Cum să Cumpăr Acțiuni Moderna în România

Moderna is a US-based pharmaceutical company specializing in biotechnology. Its main focus is on developing vaccines, including for COVID-19.

Like many other pharmaceutical companies claiming to be getting closer to a COVID-19 vaccine, Moderna shares are booming in 2020. Although the shares are listed in the US, making a purchase from Romania can be completed in less than 10 minutes using the right broker.

In this guide, we’ll show you how to buy Moderna shares online in Romania . In addition to exploring the best Romanian stock trading sites to do so with, we’ll also give you some background information about Moderna as a company.

eToro – Buy Moderna shares

Step 1: Find a Romanian broker to buy Moderna shares

However, you should also consider other factors associated with your chosen platform – such as how much they charge for buying US stocks and what payment methods they accept. And of course, the broker you choose must be licensed by the FCA.

To guide you in the right direction, below you will find a small selection of stock brokers that allow you to buy Moderna shares online in Romania.

1. eToro – Buy Moderna shares

In terms of supported markets – eToro offers 17 stock exchanges to choose from. Over 1,700 stocks, this includes NASDAQ. As a result, you can buy Moderna shares online from Romania with ease. The minimum investment amount is 50 EUR, which means you don’t even have to buy a full share.

For example, Moderna shares are currently priced at over €72 each – so you have the chance to own a “fraction” of a share if you want to start with small stakes. Outside of its stock department, eToro also offers traditional ETFs and even cryptocurrencies . It also offers CFDs, which is great for those of you who want to trade in the short term. eToro’s copy trading feature is also worth a look, as it allows you to invest passively. This is because you can mirror the portfolio of an experienced investor.

eToro gives you the option to buy and sell shares online or via your mobile phone. If you opt for the latter, it includes a native investment app for iOS and Android devices. If you want to buy Moderna shares right now, opening an account with eToro only takes a few minutes. You can fund your account with a debit/credit card, e-wallet or Romanian bank account – ensuring you meet a minimum of €200. eToro is licensed by the FCA, ASIC and CySEC – and is a partner with the FSCS.

Pro:

Cons:

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

2. OKX, alternative to traditional trading

Over 20 million traders from over 100 countries have determined that OKX is the best exchange on the market, which is why it is worth giving it a try to see if this type of investing and trading is right for you.

In fact, it is not even necessary to risk real money, as OKX comes with the option of a demo account, where you can figure out if this platform meets your needs and, moreover, if the trading strategies you have in mind are suitable and can generate profit.

Additionally, OKX has an intuitive interface, and users can start standard trading directly from the platform’s homepage, which allows for simple and spot options trading. Traders can also opt for margin trading, which allows for the use of leverage to amplify returns.

Pro:

Cons:

Banii dvs. sunt în pericol.

Step 2: Modern Stock Research

Moderna shares have performed very well in 2020, largely due to its progress with a potential COVID-19 vaccine. However, the biotech company is not the only firm active in the race to find a treatment, which means you need to consider the risks of making an investment.

In other words, if Moderna can’t bring its vaccine to broader markets – the value of your investment could suffer greatly. With this in mind, you should conduct more extensive research on the company before proceeding with your stock purchase.

Below you will find some important considerations to take into account to help elucidate.

What is Modern?

Recently launched in 2010 – Moderna is a US-based biotechnology company that focuses on a specific niche of vaccine development. This is based on inserting mRNA into human cells in order to develop immunity to a specific virus. Although the company went public in late 2018 – you may not have heard of it until recently.

That’s because Moderna is one of many companies actively seeking to develop a vaccine for COVID-19. In fact, the company was one of the first to begin trials. As of late July, Moderna has entered the third phase of its clinical testing process — which is evident in the speed at which its shares have risen over the past 10 months.

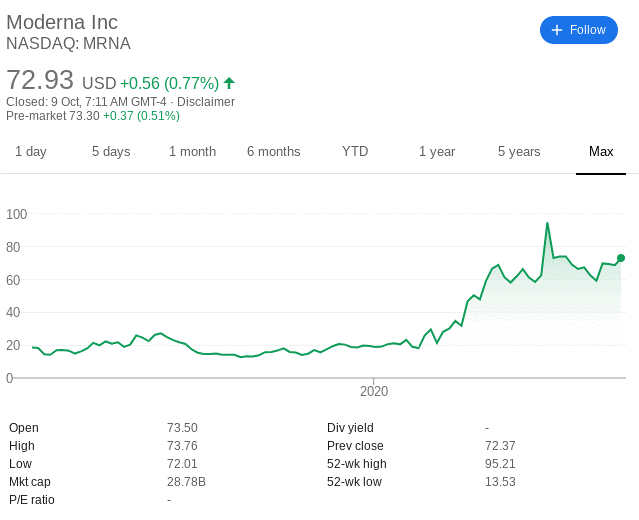

Moderna stock price history

Moderna has transitioned from a start-up to a fully-fledged PLC in just 8 years. It held its IPO in December 2018 – opting for the NASDAQ. The company priced its shares at 23 euros each – giving it an initial valuation of around 7.5 billion euros. This made it the most successful IPO for a biotech company in terms of the amount raised.

Fast forward to October 2020, Moderna has a market valuation of over €28 billion. It’s important to note that it wasn’t all that simple for Moderna – as its share price remained somewhat constant until March 2020. This is, of course, when the company announced that it was working on a COVID-19 vaccine.

Since then, the shares have been on a strong upward trajectory. In fact, they hit highs of €95 in July – representing a YTD increase of almost 400%. At the time of writing, Moderna shares have eased slightly to €73, although this still translates into gains of over 280% in 2020.

Information about dividends on Moderna shares

If you want to add some dividends to your investment portfolio – Moderna is not the right choice. To date, it has never paid a dividend, and it does not plan to do so in the foreseeable future. After all, Moderna is not only still a young company, but also invests most of its cash flow in research and development.

Should I buy Moderna shares?

Make no mistake – investing in Moderna stock in this current economic climate is a high-risk bet. That’s because investor appetite is primarily focused on a COVID-19 vaccine. Sure, Moderna was one of the first licensed pharmaceutical companies to begin clinical trials – which is a great sign.

However, there are dozens of other companies claiming to be getting closer to a potential treatment. As such, if Moderna isn’t the one to pull off this feat – its stock is almost certain to move in the opposite direction. In fact, that’s likely to be the case right at the moment when markets are freaking out about a potential delay or regular shutdown.

Here’s what you need to know before buying Moderna shares.

Everything is based on the results of phase 3

As mentioned above, investors have been pumping money into Moderna’s stock due to its progress with its COVID-19 vaccine trials. As it stands, the company is now in the crucial Phase 3 stage. We won’t know how the trial will play out until Moderna releases its results — which is imminent.

What we do know is that the FDA has already put a temporary halt on other clinical trials due to safety concerns. Notably, this includes biotech peer Inovio, as well as pharmaceutical giant AstraZeneca.

Constant losses and a major drop in revenue

Leaving aside the ongoing clinical trials for COVID-19, it’s important to point out Moderna’s financials – which do nothing but paint a good picture. For example, the company has lost more than €200 million in each of the past four quarters. This is monumental when you consider the company’s market cap.

Sure, Moderna is currently worth €7.5 billion, but it was valued at a fraction of that at this time last year. Furthermore, the shareholder should be concerned about the size of the drop in his income.

For example, while Moderna reported sales of €135 million in 2018, that figure was just €60 million the following year. That represents a 55% drop.

Step 3: Open an account and deposit funds

If you want to proceed with an investment in Moderna today, you will now need to open an account with a broker that offers you access to the NASDAQ.

You will also be able to deposit funds instantly with a debit/credit card or e-wallet – resulting in a complete purchase that should take you no more than 10 minutes.

To begin the process, visit the eToro website and open an account. You will need to enter a number of personal details, such as:

- full name

- Nationality

- Date of birth

- Home address

- National insurance number

- Contact details

- Username and password

After you complete the registration process, eToro will ask you to verify your identity. You can do this in a few minutes by quickly uploading a copy of your passport or driver’s license. In addition, you will need to upload a copy of a recent utility bill or bank statement.

Note: You can upload the above documents at a later date if you do not plan to deposit more than €2,250 right now.

You will now be asked to make a deposit – which must be at least €200.

Accepted payment methods include:

- Debit card

- credit card

- Bank transfer

- Skrill

- PayPal

- Neteller

Notes: All payment methods above are credited instantly – except bank transfer.

Step 4: Trade or buy Moderna shares

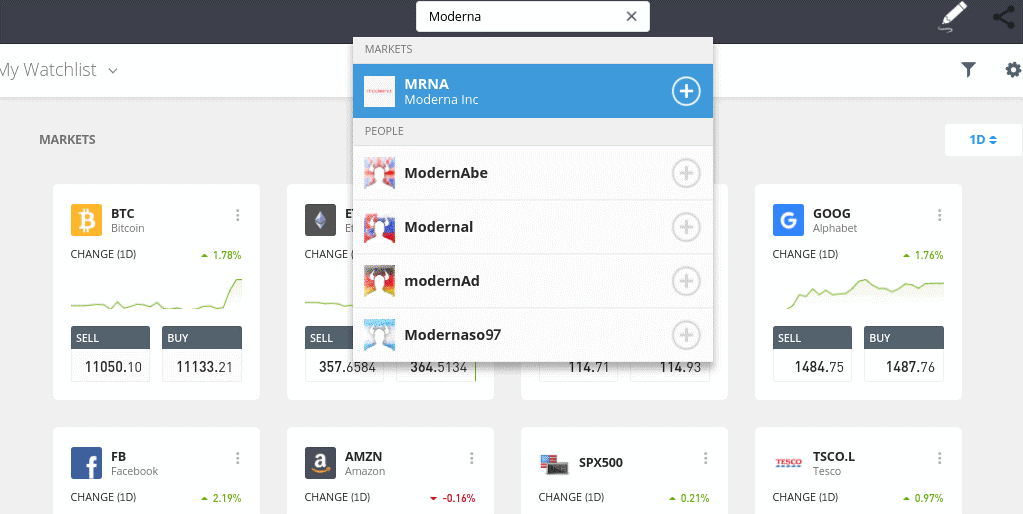

Once you have added funds to your account, you can buy Moderna shares with the click of a few buttons. First, enter “Moderna” in the search box and click on the result that loads – like the one below.

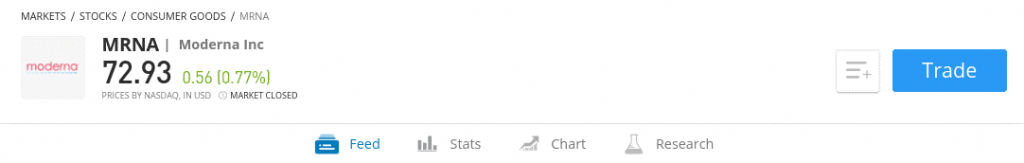

Then click the “Transaction” button.

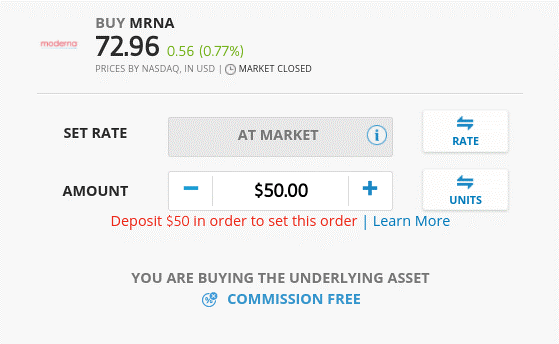

Finally, enter the amount you wish to invest in US dollars (minimum $50). By clicking the “Open Trade” button, your investment in Moderna shares will be executed instantly.

Note: If the button at the bottom of the order box says “Place Order” – this means the NASDAQ exchange is closed. You can still place your order, it just won’t be executed until the markets reopen.

Are you buying or selling Moderna shares?

Buying Moderna stock is somewhat of a gamble, as a large portion of your ability to make money depends on the company’s Phase 3 trials of its COVID-19 vaccine. Essentially, this means that both the upside and downside potential are huge. Scenario 1 is that the Phase 3 results are positive — and Moderna’s stock price follows suit. Scenario 2 is that the results aren’t as expected — or a regulatory hurdle comes into play. If that’s the case, expect the stock to fall — and quickly.

The verdict?

Moderna shares offer a high risk/high reward ratio. With this in mind, it’s best to keep your stakes to a minimum. You can invest from as little as €50 when using our top broker eToro. In addition, the platform offers a few other pharmaceutical stocks that are also working on a COVID-19 vaccine. This at least allows you to diversify.

Simply click the link below to get started!

eToro – Buy Moderna shares

Investițiile în criptomonede sunt riscante și foarte volatile. Se pot aplica taxe. Înțelegeți riscurile aici: https://etoro.tw/3PI44nZ

Frequently Asked Questions

What does Moderna do?

What stock exchange is Moderna listed on?

Do Moderna stocks pay dividends?

How close is Moderna to a COVID-19 vaccine?

How do you buy Moderna shares in Romania?