La meilleure Plateforme de Day Trading en 2026 – La plateforme la moins chère révélée

If you want to day trade financial assets like stocks, commodities, or cryptocurrencies, you need to find a suitable platform.

The one you choose should not only offer a large number of markets, low commissions and spreads, but also numerous trading tools, technical indicators, and real-time data. You also need to consider payments, customer support, and, of course, regulations.

In this guide, we review the best day trading platforms to consider in 2026 .

The List of Best Day Trading Platforms in 2026

Looking to download the best trading app right now? If so, below is a list of the ones you should consider. You can learn more about each provider by browsing the page!

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Review of the Best Day Trading Platforms

There are hundreds of day trading platforms available online. Some are remarkable, while others are flawed in key areas.

We believe the best trading platforms for day traders are those that offer thousands of financial instruments, low commissions, and an abundance of tools and features.

To help you sort things out, below we review the best day trading platforms for 2026 and beyond.

1 – eToro – Best Day Trading Platform

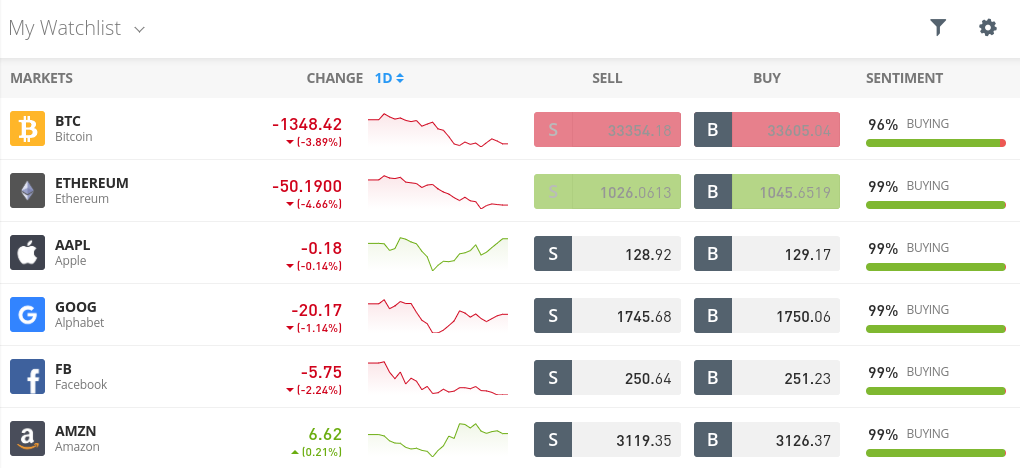

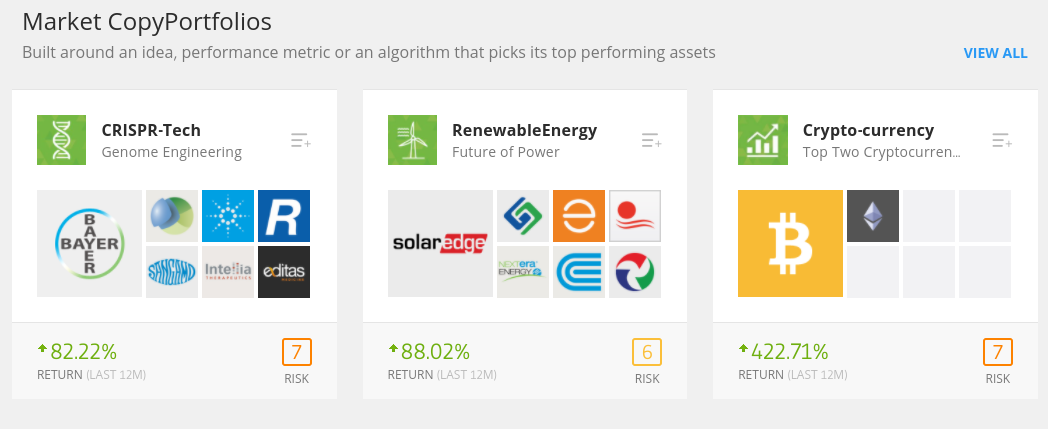

This includes over 2,400 stocks, ETFs, indices, cryptocurrencies, hard metals, energies, agricultural commodities, and forex. As such, if there’s a specific financial asset you’d like to trade, you’ll likely find it on eToro.

We also think eToro is the choice to make because it is one of the most competitive when it comes to fees.

Additionally, spreads are also very competitive on eToro—especially for forex, gold, and stocks. It’s worth noting that eToro is probably not suitable for seasoned professionals relying on advanced technical analysis. On the contrary, this platform is ideal for those who are new to this field.

eToro allows you to place orders for an investment of as little as $25 for cryptocurrency day trading and $50 for stock day trading. Another popular day trading tool for those with little or no experience is the platform’s copy trading feature. It allows you to mimic an experienced day trader. If the trader risks 1.5% of their portfolio on a foreign exchange trade, you will do the same. It won’t cost you anything extra.

In addition to low fees, tight spreads, and a huge asset library, we also believe eToro is the best place for day trading due to its strong regulatory status. Payment methods supported by this top-notch platform include debit/credit cards, e-wallets, and bank transfers.

eToro Fees

| Costs | Amount |

| Stock trading costs | 1$ |

| Forex Transaction Fees | Spread, 2.1 pips for GBP/USD |

| Cryptocurrency Trading Fees | Spread, 0.75% for Bitcoin |

| Inactivity fees | $10 per month after one year |

| Withdrawal fees | $5 |

Benefits:

Disadvantages:

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

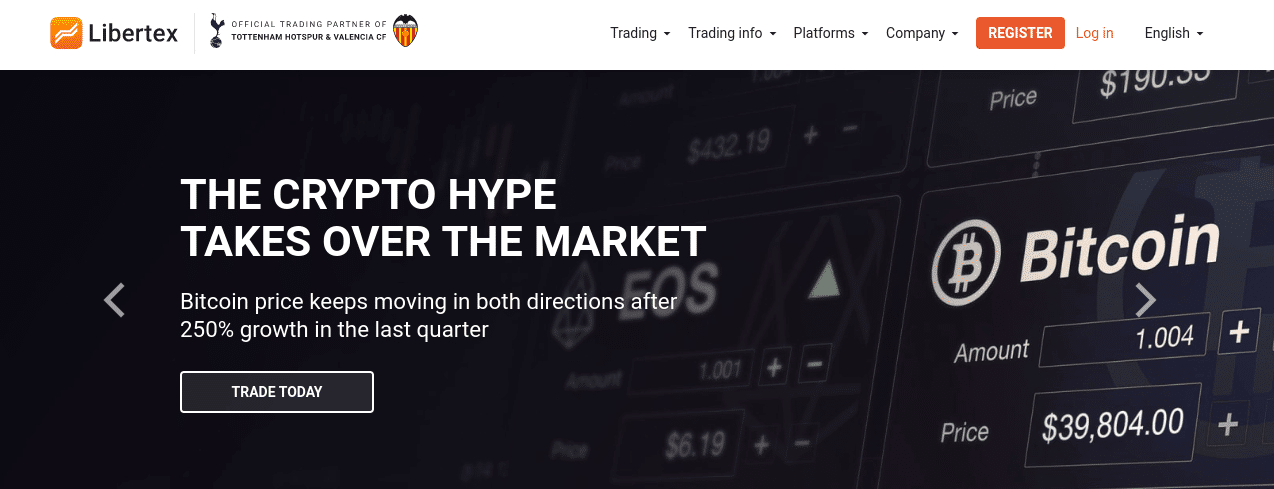

2 - Libertex – Best broker for CFD day trading with tight spreads

That said, perhaps one of Libertex 's biggest draws is that it doesn't charge spreads on any of its markets. You may find that some financial instruments come with a low commission, but many assets can be traded without fees.

In terms of what you can trade on Libertex, the CFD broker covers hundreds of popular markets. This includes indices like the Dow Jones and CAC 40, dozens of currency pairs, commodities like WTI crude oil and natural gas, and tons of stocks.

If you're wondering what type of day trader Libertex is suitable for, we believe the platform will appeal to investors of all types and sizes. For example, if you're a seasoned day trader, you'll likely want to use Libertex via MT4. If you're new to day trading, Libertex also offers its own web-based platform.

This one is much easier to use, making it perfect for beginners. In terms of security, this top-rated day trading platform has over 2.9 million clients worldwide and has been active on the brokerage scene for over two decades. Furthermore, the platform is licensed by CySEC. Finally, Libertex supports debit/credit cards, e-wallets, and bank transfers—and the minimum deposit is $100.

Fees on Libertex

| Costs | Amount |

| Stock Trading Fees | Commission. 0.034% for Amazon. |

| Fees on foreign exchange transactions | Commission. 0.008% for GBP/USD. |

| Cryptocurrency Trading Fees | Commission. 1.23% for Bitcoin. |

| Inactivity fees | $5 per month after 180 days |

| Withdrawal fees | Without |

Benefits:

Disadvantages:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investors lose money when trading CFDs with this site. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

How do Day Trading platforms work?

The main concept behind day trading platforms is that you buy and sell financial assets with the goal of making money. This is facilitated by a third-party broker who can connect you to the market of your choice.

The overall process generally works as follows:

- You open an account on a day trading platform that meets your needs.

- You deposit funds by debit/credit card, e-wallet or bank transfer.

- You choose a financial instrument to trade, such as the British pound (GBP/USD), gold, or Apple stock.

- You enter a buy or sell order, depending on the price trend of the asset.

- You close your position before the end of the trading day.

The day trading platform you choose will charge you a series of fees and commissions. These fees may come from spreads, deposit fees, or overnight financing. We'll come back to these shortly.

How to choose the best day trading platform?

We've reviewed a selection of the best trading platforms available in 2026. If you read each article, you'll probably notice that no two platforms are the same.

For example, some are suitable for seasoned professionals looking for very advanced analysis tools, while others are perfect for beginners.

It's important to choose a day trading platform that suits you and your skills, so check out the sections below to find a suitable provider.

Day Trading Tools

When investing in traditional assets like stocks, the process is relatively simple, even for beginners.

Indeed, in most cases, you will be investing in the company of your choice for several years, which means you won't be overly concerned about short-term price fluctuations. Furthermore, technical analysis will rarely be necessary.

However, day trading is a whole different ball game. After all, you'll be opening a position and closing it within hours or minutes. This means you need to choose a day trading platform that offers a wide variety of tools.

We suggest you look for the following tools in your quest for the best trading platform for day traders:

Charts and technical indicators

Perhaps the most obvious is to check the charting tools offered by the platform. If you're an experienced trader, you'll want to look for a good selection of technical indicators and charting tools.

You'll also want to have a fully customizable trading screen and the ability to send price-related alerts.

Leverage

Even those with significant trading capital will use leverage. This is especially true for forex day trading. After all, forex is traded in lots, which are typically 100,000 units of the base currency. By choosing a day trading platform that offers leverage, you'll be able to take much larger positions.

Auto Trading

Automated trading platforms are popular with both experienced and novice investors. They allow you to buy and sell assets completely autonomously, meaning you can sit back and invest passively.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

The best day trading platform we've discussed here, eToro, offers an automated tool called Copy Trading. It allows you to select a successful day trader using the eToro platform and copy all of their positions.

Real-time data

Real-time data feeds are essential for day traders, especially since financial markets move at a frenetic pace. Therefore, not having access to accurate and up-to-date asset prices can be devastating. That's why the best online brokers for day trading offer real-time quotes.

Basic research

While the vast majority of day trading is based on technical price movements, you shouldn't neglect fundamental data. This refers to financial news that can impact an asset's value.

For example, if the Federal Reserve announces that it is raising interest rates, you will want to know the second the news is released.

Execution speed

Active traders aim to enter and exit a position in minutes. The only way to do this efficiently is to choose a provider that offers ultra-fast execution speeds. The best platform will execute your order in a fraction of a second.

Assets

If you have a specific asset class in mind, make sure your chosen day trading platform supports it. You should also take a closer look at the markets offered to ensure you have access to your preferred instrument. For example, you may choose a forex trading platform because you want to trade currencies.

But you still need to explore the pairs offered. This is also the case when trading stocks. Indeed, most day trading platforms offer stocks listed in the United States.

However, if you want to trade markets in France, Europe, or elsewhere, make sure these markets are supported before signing up. At eToro, you can trade over 2,400 stocks from 17 international markets, dozens of commodities, over 55 currency pairs, ETFs, indices, and more. This platform covers all your needs.

Costs

As previously mentioned, all day trading platforms charge fees in exchange for access to the financial markets. These fees can come in a variety of forms. Below, we've outlined the main fees to consider.

Commission

Most of the best platforms allow you to trade commission-free. This means you won't pay any fees to enter or exit a position. However, many day trading platforms charge a commission—which is often a variable percentage.

For example :

- Let's say you trade cryptocurrencies on TradeStation.

- The platform charges a commission of 0.6%.

- You bet $1,000 to enter the market, which represents a commission of $6.

- If you exit the trade when it is worth $1,400, you pay a commission of $8.40.

Spreads, the gaps

With a few exceptions, such as Libertex, all day trading platforms charge a spread. In fact, it's one of their main sources of revenue. The spread is simply the difference between the buy and sell price of the asset you want to trade. This price difference allows the day trading platform to always make money. It's therefore an indirect cost for you.

- Spreads can vary greatly, not only depending on the day trading platform, but also on the specific asset.

- For example, the best day trading platforms often offer spreads of less than 1 pip on major currency pairs.

- But, on less competitive platforms, you can find spreads of 2 to 3 pips.

In most cases, the platform will display the spread (either in pips or as a percentage), which will allow you to assess how much you need to factor into your trading costs.

Overnight financing

If you're day trading, this means you'll always exit any open positions before the market closes. However, there may be times when you decide to keep a position open overnight. In this case, you'll be charged an overnight financing fee. This fee is charged each day you keep the position open after market hours.

Regulation

All of the day trading platforms we've reviewed on this page are heavily regulated. This includes a license from at least one reputable financial institution, such as the FCA, CySEC, ASIC, or the SEC.

By choosing a day trading platform licensed by one of the above-mentioned organizations, you know you are using a legitimate provider that follows the rules.

For example, eToro is licensed by three regulatory bodies, which means you'll benefit from several investor protection measures. Not only does this include regular audits and KYC checks, but client funds must be kept in segregated bank accounts.

If you come across a day trading platform that is not regulated by a reputable financial institution, you should not open an account there.

Customer Service

Not so long ago, customer service was limited to telephone support during standard market hours. However, we've found that the best day trading platforms now offer a live chat service that operates at least 24/5—sometimes 7/7. This isn't always the case, so you'll want to check what support channels are available before signing up.

Demo Account

If you're new to day trading, it's best to sign up with a platform that offers a demo account. At eToro, for example, you can trade with paper money in real market conditions. This means you can not only familiarize yourself with how day trading works, but also with the platform itself.

You don't need to deposit funds to use a demo account, but you usually need to open one first. It's also worth noting that demo accounts are ideal for experienced day traders, as they allow you to test new strategies and technical indicators without risk.

Payments

Even if you plan to start with a demo account, you'll probably want to trade with real money at some point. When you do, you'll want to make sure your chosen payment method is supported. Some of the best platforms allow you to instantly deposit funds with a debit/credit card or e-wallet.

Others only accept bank transfers. This can delay the deposit process, so keep this in mind if you want to start trading immediately. You should also check what payment fees apply and whether or not exchange fees apply.

How to Start Day Trading

Once you've chosen a platform that meets your needs, you'll need to complete the formalities of opening an account and making a deposit. Next, you'll need to create a day trading order.

If this is your first time joining a platform, we'll walk you through the eToro process.

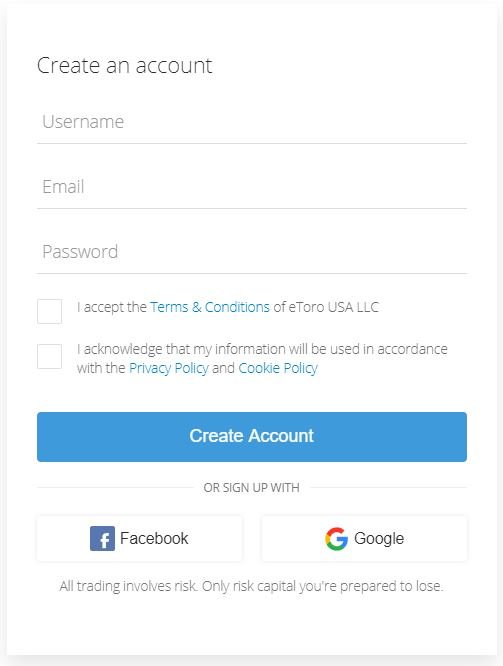

Step 1: Open an account and upload an identity document

Opening an account with eToro only takes a few minutes. Simply visit the eToro website, click "Join Now," and follow the on-screen instructions.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

You will be asked to provide certain personal information, contact details, as well as confirm your phone number.

Step 2: Confirmation of identity

All eToro users must go through a quick KYC process, as the platform is heavily regulated.

You will need to upload a copy of the following documents:

- A valid passport or driver's license

- Utility bill or bank statement (issued within the last 3 months)

Step 3: Deposit Funds

Once you've opened an account and verified your identity, you can start using the eToro demo account. This will allow you to day trade without risking any capital.

If, however, you want to start trading with real money, you need to make a minimum deposit of $100. You can choose from the following payment methods:

- Debit cards

- Credit cards

- Electronic wallets (Skrill or Neteller)

- Bank transfer

Step 4: Research an Asset to Day Trade

If you're an experienced day trader, you probably have an asset class in mind. In this case, you're looking for the specific security you want to trade. As you can see below, we're looking to trade Bitcoin .

If you would like to see which markets are supported by eToro, click on the "Trade Markets" button.

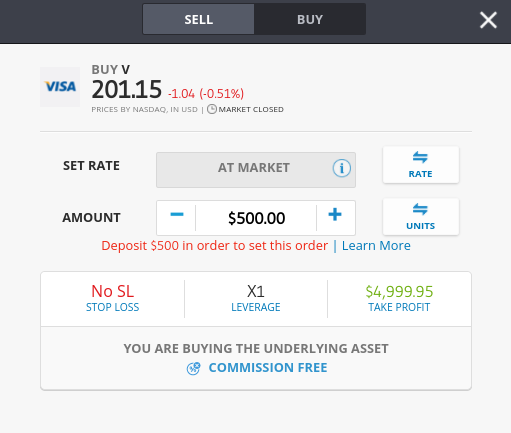

Step 5: Start Day Trading

Once you have an asset to trade, it's time to place an order. First, you need to choose between a buy or sell order. In our example, we'll choose a buy order because we think the price of Bitcoin will rise. If you think the asset's price will fall, place a sell order.

By default, you'll place a market order - meaning eToro will execute your position instantly. However, if you want to specify the price at which you enter the market, change this to a limit order. You can also set up a stop-loss order and a take-profit order ( note that these are not guaranteed against slippage ).

To complete your transaction, click on "Open Trade"!

The Best Broker for Day Trading - Conclusion

In short, choosing the right day trading platform is essential. As we've seen, you should consider supported assets, fees and commissions, licenses, customer support, and payments. You should also explore the trading tools you'll have at your disposal.

After reviewing dozens of providers, we found that the best platform on the market is eToro. This regulated day trading platform is easy to use and comes with useful tools, such as its automated copy trading feature.

eToro - The Best Day Trading Platform

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Questions and answers

What is the pattern day trader rule?

Is day trading profitable?

Can day trading be automated?

What is the best online broker for day trading?

What are the best day trading brokers for beginners?

What leverage do the best online brokers offer for day trading?

How do you make money day trading?