Cum să Cumpăr Acțiuni GameStop în România în 2026

Even if you’ve never traded a single stock – there’s every chance you’ve heard of GameStop stock in the past few weeks.

After all, the Romanian video game retailer saw its shares go from just €17 to highs of €483 in less than a month of trading.

All of this was facilitated by a group of Reddit users who collectively agreed to buy GameStop shares – subsequently leading to peak gains of over 2,700% in January 2021 alone.

In this guide, we show you how to buy GameStop shares online in Romania in 2026. We also give you a complete and honest breakdown of the risks you need to consider before investing in these shares and which brokers in Romania allow you to buy them in the easiest and most cost-effective way.

[stocks_table id=”18″]

Step 1: Find a broker that trades GameStop shares in Romania

In fact, you need to not only find a Romanian stock trading platform that gives you access to US stocks, but also one that doesn’t charge commissions.

After all, most stock trading sites in Romania charge both commissions and a foreign exchange margin when you want to buy international assets.

With this in mind, below you will find a small selection of trading apps in Romania that allow you to buy GameStop shares at a discounted price.

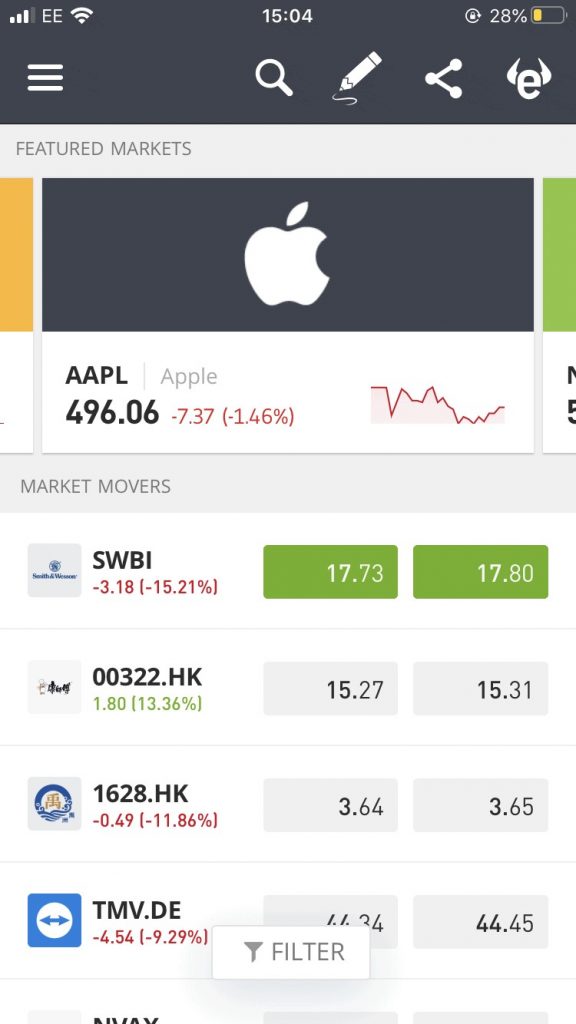

1. eToro – Buy GameStop shares

This includes the NYSE – meaning you can buy GameStop shares in Romania with ease. Other popular markets include NASDAQ (US) and the stock exchanges in Germany, France, Hong Kong and Saudi Arabia.

What you’ll love about eToro is that it allows you to buy fractional shares for as little as €50 per trade. This is especially important for high-risk stocks like GameStop, which has reached a share price of over €483 as of January 2021. If you’re thinking about creating a fully diversified portfolio of assets that includes more than just GameStop, eToro can help.

It also offers access not only to ETFs , cryptocurrencies , forex and CFDs, but also to a range of automated investment tools . For example, you can select an eToro trader you like (based on metrics such as monthly return on investment and risk assessment) and then copy them in a similar way. This ” Copy Trader ” feature requires a minimum investment of just €200 and is free.

When it comes to getting started with eToro, you can deposit funds with a Romanian debit/credit card (Visa, MasterCard, Maestro), bank transfer, or an e-wallet like PayPal and Skrill. There is a small 0.5% foreign exchange fee for all EUR deposits.

The process of opening an account, depositing funds and buying GameStop shares can be easily completed through the eToro investment app. It is available on both iOS and Android devices. Finally, when it comes to safety, eToro is not only authorized and regulated by the FCA, but your funds are covered by the FSCS.

Read our comprehensive eToro app review to learn more about what this top provider has to offer.

Pro

consul

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

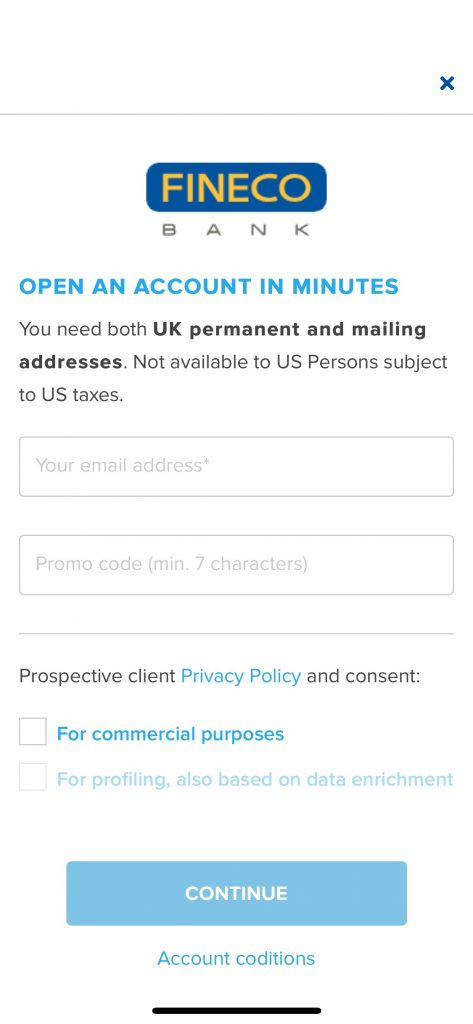

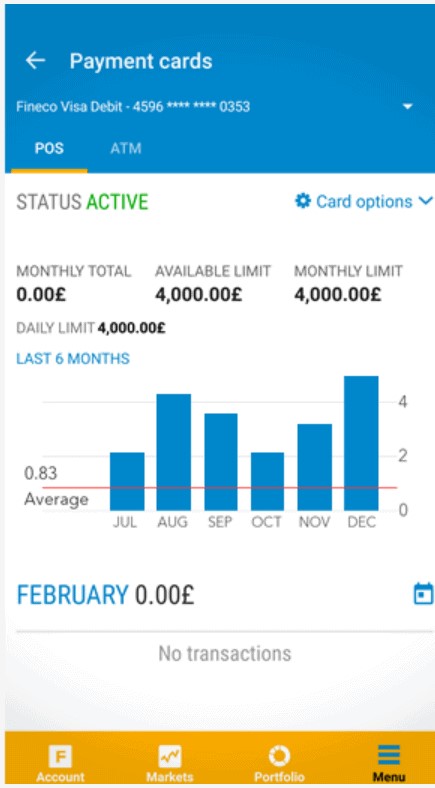

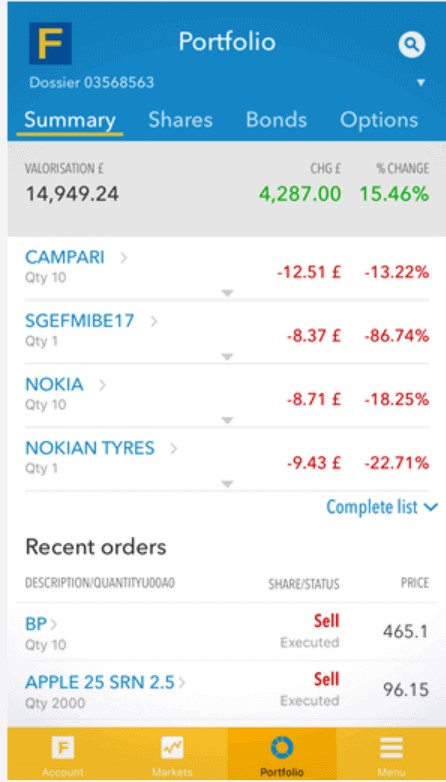

2. Fineco Bank – Trades thousands of global stocks

Plus, the provider is very cost-effective – especially when it comes to buying stocks from outside of Romania. Of course, this top broker also allows you to buy GameStop shares with a single click. All you have to do is open an account, upload your ID, and add some funds.

In terms of price, Banca Fineco charges a commission of just EUR 3.95 when you buy stocks listed in the US. If you plan to buy some Romanian stocks as well, you will pay only EUR 2.95 per transaction. Note that there is an annual maintenance fee of 0.25% applicable to all investments held on Banca Fineco.

In terms of minimum account deposits, this top broker requires a deposit of just EUR 100 and up. There are no fees for adding or withdrawing funds, although the only accepted payment method is bank transfer. If you plan to use a debit/credit card or an e-wallet from Romania, you would be better off opting for eToro.

Pro

consul

Step 2: Is GameStop a good investment?

Make no mistake about it – GameStop stock was struggling before the infamous WallStreetBets saga.

As such, you need to ask yourself whether you are investing in the company because you believe it is a good long-term investment – or are you simply following the trend on Reddit.

In any case, we recommend reading the following sections to evaluate whether or not GameStop is a good investment for you and your financial goals.

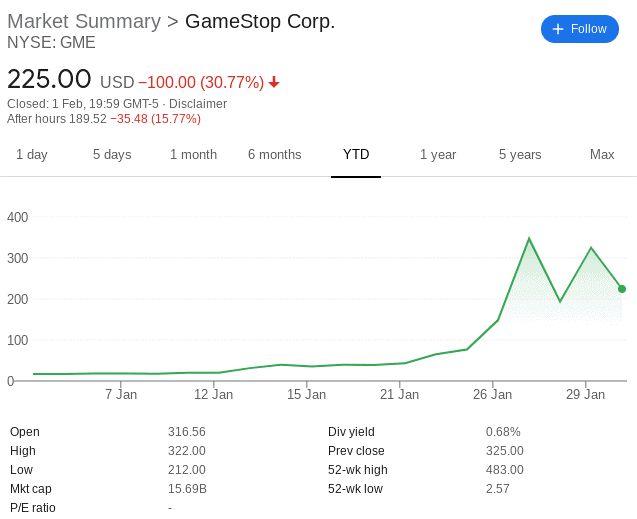

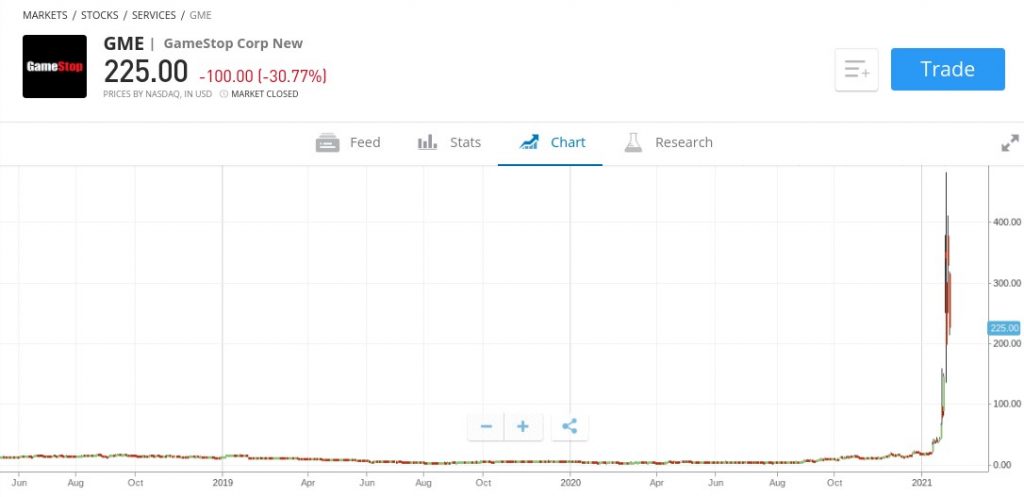

GameStop share price evolution in Romania

GameStop Corp. (GME) first went public in 2012 — opting for the NYSE. Back then, a single share would have cost you around $10. Since then, it’s been a bit of a rollercoaster ride, with GameStop stock going through several ups and downs. That said, it’s probably best to focus on the stock’s recent price action — which began in the first week of January 2021.

When the market bells first rank in 2021, GameStop shares were trading at just over €17 each. By the second week of the month, the stock had already hit highs of €40. It moved up quickly in the last week of January, and the same shares peaked at €483. That’s an increase of over 2,700% in just one month of trading.

It remains to be seen where the stock will go next. For example, in the 24 hours prior to the writing of this guide, GameStop shares were down 30%. However, just a few days earlier, the stock market closed that day with a price over 67% higher. As such, Gamestop shares are arguably some of the most volatile stocks out there today.

Does GameStop stock pay dividends?

GameStop is what the markets refer to as a “comeback” company. Simply put, this means that the company has been going through tough times in recent years, and therefore, new leadership has been brought in to turn around GameStop’s fortunes.

With rapidly declining revenues and ever-increasing debt, it will come as no surprise to learn that GameStop is not currently paying a dividend.

GameStop EPS and P/E ratio

Looking at the financial situation, GameStop reported a negative EPS (Earnings Per Share) of €5.38 and €6.59 in 2020 and 2019, respectively. This once again confirms the video game retailer’s recent troubles.

As for the P/E (Price-to-Earnings) ratio, it makes for interesting reading. At the time of writing, market estimates had the 2021 P/E ratio at -108. A negative P/E ratio means the company is losing money. The estimates for 2022 are even more alarming, with an estimated P/E ratio of -3,750.

Should I buy GameStop stock?

Given the high levels of volatility involved, you should be cautious if you’re considering buying GameStop stock. Essentially, both the upside and downside potential are huge.

Some of the main considerations you need to make about GameStop are discussed below:

The GameStop wave is essentially a Pump and Dump

Pump and dumps are usually associated with microcap penny stocks that possess small valuations. After all, it is much easier to manipulate small stocks because there are low levels of liquidity in the market. For those who don’t know, a pump and dump scheme refers to the process of artificially influencing the value of a stock.

This is done when a group of individuals “collude”—provided they all agree to buy a particular stock at a particular time. In this scenario, that stock was GameStop, and the individuals involved came from a sub-Reddit group of small investors known as WallStreetBets . The same thing happened with AMC Entertainment shares, prompting certain brokerages, like Robinhood, to suspend retail trading in the stock.

The key point here is that GameStop shares didn’t explode by over 2,700% because the company is a fantastic growth stock. Rather, its price was driven by a pump and dump operation. Essentially, there’s always a key denominator in such a practice – the stock price eventually capitulates – often below where it originally started.

WallStreetBets competes against multi-billion dollar hedge funds

On the one hand, it is true that those behind the WallStreetBets pump were able to force a “short-squeeze” on hedge funds that were “shorting” GameStop. For those who don’t know, shorting means speculating on the decline in the value of a company or asset. In the case of GameStop, it was the most shorted stock on Wall Street.

In fact, this was one of the main motivations for the Reddit pump, as forum members consider the short selling processes used to be unethical. After all, short selling in the traditional sense – as opposed to placing a sell order through CFD instruments – can force the value of a stock to fall.

- Returning to the “short-squeeze”, this can happen when the value of the shares being shorted increases by a certain amount.

- In other words, short sellers begin to experience increasing losses as the stock price moves north.

- If the stock price moves too far against short sellers – as happened with GameStop – market participants are forced to hedge their bets.

The only way to do this, rather than closing out the position, is to buy the stock they were shorting. This in turn leads to even more upward pressure. As a result, when the hedge funds were shorting, the price of GameStop’s stock rallied at an even faster rate.

Crucially, it’s important to remember that the hedge funds are behind a serious amount of capital. As such, there’s not much that the retail traders on the WallStreetBets forum can do. In other words, there’s every chance that the hedge funds will be successful in bringing GameStop’s stock price back to reality, continuing their downward pressure.

GameStop is a dying company operating in a dying industry

It’s undeniable that GameStop’s stock was in a terrible slump before the Reddit saga came to fruition and was hit hard by the coronavirus pandemic. We only have to look at its stock’s decline over the past five years to see that. For example, GameStop’s stock was worth over $32 in April 2016.

At the beginning of 2020, the same shares were worth just €5. That’s a drop of over 85%. The key concern for investors is that GameStop is being called the next Blockbuster. That is, it is involved in an industry that has been completely revolutionized and overtaken by the rise of the internet.

This is abundantly clear in the financials, not least because GameStop is facing mounting debt that, before the pump, was arguably unserviceable. Fortunately for the company, the rapid rise in its share price has allowed GameStop management to pay down €600 million in debt through an equity conversion. But this may just buy GameStop more time.

Are you buying or selling GameStop stock?

In the most exact terms – at the current price range of €100 to €400, it’s hard to shake the belief that GameStop is heavily overvalued.

As we discussed, its price increase of over 2,700% in January is not because the company represents a fantastic long-term investment.

On the contrary, it’s simply the result of the WallStreetBets pump. Even if you think the new management team at GameStop can turn things around, you’d probably want to wait until the stock returns to pre-pump levels.

Remember, you could have bought GameStop shares for €17 at the beginning of 2021.

Step 3: How to buy GameStop shares in Romania

If you have read the sections above about GameStop fundamentals and want to proceed with purchasing shares, the next step is to open an account with your chosen broker in Romania.

The steps below will show you how to do this with our top platform eToro – which allows you to buy GameStop shares.

Open a brokerage account and add funds

First, visit the eToro website and click the “Sign Up Now” button. You will be asked to enter a number of personal information and contact details – including your National Insurance Number.

You will also be asked to verify your account – as per FCA regulations.

For this, you will need to upload the following documents:

- Passport or driving license

- A recent utility bill or bank statement

Note : You can still buy GameStop shares now without uploading the above documents. However, you will need to do so before you can deposit more than €2,250 and before a withdrawal will be allowed.

You will now be asked to make a deposit.

On eToro, you can choose from the following payment types in Romania:

- Debit card

- credit card

- PayPal

- Skrill

- Neteller

- Bank transfer

Step 4: Invest in GameStop in Romania

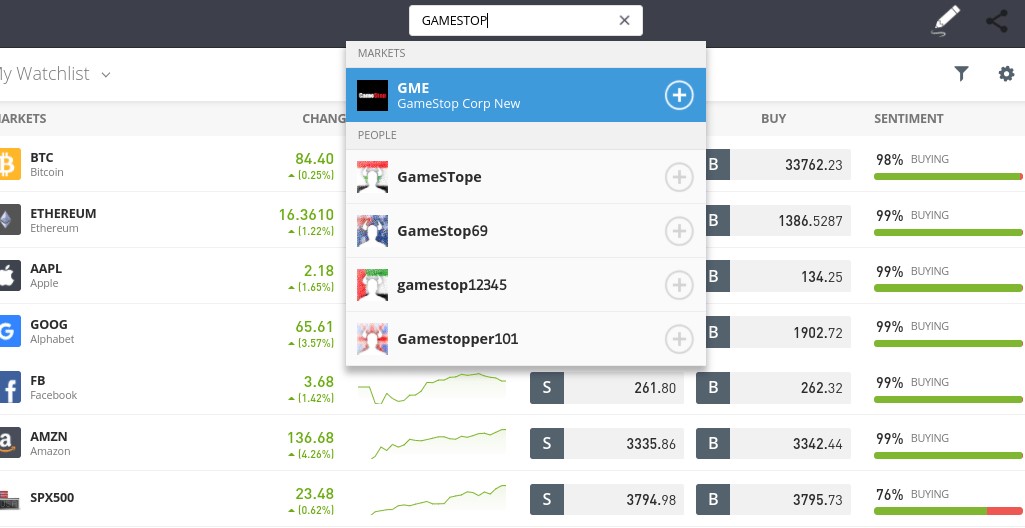

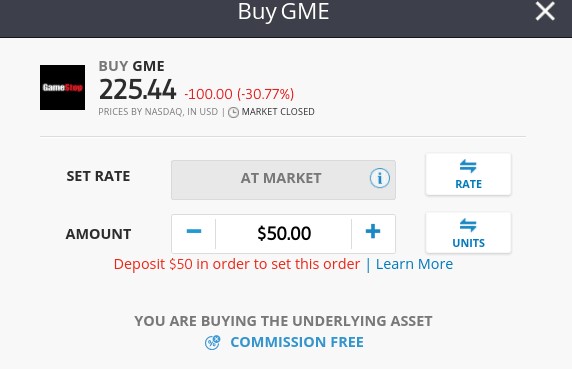

Once you have opened an account with eToro and made a deposit, you can proceed to buy GameStop shares. To get started, enter “GameStop” in the search box and then click “Transact.”

Then, enter the amount in euros – making sure you meet a minimum of 50 EUR.

If the NYSE is open, click the “Open Trade” button to instantly complete your GameStop stock purchase. If the markets are closed, click “Place Order.” Doing so will allow eToro to complete your investment when the NYSE reopens.

How to buy GameStop shares in Romania – The Verdict

GameStop shares have infamously risen by a parabolic amount in recent weeks – thanks to the WallStreetBets pump. It remains to be seen whether this upward trend continues or not. As such, you should tread carefully with this super-volatile stock.

However, if you want to buy GameStop shares online in Romania – the process couldn’t be easier than when you use eToro. This FCA broker requires a minimum investment in GameStop of just €50.

Simply click the link below to get started!

eToro – Buy GameStop shares in Romania

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

Can I buy GameStop stock?

Does GameStop pay dividends?

What is the cheapest way to buy GameStop stock in Romania?

How do you buy Gamestop options?