eToro recenzie și păreri 2025 din România – taxe, caracteristici, pro și contra

If you live in Romania and have ever thought about investing your savings or exploring ways to increase your income, you have surely heard of eToro. This trading and investment platform has become increasingly popular on the market, given that eToro offers the possibility to deposit funds and buy shares in just a few minutes.

However, each of us has different financial needs and goals. So, the really important question is: How can you find out if eToro is the right solution for you? Could the eToro broker help you achieve your financial goals? Below, we will carefully explore the platform, the basic features of this broker, as well as our specialists’ opinions on which investments are right for you.

[heel]

Moreover, we will detail:

[stocks_table id=”22″]

What is the eToro trading platform?

Within the traditional property section, eToro allows you to buy:

- Actions

- Cryptocurrencies

- ETFs (including the most popular UK and US ETFs)

Also, within the leveraged CFDs section, you can trade the following:

- COMMODITIES

- Forex (Currencies)

- Stock market indices

About the eToro platform: basic features

One of the most appealing aspects of the eToro platform is its industry-leading pricing policy, and this is because it is one of the few platforms in the online financial space that allows you to buy stocks.

The same goes for cryptocurrencies like Bitcoin or 420 other ETFs. As a stock trading platform focused on beginner investors, eToro is recommended for those looking for a platform that allows you to buy stocks and ETFs online quickly and securely.

Because it only takes a few minutes to set up and fund a trading account, this trading platform is perfect for those looking to buy stocks and ETFs for the first time, without prior experience in the field.

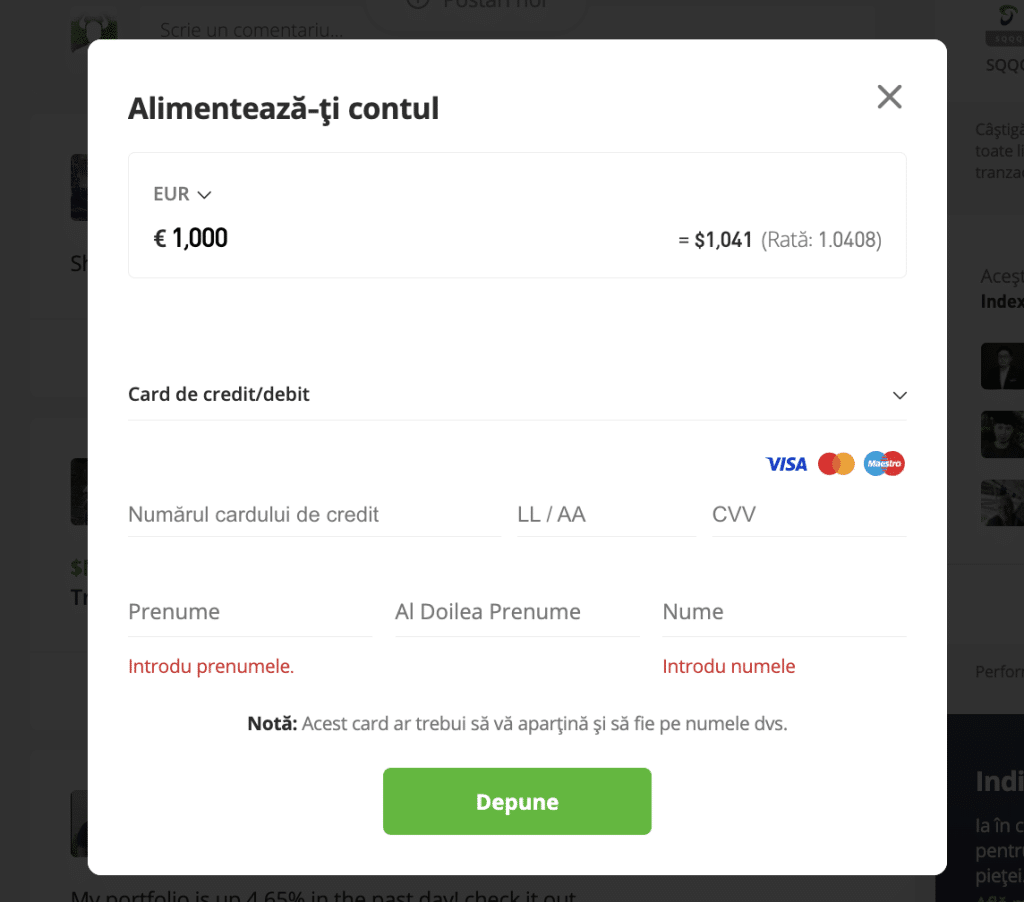

With the eToro broker, you can deposit funds using any of three payment methods:

- Bank account

- A debit/credit card

- Electronic wallet (E-wallet)

You just have to choose which shares you want to buy, how much you want to invest, and finally, confirm the transaction.

At the same time, eToro is a social trading platform. Social and ‘copy-trading’ features are some of the reasons why the trading platform is rapidly growing in popularity.

These features allow you to interact with other investors in a format similar to Facebook. So, when you’re ready to invest, you can copy the trades of other users around the world, maximizing your chances of winning by following strategies tested by individuals with more experience in the field.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Pros and cons of eToro

Pro:

Cons:

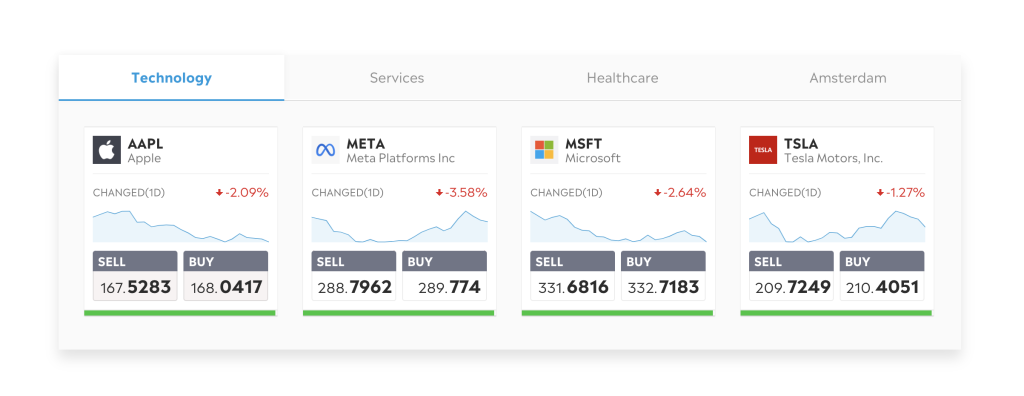

What stocks can you buy on eToro?

eToro Europe lists over 3199 companies across different stock exchanges. Although it has a smaller number than brokers like IG or Capital, you have a significant number of companies to choose from.

For example, if you want to invest in Romanian companies such as Dacia, Biofarm, BRD, you can do this with great ease with eToro.

Additionally, if you want to add international stocks to your portfolio, eToro offers a wide range of options, including traditional and leveraged instruments. Through the New York Stock Exchange (NYSE) and NASDAQ, eToro gives you access to hundreds of well-known American companies.

The international exchanges that eToro allows you to access are the following:

These include: Apple, Amazon , Facebook , IBM, Ford Motors, Nike, Disney, etc.

You can buy stocks from most industries, including:

- Retail

- Banking shares

- Technology field

- Cannabis company stocks

- Food and beverage industry stocks

There is also a good selection of dividend stocks included for those of you interested in passive income. You can track your favorite stocks via eToro's customizable watchlists.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Fractional Shares at eToro

eToro is one of the few brokers in Romania that allows you to benefit from "fractional ownership." As the name suggests, this allows you to buy a "fraction" of a stock, which is extremely beneficial for a number of reasons. For example, let's say you're planning to add some US stocks to your eToro trading portfolio.

It is good to know that the stock market has currency denominators when it comes to stock prices - for example, the NYSE will have all its stocks in dollars, and The London Stock Exchange will have them displayed in pounds sterling.

Let's take Amazon as a first example:

- At the time of writing this "eToro Opinions" review, the giant retailer has a share price of $3,184.

- For most of us, it wouldn't be convenient to spend this significant amount on a single stock .

- This prevents you from creating a diversified portfolio of stocks and could far exceed your initial investment plan.

- Buying Amazon shares on eToro requires a minimum of $10. In other words, if you invested $50 in Amazon, you would own approximately 1.6% of a single share .

This fractional ownership offering at eToro is available across all 1,700+ stocks on the platform.

Bonds , stocks and ETFs eToro

An ETF (Exchange Traded Fund) allows you to invest in a variety of different stocks by purchasing a single instrument, in a single investment.

An ETF is a financial instrument that tracks the performance of a specific stock index (a group of stocks, commodities, bonds, or other assets). You can buy or sell ETFs like stocks, giving you access to diversification and exposure to multiple markets without having to buy each individual asset.

eToro offers access to ETFs from three of the largest ETF providers – Vanguard, iShares, and SPDR. In total, eToro hosts 420 ETFs across a range of different sectors. This means you can invest in the most popular ETFs from around the world.

Once you fund an ETF on eToro , you don't need to do anything until you decide to cash out or close your position. The ETF provider will buy and sell shares on your behalf.

If you want to take your diversification strategy to the next level, eToro offers access to instruments like bonds. For example, the Vanguard Total International Bond ETF contains over 6,000 bond instruments from a variety of markets. Once again, you can invest in the entire basket of assets with a single ETF trade.

In terms of minimum investments, ETFs from eToro can be purchased with a minimum deposit of $50. If you were to deal directly with the ETF provider itself – investment companies like Vanguard require a minimum investment of $500.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Other assets available for investment on eToro

If you want to diversify your investments across a range of asset classes, eToro makes that possible too.

Here is a detailed list of instruments that can be traded on the platform:

- Indices: eToro offers 3 indices that you can buy or sell with the click of a single button. These include FTSE 100, Dow Jones 30, France 40, S&P 500, NASDAQ 100, Japan 225, etc.

- Cryptocurrency: You can buy 16 different cryptocurrencies from eToro, with a minimum investment of just $25. This includes Bitcoin, Ethereum , Ripple , Bitcoin Cash , etc. There is also cryptocurrency trading for currency pairs other than dollars, such as BTC/ETH. You can either buy cryptocurrencies and own the assets, or trade cryptocurrencies via CFDs.

- Commodities: You can also trade commodities on eToro. This operation covers various markets for oil and natural gas, gold , silver, copper, and some agricultural products.

- Currencies (FX): eToro offers a comprehensive forex trading facility, which includes over 40 currency pairs.

CFDs and leverage at eToro

Apart from stocks, ETFs and cryptocurrencies, all other asset classes at eToro are traded via CFDs (contracts-for-differences).

This means you can trade the future value of the asset in question without having to store or own it. In particular, this makes it easier to gain access to assets such as gold, silver, or oil.

Although you won't own the underlying asset, CFDs at eToro offer two key benefits over traditional investments:

- Leverage effect

- Short-selling positions

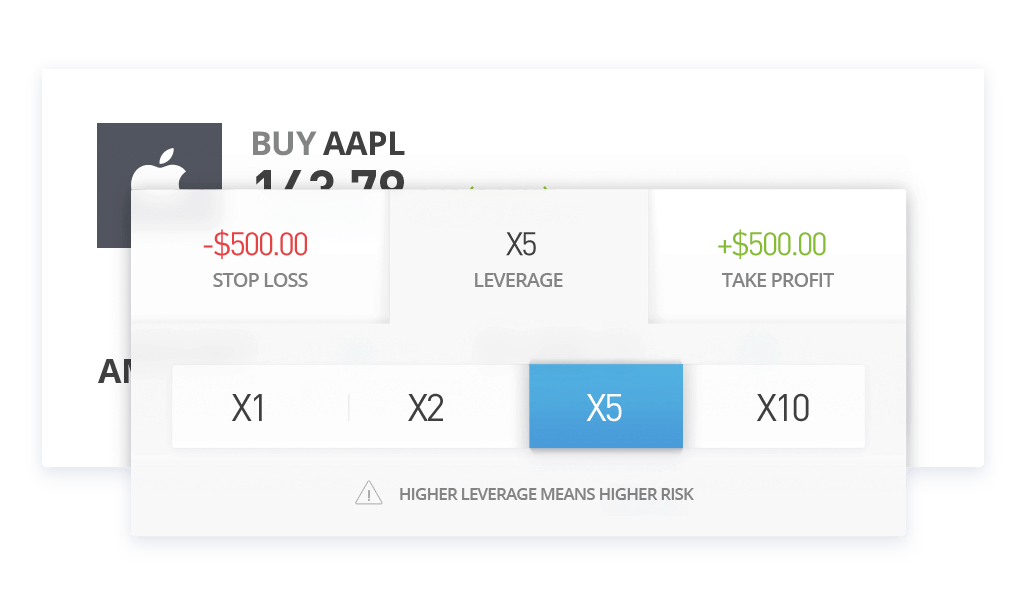

eToro leverage

Leverage allows you to trade with more money than you have in your account. This allows you to take on larger positions than traditional investments (i.e. 1:1). At eToro, the broker complies with all regulations imposed by the European Securities and Markets Authority (ESMA).

As such, users based in Romania (and Europe) will benefit from caps on the minimum amount they must deposit.

This amounts to:

- 1:20 on gold

- 1:5 per share

- 1:30 pe perechi valutare majore

- 1:2 pentru tranzacționarea criptomonedelor

- 1:10 pentru mărfurile altele decât aurul.

Efectul de levier permite să îți multiplici suma de acțiuni pe care le deții cu un anumit procent la alegerea ta.

De exemplu, să presupunem că ai intrat cu echivalentul a 100 de dolari într-o investiție în aur. În cazul în care prețul aurului a crescut cu 10% și ai aplicat efectul de levier maxim de 1:20, atunci profitul de 10 dolari ar ajunge să crească la $100 ~ 460 RON.

eToro short-selling

Una dintre cele mai populare caracteristici ale platformei eToro este opţiunea de short-selling. Acest lucru permite specularea cu privire la valoarea aflată în descreştere a unui activ.

For example, let's say you've done a lot of research on Ford stock. Based on your research, you believe the stock is significantly overvalued. While most investors in Romania will simply avoid buying the stock, a knowledgeable investor will look to short-sell to take advantage of the price drop.

So, if you placed a $500 sell order on Ford and the stock fell by 20% – your profit would be $100. To achieve this result, you will need to trade your chosen asset via CFDs.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

eToro Dividends

One of the most frequently asked questions is: does eToro pay dividends or not? The answer is yes – by investing in stocks and ETFs with an eToro account, you will be entitled to dividend payments when they are distributed by the respective organization.

In the case of stocks, the company will transfer your dividend payment to eToro. The broker, in turn, will add the funds to your cash balance. You can then withdraw the money or, even better - reinvest the funds in other assets. This will give you the best possible chance of benefiting from compound interest.

In the case of stocks, the company will transfer your dividend payment to eToro. In turn, the broker will add the funds to your cash balance. You can then withdraw the money or, even better – reinvest the funds in other assets. This will help you benefit from compound interest , and therefore a higher return.

In the case of ETFs, providers like Vanguard and iShares typically make a quarterly payment. Because the ETF will attract dividend payments throughout the month, making individual recurring payments becomes unfeasible.

Instead, the quarterly payment will cover all dividends received by the ETF provider during the relevant period. The dividends will be deposited into your main eToro account, available for immediate withdrawal.

eToro Fees and Commissions

One of the most important criteria you need to consider before joining a broker is the commission policy. In addition to stock trading commissions, there are other types of commissions that apply.

As such, below we offer you a complete analysis of the commission system offered by eToro.

Case Study: $1,000 Invested in Stocks on eToro vs. Other Brokers in Romania

Want to buy $1,000 worth of shares and aren't sure which platform to choose? Let's explore the fees you should pay with eToro, IG, or Capital.

| Etoro | Ig | Hargreaves Lansdown | |

| Stocks from Romania | $1 | $3 or $8 | $5.95 to $11.95 |

| International actions | $1 | $0 or $10 | $11.95 or 1% (min $20 / max $50) |

Now, let's see what the scenario of buying $1000 worth of shares in a long a stock position on eToro for 1 week looks like:

If you were to enter a $1,000 stock CFD position at eToro, Plus500 or MarketsX – below we list the commissions you would have to pay:

| Etoro | Plus500 | MarketsX | |

| Europe 50 | $1.35 | $0.65 | $1.25 |

| Apple | $3.15 | $4.45 | $3.20 |

Other commissions

There are some fees to avoid when using eToro.

Spreads

In the field of stocks, the spread is the difference between the "bid" price and the "ask" price of a company. This is an important concept to understand because it is an indirect trading fee that must be included in the return-on-investment.

eToro does not have a specific margin structure as this will change depending on market conditions. If you trade during standard market hours then you will benefit from the most competitive spreads.

To give you an idea of what you might pay, see the following example:

The bid and ask prices on BRD shares at the time of writing this review (during standard trading hours in Romania) are 174.24 points and 174.80 points . This translates into a spread of approximately 0.32%.

In conclusion, it is very reasonable to invest with eToro, considering that there are no taxes, costs and commissions imposed. You can use the eToro demo account to invest in your favorite stocks and see the real impact of the spread on your return. This way, you will be able to see for yourself how beneficial it is to invest with this broker.

Inactivity fee

eToro charges an inactivity fee of $10 per month after one year of inactivity.

eToro Fees Reviews: Deposit Fee and Withdrawal Fee

eToro does not charge a specific daily deposit fee. However, there is a basic currency conversion fee that you need to be aware of. This is because all account balances at eToro are denominated in US dollars.

Therefore, when you fund your eToro account, you will incur a 0.5% currency conversion fee. This means that a $1,000 deposit would cost you $5.

As for withdrawals, eToro charges a flat fee of just $5.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

eToro Stock Platform

When it comes to buying and selling stocks on eToro, the process is extremely simple. If you have a specific stock in mind that you want to search for, you have two options:

- Or you can search for a specific company to be redirected to its respective investment page.

- You can either navigate to the eToro stock database and then scroll down to the Bucharest Stock Exchange, or the company sector.

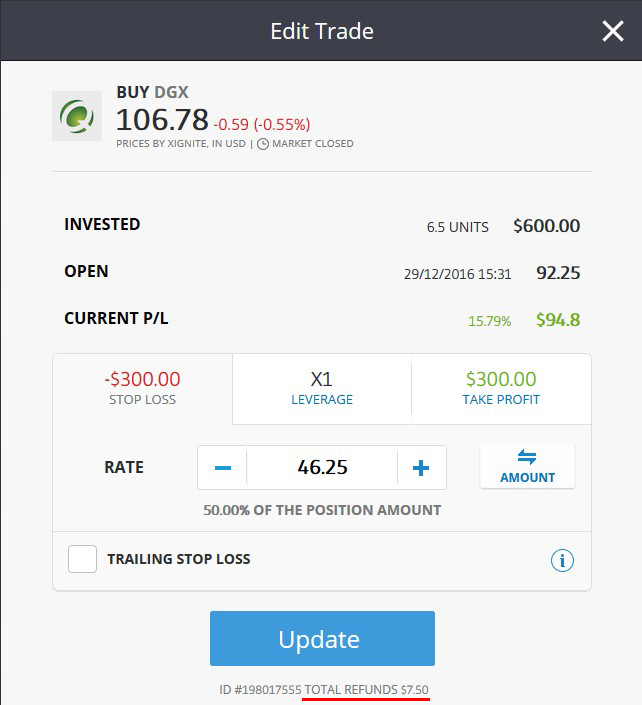

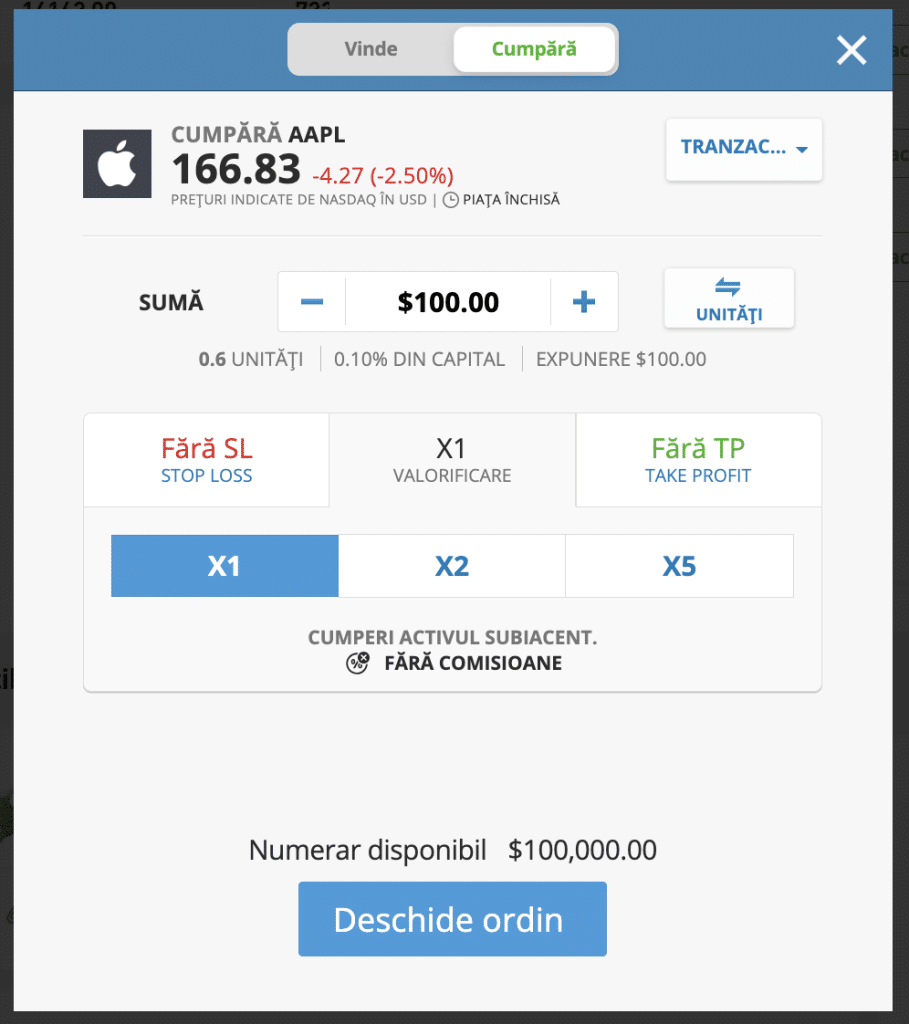

eToro Stock Orders

Although eToro is geared towards beginner investors, you will still have access to multiple orders when you place an order.

This includes:

- Market Order: This allows you to buy shares at the next available price. If the relevant stock exchange is open, the stock transaction will be executed within seconds.

- Limit Order: If you want to buy your chosen stock at a specific price, eToro allows you to set up a limit order. This way, the order will only be executed when the stock reaches the trigger price. If not, the trade will remain pending until you cancel it.

- Stop Loss Order: This special order is suitable if you plan to buy and sell stocks in the short term. Essentially, you can choose to have your trade automatically closed when your investment falls by a certain amount.

- Take Profit Order: This order is also more suitable for short-term traders. It allows you to automatically close the trade when a pre-defined profit target is met.

If you are buying shares on eToro and holding them for a number of years, a market order is most appropriate.

eToro Review: about how to buy shares on the eToro platform

eToro Social and Copy Trading

eToro is often referred to as a “social trading platform” – and rightly so. For those new to the social trading phenomenon, this works much like a social media platform, but specifically for the stocks and stock investing space.

In other words, you have the opportunity to discuss and exchange trading ideas, and even get investment advice from other eToro users in a public setting.

When an experienced investor on eToro posts some trading ideas for the coming week, you can view the post and post a response, as long as you have an eToro account. You can add eToro members of your choice to your "friends list", which then allows you to follow their activity on the platform.

This is especially useful if you are an absolute beginner in the field of investments and want to acquire new information.

Copy Trading eToro opinions

As valuable as eToro’s social trading platform is , nothing compares to its copy trading feature. As the name suggests, this allows you to choose a popular eToro investor and copy their trades.

You can copy the trader's entire portfolio , as well as all future investments!

This means that you can invest in stocks without doing any research. However, it is extremely important to do your own research and keep track of the essential data about the company you are going to invest in.

So, if you are a beginner who is still learning the ABCs of how to invest in stocks, but you want to invest, you can do so by using the eToro CopyTrader platform.

You can invest an amount that is convenient for you – as long as you meet the minimum amount of $100 ~ 460 RON.

- Let's say you're going to copy a trader who has invested $100,000 in 30 different stocks.

- Of this figure, the trader has 5% in Facebook shares - worth $5,000.

- You have $1,000 invested in your copy trading portfolio.

- Thus, a 5% investment in Facebook will mean $50 for you.

There are no additional fees for using eToro copy trading and you can withdraw your money whenever you want. You can manually cancel individual orders within a portfolio, so you always have full control over your money.

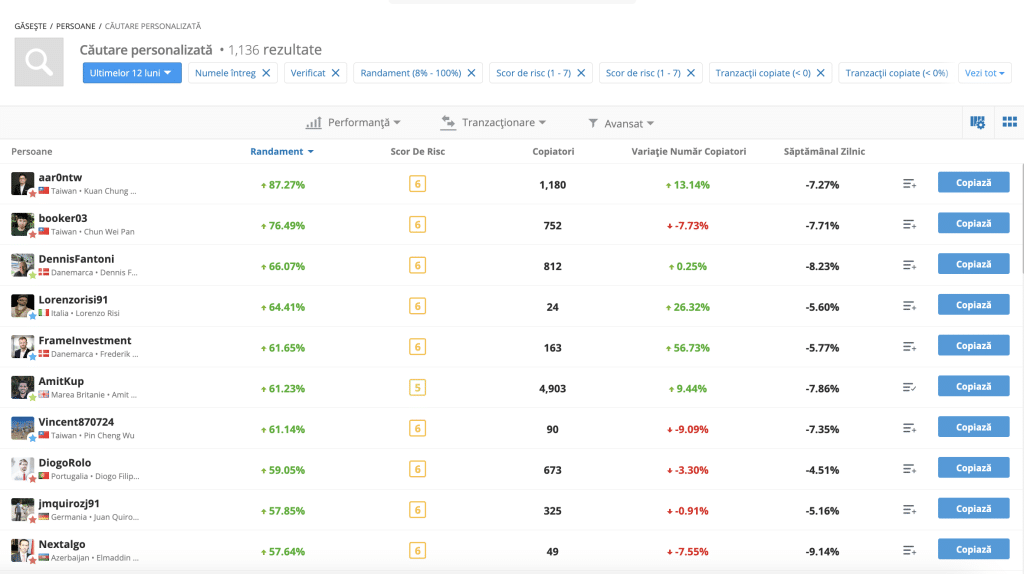

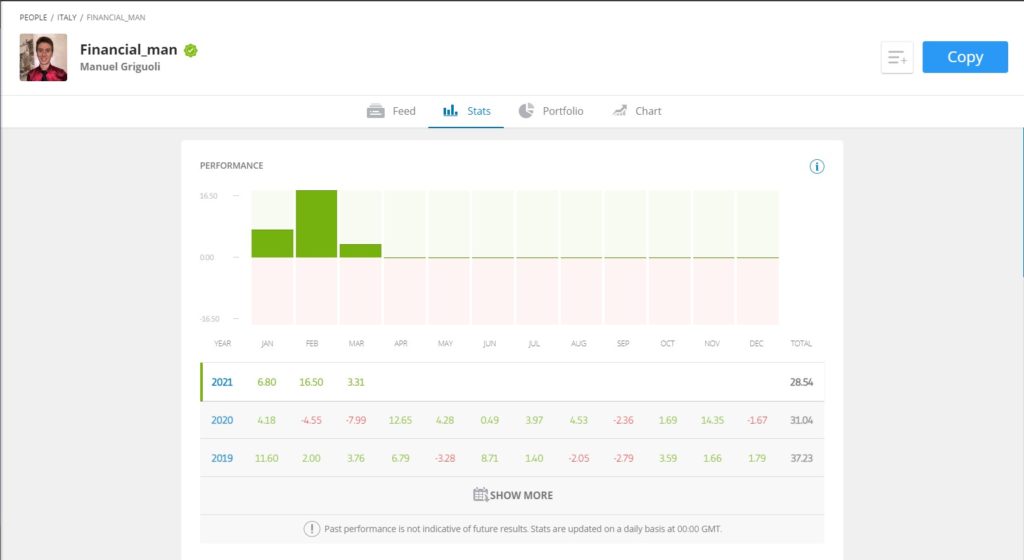

The best eToro traders to copy

At the time of writing this review, there are approximately 710,000 traders you can copy with an eToro account in real time.

Fortunately, the platform offers an extensive range of filters to select those top traders who can help you achieve your financial goals through consistent earnings.

When choosing the best eToro traders to copy, keep the list below in mind:

- Overall returns, recorded since the trader joined eToro

- Risk rating (1 being the lowest and 10 being the highest)

- Preferred asset class (stocks, ETFs, etc.)

- Average duration of transactions (indicates whether you are a short, medium or long-term investor)

- Number of traders copying them and total assets under management

- Month-by-month returns

Finding a trader to copy can be a time-consuming process, given that there are thousands and thousands of potential investors to choose from.

At the time of writing this review, there are just under 710,000 traders you can copy on eToro. Fortunately, the platform offers a full range of filters that ensure you can find not only a top trader who meets your long-term financial goals – but one who will bring you consistent profits.

To give you an idea of the types of criteria you should consider when choosing the best eToro traders to copy, check out the list below:

- Overall returns, recorded since the trader joined eToro

- Month-by-month returns

- Risk rating (1 being the lowest and 10 being the highest)

- Preferred asset class (stocks, ETFs, etc.)

- Average duration of transactions (indicates whether you are a short, medium or long-term investor)

- Number of traders copying them and total assets under management

Finding a trader to copy on eToro can be a time-consuming process. After all, you have thousands upon thousands of potential investors to choose from.

With that in mind, below we have listed three of the best eToro copy traders to consider right now.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

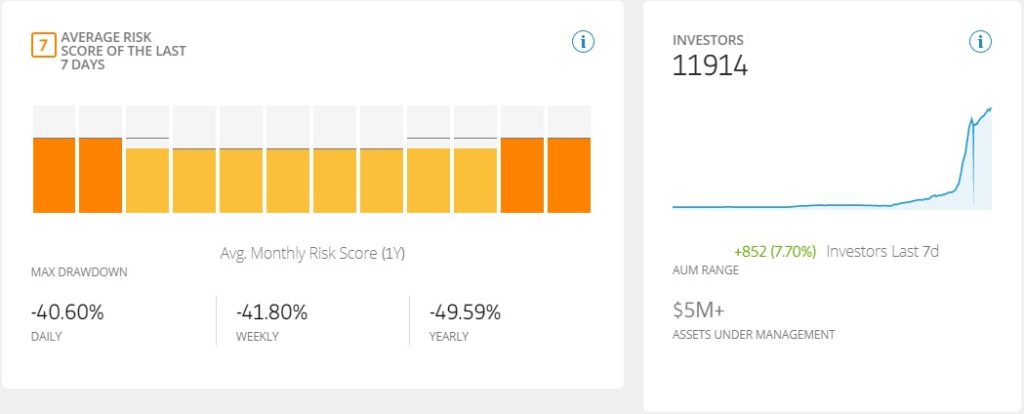

CopyPortfolios on eToro

eToro also offers more advanced copy trading tools called CopyPortfolios.

These are professionally managed portfolios that use artificial intelligence and algorithmic trading, and are of two types:

- Top Trader Portfolios: compiled by the highest performing traders on eToro

- Market portfolios: group a number of assets within a chosen market strategy

Top Trader Portfolio

One of the most popular top trader portfolios available on the platform is that of "GainerQtr." This CopyPortfolio is currently up just under 20% in 2020.

In the previous year, it returned just over 14%. The portfolio is well diversified, with 5 traders accounting for just over 25% of its weight. The rest is divided among a large number of traders from a variety of target markets.

Even though these are more advanced than the standard CopyTrader tool, you need to invest at least $5,000 in a CopyPortfolio. On the other hand, this is the most passive investment option on eToro , as everything is managed for you.

Market Portfolios

Regarding Market Portfolios, this tool allows you to target a specific segment of the financial markets. One such example is the "RemoteWork" portfolio.

As the name suggests, it offers exposure to companies associated with work-from-home. These include Twilio, Zoom, Shopify, Adobe, Salesforce, and more.

This eToro Market Portfolio has performed extremely well since the platform's inception in 2018. Over the past three years, it has returned 82% (2020 YTD), 41% (2019), and 49% (2018).

Other niche sectors that are covered by Market Portfolios include:

- Mobile payments

- Gambling

- Driverless cars

- Renewable energy

- Food and technology

Unlike Top Trader Portfolios – which require a minimum investment of $5,000 – some market portfolios can be accessed from as little as $1,000. The specific amount will depend on the portfolio you choose, however – so be sure to check this out.

eToro Popular Investor Status

"Popular Investor" status on eToro is a special status awarded to those who have been successful in their investments on the eToro platform. This status is achieved when a trader manages to attract and inspire other investors to copy their strategy.

Benefits of "Popular Investor" status:

- Recurring Payments - an annual payment of 1.5% of the copied assets, paid monthly, representing a constant source of income.

- Global Exposure - This status confers leadership within one of the world's largest investment communities, with over 30 million members with investors from around the world.

- Instant Credibility - Popular Investors benefit from the trusted reputation of the eToro brand to grow their business and gain investor trust.

- Premium Access - This position opens the door to exclusive advantages, benefits and rewards, providing a superior trading and investing experience.

Achieving "Popular Investor" status on eToro is a recognition of your skills and expertise in financial trading and provides the opportunity to earn more from social trading.

Graphical representations, documentation and analysis at eToro

eToro has some slight shortcomings in terms of documentation and analysis. Although the eToro web platform has integrated its own stock documentation page and financial analyst rating browser TipRanks , this does not provide a wealth of information.

Thus, you do not have the opportunity to view earnings reports, published accounts, or in-depth expert analysis.

However, you can view a range of analytical data on the stock you have chosen. These include charts and graphs related to the stock's pricing history, as well as the general consensus of the major hedge funds.

The absence of a fundamental news feed is another downside of eToro. The platform is limited to news developments through communication between platform users.

As such, it is advisable to obtain documentation materials from an external source, such as Yahoo Finance or Morningstar .

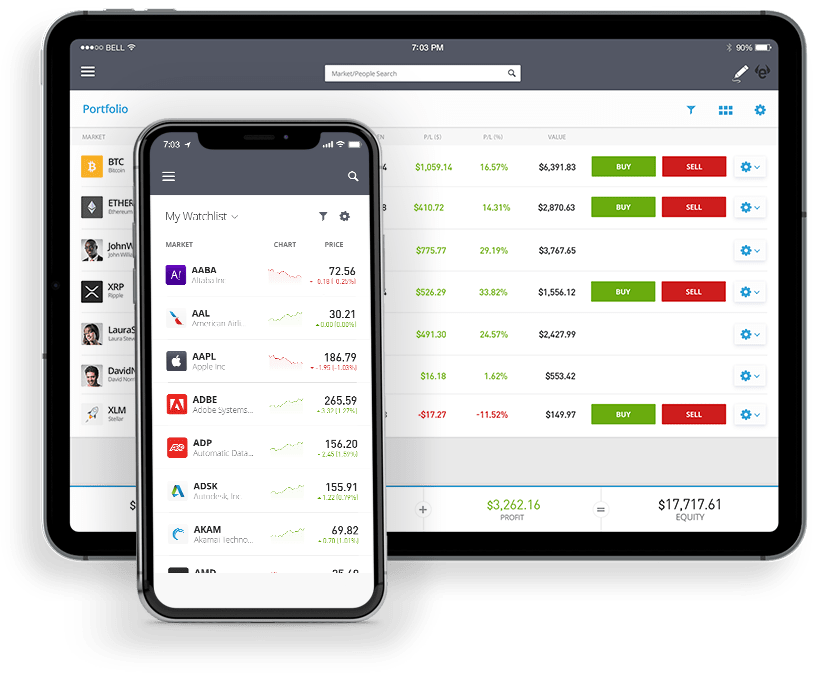

eToro on mobile: eToro mobile app reviews

The mobile trading app is available for download on both iOS and Android devices. Both the investment app and the mobile browser-based version have the same account specifications as the main website.

Whether it's about:

- Buying and selling shares

- Checking the value of your portfolio

- Depositing and withdrawing funds

Everything can be facilitated via mobile phone.

For example, you can check the value of your stock positions with a single click, no matter where you are. This also applies when it comes to closing an unfavorable position. This way, you no longer have to wait hours until you have access to a computer, which could be extremely expensive.

eToro Wallet - cryptocurrency wallet

eToro Wallet is a digital wallet used for storing and managing cryptocurrencies. It comes with several key features to facilitate trading and managing cryptocurrencies in a secure and convenient way.

Here are some benefits of eToro Wallet:

- Advanced Security: eToro Wallet offers advanced security, including two-factor authentication and cold wallet technology to protect your crypto assets from cyber threats. It is also regulated by the GFSC.

- Ease of Use: The simple and intuitive interface makes this e-wallet suitable for both new and experienced cryptocurrency users.

- Support for Multiple Cryptocurrencies: You can store and manage 74 popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and more.

- Integration with eToro: eToro Wallet integrates seamlessly with the main eToro platform, allowing for easy transfers between your wallet and your trading account.

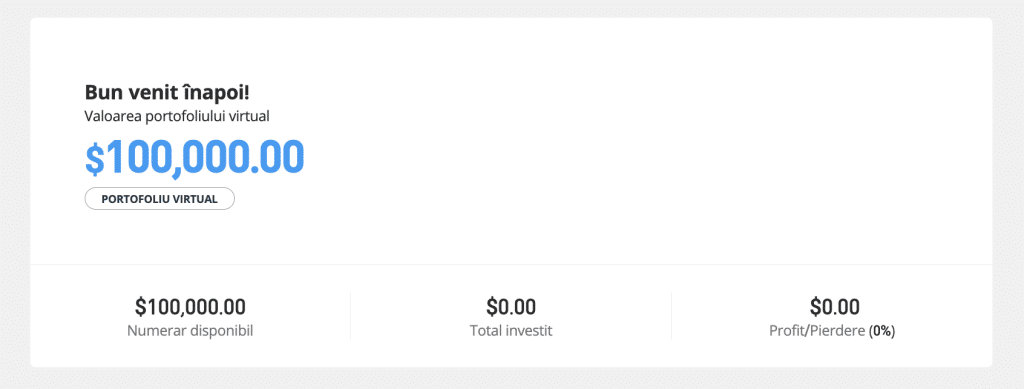

eToro demo account

If you want to better understand the mechanics of eToro and practice your investment strategies before putting your money on the line, then the eToro demo account is the right solution for you.

A demo account comes with $100,000 in fictitious money to help you learn the right investment strategies for you in a risk-free way.

This demo account provides the full functionality of the eToro platform, including its copy trading tools, as well as trading CFDs, ETFs, and cryptocurrencies.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Payment methods at eToro

One of the biggest advantages of eToro is that it offers a wide range of payment methods to choose from. These include:

Many traditional brokers in Romania will only allow you to deposit funds via bank transfer. With an eToro account, you have numerous options to choose from depending on your preferences.

Unlike competitors like Degiro (where the end-to-end deposit process often takes days), eToro offers instant deposits, so you avoid the frustration of slow transaction processing times.

Simply deposit money with a debit/credit card or e-wallet into an eToro account, and it will appear in your balance instantly.

In terms of account minimums, eToro requires a minimum deposit of $50. Since the platform offers over 3199 stocks across 17 international markets, you don't have to worry about constant FX fluctuations.

All deposits at eToro incur a 0.5% currency conversion fee. So if you deposit in GBP, EUR, AUD, or any other currency other than USD, you will pay a small fee.

For example, if you were to deposit $1,000, the fee would be $5. In conclusion, eToro eliminates the 0.5% stamp duty that you would have to pay when buying shares in Romania. As such, the FX fee is effectively offset.

eToro Withdrawals

According to Romanian anti-money laundering laws, you will have to withdraw at least the deposit amount corresponding to the same funding source.

For example, let's say you deposited $500 with your debit card and you want to make a withdrawal of $600. At least $500 of the withdrawal request must be directed to the same debit card you used to deposit – while the remaining $100 can be directed to an alternative source.

The minimum amount you can withdraw from the platform is $30. There is a flat fee of $5 for all withdrawal requests, regardless of the amount.

It is also important to note that eToro charges a 0.5% FX fee for withdrawals. This will be charged at the current GBP/USD exchange rate at the time of the withdrawal request.

Does eToro offer security?

While valid shares and trading fees are fundamental criteria to consider when choosing a broker, the regulatory status of the platform is also important.

This will guarantee that you are using a reputable and trusted broker from Romania who keeps your funds safe.

In the case of eToro, the platform holds three regulatory licenses:

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

If you are an investor from Romania, then you will fall under the jurisdiction of the FCA. The good news is that eToro Limited is a member of the FSCS. Thus, Romanian investors are covered up to $85,000 by the FSCS.

In addition to its regulatory licenses, it is important to remember that eToro has been active in the online stock trading environment since 2007. This means a history of over 14 years. As previously mentioned, the platform includes a customer base that currently exceeds 12 million investors. Therefore, you should not worry about the safety of your funds at eToro.

eToro Customer Support

eToro customer support offers a wide range of options to help users get answers to their questions and problems.

- Real-time Chatbot: eToro's automated Chatbot is available 24/7 to answer your questions. You can also use Live Chat to interact with the customer service team in real time. eToro agents are online 24 hours a day, Monday through Friday.

- Open a ticket: You can submit a question to the Customer Service Center and eToro will get back to you within 48 business hours at the email address associated with your eToro account. For questions regarding recently submitted documents, please allow 4 business days before submitting a question.

- WhatsApp: If you are a member of the eToro Club , you can communicate directly with the support team via WhatsApp. Check our WhatsApp business account number here.

- Help Center: eToro offers a range of online resources , such as frequently asked questions (FAQs), informative articles, or knowledge bases to help you find answers to your questions.

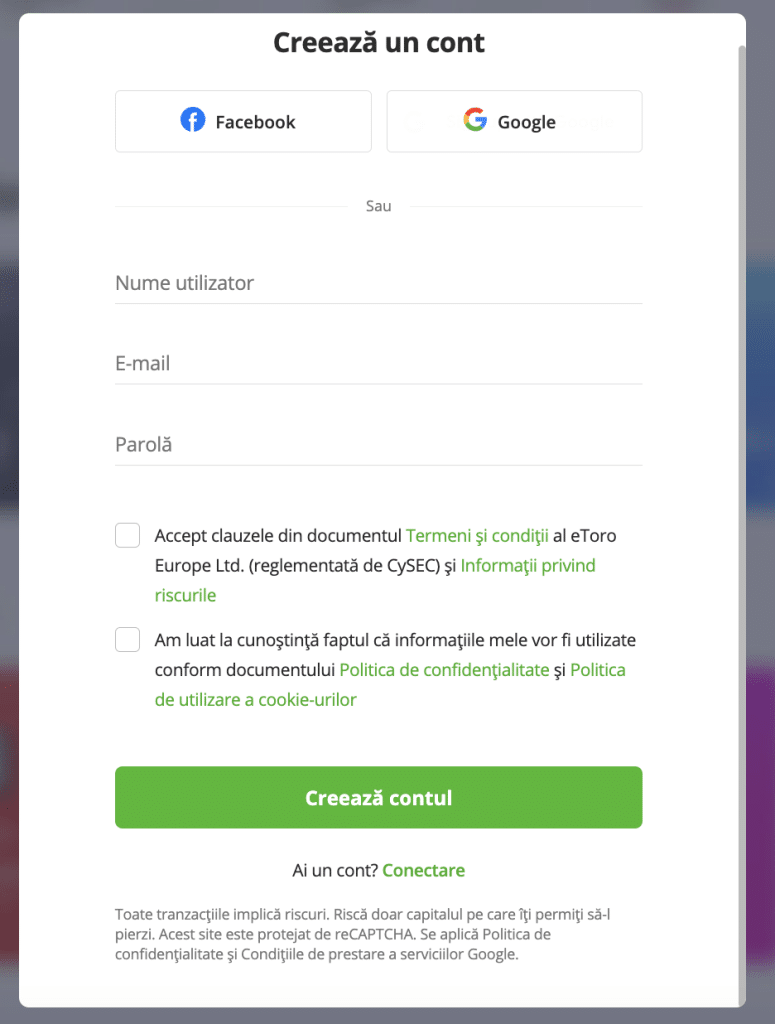

How to start investing with eToro?

Below we present the steps you need to follow to start trading on eToro.

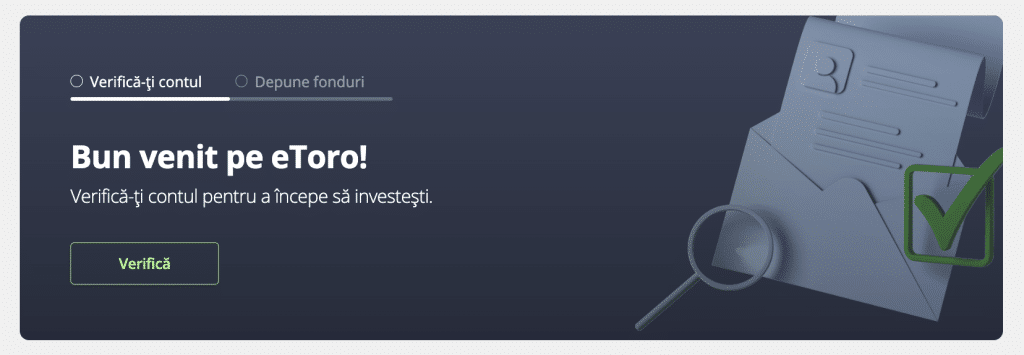

First, you will need to visit the eToro homepage and open an account. As with any FCA-regulated stock trading platform , this operation requires the disclosure of some personal details, namely: eToro will need to verify that you are the account holder. As a result, you will be asked to upload two pieces of identification, namely: eToro will process and verify your documents within an hour. In the meantime, you can start funding your account. Depositing funds to eToro is simple. You just need to select the payment method you want to use and then select how much you want to deposit. The minimum deposit is $100 ~ 460 RON. Unless you opt for a bank transfer, the deposit will be credited to your account instantly. Once funded, you can move on to buying the shares you want. If you know which company you want to invest in, you can search for it using the search bar at the top of the page. If you want to browse the eToro stock database, click on the ‘Trade Markets’ button, followed by ‘Stocks’. You can then scroll down to the stock exchange or sector the stock is associated with. In our example, we intend to buy shares in Nike, so we will enter this specification in the search box and click ‘Trade’. Then, all that remains is to specify how much we want to invest. As previously mentioned, the expression is in US dollars. You can invest a minimum of $50 in the chosen share, which is approximately $40. To complete your order to buy shares, simply click on the ‘Open Trade’ button during market hours, or the ‘Set Order’ button if the relevant exchange is closed at the time.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Step 1: Opening an account

Step 2: Identity verification

Step 3: Deposit Funds

Step 4: Buying shares

Customer reviews on eToro

Of course, we are not the only publication that has reviewed eToro. If you wanted to find a detailed analysis of this platform and started this journey after "eToro reviews", we hope that you are now clear about the functionalities of this broker.

As one of the most popular stock brokers in Romania , eToro has been reviewed by several sources on the internet. If you check other "eToro reviews" pages, you will find that most of these reviews are similar to ours.

Thus, you can be sure that eToro is a truly quality platform for trading and investing.

Summary of our eToro review

If you read this eToro review in detail, it is easy to understand why the platform has amassed a customer base of over 12 million investors. There are also no annual fees, and the payment methods provided include debit/credit cards, bank accounts, and e-wallets.

For more sophisticated trades, eToro also offers leveraged investing and short-selling. These are available for all 3,199+ stocks, as well as indices, cryptocurrencies, bonds, forex , and commodities.

In conclusion, eToro is ideal if you want to invest in the stock markets in a simple, safe and profitable way.

Are you interested in eToro's offers? Click the link below to open an account today!

eToro – The Number One Broker In Romania Recommended By Us

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently asked questions:

What is eToro?

What does eToro offer?

Is it safe to invest with eToro?

Can you open an eToro demo account?

How do you deposit funds into your eToro account?

Are there any additional costs for using eToro copy trading tools?

Do I have to pay fees for my trades on eToro?

Sources: