Cele mai bune platforme de tranzacționare pentru începători din 2026

Folosește instrumentul nostru interactiv de căutare pentru cele mai bune acțiuni, Forex, CFD, Cripto, platforme de tranzacționare sociale sau de zi românești de care ai nevoie.

- Descriem numai brokeri reglementați

- Descoperim costuri ascunse, comisioane și spread-uri

- Vezi brokeri care au recenzii bune pentru asistență

Reglementat complet

Recenzionat la nivel înalt

Sigur și de încredere

Taxe transparente

Mobil

If you are based in Romania and are looking for the best platforms to trade cryptocurrencies online, you will need to identify a provider that meets your needs .

We believe that the best trading platforms in Romania offer low commissions, a wide variety of financial instruments, including access to Romanian cryptocurrencies , easy accessibility, and high-quality customer service. In addition, of course, you will need to make sure that the trading platform you choose is regulated by the FCA.

In this guide, we review the best trading platforms in Romania, of the year 2026.

Top Trading Platforms of the year 2026 – Romania

[stocks_table id=”18″]

Given the multitude of trading platforms in Romania’s online domain, choosing a particular provider can be a real challenge. Before signing up, you will want to find out specific information about the trading broker – such as the amount of commissions charged by it , the types of assets you can trade, and how easy the platform is for the user to access. To save you the effort of countless hours of research, we present below a selection of the best trading platforms on the Romanian digital market at the moment.The best trading platforms in Romania evaluated

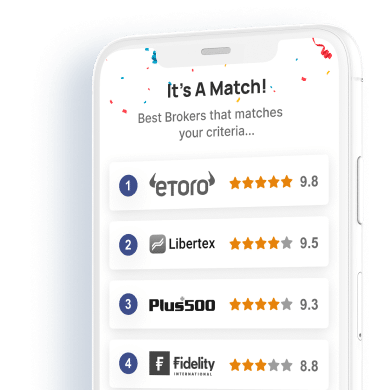

1. eToro – Overall, the best stock trading platform and not only in Romania

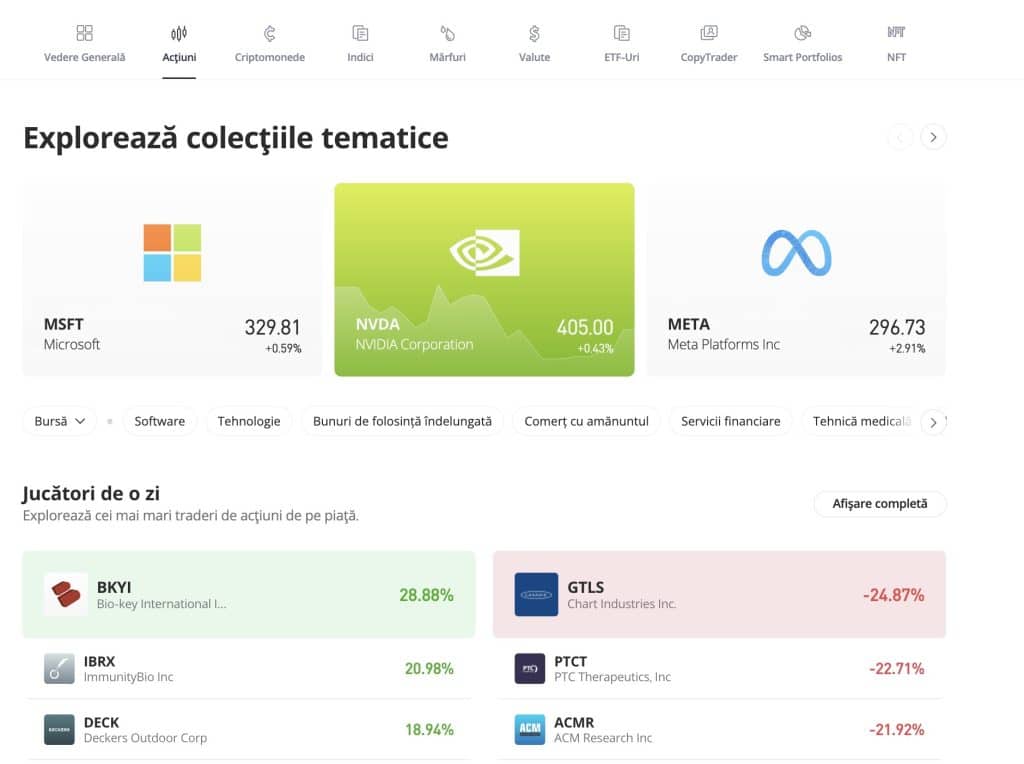

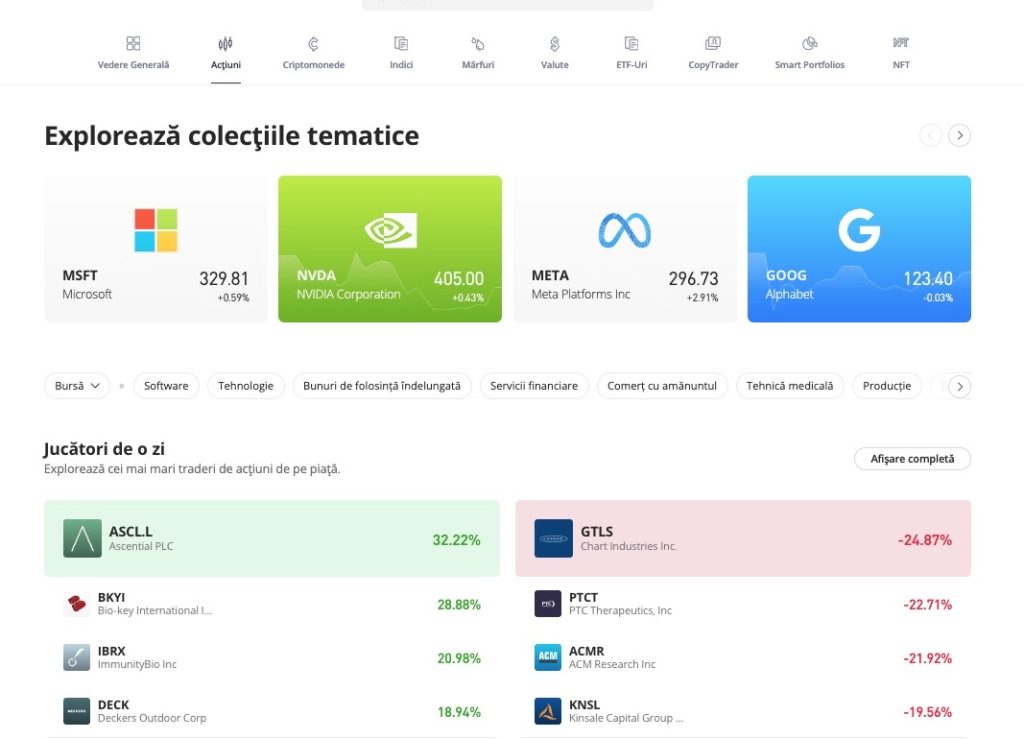

Launched in 2007, eToro is a trading platform with a database of over 17 million clients and is our recommendation for the best trading platform in Romania. This highly rated platform makes it easy for you to trade a wide range of asset classes with the click of a button .

This includes over 2,400 stocks from 17 international and Romanian markets, 250+ ETFs (exchange-traded funds), 16 cryptocurrencies of the future , and thousands of CFDs . Regarding the latter, they include everything from gold and silver to oil and forex.

Each of the stock market investments indicated by eToro involves operating transactions . There are no annual fees for maintaining the platform, and deposits will cost you only 0.5% .

In terms of user accessibility criteria, eToro is a perfect trading platform for beginners. Both the process of identifying assets and placing buy-sell orders can be done easily, due to the fact that the platform is devoid of complex financial jargon . In addition, there is even a Copy Trading function, which allows you to invest passively.

The platform works by selecting an authorized trader , choosing the amount of capital you want to invest ( a minimum of $100 ~ 460 RON) , after which all ongoing trades will be found in your personal eToro portfolio. If you want to trade smaller amounts, eToro requires a minimum stake of $25 for cryptocurrencies, $50 for stocks, and $100 ~460 RON for ETFs .

In terms of safety standards, eToro is authorized and regulated by the Financial Conduct Authority (FCA). It is also licensed by regulators in Cyprus and Australia. Essentially, by opening an account with eToro , your funds are covered by the FSCS. Finally, eToro provides an optimal selection of payment methods – including debit/credit cards, bank transfers and e-wallets such as PayPal .

At the same time, eToro offers an excellent mobile application, which highlights the full functionality of the desktop platform.

Pro:

Cons:

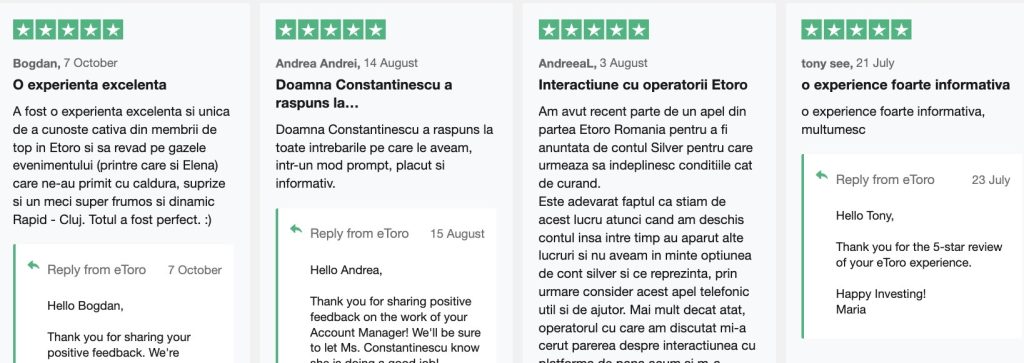

eToro Opinions - Real User Reviews

When we analyze trading platforms, we also take into account the opinions of customers who already use each trading platform. In the case of eToro, we also have a separate page dedicated to eToro Opinions . Below we have also inserted some reviews, left by eToro users from Romania.

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Pepperstone - Trading Platform with Global Access to Various Financial Instruments

Pepperstone stands out as a trusted trading platform, offering global access to a diverse range of financial assets. Successfully launched for over 10 years and very active in the market, Pepperstone attracts attention with its quality services and advanced technology that it makes available to traders.

With a solid user base, Pepperstone stands out by facilitating trading in over 150 financial instruments, including currency pairs, indices, precious metals and cryptocurrencies. The platform offers an efficient, easy-to-use trading environment for both beginners and experienced traders.

Pepperstone is regulated by several prestigious organizations in the financial industry. These include:

- ASIC (Australian Securities and Investments Commission). This is a high standard of regulation, providing significant protection for clients.

- FCA (Financial Conduct Authority). The FCA imposes strict standards on financial operators to protect the interests of consumers.

- DFSA (Dubai Financial Services Authority)

User funds are held in separate accounts from the company's funds, and for funds up to $100,000, Pepperstone offers additional insurance.

Pro:

Cons:

Your capital is at risk

3. XTB - trading platform with a single standard fee of 0.1% for over 2,100 financial instruments

XTB is considered one of the largest brokers on the market , with almost 20 years of experience in this field. Its advantage lies in the regulation it offers, but also in the development of its own platform called xStation, which offers users over 2,100 financial instruments, including 48 currency pairs. XTBl is considered a global leader in forex and CFD trading.

XTB is the perfect platform for those interested in trading, but without operating with direct risks. When it comes to CFD trading, XTB gives you access to over 3500 stocks and ETFs, 40+ stock indices and over 20 cryptocurrencies for those interested in crypto trading. Those interested in forex trading, too, will find the XTB platform particularly useful, as it offers access to over 49 currency pairs.

Now, let's take a look at the costs associated with trading with XTB. A standard fee of 0.1% is applied to each CFD trade. One of the advantages of XTB over other platforms is the variety of sub-platforms it offers: Forex & CFD in 20202, XTB also allows the use of the MetaTrader 4 platform, which is one of the most popular and sophisticated platforms for online trading. Both platforms are also available on mobile and tablet, which makes it easy to access the market anytime, anywhere.

Furthermore, XTB has also developed a mobile application that allows users to trade at any time convenient for them , making it a much more accessible and efficient option for those who want to have everything at hand. xStation mobile is available for both Android and iOS devices, which is a competitive advantage for XTB. The application also offers the possibility of trading with the help of over 1,500 instruments that users can use wherever they are.

At the same time, our experts also analyzed the possibility of trading assets directly, and this is where the main disadvantage of XTB emerged. Using this platform you will only be able to trade CFDs, not assets directly. Similarly, XTB does not offer services that support Web3 , DeFi or NFT trading, which are emerging and innovative areas in the crypto world.

If you are a beginner trader, you don't have to worry about using XTB, as the platform offers a series of weekly webinars and educational trading courses from the broker, which will help you better understand how XTB works. For experienced traders, they can use the advanced trading tools of xStation and the offers on the available markets. So, if you trade CFDs, stocks, cryptocurrencies and currency pairs - XTB is the perfect option. You can access the platform right now, via the button below.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

4. Admiral Markets - trading platform with 20 years of experience in the market

Admiral Markets is a well-known trading platform, thanks to its age and experience of over 20 years in the market. It has become an international financial company that provides its traders with robust financial security and various policies to ensure their protection and safety. Currently, the company's name has been changed to Admirals, this rebranding is the beginning of new integrated risk management solutions.

Admiral is a broker specializing in Forex and CFD trading and offers traders a variety of products and trading assets. With 4,000 CFDs and 8,400 tradable symbols to choose from, they are sure to find exactly what they are looking for. This is a boon for traders who prefer to keep all their positions in one brokerage account, making portfolio management simpler and more efficient.

Pro:

Cons:

One of the most important key features of Admiral is its focus on the security of traders using the platform: funds are always at their disposal and are kept in the most renowned tier 1 banks in accounts separate from the company's funds, and for funds reaching up to $100,000, Admiral offers additional insurance.

Your capital is at risk

5. Libertex – Low-Cost Trading Platform with ZERO Differences between Selling and Buying Prices

Libertex is a zero spread CFD trading platform , meaning that the selling price is equal to the buying price, regardless of the assets you intend to trade. At the same time, the platform allows its users to benefit from top stock market quotes, charging minimal commissions, below 0.1% per order, from both parties involved in the transaction.

For the popular currency pair NZD/USD, for example, the platform will charge a commission of only 0.012% . Not only stock exchanges can be traded on Libertex, but also a wide range of other financial instruments, such as: CFDs, commodities and ECN currencies .

For CFD trading, the platform applies a restricted leverage of 1:30 for major forex trading pairs and a lower leverage for trading other financial instruments.

Libertex offers investors two trading platforms , Meta Trader 4 and its own in-house built platform. Both platforms are available for both desktop and mobile versions. In the case of the MT4 platform , it can be downloaded directly to your device – making it an optimal option when you want to install and use an automated robot.

Libertex offers investors two trading platforms , Meta Trader 4 and its own in-house built platform. Both platforms are available for both desktop and mobile versions. In the case of the MT4 platform , it can be downloaded directly to your device – making it an optimal option when you want to install and use an automated robot.

In terms of security, it is good to know that Libertex is not regulated by the FCA . Instead, it is regulated by the main EU license issuer, CySEC. Libertex has been on the financial services market since 1997, so it has a remarkable history, which extends over a period of over two decades.

To start trading with Libertex, you need to create an account and deposit a minimum amount of $100. The account can be funded through various methods, such as: credit or debit card, bank transfer or e-wallet. Once you already have an account created, for the following trades, the platform will require a deposit of only $10.

Pro:

Cons:

85% of retail investor accounts lose money when trading CFDs with this provider.

6. OKX - Top Broker in 2026

OKX is an online cryptocurrency exchange that facilitates trading in a range of digital currencies, from Bitcoin to Chia. It has stood out in the crypto market due to its trading volume , providing users with numerous options and useful tools that simplify the buying and selling process.

The broker boasts over 20 million customers worldwide who currently use OKX services. The platform is an ideal option for both experienced and new traders as they can buy and sell with low commissions, making it a top choice for investors in 2026.

At the same time, it is necessary to specify that OKX provides interested traders with a wide range of the most promising cryptocurrencies on the market , which means that you will be able to access and enjoy the benefits of some of the most top aspects of the crypto field.

Pro:

Cons:

Banii dvs. sunt în pericol.

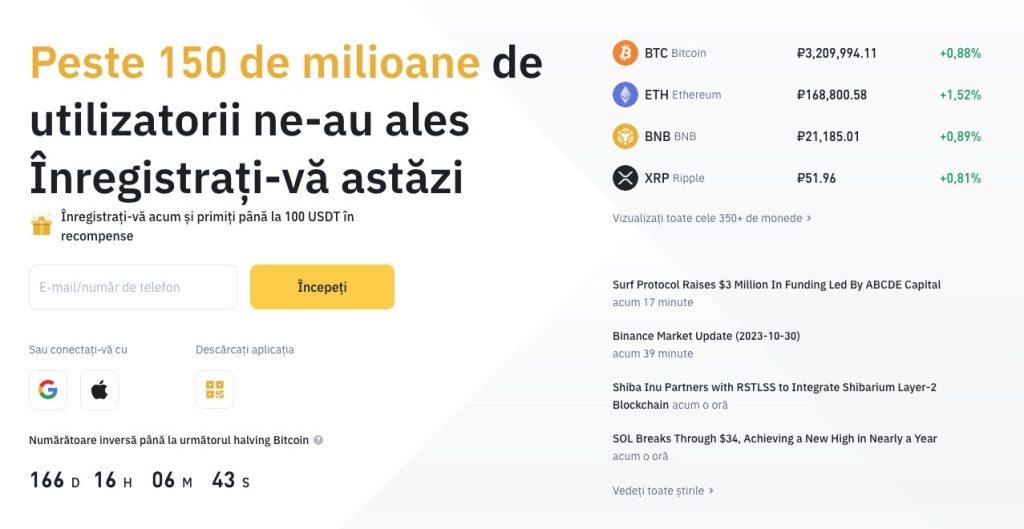

7. Binance - cryptocurrency trading platform, with over 150 million registered users

For quite a long time, it was considered that crypto trading is something necessarily complicated, complex and difficult to do. The platform offers access to over 300 digital assets, including Bitcoin, Ethereum , Binance Coin and many others. Even though it does not offer a hardware wallet, Binance guarantees an advanced level of security to its users - 2FA authentication, KYC verification .

The variety of trading instruments is another big advantage of Binance. In addition to spot and margin trading, Binance also allows for futures and options trading, as well as staking, lending, mining, and other cryptocurrency-related activities. To do all of this, you don't necessarily need access to a desktop or laptop - Binance also has a reliable mobile app.

One of the drawbacks of Binance is that it is not available in some countries due to local regulations or economic sanctions. For example, Binance does not accept users from the United States, Iran, Syria, or North Korea. Binance can also be subject to cyberattacks or technical issues that can affect the operation of the platform or the security of users’ funds.

Here is a list of pros and cons for Binance, grouped into two columns:

Pro:

Cons:

In conclusion, Binance is a very attractive cryptocurrency trading platform for users looking for security, speed, variety and low costs. To create an account on Binance, click the button below and go directly to the platform's website.

Your capital is at risk

How to choose the best Brokers in Romania

With hundreds of online trading platforms now offering accounts to Romanian residents, it is advisable to spend some time thinking about what your priorities are .

For example, are you planning to access certain investments on the stock market, such as Romanian stocks or forex, or are you more concerned with low fees and commissions ? Or maybe you are looking for a specific feature – such as automated trading ?

However, there are many criteria that you need to consider when looking for the best trading platform in Romania. In order to support you on this journey, we will list below the most important factors to consider when looking for the best trading broker in Romania - criteria that Trading Platforms experts analyze when selecting the best trading platforms.

Regulation and safety

The best brokers in Romania should be licensed by at least one reputable financial institution. Ideally, their licensing authority should be CySEC - which is responsible for maintaining the trading and investment industry in Romania in a safe and transparent climate for all. By partnering with a CySEC broker in Romania, you will benefit from a number of safety measures.

This range of measures includes:

- Segregated Funds: The best trading platforms in Romania that are regulated by CySEC must keep client funds in segregated bank accounts. In simple terms, this means that the platform cannot touch your money to repay its own debt.

- Risk Warnings: All CySEC regulated platforms must clearly state the risks associated with trading . This is usually displayed on the homepage with a percentage intended to highlight the number of retail clients who lose money.

- Regular Audits: The best brokers in Romania that are regulated by CySEC will be required to have their records audited regularly. This ensures that both you and your fellow investors can trade in a prudent and secure environment.

In addition to the above, the best trading platforms in Romania are also covered by the FSCS. This means that your funds are protected up to the first $85,000 - in the event that the trading platform ceases to exist.

With all this in mind, our top-notch trading platform in Romania is not only authorized and regulated by CySEN, but also by ASIC. It is also registered with FINRA in the US – meaning you benefit from regulatory oversight on multiple fronts.

ActiveE

There are thousands of financial instruments serving dozens of asset categories tradable online. But not all trading brokers in Romania will give you access to the stock market investments you want .

We believe that the best trading platforms in Romania offer the following assets:

- Actions

- BONDS

- ETFs

- INDICATORS

- fund

- commodities

- ERC20 coins

- Forex

Additionally, and perhaps most importantly, you need to find out whether you are trading CFDs or buying the asset directly.

When trading a CFD, you do not own the underlying asset. Instead, this allows you to easily sell short through a so-called short-selling operation and apply leverage of up to 1:30 .

If, however, you want to invest in the traditional sense, you will want to avoid CFDs. This is especially true if you want to build a long-term investment plan , as CFDs attract overnight funding. In our opinion, it is best to choose a trading platform in Romania that gives you access to both traditional assets and CFDs.

For example, eToro allows you to buy 2,400+ stocks, 250+ ETFs , and 16 cryptocurrencies, and even cryptocurrencies under $1 . It also allows you to trade thousands of CFDs on stocks, which, in addition to those mentioned above, includes forex, commodities, and indices.

commissions

When investors in Romania are looking for the best online platform for their needs, they will often focus on commissions. After all, the amount you have to pay to trade online can vary considerably .

The main commissions you need to consider when choosing the best brokers in Romania are as follows:

Stock trading fees

Stock trading fees don't just apply to buying stocks, but also to other traditional assets like ETFs , mutual funds, and investment trusts. In all cases, with very few exceptions, your chosen trading platform in Romania will charge a fixed trading fee.

In other words, no matter how much you invest, the commission will remain the same. It goes without saying that this favors investors who aim to trade large amounts.

- For example, let's say you signed up with the popular Tesla stock broker.

- If you purchased $150 worth of Tesla shares , the provider will charge you a flat trading fee of $11.95.

- This means that, in percentage terms, you pay a commission of almost 8%.

Then, when you cash out your Tesla shares , you will have to pay the $11.95 fee again .

In addition, the platform even waives the 0.5% stamp duty that you typically have to pay for stock purchases in Romania!

Trading commission

If you decide to trade assets via a CFD instrument, then your chosen platform will charge you a variable commission . This is more beneficial for entry-level traders as you will not be penalized for placing small orders.

As always, the amount of commission you pay may vary depending on the Romanian trading platform you apply to.

- For example, let's assume that the chosen Romanian trading platform charges a CFD commission of 0.2% per transaction sequence.

- If you participate with $500 , you will pay a $1 commission to enter the position

- If you close the trading position when it is valued at $750 , the 0.2% commission will increase to $1.50.

Of course, this may not seem like a lot to pay. However, the costs can quickly add up – making initially profitable trades somewhat unviable. This is especially true if you are using a trading platform that has a minimal commission policy.

Fortunately, the best brokers in Romania that we have discussed on this page allow you to trade CFDs without commission. This includes eToro and Skilling .

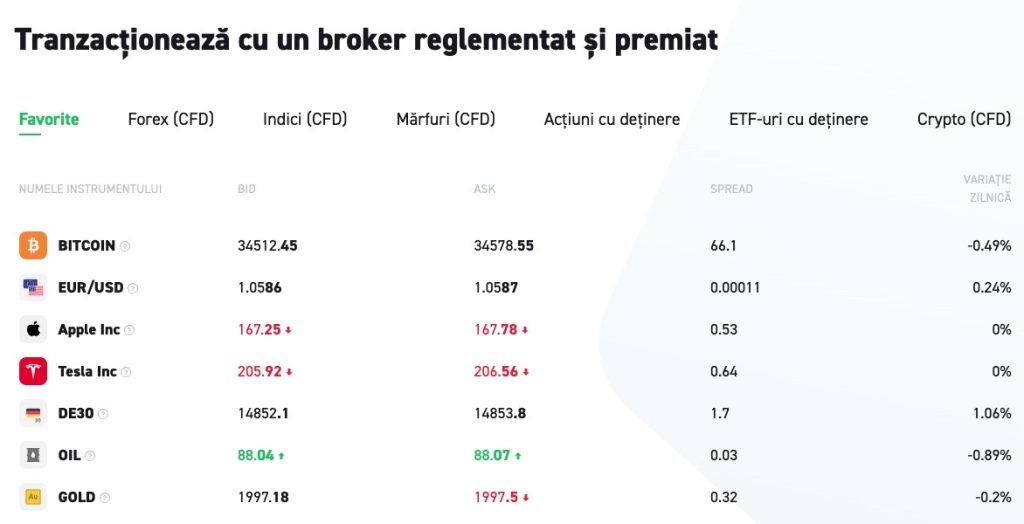

Spreads

If you are wondering how the best brokers in Romania make money without charging commission – the answer lies in the spread. This is simply the difference between the buying and selling price of the financial instrument being traded.

- For example, let's say you trade Apple shares on eToro

- The trading platform currently quotes a "buy price" of $135.10

- It quotes a "sale price" of $134.85

- Calculating the difference between the two prices gives us a spread of 0.18%

So what does this mean? The fact that when you open an Apple trade on eToro, your position is instantly depicted by the 0.18% percentage in red. In other words, your trade needs to increase in value by 0.18% for you to break even.

Other trading platform fees

The main costs to explore in detail are related to trading fees, commissions and spreads . However, there are other fees that your chosen trading platform in Romania might charge, including:

- Overnight funding: If you trade CFDs , you will invariably have to pay an overnight funding fee if your position remains open after a certain time of day. For example, in the case of eToro, this practice comes into effect after 00:00 Romanian time . This is why CFDs are only suitable for short-term strategies, as they are practiced by all trading platforms in Romania.

- Transaction fees: Some online brokers in Romania allow you to deposit and withdraw funds tax-free, while others will implement a fee . This may be based on your chosen payment method or because you are using a platform denominated in a currency other than USD.

- Inactivity fees: Certain trading platforms in Romania charge a fee if your account remains inactive for a certain period of time.

- FX Trading Fees: In many cases, Romanian brokers charge an FX fee when you want to buy, sell or trade an asset outside of Romania. For example, Capital will charge you a standard stock trading fee of $11.95 for buying US stocks , plus a 1% FX surcharge .

Overall, fees can and will have a major impact on your ability to earn profits, so first make sure you understand what you are paying for before opening an account.

Trading tools and features

Some brokers in Romania stick to basic operations, allowing you to buy and sell assets - and nothing more. In other cases, your chosen provider may offer an abundance of tools and features that can take your investing efforts to the next level.

Below, you will find a selection of useful tools offered by the best trading platforms in Romania .

Fractional ownership and low minimums

Not all traders in Romania want to risk thousands of dollars on a single investment. On the contrary, some of you might be just starting out and as such, you want to trade with small stakes. This is why we prefer the best brokers in Romania that offer "fractional ownership".

For those unfamiliar with this concept, this means that you can own or trade a "fraction" of an asset, rather than having to purchase it outright. A prime example of this is our recommendation for the best trading broker in Romania, the eToro platform, which allows you to trade cryptocurrencies from just $25 upwards .

In the case of stocks, the minimum is only $50. In other words, you don't have to fork out over $800 to buy a single Tesla share or $100,000 on a USD/AUD lot !

In line with fractional ownership, the best trading platforms in Romania allow you to start with a small amount. This translates into a low minimum deposit that is accessible to traders of all budget levels.

Automated trading

Automated trading is becoming increasingly popular in the online space. The main concept is that you can actively trade without the need for any documentation. In fact, some automated trading tools will take things to the next level by placing orders on your behalf. This operation favors not only inexperienced traders, but also those who do not have enough time to analyze the markets.

There are several ways to automate your trading. Some Romanians opt for the option of purchasing a trading robot , which they then install in MT4 . To do this, you will need to make sure that the provider you choose supports this third-party platform.

In conclusion, the safest way to get involved in automated trading is to go directly to an FCA regulated broker. eToro, for example, offers a Copy Trading feature that does not incur any additional fees. All you have to do is decide which of the verified eToro traders you want to copy, and the platform will then reflect all the trades in your own portfolio.

To provide users with relevant and up-to-date information about the most relevant automated trading platforms, we create and post reviews of cryptocurrency robots directly on our website. With their help, you can invest in Bitcoin and other popular cryptocurrencies. Below we also present a table of cryptocurrency robots that are worth paying attention to in 2026.

Orders

Regardless of the trading platform you use or the asset you want to access, you will always need to place a series of orders to execute your position.

This essentially allows your chosen platform to know what you want to achieve. All trading platforms in Romania offer buy and sell orders, this being a mandatory requirement for your entry and exit from trading.

However, the best providers in this space also offer risk management orders. These should include stop-loss and take-profit orders at a minimum, but trailing stop-loss and guaranteed stop-loss orders are also very useful .

Documentation and analysis

Unless you intend to trade in a relaxed manner, you should never execute a position without some form of documentation . Otherwise, you would be basically gambling. To support you in the documentation process, the best online trading platforms in Romania will offer you a wide range of analysis tools .

For example, platforms like eToro give you access to price charts for all of its featured assets. It also provides fundamental data on major stocks, as well as guidance on the current pulse of the market. Some of the best brokers in Romania also offer direct access to financial news, a particularly important element for long-term investors.

Demo account

Whether you are an experienced professional or a novice trader, demo accounts are invaluable. They are offered by the best trading platforms in Romania and allow you to gain access to real market conditions without risking any money. Instead, you will fall under the scope of simulated or virtual trading , which allows an investor to sell and buy without risking their real cash, the so-called paper trade operation .

For example, eToro offers demo accounts that come pre-loaded with $100,000 . You’ll still have access to the same markets, prices, and trading volume – which bodes well for testing the waters before you make a real deposit. Even if you have some online trading experience, demo accounts are also suitable for testing out new strategies.

Mobile application

The best trading platforms in Romania usually offer a mobile trading app , which is compatible with Android and iOS. Of course, you could also consider trading via your computer or laptop.

There may come a time, however, when you need to place a trade while you’re on the go. A prime example is Gamestop – which, in the 24 hours prior to the writing of this guide , saw its stock price drop by 60%.

As such, if you had held a position in this stock and were unable to close it out until you got home, your losses would have been significant .

On the other hand, if you had access to a top mobile trading app , you could have exited the position instantly and cut your losses substantially.

The best mobile trading apps also offer other key account features. For example, the eToro mobile app allows you to check your portfolio value in real time, deposit and withdraw funds, and even contact Customer Service via live chat.

Payment methods

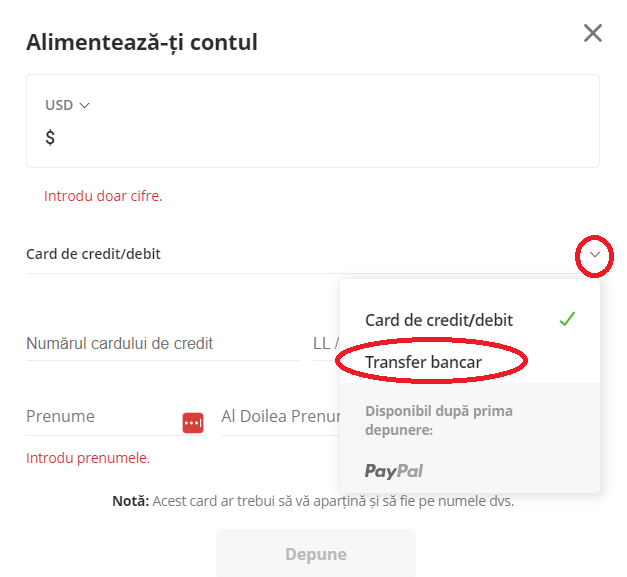

When you go through the process of opening an account with a trading platform, you will be asked to deposit some funds. The best trading platforms in Romania allow you to do this instantly with a debit or credit card. Similarly, platforms like eToro, Libertex and Skilling also accept e-wallets .

In conclusion, some trading platforms in Romania only accept deposits from bank accounts. This can take a few days to reach your trading account, which means it is not advantageous if you want to buy an asset immediately . You should also check what fees are attached to your chosen payment method.

Customer service

Identifying the customer support channels that the Romanian trading platform offers is always a good idea . Ideally, the provider should offer a live chat option. Phone support is also notable, giving you the opportunity to speak to an agent in real time. If, however, the trading platform provides support exclusively via email , it means that you may have to wait a few hours to receive a response.

How to get started with the Best Broker in Romania

This section of our guide will show you how to get started with the best online trading platform in Romania – eToro. We walk you through the process of opening an account, making a deposit, and placing your first trade!

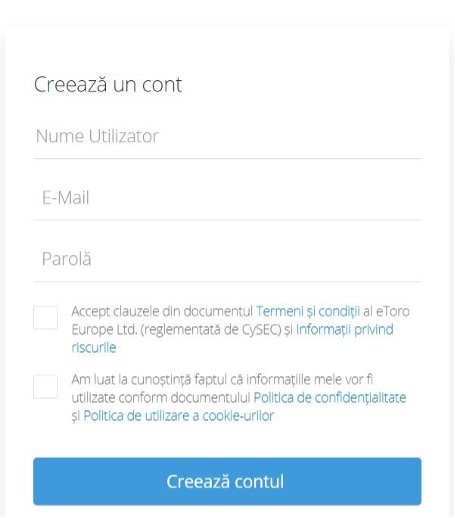

Opening a trading account with eToro is extremely easy and shouldn’t take you more than a few minutes. First, visit the eToro website via your desktop or mobile web browser. Then, click on the “Join Now” button. eToro will then collect some personal information, including your contact details and national insurance number. You will also need to choose a username and password – which you will use to log in to your eToro account. eToro is an FCA regulated trading platform, and therefore they must verify your identity. For this purpose, upload a copy of: You can upload these documents at a later date, as long as you do not deposit more than $2,250. Now it’s time to deposit some funds. If you want to use the eToro demo account first, you can do so once you feel familiar with how the trading platform works. When you are ready to trade with real money, you can choose one of the following payment methods: Once your deposit has been processed, you can start using eToro, the best broker in Romania, to trade. On the left side of the dashboard, click on the “Trade Markets” button to see which assets are supported. Or, if you already know what asset you want to trade, search for it. In the example above, we intend to trade gold . By pressing the “Trade” button next to the chosen asset, a command box will appear. Then, you need to fill in the following fields: If you wish, you can also place stop-loss, trailing stop-loss, and take-profit orders on your eToro trade. To complete the transaction, click the “Open Markets” button.Step 1: Opening a trading account

Step 2: Confirm your identity

Step 3: Deposit funds

Step 4: Finding a trading market

Step 5: Placing a CFD order

Conclusion

With more and more trading platforms in Romania entering the online market, it is easier than ever to invest online. Whether you are interested in stocks, forex, cryptocurrencies that will grow , new cryptocurrencies like Meme Kombat or TG Casino – the best brokers in Romania will frequently give you access to thousands of markets.

Our research has concluded that eToro is the best stock and not only trading platform available to Romanian residents. This FCA-regulated broker offers a multitude of tradable markets . Plus, it only takes a few minutes to open an account and you can instantly deposit funds with a Romanian debit/credit card or e-wallet!

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

Sources:What is a trading platform?

Are the trading platforms listed on this site safe to use?

What is the best trading platform in Romania?

How do I choose the best trading platform?

Can I trade cryptocurrencies on the platforms on this page?

What happens if I have technical problems with the platform?

Can eToro be accessed from Romania?