Cele mai bune ETF-uri din România – Cumpărați ETF-uri de top 2026

While there is some excitement about picking individual stocks – sometimes it is better to consider a Romania ETF. By doing so, you will often be investing in hundreds of different stocks from a variety of markets and sectors, making it quite difficult to identify the best Romania ETFs.

As such, you can easily diversify and take a more relaxed approach to investing. In addition to stock exchanges, ETFs can also track other asset classes – such as bonds, commodities and real estate investment trusts. Trading Platforms experts have invested over 45 hours researching the ETFs available to investors in Romania.

As a result, this page was created, which includes not only a list of the best ETFs in Romania, but also a brief description of each option, accompanied by a graph of recent developments.

So, we invite you to read this complete guide on the best ETF investments in Romania to consider in 2026.

[heel]

Before reading our full analysis for each investment – check out our pick for the best ETF in Romania and 10 other ETFs we find attractive.Best ETF Romania 2026 – List

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Best Romania ETFs – Detailed Analysis

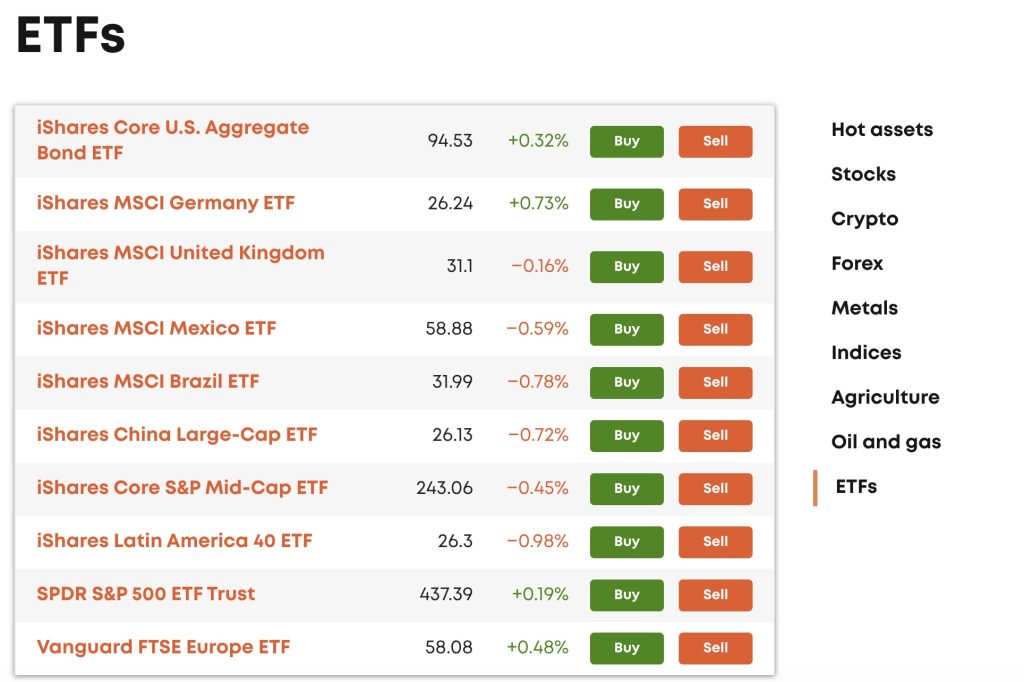

Overall, there are hundreds of ETFs available on the Romanian market – most of which can be invested in from the comfort of your home.

This covers virtually every possible market – including but not limited to dividend stocks, gold, corporate bonds, US Treasuries and real estate. As such, you should do your due diligence before taking the financial plunge.

To make your options a little easier, we discuss below the best ETF investments in Romania right now!

1. iShares Core FTSE 100 Index ETF – The best ETF for investing in the London Stock Exchange

From an investment perspective, there is much to be excited about in the UK economy. Not only is the UK hosting one of the fastest vaccine launches in the world, but the value of the pound is also extremely high. In short, there are still plenty of cheap stocks on the market right now – largely because many sectors are still struggling in the wake of the extended lockdown caused by the COVID pandemic.

With this in mind, now could be a great time to invest in the FTSE 100. This is the main index of the British capital market, which tracks the 100 largest companies on the London Stock Exchange. The easiest way to support the FTSE 100 is through an ETF. The most popular option on the market is the iShares Core FTSE 100 UCITS.

This ETF will seek to track the FTSE on a like-for-like basis, investing in all 100 companies in the correct weighting. This will be rebalanced every three months to ensure the ETF is as closely represented as the index.

To give you an idea of where your money will be allocated, you will indirectly acquire a 5% stake in Unilever and AstraZeneca, 4% in HSBC and 3% in Rio Tinto, Diageo, Royal Dutch Shell, GlaxoSmithKline, BP, and British American Tobacco. As is obvious, you will be well diversified across the UK economy.

Like the SPDR S&P 500 ETF discussed earlier, iShares will distribute your share of the dividend payment every three months. In terms of past performance, the FTSE 100 is still worth less than pre-pandemic levels. But, this offers a good opportunity to invest at a discount. The index needs another 16% to return to the 7,600 level – which it last reached in February 2020.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2.SDPR Gold ETF – The Best ETF to Buy for Gold Investing

Moving away from stocks for the moment, next on our list of the best ETFs in Romania is SDPR Gold, which is at the top of our recommendations for the best gold ETF. As the name suggests, this ETF will give you direct access to the gold markets without having to worry about physical storage. Instead, through a single ETF investment, you can benefit from rising gold prices worldwide.

In fact, the ETPR Gold SDF is the world’s largest physical gold exchange-traded fund. In layman’s terms, this means that the ETF provider – SDPR – will buy and physically store gold on behalf of its investors. This means that when the price of gold rises and falls, so will the value of the ETF.

As we discussed in our article on how to invest in gold, this store of value has been on a tremendous run for many years. In the last five years alone, gold has increased in value by over 45% and by 580% compared to the 20 years prior. Plus, gold is a great way to protect yourself against rising inflation and falling stock markets – which is why the ETPR Gold ETF is so popular.

Perhaps the main downside to this ETF is that you won’t get quarterly dividends. After all, gold is a commodity and as such – the only way you can make money is when the asset increases in price. In that case, this will be reflected in your SDF Gold ETF investment – which you can withdraw at any time during standard market hours.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

3.iShares Core US REIT ETF – The best ETF in Romania for real estate investments

There is often a misconception in Romania that the only way to invest in the real estate market is to buy a house. This means a mortgage commitment of over 35 years or a significant lump sum investment. The good news is that you can still invest in the real estate market with a small amount in the form of a REIT ETF.

For those unfamiliar, a real estate investment trust – or simply REIT – will own a portfolio of properties. This could focus on a particular sector – such as commercial properties, residential units or retail parks. Either way, as a REIT investor you will be able to grow your money just as you would if you were buying a house.

That means you’ll be entitled to your share of the monthly rental payments. You’ll also make a profit when the REIT’s value increases – which it will if the properties it owns appreciate in value. If this sounds appealing to your long-term investment goals, we recommend the iShares Core US REIT ETF.

Simply by meeting the minimum investment requirement of just $50 with an FCA broker like eToro – you can invest in the US real estate sector. In fact, this ETF will give you access to over 151 individual REITs – meaning you are investing in thousands of properties across the US.

It covers virtually every sector imaginable – such as healthcare facilities and hospitals, multi-family units, individual households, shopping malls and office buildings. The biggest advantage is that this ETF charges a management fee of just 0.08% per year – so a $10,000 investment would only cost $8 annually!

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

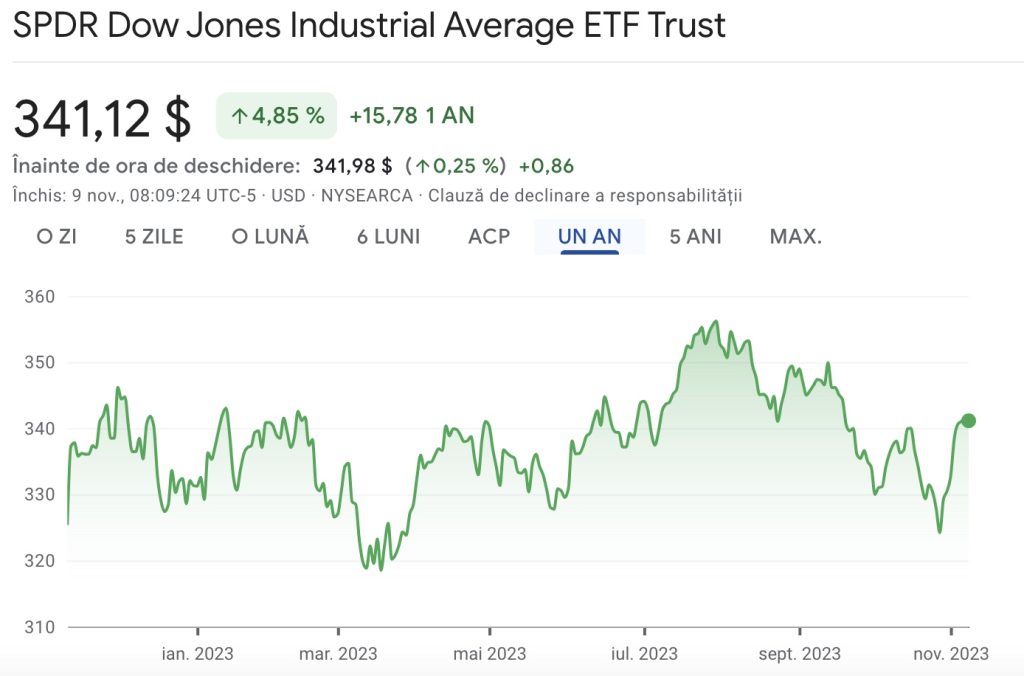

4. SPDR Dow Jones Industrial ETF – The best ETF Romania for the Dow Jones index

This ETF is the best option on the table for those of you looking to invest in the Dow Jones index. For those who don’t know, the Dow Jones is a stock market index that is made up of 30 large-cap American companies. They come from a variety of sectors, and the index is one of the best ways to gauge the strength of several areas of the American economy.

This includes companies like Microsoft, SalesForce, Visa, Goldman Sachs, Home Depot, and United Health Group. The best part of all is that the 30 companies on the Dow Jones not only dominate their respective sectors – they all pay dividends. Once again, you can invest in this commission-free ETF on eToro from just $50.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

5. Vanguard Short-Term Bond ETF – Best Romania ETF to Buy for Hedging Against Uncertain Stock Markets

The broader stock markets have been on an uptrend since 2009 – meaning we are now in the longest bull market in nearly half a century. As such, many believe it is only a matter of time before the next market correction kicks in. In layman’s terms, this means that the stock markets remain on a downtrend for several months or even years.

Therefore, in uncertain times, it is wise to consider a hedging strategy for your investments. One of the best ways to do this is to consider the Vanguard Short-Term ETF. This ETF invests in short-term debt – most of which is focused on U.S. government bonds with maturities of 1-5 years. A portion of the ETF is also made up of high-quality corporate bonds.

However, the yields on bonds held by Vanguard ETFs in the short term are very low – meaning you’ll be lucky to beat inflation. However, you’ll be able to put your money in as safe and secure an investment vehicle as possible. Essentially, this is not a long-term ETF.

Rather, it is a way to pull your investment capital out of the stock markets until everything seems to indicate that a new bull market is in full swing. In that case, all you have to do is withdraw your money from the short-term Vanguard ETF and re-inject it into the stock market.

Only this time, you won’t be buying your chosen stocks at inflated prices. Instead, you’ll be re-entering the market when many stocks are likely to be undervalued.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

6. Vanguard Growth Index Fund ETF – The best ETF in Romania for growth stocks

Growth stocks are highly sought after by investors in Romania who are aiming for above-average returns – and are willing to take on more risk to get there. However, you can greatly reduce your exposure to this sector by investing in an ETF that focuses exclusively on the best growth stocks on the market.

From this perspective, the Vanguard Growth Index Fund ETF comes in first place. This ETF will give you access to over 250 individual growth stocks across a variety of sectors. That said, the ETF has a very consistent weighting in the top 10 holdings, with a 47% allocation. This includes Apple, Microsoft, Amazon , Google, Facebook , Tesla , Visa, NVIDIA, Home Depot, and MasterCard.

As you may know, many of the aforementioned stocks have performed extremely well in recent years. In fact, many have seen double or even triple-digit gains in 2020 alone. As for the performance of this specific ETF, the returns over the past five years have been phenomenal.

For example, in the five years prior to this writing, the Vanguard Growth Index Fund ETF was priced at just $102 per share. Fast forward to the beginning of 2026 and the same ETF is trading at $256 per share. That translates to five-year returns of over 150%. Advantage #1 – the expense ratio for this top ETF is just 0.04% per year.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

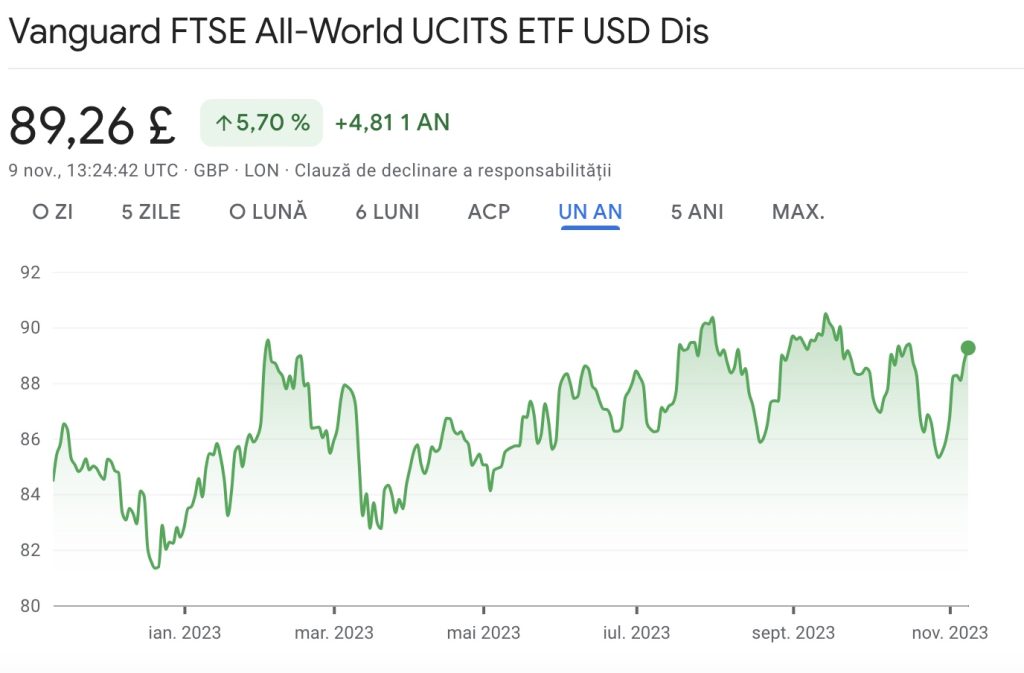

7. FTSE All-World UCITS ETF – The best ETF in Romania for a global equity portfolio

While many of the ETFs discussed on this page have focused on stocks listed in Europe and the US, some of you may be looking to gain exposure to a market with greater global exposure. In that case, there is no better option than the FTSE All-World UCITS ETF. In short, this ETF will give you access to over 3,500 individual stocks from a variety of economies.

With companies from Romania and the US covered, you will also invest in companies based in Japan, China, France, Switzerland, Australia, Canada, Germany, Taiwan and many more. This puts the most diverse industries under the sign of balance – covering everything from electricity, materials and healthcare, to finance, technology and telecommunications.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

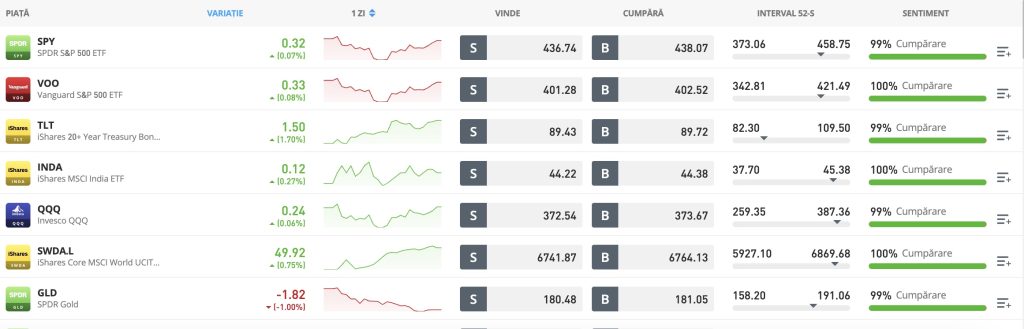

8. SPDR S&P 500 ETF (SPY) – The most popular ETF for investing in Romania with shares in over 500 companies

Available on eToro, Capital.Com, and elsewhere, the S&P 500 was the first ETF to hit the market in 1993. It is also the largest ETF, with an impressive $378 billion worth of stocks under management.

SPDR S&P 500 is an index tracking instrument. It tracks the S&P 500 index in the US. This index tracks the 500 largest companies in the US. SPY holds shares in 505 companies in total, with Apple holding the largest position in 2023, with 7.39% of the portfolio. Information technology is the largest sector covered, with 28% of the portfolio.

Considering how popular it is and what place it currently occupies in this sector, we can assume that the SPDR S&P 500 ETF will be among the most popular ETFs to invest in 2026.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

9. US Oil Fund – Best ETF to Buy for Oil Price Investing

If you’re looking for an alternative asset class that’s currently in great shape – why not consider oil? You don’t have to worry about storing or transporting large barrels to gain access to this market. Instead, you can invest indirectly in oil through an ETF.

The best option for this is the United States Oil Fund ETF – which attempts to track the benchmark West Texas Intermediate (WTI). For those unfamiliar, this is the main U.S. oil benchmark. In short, if global oil prices rise, the United States Oil Fund ETF should follow suit.

As you probably know, the value of oil hit its lowest price levels in early 2020, when the coronavirus pandemic took hold. But over the past 11 months or so, oil has been on an upward trajectory. This is clearly evident in the price of the United States Oil Fund ETF.

For example, you would have paid $17 at the end of April 2020. As of this writing, the same ETF has been trading above $40 since March 2026 . This means that in less than a year, the United States Oil Fund ETF has achieved gains of over 135%. If you like this ETF – you can enter and exit your position at any time during standard market hours.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

10. iShares Core High Dividend ETF – The best ETF in Romania for solid dividend stocks

Risk-averse investors in Romania will often build a diversified portfolio of high-quality dividend stocks. This paves the way for slow, steady capital gains along with regular dividend payments. But why settle for just a few dividend stocks when you can invest in over 75 through an ETF?

The iShares Core High Dividend ETF doesn’t just focus on dividend-paying companies – it focuses on those with a long track record on the stock market. This allows you to invest in a more predictable manner – as you’ll be supporting companies like Johnson & Johnson, Procter & Gamble, Exxon Mobile, Chevron and Cisco.

As you probably know, some of the companies mentioned above have been paying dividends for decades. As always, the ETF will collect dividends throughout the month and make a one-time distribution quarterly. You also have the chance to make money when the value of the 75 stocks held by the ETF increases in value overall.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

What are ETFs?

An exchange-traded fund, or ETF, is a portfolio of assets that are traded on a stock exchange. These investment funds include a variety of securities, such as commodities, bonds, stocks, and more, and can track a wide range of assets, indices, sectors, and strategies.

Trading ETFs, often called a “basket” of assets, allows investors to buy shares of a set of securities without actually buying the underlying assets. They can diversify their portfolio and invest in a variety of assets, markets, and industries without buying individual stocks.

How ETFs work

Exchange-traded funds, also known as ETFs, work by pooling funds from different investors, called shareholders, to purchase a variety of assets with the aim of generating a return for their holders. However, an exchange-traded fund is interesting as an investment product due to its many features that significantly differentiate it from other types of investment funds.

First, mutual funds are actively managed, meaning that managers choose which assets to buy to increase the fund’s profitability. In contrast, ETFs are passively managed and do not require much action from the investor to mimic the performance of a financial index.

Another major difference relates to how you trade and buy shares in exchange-traded funds. ETFs are traded in the same way as stocks on secondary stock markets, meaning investors can buy and sell instantly because prices are displayed in real time.

The basic principles by which ETFs operate are liquidity, transparency, taxation, and fee collection.

How to Choose the Best ETFs to Invest in – Basic Criteria

We discussed 10 of the best Romanian ETF investments to consider in 2026 . However, there are thousands of ETFs you can invest in from Romania – which means you are well advised to do your own homework.

There are several key criteria you can consider to find an ETF that is right for your financial goals – which we will detail below.

Asset class

First, take a step back and think about the type of assets you want to have access to. In the case of the 10 ETFs we discussed earlier, we covered a variety of asset classes.

This was to illustrate how diverse the ETF space is. For example, if you want to invest in a specific stock market tracking fund, such as the FTSE 100, FTSE 250, Dow Jones, S&P 500 or NASDAQ Composite – there are plenty of ETF providers to choose from. This covers ETFs similar to Vanguard ETFs, such as iShares, Invesco, BlackRock, SDPR and many more.

Or you could consider a specific niche of the equity space – such as growth stocks, dividend stocks or small-cap stocks. Outside of the equity space, there are also ETFs that can track commodities like gold, silver and oil – as well as corporate and government bonds.

Potential returns

Once you have an idea of what asset classes you like, you need to think about your long-term goals. For example, if you are aiming for above-average market returns, then ETFs that track growth stocks, high-yield corporate bonds, or volatile equity markets are more likely to suit you.

Or, if you prefer a more modest approach to risk and reward, then we recommend looking at ETFs that invest in safe asset classes. This could be a REIT ETF that tracks US and UK property, or an ETF that focuses on US Treasuries. The way to gauge your potential return is to look at the past performance of the ETF in question – perhaps over the last 10-20 years.

Risk

In short, the higher the financial return you get from an ETF investment , the more risk you should be willing to take. This is the classic risk-reward conundrum.

The risk you take on ultimately depends on the types of financial instruments and markets that your chosen ETF seems to track. For example, an ETF that tracks growth stocks will be more advantageous in this regard than one that invests in US Treasuries. However, the risks of investing in growth stocks are also much greater.

Essentially, although ETFs allow you to invest in a diversified basket of assets – there is still every chance that you will incur a financial loss. As such, make sure you have a firm understanding of the degree of risk you are taking on.

saving

It is also a good idea to think about which economies and markets you want to invest in. For example, if you are bullish on several sectors of the Romanian economy, an ETF targeting the FTSE 100 would be the best fit for you. If the US is the market you are interested in, then an ETF targeting the S&P 500 would be ideal.

So if you have a slightly higher risk appetite, it is also possible to invest in emerging markets. For example, the FTSE All-World UCITS ETF gives you access to some of the fastest growing global economies of the last decade. This includes everything from South Africa, Brazil and India to China, Thailand and Taiwan.

Essentially, trying to invest in these diverse markets on a DIY basis is very difficult as a retail investor. This is why ETFs are the best option available to you – because you can invest in hundreds of emerging stocks with a single trade!

Revenue or growth

It is also important to understand how you intend to make money from an ETF investment. For example, all ETFs are listed on a public stock exchange – meaning their value will rise and fall throughout the day. This will work in your favor if the ETF’s NAV (Net Asset Value) increases.

In other words, if the value of the assets held by the ETF performs well overall, so does the price of the ETF shares in question. Otherwise, you will make capital gains when you eventually cash in. Therefore, some ETFs are also great for generating regular income.

This includes ETFs that track REITs, dividend stocks, and bonds. In most cases, your dividend payment will be distributed every three months. However, some ETFs – such as those that track commodities like gold and oil – will not generate any income. Instead, you will only make money if the underlying asset increases in value.

Best ETF Investment Platforms 2026

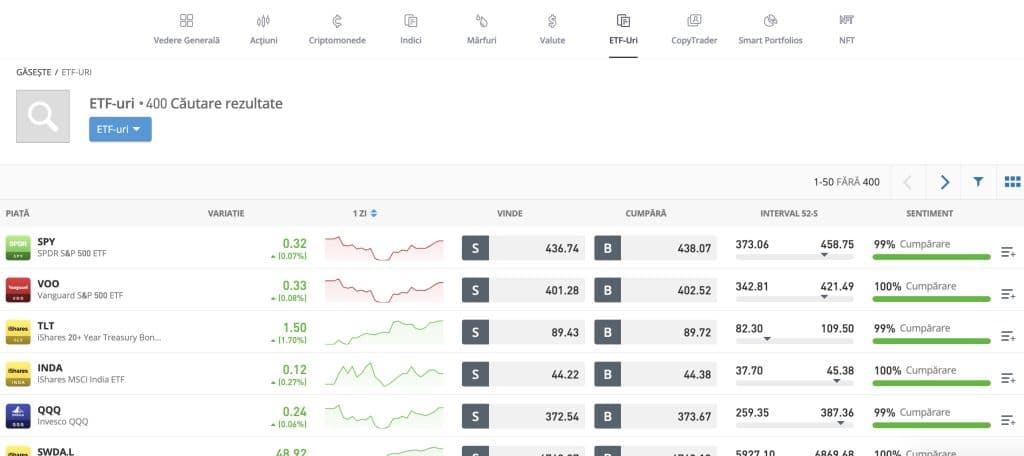

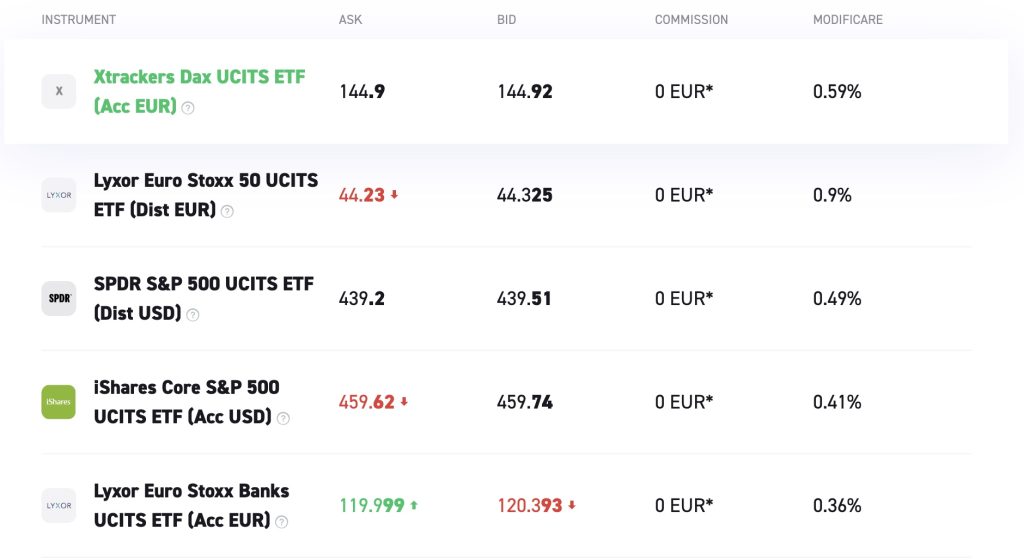

So, now that we’ve explained what you need to consider to choose an ETF that will meet your financial goals – now we need to talk about trading platforms . That is, to invest in an ETF – you need to first find a suitable brokerage site. Choosing your broker should not only focus on whether or not they offer your chosen ETFs, but also on the fees and commissions they charge.

To help you head in the right direction – below we discuss the best ETF brokers in Romania for investing in ETFs.

1. eToro – Buy ETFs

In fact, all of the best ETFs to buy that we’ve discussed today can be purchased with the click of a button on eToro.

What’s more, you only need to meet a $50 minimum investment requirement for each ETF – which is significantly less than going directly with the provider. This allows you to invest in a basket of different ETFs without needing a large capital outlay. We also like eToro because it offers a range of passive trading tools that you can combine with a traditional ETF investment.

For example, this stock broker offers dozens of CopyPortfolios across a variety of strategies and objectives. This includes a portfolio targeting the best renewable energy stocks and one tracking digital currencies like Bitcoin and Ethereum. Since a crypto-specific ETF has yet to hit the retail market in Romania, this is a great substitute.

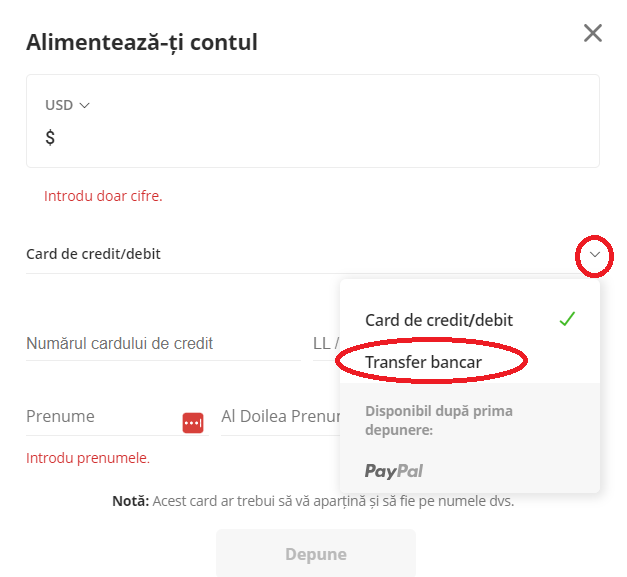

In terms of initiating an active investment of funds at eToro, opening an account takes a few minutes. You can easily deposit funds with a Romanian debit/credit card, Paypal or Skrill – all of which are processed instantly. If you want to make a bank transfer, this is also accepted – but it may take a little longer. Finally, eToro is authorized and regulated by the Financial Conduct Authority, and your trading capital is protected by the FSCS.

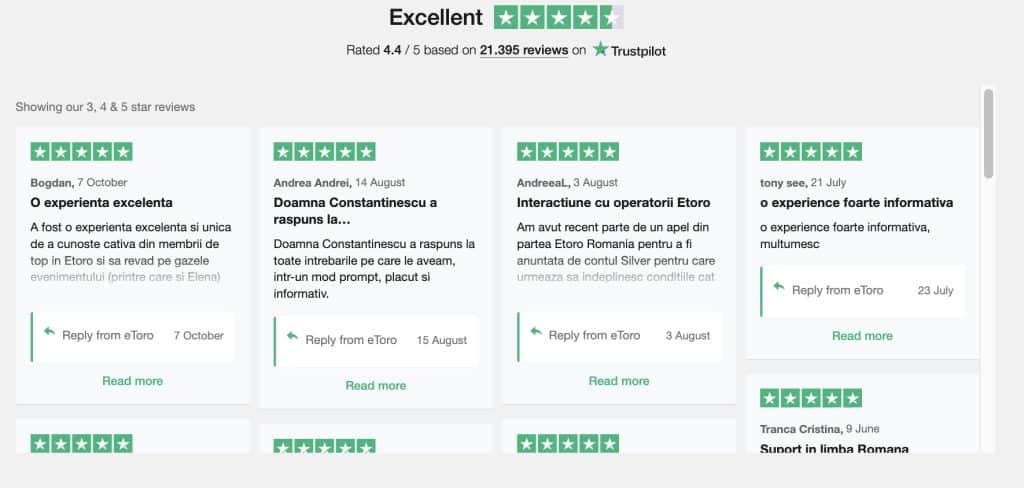

eToro Opinions

In addition to all of the above, our experts believe that the best indicator of a platform’s quality is the opinions of real users.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Pepperstone - You have access to over 100 ETFs

If you want a flexible approach to ETF trading, Pepperstone offers a diverse range of over 100 ETFs covering sectors such as mining, energy, technology, fixed income and retail. Pepperstone provides access to ETFs that track the performance of equity markets in 35 countries and 6 continents. With themes as diverse as Asia Pacific, banking, energy, technology and more, you can build a portfolio tailored to your investment vision and objectives.

Pepperstone eliminates unpleasant surprises by offering trading at direct exchange rates, with no bid/ask spread added. The low commission of $0.02 (USD) per share, per trade makes investing in ETFs with Pepperstone a cost-effective option.

By trading CFDs, you don't take ownership of the ETFs, but rather make assumptions about their underlying price. You can take advantage of ups and downs without restrictions, with the option to use leverage to maximize your earning potential. Low commissions and the ability to apply automated strategies round out the trading experience.

Pro:

Cons:

Your capital is at risk

3. XTB - The most suitable platform to invest in EFT with access to over 5700 financial instruments

XTB is another ETF Romania broker suitable for investing in EFTs. As one of the most competitive EFT and CFD brokers in the global market , XTB offers traders instant access to hundreds of global markets. In order to remain competitive, the trading platform has undergone several improvements and developments.

The broker currently has over 525,000 clients in its branch network , which is located in over ten countries around the world. According to the source , a survey conducted by XTB in Romania found a continuous increase in the proportion of people who start investing by buying ETFs: in 2021 it was 30%, at the end of 2022 it increased to 57% and reached 58% in August 2023.

After carefully analyzing the platform, we found that it offers users access to over 5700 financial instruments and 1850 CFDs on shares, which makes it very secure. The XTB team says that their main goal is to develop technology and increase their product offering, which has made XTB one of the most well-known and profitable online investment platforms in the world.

Jakub Zablocki founded the broker XTB and now has some of the most famous politicians as ambassadors. Ambassadors of the XTB platform include Connor McGregor , Joanna Jdrzejczyk and Ji Procházka. It was called X-Trade and was the first leveraged forex broker on the Polish market in 2002. It was renamed XTB after the Polish markets introduced new rules.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

4. Admiral Markets - Buy ETFs starting at 1 euro

Admiral Markets has become a renowned ETF broker in Romania over the past 20 years, with access to markets in over 130 countries around the world . The platform has 16 offices and offers its users 24/7 online support from anywhere in the world and in any language.

Admiral Markets offers a selection of over 8,000 financial instruments and allows you to trade with leverage. These include stocks, ETFs, CFDs, indices and bonds and can be traded on over 7,500 markets.

Those who want to buy shares must deposit at least 1 euro and in order to be able to make transactions they must make a minimum deposit of at least 25 euros. However, the platform compensates for this by providing a large number of account types, each with its own resources and parameters, which are designed to meet the needs of each individual investor.

Investors can choose the right account type depending on the indicator package they want or the deposit and trading amounts they want to allocate. The Admiral Markets platform suggests that it guarantees that its users' assets are protected and always at hand, as they are kept separate from the company's capital in segregated accounts at banks around the world.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

5. Libertex - Low-cost trading platform with selling prices equal to buying prices

Libertex is a popular ETF Romania broker that allows traders to access 51 pairs of FX Libertex logos, commodities, indices, ETFs, cryptocurrencies and stocks. The platform has over 3 million members and is one of the best brokers regulated in Romania by CySEC.

Along with its own trading platform, interested investors can access Libertex through MetaTrader 4 and MetaTrader5. Both can be accessed online or via a mobile app. In the case of the MT4 platform, it can be downloaded to your desktop, in case you need to install an automated robot. Libertex does not charge any spreads for forex transactions, instead charging a commission.

With a minimum deposit of $100 , investors can start trading by funding their account with credit/debit cards, bank transfers, or e-wallets.

On Libertex users can also access leveraged trading options with Libertex, and educational material is on hand to learn to trade with proper risk management, as well as customer support in case any questions or concerns arise.

How to buy the best ETFs in Romania

To conclude our guide to the best ETFs for 2026 - we'll walk you through the process of making your first investment.

The steps below are based on the FCA broker eToro - which allows you to invest in the best ETFs in Romania with no commissions and with a minimum stake of just $50.

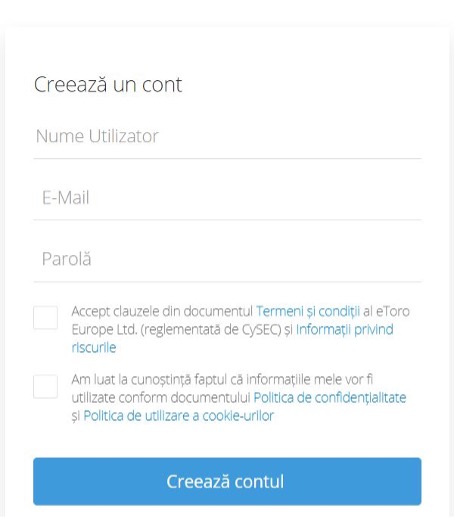

Visit the eToro website and open an account. This will require some personal information and contact details – and should take no more than 5 minutes to complete. You will also need to verify your mobile phone number and email address. To ensure that eToro complies with FCA regulations, you will also be asked to upload a copy of your passport. If you do not plan to invest more than $2,250 now and do not have the documents at hand – you can upload them at a later date. Now it’s time to make a deposit into your eToro account. You can choose from the following payment methods: If you know which ETF you want to buy right now – search for it. If not, click on the “Trade markets” button, followed by the ETF. After you click the “Trade” button next to the ETF you want to invest in, an order box will appear. All you need to do is enter your stake (minimum $50) in USD. Finally, click the “Open Trade” button to complete your commission-free ETF investment! Once you have invested in an ETF on eToro, you can keep track of its current market value by clicking on the “Portfolio” button. This will show you how much your investment is worth in real time. You can exit your ETF investment at any time during standard market hours. Upon exit, the cash will be instantly available in your eToro account. Until then, you will be entitled to your share of dividends – as the ETF provider makes a distribution.Step 1: Open an account and upload your ID

Step 2: Make a deposit

Step 3: Search for ETFs

Step 4: Invest in an ETF

Step 5: Dividends and Cash Flows

Conclusion

Our experts have reviewed the best ETFs for 2026 in Romania in this guide . They have covered a wide variety of markets - from the FTSE 100, S&P 500 and gold, to growth stocks, oil stocks and dividends. Ultimately, it is important to note that no two ETFs are the same, so it is very important for investors to do their own research before selecting the ETFs that suit their needs.

If you’re ready to start your ETF investing journey right now, eToro is a great ETF broker to consider. The FCA-regulated broker offers many of the best ETFs to invest in – all of which can be traded commission-free. The biggest advantage: the minimum investment is just $50 per ETF – so you can easily diversify your portfolio with a small amount of capital.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently asked questions

Sources :What are ETFs and how do they work?

What are the advantages of investing in ETFs in Romania?

What is the most popular ETF Romania broker for investing in ETFs in Romania?

Can ETFs be traded by novice investors?

How can investors choose the best ETFs for their portfolio?