Cum să Cumperi Acțiuni la Bursă în România Pas cu Pas în 2025

Dacă vrei să afli cum să cumperi acțiuni la bursă, însă nu știi de unde să începi, te afli în locul potrivit. Deși poate părea un subiect complex, investiția în acțiuni este, de fapt, foarte simplu de făcut.

În acest ghid pentru începători, îți vom oferi toate detaliile de care ai nevoie pentru a cumpăra acțiuni la bursă. Vom discuta despre:

Cum să cumperi acțiuni la bursă în 3 pași simpli în 2025

Înainte de a cumpăra acțiuni, trebuie să alegi un broker de încredere și potrivit pentru tine. Pentru a te ajuta, am enumerat mai jos cei mai buni brokeri din Romania, caracteristicile acestora, dar și taxele percepute de aceștia.

1. Selectează brokerul potrivit

- eToro – oferă peste 3000 de acțiuni în peste 17 burse internaționale pe platformă cu comision 0%. Acest broker de încredere este reglementat de FCA, astfel că investițiile tale sunt administrate în siguranță. Pentru a începe tranzacționarea cu acțiuni, va trebui să depui un depozit de minim $100 în contul tău eToro.

- Pepperstone – Platforma permite accesul la piețe financiare globale și la tranzacționarea acțiunilor și a ETF-urilor. Cu o gamă diversificată de active tranzacționabile, Pepperstone facilitează diversificarea portofoliului tău în mod eficient. Platforma este puternic reglementată, menținându-ți capitalul în siguranță.

- XTB – oferă acces la peste 2000 de acțiuni în peste 16 burse internaționale. XTB nu necesită un depozit minim și, asemenea eToro, oferă și un cont demo gratuit, unde îți poți testa abilitățile. XTB nu percepe comisioane pentru a tranzacționa acțiuni.

- Admiral Markets – este o platformă de trading cu peste 20 de ani de experiență ce permite tranzacționarea cu diverse instrumente financiare precum: CFD-uri, acțiuni, ETF-uri, perechi valutare (forex). În plus, utilizatorii au șansa de a accesa platformele MetaTrader 5 și MetaTrader 4, care sunt bine cunoscute și utilizate de comercianți și investitori la nivel mondial pentru gestionarea portofoliilor lor.

- Libertex – este o platformă de CFD trading care permite tranzacționarea fără comisioane. Utilizatorii platformei pot beneficia de oferta zero spread, ceea ce înseamnă că, indiferent de natura activelor pe care optează să le tranzacționeze, nu există niciun decalaj între prețul de vânzare și cel de cumpărare. Libertex oferă acces la peste 3500 de piețe, iar depozitul minim acceptat este de $20.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Deschide contul și alimentează soldul cu suma dorită

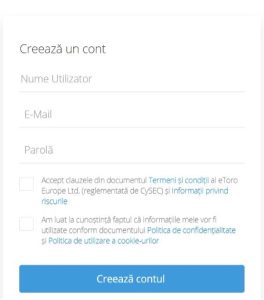

Odată ce ai ales brokerul tău de interes, este timpul să-ți creezi un cont de investiții. Să presupunem că ai ales să-ți deschizi contul la eToro, ceea ce înseamnă că va trebui să descarci aplicația mobilă pentru a începe. De asemenea, poți opta pentru deschiderea unui cont de investiții și folosirea browserului tău online.

Odată ce ai reușit să accesezi brokerul dorit, acesta îți va ghida pașii prin instrucțiuni ușoare și intuitive. Pentru a-ți crea contul, vei fi solicitat să distribui informații cu caracter personal. Nu te îngrijora – acest pas este necesar în momentul deschiderii oricărui tip de cont personal, pentru a securiza datele tale și a le asocia cu contul tău.

Pe eToro, poți face o depunere de până la $2.000 fără a încărca ID-ul. Dacă dorești să depui mai mult, va trebui să-ți verifici contul, deoarece eToro este reglementat de Autoritatea pentru Conduită Financiară.

Trebuie, pur și simplu, să încarci o copie a pașaportului și o dovadă a adresei tale. Aceasta poate fi fie un extras de cont bancar recent, fie o factură de utilități. eToro va valida documentele în câteva minute.

După îndeplinirea acestor etape, contul tău va deveni activ. Acesta este momentul în care poți alimenta soldul tău cu suma minimă de depozit. În cazul eToro, aceasta este de $100.

3. Descoperă instrumentele tale de interes și cumpără acțiuni cu un clic

Suma minimă de depozit la eToro va trebui să fie de $100. Metodele de plată acceptate includ:

- Carduri de debit/credit

- Transfer bancar

- Portofele electronice precum PayPal, Neteller și Skrill.

Odată alimentat, contul tău este gata de a începe orice proces de tranzacționare. Din acel moment, poți cumpăra acțiuni, vinde acțiuni, dar și tranzacționa instrumente mai complexe (CFD-uri) ori încerca efectul de levier.

Navighează în aplicația brokerului tău pentru a descoperi piețele și acțiunile oferite de acesta. Odată ce ai găsit ceea ce cauți, poți analiza diferite date importante despre respectiva acțiune în aplicație. Această analiză este extrem de importantă înaintea plasării oricărei comenzi, pentru a te asigura că investești într-un instrument potrivit.

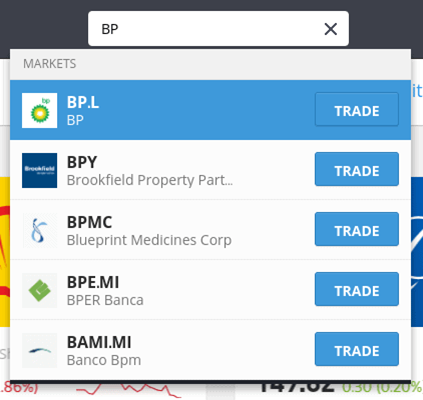

- Să presupunem că dorești să cumperi acțiuni la BP (‘British Petroleum’).

- Ca atare, introducem ‘BP’ în caseta de căutare din partea de sus a ecranului și apoi facem clic pe ‘TRADE’.

- Dacă încă nu ai decis ce acțiuni dorești să cumperi, fă clic pe butonul ‘TRADE MARKETS’ și parcurge biblioteca de acțiuni eToro.

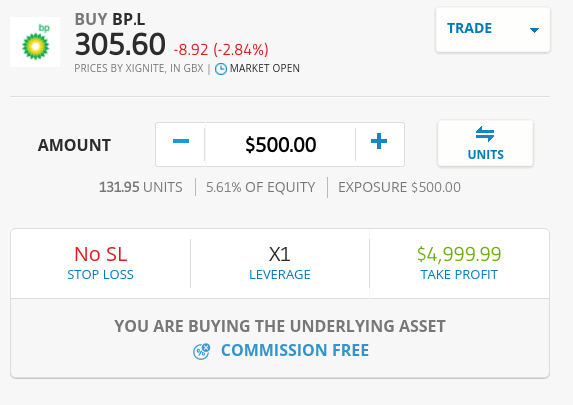

- Pentru a finaliza procesul de investiții, trebuie pur și simplu să facem clic pe ‘OPEN TRADE’.

În câteva secunde, comanda noastră va fi executată – ceea ce înseamnă că tocmai am cumpărat acțiuni BP fără comision.

Înainte de a putea cumpăra acțiuni în compania aleasă de noi, trebuie să stabilim o „comandă de cumpărare”. Prețul curent al unei acțiuni se va schimba aproape la secundă.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Ce acțiuni poți cumpăra în România?

Există zeci de mii de companii listate la bursă. În esență, piețele specifice la care vei avea acces vor depinde de brokerul la care te înscrii. De exemplu, între eToro și XTB, vei putea cumpăra, vinde și tranzacționa peste 10.000 de companii diferite.

Aici sunt incluse firmele listate pe:

- NASDAQ (SUA)

- Bursa de Valori din Londra (UK)

- Piața de Investiții Alternative (UK)

- Bursa de Valori din New York (SUA)

- Bursa de Valori din Tokyo (Japonia)

- Bursa de valori din Hong Kong (Hong Kong)

- Și multe, multe altele!

Cel mai bine este să alegi un broker de acțiuni care să acopere atât piețele românești, cât și piețele internaționale, pentru a-ți diversifica riscul. eToro, de exemplu, îți oferă acțiuni din 17 piețe diferite.

De unde să cumperi acțiuni – cele mai bune platforme de tranzacționare de acțiuni din Romania în 2025

Mai jos vei găsi o selecție a principalilor brokeri de tranzacționare a acțiunilor din Romania care îndeplinesc o serie de cerințe importante pentru tranzactionarea de instrumente financiare. Printre acestea se regasesc si licența din partea Autorității de Conduită Financiară, suport pentru carduri de debit/carduri de credit și conturi bancare din Romania și posibilitatea de a cumpăra și vinde acțiuni la companii naționale și internaționale.

[stocks_table id=”18″]

1 . eToro – Cel mai bun broker de acțiuni din Romania (0% comision și fără taxă de timbru)

eToro a obținut poziția în topul celor mai buni brokeri de acțiuni datorită inovației în Copy Trading, diversității acțiunilor oferite (peste 3000), a politicii de zero comisioane pentru acțiuni, precum și datorită experienței utilizator și reputației solide în industrie.

Din punct de vedere al siguranței, eToro este un broker reglementat de FCA. De asemenea, este licențiat în Australia (ASIC) și Cipru (CySEC). Cu un depozit minim în valoare de $100, deschiderea unui cont este foarte rapidă și ușoară.

La eToro, poți investi și în acțiuni ‘blue-chip’ britanice, cum ar fi Tesco, BT și Rolls Royce, precum și în acțiuni tehnologice populare, precum Amazon, Apple și Tesla.

Politica de zero comisioane este revoluționară pe scena investițiilor din Romania. Brokeri precum Capital percep peste $11,95 pe tranzacție. În schimb, eToro va percepe doar o taxă de conversie valutară de 0.5% pe depozit.

Dacă tranzactionezi CFD-uri pe acțiuni – unde este disponibil un levier de până la 1:5 – atunci va trebui să platesti o mică taxă (spread). Află mai multe despre diferența dintre cumpărarea unei acțiuni și tranzacționarea CFD-urilor aici.

Platforma permite depunerea de fonduri cu:

- Un cont bancar

- Un portofel electronic

- Un card de debit/credit din România

Odată ce depozitul a fost procesat, va fi convertit în dolari SUA, iar o taxă de 0,5% va fi aplicată. Platforma acceptă investiții de până la $40.000 pe tranzacție cu cardul, și fără limită în cazul transferurilor bancare.

Un alt avantaj al eToro este funcționalitatea sa în materie de copy trading, ceea ce îți oferă șansa de a copia investitori de acțiuni de succes. Această caracteristică presupune taxe suplimentare.

Menţiune obligatorie: eToro nu calculează niciun impozit pe care ai putea fi obligat să îl plătești, cum ar fi impozitul pe câștigurile de capital.

Pro:

- Marcă reglementată și de încredere de către FCA.

- Fără comisioane sau taxe de tranzacționare.

- Abilitatea de a copia tranzacțiile altor utilizatori.

- Peste 3.000 de acțiuni listate pe 17 piețe internaționale.

- Cont eToro personalizat, unde poți configura alerte de preț.

- Depunerea de fonduri cu un card de debit/credit, portofel electronic sau cont bancar din România.

Contra:

- 0,5% comision de conversie

- Spread-uri ridicate pe valută (forex)

- Nu este potrivit pentru traderii avansați care au nevoie să efectueze analize tehnice

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

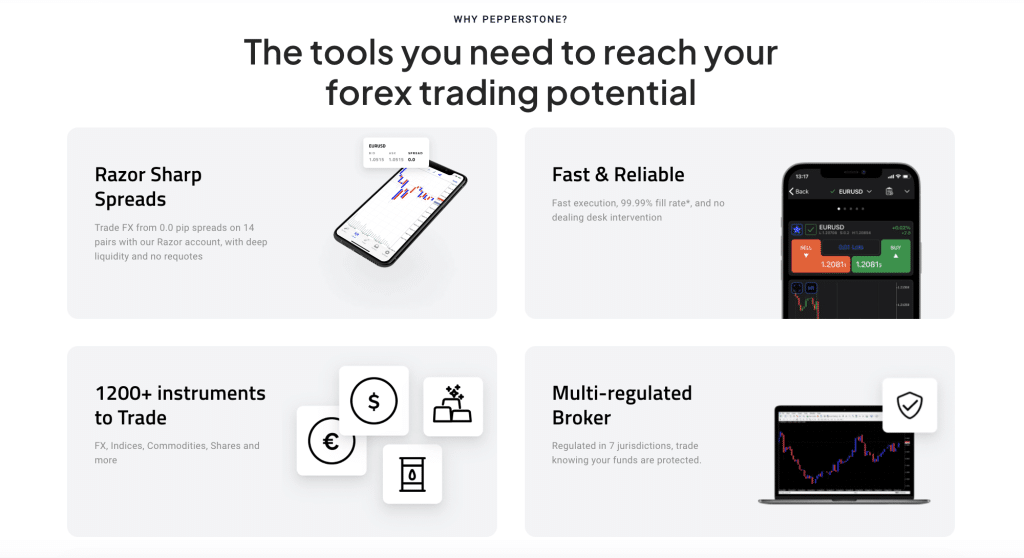

2. Pepperstone - O Platformă Eficientă pentru Tranzacționare a Acțiunilor si ETF-urilor

Pepperstone, alegerea a peste 400,000 de traderi globali, se distinge prin varietatea platformelor sale de tranzacționare, inclusiv TradingView, MetaTrader 4, MetaTrader 5 și cTrader. Cu o experiență de peste 10 ani pe piață, Pepperstone este reglementată și oferă acces la Capitalise.ai, consolidându-și reputația în rândul traderilor.

Fiind reglementată riguros, platforma asigură securitatea capitalului investitorilor. Cu toate acestea, este esențial să explorezi detaliile comisioanelor și să te informezi cu privire la opțiunile oferite pentru a lua decizii informate.

Pepperstone simplifică accesul la ETF-uri care reflectă evoluția piețelor de acțiuni în 35 de țări și pe 6 continente, acoperind o gamă diversificată de teme, precum Asia Pacific, sectorul bancar, energie și tehnologie. Astfel, investitorii pot construi cu ușurință un portofoliu adaptat propriilor viziuni și obiective de investiții.

În ceea ce privește comisioanele, Pepperstone oferă transparență totală. Cu tranzacționarea la prețuri de schimb directe, fără adaosuri la spread-ul de cumpărare/vânzare, investitorii evită surprizele neplăcute. Comisionul mic de $0.02 (USD) per acțiune, per tranzacție face investițiile în ETF-uri cu Pepperstone o opțiune rentabilă.

Pro:

- Comisioane reduse și competitive.

- Diversitatea instrumentelor financiare - peste 1200 de active disponibile pentru tranzacționare.

- Reglementată - asigură siguranța capitalului și integritatea tranzacțiilor.

- Platforme de tranzacționare de top, inclusiv TradingView, MetaTrader 4, MetaTrader 5 și cTrader.

- Experiență de peste 10 ani pe piață, cu o reputație solidă în rândul traderilor.

Contra:

- Lipsa autentificării cu doi factori (2FA).

- Serviciul de asistență funcționează doar în intervalul 24/5.

- Absența unei secțiuni dedicate de știri pe platformă.

Capitalul dvs. este supus riscului

3. XTB - unul dintre cei mai buni brokeri cu acces la peste 2000 de acțiuni

Dacă ești în căutarea unui broker care să iti ofere o gamă cât mai diversă de acțiuni, XTB este o opțiune demnă de considerat. XTB oferă acces la peste 3200 de acțiuni din peste 16 burse internaționale.

Printre acestea sunt incluse piețe importante, precum cele din:

- SUA

- Italia

- Belgia

- Suedia

- Norvegia

- Germania

- Portugalia

- Marea Britanie

De asemenea, XTB oferă acces la 300 de ETF-uri, peste 40 de criptomonede și peste 20 de mărfuri. Pentru a utiliza XTB nu este necesar un depozit minim, iar investitorii au posibilitatea să transfere fonduri prin virament bancar sau card. La fel, XTB nu percepe nicio taxă de depunere pentru transferuri bancare și carduri.

Pentru cei aflați la început de drum, XTB oferă una dintre cele mai bune aplicații de investiții, fiind o platformă de tranzacționare autorizată și reglementată de FCA.

Pro:

- Comisioane competitive: XTB oferă tranzacționare fără comisioane pentru acțiuni și ETF-uri până la €100k pe lună.

- Dobândă pe fondurile neinvestite: Utilizatorii pot obține până la 5% dobândă pe fondurile neinvestite.

- Resurse educaționale: XTB oferă webinarii zilnice și știri din piață actualizate.

- Diversitate mare de instrumente: XTB oferă acces la acțiuni și ETF-uri cu deținere, CFD-uri cu suport pe Forex, indici, mărfuri, cripto, acțiuni și ETF-uri

Contra:

- Comisioane la depunerea cu cardul

- Taxă de inactivitate de 10 EUR

- Nu dispune de autentificare în doi pași

4. Admiral Markets - platforma unde poți accesa diverse opțiuni de tranzacționare

Admiral Markets oferă soluții avansate de tranzacționare, fiind o platformă renumită cu peste 20 de ani de experiență în domeniu. Admirals oferă acces la diverse opțiuni de tranzacționare și de investiții, inclusiv instrumente financiare complexe:

- Acțiuni

- ETF-uri

- Mărfuri

- Obligațiuni

- Criptomonede

- Perechi valutare

- CFD-uri pe indici

Cu Admiral Markets poți tranzacționa acțiunile în fracțiuni, permitându-ți accesul la acțiuni de top la un cost mai accesibil. Asemenea celorlalte platforme de tranzacționare, Admiral îți oferă resurse educaționale pentru analiză. Prin intermediul webinariilor, articolelor, cursurilor de tranzacționare și a ghidurilor video, poți învăța cu ușurință despre tranzacționarea pe termen scurt, dar și despre investițiile pe termen lung.

Pe lângă educație, Admiral furnizează și caracteristici analitice specializate. Acestea constau în:

- Un program de evenimente forex

- Un podcast săptămânal despre tranzacționare

- Actualizări referitoare la evoluția piețelor globale

- O secțiune dedicată știrilor din lumea tranzacțiilor

- Evaluări fundamentale ale factorilor micro/macro-economici

- O hartă a pieței și diagrame de percepere a sentimentului pieței pentru semnale bull/bear.

În plus, comercianții pot beneficia de un set de instrumente inteligente și personalizate care garantează o experiență de tranzacționare excepțională. Aceștia mai au posibilitatea să acceseze celebrele platforme MetaTrader 5 și MetaTrader 4, cunoscute și utilizate pe scară largă de comercianți și investitori la nivel global pentru administrarea portofoliilor lor.

Pro:

- Experiență solidă

- Diversificare extinsă

- Instrumente de analiză avansate

- Acces la MetaTrader: Posibilitatea de a utiliza platforme consacrate, MetaTrader 5 și MetaTrader 4, pentru administrarea portofoliilor.

Contra:

- Schema de comisioane complexă

- Interfață complexă: Pentru începători, interfața avansată poate părea complicată.

5. Libertex – Platformă de tranzacţionare Low-Cost cu Diferenţe ZERO dintre preţurile de vânzare şi cele de cumpărare

Libertex este o platformă de CFD trading, populară în rândul acelor traderi din România care ţintesc comisioane şi taxe reduse. Libertex oferǎ CFD-uri în acţiuni de bursǎ, comoditǎţi şi valutǎ.

În prim-plan se regăseşte oferta platformei de zero spread. Aceasta înseamnă că, indiferent de natura activelor pe care optezi să le tranzacţionezi, nu existǎ niciun decalaj dintre preţul de vânzare şi cel de cumpărare.

Prin urmare, platforma de referinţă permite să beneficiezi de cotaţii de top din sfera pieţei bursiere. Adiţional, chiar dacǎ Libertex încaseazǎ un comision de la ambele pǎrţi implicate în tranzacţionare, acesta este, de multe ori, foarte redus. De fapt, comisioanele se situează în procentaje între 0.1% - 0.2% pe comandǎ.

Tranzacţiile cad sub incidenţa limitelor FCA, ceea ce înseamnă cǎ vei fi restrâns la 1:30 în privinţa perechilor de tranzacţionare forex majore şi la mai puţin, în cazul altor instrumente.

Libertex oferǎ douǎ platforme de tranzacţionare: Meta Trader 4 şi propria platformă, care a fost construită de ei.

Cu Libertex, poţi deschide un cont în câteva minute. Depozitul minim este de doar $10 şi poţi folosi:

- Un card de debit/credit din România

- Transfer bancar

- Un portofel electronic

- Voucher (PaySafe card)

Din momentul finanţării soldului, toate depozitele viitoare vor începe de la $10.

Libertex nu este reglementat de FCA. În schimb, este reglementat de principalii emitenţi de licenţǎ din UE, CySEC. În plus, Libertex a oferit tranzacţionǎri online şi servicii financiare încǎ din anul 1997.

Pro:

- Compatibil cu MT4

- Broker cu o reputaţie bunǎ

- Resurse educaţionale de calitate

- Spread zero la tranzacţionǎri CFD

- Comisioane foarte competitive – începând de la 0%

- O mare diversitate de pieţe şi instrumente financiare

Contra:

- Exclusiv trading CFD

- Nu este reglementat de FCA

Noțiuni de bază despre cumpărarea de acțiuni în România

Ca investitor într-o companie, odată ce ai cumpărat acțiuni la o firma, aceasta are obligaţia de a-ți trimite un certificat de acțiuni în termen de două luni. Astfel, vei deveni un acționar certificat.

Datorită modului în care funcționează astăzi tranzacționarea acțiunilor din România, poți cumpăra mii de acțiuni globale cu un clic de buton. Deci, cum să cumperi acțiuni la bursă? Simplu! Ai nevoie doar de un cont de broker online de încredere.

În contextul actual, taxele și comisioanele nu au fost niciodată atât de competitive. După cum am menționat, astăzi există platforme de tranzacționare de acțiuni românești care permit cumpărarea de acțiuni fără a plăti niciun fel de taxe de tranzacționare.

Cu toate acestea, trebuie să te documentezi cu privire la orice reguli de impozitare și beneficii fiscale. Astfel, vei putea evita greșeli costisitoare.

Ce sunt Acțiunile?

Atunci când o companie decide să devină "publică", înseamnă că va fi listată la bursă. Acest lucru permite investitorilor obișnuiți să cumpere "acțiuni" la firmă. După cum sugerează și numele, vei deține o "parte" a companiei în care investești - proporțional cu numărul de acțiuni pe care le deții.

Valoarea acțiunilor este determinată de forțele de pe piață. Cu alte cuvinte, dacă există mai mulți cumpărători decât vânzători, prețul acțiunii va crește. Dacă există mai mulți vânzători decât cumpărători, valoarea acțiunilor va scădea.

Investițiile pe termen scurt, mediu și lung în acțiuni și ETF-uri devin tot mai populare în România, având 159.513 investitori activi. Acest fapt se datorează randamentelor pozitive obținute din această activitate lucrativă și a creșterii nivelului de educație financiară a populației.

Vânzarea de acțiuni

Poți vinde acțiuni în orice moment în timpul orelor de piață standard. Suma pe care o primești înapoi în numerar se va baza pe numărul de acțiuni pe care le deții în raport cu prețul actual al acțiunii companiei.

Spre exemplu, dacă deții 10 acțiuni la firma Apple în valoare de $185 la momentul vânzării, vei obține suma de $1850 în urma vânzării acțiunilor.

Câți bani poți câștiga din investițiile în acțiuni?

Fiecare investiție este diferită, așa că, pentru a calcula veniturile din tranzacționarea de acțiuni, te încurajăm să folosești calculatorul nostru de investiții. Așa cum rezultă din istoricul lor, acțiunile și ETF-urile tind să producă un randament anual de aproximatinb 10%.

[su_table responsive="yes"]

| Anul | Suma inițială | Dobânda obținută | Dobânda totală încasată | Balanța de închidere |

| 2021 | 5.000 RON | 300 RON | 300 RON | 5.300 RON |

| 2022 | 5.000 RON | 318 RON | 618 RON | 5.618 RON |

| 2023 | 5.000 RON | 337 RON | 955 RON | 5.955 RON |

| 2024 | 5.000 RON | 357 RON | 1.312 RON | 6.312 RON |

| 2025 | 5.000 RON | 378 RON | 1.690 RON | 6.690 RON |

| 2026 | 5.000 RON | 401 RON | 2.091 RON | 7.091 RON |

[/su_table]

Cum să câștigi bani din acțiuni:

Câștigarea banilor din tranzacționarea de acțiuni se poate realiza în trei moduri: câștiguri de capital, dividende și strategia de creștere anuală compusă.

1 - Câștigurile de capital

Atunci când o persoană cumpără acțiuni, aceasta speră că, prin vânzarea la ordinul de piață și concretizarea profitului, va obține câștiguri de capital.

De exemplu:

- Să presupunem că achiziționezi 1.000 de acțiuni în BP la 350¢ per acțiune.

- Investiția totală se ridică la $3.500.

- Cinci ani mai târziu, acțiunile BP sunt cotate la 450¢ per acțiune.

- În acel moment, decizi să vinzi acțiunile.

- Ai realizat 100¢ per acțiune (450¢-350¢).

- La 1.000 de acțiuni, acest lucru reprezintă un profit de $1.000.

Acest profit de $1.000 reprezintă ceea ce este cunoscut sub denumirea de câștiguri de capital. Cota de impozitare specifică va varia în funcție de circumstanțele personale.

2 - Dividende

Ai posibilitatea să câștigi bani din acțiuni și sub formă de dividende. În formele lor de bază, dividendele permit companiilor mari să-și împartă profiturile cu acționarii.

Dacă și când o vor face, vei avea dreptul la partea ta din încasări. Venitul specific din dividende pe care îl obții va varia în funcție de gradul de performanță a companiei. Nu toate acțiunile plătesc dividende, dar dacă o fac, acestea sunt distribuite, de obicei, la fiecare 3 sau 6 luni.

Iată cum funcționează dividendele:

- Să presupunem că deții 500 de acțiuni în HSBC.

- Firma plătește dividende la fiecare trei luni.

- De data aceasta, HSBC anunță un randament din dividende de 7%.

- Aceasta se ridică la $0,28 pe acțiune.

- Deții 500 de acțiuni, deci vei primi un total de $140 ($0,28 x 500 acțiuni).

3 - Creșterea compusă

Mulți investitori caută să reinvestească câștigurile unui activ pentru a genera mai multe câștiguri în timp. Acest lucru este cunoscut sub denumirea de creștere compusă. Deținând o acțiune pentru o lungă perioadă de timp și reinvestind constant câștigurile de capital, poți beneficia de efectul de compunere.

Să aruncăm o privire la un exemplu concret de funcționare a creșterii compuse:

- Investești $100 pe lună într-un activ cu o rentabilitate anuală de 6%.

- Dacă menții investiția constantă timp de 10 ani, vei fi investit $13.200 și vei avea $18.915.

- Dacă ai făcut acest lucru timp de 20 de ani, vei fi investit $25.200 și vei avea $50.640.

- Dacă ai făcut acest lucru timp de 40 de ani, vei fi investit $49.200 și vei avea $209.201.

Astfel, în fiecare an câștigi mai multe dobânzi atât pentru investiția inițială, cât și pentru câștigurile tale compuse.

Creșterea compusă necesită răbdare, deoarece câștigurile inițiale sunt mici, dar, pe termen lung, ea poate fi extrem de profitabilă. Desigur, trebuie să ții cont de fluctuațiile acțiunilor, inflație și comisioane.

Taxe și Comisioane

Există o serie de comisioane și taxe de luat în considerare atunci când cauți un broker de acțiuni, inclusiv comisioane de tranzacționare, comisioane anuale de cont și comisioane de retragere.

Vestea bună este că unele platforme de tranzacționare a acțiunilor din România permit cumpărarea de acțiuni fără a plăti nicio taxă de tranzacționare sau taxe anuale. În schimb, ele își câștigă banii din 'spread' sau o taxă de conversie unică atunci când efectuezi prima depunere (eToro, de exemplu, percepe 0,5%).

Ce trebuie să iei în considerare înainte de a cumpăra acțiuni într-o companie

Deși istoricul piețelor bursiere a indicat performanţe bune – acesta nu este cazul tuturor companiilor. Dimpotrivă, multe firme - atât din România, cât și din străinătate valorează acum doar o fracțiune din maximele lor anterioare.

Astfel, este important să minimizezi riscurile atunci când investești în acțiuni, urmând sugestiile următoare:

Diversifica investitiile

Diversificarea este cea mai importantă strategie de minimizare a riscului. Un portofoliu bine diversificat te poziționează ca deținător al zecilor, sau chiar sutelor, de acțiuni diferite. Investind în firme din mai multe sectoare, nu devii supraexpus la o singură nișă, care ar putea să nu dea randamente pozitive.

De exemplu, să presupunem că ai $5.000 de investit în piețele de valori.

- Un investitor fără experiență ar putea folosi întreaga sumă de $5.000 pentru a investi într-o singură companie.

- Un investitor versat ar cumpăra, probabil, acțiuni în 100 de companii diferite la $50 fiecare. Aceasta ar acoperi, de asemenea, mai multe sectoare.

A-ți diversifica portofoliul nu presupune neapărat să cumperi acțiuni la zeci sau sute de companii. Investind în ETF-uri precum S&P500, poți deține acțiuni la diferite companii printr-o simplă investiție într-un singur instrument care se tranzacționează ca și o acțiune.

Începe investitia la bursa cu mize mici

Cum să cumperi acţiuni la bursă fara a risca toate economiile tale înainte să fii pregătit de investiții complexe? Începe cu mize mici!

Dacă nu ai investit niciodată în acțiuni, este recomandat ca primele investiții în acțiuni la bursă să fie sume mai mici. Ar fi indicat să începi chiar și cu un cont demo, pentru a învăța cum să analizezi piața și să tranzacționezi instrumente fără a risca o sumă de bani reală.

eToro permite o investiție minimă în acțiuni de $50. Începând cu sume mici, vei putea învăța cum să investești în acțiuni fără să investești mai mult decât îți poți permite.

Învăţa cum să te documentezi

Analiza acțiunilor nu este deloc complicată, precum analiza tehnică sau citirea graficelor. Trebuie doar să te asiguri că ești la curent cu orice evoluție de pe piață care ar putea afecta valoarea investiției tale.

- De exemplu, să presupunem că ai investit $3.000 în Amazon.

- Dacă Amazon anunță că intenționează să reducă sute de locuri de muncă, acest lucru ar duce probabil la o vânzare în masă de către acționari.

- Astfel, valoarea acțiunilor va scădea.

- Dacă ești la curent cu știrile din piață și vinzi acțiunile imediat ce acestea ies în presă, minimizarea pierderilor devine mult mai ușor de gestionat.

Pentru buletine informative, site-ul financiar Yahoo! Finance permite să monitorizezi constant companiile pe care le urmărești și să primești notificări în timp real atunci când apare o știre relevantă.

Analiza acțiunilor și a companiilor în care urmează să investești este esențială pentru a avea succes în investițiile pe termen lung. Astfel, trebuie să urmărești anumiți metrici constant și să fii la curent cu schimbările ce survin în urma rapoartelor trimestriale pe care le întocmește fiecare companie.

Câțiva dintre metricii pe care îi vei întâlni vor fi raportul preț-câștig (P/E), raportul datorie-capital propriu, dar și alte metode fundamentale de analiză utilizate de investitori.

Ia în considerare un portofoliu copy trading

Dacă ești un investitor la început de drum sau ai cunoștințe limitate în domeniu, trebuie să iei în calcul avantajele unui portofoliu de copy trading. Platformele pentru începători precum eToro îți permit să copiezi tranzacțiile investitorilor cu experiență pentru a beneficia de randamentele lor.

Acest lucru nu include doar portofoliul lor curent, ci fiecare investiție aferentă. De asemenea, poți examina acreditările trader-ului înainte de a investi. Copy trading îți permite să investești în acțiuni fără să depui niciun efort, aspect foarte apreciat în rândul investitorilor începători sau a persoanelor care nu au timp să își facă analiza proprie a acțiunilor.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Cum să selectezi un broker de bursă din România

Câțiva dintre cei mai importanți factori pe care trebuie să îi urmărești sunt:

Aderarea la Regulamentul Autorității de Conduită Financiară

Primul și cel mai important indicator pe care trebuie să-l iei în calcul înainte de a alege un broker de acțiuni din România este dacă acesta beneficiază sau nu de reglementare din partea Autorităţii de Conduită Financiară (FCA). Acest lucru garanteaza că poți cumpăra, vinde și tranzacționa acțiuni într-un mod sigur și fiabil.

Iata cum functioneaza rerglementarea FCA:

- Toți brokerii FCA sunt obligați să parcurgă un proces de înscriere exhaustiv înainte de a accepta legal traderii din Romania.

- Platforma va trebui să aibă evidenţele contabile auditate trimestrial de către FCA.

- Toate fondurile clienților trebuie să fie ținute în conturi bancare segregate. Aceasta este o garanție crucială, deoarece înseamnă că brokerul nu poate folosi fondurile investitorilor pentru a-și acoperi propriul capital de lucru.

- Conturile bancare segregate înseamnă, de asemenea, că, în cazul când brokerul ar avea probleme financiare, banii tai ar fi securizaţi.

Metode de plată valabile

Odată ce ai evaluat statutul reglementar al brokerului, trebuie să explorezi ce metode de plată acceptă acesta. În marea majoritate a cazurilor, platformele de tranzacționare a acțiunilor din România vor accepta un card de debit/card de credit și transfer bancar. Acesta din urmă este mai potrivit pentru depozite mai mari de $10.000.

Brokeri precum eToro acceptă și portofele electronice: Skrill, Neteller și, cel mai convenabil, Paypal.

Care sunt avantajele și dezavantajele investiției în acțiuni?

Pro:

- După cum reiese din istoricul lor, acțiunile produc randamente anuale de 5-8%.

- Lichiditate ridicată - nu vei aștepta zile întregi pentru a cumpăra sau vinde o acțiune a companiei.

- Poți câștiga venituri pasive sub formă de dividende.

- Poți minimiza riscurile prin crearea unui portofoliu diversificat de acțiuni.

- Unii brokeri online permit cumpărarea acțiunilor fără comisioane.

- Poți cumpăra acțiuni cu ușurință cu un card de debit/credit, un portofel electronic sau un virament bancar.

Contra:

- Ai putea să-ți pierzi banii în investiții nefavorabile.

- Nu există nicio garanție că acțiunile vor crește în valoare.

- Analiza acțiunilor și a altor active este un proces mai complex și de lungă durată.

Concluzie: Cumpararea de actiuni nu este deloc complicata

Procesul de cumpărare de acțiuni în România s-a schimbat considerabil în ultimul deceniu. De la convorbirea telefonică cu brokerul de acțiuni și până la plasarea comenzii de cumpărare cu un singur click, a fost o cale lungă.

Astăzi, trebuie doar să alegi o platformă online reglementată de tranzacționare a acțiunilor și să depui niște fonduri, iar apoi să alegi ce acțiuni dorești să cumperi. În câteva minute, banii tăi s-ar putea transforma în acțiuni valoroase care dau randament în fiecare secundă.

Dacă ești pregătit să investești în primele tale acțiuni și să încasezi venituri pasive, îți recomandăm să încerci eToro. Acest broker este reglementat de FCA, are comision de tranzacționare zero, oferă un cont demo gratuit și prezintă opțiunea de copy-trading pentru investitori începători.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Întrebări frecvente

Ce acțiuni ar trebui să cumpăr în 2025?

Poți cumpăra acțiuni fără un broker?

Poți cumpăra acțiuni cu doar 100 de dolari?

Care este cel mai bun broker pentru a cumpăra acțiuni în România?

Referințe:

- Top 5 acțiuni pe care să le deții în 2023

- Principii de funcționare ale ASF

- Cum să cumperi acțiuni în România prin intremediul XTB

- Cum să alegi cel mai bun broker de acțiuni în 2023

- Statistici privind investițiile în acțiuni în România

- Care sunt taxele și comisioanele percepute de eToro?

- Libertex Payment Methods