numbers. In this section, we will look at the most important and popular Apple indicators among investors.

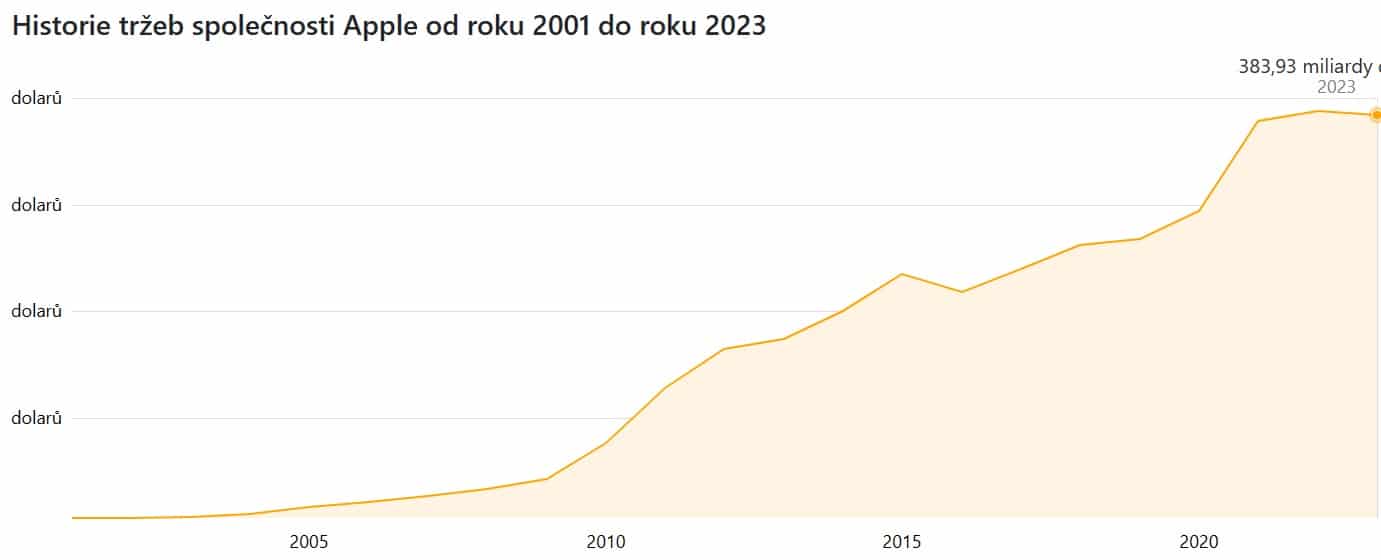

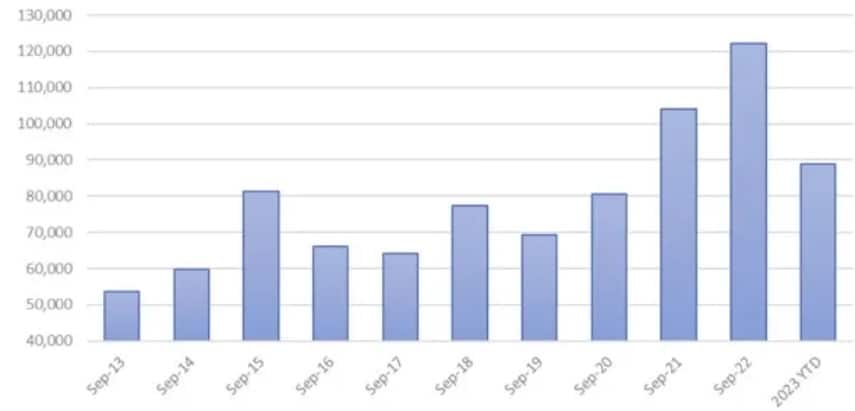

Apple is still the most valuable company in the world by market capitalization , according to the most recent data . In October 2023, the company's market capitalization was an incredible 2.711 trillion USD . In addition, it is necessary to mention the company's sales themselves, which are also astronomical for many. The company's current sales by October 2023 are 383.93 billion USD . Compared to previous years, this looks like a further increase, as in 2022 sales were 387.53 billion USD, which was an increase compared to sales in 2021, which were 378.32 billion USD.

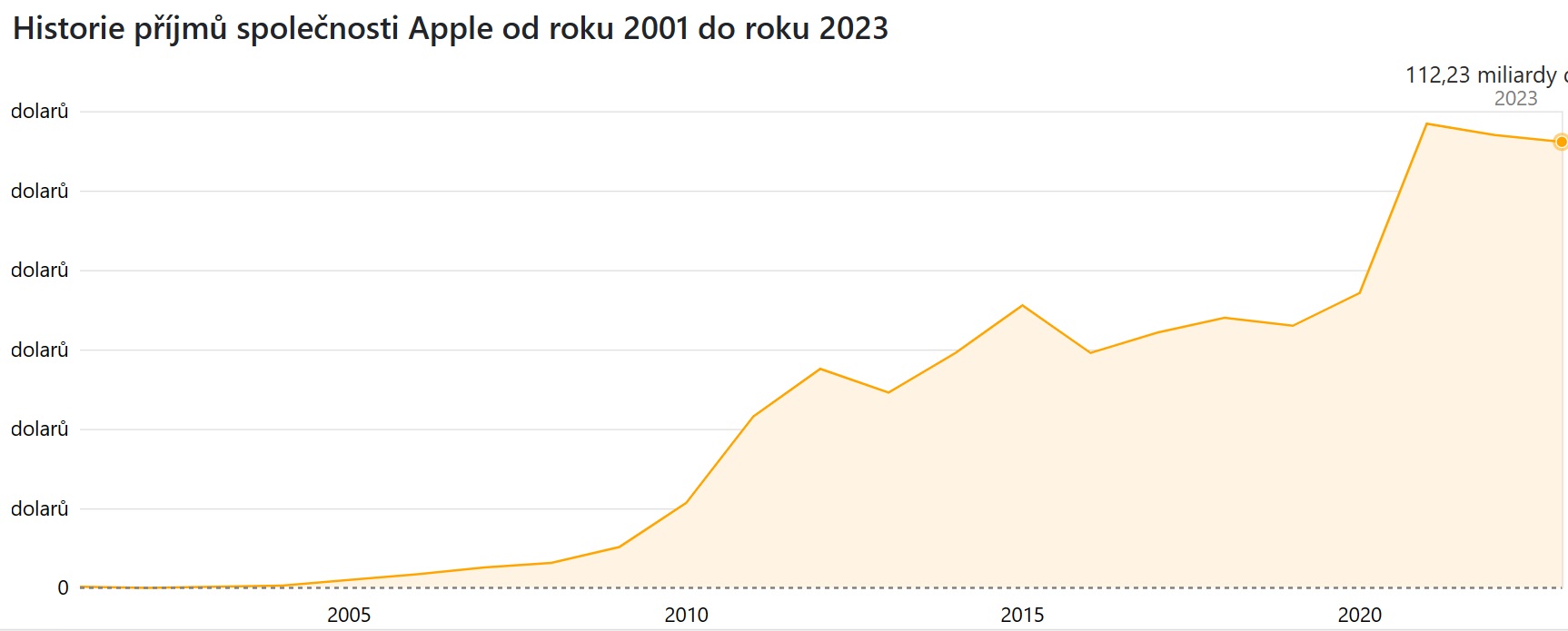

And when it comes to the company's revenue, it's not in vain at all, as the company's current profit is $112.23 billion , and there are still three months and Christmas left until the end of the year. The company earned a total of $113.96 billion in the previous year, which was a slight decrease compared to 2021, which had revenues of $116.90 billion. The revenues mentioned are the company's income before taxes.

The chart below shows the company's total revenue. It is clear from the chart that Apple is doing very well in increasing its revenue every year, which will certainly please its shareholders in particular . The company made a very big jump in net revenue mainly in 2021, by more than $37 billion.

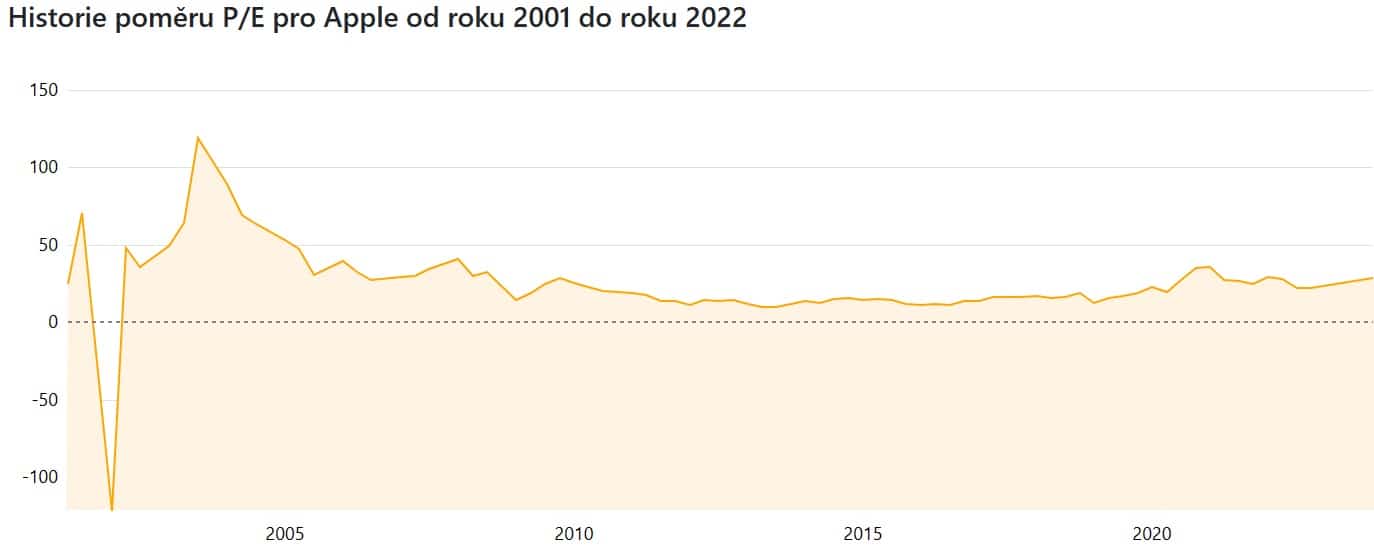

Another important indicator is the P/E ratio, which expresses the ratio between the market price of a stock and net income per share. As of October 2023, the P/E for Apple is 29.0, while at the end of 2021 this indicator was 29.2.

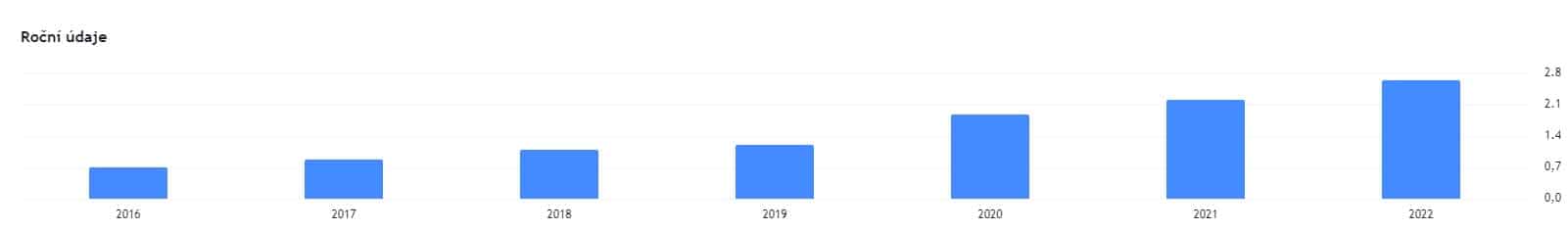

An equally important indicator is the EPS indicator. In this case, the value of the EPS indicator informs investors about the size of the profit per share of Apple. It is good for all shareholders, but also potential investors, that the size of the profit per share continues to grow over time . In 2020, the EPS value was 3.28 USD, in 2021 it was 5.68 USD, and in 2022 it increased again to 6.11 USD.

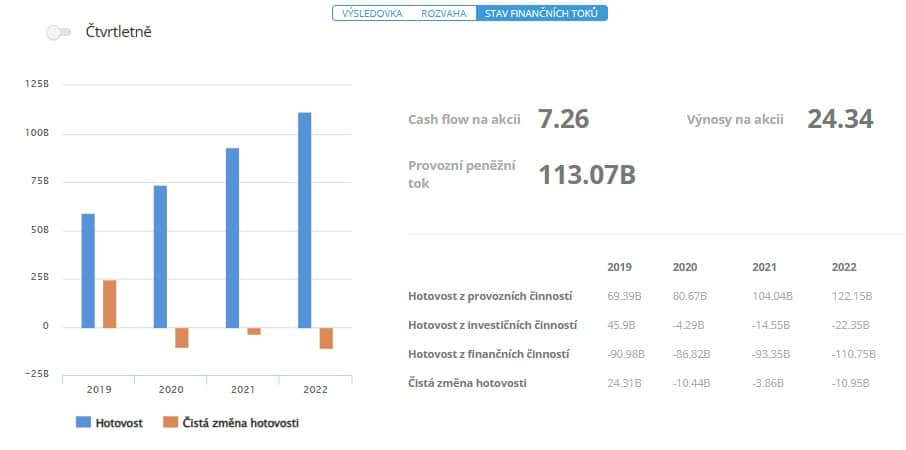

The chart below describes the company's cash flow situation. While most people have focused on the company's profits generated by iPhones and Apple services this year, few have noticed the significant year-over-year decline in cash flow from operating activities of almost 10%.

The main reasons for this decline include a 6% year-on-year decline in product sales, which was caused by supply chain disruptions and unexpected changes in working capital. And precisely because of supply chain problems, the company can pay its suppliers more quickly, which then negatively affects cash flow itself.

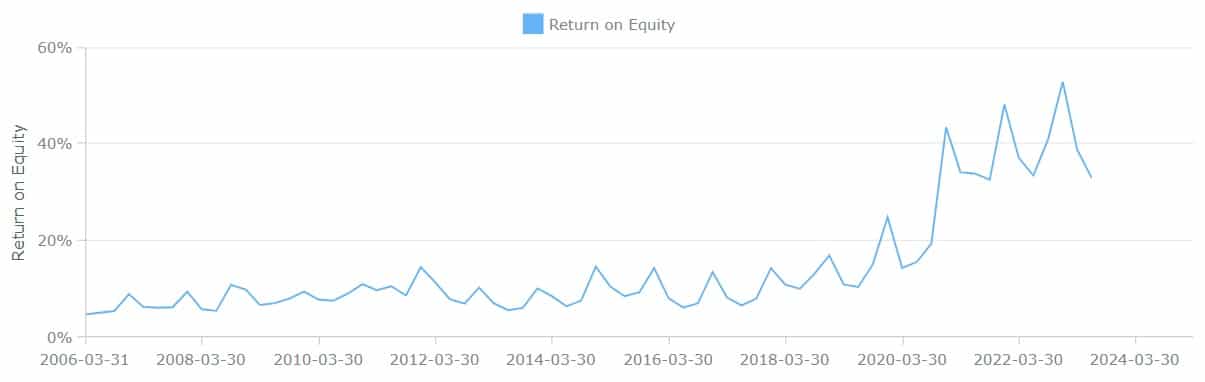

Last but not least, it is necessary to mention one indicator, which is ROE (return on equity). This indicator tells investors how much net profit is generated per dollar of invested capital. Apple had a return on equity of around 37% in 2022, while this year it is around 33% so far.

Apple's total debt in 2022 was $98.96 billion, and the company's total equity for the same year was $50.67 billion, giving it a D/E of 1.95. This is also the highest debt-to-equity ratio in the company's history. Total debt on Apple's balance sheet as of June 2023 was $109.28 billion.

Why buy Apple shares?

Now that you have some basic information about Apple stock, it's time to assess what the future holds for the tech giant. Below are some of the reasons why some investors consider Apple one of the best stocks to buy.

Apple is one of the richest companies in the world and a very popular brand among the general public . The company's total value now reaches 2.65 trillion USD and is still growing . However, the company is also known for holding huge amounts of cash reserves and short-term assets, which are very liquid. Their volume together is more than 190 billion USD. Other technology giants such as Amazon or Meta hold only a fraction of what Apple does. Having such a large amount of liquidity is, of course, a huge advantage.

A big plus for the company is the fact that it also has a sufficiently strong liquidity that protects it through adverse periods . Among other things, Apple has enough funds for further technological development, innovation and customer services. There is also the possibility of new acquisitions with promising companies. These acquisitions include, for example, the recent purchase of NextVR, a virtual reality company specializing in sporting events.

When beginning investors consider investing in Apple, they often focus on its core product, the iPhone line of smartphones. While that remains an important source of revenue for Apple, the company is increasingly relying on services revenue. In 2019 alone, Apple launched four new services to global markets, and they are showing strong signs of growth in 2026.

This includes its streaming TV service Apple TV+, game streaming, iTunes, news subscriptions, and even a credit card. In 2020 alone, revenue from this segment reached almost $54 billion. That was about 1/5 of total revenue. In 2021, revenue from services already reached $68.5 billion, and in 2022 it was already over $78 billion.

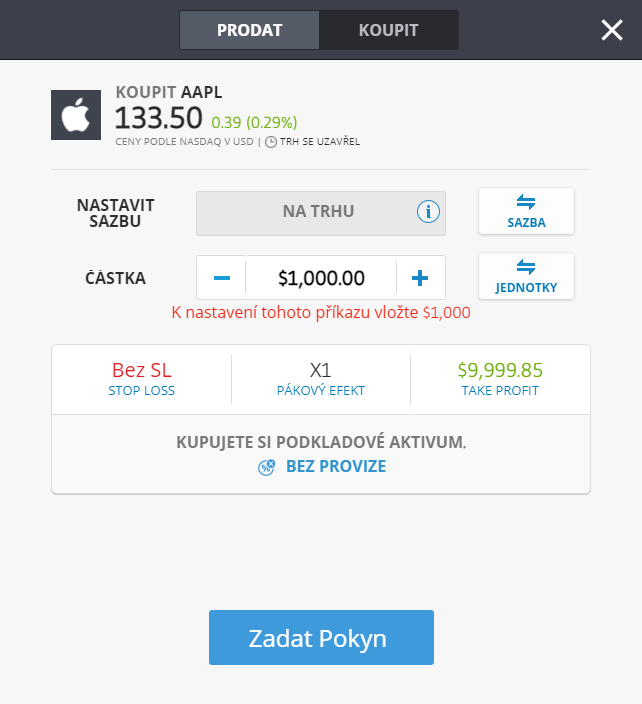

Example of an Apple stock trade

In this section, we will show you the entire process of buying Apple shares step by step. The Apple share purchase demo is done with the broker eToro.

1. Open a trading account and deposit funds

Once you have completed your own objective analysis of Apple stock, the next logical step is to open an account with your chosen broker. Regardless of which platform you choose to sign up with, the process is largely the same for most brokers. For example, you need to provide basic personal information, deposit your funds, and only then make a purchase of Apple shares.

To show you how seamless this whole process is, we will describe below how to invest in stocks with the help of one of the most popular brokers among Czech investors and traders - eToro.

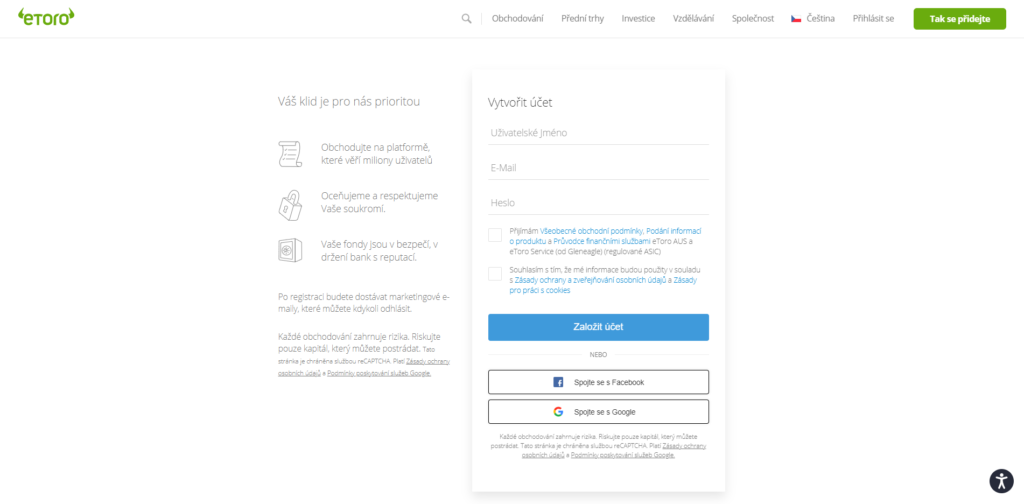

First, you need to visit the official eToro website and click on the button in the upper right corner "So join". You will then be asked to provide your personal information such as your name and surname, phone number or email.

The next step is to verify your identity. Please note, without identity verification it will not be possible to withdraw your funds from your trading account. At the same time, by verifying you will ensure that deposit limits will be lifted. And now the main thing, you will be able to withdraw your money at any time if necessary.

Therefore, you will need to upload images of these documents:

- Passport or driver's license

- The most recent invoice, for example for utilities or a bank statement

Once you have provided the above documents, you will be asked to deposit funds into your account. There is also a minimum deposit requirement of $100, and the broker will automatically charge you a 0.5% exchange fee. Supported payment methods on eToro include:

- Debit cards

- Credit cards

- PayPal

- Skrill

- Neteller

- Czech bank transfer

Apart from bank account transfers, all other deposit methods are credited almost instantly.

2. Buying Apple shares

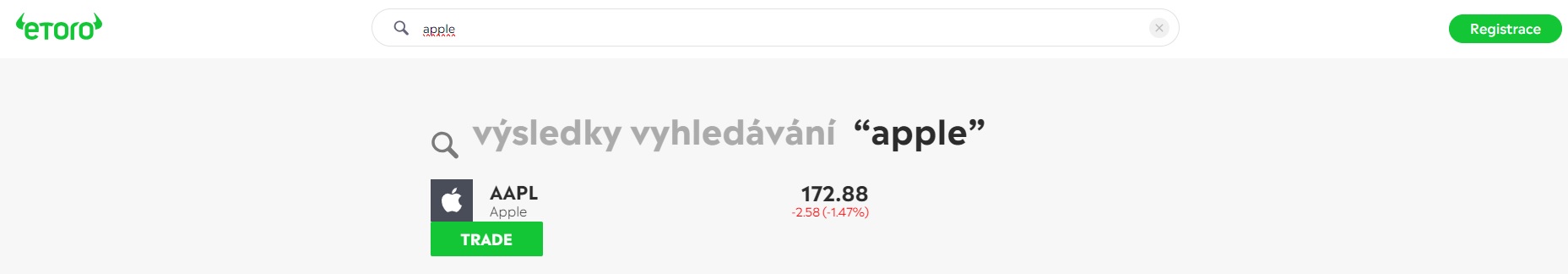

After you have deposited funds into your trading account with your chosen broker, you can buy Apple shares. How to do this? First, enter “Apple” in the search box at the top of the page. Then a result will appear, click on it.

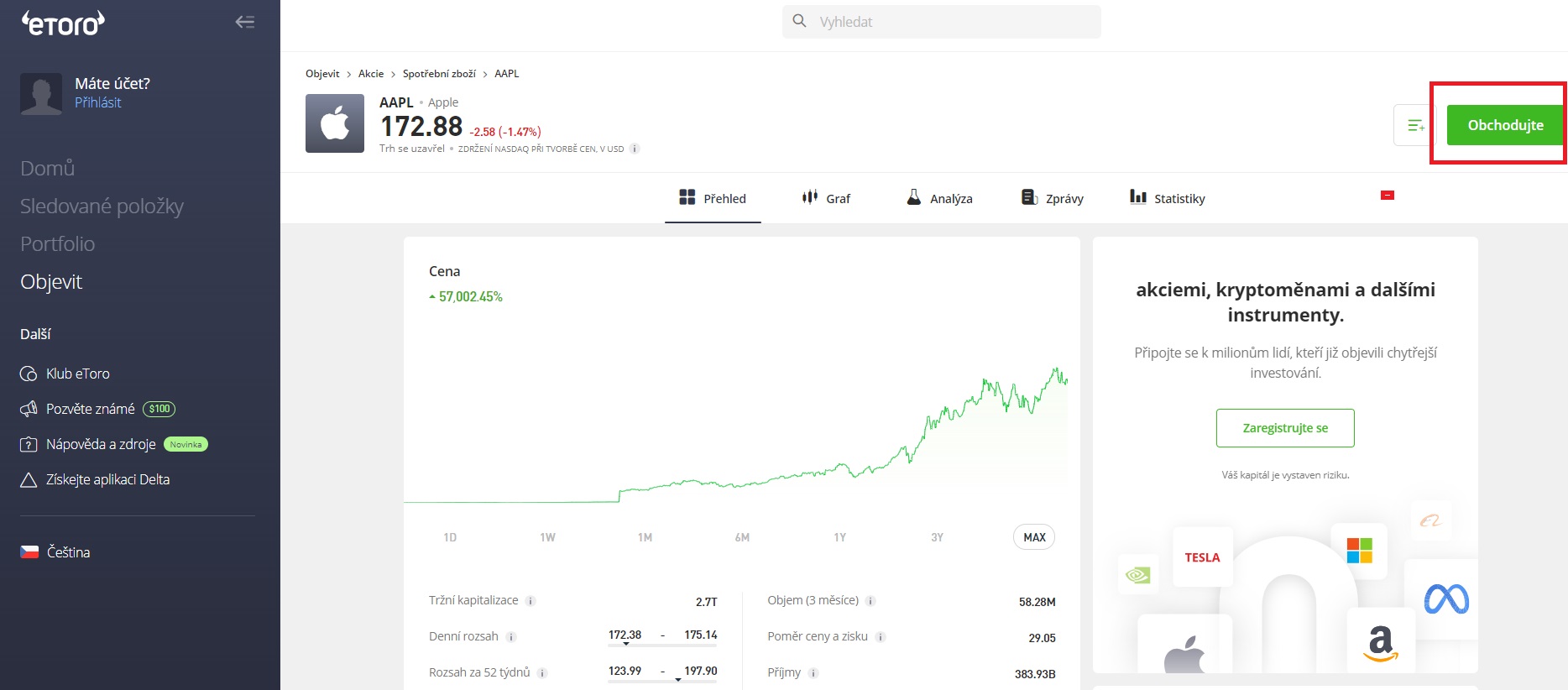

Now you have complete information about Apple shares with a chart. In the upper right part there is a "Trade" button. Use this button to start a trade.

An order window will appear. If you are happy with the current market price of Apple, simply enter the amount you wish to invest. You do not have to buy the entire share. You can invest as little as $10. To complete your purchase of Apple shares, click the "Place Order" button.

Note: If you are buying Apple stock outside of standard trading hours (9:30 AM - 5:00 PM Eastern Standard Time), you will need to click "Place Order." The stock purchase will then be completed when the markets open.

Without financial leverage

When it comes to purchasing shares, investors have two options to choose from. The first is direct purchase, which means that the investor buys a specific number of shares and thus becomes a shareholder in the company. Direct purchase of shares is one of the easiest and least time-consuming ways to acquire the chosen shares. However, the investor must always have enough funds in their trading account for the given number of shares.

Example An investor wants to buy 2 Apple shares at $170 per share. The total amount will be $340. This is also the minimum amount he must have in his trading account to be able to buy 2 Apple shares. If the price of Apple shares rises to $200 per share in the coming weeks, the investor's shares will suddenly be worth a total of $400. If the investor decides to sell these two shares, his profit would be $60.

However, since financial markets are very unpredictable, it is necessary to take into account the second possibility that may occur, which is a decrease in the price of selected shares. On the other hand, Apple pays dividends to shareholders, which could be at least a small consolation in the event of a decrease in the share price.

With leverage (CFD)

CFD trading is usually done using leverage. Leverage is a tool that allows an investor to have more capital, lent to them by their broker, than they actually have in their trading account. This is a great way to maximize profits, but unfortunately also losses. At the moment of executing a selected trade, the trader's broker blocks a certain part of their financial capital. This blocked part serves to cover any potential losses.

Example The investor opened a short position. In other words, he sold a share of Apple for $170. This trade makes it clear that the investor expects the price of Apple shares to fall in the coming days. If the investor had opened this trade without leverage, he would have had to have at least CZK 3,944 in his trading account (current dollar exchange rate CZK 23.2). However, since the investor has a leverage effect of 1:5, he can trade with much less capital. We simply divide the amount of CZK 3,944 by five and get CZK 788.8. This amount of CZK 788.8 is the minimum margin that the investor must have in his trading account in order to be able to open the given trade at all.

Which broker should I buy Apple shares from?

Although Apple is listed on the Nasdaq stock exchange under the symbol: AAPL , buying its shares is actually very simple. However, the investor must first find an online broker that offers its users trading in Apple shares. If the investor does not yet have such a broker, this part of the guide is for him. Below are reviews of the best brokers operating in the Czech Republic and also offering Apple shares. Investors should also always take into account whether the given broker is regulated and what its fees are.

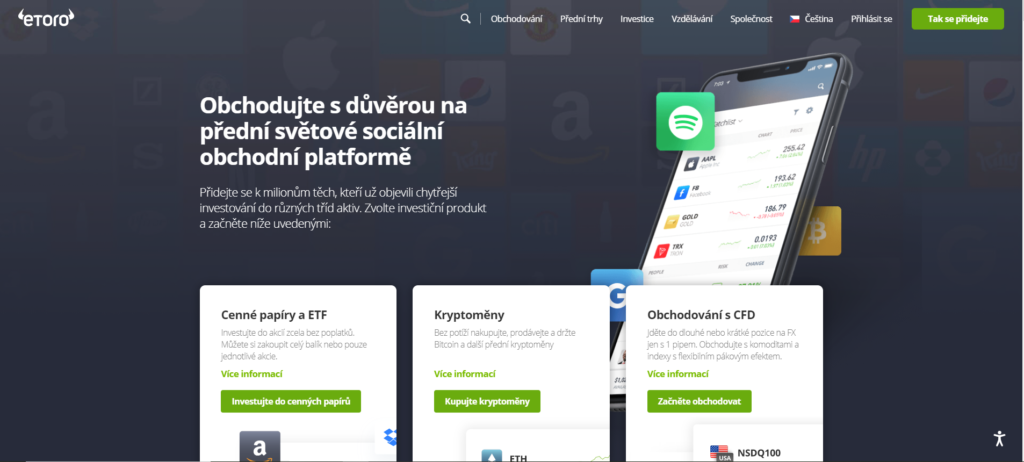

1. eToro – Leading Broker for Social Trading

This broker is also very popular with investors who do not have a large financial capital and would like to start with smaller amounts of money. However, it is not necessary to buy a whole share on eToro (the price of Apple shares is 172 USD at the time of writing this article), because the platform also offers its users the option of buying so-called fractions, i.e. partial shares.

In addition to allowing you to buy stocks, eToro also offers stock CFD trading and is considered one of the best CFD brokers. This means you can also open a short position (short sell) and speculate on whether the price of Apple shares will fall. You can also use leverage (margin) of up to 1:5 to make larger trades.

eToro is also well known for its social trading and copy trading tools , which set it apart from most standard trading platforms. eToro allows you to collaborate with other users, as it offers the option to use its CopyTrader tool, which allows you to copy the actions of professional investors.

You can use a debit card, bank transfer, or e-wallet like PayPal to deposit. However, you must meet the minimum deposit of $100. Since eToro automatically converts all deposits to USD, you will be charged a 0.5% currency conversion fee. However, this will allow you to easily invest in international companies.

In terms of security, eToro is regulated by the UK’s FCA. It is also licensed by ASIC and CySEC. If you are an investor who likes to buy and sell stocks on the go, then you will be pleased with the full-featured mobile trading app.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

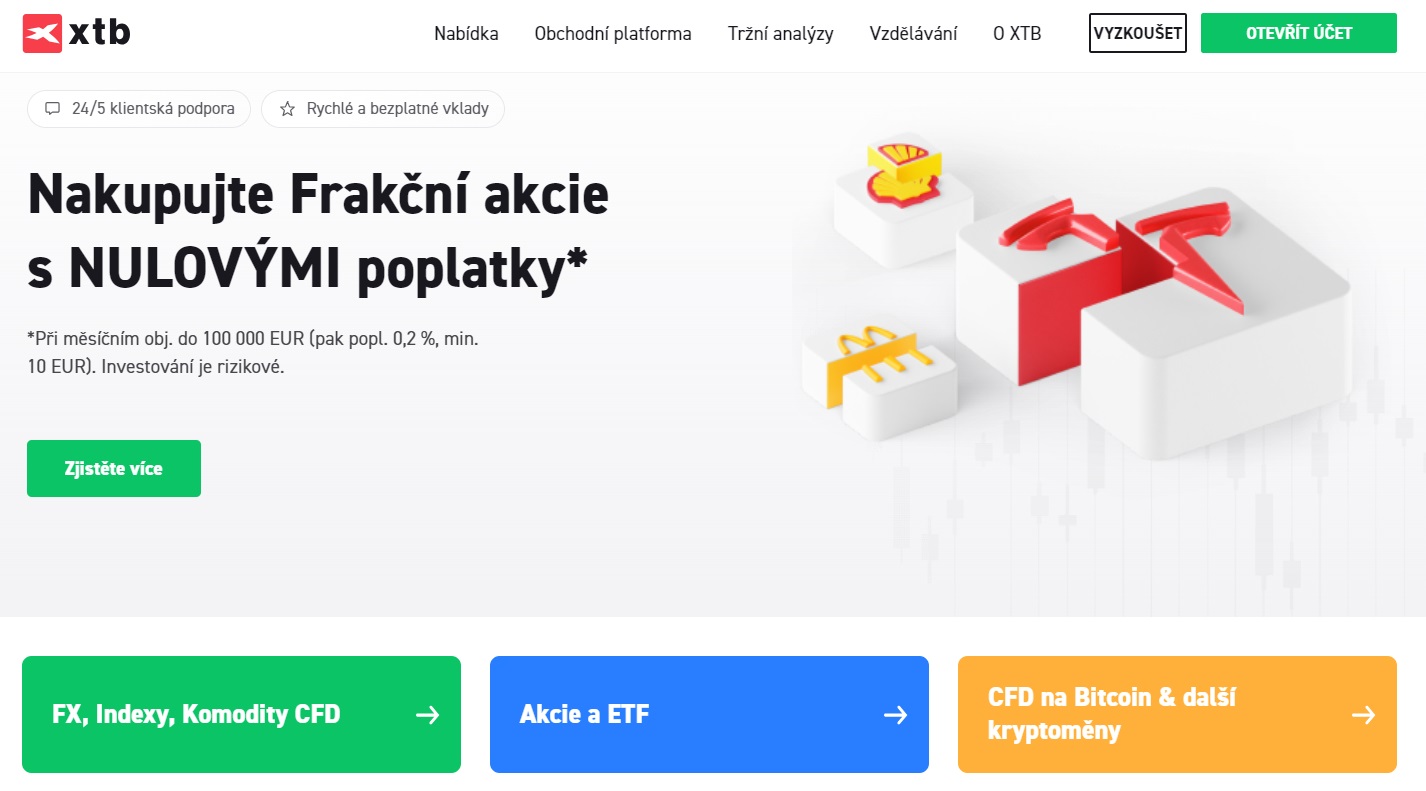

2. XTB - Buy shares with 0% fees

XTB (X-Trade Brokers) is a Polish company based in Warsaw, which specializes in trading

This broker has gained popularity mainly due to its diverse offer, which currently includes over 5,900 financial instruments. For example, traders can choose from more than 3,000 different investments in stocks , including Apple shares, growth and dividend stocks, 50 of the most famous cryptocurrencies, about 300 global ETFs, 70 forex currency pairs and several commodities, including gold . Among the advantages of XTB is the fact that it includes several developing markets (emerging markets) in its offer, which offer not only diversification for the trader, but sometimes also very promising potential.

XTB broker is regulated by several supervisory authorities, namely from Poland (KNF), Cyprus (CySec), United Kingdom (FCA) and Belize (IFSC). In addition, as a European broker, it also provides its users with the so-called "Negative Balance Protection", thanks to which traders cannot lose more funds than they have in their trading account.

A big plus is the possibility of using the demo account feature, which XTB offers for free for 30 days, as well as the xStation 5 platform, which users can use on desktop computers or mobile devices. In addition, thanks to the mobile application, traders will no longer miss a trade.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

3. Pepperstone - Australian broker with low spreads

Another very popular and leading broker offering services related to trading in financial

The broker states on its website that it primarily focuses on forex trading. However, users can also use the option of trading financial instruments such as indices, commodities, stocks or cryptocurrencies via CFD contracts. Specifically, with leveraged stock CFDs, a wide range of Australian, German, American or English stocks can be traded. A big advantage of this broker is also that traders do not have to make any minimum deposit. It is up to them how much money they start trading with. Of course, there are also demo account and social trading functions or opening an account completely free of charge.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

Conclusion

It's no surprise that Apple is often considered one of the best investments of 2026. With a market capitalization of over $2.7 trillion, Apple is one of the largest technology giants. However, there is still a lot of room for potential growth, even considering that it is one of the best companies in the world. When you consider the huge cash reserves of over $190 billion, Apple is well-equipped with the necessary funds to continue its development, innovation, new services and potential acquisitions. This is also crucial for the company's shareholders, as it reduces the risk of overexposure to its flagship iPhone. Apple is doing a great job of this corporate policy. For example, Apple's services, such as subscription TV streaming services, continue to grow year-on-year. We must not forget another important fact, and that is the dedication and loyalty of Apple's customers, which is currently the highest in the company's entire history.

If you want to invest today, popular regulated broker eToro lets you buy Apple shares from as little as $10. Simply click the link below to get started!

eToro – Buy Apple shares

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

[/note]

eToro – Nejlepší pro začátečníky i experty

FAQ

What was the value of Apple shares during the IPO?

How much does it cost to buy Apple shares?

Does Apple pay dividends?

Will I have to pay a currency conversion fee to buy shares on eToro?

What is the minimum number of Apple shares I can buy?