Cum se cumpără acțiuni Gazprom în România, în 2026

The decision to buy Gazprom shares can bring investors quite a nice passive income, as the company pays them a portion of its profit.

To be eligible for the company’s dividends, investors must wait for Gazprom’s expected dates while they hold their shares.

Today’s review will present you with the methods by which you can buy Gazprom shares , in a very detailed way.

Quick Guide – How to Buy Gazprom Shares

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

[stocks_table id=”18″]

eToro – The best trading platform for buying Gazprom shares

eToro is a very popular and efficient trading platform that offers you the opportunity to invest in a wide range of digital currencies. The platform is regulated and secure, and your virtual wallet is completely safe.

The platform offers a lot of tools that can make your investment process easier, with the platform developers constantly working to improve the platform as much as possible.

Within the eToro platform, you also have the option of copy trading , which allows you to copy an expert’s investments to earn passive income.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

OKX, one of the best exchanges on the market

OKX also offers the possibility of passive income, even though there are no profit guarantees, but users can have a fixed income product in the form of a dual investment.

Also, this exchange is ideal even for beginning investors, because OKX also brings an educational feature through which traders can learn about all OKX functionalities, as well as the basic principles of crypto trading.

Additionally, for investors who are always on the go, it is important to note that OKX also has a mobile app, compatible with both iOS and Android.

Pro:

Cons:

Banii dvs. sunt în pericol.

A closer look at Gazprom

Below we present some important things about the Russian company, Gazprom.

What does the company Gazprom represent?

Gazprom is engaged in the refining, production and transportation of oil and gas in all European countries.

A few years after its founding, Gazprom managed to achieve a total revenue of over 120 billion dollars, which launched it into first place in the ranking of companies in Russia.

Gazprom shares are quite balanced, even in times of market volatility, which helps keep it in 49th place in Forbes magazine.

Gazprom offers interest rates of up to 10% very often, and investors are very happy about this.

At the moment, Gazprom is still doing very well, both in its field, as well as in sales and economics.

Gazprom share price

Gazprom shares are currently trading at $3.31. This is not a good time for the company, with its share price steadily falling due to the conflict between Russia and Ukraine.

Two days ago, Gazprom shut down gas pipelines to several European countries for maintenance. They will be out of service for three days, which could affect market prices to some extent.

It is worth noting that this period is quite volatile for Gazprom, as the company has reduced or stopped gas deliveries to about 12 European countries. This has a big impact on the economy and prices, as many of these countries relied on Gazprom for gas or oil.

Gazprom company dividends

In 2021, there were some problems with the payment of dividends, as the company wanted to focus on something else. It was supposed to pay out $1.2 trillion to investors, exactly half of the company’s profit that year. Investors who did not receive their dividends chose to sell their Gazprom shares, which resulted in their price falling by about 30%.

It is not known whether dividend payments will resume next year, but it is certain that this does not affect the power held by Gazprom.

Which way of acquisition is more profitable – the bank or the stock exchange?

We are going to show you which method of acquisition is more profitable for you, through the bank or through a stock broker .

When you use a trading platform , the purchasing process is much faster, more efficient and more secure. This does not require your physical presence and you do not have to fill out anything, just register an account and press the respective buttons to complete the currency deposit and investment.

If, however, you want to use a bank to buy Gazprom shares, you have to physically go to that bank, wait until it’s your turn, and fill out a bunch of paperwork.

That is why using a platform is the most efficient and enjoyable method. You don’t have to leave the comfort of your home, the whole process is done strictly virtually. In addition, it is much easier to observe prices in real time using a platform of this type and make an investment at the most opportune moment possible.

One such platform is eToro . Very efficient and secure, it also has fairly low fees and commissions, and your account verification will be done extremely quickly. Follow the review below to see a guide that shows you in great detail how to access the eToro platform and how to invest through it.

Is it worth buying Gazprom shares now?

The price of Gazprom shares depends on a few important things:

- Export taxes

- Export information

- Unforeseen events, for example conflict or pandemic

- The performance of other companies in the field

- Company demand and supply

At the moment, these Gazprom shares are not considered volatile, so they have the potential to generate profit.

However, you must also consider the risks of loss, so inform yourself very well before making an investment.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

How are things going in the natural gas market?

Recently, fuel prices have increased significantly as European countries have chosen natural gas as their main source of energy. As a result, the world has abandoned coal, a fuel that was cheaper than gas.

The COVID-19 pandemic has not helped the situation at all, with energy consumption increasing in an absolutely colossal way due to the mass confinement of people in their own homes.

Now, due to the conflict between Russia and Ukraine, European countries are abandoning Russian fuel or are prohibited from using it, which is turning the population to other fuel sources.

Because of these things we cannot say for sure what is going to happen, the demand for oil being quite low at the moment. With all these things, the situation will certainly improve in the future, and at that moment it will be possible to predict what is going to happen next.

Gazprom Shares: Current Speculation

Experts in this field state that in the future, there is an extremely high possibility that Gazprom shares will grow. The following criteria could influence this:

- The loss of ground in this area of Chinese gas and oil companies

- Launch of a new gas pipeline with a very high export capacity

- The price of oil, which is constantly increasing

At the moment, the events in the economic and political plans do not allow for the growth that we have mentioned above. However, in about three years, experts are sure that the share price will easily exceed the 300 ruble threshold.

What is speculated to happen to Gazprom shares in three years?

At the moment, given the current situation and what is happening around the world, it is certain that the currencies held by Gazprom will not see any growth. In the future, however, the situation will certainly gradually stabilize, and Gazprom’s digital currencies will see growth again.

Experts predict that within three years, GAZP shares will not only reach the 2022 price again, but will also manage to surpass it very easily.

În acel moment, vor exista trei stadii de preț. Cel mai rău caz găsește acțiunile GAZP la prețul de 350 de ruble. Un caz mediu ar rezulta un preț de 400 de ruble, iar cel mai bun caz ar înseamna un preț de 500 de ruble.

Unde vor ajunge acțiunile Gazprom în opt ani?

Peste opt ani, dacă toate situațiile actuale se rezolvă în favoarea acestei companii, cu siguranță am putea vedea acțiunile Gazprom la un preț colosal de 1000 de ruble. Aceasta, totuși, este doar o speculație, cu toate că o asemenea întâmplare nu ar fi deloc o surpriză, datorită puterii pe care o deține această companie.

Cum puteți vinde acțiunile Gazprom pe care le dețineți?

O alegere excelentă este să tranzacționați valutele dumneavoastră digitale în cadrul platformei reglementate, de unde le-ați și achiziționat. Realizând acest lucru, aveți parte de sprijin și de un proces eficient și rapid, unde cu siguranță cel mai oportun moment de tranzacționare este în mâinile dumneavoastră.

Pe lângă acest lucru, este un proces recomandat de către experți și pentru investitorii începători, fără experiență în domeniu.

În același timp, dacă nu doriți să stați cu ochii pe piață și să vă riscați capitalul, puteți opta pentru dividendele companiei, lucru ce necesită doar deținerea acțiunilor Gazprom.

Care este cel mai oportun moment de vânzare al acțiunilor Gazprom?

Exact ca în cazul altor investiții, cel mai oportun moment de vânzare al acțiunilor este atunci când nivelul de preț acțiuni Gazprom este cel mai mare, mult mai mare comparativ cu prețul de cumpărare. Țineți minte că pentru tranzacționarea acțiunilor, aveți nevoie de ajutorul unei bănci sau de o platformă de tranzacționare reglementată.

Utilizând o asemenea platformă, veți avea parte de toate datele necesare pentru a observa care este cel mai oportun și cel mai profitabil moment posibil pentru tranzacționarea acțiunilor Gazprom.

Cum pot tranzacționa acțiunile Gazprom?

Decizia excelentă pentru tranzacționarea acțiunilor Gazprom este utilizarea unei platforme de tranzacționare. Căutați să achiziționați aceste acțiuni la un preț mai mic pentru a genera un profit și mai mare în viitor.

Investiți în acțiunile Gazprom utilizând platforma de tranzacționare eToro

Mai jos vă prezentăm pașii pe care trebuie să îi urmați pentru a realiza o investiție utilizând platforma eToro.

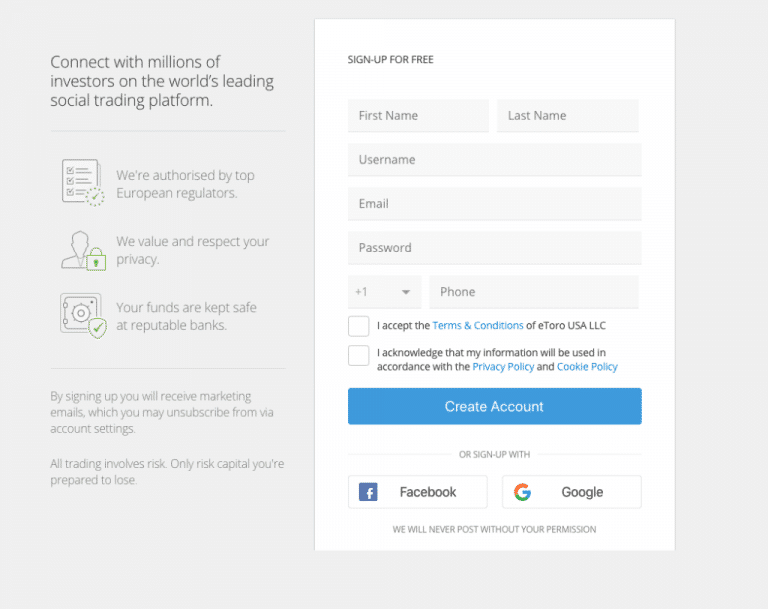

Pasul 1: Înregistrați-vă un cont în cadrul platformei eToro

Accesați pagina oficială a platformei eToro și creați-vă un cont în cadrul ei.

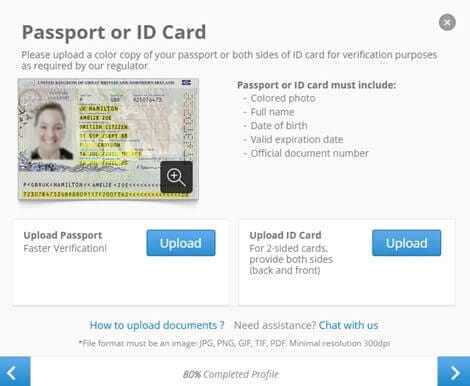

Pasul 2: Verificați contul dumneavoastră

Pentru verificarea contului dumneavoastră, încărcați în cadrul platformei o poză cu un act de identitate personal. Acest act poate fi buletinul, permisul de conducere sau pașaportul.

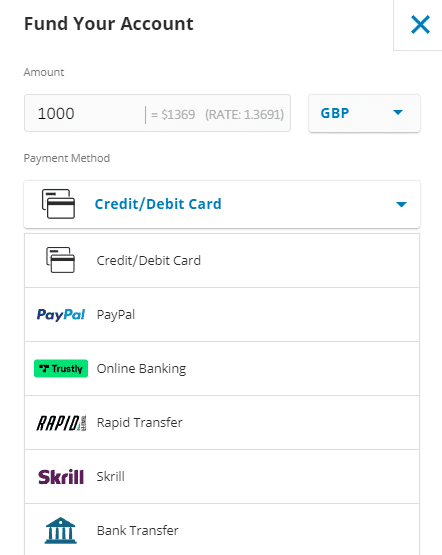

Pasul 3: Depozitați valută

Depozitați valută în cadrul contului dumneavoastră eToro. Suma minimă este de 10 dolari.

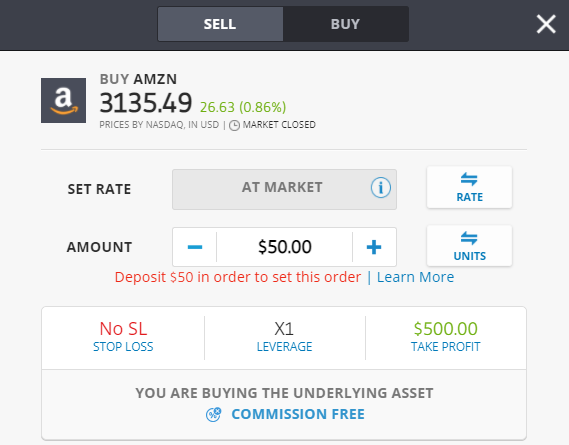

Pasul 4: Cumpărați acțiuni Gazprom

Search for Gazprom shares using the platform’s search bar, enter the desired amount, and complete the process.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Conclusion of today’s review

Gazprom is a very popular company and has generated profits for many investors. In this review, we have presented some details about it, as well as a guide that will help you invest in it.

The platform of choice for this today is eToro. eToro is extremely efficient and regulated, with a minimum deposit of just $10.

Frequently asked questions

What is Gazprom?

What is the price of Gazprom shares?

How many Gazprom shares can I purchase?

Does Gazprom offer dividends to investors?

On which stock exchange is Gazprom listed?