Cum să Cumpăr Acțiuni Novavax în România

Novavax is one of the leading American developers of recombinant vaccines, which has been making headlines lately with its coronavirus vaccine. According to recent reports, Novavax is expected to begin a large-scale trial in the coming weeks, making the company one of the leading players in the Covid-19 vaccine race.

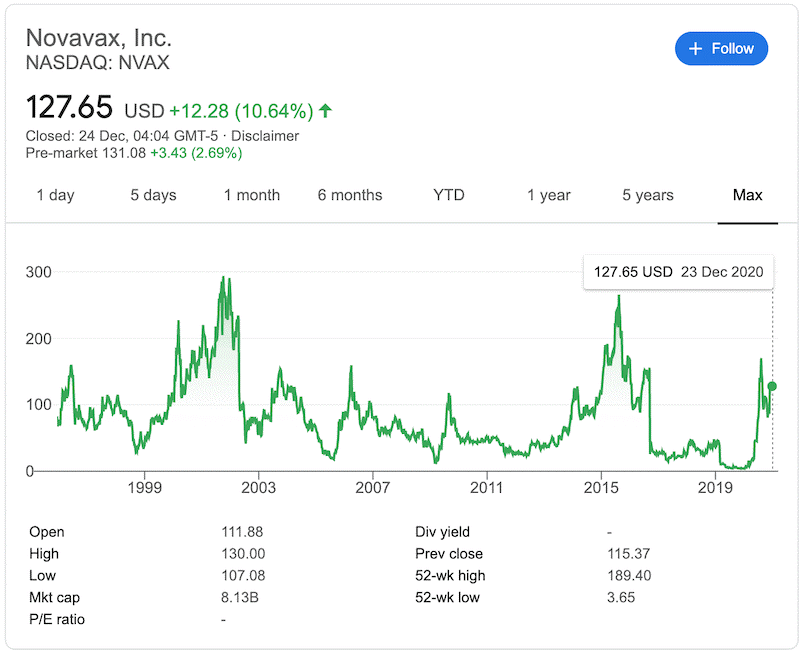

This has led to a huge increase in Novavax’s share price, more precisely an annualized return of around 3100% at the time of writing! Novavax shares started this year at a price of EUR 4.49 per share and are currently trading at EUR 127 per share, having fallen from a 5-year high of EUR 178 in August.

So it’s no surprise that Novavax shares are among the most popular investments on the market right now. If you’re thinking about buying Novavax shares, this guide will help answer some of your questions. We’ll help you find the best trading platform in Romania that offers Novavax shares, analyze Novavax share price performance, and show you how to buy Novavax shares.

How to buy Novavax shares in Romania

Novavax is a US company that is listed on the Nasdaq stock exchange, which means you will need to find a broker in Romania that can connect you to the US stock markets. Fortunately for investors in Romania, there are many brokers that offer US stocks, including Novavax, however, you will want to find a broker that is right for you. You should consider the pricing structure offered by the broker, as well as the features and trading platforms that you will have access to.

To help you find the right direction, below we suggest two highly recommended brokers in Romania that offer access to Novavax shares.

1. eToro – Buy Novavax shares

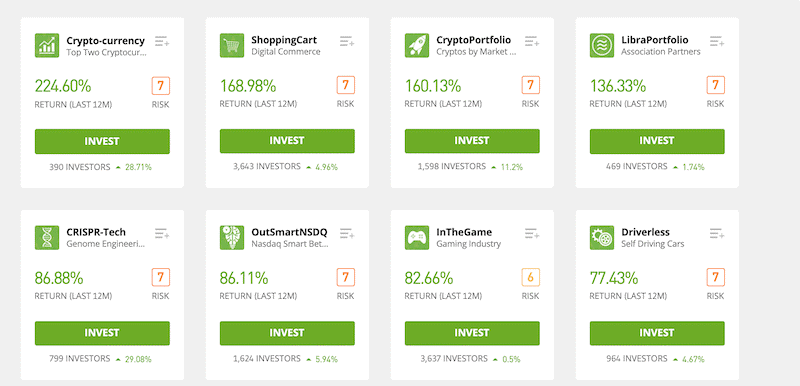

As for leverage on eToro, stocks can be traded with a leverage ratio of 5:1. eToro also offers investors access to other markets, including FX currency pairs, ETFs , indices, commodities and cryptocurrencies . In addition, eToro creates CopyPortfolios that bring together different stocks based on a specific sector, region or industry. As such, you will be able to invest in the following built-in portfolios: Crypto, Gaming, Cannabis, Autonomous Cars, Renewable Energy, ChinaTech, Drone Tech and many more.

The best thing about eToro is its social trading features. The platform interface is very similar to any other social network that you are already familiar with, and therefore, it is extremely easy to navigate and trade on this platform. This broker allows you to connect with other traders and share trading ideas and strategies. Additionally, if you are a beginner in the industry, you can use the CopyTrade tool that allows you to automatically copy the trades of other users on the platform.

In terms of fund safety, eToro is regulated by the FCA in Romania and ensures that investors’ funds are kept in segregated accounts and are protected by the FSCS with up to EUR 85,000.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. Fineco Bank – Low-cost stock trading platform for professional traders

Fineco Bank is best suited for professional traders and those looking for fast order execution and an advanced charting package. This is because it offers one of the most professional trading platforms on the market, PowerDesk. PowerDesk is an impressive trading workstation with an efficient stock screener, dozens of built-in technical indicators, a market news feed, and ultra-fast market order execution.

Overall, Fineco Bank offers a decent range of markets and products that include Forex currency pairs , indices, stocks ( CFDs and outright), ETFs, options, bonds and futures. It also offers an excellent education center that includes weekly webinars, trading events and courses, an on-demand video library and one-on-one sessions with one of the broker’s specialists.

Pro:

Cons:

Step 2: Research Novavax shares

Novavax shares have been a favorite among investors this year, largely due to its Covid-19 vaccine. According to Novavax board member Margaret McGlynn, the company will have the capacity for “two billion doses” of the coronavirus vaccine globally. This has been the major catalyst for Novavax shares’ 3,100% year-to-date return.

However, before buying Novavax shares, it is essential to do thorough research into the company’s current situation and whether its shares can continue to rise from current levels.

What is Novavax?

Novavax is a biotechnology company specializing in the development and commercialization of vaccines for the prevention of infectious diseases. Founded in 1987, Novavax is headquartered in Gaithersburg, Maryland, with additional facilities in Uppsala, Sweden, and Jevany, Czech Republic. For many years, Novavax has relied on donations to fund its operations, including an $89 million donation from the Bill & Melinda Gates Foundation in 2016. As of December 2020, Novavax is leading the development of an effective vaccine against Covid-19, alongside Pfizer and Moderna.

How much are Novavax shares worth? Novavax share price history

Novavax went public on December 5, 1995, just eight years after the company was founded. For the first few years, Novavax shares traded steadily in the €80–€100 range, peaking twice in 2001 and 2015, before falling due to Novavax’s failure to obtain positive results for its RSV vaccine in older adults. Immediately after the RSV failure, Novavax had to lay off 30% of its employees to save costs. In the same year, the company’s shares fell by more than 85%, falling from €155 in September 2016 to around €27 in December 2016.

Novavax has been going through a dark period since 2016. In 2019, the ResVax clinical trial failed for the second time, and the biotech company was forced to announce a reverse stock split to avoid being delisted from the Nasdaq. It eventually hit a low of €4.01 in December 2019.

Ironically, the coronavirus pandemic came just in time to save Novavax. Since the start of the year, Novavax’s share price has risen from €3.93 per share to a 5-year high of €178 in August. Meanwhile, Novavax shares have fallen nearly 28% due to disappointing earnings results and the early launch of Covid-19 vaccines from Pfizer and Moderna.

Novavax Stock Fundamentals – Market Cap, P/E Ratio and EPS

At the current share price, Novavax has a market cap of just over €7.3 billion. It reported EPS of -€3.21 per share for the third quarter of 2020 and a loss of -€4.39 per share for the nine months ended September 30, 2020. Since Novavax has negative earnings, the PE ratio is currently around -23. The estimated price-to-earnings (PE) growth rate for 2021 is 421%.

Information about dividends on Novavax shares

Given that Novavax is still in the growth stage, it does not yet pay dividends and has never paid dividends since its creation.

Should I buy Novavax shares?

With that in mind, Novavax stock has been the big winner of 2020 so far, with a 3100% YTD return and global recognition as one of the leading biotech companies operating in the industry. In terms of share price performance, Novavax is among the best performing stocks this year.

So, let’s take a closer look at some of the reasons why analysts believe Novavax is still a strong buy right now.

Novavax is a leading candidate for the Covid-19 vaccine

Novavax’s vaccine candidates recently entered Phase 3 trials with the unique and highly effective NVX-CoV2373. Novavax is essentially the only company on the market developing nanoparticle vaccines. The nanoparticles are what make the Novavax Covid-19 vaccine so unique. It uses a customized spike protein and adds an adjuvant, or chemical, that could weaken the virus more effectively.

This technology has convinced many governments around the world to bet on Novavax’s vaccine. Canada, the United Kingdom, New Zealand, Australia and the Philippines have already secured Covid-19 vaccines from Novavax. Overall, Novavax has already agreed to supply more than 286 million doses to various countries once its vaccine is approved.

Although the Novavax vaccine may arrive later than other candidates, it is still considered by many to be the most effective coronavirus vaccine on the market right now.

Nano-flu vaccine

In addition to its COVID-19 vaccine, Novavax is developing the NanoFlu vaccine, which met all of its primary endpoints in a Phase 3 clinical trial in March 2020. As a result, Novavax plans to submit the NanoFlu vaccine for regulatory approval from the U.S. Food and Drug Administration (FDA). If it obtains regulatory approval, Novavax’s stock price could receive another boost from the global need for a flu vaccine. This is expected to happen in 2022.

Strong financial stability

Novavax is a small company in terms of market capitalization and revenue. But 2020 was a year of change for the American biotech company. In the third quarter of 2020, the company reported €571 million in cash and €157 million in revenue, compared to just €2.5 million in the same period in 2019. According to Novavax, this increase in revenue was due to increased development activities related to the NVX-CoV2373 vaccine. More importantly, Novavax has received more than €2 billion globally for the development of its Covid-19 vaccine, with €1.6 billion from the US government.

Step 3: Open an account and deposit funds

If, following our analysis of the Novavax share price, you are still interested in buying its shares, we will now show the complete purchase process via the eToro trading platform.

To get started, you will need to open a new trading account by visiting the eToro website and completing the registration process. To do this, you need to submit a username, password, email, and then fill in personal details such as your name, address, financial situation, and trading history.

As eToro is regulated by the FCA, you will also be required to verify your identity before you are allowed to trade. As such, you will need to upload a copy of your driving licence or passport along with a recent utility bill.

You will then be asked to add funds to your account. In Romania, eToro has a minimum deposit requirement of around EUR 140, which can be done via debit or credit card, PayPal, Skrill, Neteller, and bank transfer from Romania.

Step 4: Buy Novavax shares

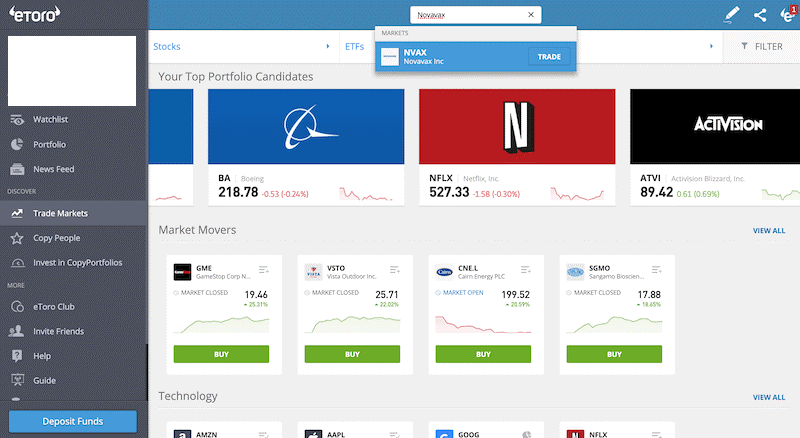

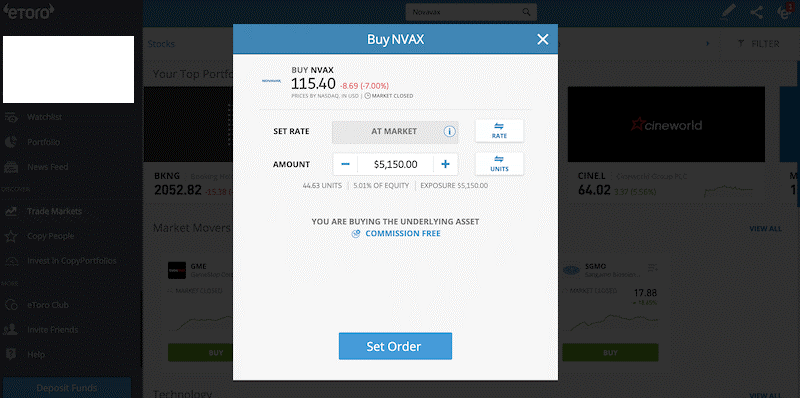

Once you have completed the registration process and funded your account, you are ready to buy Novavax shares. On the trading dashboard, type in Novavax and click the “Trade” button on the first result that appears in the drop-down menu.

You will then see an order form where you can decide the amount you want to invest in Novavax. When you are ready, click the “Place Order” button.

Another important step to take (at least for beginners) is to set stop-loss and take-profit orders. Once you have made a purchase, navigate to Your Portfolio from the left menu and enter orders to reduce your risk.

Novavax Stock: Buy or Sell?

All things considered, Novavax is still a small company, and there is obviously some risk in buying its shares right now. Novavax shares are likely to continue to be volatile in the coming months, especially with the new Covid-19 mutation spreading rapidly in Romania and other areas of the world.

On the other hand, Novavax is currently the only company on the market with advanced studies for both Covid-19 and flu vaccine candidates. Even if Novavax is not among the first biotech companies to launch a Covid-19 vaccine (like Pfizer and Moderna), it could be a dominant player in the post-pandemic era. This means Novavax has the potential to generate billions of euros in sales in the coming years.

While it is currently difficult to predict the right entry price to invest in Novavax, it seems like a great long-term “wait and see” investment opportunity.

verdict

In short, buying a stock after a spectacular performance could be a risky investment. That’s the case right now with Novavax. Given that, the stream of good news from Novavax makes this investment a valuable opportunity for long-term investors. Novavax has received 1.6 billion euros from the federal government to complete its late-stage clinical development, and it is estimated that Novavax will be able to produce a capacity for a Covid-19 vaccine beyond Pfizer and Moderna – 2 billion doses each year by mid-2021. In addition, the huge potential of the NanoFlu vaccine is another reason for Novavax stock to continue its upward trend in the future.

If you’re ready to buy Novavax shares right now, click the link below to get started!

eToro – Buy Novavax shares

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

Who is the CEO of Novavax?

Which stock exchange is Novavax listed on?

Does Novavax pay dividends?

When will the Novavax vaccine for covid-19 be available?

Can I invest in Novavax through an ISA or SIPP?