Cum să Cumpăr Acțiuni Facebook în România

Want to know how to buy Facebook shares in Romania? This US tech giant is one of the largest companies in the world and has long flirted with a market capitalization of 1 trillion euros. Even better, Facebook has aggressive plans for global growth.

To invest in Facebook stock in Romania, all you need is a mobile stock app that offers trading on the US stock exchange. In this guide, we’ll cover the top apps you can use to buy Facebook stock in Romania and show you how to buy Facebook stock in Romania . We’ll also cover everything you need to know about why Facebook stock is a good buy today.

[stocks_table id=”18″]

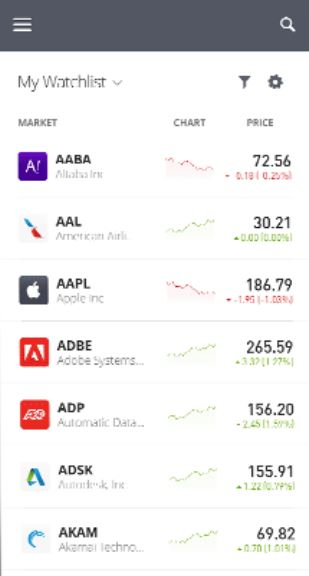

Step 1: Find a stock trading app that offers Facebook shares in Romania

While many stock brokers in Romania offer Facebook stock trading, not all are created equal when it comes to commissions, trading tools, and other key elements. To save you hours of research, we’ll cover two of the top apps you can use to buy Facebook stock in Romania today.

1. eToro – Buy Facebook shares

eToro gives you the option to buy Facebook shares directly or trade Facebook stock CFDs (contracts for difference). If you decide to trade Facebook CFDs, you can apply up to 5:1 leverage to your position.

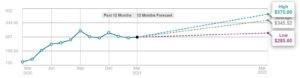

This broker stands out for the quality and depth of its trading tools. For starters, the mobile platform offers incredibly advanced charting. You can access over 100 technical studies and tools of different charts and easily customize your analysis with just a few taps. eToro also offers access to professional stock analysis, so you can check your own technical analysis against the 12-month target price that Wall Street predicts for Facebook.

eToro also has a built-in social network. You can follow traders from Romania and the US to exchange trading ideas, share stories about your winning trades, and find new stocks to trade. This network is also very useful because you can quickly see changes in market participation around Facebook stocks.

If you want to quickly build a portfolio, eToro offers portfolio copying . You can copy a preset portfolio with just a few taps, or you can mimic the actions of a day trader to actively trade around the price of Facebook shares.

eToro is regulated by the Financial Conduct Authority of Romania (FCA) and offers 24/5 customer support via phone and email. The eToro mobile app is available for iOS and Android. Read our full eToro app review to learn more about what this brokerage app has to offer.

Pro

Cons

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

OKX has a lot of great features, the first being their wide range of digital currencies available for trading, which means you are unlikely to need to switch to another exchange. Another feature worth mentioning is the Earn program, which allows traders to earn passive income through a variety of ways, such as staking, yield cultivation, lending, and margin trading. In addition, creating an account takes only 5 minutes. Thus, you need to access the official website of OKX and fill out the registration form. Later, you will receive via SMS or email a 6-digit PIN code that you need to enter into the platform. Once these conditions are met, you can deposit funds and start trading. Pro

2. OKX, crypto exchange with low fees

Cons

Banii dvs. sunt în pericol.

Step 2: Is Facebook a good investment?

Once you have decided on a stock app in Romania to buy Facebook shares, it is time to do some detailed research on this technology company. It is important to know exactly why you are buying Facebook shares and what the future might hold for this company when investing.

So, let's explore everything you need to know about Facebook shares.

Facebook share price evolution in Romania

Facebook launched on the NASDAQ stock exchange on May 12, 2012, at a price of just €38 per share. At the time, it was one of the most talked-about stock market debuts on Wall Street. Facebook shares fell sharply after the IPO to an all-time low of just €17.73.

If you had bought Facebook shares at that price, you would have a return of almost 1,500% today. From 2013 to 2018, Facebook shares began a relentless climb. The stock reached €100 per share in 2015 and €200 per share in 2018.

By the end of 2018, Facebook's share price had fallen back to just €125 per share. The company was under scrutiny over the Cambridge Analytica scandal, in which a UK-based company was found to have misused Facebook data for political advertising in the 2016 US presidential election. At the same time, Facebook was criticized for its role in human rights abuses in India and Myanmar.

Despite the criticism, Facebook shares have climbed back to over 220 euros per share before the COVID-19 pandemic hit. The shares fell to a low of 137 euros during the March market crash, but quickly reached a new all-time high in May 2020.

Since then, Facebook shares have ranged between 260 and 300 euros. The shares are now priced at 283.20 euros per share.

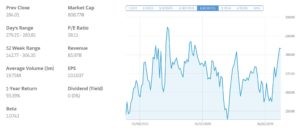

Does Facebook pay dividends?

Facebook does not pay dividends and never has. Although Facebook is very profitable, the company has no plans to issue dividends to investors at this time.

Facebook EPS and P/E ratios

Facebook reported earnings per share (EPS) of €10.09 for 2020, up from €6.43 in 2019. The company benefited from the coronavirus pandemic as users spent more time on the social network, even as advertising budgets shrank in response to the global economic crisis.

At its current share price, Facebook has a price-to-earnings ratio (P/E ratio) of 28.1. This is considered high by many value investors, but is relatively low for U.S. technology stocks. Facebook has a market capitalization of $808 billion.

Should I buy Facebook shares?

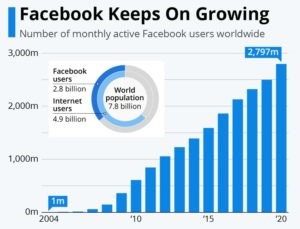

Facebook stock is one of the most closely watched stocks on Wall Street. The social networking company is used by more than 2.8 billion people around the world, including in fast-growing regions like India, Southeast Asia, and Africa. The company has also proven that it can monetize all those users and keep advertisers happy.

On the other hand, Facebook is facing pushback from regulators in the US, Europe and Australia. The company also has a reputation problem in much of the West.

So, should you buy Facebook stock today? Here's why we think Facebook stock deserves a strong buy rating.

Growth and value

Typically, investors have to choose between growth stocks and value stocks. But with Facebook, you can have both.

With a market cap of $800 billion, Facebook is hardly a startup that will see its price double every year. But the company is still valued at just a third of Apple's value, so there's plenty of room for growth. This is especially true when you consider that more people use Facebook — and have access to its social network — than use Apple products.

At the same time, Facebook's stock price doesn't really reflect this growth potential. The stock has a P/E ratio of just 28, which is incredibly low for the tech sector. Apple shares, on the other hand, have a P/E ratio of over 33, and Amazon shares have a P/E ratio of over 74. Based on this, it's easy to conclude that Facebook shares are currently undervalued.

Global infrastructure

At some point in the last decade, Facebook went from being just another social network—like Twitter or Medium—to a key part of the global infrastructure. For most of the 3 billion people who use the platform, Facebook is their primary source of media and their main connection to the internet. In fact, in many countries in Southeast Asia, Facebook is essentially the internet.

That's what makes Facebook indispensable and incredibly valuable. Even users who complain about Facebook's privacy issues or bemoan the company's size refuse to leave the social network.

At the same time, advertisers love the data Facebook provides and the prices it can charge to target ads to very specific audiences. The company grew its advertising revenue by 12% last year, even amid a global pullback in ad spending. As Facebook rolls out its tighter integration with Instagram and WhatsApp, expect the platform to cut costs and become even more efficient at connecting users and advertisers.

Difficulties can be overcome

Facebook has yet to surpass the €1 trillion market capitalization mark, largely due to several significant difficulties facing the company.

First, Facebook is facing antitrust lawsuits in the US and Europe. In the US, antitrust investigators are trying to separate Facebook, Instagram and WhatsApp.

While this could be devastating for Facebook, potential investors may see it as a black swan risk. It’s an unlikely punishment, even if Facebook is found guilty of violating antitrust law, and virtually impossible to enforce given how tightly integrated the three platforms are. A fine or regulation is much more likely, and it’s more likely to benefit Facebook, while hurting smaller competitors.

Another difficulty Facebook faces is a shift in public opinion, at least in the US and Europe. The public largely sees the company as self-serving rather than interested in the greater good, and there is a huge trust gap between Facebook and its users.

However, that hasn't hurt Facebook at all so far — and the company finally seems to be taking its image issue seriously. Even a few small gestures of goodwill from Facebook can go a long way toward restoring trust in its platform and maintaining cash flow for years to come.

Are you buying or selling Facebook shares?

Based on everything we've discussed, we believe Facebook shares should be considered a good buy for investors in Romania. This company has incredible cash flow, a user base of over 3 billion people, and the ability to grow advertising revenue even during an economic crisis. All of these factors helped Facebook grow its revenue by 12% last year and pushed the shares to a new all-time high.

There are some existential threats to Facebook, including antitrust actions in the US and Europe and deep distrust between the company and its users. However, long-term investors may want to take an optimistic view of these issues.

Facebook has proven to be very adept at bending technology regulations to its will, and it looks like the current antitrust enforcement efforts will end up the same way. Facebook's trust issues have failed to seriously hurt the company, and the platform is now doing much more to repair its image than it has in the past.

Overall, we believe there are many reasons to be bullish on Facebook and relatively few reasons to be bearish. Combined with a relatively low P/E ratio, which signals that investors are wary of these stocks, all of this suggests that Facebook shares are currently undervalued and could be poised for significant price appreciation in the years ahead.

Step 3: How to buy Facebook shares in Romania

Are you ready to buy Facebook shares in Romania? We’ll show you how to invest in Facebook using eToro. The eToro mobile app stock trading , advanced charting and analysis tools, and a built-in social network. Plus, this broker is FCA regulated and offers customer support when you need it.

Open a trading account and deposit funds

To get started with eToro, go to Google Play or the Apple App Store and search for “eToro.” Tap on the app and then tap “Install” to add it to your device.

Open the eToro app and then tap “Sign Up Now” to create a new account. You can sign up using your email address, your Google login, or your Facebook login.

eToro requires you to verify your identity to comply with FCA Know Your Customer (KYC) regulations. Simply take a photo of your driving license or passport and a photo of a recent utility bill to complete this verification step.

Then, deposit funds into your eToro account - it requires a minimum deposit of €160, which you can pay via debit card, credit card, PayPal, Neteller, Skrill or bank transfer.

Step 4: Invest in Facebook in Romania

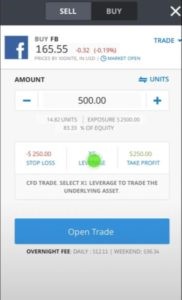

You are now ready to buy Facebook shares with eToro. From the mobile app dashboard, tap the magnifying glass at the top of the screen and search for “Facebook.” When it appears, tap the company, then tap “Trade.”

In the order form, enter the amount you want to invest in Facebook shares. You can also select a stop loss or take profit level, if it fits your investment strategy.

When you're ready, press "Open Trade" to buy Facebook shares with eToro.

How to buy Facebook shares in Romania - Verdict

Facebook is one of the world's largest technology companies, but the social media giant still has room to grow. The company has managed to increase advertising revenue even in the midst of the coronavirus pandemic and has ambitions to expand its user base further across the developing world. While Facebook has faced some regulatory challenges, they are likely to be resolved in the company's favor.

With all of this in mind, we think Facebook shares are a strong buy today. Are you ready to buy Facebook shares in Romania? Click the link below to get started with eToro!

eToro – Buy Facebook shares in Romania

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

Who is the CEO of Facebook?

Can I buy Facebook shares with an ISA or SIPP?

Could Facebook be shut down?

Does Facebook operate in China?

Does Facebook pay for news?