Meilleures applications de trading en 2026 – Nous vous présentons les meilleures applications pour les débutants.

The best online brokers now offer a dedicated mobile trading app. Typically compatible with iOS and Android devices, the best apps allow you to buy and sell financial instruments with a single click. That said, you should do a lot of research before choosing one that meets your needs.

To help you get your bearings, this guide reviews the best trading apps to consider in 2026.

Top Trading Apps in 2026

Looking to download the best trading app right now? If so, below are the top-rated ones to consider. You can learn more about each provider by scrolling down!

Best Online Trading Apps Reviewed

There are hundreds of trading apps on the mobile investing scene today. This is a good thing because you’re sure to find a provider that helps you achieve your financial goals.

However, you need to focus on a number of parameters to find the best one, such as those relating to tradable markets, commissions, ease of use, and regulation.

We’ve done the hard work for you by reviewing the best trading apps currently available on the market!

1 – eToro – Best Free Trading App in 2026

You won’t need to pay anything to open a brokerage account, and you won’t have to pay any ongoing platform fees. After completing the 10-minute registration process, you’ll have access to thousands of tradable markets.

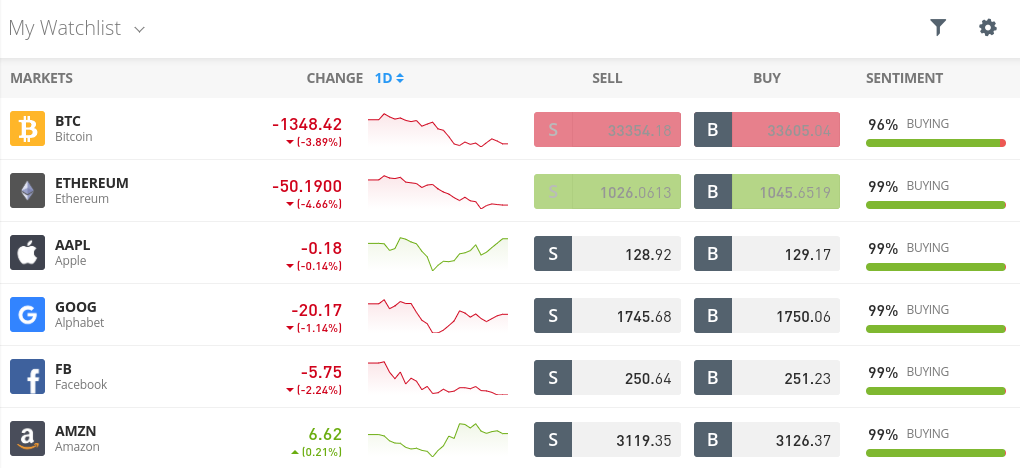

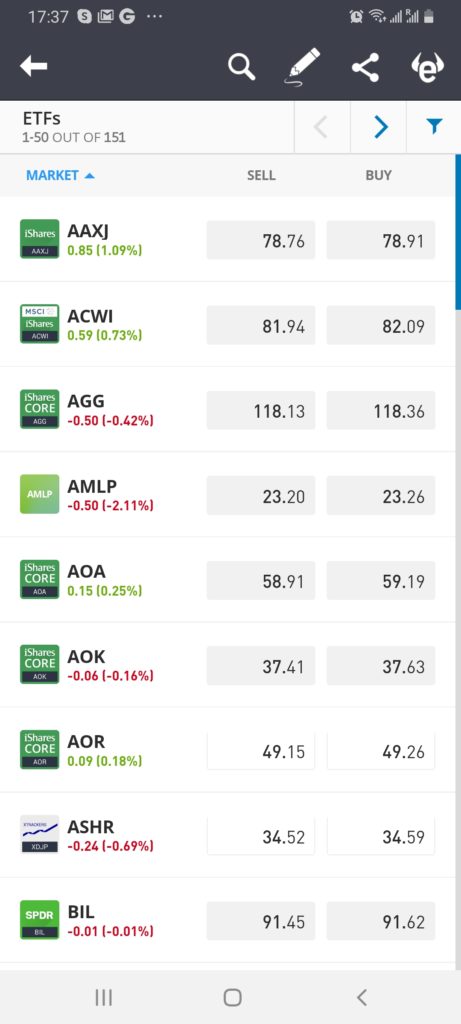

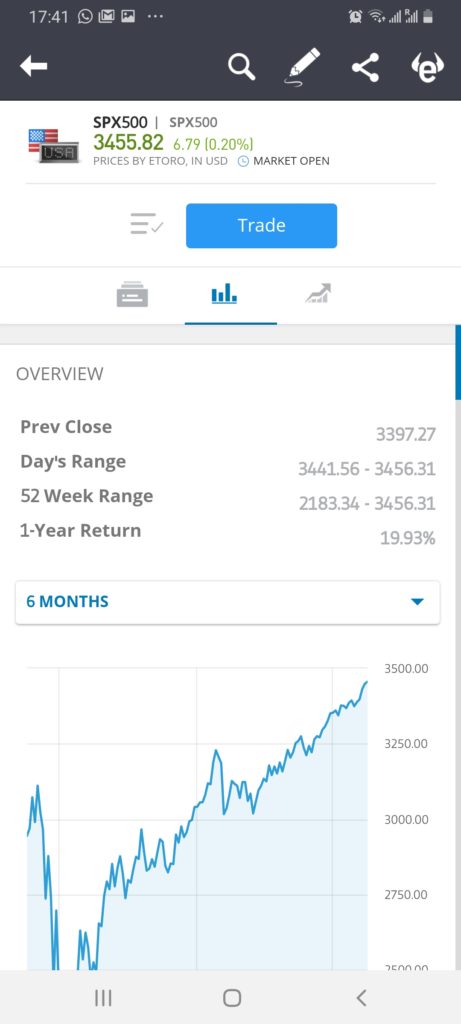

This includes over 2,400 stocks from 17 international markets, over 250 ETFs, 16 cryptocurrencies, and tons of CFD instruments. These include everything from gold, silver, and oil to natural gas, wheat, and copper. You can also trade currencies with over 55 supported pairs.

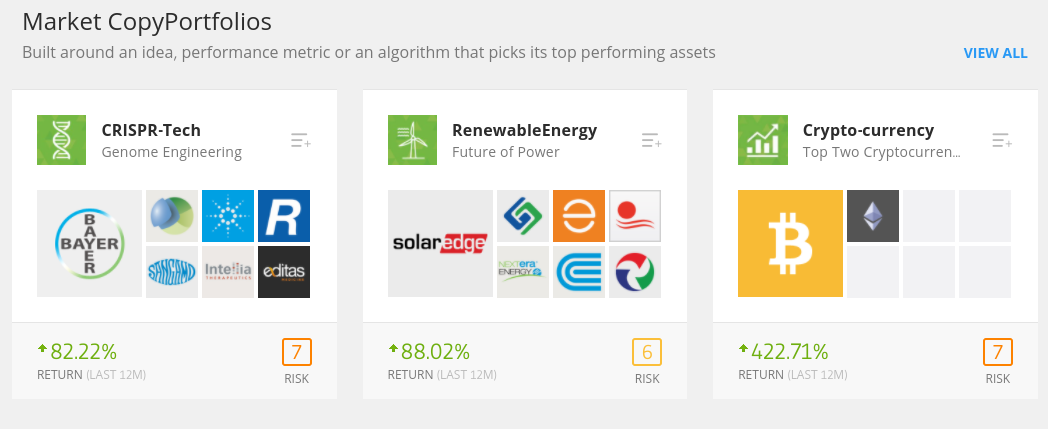

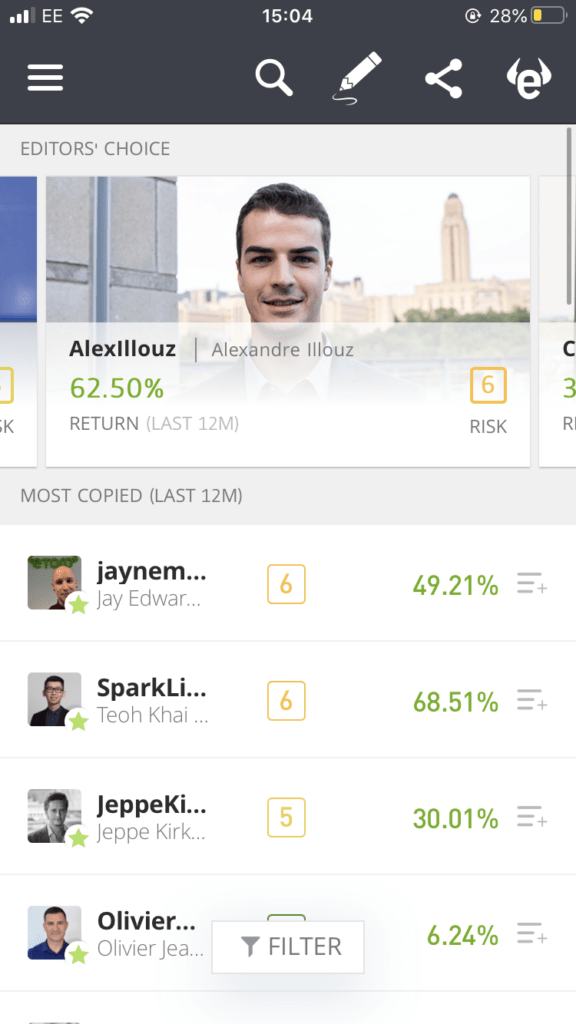

When it comes to basic features, the eToro trading app allows you to invest socially and passively. For example, the Copy Trading tool lets you choose from thousands of experienced investors and then copy all their open positions. It also lets you invest in diversified portfolios managed by the eToro team.

We also appreciate that they offer a full demo account, pre-loaded with $100,000. Unlike many other trading apps you’ll find on the Google Play or Apple stores, eToro is heavily regulated.

If you want to go with eToro, you only need to make a minimum deposit of $100. You can deposit funds into your account directly from the app, with supported payment methods including debit/credit cards and e-wallets.

Fees on eToro

| Costs | Amount |

| Stock market transaction fees | 1$ |

| Foreign exchange transaction fees | Spread 2.1 pips for GBP/USD |

| Cryptocurrency Trading Fees | Gap, 1% for Bitcoin |

| Inactivity fees | $10 per month after one year |

| Withdrawal fees | $5 |

Benefits :

Disadvantages:

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

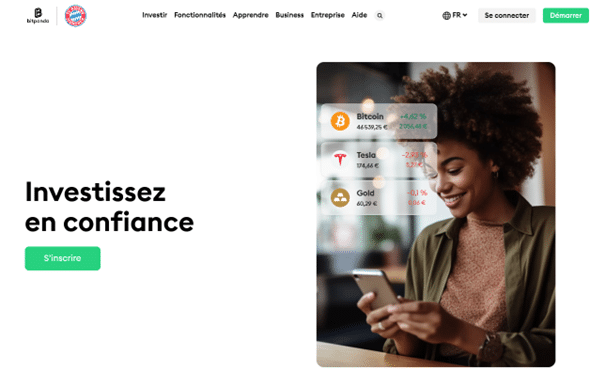

2- Bitpanda: Best trading app for diversification

This brokerage platform is a benchmark in Europe, holding several licenses to offer its services. In fact, Bitpanda is recognized and authorized by the financial market authorities of Austria and France. The company has become even more popular by becoming a sponsor of Bayern Munich, the German football club.

With a Bitpanda account, you can trade over 3,000 digital financial assets, including 400+ cryptocurrencies, company stocks, ETFs, and precious metals. Bitpanda even invented a financial instrument called Crypto Indices on the platform. This is a financial instrument that allows you to trade a predefined basket of cryptocurrencies. It has the advantage of limiting concentration risks.

To satisfy its 4 million users, Bitpanda allows you to trade with as little as €1. Several other currencies are supported: CHF, PLN, DKK, SEK, GBP, USD, HUF, and CZK. The numerous features available on this trading app also explain its popularity. First, its Spain Plan allows you to invest in certain assets gradually and regularly. This technique protects you from the whims of the market. Additionally, you have the Cash Plus feature, which allows you to manage your fiat transactions with complete peace of mind.

| Costs | Amount |

| Stock market transaction fees | 1.49% |

| Foreign exchange transaction fees | Variable deviations |

| Cryptocurrency Trading Fees | 1.49% |

| Inactivity fees | None |

| Withdrawal fees | No fees |

Benefits :

Disadvantages:

How to Choose the Best Trading App for You

We've reviewed 10 of the best mobile trading apps to consider in 2026 and beyond. Since no two trading apps are the same, each provider will appeal to a specific type of investor.

For example, while some apps are excellent long-term investments, others are more suitable for short-term CFD trading.

With this in mind, below we will cover some of the most important parameters to consider in your search for the best trading app.

Regulation

Whichever app you're interested in, you should ensure it's licensed and regulated by a reputable financial institution. This regulatory body doesn't necessarily have to be based in your home country, as many of the trading apps featured on this page have a global presence.

- For example, eToro, which is our top-rated trading app in 2026, is regulated by three top-tier bodies.

- These are the FCA (UK), ASIC (Australia) and CySEC (Cyprus), which means you benefit from regulatory oversight on three fronts.

- For those of you based in the US, the eToro trading app is registered with FINRA.

By choosing a regulated trading app, you can rest assured that your funds are safe. You can also be sure that the app provider offers transparent fees and fair trading conditions for all clients.

Assets

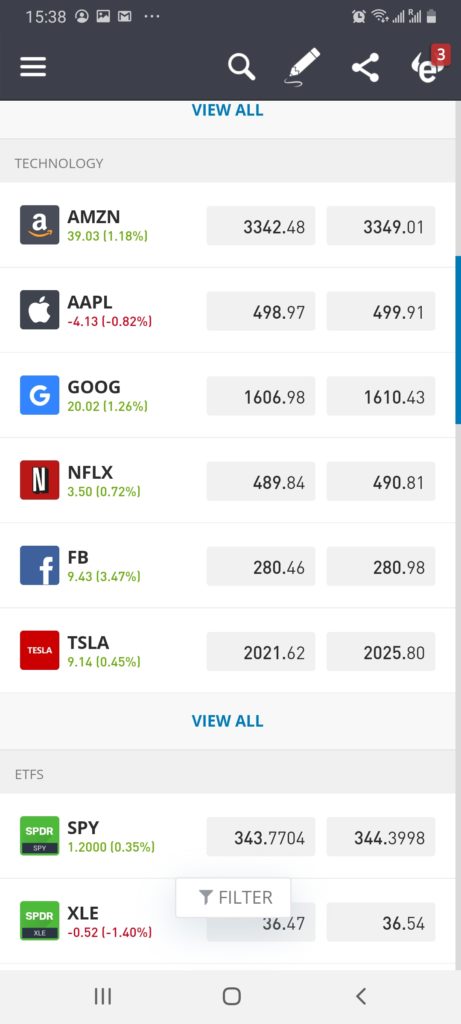

There's often a wide variation in the types of assets you can trade or invest in when choosing an app provider. First, you need to determine whether you want to invest in traditional securities like stocks and mutual funds, or whether you consider yourself a short-term day trader.

In the latter case, you'll probably want to use a CFD trading platform app. This way, you can trade assets on your phone without needing to own them. Not only will the fees and spreads be low, but you'll also potentially have access to thousands of assets. This could include forex, metals, energies, interest rates, stocks, indices, and much more.

On the other hand, if you're looking to create a long-term investment plan, make sure the trading app offers traditional ownership. This means that by investing in stocks, ETFs, or mutual funds, you'll be entitled to your share of dividends.

Our top-rated trading app, eToro, actually covers both long-term and short-term strategies. It offers thousands of traditional stocks and ETFs, as well as CFD instruments.

Costs

Once you've verified that your chosen app supports your preferred financial market and strategy, it's time to consider how much you'll be charged.

Again, the type and amount of fees you pay can vary greatly from app to app, so we've broken down the main fees to look out for below.

Transaction fees

Transaction fees are associated with traditional long-term assets like stocks, ETFs, and mutual funds. The best trading apps typically charge a fixed transaction fee, such as $10 per trade.

This means that no matter how many shares you buy, you'll always pay $10. You pay another $10 when you cash in your shares. While these fixed fees may seem attractive at first glance, they won't be if you're looking to trade frequently or invest small amounts.

For example, if you bought $40 worth of stock with a $10 transaction fee, that means you're paying a 25% commission just to enter the market.

Commission fees

If you use a CFD trading app, then you will likely pay a variable commission. This means you are charged based on the amount of your stake.

- For example, if the trading app charges a 0.2% commission on gold CFDs and you bet $500, you will pay $1 to enter the market.

- Then, if you sell your gold CFD position when it is worth $900, you pay a commission of $1.80.

That said, the best trading apps we've reviewed on this page don't charge any commissions when you buy and sell CFD instruments.

Overnight financing costs

Whether or not your chosen trading app charges a commission, if you access CFD markets, you'll always need to consider overnight financing fees. As the name suggests, this is a fee charged by the trading app for each night you keep your position open.

- For example, let's assume that overnight financing charges apply from 11pm GMT.

- If you opened a position on Tuesday at 10am GMT, your first overnight financing fee will be charged at 11pm GMT the same day.

- If you keep the position open for another day, the overnight financing fee will be charged again at 11pm GMT.

The reason for this is that CFDs are leveraged financial products, meaning you only have to bet a small percentage of the asset's value. In turn, this means you are effectively borrowing excess capital from the provider, which incurs daily interest charges.

Spreads

Spreads are charged by all trading apps except Libertex. The spread is the difference between the buy and sell price of the asset, and it's how trading providers can consistently make money.

The greater the difference between the two prices, the more you indirectly pay. The best trading apps featured on this page offer very competitive spreads—especially in highly volatile markets.

However, it can be difficult to know what spreads you're actually paying if the app doesn't provide this information. If it doesn't, you'll have to calculate it yourself to make sure you're not overpaying to access the market of your choice.

Trading Tools and Features

With many trading apps now offering zero commissions and competitive spreads, providers will seek to differentiate themselves by offering several notable features that can enhance your trading experience.

Here are some of the best features to look for:

Leverage and Margin Trading

If you're considering trading via your phone but don't have access to a lot of capital, you might want to consider an app that offers leverage.

As we briefly mentioned, leverage allows you to trade with more than the amount you have in your account. Most trading apps that offer CFD markets offer leverage.

The specific amount you can get varies depending on the provider, your location, and the asset class involved.

But, to give you an idea:

- UK and EU clients are limited to a maximum leverage of 1:30, meaning you can trade with 30 times the amount you have in your account.

- US clients, while not having access to CFDs, can trade currencies with leverage of up to 1:50.

- Residents of other countries, such as those in Asia and the Middle East, can often trade with leverage of up to 1:300.

Some of the best apps also offer margin options for stock investments. It works similarly to leverage, but you're not trading CFDs or forex.

For example, Webull allows up to 4x margin on stock trades, multiplying your buying power by the same factor. However, you must have at least $2,000 in your margin account to qualify.

Fractional shares

Most retail investors won't want to spend more than $3,000 on a single Amazon share. The good news is that you no longer need to, as the best trading apps support fractional ownership.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

This means you can invest much smaller amounts, allowing you to own a fraction of a stock. eToro allows fractional ownership starting from just $25 on cryptocurrencies and $50 on stocks.

Copy Trading

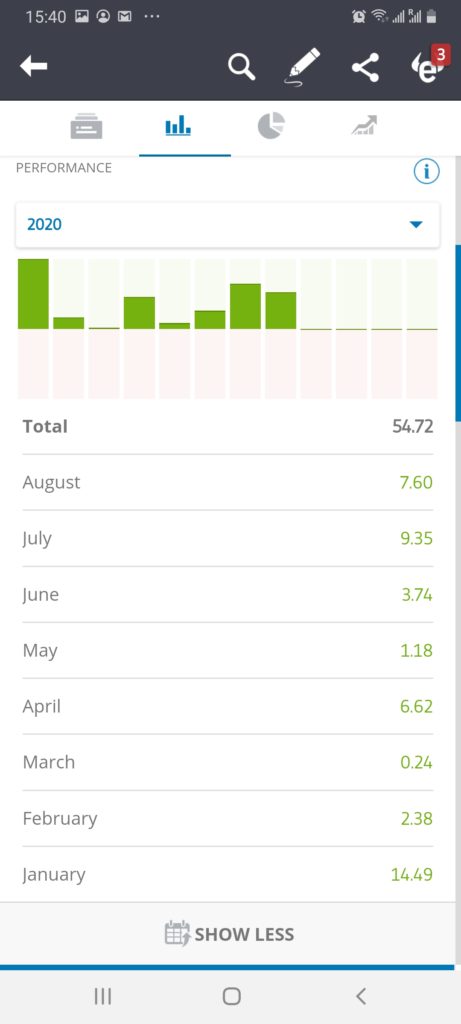

The best trading app providers in 2026 offer automated trading tools. eToro, for example, allows you to copy another trader exactly.

For example, you might decide to copy a successful stock trader with an impeccable track record on the platform. If the trader risks 10% of their balance on Square stocks, you'll do the same. Ultimately, this allows you to invest and trade without having to make any effort.

The eToro Copy Trading tool is also ideal for those who have no knowledge or understanding of how to research financial instruments.

Education, research and analysis

Trading providers are well aware that many investors are new to the industry, which is why the best apps come with a variety of educational tools.

- This may include

- trading guides

- webinars

- Market information

- podcasts

- Trading tips

- Social Trading Tools

- Video explanations

- Mini-course

If you already have some understanding of how trading works, you'll want access to research and analysis tools. The best apps we've reviewed on this page offer everything from technical indicators and charting tools to financial news and real-time data feeds.

User experience

The user experience offered by trading apps can vary considerably. Therefore, you need to ensure that the app is easy to use and that your investing efforts aren't hampered by a small screen.

This is especially true if you want to trade for the short term rather than the long term. By this, we mean buying and selling assets as a day trader or swing trader. After all, you'll need to enter and exit the market with the click of a button—so you don't want to choose an app that's cumbersome and difficult to use.

Likewise, if you're a short-term trader, you'll be performing technical analysis and researching price trends, so a top-notch user experience is crucial.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Even if you're simply looking to add a few stocks or mutual funds to your portfolio, the trading app should make the process seamless. For example, it should offer a clear search function, and placing an order should be a breeze.

Payment Methods

Once you've opened an account on your chosen app, you'll be asked to make a deposit. The best providers allow you to do this instantly and, most importantly, through the app.

For example, the eToro trading app allows you to deposit funds instantly via your debit/credit card, Neteller, Skrill, etc.

D'autres prestataires présentés sur cette page, comme International Brokers et TD Ameritrade, ne prennent en charge que les transferts bancaires traditionnels. Cela signifie que vous devrez vous connecter à votre compte bancaire en ligne ou mobile et transférer manuellement l'argent.

Service client

Si vous avez besoin d'aide pour votre compte, vous devez pouvoir contacter facilement un membre de l'équipe d'assistance.

Les meilleurs prestataires de trading offrent un service de chat en direct, ce qui signifie que vous pouvez parler avec un technicien en temps réel. Vous devez également vérifier à quelles heures de la journée l'équipe d'assistance travaille.

La plupart proposent un service clientèle du lundi au vendredi, pendant les heures d'ouverture du marché. eToro va plus loin en proposant une assistance 24 heures sur 24 et 5 jours sur 7.

Démarrer avec la meilleure application de trading gratuite

Si vous envisagez d'utiliser une application de trading pour la première fois, nous allons vous montrer comment démarrer. Bien que vous soyez libre d'utiliser celle de votre choix, les instructions ci-dessous vous permettront de vous familiariser avec l'application de trading eToro.

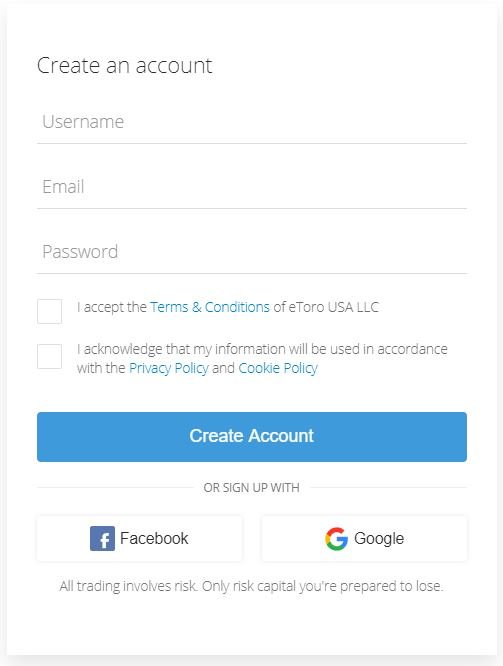

Étape 1 : Rendez-vous sur le site Web d'eToro et ouvrez un compte

Même si vous souhaitez commencer par la fonction de trading de démonstration d'eToro, vous devez ouvrir un compte. Le processus ne prend que quelques minutes et nécessite uniquement quelques informations personnelles de votre part.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Après avoir accédé au site d'eToro et cliqué sur le bouton "Join Now", vous devrez fournir les informations suivantes :

- votre nom

- Adresse personnelle

- Date de naissance

- Adresse électronique

- Numéro de portable

- Numéro d'identification fiscale

- Nom d'utilisateur/mot de passe

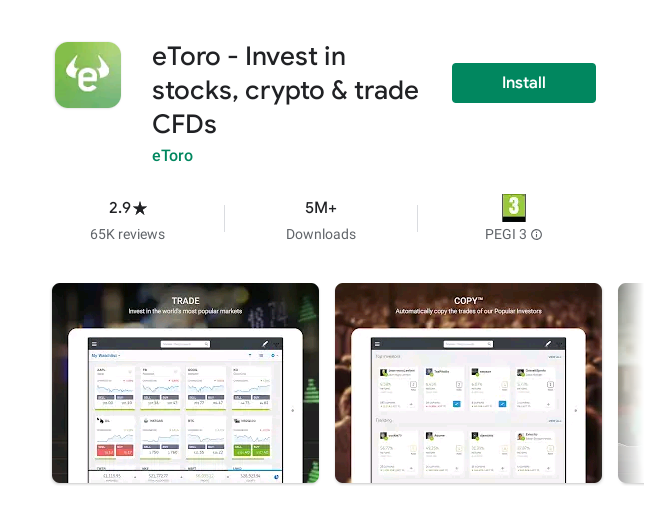

Étape 2 : Télécharger l'application de trading eToro

Une fois inscrit chez eToro, la plateforme vous redirigera vers la page de téléchargement officielle en fonction de votre système d'exploitation. Pour préciser, l'application est disponible à la fois sur iOS et Android.

Une fois que vous avez téléchargé et installé l'application, ouvrez-la.

Étape 3 : Connexion

Vous pouvez maintenant vous connecter à votre compte eToro via l'application. Vous devez utiliser le nom d'utilisateur et le mot de passe que vous avez créés lors de votre inscription.

Étape 4 : Déposer des fonds

Une fois que vous vous êtes connecté, vous pouvez trader gratuitement via le compte démo. Si vous souhaitez investir ou négocier avec de l'argent réel, vous pouvez déposer des fonds directement depuis l'application.

Les méthodes de paiement comprennent :

- les cartes de débit

- les cartes de crédit

- Neteller

- Skrill

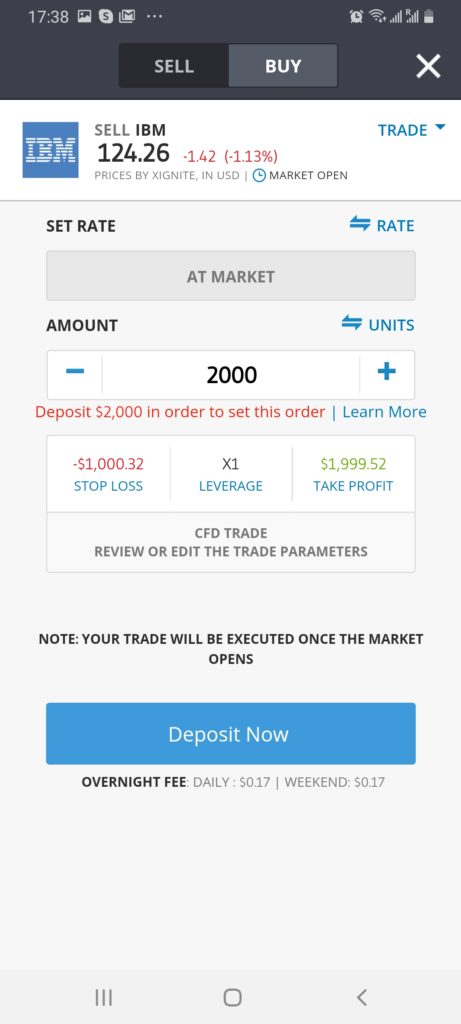

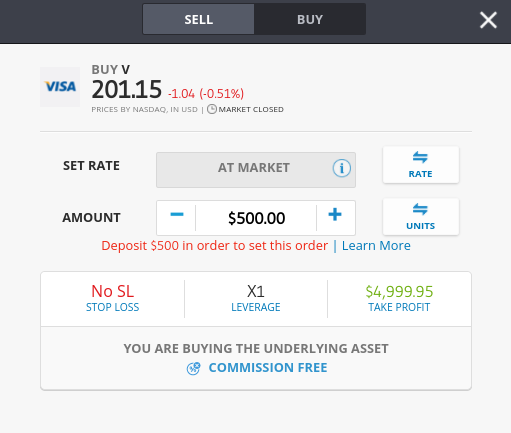

Step 5: Invest or Trade

As soon as you have made a deposit with one of the payment methods listed above, you can start trading immediately.

To find the desired asset, use the search function at the top of the app screen. You can also browse the asset library by clicking on the corresponding financial instrument, such as cryptocurrencies or ETFs.

Then, all you have to do is place an order. Simply click the "Trade" button next to the asset and enter your stake in US dollars. To place your order, click the "Open Trade" button.

Best Trading Apps in 2026 - In Conclusion

In short, choosing a trading app can be difficult, as there are many factors to consider. For example, it should not only have an excellent reputation and offer competitive rates, but it should also support your chosen financial market.

And of course, you need to look at the features and tools it offers and see if it provides a good user experience. Taking all these important considerations into account, we found that the best is eToro.

This regulated brokerage app allows you to invest in traditional assets and trade CFDs. The app is easy to use and takes just 10 minutes to get started. We also really like the Copy Trading features, which allow you to trade effectively but completely passively.

eToro - Best Trading App

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Questions and Answers

What is the best trading app for beginners?

Are there any free trading apps?

What are the best mobile trading apps for stocks?

Are the best trading platform apps safe?

How much do the best brokerage apps cost?

How do I find the best online trading app?

Which app is best when it comes to leverage?