Les meilleures actions pharmaceutiques à acheter en 2026

Pharmaceutical companies are businesses focused on the research, development, manufacturing, and sale of drugs to treat diseases and conditions. Pharmaceutical stocks have seen a surge following the discovery of a vaccine for Covid-19.

This guide features some of the best pharmaceutical stocks to buy this year, and also the best brokers offering them.

List of best pharmaceutical stocks 2026

- BioNTech – The Best Pharmaceutical Stock to Buy for Long-Term Gains

- Johnson & Johnson – The Best Pharmaceutical Stocks for Guaranteed Returns

- Moderna – Best Pharmaceutical Stocks for Future Profit

- Novavax – The Best Pharmaceutical Company for Big Gains

- Pfizer – Cheap pharmaceutical stocks for under $50.

- West Pharmaceutical – The Best-Performing Pharmaceutical Stocks You Can Buy

- Gilead – The Stock of a Big Pharma at a Low Price

- Bristol Myers Squibb – The Best Pharmaceutical Stock with a High Dividend

- Otsuka – Top Asian Pharmaceutical Stocks to Watch

- Teva – Best Pharmaceutical Stocks to Buy for Under $20

You can invest in all these pharmaceutical stocks and many more on eToro , our recommended stock broker!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

The best pharmaceutical stocks in detail

Now let’s see why the ten best pharmaceutical stocks we’ve listed are worth including in your portfolio.

1. BioNTech – The Best Pharmaceutical Stock to Buy for Long-Term Gains

BioNTech (short for Biopharmaceutical New Technologies) develops and manufactures active immunotherapies to treat certain diseases in patients. Based in Mainz, Germany, BioNTech develops pharmaceutical products based on the principle of messenger ribonucleic acid (mRNA) for use in targeted cancer immunotherapies, protein replacement therapies for rare diseases, and cell engineering.

During the global pandemic, BioNTech partnered with American biotechnology giant Pfizer to manufacture its own Covid-19 vaccine. The partnership proved successful, as the Pfizer-BioNTech Covid-19 vaccine received regulatory approval with 95% efficacy in adults. This vaccine was recently approved for booster shots by the UAE Ministry of Health and Prevention. BNTX has had a stellar year so far. Starting the year at just over $100, BNTX reached a 52-week high of $463.14 on August 11 before falling back. It has been unable to re-attain its previous high since that plunge. However, BNTX stock has largely traded above the 20-day moving average (MA) with a value of $200 for most of the year.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

2. Johnson & Johnson (JNJ) – Best Pharmaceutical Stocks for Guaranteed Returns

Occupying a prominent position on the list of multinational biotechnology companies, JNJ is an American global company specializing in the manufacture of medical devices, pharmaceuticals, and consumer goods. However, JNJ derives most of its revenue from its pharmaceutical business, with immunology drugs Stelara and Tremfya and cancer treatments Darzalex and Erleada being its best-selling products.

The healthcare giant has been at the forefront of the fight against the Covid-19 pandemic with its single-dose Janssen vaccine. The product’s appeal waned after side effects were detected earlier this year. However, Johnson & Johnson is still well positioned to profit from the pandemic, if the U.S. Food and Drug Administration (FDA) approves its product for the general American population.

Currently, Janssen has Emergency Use Authorization (EUA) for individuals 18 years of age and older. JNJ stock has been on an upward trend for most of this year. Starting at $153.49, JNJ jumped 15% to $170.34 in early January. Like many pharmaceutical stocks, JNJ peaked in mid-August and surged to $178.86, after hitting a low of $160.94 in June. At the time of publication, JNJ stock is trading in the red zone thanks to the company’s efforts to get its Covid-19 vaccine approved.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

3. Moderna – Best Pharmaceutical Stocks for Future Profit

Based in Massachusetts, USA, Moderna is a pharmaceutical and biotechnology giant focused on messenger RNA (mRNA) vaccination technologies. Moderna’s technology inserts synthetic nucleoside-modified messenger RNA (modRNA) into cells.

The mRNA then reprograms cells to enable an immune response to external attacks. SpikeVax is approved by the US FDA for use in people aged 18 and older. With an efficacy of 94.1% in adults, SpikeVax has received approval from the European Medicines Agency (EMA) for adults and children aged 12 to 17.

MRNA stock has been one of the best-performing pharmaceutical stocks year-to-date. MRNA has averaged $200 in volatile markets after hitting $501.06 on August 10. MRNA has surged 264.44% this year, while its price-to-earnings (P/E) ratio for the second quarter of 2021 was $6.46. Following a stock market decline, MRNA has tumbled 40% from its August high and is currently trading at $316.05.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

4. Novavax – Best Pharmaceutical Company for Big Gains

Based in Maryland, USA, Novavax is a biotechnology company focused on developing vaccines to combat serious infectious diseases. Before the global outbreak of Covid-19, Novavax developed experimental vaccines against Ebola, influenza, respiratory syncytial virus (RSV), and several other viruses.

Like other companies, Novavax has been working on an experimental vaccine against this global pandemic. Still under review by the World Health Organization (WHO), Novavax’s solution is expected to be the first Covid-19 protein subunit vaccine. Unlike other vaccines that need to be kept at sub-zero temperatures to remain effective, Novavax vaccines can be stored at normal refrigerated temperatures (2 to 8 degrees Celsius).

NVAX stock has been largely controlled by the whims of the market, with significant rallies and declines. The Maryland-based company started the year with a bang, reaching $331.16 before falling to $156 in early March. A subsequent rally took it to $264.72 the following month before plunging again to $117.86. Continuing its sporadic rise, NVAX jumped once more to $278.50 before falling back and finding support at $165.41.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

5. Pfizer – A cheap pharmaceutical stock for under $50.

Pfizer is one of the best pharmaceutical stocks on the market today. With high-performing drugs and medical devices such as Epipen, an epinephrine auto-injector, Depo-Provera, a birth control injection, and Dimetapp, a children’s cough medicine, Pfizer has remained at the forefront of global drugs and medical devices since its founding in 1849.

The company boasts a large number of successful drugs that generate over $1 billion in annual revenue. This has allowed the company to increase its dividends over the past ten years. Thus, income-seeking investors have been able to obtain dividends exceeding 30% over the past five years. Joining the club of biotech companies in the fight against Covid-19, Pfizer has partnered with BioNTech to produce the Pfizer-BioNTech Covid-19 vaccine, which is marketed under the name Comirnaty.

The drug enjoyed tremendous success after its FDA approval for people 16 and older. A recent CDC authorization recommends booster shots for people over 18, six months after the first injection. Pfizer’s stock rebounded a bit later than other pharmaceutical companies.

Trading at a moving average of $40, PFE stock reached a 52-week high of $51.96 on August 18, where it encountered resistance. A subsequent rally and plunge allowed PFE to retest the $51 threshold, but failed to break through. PFE lost steam and slowly slipped back towards the $40 area. At press time, PFE was trading below the 20-day moving average of $43.90 and trading at $41.93.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

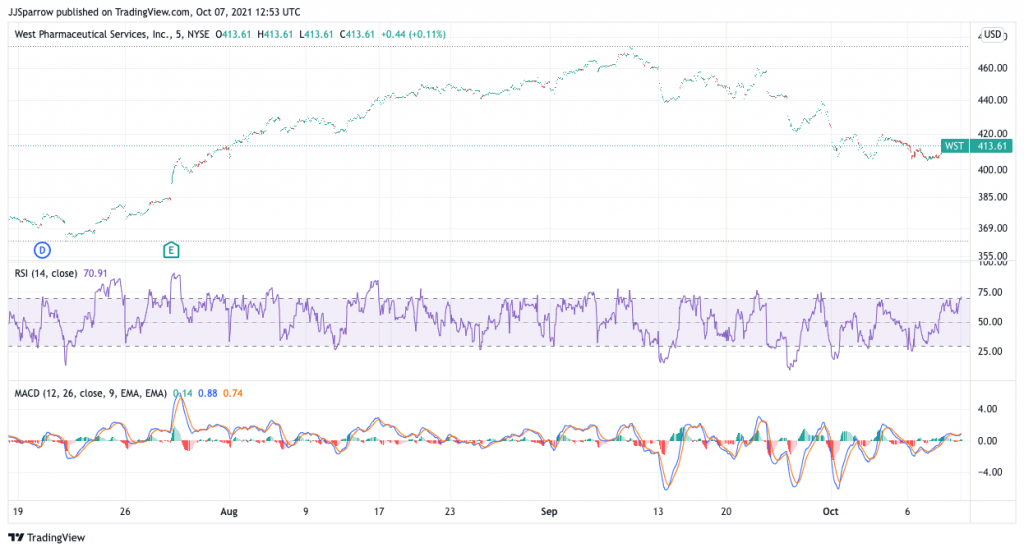

6. West Pharmaceutical – Top-performing pharmaceutical stocks to buy

West Pharmaceutical is not a pharmaceutical company in its own right; it primarily focuses on the design and manufacture of packaging and delivery systems for injectable medications. Based in Pennsylvania, West Pharmaceutical produces rubber components for packaging injectable medications, providing a sterile environment for manufacturers of drugs such as penicillin and insulin.

While not directly involved in the treatment of Covid-19, West Pharmaceutical plays an indirect role in controlling the respiratory disease that originated in Wuhan. It is the manufacturer of rubber stoppers for injectable medication bottles and syringe plunger tips. Given its vital role in the pharmaceutical industry, West has since acquired new equipment in northern Pennsylvania and North Carolina to double its production capacity for products used in Covid-19 vaccines.

West Pharmaceutical was one of the best-performing pharmaceutical stocks, trading above the $350 mark for much of the year. WST stock rose steadily, hitting a record high of $475.69 on September 9. A decline has since seen WST stock fall to $411.99, reflecting the overall market outlook.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

7. Gilead Sciences, Inc – A leading pharmaceutical company at a discounted price

Gilead Sciences, Inc. is a biopharmaceutical company headquartered in Foster City, California. The company focuses on the research and development of antiviral drugs used in the treatment of HIV, hepatitis B and C, and influenza, including Harvoni and Sovaldi.

With over 11,800 employees, Gilead Sciences is one of the world’s leading biotechnology companies and saw a sharp increase in revenue, from $22.127 billion to $22.449 billion in 2019. Following the Covid-19 outbreak, Gilead Sciences launched Velkury, also known as Remdesivir. Velkury was fully approved by the FDA last year and generated over $873 million in revenue. It became the company’s second-best-selling drug in the third quarter of 2020, behind the HIV drug Biktravy.

However, a subsequent study published in the Annals of Internal Medicine showed that the Velkury vaccine had little « antiviral effect » on hospitalized patients with COVID-19 syndrome. This led the company to halt a phase 3 trial of intravenous infusion of Remdesivir in high-risk, non-hospitalized patients. Gilead based its decision on the rapidly « evolving COVID-19 landscape. »

Despite this, Gilead Sciences reported a 21% year-over-year jump in product sales in the second quarter of 2021. Sales were primarily driven by Velkury and Biktarvy, with both drugs boosting revenue to $6.2 billion compared to the same period last year.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

8. Bristol Myers Squibb (BMY) – Best Pharmaceutical Stock with a High Dividend Yield

Founded in 1858 by Edward Robinson Squibb, Bristol Myers Squibb (BMY) is an American multinational pharmaceutical company. It manufactures prescription pharmaceuticals and biologics in several key areas: cancer, HIV/AIDS, cardiovascular disease, diabetes, hepatitis, rheumatoid arthritis, and psychiatric disorders, among others.

It is best known for manufacturing the blood thinning drug Eliquis. BMY’s cancer drug Opdivo is also very popular in US specialty hospitals. Bristol Myers has been expanding and recently acquired drugmaker Celgene in 2019, while adding three other cancer drugs—Revlimid, Pomalyst, and Abraxane—to its portfolio.

Fortune 500 company Bristol Myers Squibb saw its revenue increase 63% in 2020. Its dividend payout ratio has remained high, with investors earning 29% over the past five years. BMS was a latecomer to the Covid-19 vaccine race, but it secured global rights to a pair of SARS-CoV-2 antibodies discovered by Rockefeller University. BMY stock has experienced periodic rallies and subsequent declines. After reaching a yearly high of $69.20, BMY has spiraled downward and seen its value reduced by more than 10%. At press time, BMY stock is trading at $59.15, below the 20-day moving average price of $60.30.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

9. Otsuka – Top Asian Pharma Stocks to Watch

Japanese pharmaceutical giant Otsuka Pharmaceutical Co., Ltd. is a subsidiary of Otsuka Holdings Co., Ltd. Founded in 2008, it is the second largest drugmaker in Japan after Takeda Pharmaceutical Company.

The company is committed to addressing treatment needs through the research and development of highly innovative drugs and diagnostics. It focuses on medical needs in the areas of central nervous diseases, oncology, cardiovascular and renal disorders, tuberculosis, ophthalmology, and neurological disorders.

As part of the fight against Covid-19, Otsuka has partnered with Denka Company to launch the Quick Navi Flu + Covid-19 Ag in Japan. This diagnostic kit is expected to allow healthcare professionals to easily detect the presence of influenza and Covid-19 in patients. The kit will be able to provide results within 15 minutes.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

10. Teva – Best Pharmaceutical Stocks to Buy for Under $20.

Teva Pharmaceuticals is a leading Israeli pharmaceutical company headquartered in Petah Tikva, Israel. Founded in 1901, Teva Pharmaceuticals specializes in the genetic medicine industry. It was once the world’s largest generic drug manufacturer before being acquired by Pfizer in 2020. It is the eighteenth-largest pharmaceutical company in the world and has operations in Europe, Australia, North America, and South America.

Despite its intentions to partner with other biotech companies to develop a vaccine against the global pandemic, Teva Pharmaceuticals has so far been unable to secure a partnership. According to CEO Kare Schultz, the company’s offer was not accepted, and there is little chance the healthcare giant will work on a cure.

Meanwhile, Teva has $10.6 billion in assets under management (AUM) and a dividend yield of 3.49%.

TEVA stock started the year on a high but has since declined. Breaking above the $13.04 threshold on February 10, TEVA has since followed a downward trend with momentary rallies. Following its non-participatory role in the fight against Covid, TEVA stock reached a yearly low of $8.26 on July 19. A brief surge took it up to $10.30, before the stock traded sideways for most of July. However, TEVA has shown resilience and is trading above the 20-day MA of $9.28. It currently sits at $9.82 with a projection of a more upward trend.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Where to buy the best pharmaceutical stocks

Now that you have a general overview of the ten best pharmaceutical stocks to buy this month, let’s explore the best platforms for buying these stocks . To compile our list, our research focused on platforms that allow you to trade pharmaceutical company stocks. We also considered brokerage fees, commissions, user-friendliness, security, and accepted payment methods.

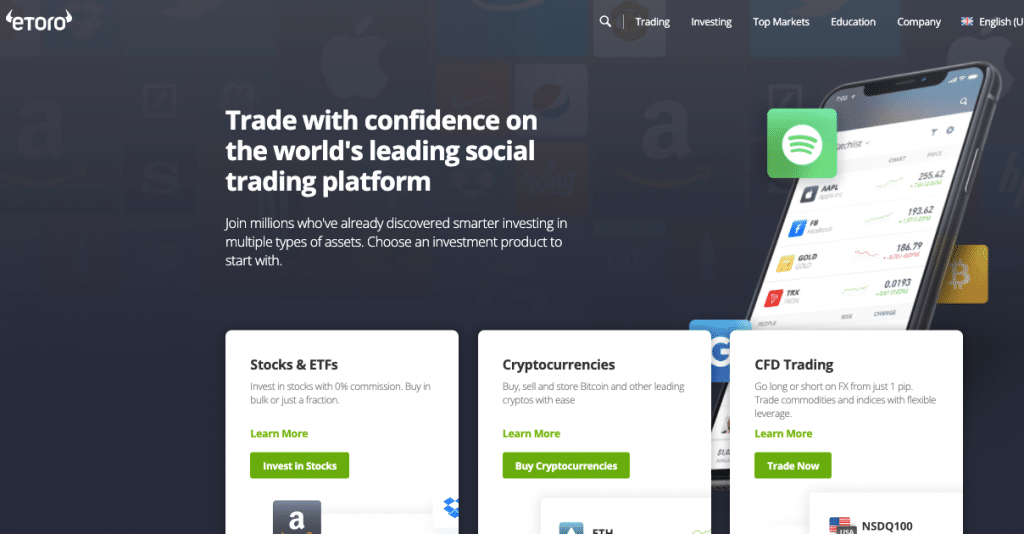

1. eToro – The Best Online Broker for Buying Pharmaceutical Stocks

Founded in 2007, eToro is a popular, highly intuitive, secure, and profitable trading platform . As a result, you can enjoy trading. Plus, monthly and annual fees are waived, giving you more buying power.

eToro’s popularity has allowed it to attract over 20 million users in 140 countries, thanks to its extensive portfolio of investment services. The best pharmaceutical stocks to buy are available on the eToro platform, along with the accompanying exchange-traded funds ( ETFs) .

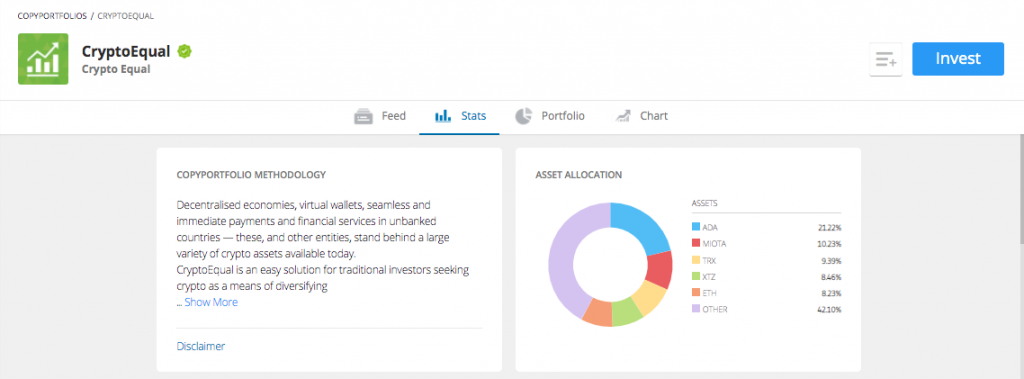

Additionally, eToro offers exposure to over 17 global financial markets, including commodities, forex trading, cryptocurrencies , stocks, and bonds. Its CopyTrade feature allows less experienced traders to copy the trading moves of professionals. In addition, the CopyPortfolio is the platform’s internally managed portfolio. CopyPortfolio helps traders automatically diversify their investments across multiple regions and sectors. This portfolio is frequently rebalanced based on the best-performing sector at the time.

eToro also supports a plethora of payment methods. You can buy your best pharmaceutical stocks via bank transfer, credit or debit card, e-wallets like Skrill, Neteller, or others. The minimum deposit is $100.

Benefits :

Disadvantages:

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Are pharmaceutical stocks a good investment?

Last year, the pharmaceutical industry struggled to find a solution to the global pandemic. As a result, all biotech companies focused their attention on finding a cure while paying less attention to other areas. This led to a decline in their performance compared to the financial market, where Amazon and Apple stocks dominate. The iShares Biotechnology ETF (IBB) posted a total return of 27%, compared to the Russell 1000’s total return of 35.1% as of September 16.

However, many pharmaceutical companies pay attractive dividends, which can be ideal if you’re a long-term investor. A long wait won’t have a direct impact on you, as you can let your investment grow over the years. With the world still struggling with the Covid situation, biotechnology companies will remain essential for some time to come. We can therefore expect significant investment in this sector in the coming years.

Another key reason to diversify your portfolio is the rapidly aging global population. With increasing life expectancy, many more people will rely on prescription drugs in the coming years.

Pharmaceutical stocks in the era of COVID

Pharmaceutical stocks have become a popular choice for investors as the world grapples with the impact of the coronavirus. Given the key roles and players in the industry, many consider this period to be a golden age for the biotech sector.

Several attempts have been made by various pharmaceutical companies to come up with a solution. However, perfection is far from being achieved, which ultimately leaves room for the best to thrive. If a biotech company is able to solve problems related to manufacturing processes, logistics, and, above all, efficiency, the company’s value would likely explode.

However, compared to the broader financial markets, pharmaceutical stocks have been slow to get off the ground. This has affected the sector’s annual returns. At the same time, growing conviction and collaboration in the search for a cure have allowed pharmaceutical stocks to slightly jump 0.26% on the Dow Jones US Pharmaceutical Index, closing at $708.30. The index has gained 8.07% year-to-date (YTD) compared to other sectors, and its year-over-year gain is estimated at 16.18%.

According to the S&P Pharmaceuticals Select Industry Index, the annual return on investment is 3.34%. However, this figure is expected to change soon. According to a report by Grand View Research, the global biotechnology market is expected to grow at a compound annual rate of 15% over the next seven years, reaching $2.4 trillion.

Pharmaceutical Penny Stocks

Penny stocks are shares of small, struggling companies that are underperforming in the market. However, this year, penny stocks have become media darlings thanks to the concerted efforts of retail investors.

The pharmaceutical sector has not escaped this phenomenon and we have listed some of the best pharmaceutical products under $5 that you can add to your portfolio:

- Catalyst Pharmaceuticals focuses on the treatment of rare neuromuscular and neurological diseases. CPRX stock is currently trading at $5.96.

- Acasti Pharma specializes in cardiovascular diseases and is a well-known manufacturer of CaPre (omega-3 phospholipid). ACST shares are currently trading at $1.80, up 1.44% in the last 24 hours.

- American Shared Hospital leases state-of-the-art medical equipment to hospitals and medical centers. With a market capitalization of $10 million, AMS stock is currently trading at $2.74, down 1.08% today.

How to choose the best pharmaceutical stocks?

Deciding on the best pharmaceutical stocks to add to your portfolio can be difficult. Below, we offer some criteria to help you get started.

Finances

The first thing to consider is the company’s financial performance over a given period. A company may appear financially sound from the outside and still be carrying a significant amount of debt. This is a major red flag if you can’t find a way to pay off those debt obligations. A quick look at the price-to-earnings ratio (P/E ratio) can help determine whether the stock is trading at a discount or a premium.

Growth or regular dividends

The underlying reason for your investment will help you make a decision in this case. Whether you’re motivated by a company’s growth or dividends, this will immediately help you choose the best pharmaceutical stocks for you. If you’re looking for growth, pharmaceutical penny stocks might be the best solution, while a dividend-focused investing strategy will lead you to choose companies like BioNTech and JNJ.

How to buy pharmaceutical stocks on eToro?

Now that you’re ready to buy pharmaceutical stocks, we’ll walk you through the process of doing so on the eToro platform . The following steps will take approximately 10 minutes.

Step 1: Register

Go to the eToro website and click « Register Now » to access the registration page. There, you’ll need to provide your first and last name, email address, and phone number. You’ll also need to choose a strong password.

Step 2: Upload your identity

eToro is a regulated broker, which means you’ll need to upload several documents as part of the platform’s Know Your Customer (KYC) policy. You can do this online with a photo of your ID or driver’s license. You’ll also need to upload proof of address, which can be provided by a utility bill or a recent bank statement.

Step 3: Fund your account

You’ll need to meet the minimum deposit threshold to access the best pharmaceutical stocks on eToro. The broker supports:

- Bank transfer

- Debit card

- Credit card

- Skrill

- Neteller

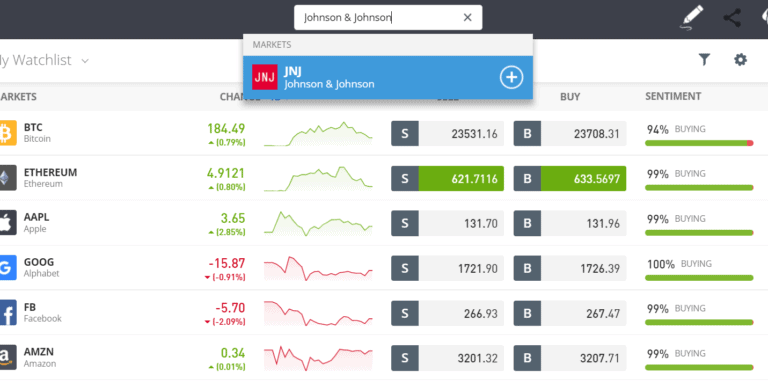

Step 4: Buy Pharmaceutical Stocks

Once your deposit is complete, you’re now ready to buy your favorite pharmaceutical stocks. eToro makes this process easy. All you have to do is type what you want to buy into the search bar. Alternatively, click the « Trade Markets » button and then select « Stocks. »

Past performance is not a guarantee of future results.

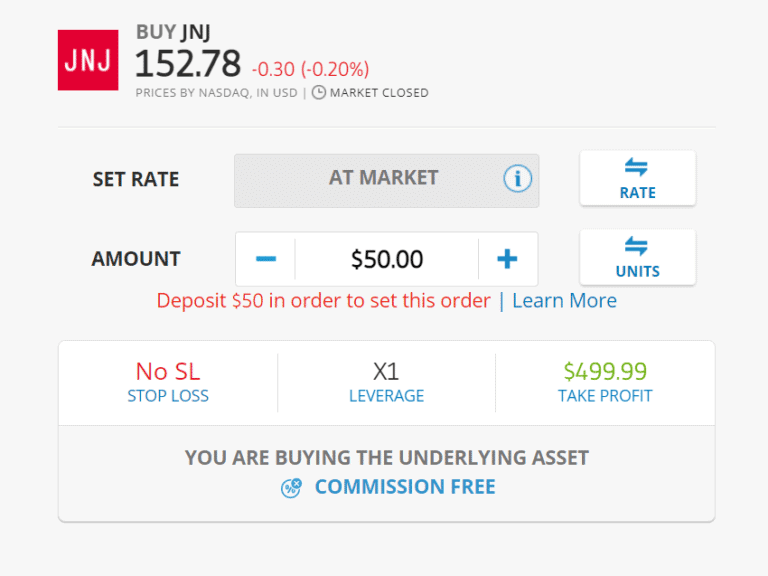

Next, click the « Industry » button and select « Healthcare. » You’ll get a complete list of stocks in that sector. For learning purposes, we’re going to buy JNJ stock, the world’s largest pharmaceutical company. So, we’ll click on « JNJ » and select the « Trade » button.

Step 5: Buy JNJ stock

Past performance is not a guarantee of future results.

You can now purchase your shares. Simply enter the amount you’re willing to invest and confirm your transaction. Remember to set your stop loss and take profit limits before closing the purchase page.

Conclusion

There are many pharmaceutical companies, and the most well-known brands have dominated the biotechnology sector for several years. As a result, investors are more familiar with these large companies. Considering the risk/reward ratio and the current pivotal position the world finds itself in, pharmaceutical companies are expected to continue growing in the coming years. All of the companies we’ve introduced you to could provide the financial boost you need.

If you’re looking to buy pharmaceutical stocks, we recommend using the eToro platform due to its user-friendly platform, and multiple payment methods.

eToro – The Best Platform to Buy Pharmaceutical Stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Frequently Asked Questions About Pharmaceutical Stocks

Can you invest in pharmaceutical companies?

Which pharmaceutical products should I invest in?

Is it worth investing in pharmaceutical companies?

What are the best pharmaceutical stocks to buy now?

Does Trump have any stakes in pharmaceutical companies?