Cum să Cumpăr Acțiuni Amazon în România

Most large company stocks have seen double-digit percentage losses during the COVID-19 lockdown, but Amazon is not among them. On the contrary, the online retailer continues its upward trajectory. If you want to buy Amazon shares, you will need to use a Romanian stock trading platform that gives you access to the US-based NASDAQ.

In this article, we explain how to buy Amazon shares online in Romania . It covers the steps needed to buy Amazon shares in the fastest, cheapest and safest way, as well as details on the best broker in Romania to do so.

How to Buy Amazon Stock – Step-by-Step Guide 2026

To start buying Amazon shares, you need to follow the steps below:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

[stocks_table id=”18″]

Step 1: Find a stock broker in Romania that offers Amazon shares for purchase

On the contrary, you should take some time to examine the types of fees and commissions the platform charges, what payment methods from Romania are accepted, and, fundamentally – whether or not the broker is licensed by the FCA.

Considering all this, below you will find some popular stock brokers in Romania that allow you to buy Amazon shares online.

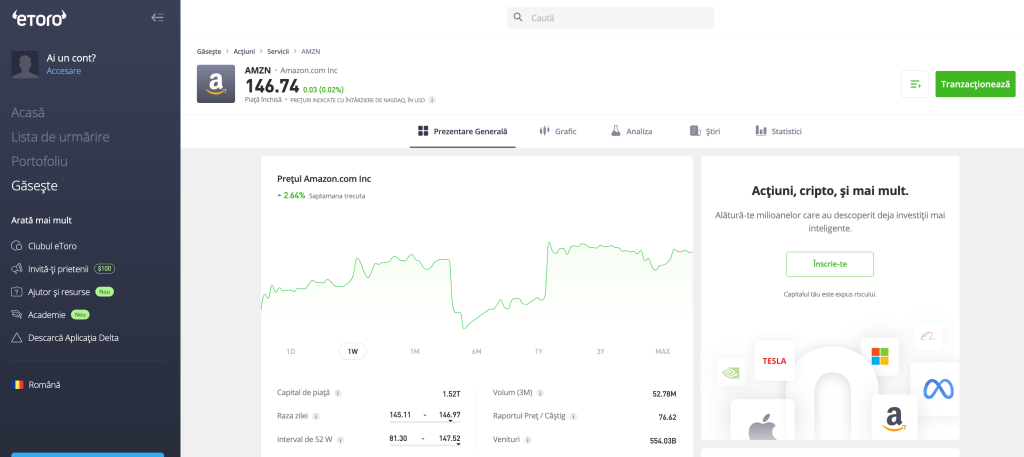

1. eToro – The Leading Social Trading Broker

eToro is a market-leading broker that gives you access to over 800 stocks, including Amazon.

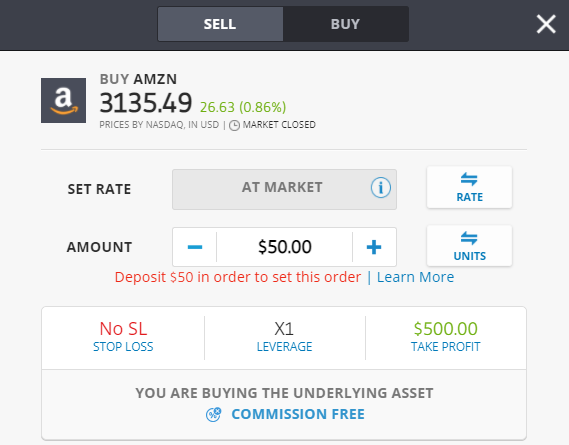

One of the unique aspects of eToro is that it allows you to both buy stocks traditionally and trade CFDs . By trading CFDs, you can speculate on price declines and use eToro’s 1:5 leverage to make larger trades.

eToro is renowned for being a social trading platform , meaning you can interact with other members of the trading community. It also offers innovative copy trading tools, meaning you can copy the entire portfolio of top-performing investors !

Minimum deposits start at $200. Therefore, eToro doesn’t force you to buy entire Amazon shares, which are now priced at over $1,000 each. Instead, you can invest from as little as $50, which means you can buy a “fraction” of Amazon shares.

Regarding the safety of your funds, eToro is regulated by the FCA, as well as ASIC (Australia) and CySEC (Cyprus), so your funds are protected. Another benefit of eToro is that it offers an excellent stock trading app , which you can use to buy Amazon shares from your mobile.

Advantages:

Disadvantages:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Pepperstone – A Popular Platform for Stock Market Investing and Buying Stocks

Pepperstone (based in Australia) is regulated by the FCA, CySEC and ASIC. The platform provides a safe and transparent trading environment, offering two main account types: Standard and Razor. The Standard account stands out for its tight spreads (starting from 1 pip) and the absence of commissions, making it suitable for less active traders. On the other hand, the Razor account is intended for those interested in active trading, offering spreads from 0 pips, but involving a commission fee.

With the ability to diversify your portfolio across stocks and ETFs, Pepperstone is an ideal solution for the complex financial needs of investors like you. The platform offers direct access to stocks like Amazon, opening the door to investing in top companies. It is easy to use and allows investors to buy Amazon shares effortlessly, providing real-time insights and detailed analysis for informed decision-making.

Pepperstone stands out for its fast execution (~30ms), which makes it attractive to traders who value performance. In addition, the platform allows you to copy trades of other traders.

Pepperstone caters to both professional and retail traders. With notable advantages in trading costs, Pepperstone remains a popular choice among traders who value transparency and efficiency.

Pro:

Cons:

Your capital is at risk

3. XTB - Trading platform that does not charge commissions

According to our research, the XTB platform can also be used by traders to buy Amazon shares. The platform offers its users a variety of financial instruments at pleasantly surprising prices. Users have access to CFDs such as: widely recognized cryptocurrencies, over 20,000 stocks from around the world , over 150 EFTs, as well as other assets.

XTB states that it does not charge commissions or a minimum deposit for registrations, in addition, it even has a demo account, which is also absolutely free, where users can test the platform's tools and practice before risking their assets. All of the above makes the XTB platform of interest to both experienced investors and those who are just starting out.

Another attractive feature of XTB is the fact that it has developed its own platform - xStation . We were able to test this platform and determined that it offers a multitude of graphical and analytical tools as well as technical indicators designed to ensure more efficient and calculated investments for its users.

XTB has a range of educational materials and even has a mobile app that is available for both iOS and Android (something we rarely find among similar trading platforms).

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

4. Admiral Markets - FCA regulated broker and MT4 compatible

Admiral Markets offers over 8,000 financial instruments and leveraged trading. These include stocks, CFDs, indices and bonds and can be traded on over 7,500 markets.

Unlike XTB, which does not charge any deposit, Admiral Markets requires a minimum deposit of 1 euro for those who want to buy shares and a minimum of 25 euros to be able to make transactions. However, the platform compensates for this by having several types of accounts, with different resources and parameters that are supposed to satisfy the requirements of any investor.

Depending on the desired indicator package or the deposit and trading amounts they are ready to allocate, users can choose the right account type. When selecting a trading platform or broker, investors prioritize the security of their funds first and foremost, and Admiral Trading promises that its users' assets are protected and always at hand, as they are kept separate from the company's capital in segregated accounts at banks around the world.

Admiral Markets has grown into a financial group with access to markets in over 130 countries over the past 20 years. The platform has 16 offices around the world offering multilingual customer service.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

5. Libertex - Buy Amazon assets with low fees and commissions

Libertex , which adheres to the zero spread policy (the selling price is equal to the buying price for all types of traded assets), allows its users to carry out transactions with reduced commissions and fees. Within the Libertex platform you can carry out transactions, applying the leverage effect, with commodities, CFD assets or ECN currencies.

Thus, you can benefit from the top quotes on the market through the platform. Furthermore, even though Libertex receives a commission from both parties involved in the transaction, it is usually extremely small, well below 1%.

Libertex allows you to select from 2 trading platforms , a self-issued platform and MetaTrader4, both of which are available on both desktop and mobile versions.

You can open an account in just a few minutes if you want to buy Amazon assets through Libertex. To do this, you need to register on the platform and transfer the minimum deposit, which is $100. The platform offers a lot of funding options: e-wallet, bank transfer or debit/credit card.

Libertex has been providing financial services and online trading since 1997, so the platform has a remarkable history of over two decades, which gives it added credibility. In terms of safety, it is important to note that Libertex is not under the supervision of the FCA. Alternatively, CySEC, the main licensing authority in the European Union, is responsible for this.

85% dintre investitorii de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor.

Step 2: Search for Amazon shares

While Amazon has rewarded shareholders handsomely over the past decade, it's important to do your own due diligence. In this section of our guide, we explore some of the most important factors you should consider before buying Amazon stock.

Amazon stock price history

Launched in 1994 by Jeff Bezos, Amazon began as an online library. It then moved into other areas of online retail, such as DVDs, CDs, and consumer goods. Just three years after its founding, Amazon made the decision to go public. Opting for the technology-focused NASDAQ, Amazon shares were initially valued at $18. The company was thus valued at just under $500 million.

It can be said that it was a bumpy road for Amazon in the following years, as Amazon benefited greatly from the financial boom in the Internet sphere, the dot com boom . But, like the rest of similar companies in the industry, Amazon suffered massively from the negative effects of the financial collapse in the same sphere, the dot com crash . In fact, it took almost 14 years for its shares to return to the higher levels they reached before the crash.

Since then, it’s been nothing but an upward trajectory for Amazon shareholders. In fact, as of this writing in July 2020, Amazon shares are priced at just under $2,900. That translates to a share price increase of nearly 16,000% from the initial IPO price. However, you have to factor in multiple stock splits along the way – meaning your return on investment would be even higher.

In simple terms, if you had invested $1,000 in Amazon in 1997, your investment would now be worth over $1.2 million. To put all of this into perspective, Amazon currently has a market cap of over $1.44 trillion. On top of that, founder and CEO Jeff Bezos himself has a personal net worth of over $177 billion .

Amazon Dividend Information

Considering all of the above - the fact that Amazon is now the largest, most successful, and most profitable business in the world - you might be surprised to learn that the company still pays a single cent in dividends. This is somewhat odd considering how financially strong the company is.

However, the company has reiterated that it plans to reinvest its dividends to keep the business growing. After all, the company has diversified into a number of other high-end, cash-flow-strong sectors, including artificial intelligence, cloud computing, and digital streaming.

Should I buy Amazon stock?

Swing traders will be invading Amazon as of this writing, not least because the trend continues to head north. Specifically, Amazon shares are at an all-time high since April 2020.

This is particularly interesting when you consider the impact the COVID-19 pandemic has had on broader stock markets - with some of the largest PLCs losing between 30-50% of their value. Ultimately, there's no reason to believe Amazon's revenue will drop significantly anytime soon, so it will be interesting to see how high the company can go in the next 6-12 months.

The core retail business continues to thrive year after year

When we look at the level of stock market growth that Amazon has achieved in recent years, we would normally be tempted to attribute this to an upstart company like Tesla . However, it is important to remember that Amazon and its core business model - online retailing, have been around since 1994.

Ultimately, Amazon's retail sales continue to grow at an exponential rate. For example, sales increased by 19% in 2019 compared to the previous year, and in 2020 they are expected to grow by just under the same figure.

Amazon brand loyalty is essential

Customer loyalty is absolutely essential if Amazon intends to maintain its position at the top of the online retailing hierarchy. This is especially true when you consider the numbers associated with its Prime membership service. For example, it was recently found that 24% of Prime members plan to spend more at Amazon this year.

Then, a Bank of America study found that 67% of Premium members are either unlikely or very unlikely to cancel their plan, while 6% said they intend to cancel, which is actually 2% less than the percentage reported by the same study conducted the previous year.

Unprecedented diversification

While online retail is booming for Amazon, let's not forget about its other innovative ventures. For example, the company recently entered the online shopping space. To gain a firm grip on this sector, Amazon is expanding its super-fast 1/2-hour delivery times. Moreover, it has canceled its $15 monthly fee for most of its Premium members. In return, it expects this to attract even more Prime subscribers.

Then there's Amazon Web Services (AWS), which is expected to generate over $45 billion in sales in 2020. That's more than Google and Microsoft combined for their own cloud computing services. Amazon is also expanding its reach into artificial intelligence and drone delivery, so that's another set of sectors to keep an eye on in the coming years.

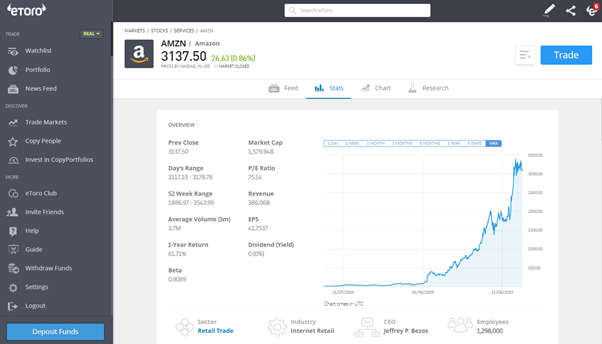

Step 3: Open an account and deposit funds

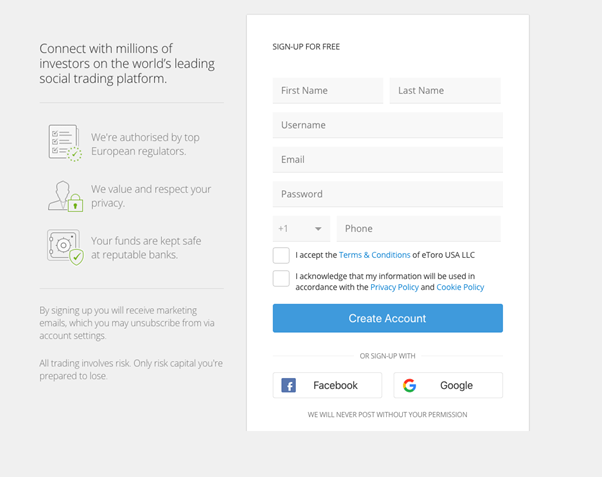

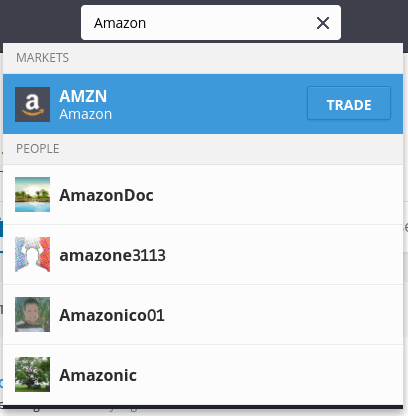

So, now that you have some information about Amazon, you are ready to take the next step. As such, we will now guide you through the steps of buying Amazon shares online in Romania. While there are many suitable brokers to choose from, we decided to show you how to invest in shares with eToro. This is because this FCA-regulated trading platform allows you to buy Amazon shares and you can instantly deposit funds with a debit/credit card or e-wallet. So, the first thing you need to do is go to the eToro website and open an account. In addition to choosing a username and password, you will need to provide a number of personal details. This will include your full name, home address, date of birth and contact details. You will also be asked to verify your identity. You can do this later if you do not intend to deposit more than €2,000. However, you will need to do this before you can make a withdrawal. Therefore, it is best to upload the necessary documents now. These will include: You will also need to meet a minimum deposit threshold of $200 at eToro. However, you don’t need to invest the entire amount right away, as you can get Amazon shares for as little as $50. In terms of accepted payment methods, eToro supports the following options: After confirming the deposit, the funds will be credited instantly (except for bank account transfer). Now that you’ve funded your brokerage account, you’re ready to buy Amazon shares. If you opt for eToro, all you need to do is enter ‘Amazon’ in the search box at the top of the page, then click on the result that appears (as in the screenshot below). After that, click on the ‘Trade’ button. To complete the investment process, you will be asked to enter your total stake in USD. As long as the amount is over $50, you can invest as much or as little as you like. Finally, click ‘Open Trade’ to buy Amazon shares! Note: If you are buying Amazon outside of standard market hours (9:30 AM – 5:00 PM Eastern Standard Time), you will need to click ‘Set Order’. The purchased stock will be completed when the markets open.

Step 4: Buy Amazon shares

Summary

In short, those who backed Amazon early in its corporate journey are now looking at six-figure percentage gains. While the miss may be frustrating, it's probably not too late to get on board. In fact, the company has increased its stock value by more than 52% over the past 12 months. With Amazon consistently hitting new all-time highs in 2020, there's no telling how big this NASDAQ stock can become, which is why it's considered one of the best stocks to buy by many commentators.

As such, if you are looking to buy Amazon shares in the fastest, safest and most profitable way possible, we suggest using eToro. With Innovative copy trading tools and an FCA license, eToro is an excellent choice.

Simply click the link below to get started!

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently asked questions

How much did Amazon stock cost when it first went public?

How much does it cost to buy Amazon stock in Romania?

Does Amazon pay dividends?

Do I have to pay a conversion fee to buy shares on eToro in Romania?

What is the minimum number of Amazon shares I can buy?