Cum puteți achiziționa acțiuni de petrol în anul 2024

În urma situației din Ucraina și a problemelor pe care unele companii le au cu stocurile, acțiunile precum petrolul au luat din nou amploare în cadrul investitorilor de rând. Datorită unei perioade bune a pieței, petrolul a devenit una dintre cele mai de succes acțiuni.

O mișcare extrem de bună la momentul actual este lansarea unei investiții în acțiunile de petrol. Pentru a vă ghida spre această mișcare, astăzi vă vom prezenta cum să achiziționați acțiuni de petrol, fără comisioane și din liniștea domiciliului dumneavoastră.

O îndrumare rapidă asupra procesului de achiziționare a acțiunilor de petrol

- Primul pas – Înregistrați-vă un cont în cadrul platformei eToro: În urma accesării site-ului oficial eToro, apăsați pe butonul „Join Now” și înregistrați-vă un cont în cadrul platformei.

- Al doilea pas – Încărcați o poză cu un document de identificare personal în cadrul platformei eToro: Puteți utiliza un buletin, pașaport sau permis de conducere pentru a vă verifica identitatea, proces ce va dura extrem de puțin timp.

- Al treilea pas – Depozitați valută: Pentru depozitare, se pot utiliza metodele următoare: card de debit/credit, portofele virtuale sau transfer bancar. Depozitarea minimă este în cadrul platformei este de 10 dolari.

- Al patrulea pas – Accesați acțiunile de petrol: În bara de căutare a platformei introduceți numele acțiunii de petrol pe care doriți să o achiziționați. După ce ați realizat acest lucru, apăsați pe butonul „Trade”.

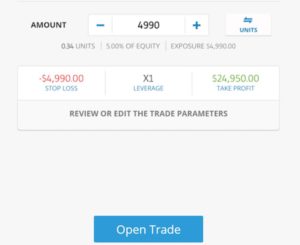

- Al cincilea pas – Achiziționați acțiunile de petrol: Introduceți suma dorită, minim 10 dolari, și apoi apăsați „Open Trade” pentru a finaliza procesul.

74% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

Platforme de tranzacționare populare din cadrul cărora puteți achiziționa acțiuni de petrol

eToro – Cea mai bună platformă pentru a achiziționa acțiuni de petrol în anul 2022

eToro este cea mai mare platformă de acest tip și cea mai de încredere, fiind cea mai bună alegere pentru a achiziționa acțiuni de petrol în anul 2024. Această platformă vă oferă acces la mii de acțiuni ce se pot tranzacționa, fiind folosită de peste 25 de milioane de utilizatori doar în Statele Unite ale Americii.

eToro este utilizată de investitori de pe întregul glob, tranzacționarea acțiunilor de petrol având zero comision. În plus, contul dumneavoastră eToro vă permite să accesați o sumedenie de piețe financiare.

Platformă vă permite să investiți în acțiuni pornind de la o sumă de doar 10 dolari, lucru ce vă oferă șansa de a tranzacționa acțiunile extrem de scumpe la un preț mai accesibil.

Dividendele obținute în urma achiziționării acțiunilor de petrol sunt depuse direct în contul dumneavoastră personal eToro. Acestea se pot reinvesti în acest domeniu sau se pot extrage la cererea utilizatorului. În plus, există foarte multe burse fără comision ce sunt valabile pentru achiziționare, dacă doriți să aveți un portofoliu virtual mai diversificat.

Dacă doriți să investiți în bursa de petrol, acest lucru este posibil. Folosind facilitatea platformei de „copiere a portofoliilor”, puteți tranzacționa în funcție de alegerile experților. Acest lucru vă permite să investiți pasiv, deoarece trebuie doar să alegeți un expert ce are rezultate satisfăcătoare.

Argumente pro

- Depozitare minimă de doar 10 dolari

- Acțiunile de petrol au comision zero

- Cardurile de debit/credit și PayPal sunt acceptate în cadrul platformei

- Verificată de foarte multe companii de top

- Facilitatea de „copiere a portofoliilor” pentru tranzacționare este prezentă

- Platforma este foarte accesibilă

Argumente contra

- Nu este cea mai bună alegere pentru investitorii avansați

74% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

Ce reprezintă acțiunile de petrol

Acțiunile de petrol reprezintă companiile ce se ocupă cu extracția petrolului. Pe scurt, atunci când achiziționați acțiuni în cadrul unei platforme de tranzacționare, banii dumneavoastră sunt investiți în cadrul companiei respective cu gândul că aceasta va crește în valoare cu timpul.

Domeniul petrolului vă permite să aveți parte de un profit mare și să primiți dividende, atunci când dețineți acțiunile respective.

În general, toate companiile ce se ocupă cu petrol oferă deținătorilor de acțiuni, dividente. Acest lucru reprezintă primirea unei plăți trimestrial sau de două ori pe an. Investitorii trebuie să aleagă cu foarte mare grijă compania în care doresc să investească deoarece piața este volatilă. Companiile stabile, cu cea mai mare putere financiară, pot genera aceste plăți destul de profitabile.

Investiția în cadrul acțiunilor de petrol este asemănătoare cu investiția în cadrul altor acțiuni. Țelul dumneavoastră este achiziționarea acestor acțiuni la un preț foarte mic, pentru a avea parte de un profit colosal atunci când prețurile cresc. Totuși, înainte de realizarea acestui pas, trebuie aruncată o privire foarte atentă asupra prețurilor recente pentru a observa cum se descurcă domeniul petrolului.

Atunci când alegeți compania în acțiunile căreia doriți să investiți, trebuie să căutați să fie cât mai puternică și mai stabilă în caz de prăbușire a prețurilor. Este o alegere înțeleaptă investiția în cadrul unei companii ce are un cost de producție mic și poate rezista dacă intervine o fluctuație a prețurilor. Companiile de mijloc din acest domeniu au cel mai mare potențial de a avea calitățile necesare, enunțate mai sus, având obligații contractuale serioase.

Prețurile acțiunilor de petrol

Prețurile acțiunilor de petrol au avut parte de o perioadă foarte complicată datorită situației actuale dintre Ucraina și Rusia. Acest lucru se întâmplă datorită rezervelor foarte mari de gaz natural ale Rusiei, fiind și una dintre cele mai mari exportatoare de petrol din lume.

În urma publicării prețurilor de către Oil Price Charts, putem observa prețul de 119.72$ al unui baril de petrol Brent, ce a avut parte de o creștere cu 1.79%, precum putem observa și prețul unui baril de petrol WTI, ce a avut parte de o creștere cu 1.71%, ajungând la prețul de 118.87$.

Producția petrolului se va spori la nivel global, iar experții spun că prețurile ar putea crește.

Pentru acoperirea stocului de petrol al Rusiei, companiile globale trebuie să crească investițiile masiv în acest domeniu pentru a putea umple rezervele utilizate între timp.

Speculații privitoare la prețurile acțiunilor de petrol

Experții consideră că prețul petrolului în anul 2024 este determinat de conflictul dintre Ucraina și Rusia, precum și de discuțiile Iranului cu privire la armele nucleare.

Se speculează faptul că petrolul Brent ar putea ajunge la un preț între 115$-130$/barilul. Totuși, o întâmplare nefericită ar fi scăderea barilului la prețul de 60$-85$ datorită economiei din China.

UBS menționează faptul că o perioadă politică destabilizată din punct de vedere a producției de petrol în regiunile Venezuela, Libia, Nigeria și Orientul Mijlociu ar putea duce la o scădere semnificativă a stocului de petrol.

ANZ Research susține faptul că petrolul Brent ar avea un preț de aproximativ 86.80$ în viitorul apropiat. În anul 2023, se estimează că prețul ar putea scădea la 86.20$. Cu toate acestea, petrolul WTI ar putea ajunge la prețul de 85.10$ în anul 2023, comparativ cu prețul de 83.90$ în anul 2022.

Compania Rystad Energy a precizat că în 2023 prețul petrolului ar putea fi mai mic datorită cererii și a stocului. În 2025, după spusele Statelor Unite, petrolul Brent ar putea ajunge la 66 de dolari/barilul, în timp ce petrolul WTI ar putea ajunge la 64$/barilul.

Trei acțiuni de petrol ce merită achiziționate

Vă vom prezenta cele mai bune trei acțiuni de petrol din Statele Unite pe care le puteți achiziționa în anul 2024.

1. ConocoPhillips – Cea mai bună acțiune de petrol pentru achiziție

Această companie operează într-o sumedenie de țări, având sediul primar în Statele Unite. Este una dintre cele mai mari companii și țelul ei este acela de a descoperi petrol și gaze naturale.

ConocoPhillips își dorește să le ofere deținătorilor de acțiuni un procent sub formă de profit destul de mare în următorii ani. Dividendele se vor tranzacționa către investitorii constant, iar acțiunile se vor lansa către reachiziționare.

În anul 2021, acțiunile companiei avea un preț de 6.07$/acțiunea, mult mai mult comparativ cu anul precedent. 6 miliarde de dolari sub formă de dividende au fost oferite înapoi investitorilor prin intermediul achiziționării acțiunilor și a dividendelor. Compania a făcut public anunțul referitor la dorința ei de a returna două miliarde de dolari investitorilor ce dețin acțiuni în anul 2024.

Compania are un profil financiar de excepție și un portofoliu destul de ieftin, având constant recenzii foarte bune, cu un sistem de tip pârghie redus și o economie ce poate susține orice problemă.

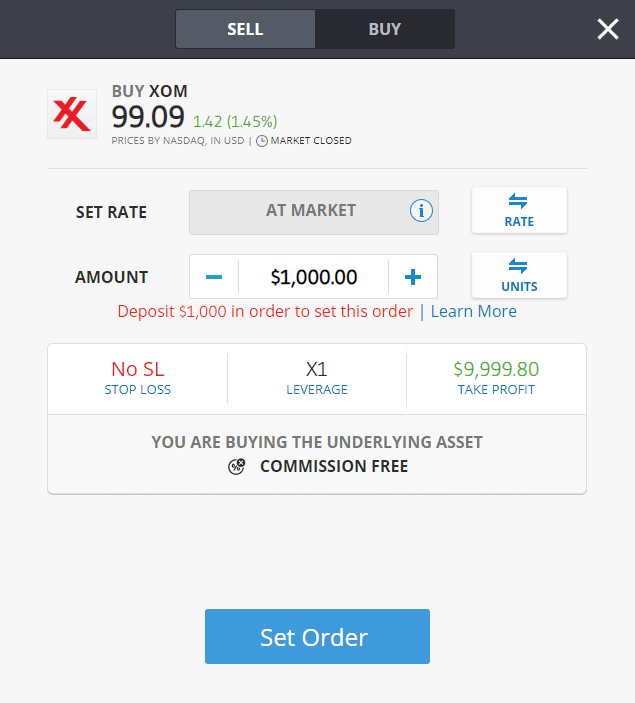

2. Exxon Mobil – O alegere excelentă în materie de acțiuni de petrol pentru a avea parte de dividende

Această compania produce gaze și petrol, fiind lansată în anul 1999 după îmbinarea companiilor Mobil și Exxon. Exxon Mobil este una dintre cele mai mari companii de pe piață în materie de petrol, având o valoare totală de peste 350 de miliarde de dolari.

Compania dorește să devină mult mai eficientă și să își reducă costurile semnificativ. În anii aceștia, compania a reușit acest lucru, returnând investitorilor un profit plăcut. Pe lângă aceste lucruri, a îmbunătățit sistemul de tip pârghie de le oferă acum un profit extrem de mare în momentul creșterii prețului petrolului.

În anul următor, se speculează că Exxon Mobil va avea un preț/acțiune de 8.61$.

Exxon Mobil rămâne axată pe entuziasmul investitorul și pe dorința lor de a avea parte de prețuri mari ale petrolului, pentru a face profit. Chiar dacă această companie a avut parte de o creștere cu 60% în acest an, se speculează faptul că ea ar putea ajunge la un preț al barilului de petrol WTI de 120$, iar în viitor chiar de 130$.

Cât timp valuta este generată, compania își menține dividendele. Exxon Mobil investește în surse de combustibil curate, precum carbon și în surse de combustibil ce au puterea de a se regenera, deci investitorii ce se feresc de petrol pot alege cu siguranță această companie.

3. Phillips 66 – O acțiune de petrol foarte bună și stabilă

Această companie se ocupă cu prelucrarea conglomeratelor pentru a oferii lumii o energie diversificată.

Phillips 66 are parte de cele mai mici costuri din acest domeniu, ocupându-se cu produse crude pentru a le utiliza în petrochimii și rafinării, lucru ce i-a crescut exponențial profitabilitatea.

Compania are performanțe diferite de alte companii din domeniu, având parte de o creștere cu 5% după un an și 11% după cinci ani.

Phillips 66 are un profil financiar foarte stabil, cu o economie foarte mare. Datorită costurilor mici, ea poate investi în proiecte foarte scumpe ce îi generează profit.

Compania se ocupă cu investiții înțelepte, returnând în acest mod valută către investitori.

74% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

Achiziționați acțiuni de petrol în cadrul platformei eToro

În zilele noastre este extrem de simplu să achiziționați acțiuni. Acest lucru se poate face foarte ușor în cadrul platformei eToro, fiind o alegere excelentă pentru toți investitorii interesați de acest domeniu.

Mai jos vă vom prezenta în foarte mare detaliu toți pașii pe care trebuie să îi realizați pentru a face o investiție.

Primul pas: Înregistrați-vă în cadrul platformei eToro

E foarte ușor să vă înregistrați în cadrul platformei eToro. Intrați pe site-ul oficial, apăsați pe butonul „Join Now” și introduceți datele dumneavoastră personale. Platforma va avea nevoie de adresa, numele și CNP-ul dumneavoastră. Toate platformele de acest tip necesită datele personale.

Al doilea pas: Încărcați un document de identitate personal și confirmați-vă identitatea

Platforma va avea nevoie de un document de identitate personal, al dumneavoastră. Documentele ce pot fi folosite sunt buletinul, pașaportul sau permisul de conducere. Copia documentului trebuie să fie clară.

Pe lângă acest document, trebuie să încărcați o dovadă a locației. Acest lucru se poate face prin încărcarea unei facturi sau a unei extrageri bancare, spre exemplu.

Procesul este extrem de rapid și eficient, deci nu veți aștepta mult.

Al treilea pas: Depozitați valută în cadrul platformei

Pentru a tranzacționa în cadrul platformei eToro, trebuie să depozitați valută. Această depozitare se poate face prin intermediul unui card bancar Visa sau Mastercard, PayPal, portofel virtual sau transfer bancar. În cazul în care depozitați din Statele Unite, nu veți avea parte de o taxă de depozitare.

Al patrulea pas: Căutați acțiunea de petrol dorită

Introduceți numele acțiunii de petrol pe care doriți să o achiziționați în bara de căutare a platformei eToro, ce se află în partea de sus a ecranului.

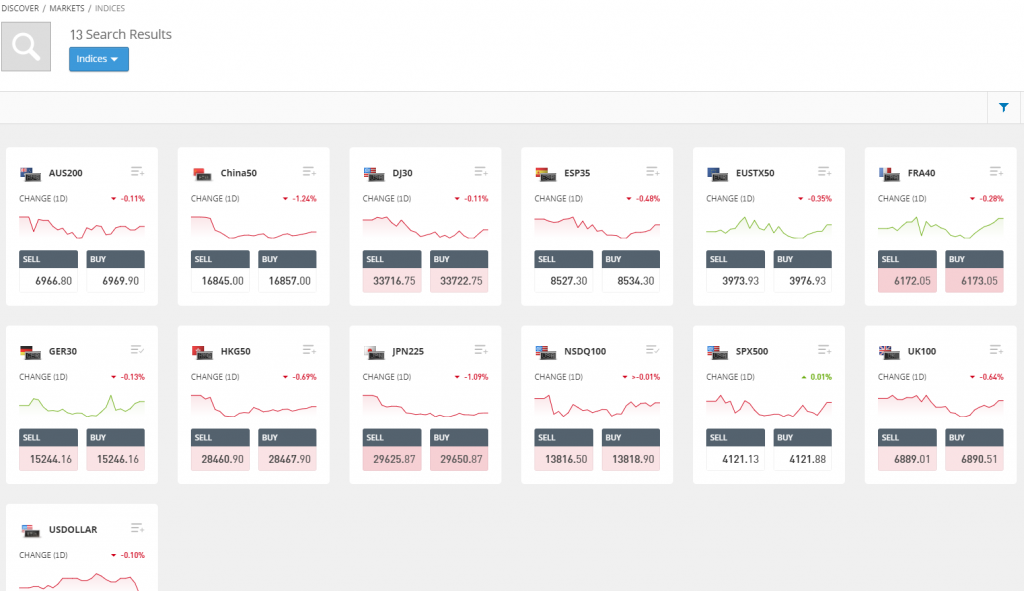

De exemplu, căutați „Exxon Mobil” și apăsați tasta Enter. Dacă doriți să explorați piața, apăsați pe „Discover” și observați toate acțiunile de petrol din cadrul platformei eToro.

Al cincilea pas: Achiziționați acțiunea de petrol aleasă

Apăsați pe butonul „Trade” și introduceți suma dorită pentru achiziționare. În urma realizării acestui pas, apăsați pe „Open Trade” și finalizați tranzacția.

Concluzia recenziei de astăzi

O investiție în cadrul acțiunilor de petrol, mai ales acum cât piața mărfurilor este în creștere, reprezintă o idee extrem de înțeleaptă, ce are un potențial de profit uriaș.

Puteți realiza această investiție în cadrul platformei de tranzacționare eToro, fiind un proces extrem de simplu.

eToro este și destul de accesibilă, având o depozitare minimă necesară de doar 10 dolari, fără comisioane de achiziție.

74% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

Întrebări puse frecvent

Cum pot să investesc în acțiuni de petrol dacă nu dispun de o sumă foarte mare de bani?

Ce este bursa petrolului?

Plătește bursa petrolului dividende?