CFD trading: Liste de meilleures plateformes 2022

CFD trading platforms typically allow you to trade thousands of financial instruments—without needing to own the underlying asset. Instead, you’ll be looking to predict whether the price of the asset—whether it’s stocks, commodities, cryptocurrencies, or currencies—will rise or fall.

In this guide, we review the best CFD trading platforms to consider in 2022. We consider the key parameters that will make or break a CFD trading platform – such as available markets, commissions, platforms, payouts, and regulation.

[knock]

Top CFD Trading Platforms 2022

Below is a list of the best CFD trading platforms currently available on the market. Scroll down to read the review of each top-rated CFD provider!

- eToro – The World’s Best CFD Trading Platform

- Libertex – A low-cost CFD trading platform with tight spreads

- Plus500 – A UK broker for CFDs with tight spreads

- IG – The Best CFD Trading Platform for Forex

- Trading 212 – The best CFD trading platform for small stakes ($1 minimum)

Comparison of the best CFD trading platforms

There are hundreds of CFD trading platforms that allow you to buy and sell financial instruments with just a click.

To find one that meets your needs, you should consider the markets offered by the CFD platform, the amount of fees and commissions it charges, as well as other parameters relating to regulation, payments, and trading tools.

To help clear the fog, below is a selection of the best CFD trading platforms in 2021. Whether you’re looking for stock CFDs or forex CFDs, we’ve got you covered.

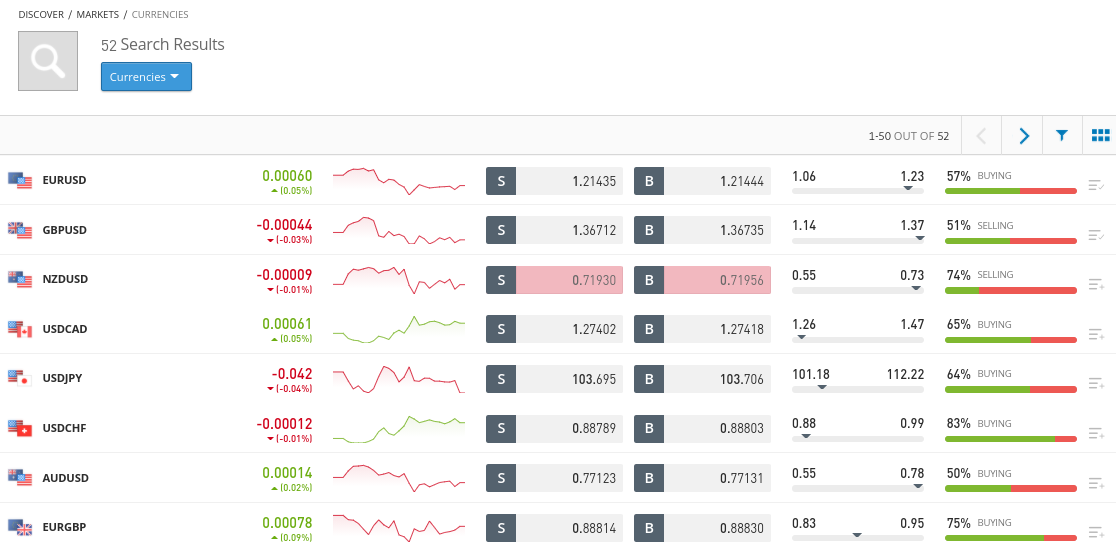

1- eToro – The best CFD trading platform worldwide

This includes everything from stocks and cryptocurrencies to forex and commodities.

There are also no maintenance fees, and spreads are generally very tight. Major currency pairs have spreads of just 0.008%, while gold’s is around 0.05%. As with all the best online CFD trading platforms, eToro gives you access to leverage. The amount of leverage you can get, however, depends on your location. ( Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You will never lose more than the amount you invest in each position. )

Past performance is not a guarantee of future results.

In most cases, it’s capped at 1:30 on major currency pairs, 1:20 on minor/exotic currencies and gold, and even less on other asset classes. All CFD trading markets at eToro also give you the option to go long and short. This allows you to profit from both rising and falling markets.

eToro is also a great choice to consider if you’re a beginner. This platform itself was built from the ground up—with the aim of attracting non-professional traders. The minimum investment starts at just $25, which is ideal for those on a budget.

Past performance is not a guarantee of future results.

We also like eToro’s Copy Trading feature, which allows you to « copy » an experienced CFD trader. By doing so, every buy/sell position the trader places will be reflected in your own eToro portfolio. You must make a minimum investment of $200 per trader.

To get started, opening an account, uploading your ID, and making a deposit typically takes less than 10 minutes. You can choose from several payment methods—including debit/credit cards, bank transfers, and e-wallets such as Skrill.

To learn more about this trading platform, check out our eToro review .

eToro Fees

| Registration fees | Amount |

| CFD Trading Fees | 0.09% per trade on ETF and stock CFDs |

| Forex Trading Fees | Spread, 2.1 pips for GBP/USD |

| Cryptocurrency Trading Fees | Spread, 1% for Bitcoin |

| Inactivity fees | $10 per month after one year |

| Withdrawal fees | $5 |

Benefits :

Disadvantages:

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

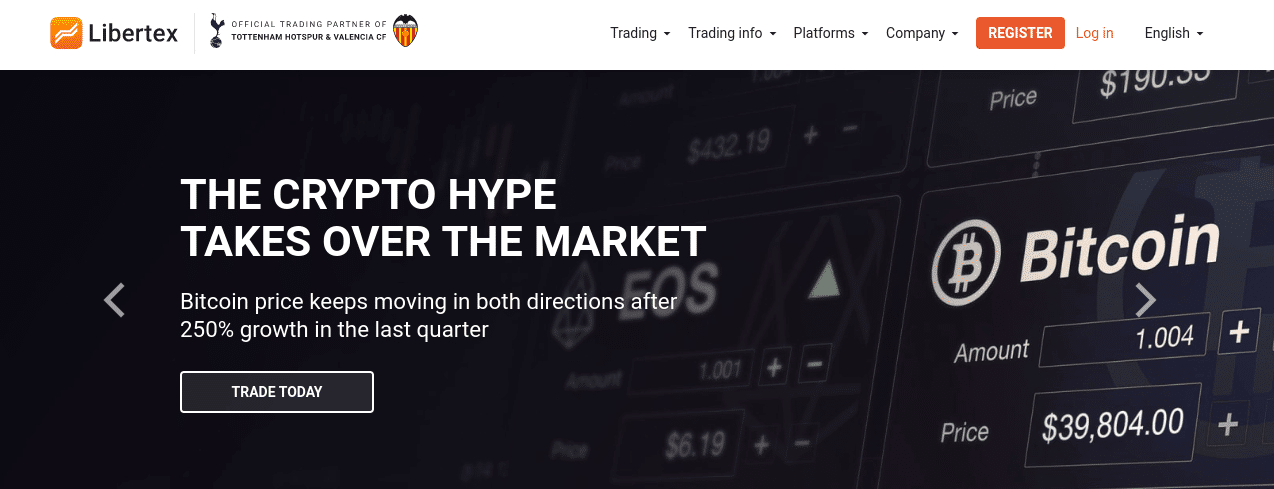

2- Libertex – The low-cost CFD trading platform with tight spreads

Aside from stock trading, Libertex also allows you to buy and sell currency pairs, commodities like gold and oil, and even cryptocurrencies like Bitcoin and Ethereum. No matter which CFD asset class you're interested in, Libertex is a broker with tight spreads.

This means there is no spread between the bid and ask price of the financial instrument in question. Instead, Libertex charges a small commission on every trade you make. While the exact commission varies from asset to asset, it is generally very competitive on this top-rated CFD trading platform.

For example, currency pairs like USD/CAD and NZD/USD can be traded with a commission of just 0.011% and 0.012% per slide, respectively. Prices are even more competitive in the commodities department, as you can trade Brent crude oil CFDs with a 0% commission.

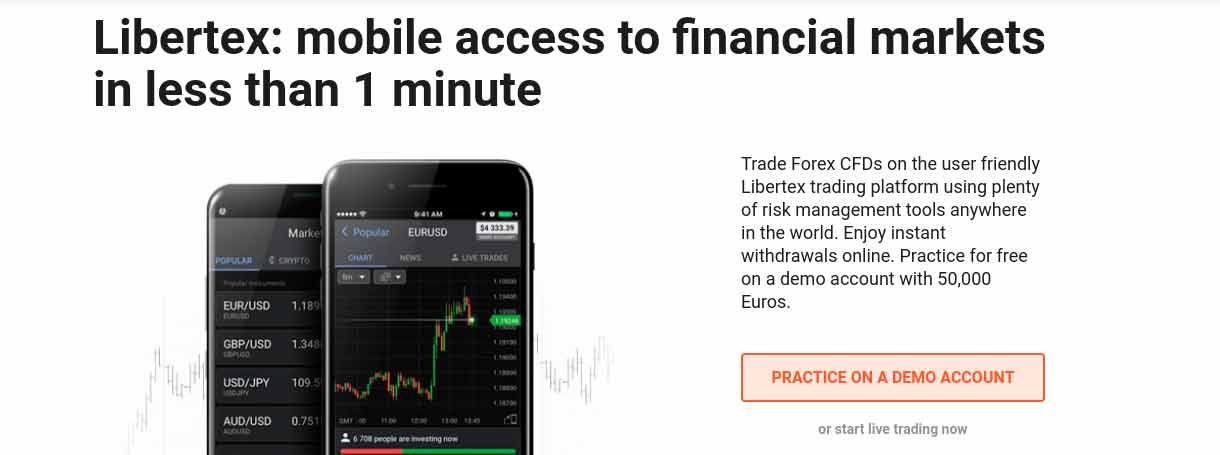

Regarding its platform, Libertex allows you to trade via MetaTrader 4 (MT4). You can also do so from its main website, as the provider offers its own native platform. This is also available via a mobile app, compatible with iOS and Android.

Just like eToro, Libertex allows you to go long and short on all CFD markets, and leverage is also available. You can easily open an account on this CFD trading platform by making an initial deposit of $100. Libertex then allows you to fund your account with a minimum of just $10 per trade.

The provider supports debit and credit cards, as well as e-wallets. Finally, Libertex is regulated by the EU-based CySEC and has been active in the online trading space since the late 1990s. As such, it enjoys an excellent reputation that now spans more than two decades.

Libertex Fees

| Registration fees | Amount |

| CFD Trading Fees | Free |

| Forex Trading Fees | Commission. 0.008% for GBP/USD. |

| Cryptocurrency Trading Fees | Commission. 1.23% for Bitcoin. |

| Inactivity fees | $5 per month after 180 days |

| Withdrawal fees | Free |

Benefits :

Disadvantages:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3- Plus500 - UK CFD broker with tight spreads

One of the main advantages of Plus500 is that it offers an extremely diverse asset library. For example, you can trade not only all major and minor currency pairs, but also a host of exotic currencies.

If commodities are more your thing, Plus500 offers CFDs on metals, energy, and agriculture. This includes everything from wheat to livestock, and from oil to gold and silver. In the area of CFD stock trading, Plus500 offers thousands of markets.

This includes stocks listed in the US, South Africa, Australia, the UK, and several European exchanges. You'll also find markets covering ETFs, cryptocurrencies (availability subject to regulation), and indices. In addition to offering a huge library of CFD instruments, Plus500 is popular because it charges no trading commissions.

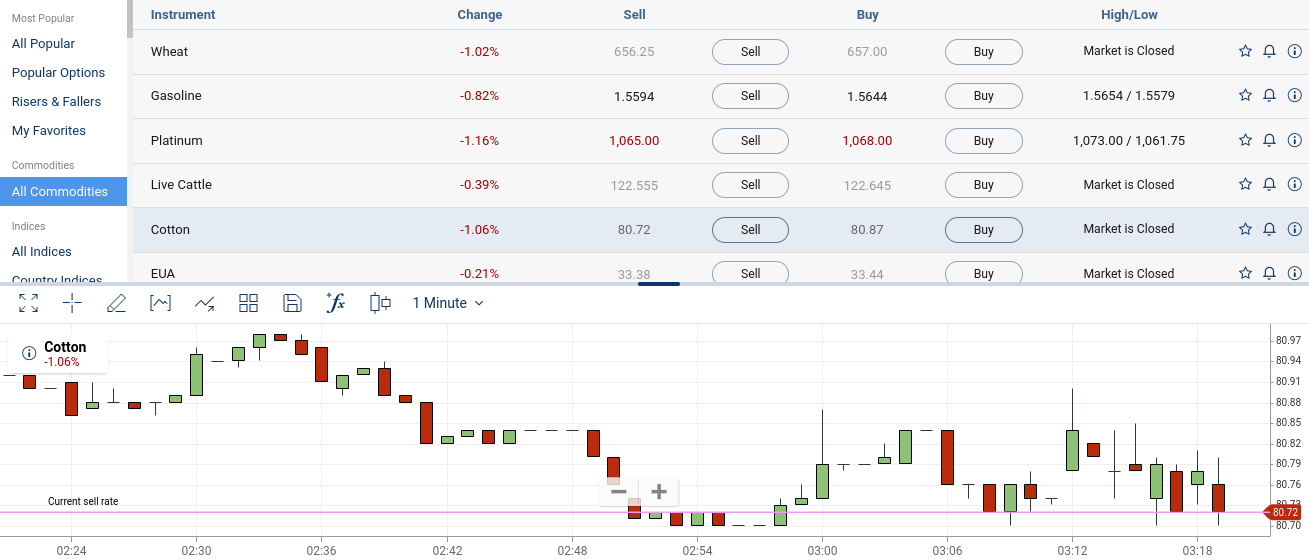

Spreads on major assets are generally very competitive. While Plus500 isn't compatible with third-party trading platforms like MT4 or cTrader, its proprietary platform offers all the tools and features you need. This includes multiple order types, leverage, buy/sell positions, and fully customizable real-time charting tools.

As for the basics, Plus500 requires a minimum deposit of $100. It supports debit and credit cards, bank transfers, and PayPal. There are no fees for depositing or withdrawing funds, although Plus500 reserves the right to charge you if you exceed the monthly withdrawal limit or request a payment below the minimum withdrawal amount.

Plus500 Fees

| Registration fees | Amount |

| CFD Trading Fees | Variable spread |

| Forex Trading Fees | Spread. 1.3 pips for GBP/USD |

| Cryptocurrency Trading Fees | Spread. 4.11% for Bitcoin |

| Inactivity fees | £10 per month after three months |

| Withdrawal fees | Free |

Benefits :

Disadvantages:

72% of retail CFD accounts lose money.

4- IG – The best CFD trading platform for Forex

However, it's the forex CFD trading service that stands out in our eyes - the platform supports over 80 currency pairs. In particular, IG is ideal if you want to access less liquid currency markets like the Mexican peso or the South African rand.

Fees are also very competitive on this top-notch platform. For example, forex trading is commission-free, with spreads starting at just 0.6 pips on major pairs. Even minor pairs are attractive, such as EUR/JPY, with an average spread of just 1.5 pips. According to IG itself, the average spread on the aforementioned pair is 2.27 pips.

IG also offers leverage on its CFD forex trading markets—with the ability to trade major pairs with a margin of just 0.5%. This means that a $100 stake can potentially give you access to trading capital of over $20,000. It's worth noting that IG is more than just a forex broker.

The platform also offers CFD markets on stocks, indices, cryptocurrencies, bonds, interest rates, commodities, indices, and more. Again, these markets cover not only major exchanges, but also emerging economies. Regarding supported platforms, IG offers its own native web trading facility, accessible online or via the mobile app.

IG is also compatible with MT4. If you want to start working with IG today, you can open an account in just a few minutes. However, you'll need to make a minimum deposit of $250 before you can start trading. That said, IG also offers a demo account that requires no deposit. Supported payment methods include debit/credit cards and bank transfers.

IG fees

| Registration fees | Amount |

| CFD Trading Fees | Spread, as low as 0.2 on indices |

| Forex Trading Fees | Spread, 0.9 pips for EUR/USD |

| Cryptocurrency Trading Fees | Spread, 40 pips for Bitcoin |

| Inactivity fees | $18 for two years of inactivity |

| Withdrawal fees | Free |

Benefits :

Disadvantages:

Your capital is at risk.

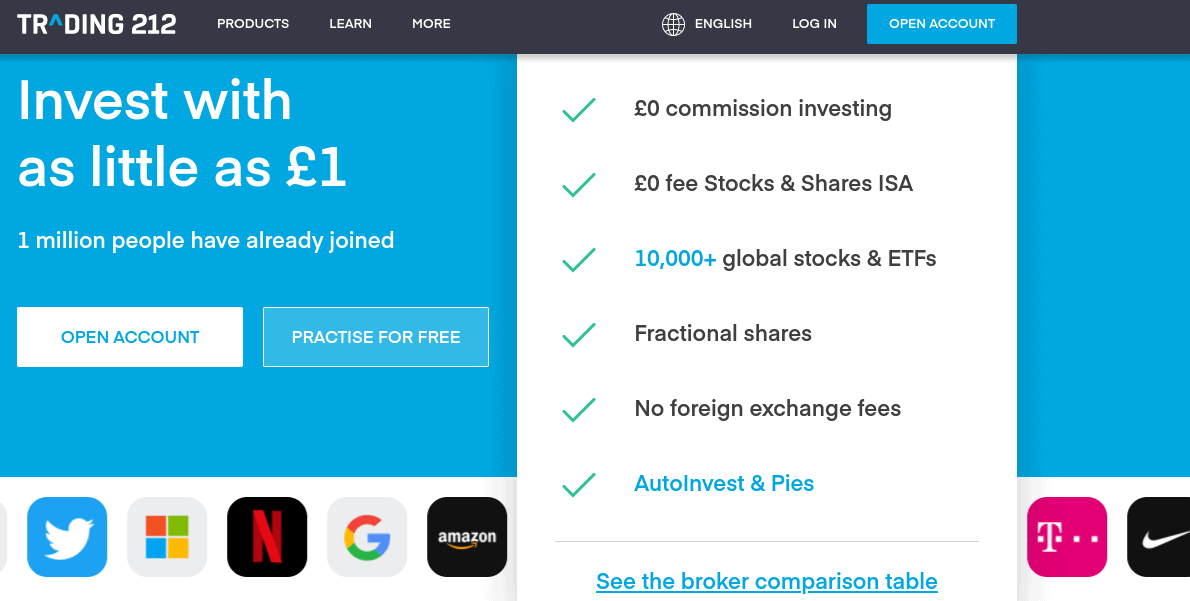

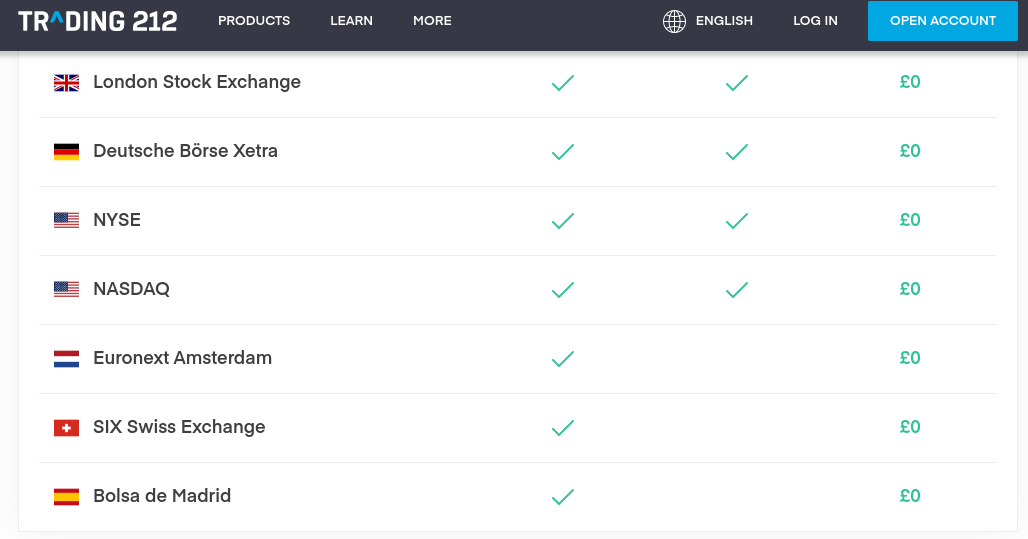

5- Trading 212 – The best CFD trading platform for small stakes ($1 minimum)

That said, if you're looking to trade with real money, Trading 212 lets you start with a minimum deposit of just $1. This is a negligible amount, making it perfect for those looking to learn the ropes of CFD instruments little by little.

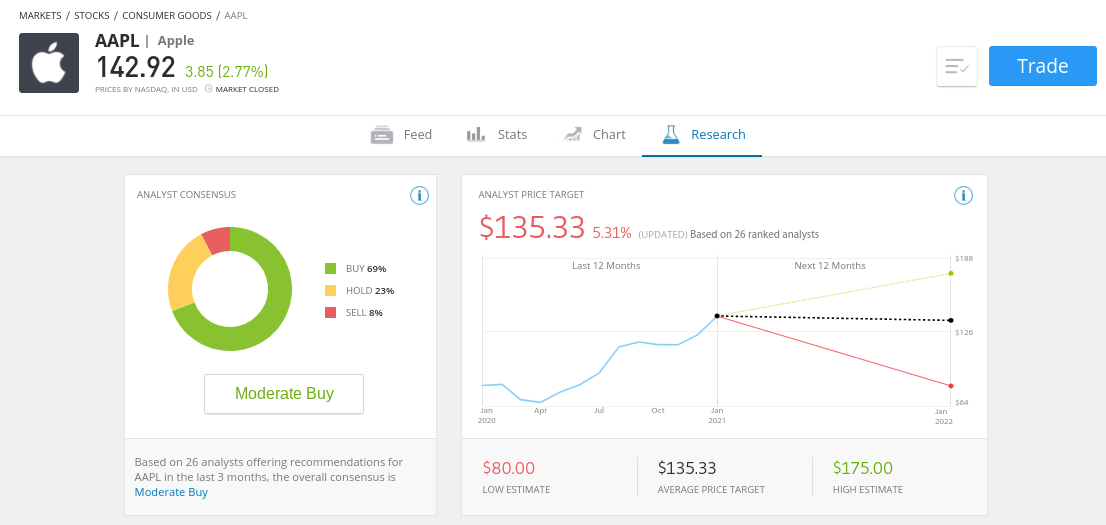

Trading 212 is able to support such small stakes because it offers fractional assets. For example, let's say you decide to trade Apple stock, which is currently priced at $142 per share. If you trade $1, you're trading 0.70% of a single Apple share. In addition to stocks, Trading 212 also offers CFDs on forex, commodities, cryptocurrencies, and more.

You won't have to pay a commission if the asset in question is priced in the same currency as your Trading 212 account. For example, if you deposit in US dollars and trade gold, no commission will apply since hard metals are priced in USD.

However, if you decide to trade assets priced in a currency other than your Trading 212 account currency, a small 0.5% foreign exchange fee applies. It's worth noting that Trading 212 also gives you access to traditional stocks and ETFs. This means you can invest in the asset and receive your share of the dividend payments.

This transaction is also commission-free at Trading 212—even on assets priced in a different currency. In terms of security, Trading 212 has been offering brokerage services since 2004. The provider is regulated, and its mobile trading app has excellent reviews. For example, the app is rated 4.2/5 on Google Play and 4.7/5 on the Apple Store.

Trading Fees 212

| Registration fees | Amount |

| CFD Trading Fees | Variable spread |

| Forex Trading Fees | Spread, 1.4 pips for EUR/USD on average |

| Cryptocurrency Trading Fees | Spread, 40 pips for Bitcoin |

| Inactivity fees | Free |

| Withdrawal fees | Free |

Benefits :

Disadvantages:

Your capital is at risk.

How to choose the best CFD trading platform?

While we've discussed the best CFD trading platforms available online today, there are hundreds of other providers active in this space, so you may come across a platform you like that we haven't discussed today.

If so, we suggest you do your research before opening a CFD trading account. This way, you can be 100% sure that the provider is right for you.

The most important parameters to consider when searching for the best CFD trading platforms are:

Regulations

The CFD trading industry is heavily regulated in most countries around the world. This is because CFDs are complex instruments that allow you to trade with more money than you have in your account through leverage. As such, in some countries, such as the United States, CFD trading is completely prohibited.

When looking for the best CFD trading platform for your needs, you need to ensure the provider is licensed to operate. This is a fairly straightforward process, as there are several leading regulators that dominate this space.

For example :

- FCA (UK)

- CySEC (Cyprus)

- ASIC (Australia)

- MAS (Singapore)

Therefore, if your chosen CFD platform is licensed by at least one of the above-mentioned bodies, as is the case for each of the providers we have selected, you can be sure that it is heavily regulated.

These regulators ensure that your funds are kept in separate bank accounts from those of the CFD platform and that the platform does not offer you leverage greater than that permitted in your country of residence.

CFD assets and supported markets

The beauty of CFD platforms is that they often give you access to thousands of financial markets. After all, CFDs' sole purpose is to track the asset's price movements in real time, meaning you don't need to own the product.

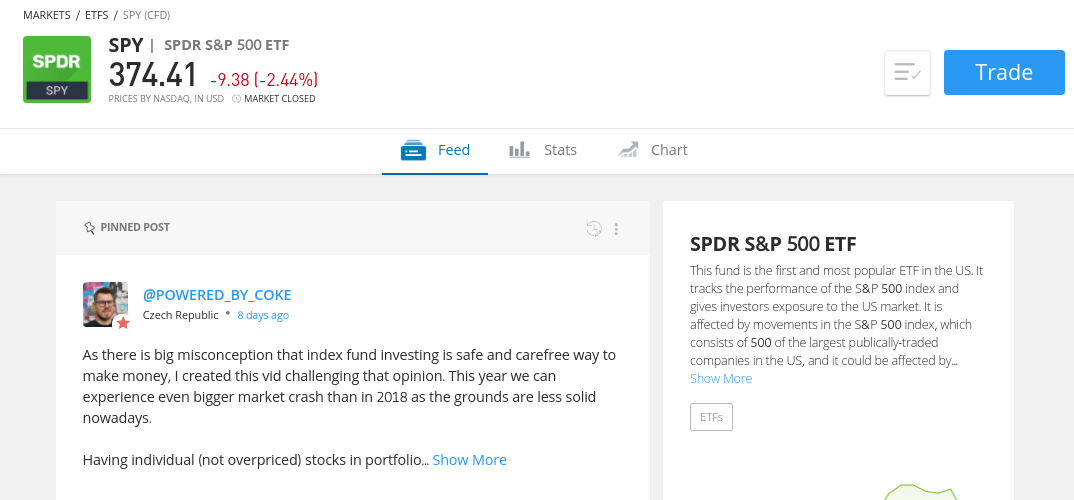

That said, there's often a wide disparity in the assets you'll have access to on your chosen CFD trading platform. For example, eToro covers everything from stocks, ETFs, indices, cryptocurrencies, forex, and commodities.

Past performance is not a guarantee of future results.

This encompasses most of the global trading sphere—so if a market exists, you'll likely find it on eToro. At the other end of the spectrum, we've encountered many CFD brokers that offer a very small number of markets.

Therefore, be sure to check which assets you can trade before opening an account on a CFD trading platform.

Registration fees

Another advantage of trading CFDs—as opposed to buying and selling traditional assets—is that you often benefit from lower fees. Again, this is because the broker is not required to purchase the asset on your behalf.

However, trading fees can vary considerably depending on the platform you choose. Below, we outline the main fees to consider.

Commissions

Make no mistake: the best CFD brokers in the online space allow you to trade commission-free. Of course, platforms still need to make money, but they often do so through the spread.

However, some trading platforms charge a commission, usually as a percentage. For example, if the CFD trading platform charges 0.2% and you stake $500, the commission will be $1.

Trading spread

While there are many providers offering commission-free services, the best CFD trading platforms will always charge a spread. The only exception to this rule is Libertex, which compensates by charging a small commission.

The spread is an indirect cost that you must take into account and which translates into the difference between the buy price and the sell price of the asset.

- For example, if the difference between the two prices is 0.5%, that's what you pay via the spread.

- Simply put, you need to make 0.5% gains on your CFD trade to break even, and anything above that is a net profit.

For example, forex and gold can be traded with an average spread of 0.008% and 0.05%, respectively. It's worth noting that not all CFD trading platforms clearly advertise the spreads they vary.

So you may need to do some calculations on your end. You can easily do this by calculating the percentage difference between the bid (buy) and ask (sell) prices of the financial instrument in question.

Overnight financing

Although CFD trading instruments offer the advantage of lower commissions and spreads, there's a chink in the armor: overnight financing. For those unaware, this is a fee charged by CFD trading platforms for each day you keep the position open. The platform may apply this fee at a certain time of day, such as 10 p.m.

- The reason overnight financing is charged is because CFDs are leveraged financial products.

- As such, overnight financing can be thought of as a daily interest charge that you pay to access your chosen markets.

- As for the amount you will have to pay, it is usually an annual interest rate which is then calculated based on your exposure.

The best CFD trading platforms clearly display what you'll pay in overnight financing fees before you place your trade. eToro, for example, displays the daily fees in dollars and cents.

Ultimately, overnight financing means that CFD trading is better suited to day traders or swing traders. So, if you want to trade assets for several months or years, it's better to opt for traditional investment vehicles like stocks or ETFs.

Other CFD trading platform fees

There are several other fees you may encounter when researching the best CFD trading platforms.

This includes:

- Deposit and Withdrawal Fees : You may have to pay a fee to deposit and/or withdraw funds. In this case, it is often a percentage of the transaction amount.

- Exchange Fees : Some CFD trading platforms charge you an exchange fee when you trade an asset priced in a currency other than your account currency. Exchange fees may also apply when you make a deposit.

- Short selling dividend-paying stocks: If you short sell dividend-paying stock CFDs, the platform will likely debit your account to cover the payment. On the other end of the trade, those long the stock CFD will receive the dividends.

- Inactivity Fees: Even the best online CFD trading platforms charge inactivity fees. For example, if your account is marked as inactive for 12 months, you may have to pay a monthly fee. However, if your balance is zero, no fee will be applied.

The best thing to do to find a low-cost online CFD trading platform is to check the fee schedule on the provider's website before signing up.

Trading Tools and Features

The best CFD platforms offer a variety of tools and features that can enhance the trading experience, while others offer little more than a basic service.

Here are some of the most notable tools to look for:

Leverage

The best online CFD trading platforms offer leverage on all supported exchanges. As we briefly discussed earlier, leverage allows you to increase your account balance and therefore trade CFDs with more than you have available. Essentially, this allows you to amplify your profits on successful trades.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Again, the amount of leverage you have will depend on several factors, including:

- Financial instrument - major currency pairs usually have the highest limits.

- Your country of residence - Europeans and UK residents are limited to a maximum of 1:30, while other nations have no limit.

- Whether you are a retail customer or a professional trader.

Be careful, leverage not only has the potential to explode your profits, it can also increase your losses. Therefore, be careful and make sure you understand the risks.

Trading orders

The best online CFD trading platforms allow you to choose from several order types.

This includes:

-

-

- Buy and sell orders

- Limit orders

- Market orders

- Stop-loss orders

- Trailing stop-loss orders

- Profitable orders

- Valid until order cancellation

-

If your chosen online CFD trading platform doesn't offer your preferred order types, another option is to trade via MT4/5 or cTrader. This is provided, however, that the provider in question is compatible with the aforementioned third-party platforms.

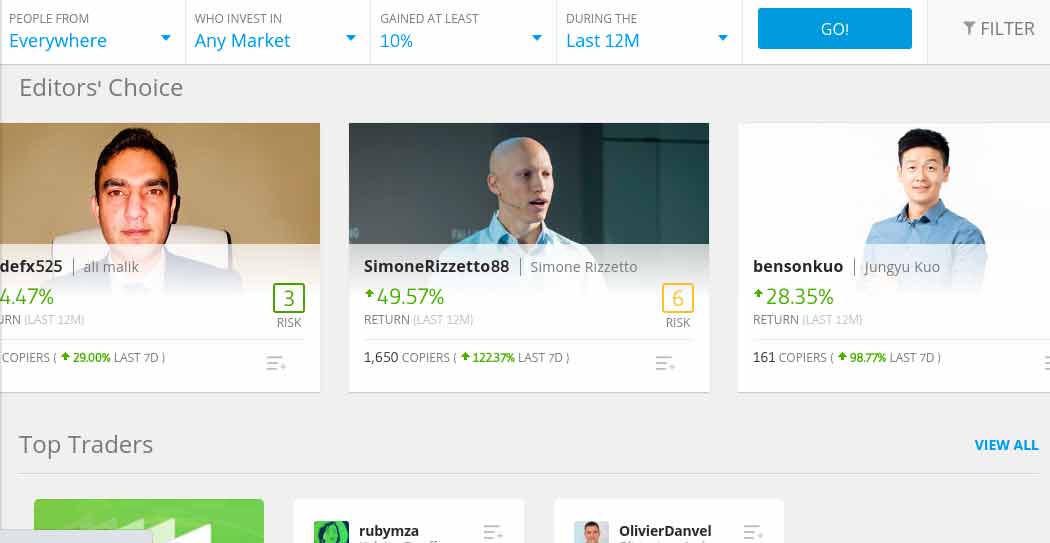

Copy Trading

The phenomenon of "Copy Trading" has grown exponentially in recent years. As we briefly explained earlier, this allows you to copy a successful trader, exactly as they appear. This allows you to actively trade CFDs without any prior experience. In other words, it's a 100% passive way to access the global financial markets.

Past performance is not a guarantee of future results.

There are several ways to use the Copy Trader feature, such as purchasing and installing a robot in MT4. However, the most user-friendly, transparent, and secure way to do so is through eToro. This regulated CFD trading platform gives you access to thousands of verified traders.

Everything at eToro is transparent, which means you can see the following statistics of the Copy Trader you have chosen:

-

-

- Total profit and loss since joining eToro

- Average monthly returns

- Preferred asset class (e.g., stocks or currencies)

- Risk assessment

- Average duration of trades

- And much more

-

Not only is eToro's Copy Trading tool easy to use, but there are no additional fees to consider. Plus, you can always add assets to your portfolio as and when you want—so you retain complete control over your account.

Alerts and notifications

No matter which CFD market you're interested in, financial instruments change in value every second, so it's important to stay up-to-date on what's happening at all times.

The best way to stay ahead of the curve is to choose a platform that offers alerts and notifications. At its most basic, the platform can allow you to set up a price alert on the CFD assets you want to trade.

- For example, the price of gold may be $1,850 per ounce, but you may not want to enter the market until it reaches $2,000.

- When this happens, the platform sends an alert to your mobile phone in real time.

The best online CFD trading platforms go even further by allowing you to set up volatility alerts. For example, if Facebook shares rise or fall by more than 5% during a single trading day, the provider will send you an alert.

Education, research and analysis

The best CFD trading platforms recognize that not all account holders are seasoned professionals. On the contrary, many traders are entering the world of CFDs for the very first time.

That's why we find that the best platforms offer an abundance of educational resources. These could be guides on how to buy and sell specific assets, explanations of the main order types, or even weekly webinars hosted by an in-house trader.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

We also note that the best CFD trading platforms provide research and analysis tools. The ability to perform in-depth technical analysis from the platform is particularly important. If MT4/5 is supported, this is also sufficient.

Your chosen asset class can also be influenced by real-world events, such as interest rate adjustments, supply disruptions, or increased geopolitical uncertainty. That's why the best CFD trading platforms also provide you with financial information.

User experience

CFD trading platforms can be a real battleground, intimidating for those with little or no experience in the financial markets. That's why the platform's end-to-end user experience is a crucial metric to consider. You can usually get a sense of the provider's suitability for beginners when you first visit the platform's website.

Past performance is not a guarantee of future results.

However, to determine whether the platform is user-friendly or not, you need to test it for yourself. The best way to do this is to choose a platform that offers demo accounts. All the providers we mentioned above offer them, with no obligation to make a deposit.

Past performance is not a guarantee of future results.

Ultimately, this allows you to try out the platform before making a financial commitment. In addition to the trading experience itself, the best CFD platforms should simplify the process of depositing and withdrawing funds.

Mobile application

All of the best CFD trading platforms we've discussed today offer a fully-fledged mobile app. Even if you're not interested in trading via a mobile app, it's still crucial to have access to one. After all, you might be away from your main desktop computer and want to open a new position.

Or, you may be away from home and discover that one of your positions is collapsing and want to close it immediately. The best CFD trading apps not only offer a great user experience, fully optimized for your operating system, but they also give you access to all the account features found on the main platform.

This should include the ability to deposit/withdraw funds, check your portfolio value, enter and exit positions, perform research, etc.

Payment Methods

This means you'll likely have to wait 2-3 days for the funds to arrive—sometimes longer. That's why the best CFD trading platforms allow you to make an instant deposit with a debit/credit card.

This is a service offered by all the providers listed on this page. eToro goes even further by supporting e-wallet deposits and withdrawals.

This includes Neteller and Skrill. Remember to check if your chosen payment method incurs any fees. Specifically, some CFD trading platforms will charge you additional fees if you use a credit card. IG, for example, charges 0.5% and 1% on MasterCard and Visa credit cards, respectively.

Customer Service

The best CFD trading platforms are available when you need help. The best way to do this is to have a live chat feature, accessible on the provider's website without having to log in. While phone support is sometimes available, it can be cumbersome if the provider is located abroad.

We found a plethora of CFD trading platforms that only offer email support—meaning you won't be able to speak to an agent in real time. In terms of support hours, some platforms operate 24/7, while others opt for a 5/7 service—in line with the financial markets.

How to start trading CFDs

If you're completely new to the world of CFD trading, we'll now explain how to get started. This includes opening an account, making a deposit, and placing your first order.

The guidelines below will show you how to trade CFDs on the eToro platform.

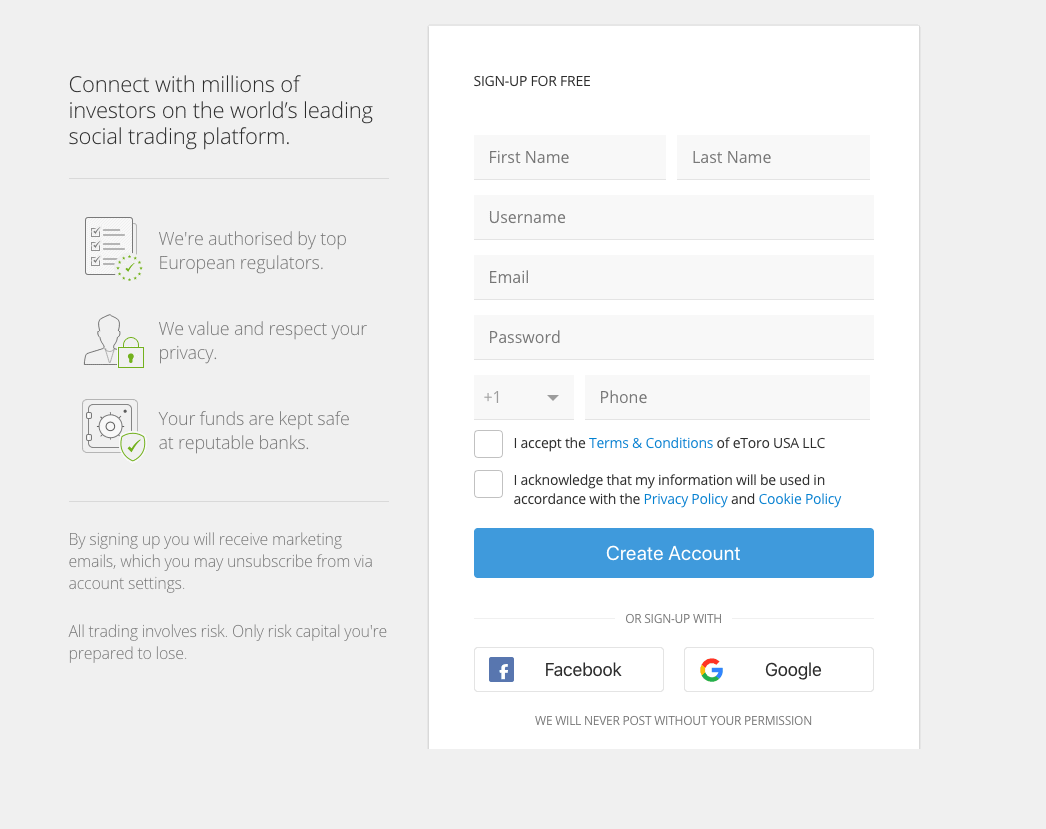

Step 1: Open an account

As we noted earlier, the world of CFD trading is heavily regulated. As such, eToro requires you to go through a quick registration and verification process before you can start trading.

To get started, go to eToro and click "Register Now."

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

The CFD trading platform will then collect certain information about you, including:

- Personal information

- Contact details

- National tax number

- Previous negotiation experience

You will also need to create a strong username and password.

Step 2: Confirm identity

Once you open an account on eToro, the provider will ask you to submit certain identification documents.

This includes:

- Valid passport or driver's license

- Utility bill or bank statement (issued within the last 3 months)

eToro uses automated FinTech products to verify documents, so you should get the green light in less than two minutes.

Step 3: Deposit Funds

You now need to make a deposit in order to start trading CFDs with real money.

On eToro you can choose from the following payment methods:

- Visa

- MasterCard

- Maestro

- Skrill

- Neteller

- Bank transfer

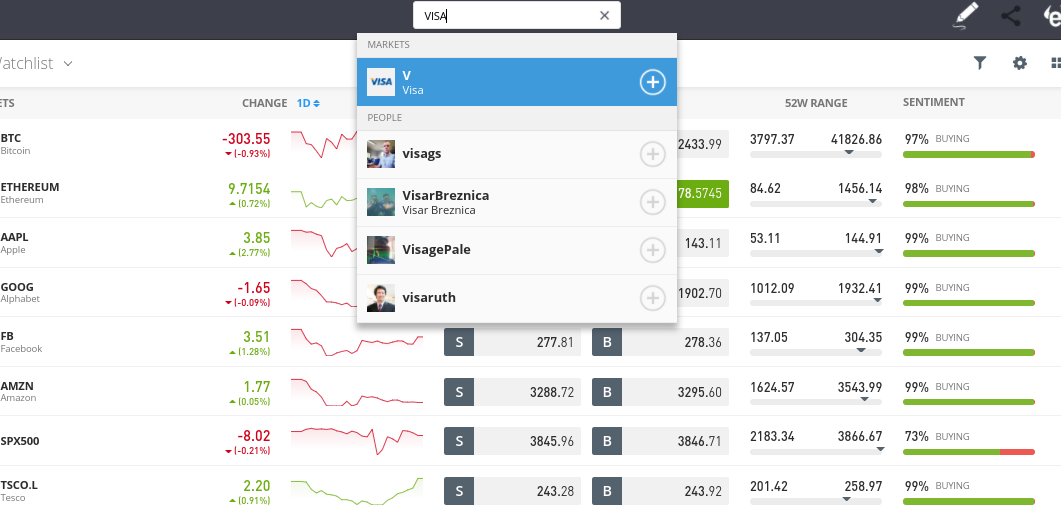

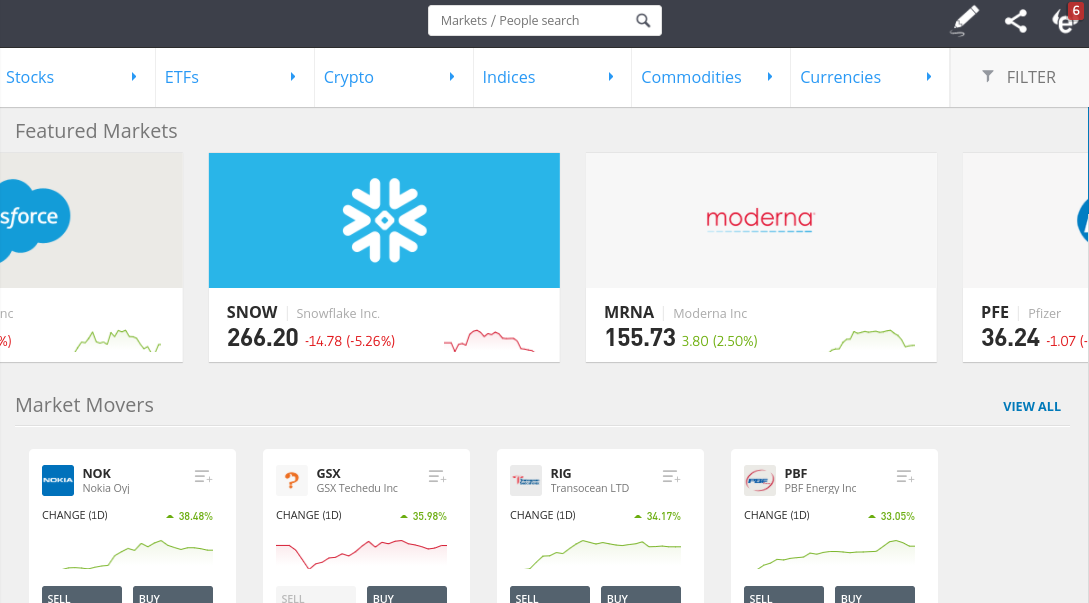

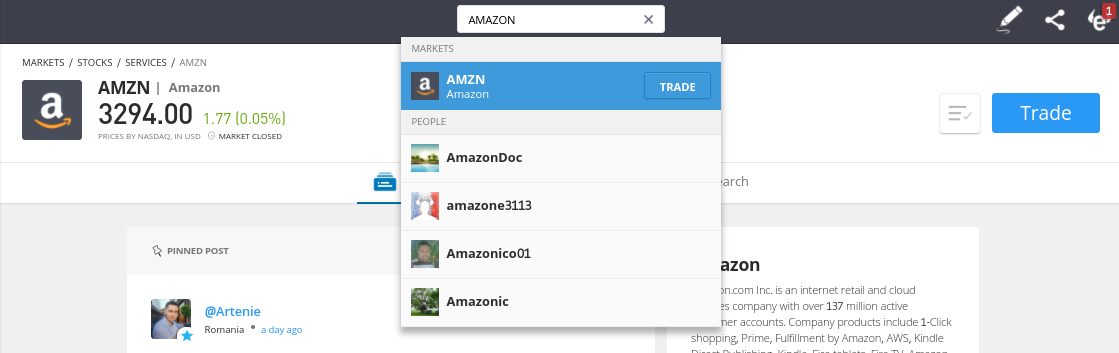

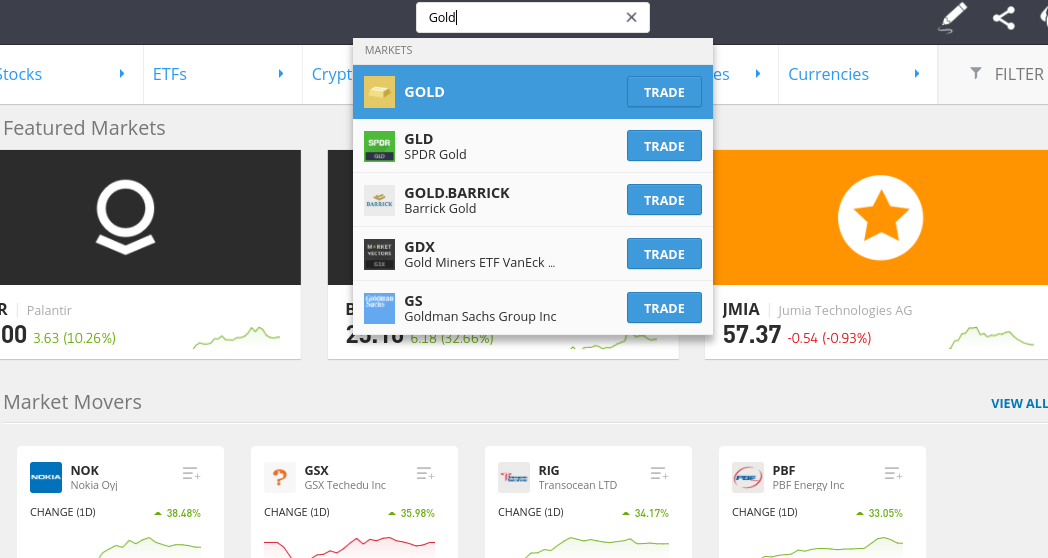

Step 4: Research a CFD Trading Market

eToro makes it easy to find the CFD trading markets you want. In fact, if you already know which financial instrument you're interested in, all you have to do is search for it.

In the example below, we are looking to trade CFDs on gold - so we enter "Gold" into the search box and click the "Trade" button.

Past performance is not a guarantee of future results.

You can also click the "Trade Markets" button on the left side of the dashboard to view all the assets available on eToro. You can divide them according to the respective asset class—for example, commodities or indices.

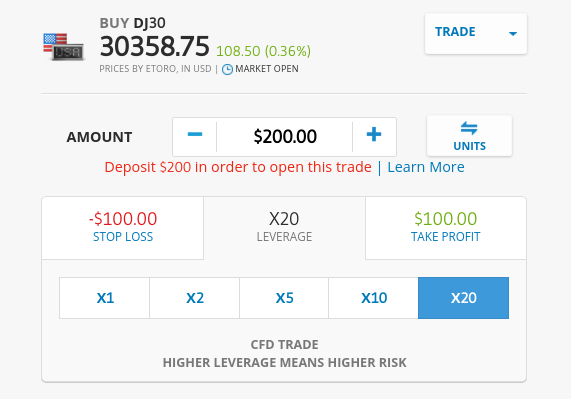

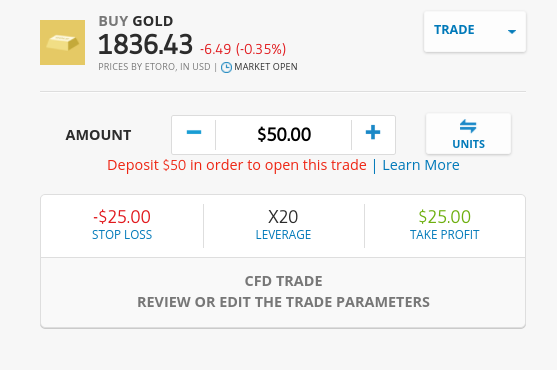

Step 5: Place a CFD trade

The final step in the process is to place an order. Essentially, this order tells eToro which trade you want to make on the CFD market of your choice.

Past performance is not a guarantee of future results.

The fields you will need to fill in are as follows:

- Buy/Sell: This states whether you think the value of the CFD instrument will increase (buy order) or decrease (sell order).

- Amount: The "Amount" field is where you enter your bet. In our example, we are betting $50.

- Leverage: If you wish to apply leverage, select the required multiple. In our example, we are applying leverage of 1:20 on our gold CFD trade.

- Stop-Loss: By entering a stop-loss order price, eToro will automatically close your CFD trade if its value drops by a certain amount. ( Note: they are not guaranteed against slippage ).

- Take-Profit: You also enter a price at which you want your CFD trade to be closed when it reaches a specific profit target.

Finally, click the "Open Trade" button to place your CFD trade on eToro!

Conclusion

The world of CFD trading platforms is overcrowded today. With so many providers at your disposal, knowing which platform to sign up with can be a long and daunting process. That's why we're presenting the best online CFD trading platforms in the arena in 2021.

That said, we found eToro to be by far the best CFD trading platform of all the providers we reviewed. This is because the platform offers tight spreads and hosts thousands of tradable markets. Additionally, it's heavily regulated, easy to use, and even offers CFD copy trading services at no extra cost.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

FAQ

What is the meaning of a CFD?

Which CFD trading platforms have the lowest fees?

What is the best CFD trading platform?

Which CFD trading platforms do professional traders use?

Are CFDs legal in the US?

How does commission-free CFD trading make money?

What CFDs can you trade online?