Qu’est-ce que le trading de CFD et comment devenir un trader de CFD en 2021 ?

The term « CFD trading » is probably familiar to you – and you may be considering becoming a CFD trader!

Although many novice investors initially learn to buy company shares, contracts for difference (CFDs) are an increasingly popular type of investment.

With online CFDs, investors don’t buy shares directly. Instead, they purchase a contract with their broker that allows them to speculate on fluctuations in the company’s value, just like with stocks.

Trading CFDs in France offers several advantages over buying shares directly. In this guide, we’ll cover everything you need to know about online CFD trading in France and reveal the best CFD trading platform for 2021.

CFD Trading Tutorial in France – Step-by-Step Guide

Want to trade CFDs on the financial markets? Let us show you how to start your journey with eToro:

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

What is CFD trading and what are CFDs actually?

CFD trading is a form of derivatives trading (CFDs). This means that instead of investing directly in a financial asset, trading is done through a contract based on the value of the asset in question.

For example, instead of buying or selling stocks directly, you buy and sell a contract whose value depends on the underlying price of the stock.

CFD trading may seem complicated to beginners, but it’s actually quite simple. In most cases, CFD trading works exactly like buying shares directly. If the share price increases by 5%, the value of your CFD contract also increases by 5%.

Cependant, il existe des avantages spécifiques à négocier des CFD en ligne. Nous allons passer en revue ces avantages tout au long de cet article, mais l’un des aspects les plus importants est la possibilité de négocier presque tous les instruments financiers disponibles.

Vous pouvez négocier des actions, par exemple, ainsi que le Forex, les matières premières, les crypto-monnaies, les fonds négociés en bourse (ETF), et bien plus encore.

Exemple de trading CFD – Simulation CFD

Prenons un exemple pour comprendre comment fonctionne le trading des CFD en France. Disons que vous voulez acheter des actions Royal Mail, qui se négocient à 181 p par action. Vous pouvez vous rendre chez votre courtier en CFD et acheter des CFD pour les actions Royal Mail d’une valeur de 181p par contrat.

Si le cours de l’action Royal Mail passe à 190 p, la valeur de vos contrats CFD passera également à 190 p. Si vous choisissez de vendre vos contrats à ce prix, vous recevrez un bénéfice de 9,5 % – exactement le même que celui que vous auriez réalisé si vous aviez acheté directement des actions Royal Mail.

Ce qu’un trader peut négocier avec les CFD

Comme nous l’avons déjà mentionné, il est possible de négocier divers instruments financiers en CFD, en plus des actions.

Les CFD sont extrêmement flexibles et peuvent donc être utilisés pour négocier tout type d’instrument financier. Les types de CFD les plus populaires en France sont les suivants :

- CFD sur actions

- CFD sur le Forex

- CFD sur les matières premières (or, argent et pétrole, par exemple)

- CFD sur les crypto-monnaies

- CFDs sur les ETF

- CFD sur obligations

Bien qu’il s’agisse des types de CFD les plus courants disponibles auprès des principaux courtiers en France, il serait possible de négocier des CFD sur des types d’actifs financiers moins courants.

Par exemple, des CFD qui suivent la valeur de biens immobiliers ou même d’œuvres d’art.

Dans chacun de ces actifs, la valeur du CFD suit directement le prix de l’actif sous-jacent. Par exemple, imaginez que vous commencez votre trading CFD en Bitcoin. Si la valeur du bitcoin augmente de 2 %, la valeur de votre CFD en bitcoin augmente également de 2 %.

Il en va de même pour le Forex, les matières premières, les indices et tout autre actif négocié en CFD.

Les raisons de devenir un trader CFD

Puisqu’il est possible d’acheter directement des actions et d’autres actifs, quelles sont les raisons qui justifient l’utilisation des CFD ? Il existe plusieurs avantages particuliers qui rendent le trading des CFD si populaire.

Propriété indirecte

Le principal avantage des CFD est que vous n’avez pas à devenir propriétaire de l’actif. Cela peut ne pas sembler très important si vous ne négociez que des actions – dans la plupart des cas, les certificats d’actions sont stockés numériquement dans un compte de négociation d’actions, ce qui ne nécessite aucun effort de votre part pour acheter ou vendre.

But what if you want to trade currency pairs or key commodities like oil? To buy oil directly, you need to find a way to transport the barrels of crude and storage facilities.

Trading in the foreign exchange market requires converting one currency into another, which often involves navigating the complex legalities and tax regulations associated with foreign currencies.

When trading CFDs, you don’t have to worry about any of these issues.

You are only buying a contract, not a barrel of oil or a foreign currency – the profit potential from the price movements of the respective asset is the same.

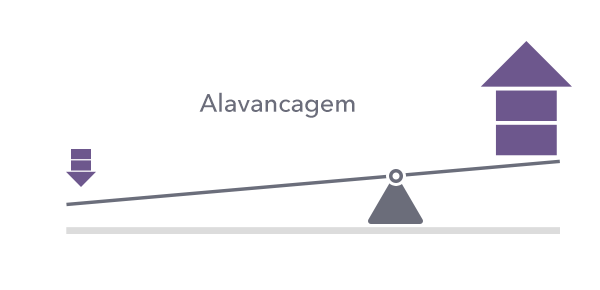

Leverage in CFDs

Perhaps the main reason why CFDs are so popular among stock traders is the ability to trade with leverage. With leverage, the trader essentially uses money borrowed from their broker to increase the size of their position.

Let’s say you want to buy AstraZeneca shares, currently trading at €8.60. If you have €100 in your trading account, you can only buy 11 CFD contracts.

However, with leverage, you can invest more money than you have available.

For example, if you use 1:10 leverage in your trading, you can buy 110 contracts for AstraZeneca stock (a total cost of $946) with only $100 in your account.

The advantage of using leverage is the potential multiplication of your profits if the value of Astra Zeneca shares increases.

For every 1% increase in the underlying asset’s price, the price of your CFD position—with 1:10 leverage—increases by 10%. Therefore, with leverage, you can multiply your returns on successful trades.

Additionally, because you need less money to invest in each position, you can diversify your trades without adding additional funds to your account.

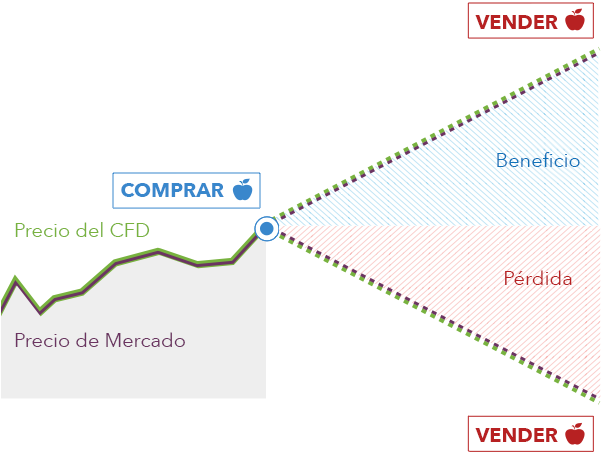

Make money both ways with CFD trading

Another major advantage of CFD trading in France is the ability to make profits even when asset prices decline. You can open a short sell order for your CFD contracts instead of buying them.

If the Facebook stock price, for example, falls by 5%, the value of your CFD position increases by 5%.

Fractional investment

Another advantage of trading stocks through CFDs, especially if you are investing in expensive stocks like Amazon, is that you can invest as much as you want – you don’t have to buy entire shares.

So, while each Amazon share is worth over $3,400, most CFD brokers allow any amount to be invested, for example, from £50 per investment.

CFD trading rates in France

While the application of commissions is a common practice among stockbrokers, most CFD brokers in France are completely exempt from them.

This means that when trading CFDs, you do not need to pay fixed fees of several euros for each open trade.

However, CFD trading isn’t completely free. CFD trading platforms typically charge a spread (spread), which can range from less than 0.1% to more than 0.5%.

The spread is the difference between the buy and sell price of each contract for difference (CFD), so it’s built into your trades. The good news is that for most traders, spreads of around 0.1% per share in CFD trading are still much cheaper than commissions.

Risks of online CFD trading

Online CFD trading carries the same risks as other types of transactions. There is always the possibility of devaluation of the traded asset, which would also lead to a devaluation of your invested CFD contracts.

In this situation, you can choose to sell your contracts and take the loss, or keep your position open in the hope that the value will rise.

If you trade with leverage, CFD trading is no riskier than trading assets directly. However, when trading CFDs with leverage in France, the risks increase significantly.

It’s worth noting that leverage also multiplies your losses. If you trade CFDs with leverage of 1:10, and the value of the underlying asset drops by 1%, the value of your CFD position will decrease by 10%.

Most brokers require a minimum account balance equal to the value of your positions, so you may need to add money to your CFD trading account to keep your leveraged position open.

On the other hand, other brokers automatically sell any position at a loss.

Another thing to keep in mind is that leverage requires borrowing money from the broker, which incurs interest charges. You’ll have to pay the broker for each day your leveraged CFD position remains open—the swap fee.

If price increases don’t occur as quickly as you expected, interest rates may end up being higher than your profit.

Best CFD Trading Strategies for 2021

There are several different approaches to CFD trading. But regardless of your goals or trading style, it’s important to approach each trade with a clear plan.

To help you get started, let’s explore some of the most popular strategies for CFD day trading:

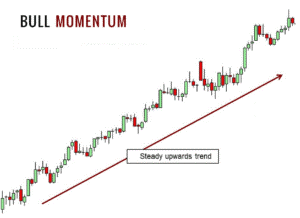

Momentum Trading

Momentum trading is one of the simplest CFD trading strategies for beginners. Simply identify a stock or other asset that is rapidly rising in value with high volume. As long as other traders trade that asset, its price will continue to rise for a while.

Once the momentum begins to dissipate, sell your position and collect your profits. Remember, it’s better to sell too early and take a profit than to sell too late and lose what you could have earned.

Stock momentum is often triggered by news and company announcements, so you can identify potential opportunities by following market information.

Breakout Trading

Breakouts are another popular target for traders. To find these breakout points, one must first identify resistance areas that the stock in question has not yet managed to break through.

When the stock price finally breaks through this resistance level, it is likely to continue rising.

The key to this type of strategy is to avoid being fooled by false breakouts. A true breakout must break through the resistance level with high trading volume.

It is also possible to use technical analysis tools to identify other factors, such as momentum (trend), which indicate continued growth in the asset’s value.

Scalping

Scalping is a CFD trading strategy that requires a high level of concentration and patience. The goal of scalping is to profit from small, brief price movements that occur regularly throughout the day.

You can look for small bursts or increases in trading volume. Typically, scalping trades are opened and closed in just a few minutes.

Scalping is particularly suitable for CFD traders because it is possible to apply leverage to trades. The price movements involved in this strategy are typically only a fraction of a percentage point.

However, with a leverage of 1:10, this same price change represents profits equivalent to several percentage points.

Tips for Success as a CFD Trader

Trading CFDs can be very profitable, but it is important to remember the risks associated with this type of trading.

Let’s look at five CFD trading tips you can use to reduce your risk exposure and increase your profits.

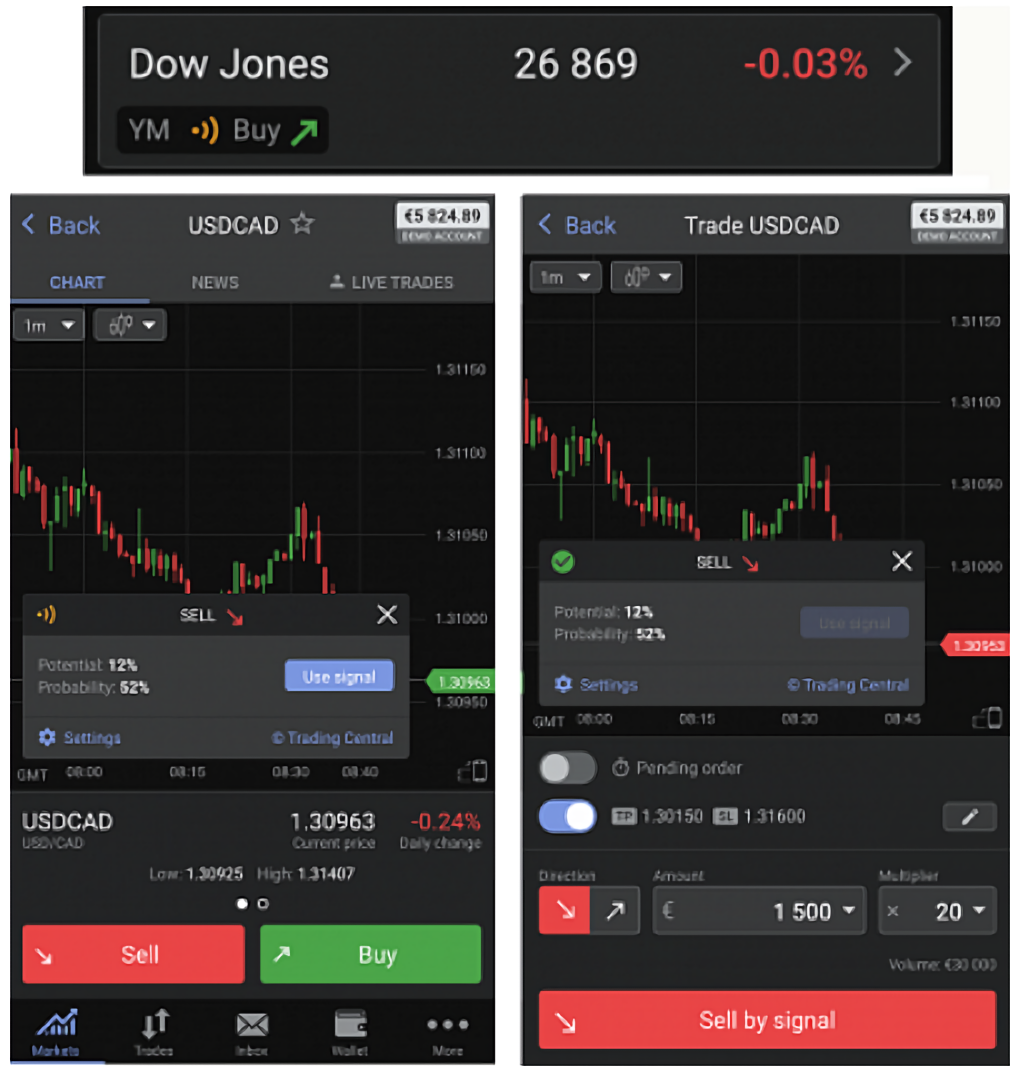

Start with a demo account

One of the best things you can do when you begin your journey into the world of CFD trading is to open a free demo account.

Most brokers in France offer this type of trading platform, which allows you to buy and sell CFDs just like you would on a real CFD trading account – but without committing your real money to your trades.

A demo account is a fantastic tool to familiarize yourself with CFD trading and learn how to develop a strategy for your future real CFD trading account.

It is important to treat the demo account as if it were a real trading account, with real money, in order to practice good risk management practices.

Multiple positions

Since most CFD brokers do not charge commissions on their trades, there is no downside to placing multiple buy and sell orders.

Instead of executing your trade with a single large order, you can mitigate risk by buying and selling with multiple orders.

The advantage of cautiously entering multiple positions is that if the asset price falls after your first purchase, you can buy more at a lower price.

By selling, you can collect some profits by keeping your position open in certain CFD contracts to earn a higher return if the price continues to rise.

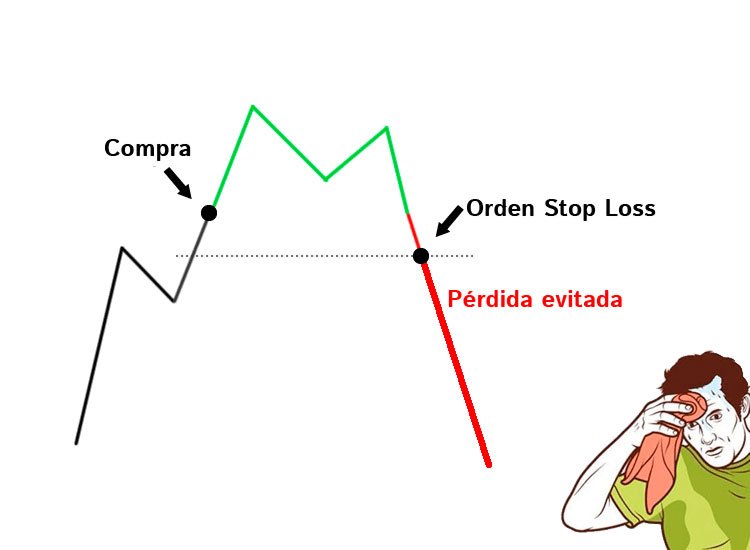

Use Stop Loss Orders

A stop loss is a sell-loss order. It corresponds to a price below the current market price of your CFD contract, at which the broker must sell your position. Stop-loss orders are essential for good risk management. When you set a stop-loss order, nothing happens immediately.

If the value of your position decreases significantly, your broker will automatically sell your position to limit your loss.

Alternatively, you can also use stop-loss orders to ensure a certain profit. Simply set your stop loss higher than the purchase price of your CFD. This limit will be called the take profit.

Using CFD technical analysis tools

Technical analysis is an essential tool for analyzing the value of stocks, forex currency pairs, and other assets. This type of analysis considers the asset’s past price history to predict its future movement.

While you shouldn’t rely solely on a single technical indicator, using multiple indicators and price charts together can help you develop trading strategies and identify potentially profitable CFD trades.

Diversify your CFD portfolio

One of the main advantages of CFD trading is the ability to open more positions without adding more money to your account.

Whether you trade fractional shares or use leverage, trading with CFDs is not too expensive.

You can use this feature to your advantage by diversifying your portfolio. You can invest in CFDs on shares of companies in different market sectors—for example, buying oil stocks, blue-chip stocks, and pharmaceutical stocks.

You can also trade stock CFDs and currency CFDs to diversify your portfolio across multiple categories of financial instruments. The more diversified your portfolio, the more protected you are in the event of a significant decline in the value of a particular company or market sector.

Best CFD Trading Platforms in France

To begin your journey into the world of CFD trading in France, you need to open an account on a CFD trading platform.

There are many brokers to choose from and they vary greatly in terms of cost, the number of CFDs available, and the number of trading tools included.

Therefore, to make your choice easier, we present four of our favorite brokers operating in France.

It is also possible to trade forex, commodities, cryptocurrencies, and indices. eToro broker charges low spreads compared to the industry average. What really sets eToro apart, however, is its CFD trading platform. eToro has its own social trading network where you can interact with other CFD traders, ask questions, and analyze market sentiment. You can also take advantage of copy trading, which uses a portion of your portfolio to automatically copy the positions of other experienced traders. Additionally, eToro offers a built-in charting platform with dozens of technical studies. It doesn’t include some more advanced features, such as Forex signals, but it’s powerful enough for most intermediate-level traders. eToro also offers a mobile app to help you monitor the market on the go.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.1 – eToro – The best CFD trading platform in the UK

Benefits :

Disadvantages

With AvaTrade, it is possible to trade with a variety of different account types, including CFD trading accounts, options trading accounts, and swap-free Islamic accounts. The broker is also globally regulated, ensuring peace of mind and security of its clients’ funds. With AvaTrade, you can trade CFDs on over 1,250 global markets across stocks, commodities, indices, currencies, cryptocurrencies, and more. You can also access a wealth of educational and research tools, including articles, videos, and a blog. Additionally, if you have any questions, AvaTrade offers customer support in over 14 different languages, Monday through Friday.

71% of retail investors lose money when trading CFDs on this website.2 – AvaTrade – CFD Broker with Multiple Account Types

Benefits :

Disadvantages

CFD Trading Tutorial in France - Step-by-Step Guide

Want to trade CFDs online? Let us explain how to start your journey at eToro.

To open an account with eToro, simply go to its homepage and click « Join Now. » The broker will ask you for a username and password. Then, you must enter some personal information, such as your name, date of birth, email address, and phone number.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. eToro also requires identity verification to ensure compliance with applicable regulations. You must upload a copy of your ID card, driver’s license, or passport, as well as a copy of a utility bill or bank statement issued within the last three months. After setting up your account, you need to deposit funds. eToro requires a minimum deposit of $100, which you can make using the following payment methods: You’re now ready to start your first CFD trade. Enter the name of any stock, currency, ETF, or cryptocurrency into the search bar, or browse the available assets in your dashboard. When you find the asset you want to trade, click « Trade » to open a new order form. Enter the amount you wish to invest. You can also set a stop loss or take profit to control the risk associated with your trade. If you want to apply leverage to your trade, you can also set this option in this window. When your order is established, click « Trade » to open your CFD position.Step 1: Open a CFD trading account

Step 2: Fund your account

Step 3: Open a CFD trade

Conclusion

CFD trading is an increasingly popular way to buy stocks, Forex, cryptocurrencies, and a variety of other financial instruments.

With CFDs, you don't have to take ownership of the asset and you can multiply the value of your position through leverage.

Frequently Asked Questions

Is there a difference between CFD trading and spread betting?

Is it possible to earn dividends from trading CFDs?

What is the best CFD trading app?

Can I take a CFD trading course to learn more?

What are the best books on CFD trading?