Forex Trading en France – Guide complet du FX Trading en 2026

Naturally, you’ve heard of Forex trading—the Forex market is one of the largest financial markets in the world. Over $5 trillion in currency is traded every day!

If you’re considering taking the plunge and investing in the forex market, this beginner’s guide will cover everything you need to know.

In it, we explain in detail how Forex trading works in France, highlighting the benefits of Forex trading and offering strategies and tips to help you get started.

Additionally, we’ll evaluate five of the best French brokers to start your online forex trading journey today.

How to Start Trading Forex – How Forex Trading Works

- To start trading in the forex market, you need to follow these steps:

- Open a Forex trading account (we recommend eToro)

- Deposit funds

- Open a position in the foreign exchange market – also known as a trade.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

How Forex Trading Works – What is Forex Trading?

If you have ever exchanged euros for dollars, pounds, or any other currency while on vacation, you have indirectly participated in Forex trading.

However, when we talk about FX trading in France, we are specifically referring to the act of exchanging currencies with the aim of profiting from fluctuations in their value.

One of the most exciting things about Forex trading is that the market is global.

This is a big difference from the stock market, where individual transactions typically only involve shares of companies based in a given country.

The foreign exchange market is also gigantic, with over $5 trillion worth of currency traded every day.

The size of this market is dictated by the fact that it is essential, not only for a Forex trader, but also for the circulation of the global economy.

If you want to buy clothes made in Italy, for example, you will pay the import company in pounds, which in turn will pay the Italian manufacturer in euros.

Currencies are also constantly changed by major banks around the world.

The French FX Trading market operates 24 hours a day, five days a week – from 10 pm on Sunday to 10 pm on Friday.

When trading in the foreign exchange market, there is no centralized transaction like there is when buying stocks.

Instead, a buy position is placed on a global computer network and can be traded by a French or global Forex broker, bank, or any other individual trading on the global network.

Because online forex trading takes place worldwide, the market can be very active at any time of day.

Currency pairs for forex trading

One of the fundamental things every beginner should know about Forex trading (France) is that the value of one currency is always linked to the value of all others.

This is another important distinction that differentiates this market from stock buying.

The pound has no predefined value. Its value is calculated in relation to, for example, the dollar or the euro.

The value of the pound may increase against the dollar or the euro by different amounts, or increase against the dollar and decrease against the euro simultaneously.

Therefore, all transactions in Forex trading (in France) are made through currency pairs. There are three types of online Forex currency pairs:

Main pairs

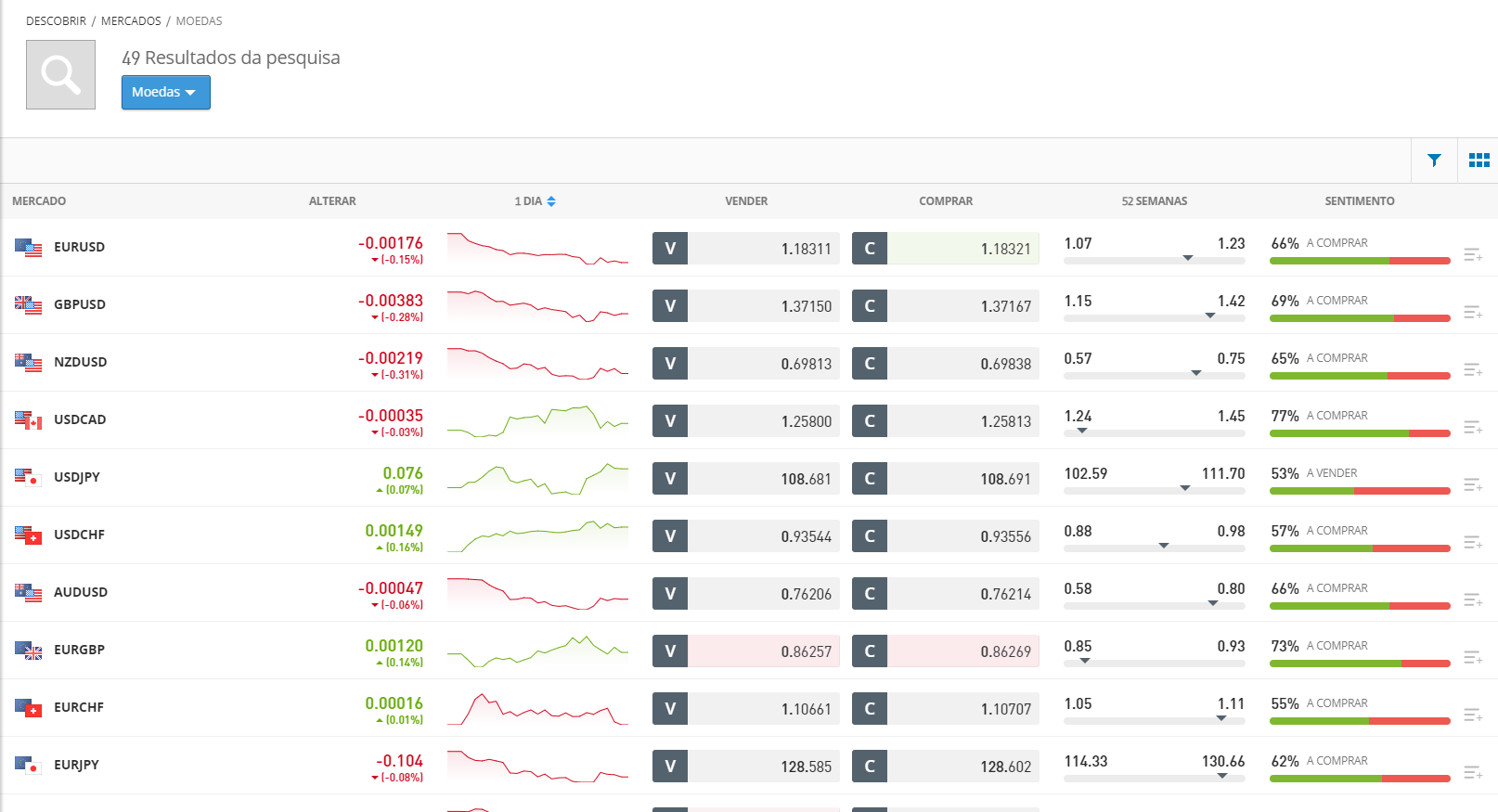

There are seven major currency pairs in the foreign exchange market, all involving the US dollar:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven major pairs represent the majority of transactions carried out daily on the foreign exchange market, in France and throughout the world.

If you’re looking to learn forex as a beginner, you should start by investing in these major currency pairs, as they’re always available for buying and selling, and generally have lower fees than other, less common ones.

Secondary pairs

There are over 20 different secondary currency pairs in the forex market. Typically, each of these pairs consists of currencies other than the US dollar (USD) that are part of the major pairs, or they are paired with the USD and other global currencies.

For example, JPY/AUD and GBP/EUR are considered secondary currency pairs.

The Exotics

Exotic pairs are less frequently traded currency pairs. For example, JPY/ZAR and EUR/HUF are considered exotic pairs in the online Forex trading market.

They can be quite illiquid – meaning few people buy or sell them frequently – so they are generally best suited to Forex traders with advanced knowledge.

Reasons to invest in Forex trading in France

The foreign exchange market has several characteristics that make Forex trading particularly suitable for beginners. Let’s examine some of the best reasons to invest in Forex trading in France in 2021.

Accessibility

For many traders, the main attraction to the Forex market is its extreme accessibility.

Few other markets allow you to log in anytime and start investing immediately.

Since the Forex market operates 24 hours a day, this is possible.

There are also few limits on the type of currencies you can invest in, especially compared to the stock market – where most brokers only offer stocks from one or two countries.

Moreover, you don’t need a large capital to start Forex trading in France today.

Many of the best Forex trading brokers only require deposits of around $50 to $100 to set up a real Forex trading account.

It is therefore possible to start buying and selling currency pairs with a small initial investment.

Liquidity

Due to the high volume of currencies traded daily, finding a buyer for the currency you are trying to sell is virtually guaranteed at any time of day.

This concept is known as liquidity – there is a constant flow of currency pairs around the world.

Liquidity is a beneficial aspect because it means you are less likely to be stuck in a particular investment, unable to close your position when you want.

High liquidity is also important because it helps keep the price of your forex trade low. We’ll detail the costs of forex trading and how they are influenced by liquidity.

Buying and selling in the foreign exchange market

Another interesting element of trading in the foreign exchange market is the ability to bet on the fall in the value of one currency (relative to another currency), just as easily as predicting its rise.

When you short sell a particular currency, you profit from its devaluation.

This gives you more flexibility to save your positions and create more complex strategies .

Forex Trading Leverage (in France)

A crucial aspect of foreign exchange trading (in France) is the ability to leverage your transactions (investments).

With leverage, you can receive a loan from your forex broker to increase the effective value of your investment.

For example, if you open a position with a leverage of 1:10, you can open a market position of $1,000 with only $100 in your Forex trading account.

The advantage of using leverage is that it multiplies your profits.

Let’s say you buy the GBP/USD pair with 1:10 leverage. If the dollar increases in value by 1% against the pound, the value of your position increases by 10%.

Thanks to leverage, you can make significant profits with small fluctuations in the value of the currency pair.

Additionally, it is possible to invest in multiple currency pairs to hedge your positions, as you only need a small investment to open large positions.

Costs of Forex Trading (in France)

The spread is the difference between the amount you can buy a currency pair for and its potential selling value at the same time.

Spreads vary by currency pair and broker, ranging from 0.05% to 1% or more. Typically, you’ll find the narrowest spreads on major currency pairs and the highest spreads on exotic pairs.

It is worth noting that if you trade currencies with leverage, you are likely to pay additional fees.

Most brokers charge overnight interest rates – called swap fees – if you hold a leveraged position after 10 p.m. (GMT), even though the forex market « never sleeps. »

Therefore, if you use leverage in your online forex trading, it is best to only keep your positions open for a few hours at a time.

Risks associated with foreign exchange transactions in France

Investing in Forex trading – like all types of investing – carries certain risks.

There’s always the possibility that something could go wrong with your investment, causing your position to devalue. If that happens, you can always sell at a loss.

You can also hold your position in the hope that its value will increase again – which is not guaranteed – but you risk suffering a larger loss.

It is important to never forget that using leverage increases your risk in online Forex trading.

First, possible losses are multiplied.

Just as a 1% increase in the value of a currency pair means a 10% return, in a position with 1:10 leverage, a 1% decrease also means a 10% devaluation of your position.

Additionally, using leverage involves borrowing capital from the FX broker you are using in France.

Most forex brokers require that your account contain more money than your position, in case your position starts to lose value.

Therefore, you may be forced to quickly add money to your account, at the risk of the brokerage firm automatically selling your position at a loss.

Given these additional risks, if you are a beginner Forex trader, you should take an extremely cautious approach to using leverage.

Popular Forex Trading Strategies

If you want to increase your chances of making money with Forex trading, having a sensible and effective strategy is absolutely vital.

There are as many trading strategies as there are traders – each must develop their own personalized strategy, tailored to their goals, risk tolerance, and style.

This process takes time and practice, so we recommend starting your demo journey to find out what works for you.

With that in mind, let’s look at three day trading strategies you can try.

Scalping on Forex

Scalping is a short-term trading strategy that involves buying and selling a particular currency pair during the day.

The goal of scalping is to profit from the small price fluctuations that occur within seconds or minutes.

Scalpers (those who adopt this strategy) closely follow technical indicators to identify potential entry and exit points.

The price fluctuations involved in scalping are small, so the returns on each individual investment may be only a fraction of a percentile.

However, with enough successful investments throughout the day, these small gains can translate into substantial profits.

Swing Trading in Forex

Swing trading is a medium-term Forex strategy.

Typically, traders who adopt this strategy look for indicators of momentum in the value of a particular currency pair.

Ideally, you should initiate your position after a strong reversal, when the value begins to increase or decrease on high trading volume.

Keep the position open as long as the currency pair shows a solid trend in a specific direction, and sell as soon as the trend begins to dissipate.

Aggressive swing traders are then able to speculate on a trend in the opposite direction, if one occurs.

Currency Trading with News

Much of the volatility seen in foreign exchange trading is driven by current events.

World events, politics, weather, trade agreements, and financial reports can cause value to fluctuate in either direction.

An effective Forex trading strategy involves following current events to predict the appreciation or devaluation of a particular currency in the short or long term.

Then open an investment position based on the news and your analysis.

Automate your foreign exchange transactions

Many intermediate and advanced traders choose to automate their online forex trading.

Automating your trading reduces the workload required for day trading – in addition to eliminating the psychological element, which often hinders decision-making.

There are two main methods you can use to automate Forex trading: Forex signals and automated Forex robots.

Forex Trading Signals

Forex signals are sets of technical and fundamental performance indicators. With FX Signals, you receive an alert on your computer or smartphone as soon as a specific set of parameters is observed in the market.

For example, when multiple indicators align, you can receive an alert on your phone with information about the relevant currency pair, the current price, and potential entry and exit points.

Forex signals can be created manually, or use artificial intelligence to improve their effectiveness over time.

It is also possible to purchase signals created by Forex trading professionals through your broker or any other online trading platform.

Forex Robots

Forex robots represent the next level in terms of trading signals, fully automating your investments.

These robots use Forex signals not only to identify and alert you to potential trading opportunities, but also to automatically invest on your behalf.

Robots can operate 24/7, making them particularly suitable for automated Forex trading.

Tips for Forex Trading

Currency exchange in France is affordable, but it’s important to be sure of what you’re doing before you begin.

So let’s look at five tips you can use to prepare for the forex market.

1 – Take a free Forex trading course

Our guide is a great starting point for learning Forex in French if you are a beginner.

However, before investing your money in the foreign exchange market, taking a Forex trading course is a great idea.

You can find high-quality free courses from your broker or other professional online services.

2 – Read the best Forex trading books

Professional traders have invested years of their lives honing their strategies and techniques in the forex market. By reading a book, you can learn some of their most useful tricks.

We recommend “Forex for Beginners: What You Need to Know to Get Started, and Everything in Between” by Anna Coulling and “How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life” by Courtney Smith.

3 – Try a Forex demo account

Another great way to ease your entry into the world of forex trading is to start with a demo account.

With a Forex demo account, you can practice trading freely on your broker’s platform, access real-time price data, and track your performance over time without risking real money.

4 – Start small

When you decide to start trading with a real account, it is advisable to start with only small investments.

Focus on one or two currency pairs instead of trying to invest in all currencies simultaneously.

Additionally, try to invest without leverage or with minimal leverage levels to limit your risk.

5 – Use the stop loss (loss limit)

One of the best practices you can adopt to limit your risk in FX trading is to use a stop loss function. With a stop loss, your broker will automatically sell your position if the value falls beyond the set level.

Stop losses are especially important in forex trading because the market is active 24/7, making it impossible to constantly monitor your positions.

The Best Forex Trading Platforms in France

To start investing in Forex in France, you need a secure trading platform.

Look for a service that offers low spreads, high leverage, and access to a wide range of currency pairs. Below are four of our favorite platforms:

1 – Libertex – No Spread Forex Trading Broker

With Libertex, traders pay a small commission when buying and selling, with no spread. Additionally, you can trade currencies using CFDs, which means potential profits based on market rises and falls.

There is a wide choice of account types, with the VIP+ account offering a 50% discount on all commissions and many additional trading features.

This broker also provides its own comprehensive web platform, complete with sentiment indicators, live news, and other features.

Benefits :

Disadvantages:

85% of retail investor accounts lose money when trading CFDs with this provider.

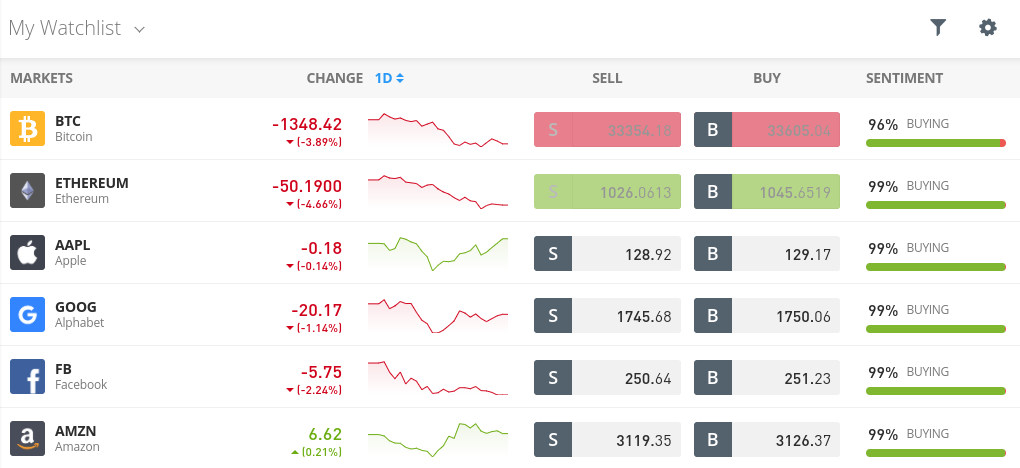

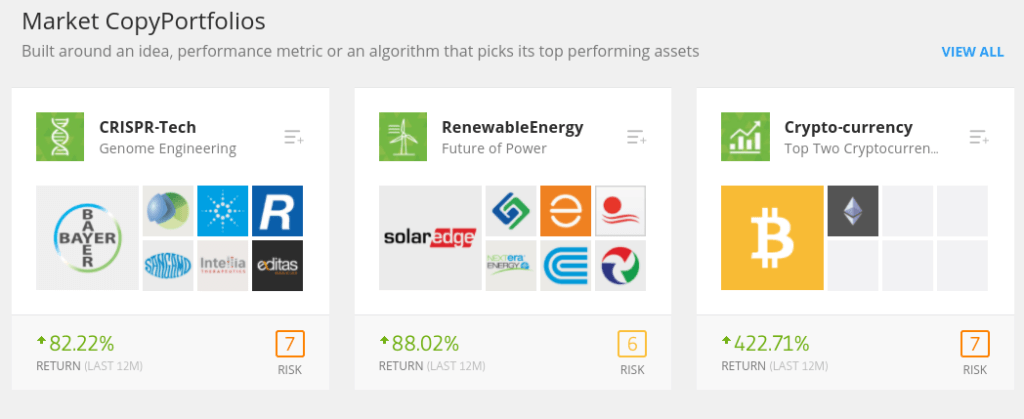

2 - eToro - The best Forex trading platform in France

This Forex broker has a social trading network, where you can interact with thousands of traders from all over the world.

With this feature, you can see which currency pairs are being bought by others, with the ability to start conversations and analyze market sentiment.

Additionally, you can configure the Copy Trading option to automatically copy positions of experienced and expert traders.

eToro also offers powerful charting with dozens of built-in technical studies.

You can also follow the news through the platform, making it easy to stay informed about important developments. The only drawback with the eToro platform is the lack of technical analysis of the charts.

You can find tight spreads as low as 0.008% for most major currency pairs.

eToro does charge some account fees, including withdrawal fees, but they are relatively low and easy to avoid.

We also like the fact that it is possible to invest in major currency pairs with leverage of 1:30.

Benefits :

Disadvantages:

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

3- AvaTrade - Forex Broker with Multiple Account Types

AvaTrade is a stock broker that offers a wide range of different account types.

These include CFD trading accounts, options trading accounts, and swap-free accounts. Using a broker that offers this variety is ideal for maintaining flexibility in varying market conditions.

The broker also offers a wide selection of trading platforms, including MetaTrader 4, MetaTrader 5, AvaOptions, AvaSocial, and AvaTradeGO.

Among these platforms, you can perform algorithmic trading, options trading, social trading, and copy trading on any desktop, web, and mobile device.

You can trade on over 1250 global markets, including all major, minor and exotic currency pairs, commission-free.

Additionally, you can have peace of mind knowing that AvaTrade is regulated in six jurisdictions, including the CBI, ASIC, FSA, FSCA, FRSE, and BVI FSC.

Benefits :

Disadvantages:

Your capital is at risk.

Getting Started with FX Trading - eToro France

Ready to begin your online Forex trading journey? Let us guide you through opening your first market position with eToro.

Visit the eToro homepage and click « Join Now » to open a new account. You will need to enter a new username and password, as well as some personal information, such as your name, date of birth, email address, and phone number. To comply with government regulations, eToro also requires verification of your identity. Bring a copy of your driver’s license, ID card or passport, as well as a copy of any recent bills or bank statements proving your address. Now it’s time to fund your account. eToro accepts a wide range of payment options, including debit or credit cards, e-wallets, or bank transfers. When making the first deposit to your account, the minimum deposit amount is $ 100 . With your account funded, you are ready to open your first Forex trade in the market. Search for a currency pair, such as « GBP/USD » in the eToro dashboard, then click « Trade » to open a new position. In the transaction form, indicate the amount you wish to invest (the minimum amount is $100) and choose to buy or sell the currency pair. If you want to apply leverage to your trading or set a stop loss, you can do so in the same menu. Once your trade is set up, click « Trade » again to finalize your Forex trading investment on the platform.Step 1: Open a Forex Trading Account

Step 2: Deposit Funds

Step 3: Open a position in the market

Conclusion – FX Trading Guide in 2021

Forex trading gives you access to a global market with huge movements, active 24 hours a day.

By trading Forex, you can speculate on the price of one currency against another. The foreign exchange market is widely accessible due to its global nature and requires only a small initial investment.

If you're ready to invest in Forex trading in France, create your eToro account today. Simply click below to get started!

eToro - The best Forex trading platform in France

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Frequently Asked Questions

Forex Trading - How Does It Work in Practice?

What are pips in online Forex trading?

How do margins work in leveraged Forex trading?

Is Forex trading considered suitable for Islamic people?

What is the best Forex trading app for smartphones?

Is Forex trading profitable?