eToro Avis 2026 – Test Complet de la Plateforme

eToro is currently one of the largest online brokerages, with over 20 million users. You can even invest passively using the Copy Trading feature. And it’s all very easy to use.

But, is eToro the right online broker for you?

In this eToro Review 2026, we’ll cover everything you need to know about this site.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

What is eToro?

eToro is an online brokerage launched in 2007. The trading platform , which bills itself as the « world’s leading social trading network, » now hosts over 20 million traders and investors. eToro’s popularity in such a short time is attributed to several notable features.

Perhaps the spearhead of this is its social trading offering, essentially a Facebook for the online investing world. In other words, eToro allows you to communicate with other users of the platform, post and reply to threads, and even like comments. This allows you and your fellow investors to discuss trading strategies.

You then have an innovative tool, Copy Trading, which allows you to select an experienced eToro investor and copy their portfolio and current positions identically.

Unlike many of its industry counterparts, the eToro platform is really easy to use. It’s also ideal for beginners. And of course, eToro is heavily regulated in multiple jurisdictions, so your capital is safe.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

[end-brand-section name= »pros_cons »]

Advantages and disadvantages

Before we dive into the ins and outs of our full eToro review, let’s take a look at the main pros and cons we discovered.

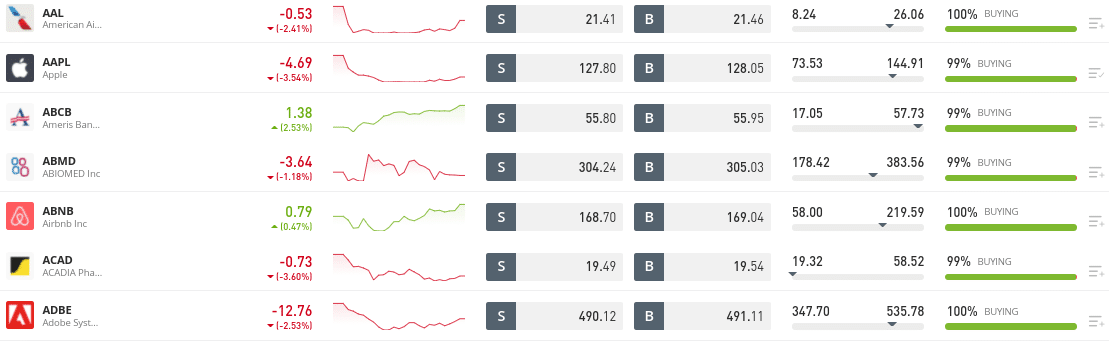

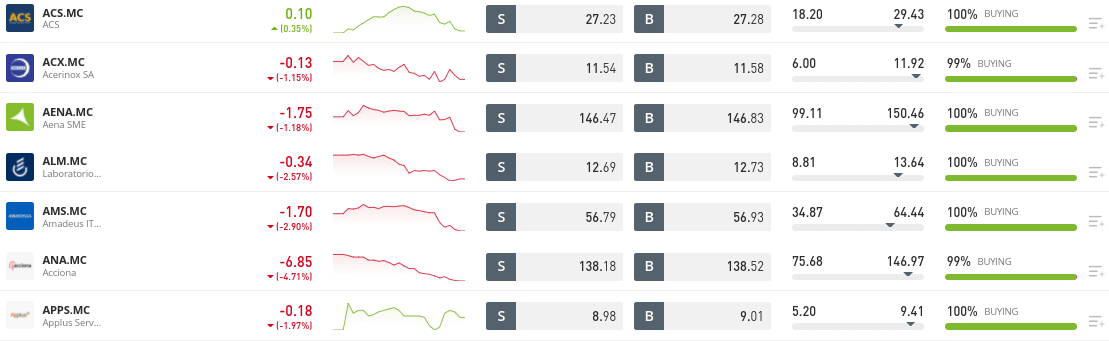

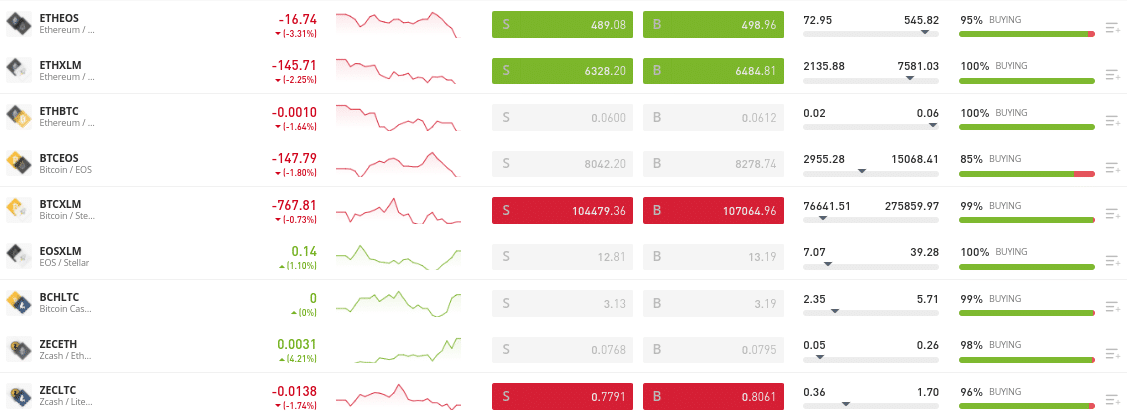

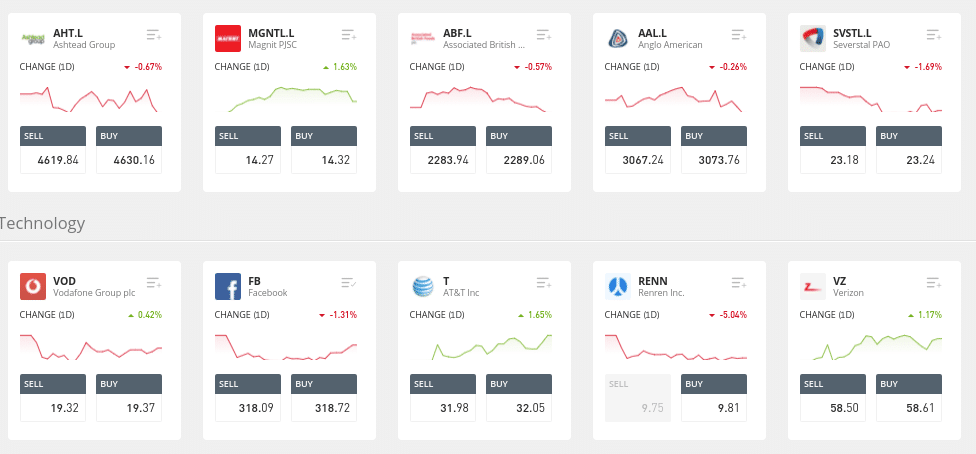

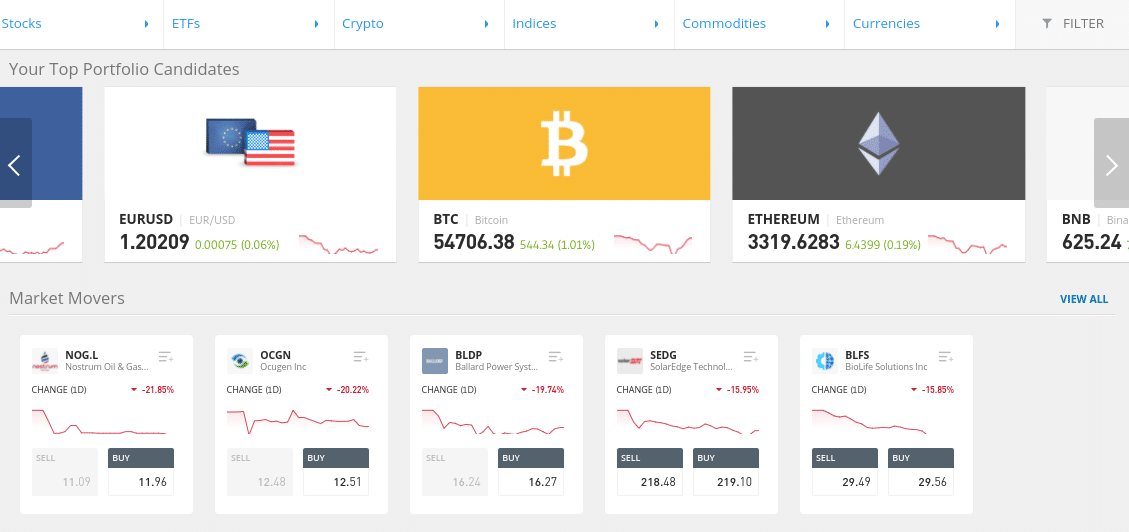

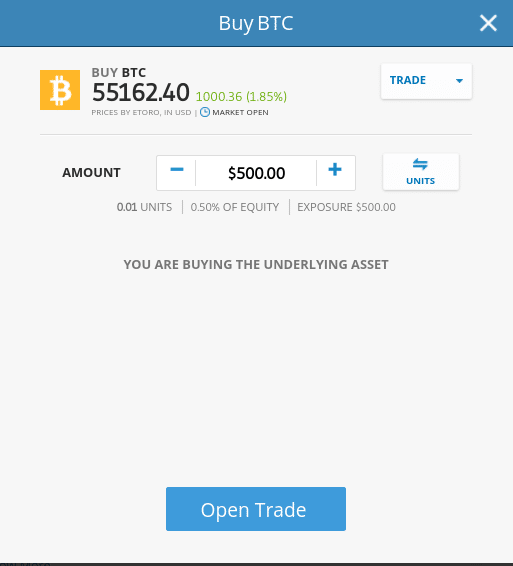

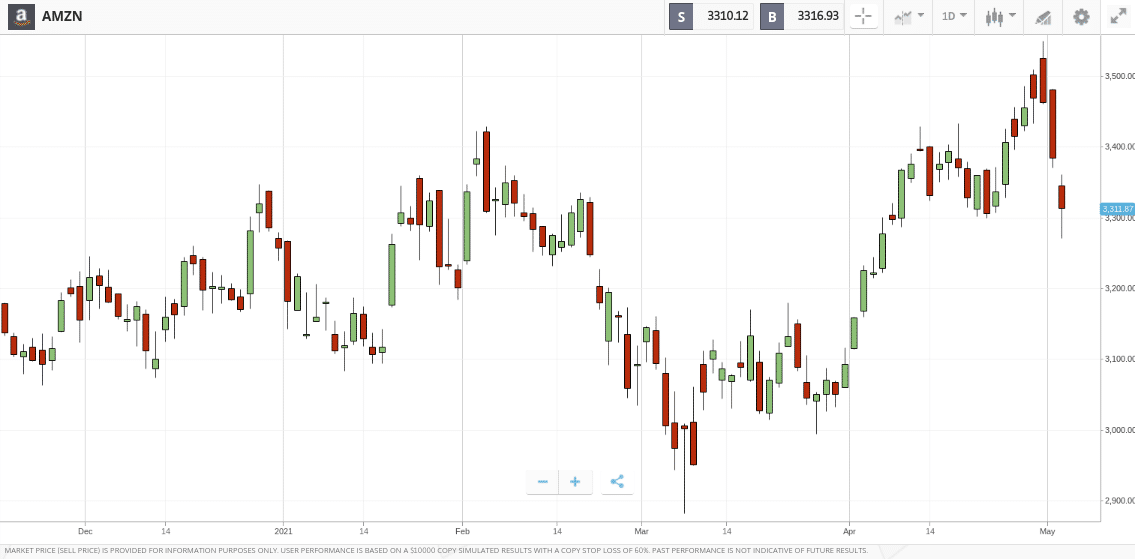

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. Dans la première partie de notre test approfondi d'eToro, nous avons examiné les marchés et les classes d'actifs qu'eToro prend en charge. Remarque : comme nous le couvrons plus en détail ci-dessous, certains actifs (actions, ETF, crypto-monnaies) peuvent être achetés et possédés, au sens traditionnel, tandis que d'autres (forex, matières premières, indices) sont négociés en tant que CFD à effet de levier. Commençons par le service de trading d'actions d'eToro. En un mot, ce site de courtage vous donne accès à des milliers d'actions. Il s'agit non seulement des deux principales bourses américaines, NYSE et NASDAQ, mais aussi de 15 autres marchés internationaux. Cela comprend : Comme vous pouvez le voir ci-dessus, vous allez avoir accès aux marchés boursiers d'Amérique du Nord, d'Europe, d'Asie, du Moyen-Orient, entre autres. Il y a un certain nombre de points clés à noter concernant le trading d'eToro. Tout d'abord, lorsque vous achetez des actions, vous en êtes le propriétaire à part entière. Cela signifie que vous êtes officiellement un actionnaire et donc que vous aurez droit de toucher les dividendes de la société concernée. Deuxièmement, eToro prend en charge la propriété fractionnée. Cela ouvre la voie aux petits investissements. La propriété fractionnée est un aspect crucial de la scène boursière moderne, surtout si vous souhaitez investir dans des sociétés cotées aux États-Unis qui peuvent être considérées comme "onéreuses". Par exemple, les actions d'Amazon se négocient à plus de 3 300 dollars, et Tesla à plus de 700 dollars. Chez eToro, l'investissement minimum en actions est de 50 $ seulement, quel que soit le prix des actions. Si les investissements en actions fractionnées sont nouveaux pour vous, voici comment cela fonctionne chez eToro. Not only is eToro's fractional share investing tool ideal for those on a budget, but it's also ideal for diversification purposes. For example, if you deposit $1,000 on eToro, you can buy 20 different stocks for $50 each. This allows you to create a risk-inverse portfolio. We mentioned above that when you buy stocks on eToro, you own them outright. That said, the online broker also allows you to trade stocks via CFDs. This will be of interest to those looking to trade in the short term. Indeed, CFDs on stocks allow you to benefit from additional advantages, such as leverage and short selling. For example : All stocks and exchanges that can be bought in the traditional sense can also be traded via CFD instruments. Now that we've covered stocks, in this section, we'll look at cryptocurrencies. This sector is divided into several digital currency markets and pair types, so we'll break them down one by one. If you're a long-term cryptocurrency investor, you'll be happy to know that eToro allows you to buy and own 19 different digital tokens. This includes: eToro is constantly adding new digital currencies to its list based on market demand. For example, a few days before this review was written, the broker added Dogecoin. In terms of ownership, you'll be purchasing the cryptocurrency of your choice with no strings attached, meaning you can hold onto your investment for as long as you like. Of course, you'll also need to consider how you plan to store your newly purchased digital coins on eToro.

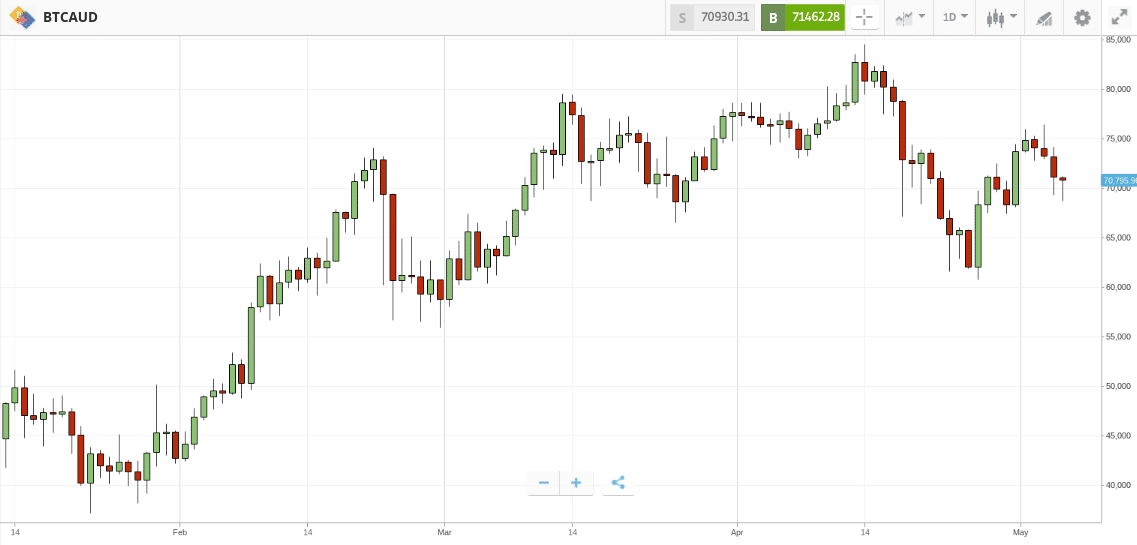

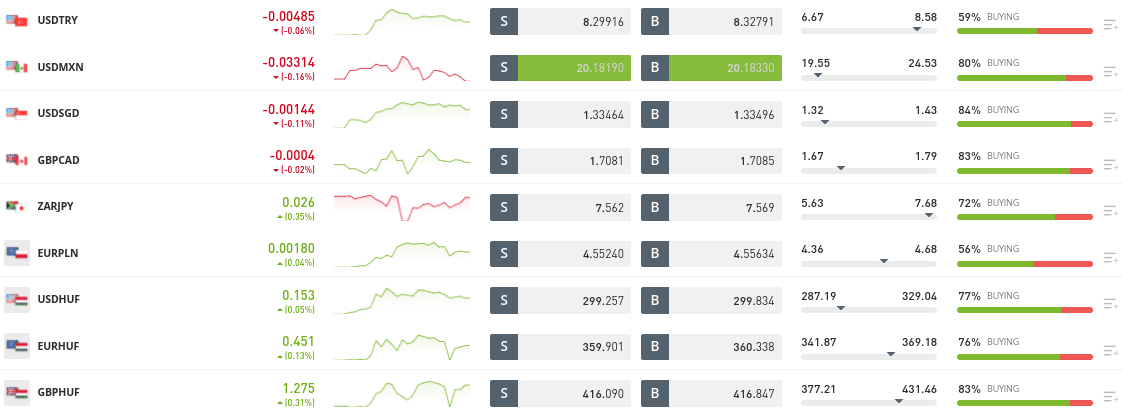

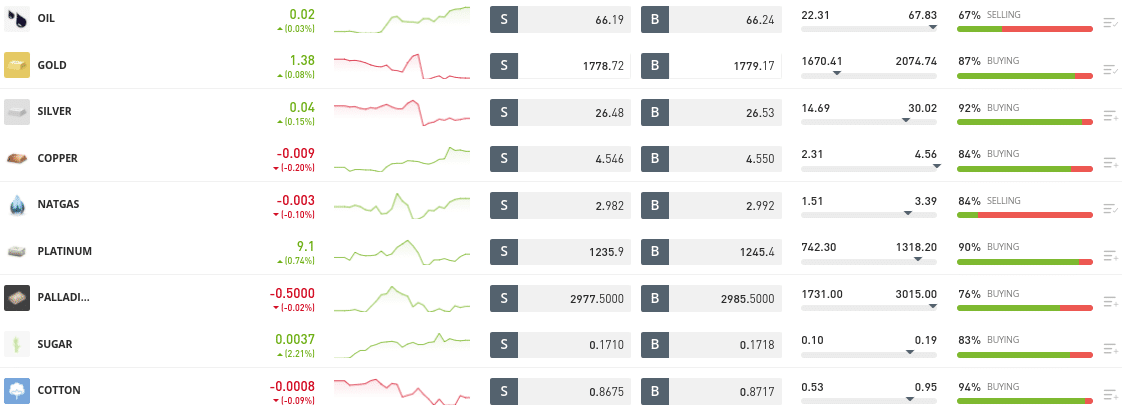

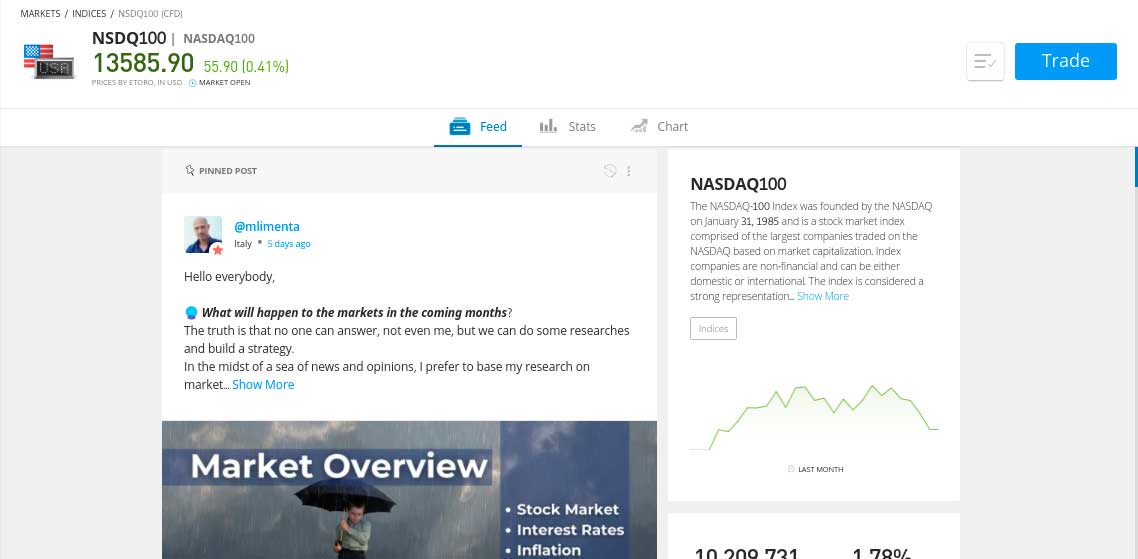

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. In addition to being able to purchase digital tokens on the eToro website, you can also engage in cryptocurrency trading . Again, this will be of interest to those of you who are interested in adopting a day trading strategy with cryptocurrencies. As we discussed earlier, this not only allows you to apply leverage, but also to enter a short-sell position. Regarding the first point, most traders are limited to 1:2 leverage. This means you can trade cryptocurrencies with twice the amount you have in your eToro account. As for supported markets, they come in two forms. First, you have crypto-fiat pairs. This means you're trading the exchange rate between a fiat currency and a cryptocurrency. The 19 tokens we listed above can all be traded against the US dollar. Additionally, many of them can also be traded against another fiat currency, such as the British pound, euro, Japanese yen, or Australian dollar. Second, you have crypto-to-crypto pairs. As the name suggests, this means you'll be trading between two digital currencies. For example, Bitcoin and Ripple (BTC/XRP) or EOS and Ethereum (EOS/ETH). Crucially, whether you're buying cryptocurrencies or trading via CFDs, the minimum stake is just $25. Again, this is done through eToro's Fractional Ownership tool. If your preferred asset class is forex, eToro has you covered. At the time of writing, the brokerage offered 49 forex trading pairs. All of them could be traded 24 hours a day. You can access all major and minor pairs, including EUR/USD, GBP/USD, and EUR/GBP. eToro is also a great option if you're a risk-taker. Or if you're interested in trading exotic currencies. Some of the exotic currency pairs hosted by eToro include: In terms of leverage, most traders on eToro will be offered 1:30 on major pairs, and 1:20 on minor and exotic pairs. This is ideal if you want to trade forex but only have access to limited starting capital. eToro currently offers over 250 ETFs, which is ideal if you're looking to invest in a diversified portfolio of assets. This includes index funds such as the Dow Jones, FTSE 100, and S&P 500—backed by providers like Vanguard, iShares, and SPDR. You can also invest in ETFs that track commodities like gold and silver, as well as portfolios that track dividend stocks, growth stocks, blue-chip stocks, and more. Regardless of which ETF you choose to invest in, the minimum investment is only $50. You'll, of course, be entitled to dividends as the ETF provider makes a payment. If you'd like to initiate commodity trades from home, eToro offers access to 31 markets. These can also be done via leveraged CFDs. The offer is typically 1:20 on gold and 1:10 on other assets. Short selling is also available if you believe a commodity is overvalued. The commodities trading department on eToro consists of three main categories: The minimum trade size when buying and selling commodity CFDs on eToro is only $50. The final asset class we covered during our eToro review process is indices. In total, you can speculate on the future value of 13 different indices, including the FTSE 100, Dow Jones, S&P 500, Spain 35, Hong Kong 50, and more. Leverage of 1:20 and 1:10 will be offered on major and minor indices, respectively.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. [end-brand-section name="fees"] Now that we have seen which financial instruments are supported by the broker, in this section we will detail the main fees that you will have to pay. Before explaining the fee structure in more detail, check out the eToro fee table below. As mentioned above, there are no ongoing platform fees at eToro - meaning you can hold your investments for as long as you like without having to worry about monthly or quarterly fees. eToro uses the industry's standard variable spread system . For those unaware, this means that the spread, which is the difference between the buy and sell price of an asset, varies throughout the day. It will generally be more competitive during busy market hours, such as when trading EUR/USD during the US/European crossover. The spread, of course, varies considerably depending on the market you wish to trade. For example, if you trade major stocks listed on NASDAQ or NYSE, you will pay an average of 0.2%. If you trade gold or a major index like the Dow Jones, this percentage will be even lower. For cryptocurrencies like Bitcoin, we found the spread to be 1% on average, and slightly higher for other digital assets. Ultimately, while listing all spreads is beyond the scope of this eToro review, we found the broker to be generally very competitive. First, if you are a US resident depositing US dollars, you can fund your account without paying any fees. eToro charges a conversion fee based on PIPs, which will reflect a fee of 1.5% or 3.0%, depending on the currency and/or payment method. In terms of withdrawals, eToro charges a flat fee of just $5, which is payable regardless of the amount you wish to withdraw or the payment method you use. Like most brokers in the online space, eToro charges an inactivity fee. It will cost you $10 per month after 12 months of inactivity. Of course, if you have assets in your portfolio, the inactivity fee won't apply. Furthermore, if your account balance is empty, you don't have to worry about this fee. If, on the other hand, you have funds in your account but no assets in your wallet, the inactivity period will start counting down. Simply make a transaction and the counter will reset to zero. If you decide to buy an asset like stocks or cryptocurrencies in the traditional sense, you don't have to worry about overnight financing. These fees only come into effect if you: If you're an experienced trader, you'll know that all CFD trading platforms charge overnight financing fees. After all, CFDs are leveraged financial instruments. As always, the amount you pay on eToro will depend on several variables. For example: The good news is that you can view your daily fees in dollars and cents when you place an order on eToro. When you make changes to your order, such as the stake amount or leverage, the overnight financing fees are updated. This allows you to have a complete understanding of your trading costs before entering a position. We mentioned earlier in our review that the broker is particularly popular with inexperienced traders. This is because the eToro website is as simple as possible. You can see for yourself as soon as you land on the eToro homepage. The layout is clean and crisp. Initially, you'll be presented with a list of popular financial instruments, such as Facebook, Amazon, and Apple stocks, gold, and the S&P 500 index. However, you can view the full asset library by clicking the "Trade Markets" button. You can then select a specific asset, such as stocks, to see a more detailed overview of what's on offer. You can also find your preferred market using the search box at the top of the page. However, once you've found the asset you want to buy or trade, placing an order is also simple. In fact, all you have to do is enter your stake and confirm your positions. This is a stark contrast to other online trading platforms that are crammed with overly complex tools and features. For example, if you're a beginner just looking to buy a few stocks, you're probably not interested in technical indicators and detailed order books. If that's the case, eToro might be for you. Our review focused particularly on the fact that the platform claims to be the "world's leading social trading network." For those unfamiliar with this phenomenon, it works similarly to social media platforms like Facebook. For example, you have the option to upload a profile picture and choose a username. You can post your thoughts in a message, which other eToro traders can then see. Some traders may decide to "like" or reply to your message. You can also add traders to your "watch list," which means you'll be notified if and when they comment or "like" a post on the eToro website. Overall, we really like the social trading aspect of eToro, as it allows you to connect with like-minded people. It also allows you to learn and grow while trading, as you can observe what the most successful investors are doing. You can also use the social trading tools to gauge the overall market sentiment at any given time.

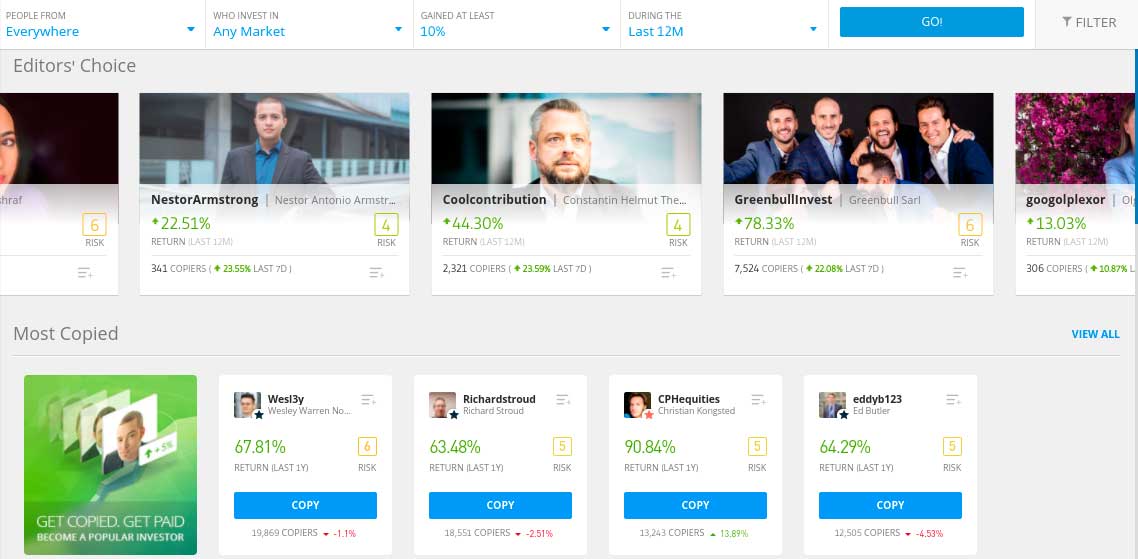

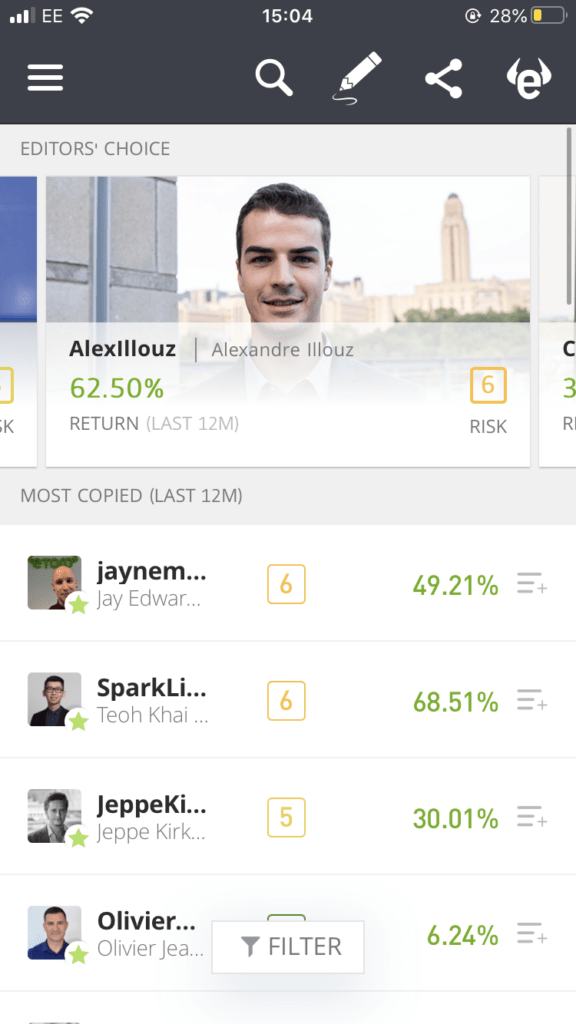

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. A direct derivative of social trading is copy trading. In our opinion, this is arguably eToro's flagship product, as it opens the door to 100% passive trading. The main concept is as follows: When you invest in copy trading, your mirrored positions will be proportional to the amount you invest. The minimum per trader is only $500. Past performance is not an indication of future results. Here's a more detailed example of how eToro's copy trading tool works: As you can see above, the automated trading aspect of this feature is very beginner-friendly. After all, you don't need to spend time researching the financial markets. Instead, simply choose a trader to copy and allow them to trade on your behalf. You always retain full control of your eToro portfolio, so you can add or remove assets as you wish. You can also decide to stop copying a trader at any time. When you do, any open positions you copied will be closed. Once you click the "Copy Individuals" button on the left side of your account, you'll have access to thousands of verified traders. As you can imagine, it's impossible to review every trader's credentials, so you'll have to use the filter option. This is great because you can find a trader who specifically meets your needs, financial goals, and risk appetite. To give you an idea of some of the filters you can use to find a trader, you will have the following options: Once you've refined your filters, you can click on a trader to take a closer look at their statistics. For example, you can see how much the trader has earned each month since joining eToro. You can also explore the trades he currently has in play and the total amount of risk associated with them. Additionally, you can see how many other eToro clients are copying the trader in question and the value this represents in dollars. If the idea of sifting through thousands of investors seems daunting, we've listed three of eToro's top copy traders currently active on the site below. This trader is based in the UK and has been using eToro since 2013. As such, we have over 8 years of trading data to work with. In short, Jeppe Kirk Bonde has generated average annual returns of 30% since joining in 2013. This means he has almost outperformed the broader financial markets. Aside from a very small stake in the Bitcoin market, he focuses exclusively on stocks. In 2019 and 2020, the trader grew his portfolio by 45% and 36% respectively. In the first four months of 2021, he gained 10%. Just like Jeppe Kirk Bonde, this trader has an excellent track record on the brokerage site. In other words, he has generated returns of over 650% over the past five years for his followers. At the time of writing, nearly 20,000 eToro clients were copying this trader. This represents millions of dollars of capital under management. All of Wesley Warren Nolte's assets are in the form of stocks, most of which are based in the United States. The trader aims to outperform the S&P 500 by at least 20% this year. Victor Pedersen, who goes by the username Miyoshi, is a swing trader based in Denmark. Although he joined eToro relatively recently, in January 2018, he has already achieved great results. In fact, during his first year of trading, Victor Pedersen achieved financial returns of over 103%. The following year, the trader made 68%, and during the first four months of 2021, he was almost 8% in the black. He is very active on eToro, with an average of 48.45 trades placed each week. The average trading duration is only 1.5 weeks, and he aims to "radically" outperform the S&P 500.

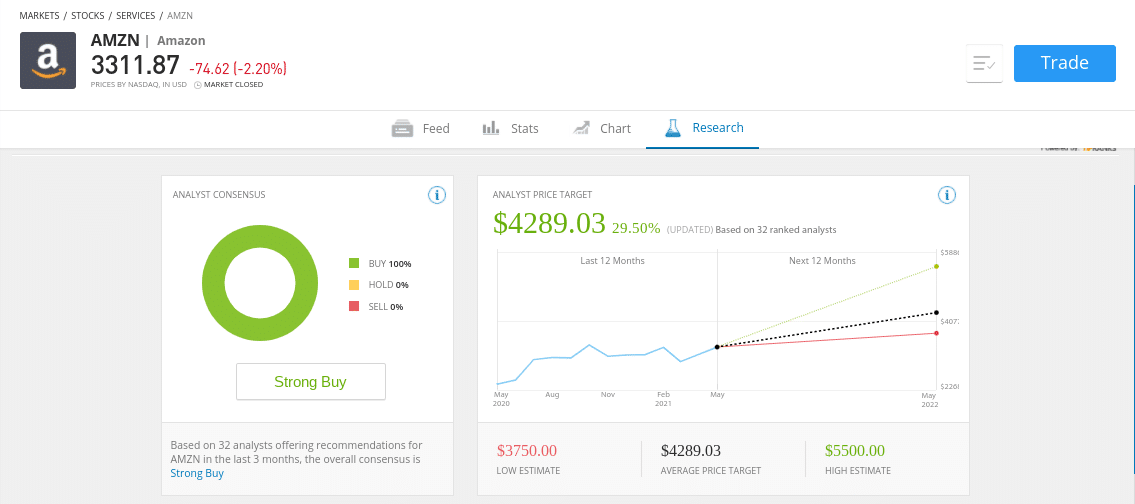

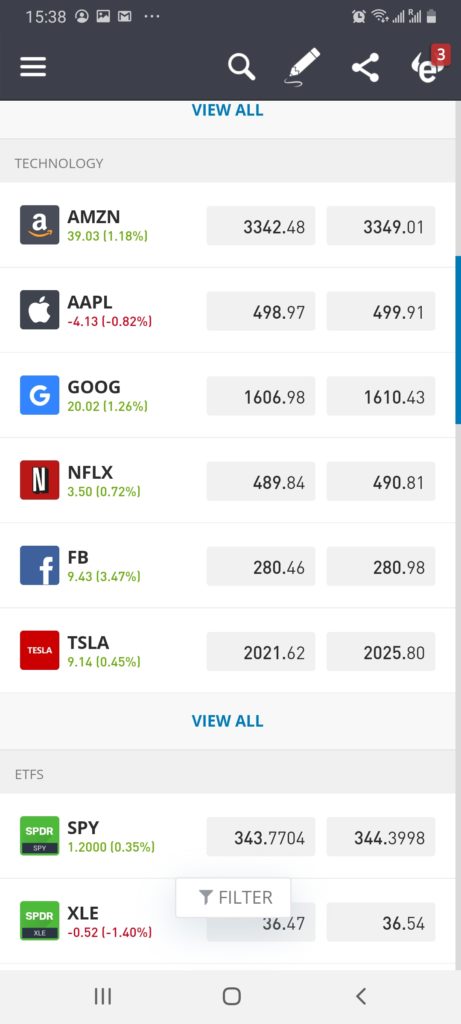

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. Note : If you want more information on any of the traders above, search for their username on the eToro website. Information comes from the eToro website. Past performance is not an indication of future results. eToro is a very user-friendly trading platform that is generally favored by inexperienced investors who have no knowledge of financial analysis. With this in mind, you won't be surprised to learn that the number of research and analysis tools is somewhat limited. Of course, you can view real-time price charts for all supported markets, but this will be too basic for an experienced technical trader. Those with experience analyzing charts will likely use a third-party platform, such as Trading View. On the other hand, eToro offers a fairly comprehensive fundamental research tool on major stocks. For example, you can view key market sentiment metrics, including insights into whether analysts think the stock is a buy, sell, or hold stock. You can also view price targets and hedge fund ratings. [end-brand-section name="account_types"] When you sign up on the eToro website, you'll get a Standard account by default. This gives you access to all the markets, tools, and features discussed so far in this eToro review. If, however, you want an Islamic account, eToro can offer you a retail investor account. You'll need to contact them to open one and you'll need to deposit at least $1,000 to be eligible. Additionally, eToro also offers corporate accounts. The minimum deposit for this type of account is $10,000. [end-brand-section name="mobile_app"] More and more investors are turning to the eToro trading app, available on iOS and Android devices. The app is connected to your main eToro account, meaning you can switch between the two as you see fit. Most importantly, the eToro app has the same features as the website. This means you can buy, sell, and trade on your favorite financial market from anywhere. The app, like the main website, is very user-friendly. It was built from the ground up and is therefore designed specifically for your operating system, whether iOS or Android. You can easily deposit funds through the app, as well as request a withdrawal. If you want to find an asset or place an order, you won't be bothered by a smaller screen.

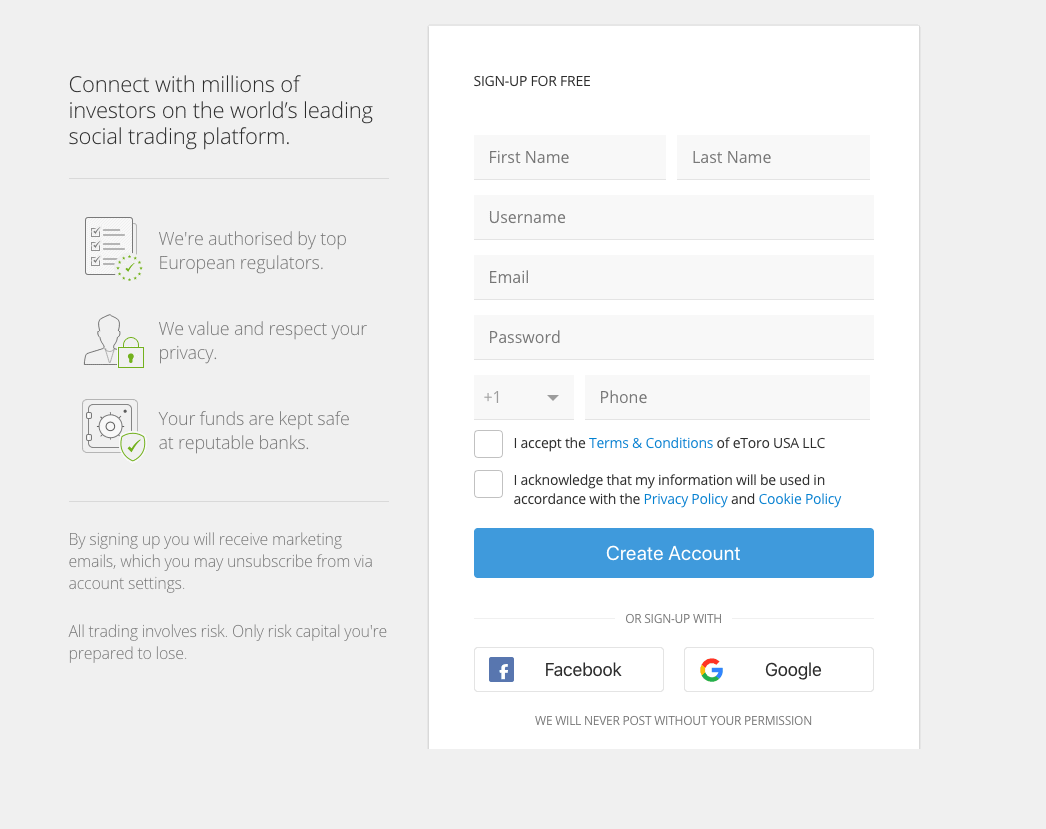

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. Another notable feature of eToro, whether online or through its mobile app, is how easy it is to find what you're looking for. Unlike many other brokers in this field, eToro allows you to deposit funds instantly via debit/credit card or e-wallet. Supported payment types are: All deposits, except bank transfers, are processed instantly by the site. This means you can start trading immediately. Regarding withdrawals, you can cash out your funds using the same payment method that you used for depositing. The minimum deposit at eToro depends on your location. We're big fans of eToro's demo account for several reasons. There's no need to deposit funds or even upload a login to use the demo account. Which is awesome.

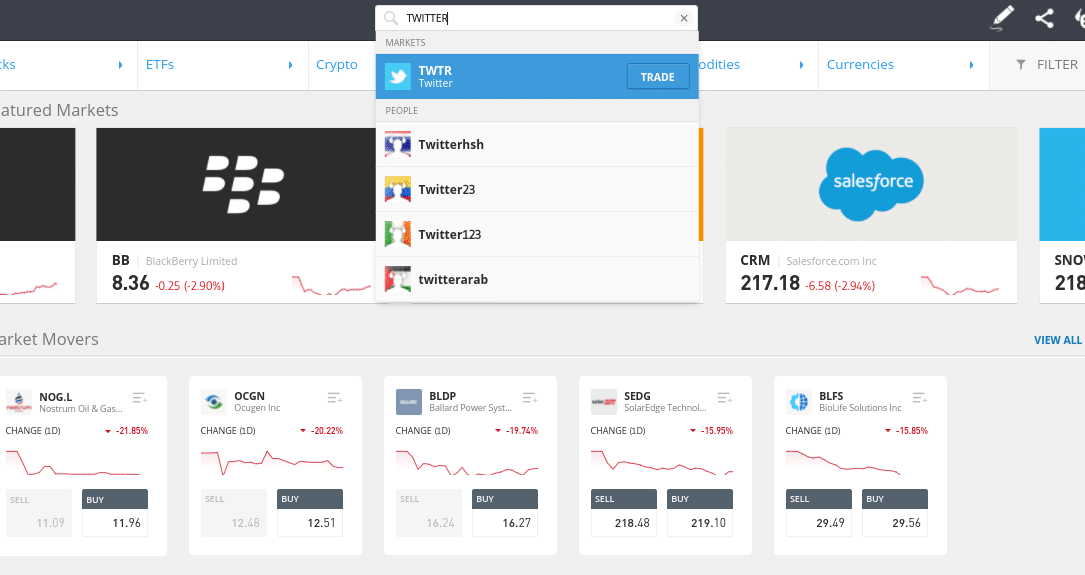

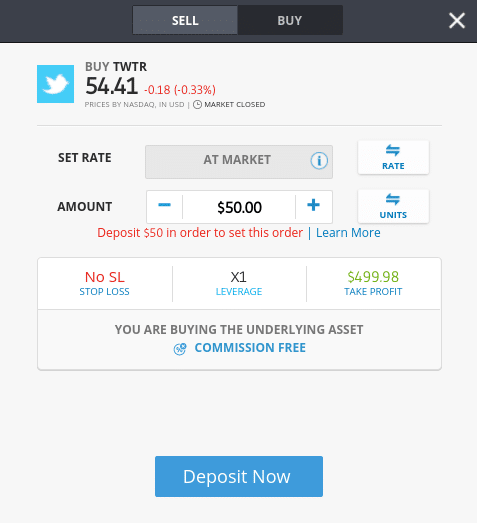

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. In accordance with KYC regulations, you will need to upload a copy of your ID. This can include a valid driver's license, passport, and, in some cases, a national identity card. You must also provide proof of residence. This could include a bank statement or a recent utility bill. You can instantly deposit funds into your eToro account via the following payment methods: Bank transfers are also accepted, but they may delay the deposit process by a few days. If you know what asset you want to buy or trade, use the search box at the top of the page. As you can see below, we're searching for "Twitter" stocks. You can also manually select supported instruments by clicking the "Trade Markets" button. You now need to fill out a simple order form to complete your investment or transaction. Simply enter your stake in the "Amount" field and click "Place Order" to complete the order. Finally, this comprehensive eToro review has covered in detail what this extremely popular brokerage site has to offer. In short, over 20 million clients now enjoy markets, low minimum stakes, and a wide range of deposit methods. Investors are also attracted by eToro's social trading and copy trading features, as well as its strong regulatory position. Overall, eToro meets all the requirements one would expect from a trading platform.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position. eToro is a multi-asset platform that offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You will never lose more than the amount you invest in each position. Past performance is not a guarantee of future results. The trading history presented is less than 5 full years old and may not be sufficient as a basis for an investment decision. Copy trading does not constitute investment advice. The value of your investments may increase or decrease. Your capital is at risk. Cryptoasset investing and custody is offered by eToro (Europe) Ltd as a Digital Asset Service Provider, registered with the AMF. Investing in cryptoassets is highly volatile. No consumer protection. Profit tax may apply. eToro USA LLC does not offer CFDs and makes no representation or liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner using publicly available, non-entity-specific information about eToro.Benefits :

Inconvénients :

Les Actifs Disponibles sur eToro

1. Les Actions

La propriété fractionnée d'eToro

CFDs on shares

2. Cryptocurrencies

Buy Cryptocurrencies on eToro

Cryptocurrency Trading on eToro

3. Forex

4. ETFs on eToro

5. eToro Commodities

6. eToro Indices

eToro Review: Fees and Commissions

eToro Fees Review (Trading)

Active

Commission

Stocks

1$

Crypto

1%

Forex

From 1 PIP

ETFs

0%

Basic products

From 2 PIPs

Clues

From 0.02 points

eToro Fee Review (Non-Negotiable)

Type of fees

Charge

Open an account

FREE

Platform Fees

FREE

Inactivity fees

$10/month after 12 months

Withdrawal fees

$5

Spread

Deposit and withdrawal fees

Inactivity fees

Overnight financing

eToro User Review

eToro's Social Trading

Etoro CopyTrading Review

How the copy trading tool works

How to Choose an eToro Copy Trader

The Best eToro Copy Traders 2026

1 - Jeppe Kirk Bonde - 30% average annual return since 2013

2 - Wesley Warren Nolte - Return of 650% over the last 5 years

3 - Victor Pedersen - Successful eToro Swing Trader

Charts and Analysis on eToro

eToro App Account Types

eToro App Review

eToro Payments

Minimum deposit at eToro

eToro Demo Account

Step 2: Confirm identity

Step 3: Deposit Funds

Step 4: Asset Search

Step 5: Buy Assets

The verdict: eToro is a regulated and trustworthy platform

FAQ

What is eToro?

How does eToro work?

How does eToro make money?

Is eToro available in the US?

What is the risk level at eToro?

Which cryptocurrencies does eToro support?

How do I make money on eToro?

How much does eToro cost?

Is eToro safe?