Cum să cumpărați acțiuni Tesla în 2026 din România

Tesla is no longer just a car company, it’s a brand that has become much more than that. The Palo Alto-based company not only makes electric cars, but is also an energy storage manufacturer that seeks to integrate renewable energy solutions for homes and businesses.

Tesla is also one of the most widely discussed companies in the world and, as such, its share price has become interesting to watch and even more so, attractive from an investment point of view.

If you want to buy Tesla shares and have no idea where or how to start, this guide is just what you need. We will explain how you can buy Tesla shares in Romania and suggest top brokers that offer Tesla shares. We will also analyze Tesla’s history and outlook to help you decide if it is the right time to buy or sell Tesla shares.

How to Buy Tesla Stock – Step-by-Step Guide 2026

To start buying Tesla shares, you need to follow the steps below:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

[stocks_table id=”18″]

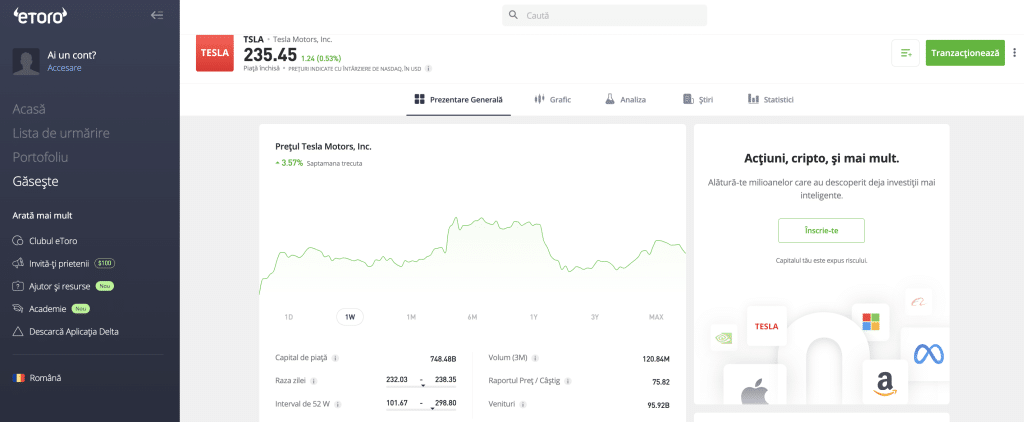

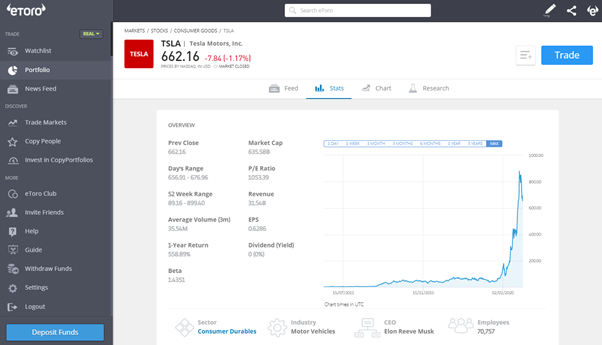

With this in mind, you will need to find an FCA regulated broker that not only allows you to buy Tesla shares, but also offers low trading fees and a reliable trading platform . To help you find the right broker for your needs, we list the best FCA brokers operating in Romania below. eToro is one of the most popular online brokers in Romania and around the world. The broker was founded in 2006 and has over 12 million active clients on its platform. The main reason for its popularity is that it offers users a social trading experience , so that investors can start discussions with other members, view other traders’ positions, and even copy the trades of top traders on the platform. eToro gives investors access to more than 800 global stocks from leading exchanges, including the US market. You can trade US companies such as Amazon , Facebook , Google and Tesla. One of the key benefits of eToro is that it allows you to buy stocks directly or use contracts for differences (CFDs). Since eToro is also a CFD broker , it allows you to leverage your stock position by 5:1, meaning you can buy a Tesla share with a 20% margin requirement. When it comes to pricing, eToro is one of the most cost-effective options. To buy Tesla shares on the eToro platform, you will be required to deposit a minimum of $200. The broker accepts many payment methods from Romania, including a debit/credit card, a bank account, and e-wallets such as PayPal. If you want to try the platform, you can do so by purchasing the free $100,000 eToro demo account.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

To invest in Tesla shares, Pepperstone offers an engaging and accessible platform for Romanian investors. With a 0% commission, investors can explore various financial options and, in particular, buy Tesla shares at no additional cost. Pepperstone provides a simple and secure experience when buying stocks, including Tesla. Users benefit from real-time information and market analysis, essential for informed decisions. In addition to stocks, Pepperstone offers a variety of ETFs, allowing for portfolio diversification. The platform provides advanced tools for effective portfolio management, helping investors achieve their financial goals. It also offers educational resources for investors, including video tutorials, webinars, and market analysis. Romanian investors can access these materials to develop their knowledge and skills in the field of investments.

XTB won the Best Customer Service award from ForexBrokers.com in 2021 and is regulated and protected in the UK and other countries. Although the platform has some of the lowest commissions in the country, some beginners might find it difficult to understand at first because the broker works using a spread-based structure instead of charging a fixed commission. The platform also has non-trading fees, such as an inactivity fee, which applies after one year, and deposit and withdrawal fees. In addition, XTB offers free deposits via bank transfers and credit and debit cards. Using one of the above methods, you can deposit for free in euros, dollars, and pounds sterling. As for the app, XTB offers its users an intuitive and efficient interface, which makes trading go smoothly and with little effort. Indeed, the app combines everything an early investor might need, while also being easy to use for investors just starting out. In addition, you can benefit from XTB's customer service, its team is available 24/7 via live chat, email or phone.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Admirals , also known as Admiral Markets, is notable for being regulated by multiple financial authorities, including the FCA, ASIC, and CySEC. It also offers negative balance protection, although it does not hold a banking license. In particular, Admiral Markets offers a competitive advantage over other platforms when trading stocks like Tesla with its low forex CFD fees, making it an attractive choice for investors looking for cost-effective options. The account opening process is fast and entirely online, with a $100 deposit. Admirals impresses by not charging any fees for deposit and withdrawal transactions. Its users have a variety of options to deposit funds, including credit/debit cards, bank transfers, and e-wallets. It is important to note that for some users, some e-wallets are not available. Admiral Traders uses the MetaTrader web trading platform , which offers an efficient fee report, but its biggest drawback is that it lacks modern design elements, price alerts, and two-step authentication. Admiral Traders also has a mobile app designed with robust search features and an easy-to-use interface.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Libertex has been in the financial services market and has been offering online trading since 1997 with an extensive history of over 20 years. Unlike other platforms we have previously reviewed, Libertex is not regulated by the FCA in Romania, instead it is under the supervision of CySEC , which is among the most important license issuers in the EU. The two trading platforms offered by Libertex include the self-issued platform and MetaTrader4 - both of which can be accessed on both desktop and mobile versions. If you want to buy Tesla assets through Libertex you need to register on the platform and transfer at least $100 which is the minimum required deposit. A variety of funding methods are available on the platform, including bank transfers, e-wallets and debit and credit cards. By virtue of its zero spread policy, Libertex allows its users to trade with low commissions and fees. You can trade on the Libertex platform using leverage with commodities, CFD assets or ECN currencies. Therefore, through the platform, you can benefit from the top quotes on the market . - Furthermore, even though Libertex receives a commission from both parties involved in the transaction, it is usually very small, below 1%.

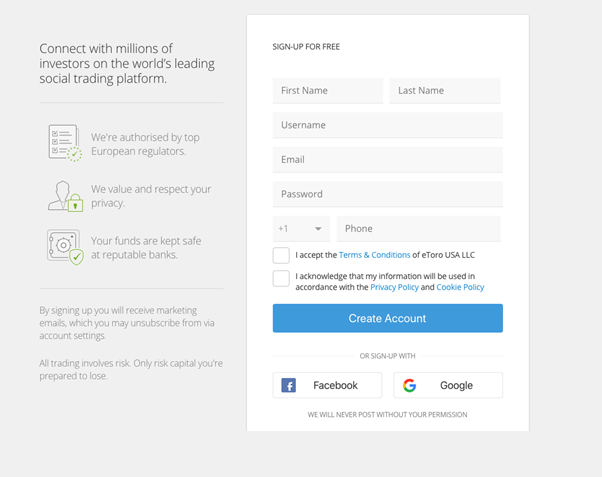

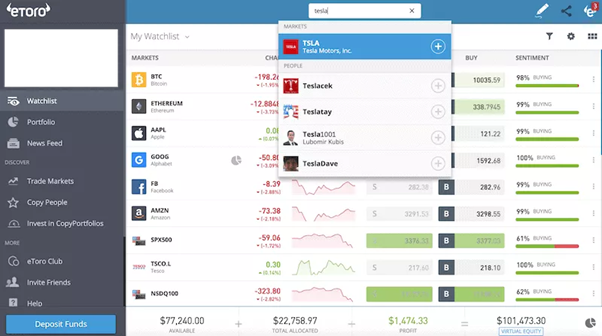

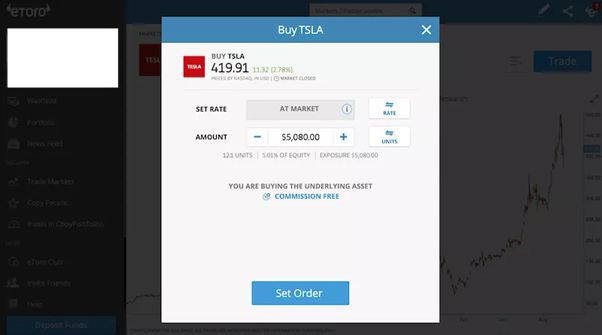

85% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor. Tesla shares have been on a steady rise since the beginning of the year, but that doesn't necessarily mean you should buy Tesla stock right now. Tesla is growing rapidly, but at the same time, some analysts and investors believe the stock is overvalued. To make a good decision, it's important to do your own due diligence before making any investment. Below, we'll cover all the basics you need to know about the company, including Tesla's history, its stock price performance, and the company's vision for the future. Tesla was founded in 2003 by a group of engineers, shortly after General Motors stopped production of its first electric vehicle. The company builds pure electric vehicles and produces home-to-grid energy storage batteries and solar products, such as solar panels. Tesla's eccentric CEO, Elon Musk, joined the company in 2004 after investing $6.3 million in Tesla stock during a Series A investment round. The company eventually went public in June 2010 and raised $226 million in its Initial Public Offering (IPO), when it offered 13.3 million shares at $17 per share. Since then, Tesla's stock price has been on a meteoric rise, reaching an all-time high of $498.32 earlier this year. On August 11, 2020, Tesla announced a five-for-one stock split, which was implemented on August 31. For those unfamiliar with the term, a stock split is a decision by a company's board of directors to increase the number of shares outstanding by issuing more shares at a lower price. Between August 11 and August 31, Tesla's stock price rose by 81%, but on September 8, some of the stock's gains were erased after Tesla fell 21%, the worst single-day loss in the company's history. Keep in mind that Tesla's stock split doesn't change much, but it can be a bit confusing. The company's earnings per share calculations change based on the new stock price, and you may need to adjust the new prices to the pre-split figures. For example, if we look at Tesla's historical chart, the stock price on the day of the IPO is $3.84, adjusted for a 5-1 split. Tesla has never declared dividend payments to shareholders. The company is transparent about its intentions, stating on its official website that it does not anticipate paying any cash dividends in the foreseeable future due to its intentions to continue the company's growth trend. Many people have high hopes for Tesla's cutting-edge technology and innovative vision. It's clear that Tesla investors are looking beyond the immediate future, and some even see a strong resemblance to Apple. Whether or not it's an illusion is up for debate, but there are certainly a few key factors that give Tesla the competitive advantage it has achieved so far. First, the company is a leading global manufacturer of electric vehicles. Last year, Tesla became the world's largest electric car manufacturer based on sales, surpassing China's BYD. Globally, Tesla delivered between 367,000 and 368,000 electric vehicles in 2019. Another huge factor to consider when analyzing Tesla is the data it collects. Tesla's electric cars constantly record and collect data, using cameras and other navigation tools to store as much data as possible while driving. This data is of enormous importance to its valuation, with the company, according to McKinsey & Co, expected to be worth $750 billion a year by 2030. After all, Tesla doesn't just sell electric cars. Tesla Superchargers are the fastest and most efficient way to charge electric vehicles on the market, and the new battery modules are expected to last between 300,000 miles and 500,000 miles. Tesla also makes rooftop solar products, as well as a wide range of solar panels. If you're ready to buy Tesla shares in Romania, you'll first need to open an online trading account with a brokerage firm. To help you get started, we'll walk you through the process using our recommended broker, eToro. To create an online CFD trading account with eToro, you will need to go to the broker's homepage and click on the 'Join Now' button in the center of the screen. This will take you to a registration form, where you will need to create a username and password and then enter some personal information which includes your full name, email address, date of birth, nationality. In the next step, you will be asked to verify your identity by uploading a copy of your passport, as well as a recent utility bill or bank statement. This is necessary because eToro is a regulated broker and authorized by the top financial regulator in Romania, the FCA. Once your account has been approved, you can deposit funds into your account. As a resident of Romania, you will need to meet a minimum deposit requirement of $200 to get started with eToro. You can make a deposit using one of the payment methods provided by eToro: Now that your account is funded and approved, you are ready to buy Tesla shares. On the eToro dashboard, enter Tesla or TSLA in the search box at the top of the screen and click on the first result that appears. eToro then takes you to the Tesla stock page. On this page, you can find useful information about the stock and the company, including alerts, statistics, interactive charts, and research tools. Once you are ready to place a buy order, navigate to the 'Trade' button and click it. You will now be directed to an order form where you need to enter the amount you wish to invest in Tesla shares. Then, click on the 'Open Trade' button. Note that eToro allows fractional trading, which means you can invest in Tesla for any amount over $40. Note: If you are purchasing Tesla shares outside of standard market hours (9:30 AM - 5:00 PM Eastern Standard Time), you will need to click 'Set Order'. Your Tesla share purchase will be completed when the markets open.Step 1: Find a stock broker in Romania that offers Tesla shares

1. eToro – Buy Tesla Shares

Pro:

Cons:

2. Pepperstone - A Suitable Option to Buy Tesla Stocks

Pro:

Cons:

Your capital is at risk

3. XTB - An efficient platform to buy Tesla shares

4. Admiral Markets - FCA regulated broker with which you can buy Tesla shares

5. Libertex - Broker with over 20 years of experience in the stock trading market

Step 2: Research Tesla shares

How much are Tesla shares worth? Tesla stock price history

Information about Tesla dividend stocks

Should I buy Tesla shares?

Step 3: Open an account and deposit funds

Step 4: Buy Tesla shares

Tesla shares, buy or sell?

Tesla shares have risen +294.53% this year, and analysts remain bullish on Tesla despite concerns about the Covid-19 pandemic and market turmoil.

However, the number of Tesla shares that have been shorted but not yet redeemed or closed (so-called 'short interest') stands at 22% at the time of writing, making Tesla the first company ever to have a $20 billion short bet against it. This is a phenomenon called a short squeeze, which refers to the total number of open short positions in a financial asset. As such, the battle between buyers and sellers could intensify and a small correction could lead to a significant drop in value.

Tesla stock is indeed dangerous and could be overvalued at its current price of $330.21. The split has generated a wave of demand for Tesla shares, given that investors receive five shares for one; however, as of this writing, Tesla stock is in a difficult position. So far this year, Tesla shares have fallen from $183.48 on February 19 to $72.24 on March 18, but have recovered to hit an all-time high of $498.32 in August.

Tesla stock is unlike any other company, being one of the most popular stocks among retail investors. While Tesla shares can fluctuate over the course of a few days, they are much closer to a buy than a sell from a long-term perspective.

November 2020 Update: When this guide was originally published, Tesla was trading at $330.21. Just over two months later, Tesla shares are currently trading at $489.61. This represents a share price increase of over 48%.

How to sell Tesla shares

The easiest way to short sell Tesla stock is by using a top-rated trading account, such as eToro. To do this, you will need to sign up for a free online trading account, log in to your trading dashboard, select Tesla shares, and place a short sell order.

Summary

In short, the outlook for Tesla investors will become clearer in the coming days and weeks. Tesla has much more room for growth, both in terms of profitability and its share price. Obviously, a number of analysts see the recent pullback as an investment opportunity, raising their price targets to $500 - $700.

One thing is for sure, Tesla is extremely volatile and unpredictable, so if you don't handle volatility very well, it may not be the right investment for you. On the other hand, some say Tesla is the perfect "buy and forget" investment currently on the market, with one of the best stocks to buy for long-term investors.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently asked questions

On which stock exchange is Tesla listed?

Does Tesla pay dividends?

What is the minimum amount of Tesla shares I can buy?

Is Tesla a component of stock indices?