La meilleure plateforme de trading social en 2026 – La plateforme la moins chère révélée

Social trading platforms allow you to connect with other investors, much like Facebook. The main concept is that you can share and discuss investment opportunities with other traders. Often, the best social trading platforms allow you to « copy » successful traders, opening the door to a passive investing experience.

In this guide, we review the best social trading platforms to consider in 2026 and how to get started with an account today!

Best Social Trading Platform in 2026

Want to start investing with the best social trading platform in 2026 right away? If so, check out the list below to see which providers made the cut. You can scroll down to read a full review of each social trading platform.

Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk.

Best Social Trading Platforms Reviewed

Although social trading and copy trading are becoming increasingly popular among the average investor, the number of top-tier platforms active in this space is still relatively small.

After all, you need to focus not only on the platform’s social trading features, but also on other key parameters such as regulation, tradable markets, fees, payments, and more.

With all of this in mind, below is a selection of the best social trading platforms to consider in 2026. Whether you’re looking for a social trading platform for forex, stock trading, or Bitcoin trading , we’ve got you covered.

1 – eToro – Best Social Trading Platform

First of all, eToro, as one of the best forex brokers in the industry, is highly regulated. It holds licenses from the FCA, ASIC, and CySEC. This ensures that you can use its social trading tools safely and securely. eToro supports a wide variety of asset classes, including over 2,400 stocks and 250 ETFs from over 17 international markets.

Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk.

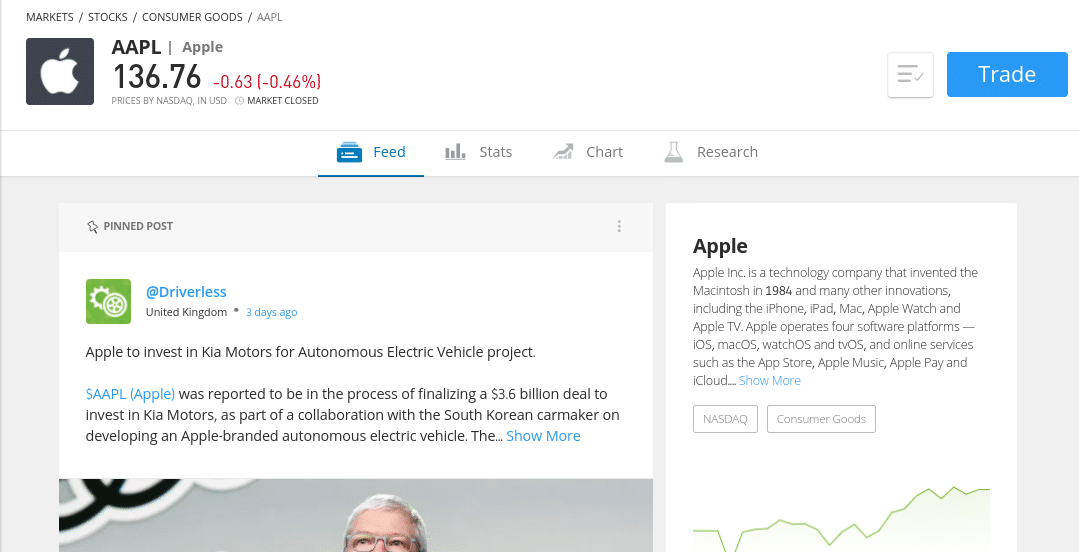

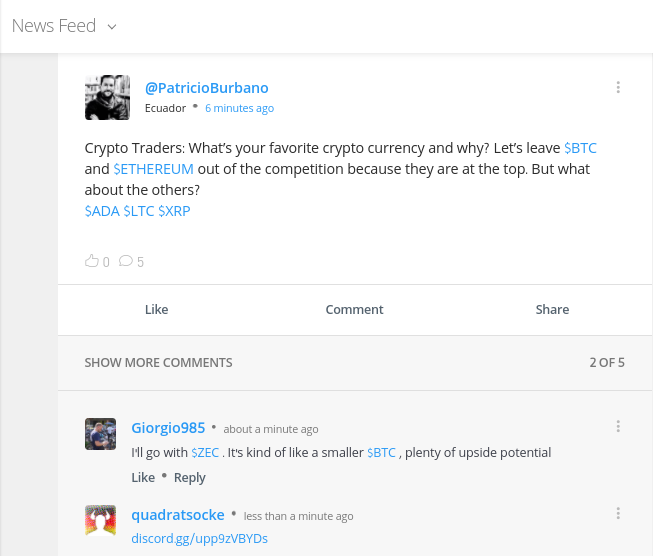

The platform also supports cryptocurrencies, commodities, forex, and much more. Each market supported by eToro has a « social element. » For example, if you click on Apple stock, you’ll see a list of relevant threads posted by other eToro traders. Each thread allows you to « Like » and « Comment, » just like you would on social media! Additionally, you can choose to « Follow » eToro traders whose profiles you like.

That said, the most compelling and perhaps innovative social feature eToro offers is its Copy Trading tool. This tool takes things to the next level, as you can copy an eToro trader exactly as they appear. Thousands of users have joined the Copy Trading program, so you can find an investor who matches your financial goals and risk appetite. There’s also tons of data to mine, such as past performance, trading history, risk profile, average trade duration, and preferred assets.

Past performance is not an indication of future results

Once you copy a trader on eToro—which requires a minimum investment of $100—everything they do is reflected in your own trading account. For example, if the trader risks 15% of their portfolio buying IBM stock, and you invested $1,000 in the trader, $150 worth of IBM stock will be added to your portfolio!

To begin with, eToro supports a range of payment methods, including debit/credit cards, e-wallets, and bank transfers.

Fees on eToro

| Costs | Amount |

| Forex Trading Fees | Spread, 2.1 pips for GBP/USD |

| Cryptocurrency Trading Fees | Gap, 1% for Bitcoin |

| Inactivity fees | $per month after one year |

| Withdrawal fees | $5 |

Benefits :

Disadvantages:

Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk.

How to choose the best social trading platform for your needs?

While eToro is by far the industry leader, you may come across a social trading platform that we haven't discussed today.

If so, you'll want to make sure it's a good fit for your goals before opening an account there.

The most important factors you need to consider are detailed below.

Social characteristics

First and foremost, you should check how "social" your chosen platform is. For example, while some online brokers only offer copy or mirror trading, others go further by offering a full social experience. For example, eToro lets you see what your peers are speculating on when you click on an asset.

For example, if you're considering trading Bitcoin, you'll find tons of threads on the relevant trading page. You'll have the opportunity to participate in the conversation by replying to specific posts, "liking" favorite views, and even following an eToro trader of your choice.

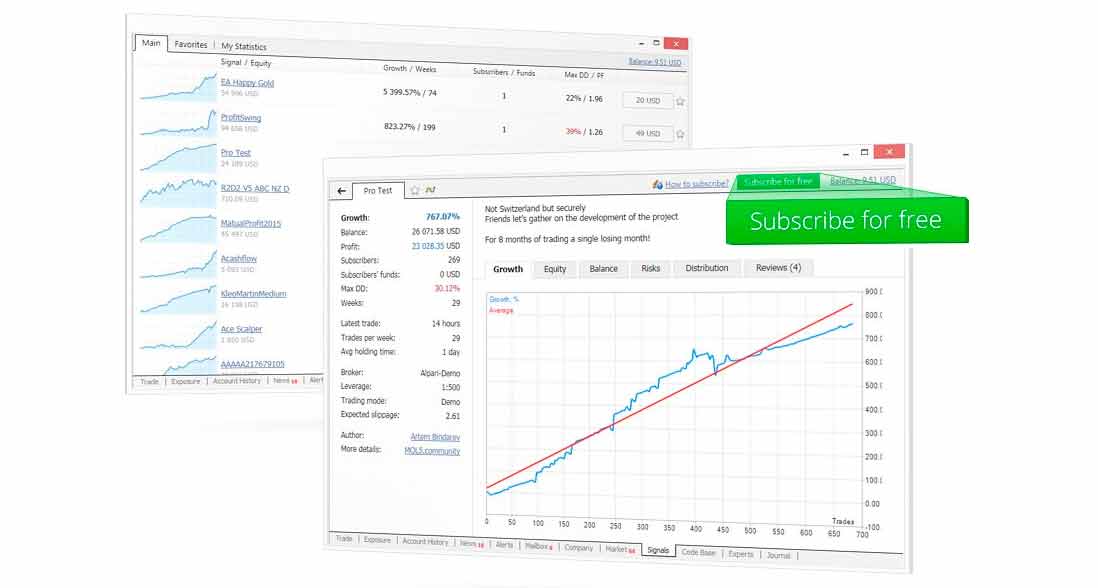

Proprietary platform or MT4

It's also important to assess whether your chosen provider offers a proprietary platform. This means you can access social trading and copy trading features directly from the provider's website, without having to download or install any software.

We generally find that this is what the best social trading platforms offer. On the other hand, some platforms advertise social trading tools, but in reality, you are simply using a broker that supports MetaTrader 4 (MT4). For those unaware, MT4 is a third-party trading platform that is particularly popular with seasoned professionals and provides trading signals.

This platform sits between you and your broker. In addition to advanced trading tools, MT4 also offers social trading features. The ability to copy other traders using the MT4 platform is highlighted.

Copy Trading Tools

The best platforms allow you to "copy" other members of the trading community. This is something that more and more brokers are offering, as they understand that some people want to invest passively. There are a wide variety of factors that will determine whether or not the copy trading feature offered is worth considering.

This includes:

Traders' Choice

We've discovered platforms that allow you to copy other traders on the site. But in many cases, you only have a handful of traders to choose from. This is problematic because there's little chance you'll find someone who perfectly matches your financial goals and risk appetite.

Past performance is not a guarantee of future results.

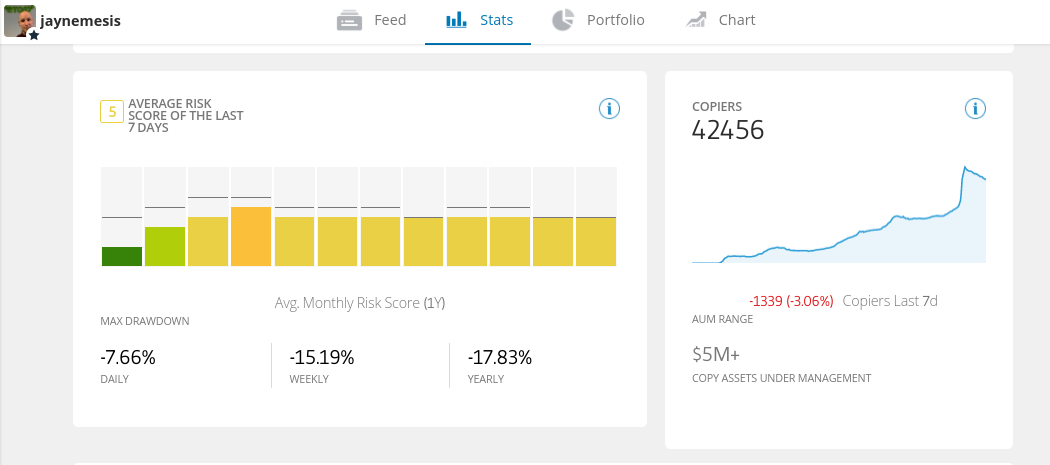

At the other end of the scale, eToro is home to over 700,000 certified copy traders (out of 17 million investors). This is crucial because you can really do in-depth research on the trader before deciding to invest. For example, you can check their trading performance history—in terms of average monthly returns.

You can also view the trader's average time frame, showing whether they are a day trader, a swing trader, or a long-term buy-and-hold investor. Other important metrics that can be explored on eToro include their preferred asset class, risk assessment, and a full biography of the individual's trading experience and goals.

Minimum investment

If you decide to use your platform's copy trading feature, it's important to assess the minimum investment. If the amount is too high, it can make diversification difficult. At eToro, the social trading platform requires a minimum investment of just $200 per trader. For example, if you deposit $2,000, this will allow you to diversify your investments across 10 different investors.

Controlling your Portfolio

Some platforms allow you to copy a trader exactly but offer no control over your portfolio. This means you can't add or remove assets yourself.

eToro not only allows you to copy any trader you choose, but also allows you to easily add individual assets to your portfolio whenever you want. For example, you can copy a forex day trader but also decide to invest in blue chips.

Social Trading Fees

All social trading platforms are designed to make money, so you should consider the fees you'll be charged before opening an account.

The main costs to consider are:

- Commissions: Even if you choose to copy a trader, your chosen social trading platform may charge a commission. If so, it's usually a percentage of the amount you trade. For example, you might have to pay 0.10% each time your chosen trader buys and sells an asset.

- Copy trading fees: some platforms charge a commission.

- Deposit and Withdrawal Fees: Many social trading platforms charge fees when you deposit or withdraw funds. The specific amount often varies depending on the payment method you choose.

- Overnight Funding: If your chosen copy trader keeps a leveraged CFD position open overnight, additional fees apply. These fees will be passed on to your own social trading account—in an amount proportional to what you invested in the copy trader.

And finally, if your chosen copy trader incorporates fees when buying and selling assets on your behalf, you should expect to pay a proportional amount.

Regulation

It's important to remember that social trading platforms are still brokerage firms. In other words, they give you access to the financial markets, and therefore, reputation and trust are crucial. This is why the best social trading platforms are heavily regulated by reputable financial institutions.

Manual or algorithmic

We should also point out that there are two types of automated trading options you might encounter. This guide has so far covered manual copy trading, which means you invest in a trader who conducts their own research and personally places their buy and sell orders.

That said, some social trading platforms also support algorithmic trading. This means you install a software file containing pre-programmed trading conditions. The "robot" then buys and sells assets autonomously, with trading decisions supported by AI and machine learning.

To benefit from this, a platform must be compatible with MT4, MT5, ZuluTrade, or cTrader brokerages. While AI trading has its advantages, it is much riskier than sticking with traditional copy trading services.

Indeed, robots are only designed to follow algorithm-based code, which means they are unable to evaluate real-time financial news feeds. A perfect example is a stock reporting worse-than-expected quarterly results, such as a decline in revenue or operating margin. A human copy trader would be fully aware of this, and this is the best course of action.

Demo Account

When looking for traders to copy, you'll likely base your choice on their track record. While this makes sense, it's important to remember that past performance is never a sure indicator of future results. Therefore, it's best to test a trader before risking any money.

Past performance is not an indication of future results.

The best way to do this is undoubtedly to copy the trader through a demo account. The best platforms offer demo accounts that reflect real-life market conditions. eToro, for example, offers demo accounts with a preloaded balance of $100,000 to all registered members.

Payments

If you're looking to use social trading tools to make money, you'll need to make a deposit first. The best social trading platforms allow you to open your account with a debit or credit card, as these are usually processed instantly.

eToro also offers e-wallets. Some platforms only support bank wire deposits. In these cases, you'll have to wait at least two business days for the funds to be credited.

How to start social trading

If you've followed our guide so far, you should now have a good idea of what to look for in a social trading platform. To wrap things up, we'll now show you how to get started.

The procedure below is based on the market leader in social trading, eToro, which offers a regulated and accessible way to access it.

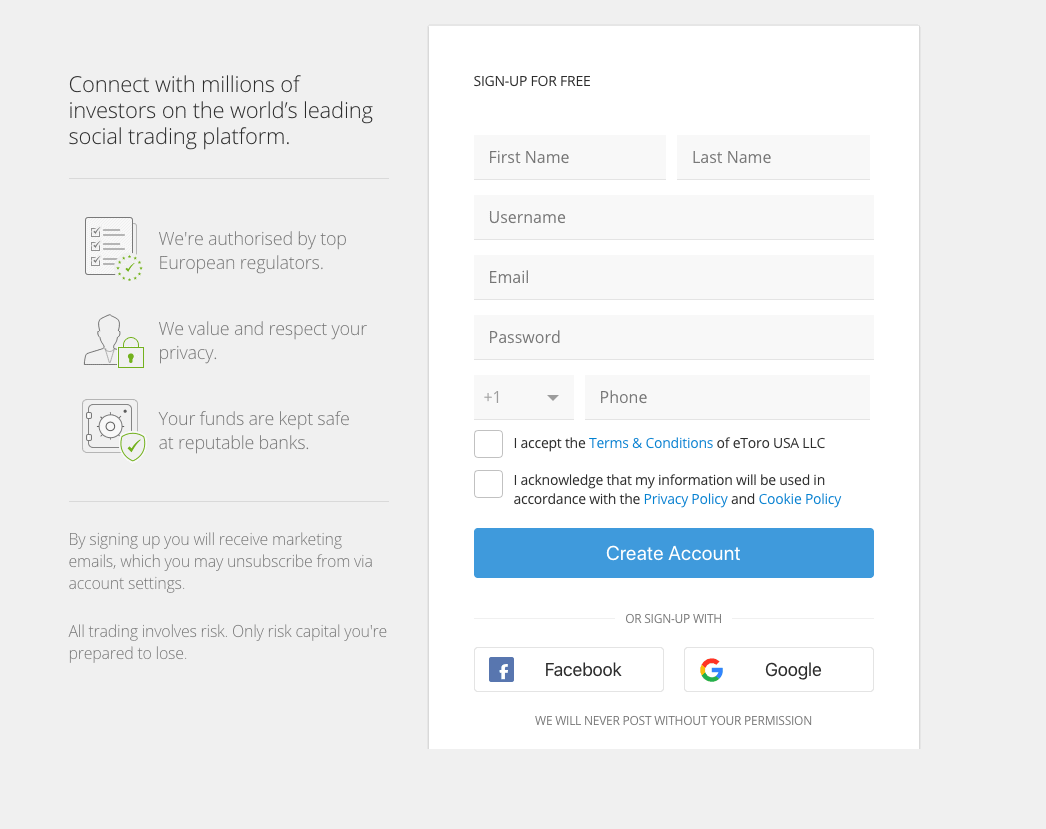

Step 1: Open an account and upload an ID document

eToro is regulated by three financial institutions, so you'll need to go through an account opening process first. To get started, go to the eToro homepage and click the "Join Now" button.

Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk.

You will be asked to enter your personal information and contact details. In addition, you will be asked to upload a copy of your ID and proof of address (bill or bank statement).

In most cases, eToro can validate your document instantly - meaning the account opening process should take less than 10 minutes.

Step 2: Deposit Funds

You'll then be asked to make a minimum deposit of $100. This amount is the minimum investment for copy trading, so it's important to keep it in mind. For example, if you want to copy three different traders, you'll need to deposit at least $600.

You can choose from the following payment methods on eToro:

- Debit cards

- Credit cards

- Electronic wallets (Paypal, Skrill or Neteller)

- Bank transfer

As stated earlier, unless you opt for a bank transfer, all other deposit methods are processed instantly.

Step 3: Search for Copy Trading

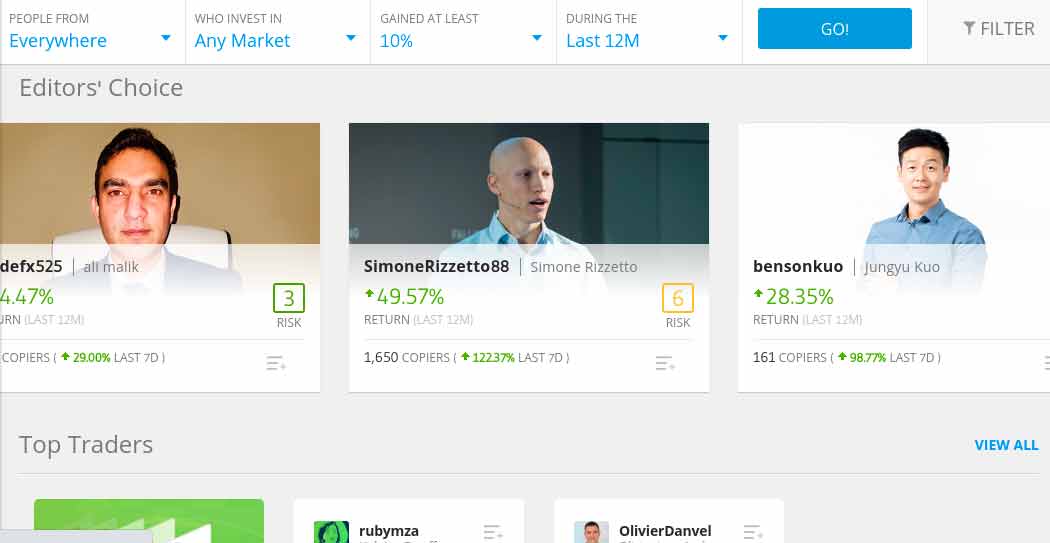

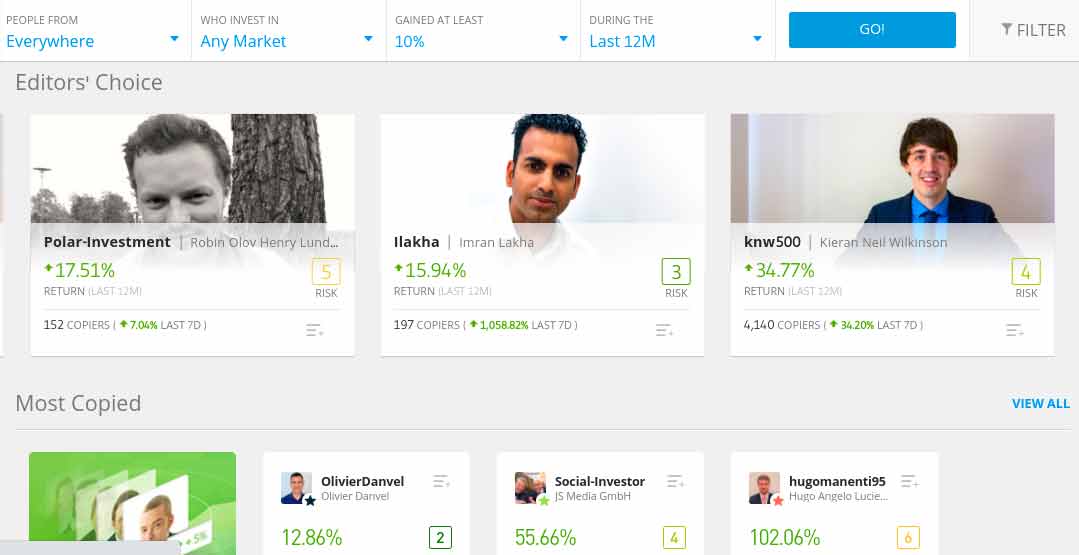

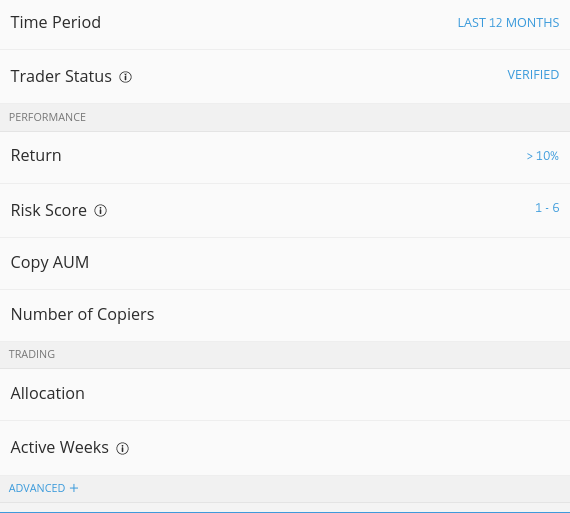

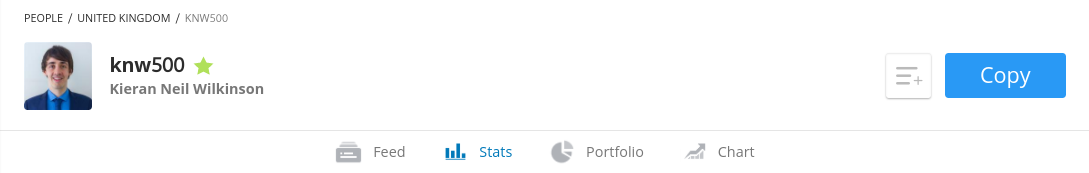

Now that you've made a deposit, it's time to browse the many approved copy traders available on eToro. To do this, you'll first need to click the "Copy People" button. With over 700,000 traders to choose from, it's best to use some of the filters at the top of the screen.

This includes:

- "Who Invest In": You can choose the asset class you want to trade through the selected investor - such as stocks or forex.

- "Gained at Least": You can select the minimum amount of profit the copied trader made in percentage terms.

- 'During the': You can set a time period for your target profit percentage. For example, you might want a trader who has made at least 10% in the last 12 months.

Once you are satisfied with your filters, click the "Go" button.

Next, it's best to select additional filters to find a social trader that meets your financial goals.

This includes:

- Risk Score: eToro automatically assigns a risk score to copied trades based on history. This score ranges from 1 to 6, with 1 being the lowest risk.

- Copy AUM: AUM (Assets Under Management) represents the amount of money that has been invested in the trader.

- Average Trade Duration: This is an important filter because it tells you what type of trading strategy the individual is adopting. For example, if the average trade duration is 5 hours, you know you're investing in a day trader. If the average duration is 10 months, then you're backing a long-term investor.

There are many other filters available, so take the time to explore the platform to find a trader that meets your needs.

Step 4: Invest in social traders

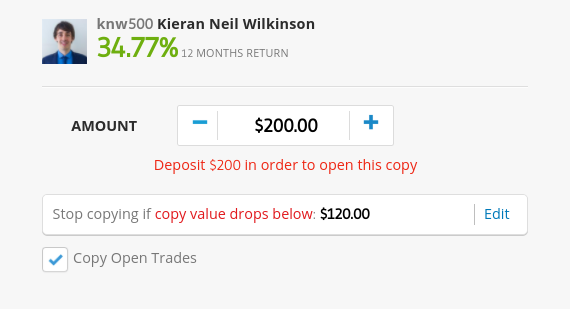

On the profile page of the eToro trader of your choice, you must click the "Copy" button to make a social trading investment.

Next, an order box will appear, as shown in the image below. You will first need to select the investment amount—which must be at least $200. By default, you will only copy the individual's current trades.

But if you want to fully enjoy the social trading experience, you can check the "Copy Open Trades" box. This means you'll also copy the trader's "current" portfolio.

Past performance is not an indication of future results.

Remember that you can add and remove assets from your social trading portfolio on eToro, so you maintain complete control over your investment funds.

Finally, confirm the order to start copying your favorite social trader!

In conclusion

Interest in social trading platforms among casual investors is growing rapidly. The main appeal lies in the fact that you can now actively trade the financial markets without having to lift a finger. Simply select a trader you like, choose the amount you want to invest, and voila: you can start enjoying a passive investing experience.

That said, you should spend some time researching a social trading platform that meets your needs. We found that eToro stands out from the rest for several reasons. The platform—which now has over 17 million clients and over 700,000 verified copy traders—is heavily regulated, offers thousands of markets!

eToro - Best Social Trading Platform for Trading Stocks

Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk.

Questions and Answers

What is the best social trading platform?

Is social trading legal?

Are social trading platforms regulated?

Who is the best copy trader on eToro?

What is the difference between social trading and copy trading?

What are the fees for social trading platforms?

How much do you need to copy a social trader?