Cum să Cumpăr Acțiuni Virgin Galactic în România

If you want to invest in the leader in space tourism, then you should look at Virgin Galactic. The company is backed by British billionaire and tycoon Richard Branson , and in this review, we will discuss how to buy Virgin Galactic shares.

Apart from this, we will also discuss what exactly Virgin Galactic is, whether it is worth investing in the company, and much more!

How to buy Virgin Galactic shares – Quick steps

Want to buy Virgin Galactic shares? First, you’ll need to find a stock broker . For this guide, we recommend Etoro , one of the most highly rated and popular trading platforms . Check out these 4 easy steps below to get started buying Virgin Galactic shares.

- Create an account at eToro : Go to the eToro website and create an account.

- Upload a valid ID : You will need to verify your account with one or more valid ID documents, such as a driver’s license and passport.

- Make an initial deposit : Before you can start trading, you will need to fund your account via a credit or debit card (Visa/Mastercard etc.), a transfer through your bank account or any of the available e-wallets.

- Buy Virgin Galactic shares : Search for the symbol “SPCE” and you should be able to see the Virgin Galactic profile and start buying or selling shares.

[stocks_table id=”18″]

Step 1 – Choose a broker to buy Virgin Galactic shares

1. eToro: Overall the best trading platform

Trade on the web platform or through their mobile app. If you are new to trading, you have access to several educational resources as well as their top feature, copy trading. Copy trading at eToro allows you to invest and take the same trading positions as popular traders and investors.

Choose the investor you want to copy or choose from a number of specific traders to copy. If that’s not enough, you also have access to a demo account that offers 100 thousand euros of virtual capital. Easily learn new trading techniques and test your strategies with this feature.

eToro fees and commissions:

| Tax | Value |

| Share trading commission | |

| Currency trading commission | Spread, 2.1 pips for GBP/USD |

| Cryptocurrency trading commission | Spread, 0.75% for Bitcoin |

| Inactivity fee | 10 EUR per month after one year |

| Withdrawal fee | 5 EUR |

Pro

Cons

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. OKX, the second most used crypto exchange

Currently, OKX has over 20 million users from over 100 countries and offers the possibility of trading over 400 cryptocurrencies. These include both cryptocurrencies with an already well-established reputation on the market, such as Bitcoin or Ethereum, as well as new projects, such as Tamadoge.

OKX also offers both a centralized exchange (CEX) and a decentralized exchange (DEX) to meet the needs of different investors. A centralized exchange can be understood by comparing it to traditional banks. Thus, traders opt for such an exchange to keep their assets and funds safe.

On the other hand, traders who opt for a decentralized exchange have full control over the assets they hold, without the need for a third party.

Additionally, if you are a beginner, you have options where you can learn everything you need to know about crypto trading before you get down to business, along with a demo account that you can use to familiarize yourself with the platform and test your trading strategies.

Pro

Cons

Banii dvs. sunt în pericol.

3. Libertex: Cheap trading app with zero spreads

Those who already trade with different setups with MetaTrader 4 or MetaTrader 5 would be pleased to hear that Libertex has integrations with both. Trading stocks like Virgin Galactic shares can be made easier by the multiple tools and resources available on the site as a whole.

Libertex Commissions and Fees:

| Fee | Value |

| Share trading commission | 0.034% commission for Amazon. |

| Currency trading commission | Commission 0.008% for GBP/USD. |

| Cryptocurrency trading commission | 1.23% commission for Bitcoin. |

| Inactivity fee | €5 per month after 180 days |

| Withdrawal fee | Free |

Pro

Cons

85% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

4. Skilling: Online broker for beginners and advanced traders with low spreads

One of the easiest and best platforms to use for anyone, at any level of trading, is Skilling. The broker is probably the best at adapting to your level. For example, they have three different platforms, depending on the markets you want to trade and your level of experience.

New users looking to buy Virgin Galactic shares, for example, can use their Skilling Trader platform, which is easy to understand and suitable for traders of all levels. They also offer the more advanced Skilling cTrader, which is an advanced trading platform designed to meet the most stringent requirements of traders.

Skilling Fees and Charges:

| Fee | Value |

| Share trading commission | 0% commission on merchant account |

| Currency trading commission | Variable spreads starting at 0.7% |

| Cryptocurrency trading commission | Spread 0.20% for Bitcoin. |

| Inactivity fee | €10 per month after one year |

| Withdrawal fee | Free |

Pro

Cons

56% din conturile de investitori de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

5. AvaTrade: Best Futures Trading Platform

The online broker operates entities on an international scale and as such is licensed and regulated by several top-tier financial authorities. These include the Australian Securities and Investments Commission (ASIC), the South African Financial Sector Conduct Authority, and CySEC.

AvaTrade Commissions and Fees

| Fee | Value |

| CFD trading commission | Variable spread |

| Currency trading commission | Spread 0.9 pips for EUR/USD |

| Cryptocurrency trading commission | 0.25% commission (above market) for Bitcoin/USD |

| Inactivity fee | 50 EUR per semester after 3 months of inactivity |

| Withdrawal fee | Free |

Pro

Cons

71% din conturile CFD-uri cu amănuntul pierd bani cu acest furnizor.

How to buy Virgin Galactic shares – Broker comparison

| Trading platform | Stock trading fees | Currency trading fees | Overnight fees

|

| eToro | 1$ | Variable spread | Overnight fees for CFDs. No overnight fees for unleveraged stocks, ETFs and cryptocurrencies. |

| OKX | Variable spread | Variable spread | Yes. Leverage-based for stocks, crypto and thematic assets. Full position value-based for forex, commodities and indices. |

| Libertex | Commission 0%-0.46% | Commission | Yes. Taken at the end of each trading day at 21:00 GMT as interest, which can be positive or negative. For CFDs, the overnight fee is tripled when held from Friday to Monday. |

| Skilling | 0% commission | Variable spread starting from 0.7 pips | Yes. It applies to all instruments. |

| Avatrade | Variable spread | Spread 0.9 pips for EUR/USD | Yes. Charged for positions that remain open at 22:00 GMT. Applies to all instruments. |

Step 2 – Research Virgin Galactic shares

Like other growth companies, buying Virgin Galactic shares can be tricky due to the many different factors that investors need to consider when making a trade. Although often considered a riskier investment, growth stocks can, on the contrary, offer huge returns for those who invest well.

If we want to discuss how to buy Virgin Galactic shares, we must first do the necessary research and understand the current technical and fundamental analysis of the stock. We also need to have an idea of the Virgin Galactic stock price prediction to make a well-informed decision.

What is Virgin Galactic?

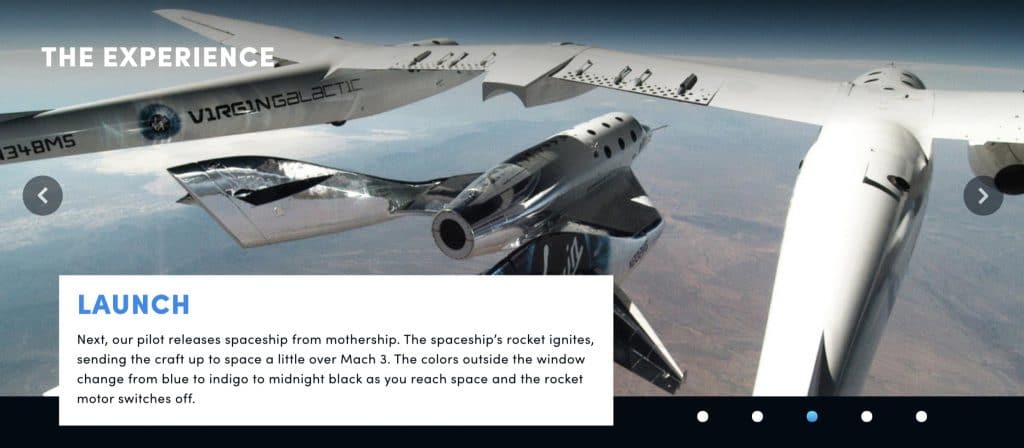

Founded in 2004 by then-Sir Richard Branson, Virgin Galactic is an American spaceflight company headquartered in California and operating out of New Mexico. The company is currently developing commercial spacecraft and aims to offer the next generation of space tourism, suborbital flights.

Despite many delays over the years, the first fully crewed suborbital spaceflight was completed in July 2021, with Branson aboard. This was a pivotal moment for the company, as the founder had fulfilled one of his dreams of going into space.

Those looking to buy Virgin Galactic shares might want to know why the company is pushing so hard for space travel and tourism. On their website, Branson states, “I truly hope that there will be millions of children around the world who will be captivated and inspired by the possibility of one day going into space.”

Virgin Galactic Stock Fundamentals

When we talk about Virgin Galactic shares, we also need to discuss the company’s fundamentals.

With a market cap of €4.3 billion, Virgin Galactic is considered a mid-cap company. This means that the company is already well-established in its industry as a large-cap company, but still has room to grow as a small-cap company.

The stock currently has a 58% float, with 255 million shares outstanding. This is at the lower end of the industry average. Short interest is high at around 17% as of November 15, 2021.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

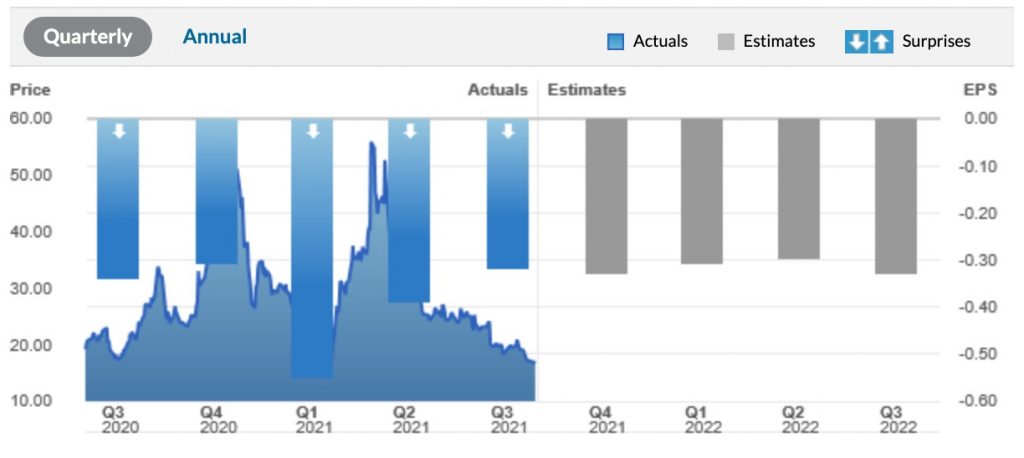

With data from the last three earnings reports of the year, Virgin Galactic shares have missed their earnings estimates by significant amounts each of the past three times. Those reports have sent the stock price to its lowest level of the year. In addition, news of flight delays and regulatory issues have continued to swirl around the company.

However, in a report last month, Virgin Galactic reopened ticket sales with prices starting at 450 thousand euros and so far, 700 people have already booked space flights before ticket sales closed.

Virgin Galactic stock dividends

Since its public offering in 2019, Virgin Galactic stock has yet to issue dividends to its shareholders. There are also currently no reports of a future dividend offering, so shareholders and investors will rely on the Virgin Galactic stock price prediction for their earnings.

Should I buy Virgin Galactic?

In technical analysis of Virgin Galactic shares, the company is at oversold levels based on the relative strength index (RSI). The highest level this year was around 62 euros and the lowest at 14 euros. Currently, Virgin Galactic closed at 16.73 euros, relatively close to its support in the 14-15 euros range.

In other respects, nothing much has changed at the company since it was 50 years old and is now around 10. Yes, Virgin Galactic’s stock has been the victim of several delays, but they have announced that they will use the first half of 2022 as a period of renovation and improvement. Although there will be no flights for a few months, a lot of planning, restructuring and development is bound to take place.

From a certain perspective, Virgin Galactic shares face similar problems to those of large-cap Tesla . When electric vehicles (EVs) were still a nascent product on the market, Tesla had to transition from an R&D company to a development and manufacturing company. They had proven the product and now needed a way to become scalable.

On that note, Virgin Galactic shares are in the midst of a transition from an R&D company to a full-scale manufacturing company as it prepares vehicles for more space flights.

With their two ships, VSS Imagine and VSS Unity, operating at full capacity by 2023, they could generate up to €130 million in revenue. In addition, there is news of a new spacecraft called the “Delta” model, which aims to have a shorter response time and eventually produce more flights per month.

Virgin Galactic’s share revenue is expected to reach €1.7 billion in 2023.

Is it worth investing in Virgin Galactic shares these days?

Given everything we’ve mentioned for Virgin Galactic shares, the short-term outlook for the company isn’t all that great, but the medium- and long-term outlook looks promising. Again, nothing has changed in the company from when the price went up to 50 to now, at 10.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

It’s also important to consider the industry that Virgin Galactic shares are part of. One report estimates that the global suborbital transportation and space tourism market will reach €2.58 billion in 2031.

Those looking for medium to long term stocks to invest in should definitely consider whether Virgin Galactic is worth investing in and whether they should buy Virgin Galactic shares. Any trader looking at the daily chart can tell that users are buying at a discount and that there is also the potential to go short with such high short interest.

Virgin Galactic stock price prediction

Without any big news for Virgin Galactic stock or the industry it is in, it is possible to say that the stock could trend sideways as it approaches support. There could be many interpretations for a Virgin Galactic stock price prediction, but one could say that as growth sectors rise after this year’s decline, we could see an improvement in Virgin Galactic stock price.

Again, being a mid-cap company, Virgin Galactic shares can make huge moves when conditions are right, as they did in February and July. Investors and traders are familiar with the common adage “buy the rumor, sell the news,” and those who bought Virgin Galactic shares in the short term using this method may have been successful.

Ultimately, Virgin Galactic’s stock price prediction asks investors to identify how undervalued the stock might be and see how well it fares in the coming months, especially in the so-called “upgrade” phase. Progress for the company seems pretty unclear in this phase, but beyond that, there appears to be plenty of upside potential.

Step 3: Open an account and invest with eToro

In this final section, we’ll show you a step-by-step guide on how to buy Virgin Galactic shares through eToro. Follow along below to open an account and start investing in stocks and other financial instruments with eToro.

1. Create your account

Go to the eToro website and click the “Sign Up Now” button. You should be able to create an account using your email address or a Facebook or Google account. Fill in the required details.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

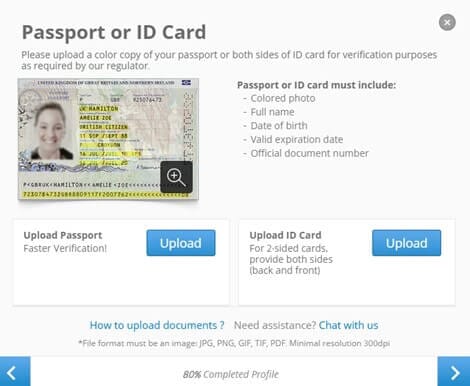

2. Verify your identity

For this next step, you will need to verify your identity so that you can deposit and trade live. Upload a clear image of a valid ID, such as a passport or driver’s license, and continue to follow the instructions given to you by eToro. Once all the documents have been submitted, allow a few days for processing.

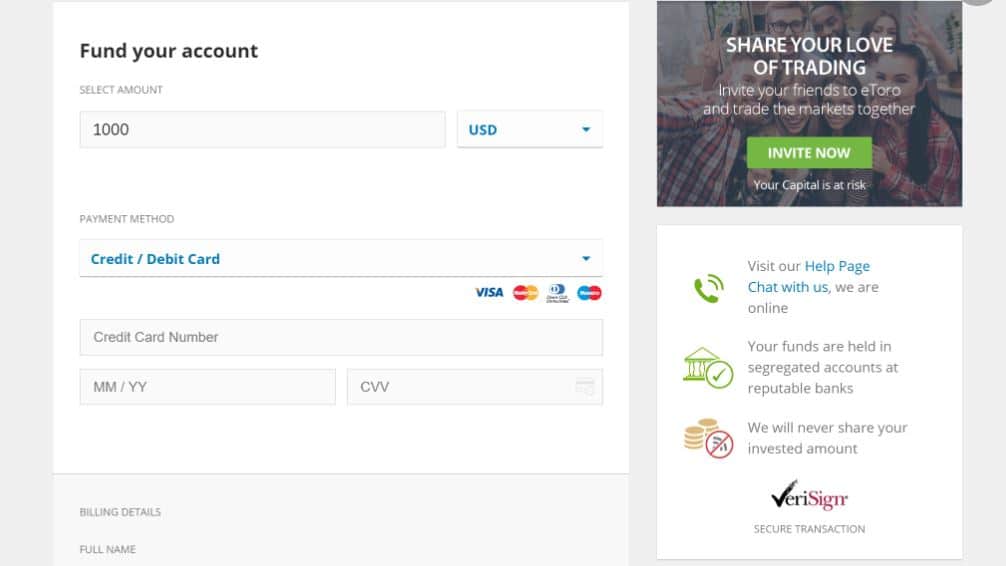

3. Deposit funds

Once eToro has fully verified your account, you can now deposit funds. Choose from a wide range of payment options and make sure you meet the minimum deposit rules. For many countries, this is 50 EUR. Also, keep in mind that although you can see your shares in EUR, eToro operates and trades in USD.

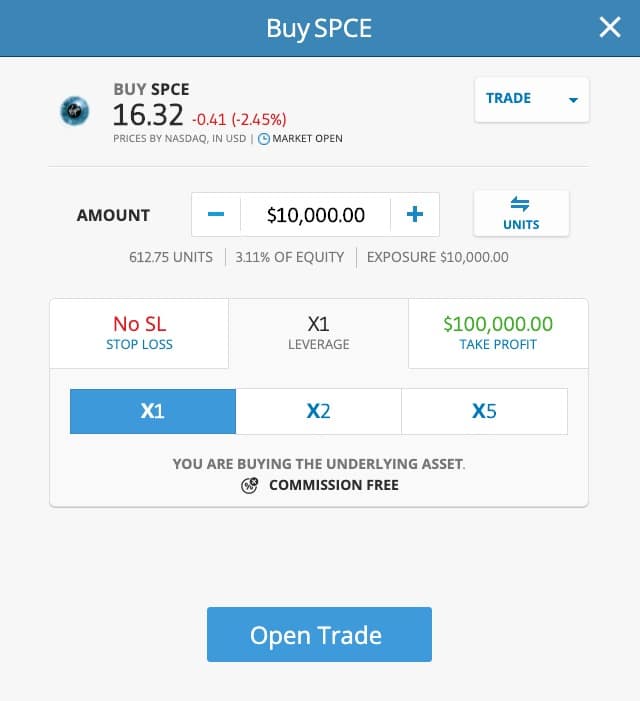

4. Buy Virgin Galactic shares!

Finally, you will buy Virgin Galactic! Go to the search bar and enter the ticker symbol “SPCE” and click the “Trade” button when it appears. In the order form, enter how many shares you want to buy.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

In this section, you can also set your stop losses and take profits. This allows you to close a trade when it reaches a certain price. Make sure you review and fully understand your trading strategy before attempting to use these features.

Conclusion

Whether you believe the company is undervalued and can improve in the long term, or the chart-based price is at a discount and has a lot of bullish pressure, buying Virgin Galactic shares seems reasonable depending on your strategy. However, we will also have to wait and see what new rumors emerge and concrete news we receive regarding the spaceflight company, as well as the entire space travel industry as a whole.

If you want to buy Virgin Galactic shares, invest and buy shares using the eToro platform. Click the link below to start trading!

eToro – The best trading platform for buying Virgin Galactic shares

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

What is Virgin Galactic?

Can I buy Virgin Galactic shares from abroad?

Are Virgin Galactic shares a call option?

Can I buy Virgin Galactic shares on eToro?

How do I invest in Virgin Galactic shares?