Cum puteți achiziționa acțiuni de petrol în anul 2026

Following the situation in Ukraine and the problems that some companies are having with their stocks, stocks like oil have gained momentum again among ordinary investors. Thanks to a good market period, oil has become one of the most successful stocks.

An extremely good move at the moment is to launch an investment in oil stocks. To guide you towards this move, today we will show you how to buy oil stocks from the comfort of your home.

A quick guide to the process of buying oil stocks

- First step – Register an account on the eToro platform: After accessing the official eToro website, click on the “Join Now” button and register an account on the platform.

- Second step – Upload a photo of a personal identification document within the eToro platform: You can use an ID card, passport or driver’s license to verify your identity, a process that will take extremely little time.

- Step Three – Deposit Currency: For deposit, the following methods can be used: debit/credit card, virtual wallets or bank transfer. The minimum deposit on the platform is $10.

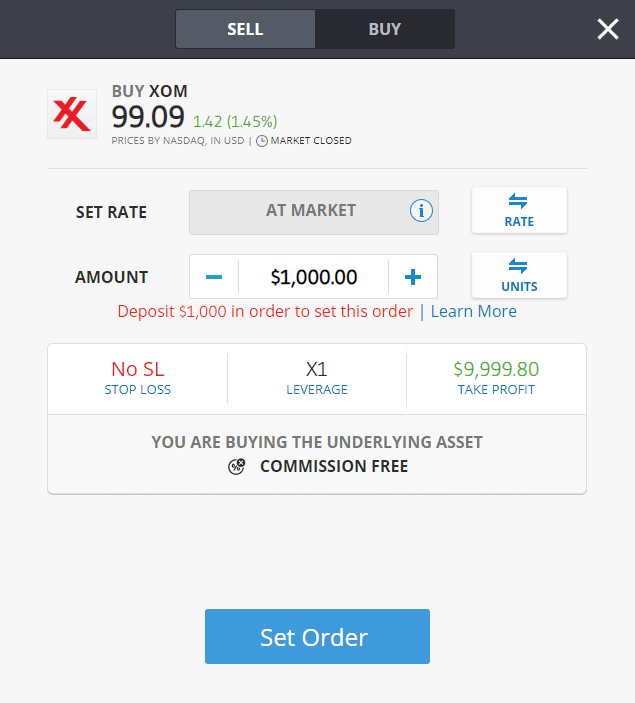

- Step Four – Access the oil stocks: In the platform’s search bar, enter the name of the oil stock you want to purchase. Once you have done this, click on the “Trade” button.

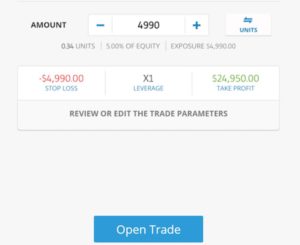

- Step Five – Purchase the Oil Shares: Enter the desired amount, minimum $10, and then press “Open Trade” to complete the process.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Popular trading platforms where you can buy oil stocks

eToro – The Best Platform to Buy Oil Stocks

eToro is the largest and most trusted platform of its kind, making it the best choice for buying oil stocks in 2026. This platform gives you access to thousands of tradable stocks, and is used by over 25 million users in the United States alone.

eToro is used by investors all over the world, trading oil stocks. Plus, your eToro account gives you access to a wide range of financial markets.

The platform allows you to invest in stocks starting from just $10, which gives you the chance to trade extremely expensive stocks at a more affordable price.

Dividends from oil stocks are deposited directly into your personal eToro account . They can be reinvested in this sector or withdrawn at the user’s request. In addition, there are many exchanges available for purchase if you want to have a more diversified virtual portfolio.

If you want to invest in the oil market, this is possible. Using the platform’s ” copy portfolio ” feature, you can trade according to the experts’ picks. This allows you to invest passively , as you only need to choose an expert with satisfactory results.

Pros

Arguments against

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

What do oil stocks represent?

Oil stocks represent companies that are involved in the extraction of oil. In short, when you buy shares on a trading platform , your money is invested in that company with the idea that it will increase in value over time.

The oil industry allows you to make a large profit and receive dividends when you own the shares.

Generally, all oil companies offer their shareholders dividends. This means receiving a quarterly or bi-annual payment. Investors must choose the company they want to invest in very carefully because the market is volatile. Stable companies with the greatest financial strength can generate these quite profitable payments.

Investing in oil stocks is similar to investing in other stocks. Your goal is to buy these stocks at a very low price so that you can make a huge profit when the prices rise. However, before you take this step, you need to take a very close look at recent prices to see how the oil sector is doing.

When choosing the company in which you want to invest, you should look for one that is as strong and stable as possible in the event of a price crash. It is a wise choice to invest in a company that has a low cost of production and can withstand price fluctuations. Mid-cap companies in this field have the greatest potential to have the necessary qualities, listed above, and have serious contractual obligations.

Oil stock prices

Oil stock prices have been going through a very difficult time due to the current situation between Ukraine and Russia. This is due to Russia’s very large natural gas reserves, as well as being one of the largest oil exporters in the world.

Following the publication of prices by Oil Price Charts, we can see the price of $119.72 for a barrel of Brent oil, which increased by 1.79%, as well as the price of a barrel of WTI oil, which increased by 1.71%, reaching the price of $118.87 .

Oil production will increase globally, and experts say prices could rise.

To cover Russia’s oil stock, global companies must massively increase investments in this area to be able to fill the reserves used in the meantime.

Speculation on oil stock prices

Experts believe that the price of oil in 2026 is determined by the conflict between Ukraine and Russia, as well as Iran’s talks on nuclear weapons.

There is speculation that Brent oil could reach a price between $115-$130/barrel. However, an unfortunate event would be a drop in the price of a barrel to $60-$85 due to the Chinese economy.

UBS mentions that a politically destabilized period in terms of oil production in the regions of Venezuela, Libya, Nigeria and the Middle East could lead to a significant decrease in oil stocks.

ANZ Research says Brent crude is expected to trade at around $86.80 in the near future. In 2023, it is expected to fall to $86.20 . However, WTI crude is expected to trade at $85.10 in 2023, compared to $83.90 in 2022.

Rystad Energy said that oil prices could be lower in 2023 due to demand and inventory. In 2025, according to the United States, Brent oil could reach $66/barrel , while WTI oil could reach $64/barrel.

Three oil stocks worth buying

We’ll show you the three best US oil stocks to buy in 2026.

1. ConocoPhillips – Best Oil Stock to Buy

This company operates in a number of countries, with its primary headquarters in the United States. It is one of the largest companies and its goal is to discover oil and natural gas.

ConocoPhillips wants to give shareholders a fairly large percentage of its profits in the coming years. Dividends will be paid to investors on a regular basis, and shares will be repurchased.

In 2021, the company’s shares were priced at $6.07/share, significantly higher than the previous year. $6 billion in dividends were returned to investors through share buybacks and dividends. The company publicly announced its intention to return $2 billion to shareholders in 2026.

The company has an exceptional financial profile and a fairly cheap portfolio, consistently receiving very good reviews, with a low leverage system and an economy that can support any problem.

2. Exxon Mobil – A great oil stock choice for dividends

This company produces gas and oil, having been launched in 1999 after the merger of Mobil and Exxon. Exxon Mobil is one of the largest companies in the oil market, with a total value of over 350 billion dollars.

The company wants to become much more efficient and significantly reduce its costs. Over the years, the company has succeeded in this, returning a nice profit to investors. In addition to these things, it has improved the leverage system that now offers them an extremely high profit when the price of oil increases.

Next year, it is speculated that Exxon Mobil will have a share price of $8.61 .

Exxon Mobil remains driven by investor enthusiasm and their desire to profit from high oil prices. Even though the company has seen a 60% increase this year, there is speculation that it could reach a WTI price of $120 a barrel, and even $130 in the future .

As long as the currency is generated, the company maintains its dividends. Exxon Mobil invests in clean fuel sources, such as carbon and renewable fuel sources, so investors who are wary of oil can safely choose this company.

3. Phillips 66 – A very good and stable oil stock

This company deals with the processing of conglomerates to provide the world with diversified energy.

Phillips 66 has the lowest costs in this field, dealing with crude products for use in petrochemicals and refineries, which has exponentially increased its profitability.

The company performs differently from other companies in the field, experiencing a growth of 5% after one year and 11% after five years.

Phillips 66 has a very stable financial profile, with very high savings. Thanks to its low costs, it can invest in very expensive projects that generate profit.

The company deals with wise investments, thereby returning currency to investors.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Buy oil stocks on the eToro platform

Nowadays it is extremely easy to buy shares. This can be done very easily within the eToro platform, making it an excellent choice for all investors interested in this field.

Below we will present in great detail all the steps you need to take to make an investment.

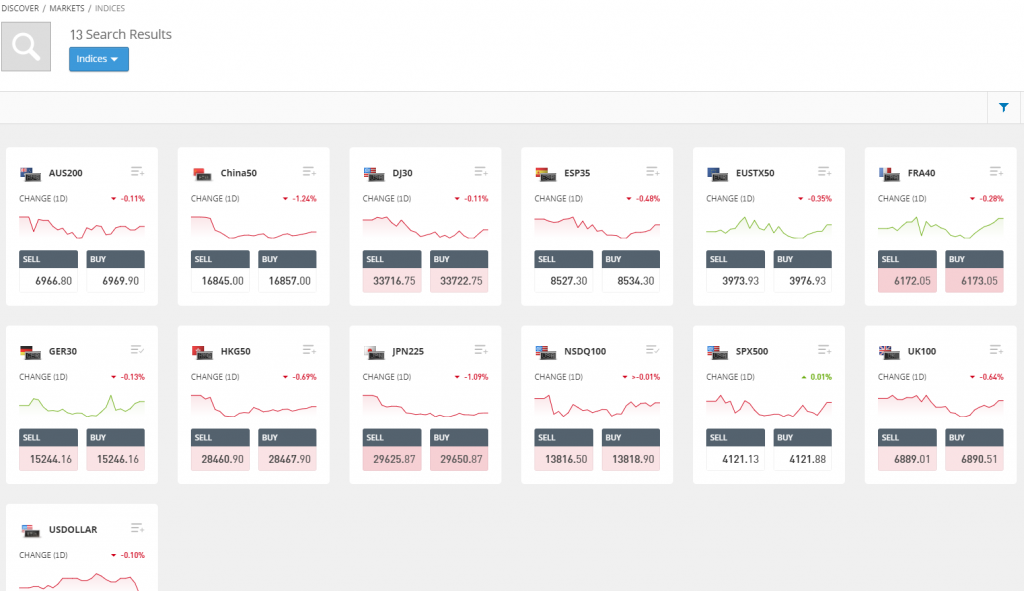

It is very easy to register on the eToro platform. Go to the official website, click on the “Join Now” button and enter your personal data. The platform will need your address, name and CNP. All platforms of this type require personal data. The platform will need a personal identification document of yours. The documents that can be used are your ID card, passport or driving license. The copy of the document must be clear. In addition to this document, you must upload proof of location. This can be done by uploading an invoice or bank statement, for example. The process is extremely fast and efficient, so you won’t have to wait long. To trade on the eToro platform, you need to deposit currency. This deposit can be made via a Visa or Mastercard bank card, PayPal, virtual wallet, or bank transfer. If you deposit from the United States, you will not be charged a deposit fee. Enter the name of the oil stock you want to purchase in the eToro platform search bar at the top of the screen. For example, search for “Exxon Mobil” and press Enter. If you want to explore the market, click “Discover” and see all the oil stocks on the eToro platform. Click on the “Trade” button and enter the desired purchase amount. After completing this step, click on “Open Trade” and complete the transaction.Step One: Register on the eToro platform

Second step: Upload a personal ID document and confirm your identity

Step Three: Deposit Currency Within the Platform

Step Four: Search for the desired oil stock

Step Five: Purchase your chosen oil stock

Conclusion of today’s review

An investment in oil stocks, especially now that the commodities market is rising, is an extremely wise idea with huge profit potential.

You can make this investment within the eToro trading platform, and it is an extremely simple process.

eToro is also quite affordable, with a minimum required deposit of just $10.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently asked questions

How can I invest in oil stocks if I don't have a lot of money?

What is the oil exchange?

Does the oil exchange pay dividends?