Cum să Cumpăr Acțiuni Pfizer în România

With a market capitalization of €213,662 billion, Pfizer is the second-largest biotechnology and pharmaceutical company in the world. The US healthcare company also ranks 64th on the 2020 Fortune 500 list of the largest US corporations by total revenue, which is why many investors find Pfizer shares so attractive.

If you’re thinking about adding Pfizer to your stock portfolio, this guide will cover everything you need to know. We show you how to buy Pfizer shares online in Romania, suggest the best stock brokers in Romania, and give you a step-by-step walkthrough of how to buy Pfizer shares.

Step 1: Find a stock broker in Romania that offers Pfizer shares

But you also need to make sure that the broker you choose is regulated in Romania and offers low trading fees and unique trading platforms and features. To help you find the right one, let’s take a look at two of the most trusted and well-regulated stock brokers in Romania that allow you to buy Pfizer shares.

1. eToro – Buy Pfizer shares

If you are an investor from Romania, the minimum deposit starts at around EUR 160. To deposit funds, you can use a credit/debit card, bank transfer or e-wallets such as PayPal, Skrill or Neteller. Note that you can also buy and sell fractional shares on the eToro platform, which means you don’t have to buy a whole share of a company. Instead, you can buy shares from as little as EUR 50 when you have a stock trading account with eToro.

eToro is also highly regulated in Romania and around the world. It holds licenses from the FCA, ASIC and CySEC. Furthermore, it is a member of the Financial Services Compensation Scheme, which means that your funds will be protected up to the first €85,000 in the event that the broker becomes insolvent.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Plus500 – Low-fee CFD stock trading platform

Plus500 is another well-known CFD broker that allows you to trade thousands of stocks, including Pfizer. Like eToro, this broker allows you to buy and sell stocks with up to 5:1 leverage, so you can take a large position when buying shares of a company with relatively little money in your account.

Plus500 is 100% commission-free for CFD trading, meaning you don’t have to pay a fixed commission when you buy and sell shares. Plus500’s spreads are also very tight, making it one of the most cost-effective stock brokers in Romania. On this platform, you’ll find some of the best stocks to buy from companies listed in the US, Romania and Germany.

This broker also offers one of the most popular and easy-to-use stock trading platforms. It includes price alerts, risk management tools, an economic calendar and a built-in charting package. For traders on the go, Plus500 allows the use of guaranteed stop and trailing stop orders that can be added to your trades to effectively manage your risk.

In terms of regulation and the safety of your funds, you should have no worries when trading at Plus500 as it is regulated by the FCA. To get started, you will need to meet the minimum deposit requirement of EUR 100. You can do this with a debit card, credit card, e-wallet (PayPal or Skrill) or a Romanian bank account.

Pro:

Cons:

72% din conturile CFD cu amănuntul pierd bani.

Step 2: Investigations into Pfizer’s actions

Even though Pfizer is one of the largest companies in the world and is considered a top company, that doesn’t necessarily mean it’s the best investment at the moment. As such, we suggest you do some research into Pfizer’s stock price performance, the company’s history, and its future prospects.

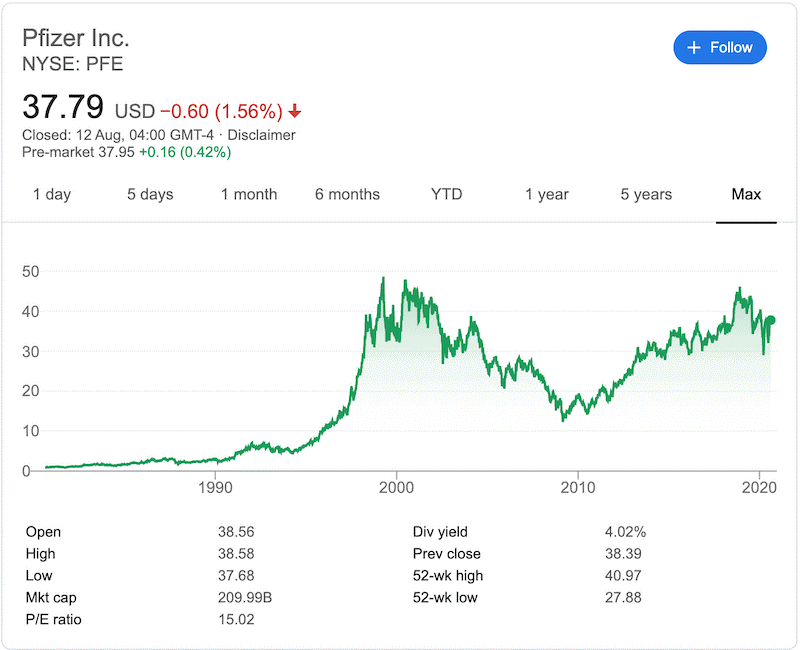

Pfizer stock price history

Pfizer was founded in 1849 in New York City by Charles Pfizer and his cousin Charles F. Erhart. Initially, the two men used a loan from Pfizer’s father as capital to produce a popular antiparasitic drug called Santonin, which was a huge success. The demand for disinfectants, preservatives, and painkillers during the American Civil War doubled the company’s revenue, and again during World War II, Pfizer was the only company with the capacity to develop and market mass-produced penicillin for the treatment of wounded soldiers and civilians.

Pfizer continued to expand over the next few decades. In 1955, the company signed a major partnership with the Japanese company Taito to produce and distribute antibiotics. In the 1970s, Pfizer continued with several acquisitions, such as pharmaceutical manufacturer Mack Illertissen. Today, some of Pfizer’s best-known drugs include Advil, Bextra, Celebrex, Diflucan, Lyrica, Robitussin, and Viagra.

Pfizer first went public in 1942, and since then, its shares have risen at an annual rate of 14.4%. It also joined the Dow Jones Industrial Average in 2004, and during that time, Pfizer’s stock price has outperformed the index.

Like any other major company, Pfizer’s stock price has traded in a range over the past three decades. This can be attributed to the fact that the company pays a solid dividend and has seen consistent, moderate growth in its healthcare sector.

Pfizer has been in the news lately for its COVID-19 vaccine. But while Pfizer is one of the leading pharmaceutical companies producing a COVID-19 antiviral treatment, its YTD return is currently negative at -0.59%. Ultimately, Pfizer is a company that offers multiple layers of valuation and is a defensive stock that is typically resilient to economic downturns.

Pfizer dividend information

Pfizer is a favorite dividend-paying stock among investors looking for a return on their savings. The company pays an annual dividend of $1.52 per share, with a dividend yield of 4.02%. In this regard, Pfizer pays a similar quarterly dividend compared to other healthcare companies that pay an average dividend of $0.38 each quarter. However, this is much higher than the 2% you can expect from the average S&P 500 company.

Should I buy Pfizer stock?

With that in mind, below you’ll find the reasons why investors and analysts are bullish on Pfizer stock.

Pfizer’s stock price is pretty cheap

According to market consensus, Pfizer stock currently appears to be undervalued, especially considering Pfizer’s growing pipeline and efforts to develop a Covid-19 vaccine. At the time of writing, Pfizer is trading at €38.06 per share, and its price-to-earnings ratio is 15.08. With the average healthcare services PE ratio standing at around 25.50 as of August 10, 2020, it appears that Pfizer shares are currently trading at a discount.

One notable thing about Pfizer is that it has a lot of cash — over the past year, Pfizer’s profitable operations generated $12.6 billion in free cash flow. This will allow the company to continue its expansion and maintain its position as the world’s largest biopharmaceutical manufacturer.

Resilient earnings and growth potential

In August, Pfizer reported better-than-expected second-quarter earnings and upgraded its outlook for the second half of 2020. The pharmaceutical company reported quarterly earnings of €0.78 per share, beating analysts’ consensus. In fact, over the past four quarters, Pfizer has beaten EPS estimates three times. In addition, Pfizer reported a profit of €9.52 billion and revenue of €11.8 billion.

This revealed the company’s business resilience in difficult times. Pfizer improved its outlook for the full year, with EPS expectations between €2.85 and €2.95, up from its previous forecast of €2.82 to €2.92. It also raised its revenue expectations to €48.6 billion to €50.6 billion for 2020, up from its previous forecast of €48.5 billion to €50.5 billion.

Partnership with Gilead, BioNTech and Direct Relief to fight Covid-19

In March 2020, Pfizer launched a collaboration plan with large and small pharmaceutical companies to work together to develop and commercialize a COVID-19 vaccine.

Pfizer and BioNTech have entered into a global partnership agreement to develop a coronavirus vaccine to prevent COVID-19 infection. And while Pfizer and BioNTech are among several companies that have joined the race to develop a vaccine to fight the virus, this collaboration could be a success. The joint operation ensures that the US government will pay both companies €1.95 billion upon receipt of the first 100 million doses, after the vaccine is approved by the FDA.

Pfizer then announced a multi-year agreement with Gilead Sciences to manufacture and supply Gilead’s remdesivir to treat the coronavirus. As of August 2020, Gilead is one of the leading candidates for treating Covid-19 patients.

Pfizer is also partnering with Direct Relief, a humanitarian aid organization, to provide supplies to Covid-19 hospitals in all 50 regions of the United States and 80 countries.

Step 3: Open an account and deposit funds

Now that we’ve covered the pros and cons of Pfizer stock, you’re ready to take the next step. We’ll now walk you through the process of opening an online trading account and buying Pfizer stock. While there are many online stock brokers that allow you to buy Pfizer stock, we’ve decided to show you how to buy stock with eToro.

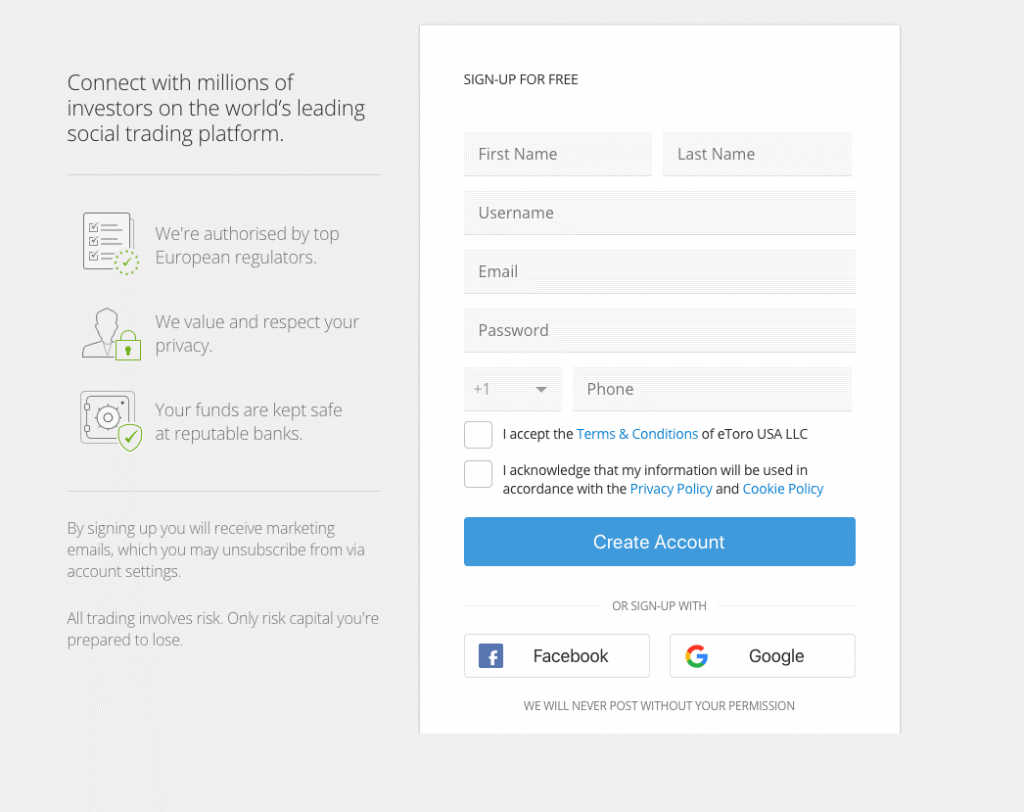

To get started, visit the eToro homepage and register for a trading account by clicking the “Sign Up Now” button in the center of the screen. You will immediately be taken to a registration form where you need to provide some personal details, including your full name, email address, contact information, and then create a password.

As previously mentioned, eToro is regulated by the FCA, which means you will be asked to verify your identity. To do this, you will need to upload a copy of your driving license or passport and a utility bill or bank statement showing your address.

Once your account has been approved, you can add funds to your trading account. You will need to deposit a minimum of EUR 200.

When it comes to depositing funds, eToro accepts the following options:

- Debit card

- credit card

- Paypal

- Skrill

- Neteller

- Romanian bank transfer

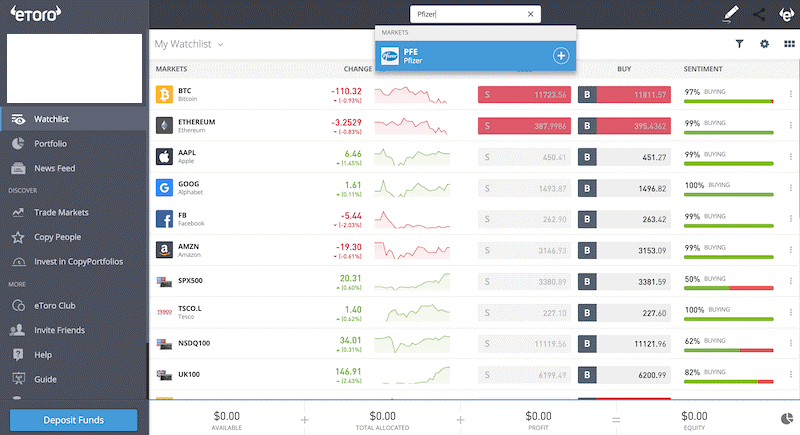

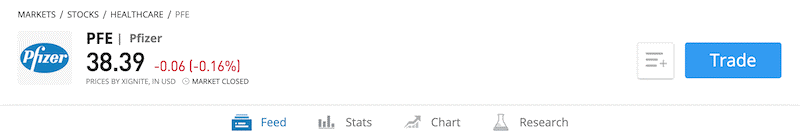

Step 4: Buy Pfizer shares

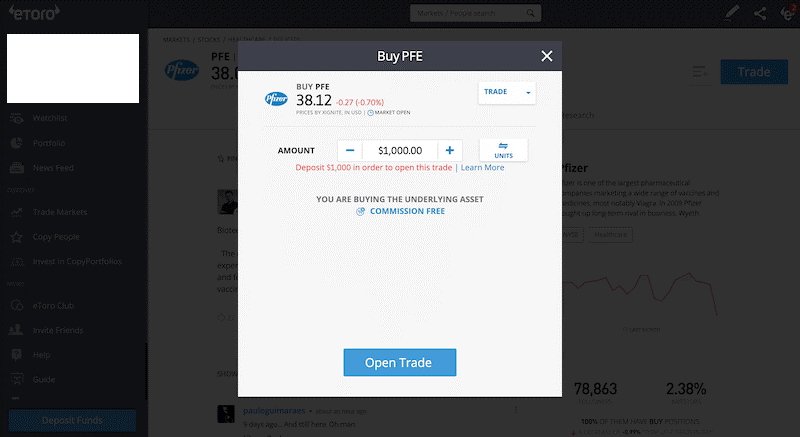

Once your eToro account has been approved and funded, you can buy Pfizer shares. The process of buying shares through eToro is very simple and easy to follow. All you need to do is log in to your trading dashboard and type Pfizer or PFE into the search box and then click on the result that appears.

On the Pfizer stock page, click “Transaction” to open an order form.

To complete the purchase process, you need to enter the amount you want to invest in Pfizer shares. It is also recommended to set a stop loss order to try to minimize large losses. Finally, click the “Open Trade” button to send the order to the market.

Note: If you are purchasing Pfizer stock outside of standard market hours (9:30 am – 5 pm, Eastern Standard Time), you will need to click “Place Order.” Your purchase of Pfizer stock will be completed when the markets open.

Are you buying or selling Pfizer shares?

Those who prefer high-volatility stocks will find better solutions when trading stocks like Apple, Amazon , and Netflix. But if you’re looking for a long-term investment option, Pfizer may be the safest option for you. Long-term investors could benefit not only from stock price appreciation, but also from dividend payments.

Pfizer has shown extremely strong performance in recent years, and its financial stability is impressive. What’s more, Pfizer EPS has grown 23% per year over the past three years, and the average annual share price has increased 4.8%. This essentially means that the share price has grown modestly compared to the company’s EPS.

Pfizer management is optimistic about the second half of 2020 as COVID-19 restrictions are less severe now. If the company succeeds in developing a working Covid-19 vaccine, the stock will get a big boost. Otherwise, Pfizer is a solid dividend stock to buy and hold.

Verdict

The COVID-19 pandemic has clearly shown that healthcare companies have the potential to treat this disease. Pfizer is a leading biopharmaceutical company with huge potential to develop a vaccine against the coronavirus, along with its operational activities. As a pharmaceutical giant with a high profitability, there is a good chance that Pfizer shares will provide a big return in the form of share price growth or dividend distribution.

Additionally, since it will be a smart decision to avoid stocks that depend entirely on the success of the Covid-19 vaccine development, Pfizer is an ideal stock to buy in the context of the coronavirus pandemic.

Simply click the link below to get started!

eToro – Buy Pfizer shares

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

Which stock exchange is Pfizer listed on?

Does Pfizer pay dividends?

Can I collect Pfizer dividends when I trade CFDs?

What is the minimum number of Pfizer shares I can buy?