Les Meilleures Plateformes de Trading en France pour 2026

Utilisez notre outil de recherche interactif pour trouver la Meilleure plateforme de trading en France qui correspond à vos besoins.

- Nous ne proposons que des courtiers régulés

- Nous découvrons les frais cachés, les commissions et les spreads

- Découvrez des courtiers qui sont bien notés pour leur service client

Entièrement Régulés

Examinés par des Experts

Sûrs et Fiables

Frais Transparents

Adapté aux Mobiles

Trading platforms are the essential connection between you and your chosen financial market. So, whether you’re interested in stocks, forex, commodities, or cryptocurrencies, you need to find a free trading platform that meets your needs.

At TradingPlatforms.com, we strive to bring you the best trading sites from 2026 and beyond. This includes trading platforms that offer the best fees and commissions, the most diverse asset classes, and, of course, the best regulatory stance.

Read on to find out which trading platforms stand out from the rest!

List of the best online trading platforms 2026

Here’s a quick overview of the best online trading platforms in 2026:

The best brokers & stockbrokers in 2026

Below is a quick list of the top trading platforms to consider in 2026. Scroll down to read our full review of each trading platform provider!

- eToro : The best trading platform right now, it gives you the ability to copy the strategies of top traders. On eToro, you’ll have access to a vast community, and thanks to social trading, it’s possible to learn trading quickly, no matter where you are in the world.

- Avatrade : Best trading platform with extensive analysis software. With this online broker, you can quickly learn to trade and become proficient. With its extensive educational resources, AvaTrade provides everything you need to become an excellent trader.

- XTB : Tailor-made solutions for European traders. Specializing in CFD trading, XTB allows you to invest in various assets without actually owning them. With this trading platform, you don’t need to fully understand how investing works.

- Admiral Markets : Best European broker for its educational resources. If you’re just getting started in trading, Admiral Markets is the ideal platform for you. It offers everything you need to become an accomplished trader.

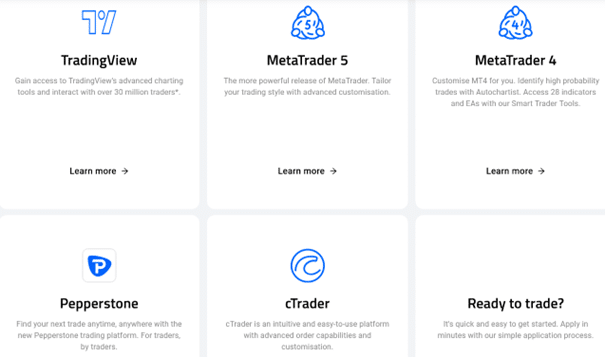

- Pepperstone : Best MetaTrader Broker. With this broker, you have the opportunity to trade on the best trading platform available. Pepperstone provides you with the renowned MetaTrader, which offers you immense possibilities.

The best French trading platforms in 2026 – in detail

You’re probably wondering which trading platform is best. With hundreds of providers active in the online space, choosing the right trading platform for your needs is no easy task.

Not only should the platform have an excellent reputation and support your chosen financial market, but it should also offer competitive rates and top-notch customer service. You should also consider metrics related to trading tools and features, educational resources, and chart reading indicators.

To help point you in the right direction, below is our comparison of trading platforms in 2026. We will present them in detail and their specific features.

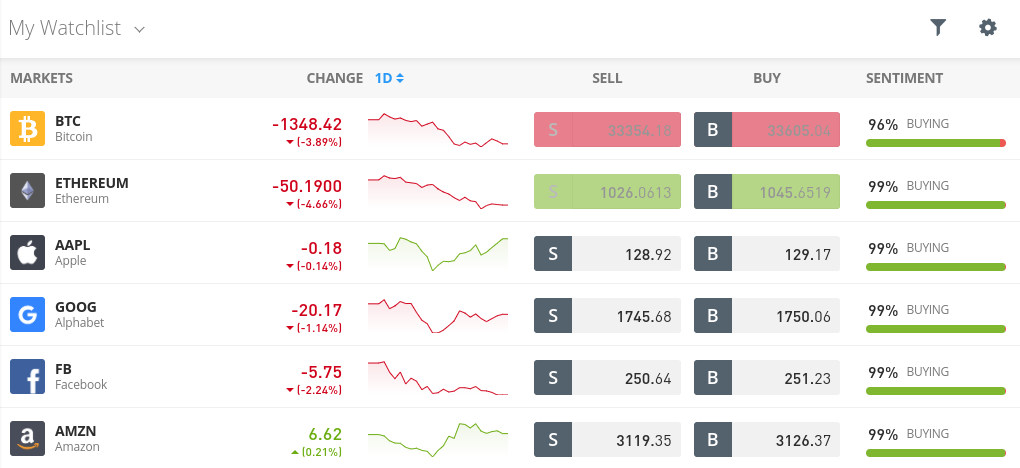

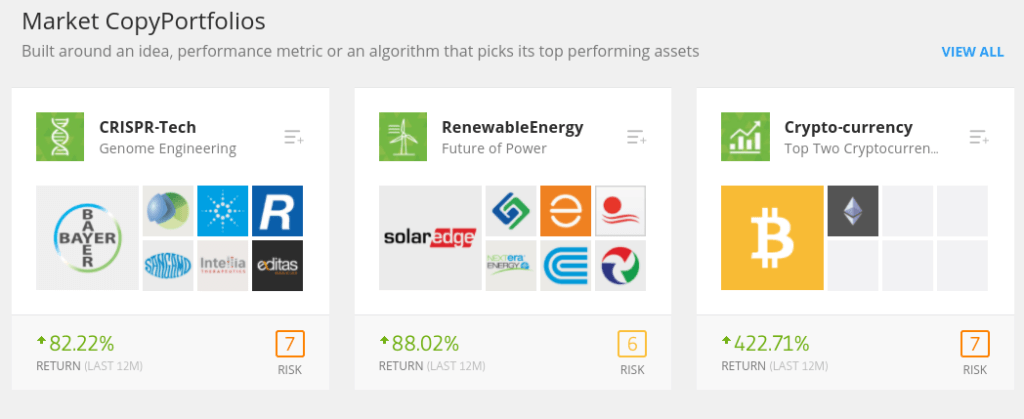

After researching hundreds of online providers, we discovered that the eToro trading platform is the best in 2026. This broker is ideal if you’re new to online trading. The platform is incredibly easy to use and can be accessed with very small amounts. For example, the minimum deposit is only $100, and you can trade from as little as $25. In terms of assets, the eToro trading platform offers several asset classes. This includes 2,400 securities spread across 17 different markets. For example, you can buy shares in companies based in the United States, Canada, the United Kingdom, Hong Kong, and many European stock exchanges. Past performance is not a guarantee of future results. eToro also allows you to trade over 250 ETFs and 16 cryptocurrencies. If you’re looking to trade commodities, the platform supports everything from gold and silver to oil and natural gas. And of course, the eToro trading platform also offers tremendous ease of forex trading . Another reason eToro tops our list of the best trading platforms for beginners is that it offers passive investing tools. With its CopyPortfolio feature, you can benefit from a professionally managed investment strategy. This means the eToro team will buy and sell assets on your behalf. Past performance is not a guarantee of future results.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.1. eToro – Best Trading Platform Right Now

For:

Against:

Avatrade allows you to trade currencies and stocks online. The broker also offers CFD trading on commodities, cryptocurrencies, ETFs, bonds, and indices. In total, Avatrade offers 1,260 symbols and 55 Forex pairs. Avatrade’s commissions vary depending on the asset. For trading a major currency pair like EUR/USD, the spread is 0.9. For the USD/CAD pair, it’s 2. Cryptocurrency trading incurs fees of 2% or less. The broker is very transparent about its fees. If you manage to get a professional account, you can take advantage of reduced trading fees. Deposits are instant, and the minimum deposit on Avatrade is €100. Withdrawals take two business days. After creating your account, you’ll have access to several software programs to analyze the market and place your trades. MetaTrader 5 and WebTrader are examples. Additionally, Avatrade offers social trading and copy trading. These features allow you to learn from other traders’ techniques when opening and closing positions. If you prefer, you can trade on your smartphone with the Avatrade mobile app. Those who want to learn more about trading can take advantage of the site’s many educational resources. These are available in the form of videos or web tutorials.

2. Avatrade: Best trading platform with many software for analysis

For:

Against:

Clients based in Europe can trade stocks and ETFs in real time. Alternatively, XTB offers CFD trading on forex, stocks, indices, cryptocurrencies, and commodities. In total, XTB offers over 5,400 assets to trade. XTB has already won several awards, including Best Broker for Beginners. Its trading software is easy to use, and its website presents information in a very clear manner. With XTB, clients have access to xStation 5 and xStation mobile software. You can download its Android or iOS app to continue trading on your smartphone. As for trading fees, they take the form of spreads at XTB and vary greatly depending on the asset. However, they are among the lowest on the market. If your stock trading volume reaches $100,000 per month, you won’t pay any commission. Trading via cryptocurrency CFDs will cost you $3.50 per trade. XTB applies a high conversion rate of 0.5%. This rate applies when you want to make a purchase in USD while your account is in EUR. You can deposit and withdraw money from your XTB trading account for free. This is provided you use a debit card for the deposit. The withdrawal must also be at least €200. There are no maintenance fees. However, if your account remains inactive for a year, XTB will start charging an inactivity fee of €10 per month.

78% des comptes d’investisseurs particuliers perdent de l’argent lorsqu’ils négocient des CFD avec ce fournisseur. Vous devriez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.3. XTB: Tailor-made solutions for European traders

For:

Against:

The financial instruments available on Admiral Markets are mainly stocks, ETFs, as well as CFDs on commodities, stocks, currency pairs, indices, bonds, cryptocurrencies and ETFs. Naturally, deposits are free at Admiral Markets. You are entitled to one free withdrawal per month . An impressive number of currencies are accepted on the site for your payments: EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN and RON. Payment methods at Admiral Markets include: bank transfer, debit or credit cards, e-wallets (PayPal, Skrill, Neteller, Klarna etc.). The minimum deposit at Admiral Markets is $100. Trading veterans in Europe are familiar with Admiral Markets for its extensive educational resources. The platform offers all the basic information traders need to improve their understanding of the financial markets. The « Education » section of the site will introduce you to its many resources : Forex and CFD webinars, seminars, a trader’s glossary, and even ebooks. This broker is also highly regarded for its extensive MetaTrader. Tradable assets on Pepperstone include: 60+ currency pairs, 12+ commodity CFDs, 5+ cryptocurrency CFDs, 16 index CFDs, 3 currency index CFDs and 60+ stock CFDs. Opening an account on this platform is quite easy, especially since its mobile application is easy to use. This mobile platform is powered by MetaTrader 4. This is important because Pepperstone is currently the best broker on MetaTrader platforms. If you enjoy working in a highly personalized environment with plugins that suit you, then Pepperstone is the ideal platform for you. Fees at this broker are in the lower-mid-range. Most of the time, you'll pay fees in the form of commissions and spreads. Pepperstone doesn't charge inactivity fees , making it an excellent platform for casual traders. For your payments on this platform, you can use the following currencies: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD. Payment methods vary greatly depending on the jurisdiction. In some countries, only bank transfers are accepted. In France, PayPal, Skrill, Neteller, credit and debit cards are accepted.

83% of retail investors lose money when trading CFDs on this site.4. Admiral Markets: Best European Broker for Educational Resources

For:

Against:

5. Pepperstone: Best MetaTrader Broker

For:

Against:

What is a broker?

A broker is a financial intermediary. They act as an intermediary between a buyer and a seller. Thus, the broker conducts financial transactions on behalf of a third party.

Originally, a broker was responsible for buying and selling financial securities. However, in the financial sector, the definition of a broker has broadened. A broker is not only an intermediary, but can also be a market manager.

The best brokers on the market today are all market-making brokers. Those that simply act as intermediaries are generally more expensive and less reliable.

In online trading, the broker is the trader's counterpart. They are responsible for managing the trading account. They can also accept deposits and pay withdrawals. Furthermore, they are able to execute orders placed by the trader. The broker's profit is generally linked to the commissions charged for each transaction. These can vary depending on the broker chosen.

The spread is the difference between the buy and sell price. This difference represents a cost for the trader, because whether a transaction is successful or unsuccessful, the trader must settle it. With a high spread, there is no need to charge the client a commission . On the other hand, some online brokers offer a low spread but charge commissions.

How to Choose the Best Trading Platform for You

Given the sheer number of trading platforms on the market, finding a suitable provider can be a time-consuming process. Therefore, it's important to find a trading platform comparison site that showcases the best brokers.

After all, you're investing your hard-earned money, so you need to be 100% sure that the trading platform you choose is right for you and your financial goals.

Good news! By ticking off a 'checklist' of key metrics, finding the best 2026 trading platform doesn't have to be monotonous.

The most important factors to consider are:

- Platform Regulations and Security

- Proposed assets

- Trading Fees

Trading platform fees

Trading Commissions

Trading commission can come in two different forms:

- For example, some trading platforms charge a flat fee. This means you might pay $15 to buy a stock and another $15 when you withdraw .

- In other cases, you may pay a variable fee. For example, the trading platform may charge 1% on all buy and sell positions.

Spreads

If you're a long-term investor looking to hold stocks or funds for several years, you shouldn't pay too much attention to the spread. But if you're a short-term trader looking to buy and sell currencies, commodities, or cryptocurrencies, then the spread is crucial.

For those unfamiliar, this is the price difference between the buy and sell rate of the chosen asset. In some cases, it is calculated as a percentage. However, if you are trading on the forex market, the spread is displayed in pips.

Other costs

Besides commissions, spreads, and transaction fees, there are several other fees you may need to be aware of before joining your trading platform of choice.

This includes:

- Inactivity Fees: Some trading platforms will charge you a fee every month if your account is marked as inactive. This usually happens after 12 months of inactivity, but can be much sooner. Always check if you have funds in your trading account.

- Margin Fees: If you plan to trade on margin, you should know the financing rates the broker charges. This is usually a percentage charged for each day you keep the position open.

- Account Fees: It's also important to check whether your chosen trading platform charges ongoing account fees. If so, these fees are likely charged monthly.

Tools and Features of Reliable Online Trading Platforms

If you're looking for a simple trading platform that allows you to buy and sell assets, you might not be concerned about the secondary features offered. However, this aspect shouldn't be overlooked, as there are many useful trading tools that you might be missing.

This includes:

Stock splitting

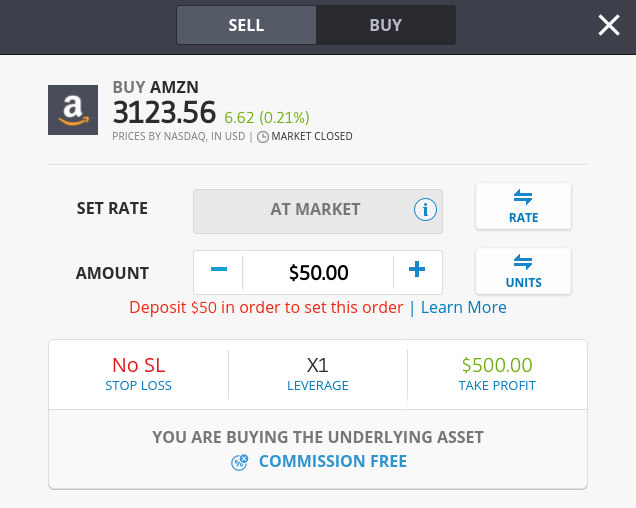

The ability to buy fractional shares is really important if you're a retail customer on a budget. After all, you might not want to shell out more than $3,000 for a single Amazon share or $1,700 for a Google share. With that in mind, fractional shares allow you to buy a "portion" of a stock.

Past performance is not a guarantee of future results.

Our top-rated trading platform, eToro , for example, lets you invest in any of its 2,400 stocks starting from just $50. This means that if you invest $50 in a stock priced at $500, you get 10% of the corresponding share. This is not only ideal for investing small amounts, but also for building a diversified portfolio.

Types of orders

No matter which trading platform you choose, you'll need to place an "order" to execute a position. The broker needs to know what you want to achieve with your order. All trading platforms offer buy and sell orders, but there are other order types you'll likely want to have available.

For example, the best online trading platforms also offer stop-loss and take-profit orders. These two are crucial for risk-averse trading. Another important order, offered by trading platforms like eToro, is the trailing stop-loss. This allows you to keep a profitable position open until it drops by a certain percentage.

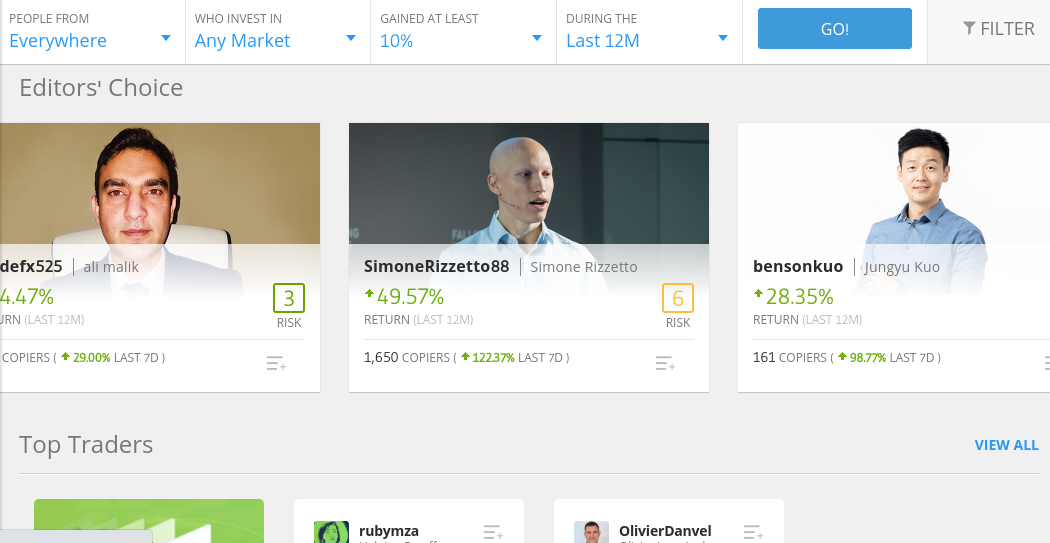

Copy Trading

If you're looking to actively trade the financial markets but lack the necessary experience or expertise, it's worth considering a platform that offers a copy trading feature. In its most basic form, this option allows users to passively copy all the trades of their favorite expert traders.

Past performance is not a guarantee of future results.

eToro, for example, welcomes thousands of verified investors who have joined its Copy Trading program. You can view each trader's profile, examining key metrics such as past performance, average monthly returns, risk rating, preferred asset class, and average trade duration.

When you find someone you want to copy, you must meet the minimum deposit of $100. Once confirmed, each position placed by the trader will be reflected in your own trading account. You can, of course, stop copying the trader at any time.

MT4/MT5

If you're a seasoned trader, you know that the MetaTrader (MT) series is extremely popular. For those who don't know, MT4 and MT5 are third-party trading platforms that sit between you and your chosen brokerage. Many traders opt for a broker that offers access to these platforms because they come with advanced tools.

MT4 and MT5 offerings, for example:

- Dozens of technical indicators

- Drawing and chart customization tools

- Real-time quotes

- Mirror trading

- Ability to deploy automated robots

- Mobile functionality

Not all trading platforms support MT4 and/or MT5, so you'll need to check if this is something you're interested in.

Trading alerts

Financial markets can and will move incredibly quickly. Therefore, you'll want to know what's happening when a key event occurs. With this in mind, it's a good idea to choose a provider that offers alerts. The best online trading platforms allow you to set up price notifications—which can be sent via the provider's app or email.

Past performance is not a guarantee of future results.

This gives you the added benefit of being notified when an asset reaches a specific price target. For example, you might want to manually trade the GBP/USD pair when it reaches 1.36. Additionally, the best trading platforms allow you to set up volatility alerts. This means you'll receive a notification if any of your selected assets experience a volatile rise or fall.

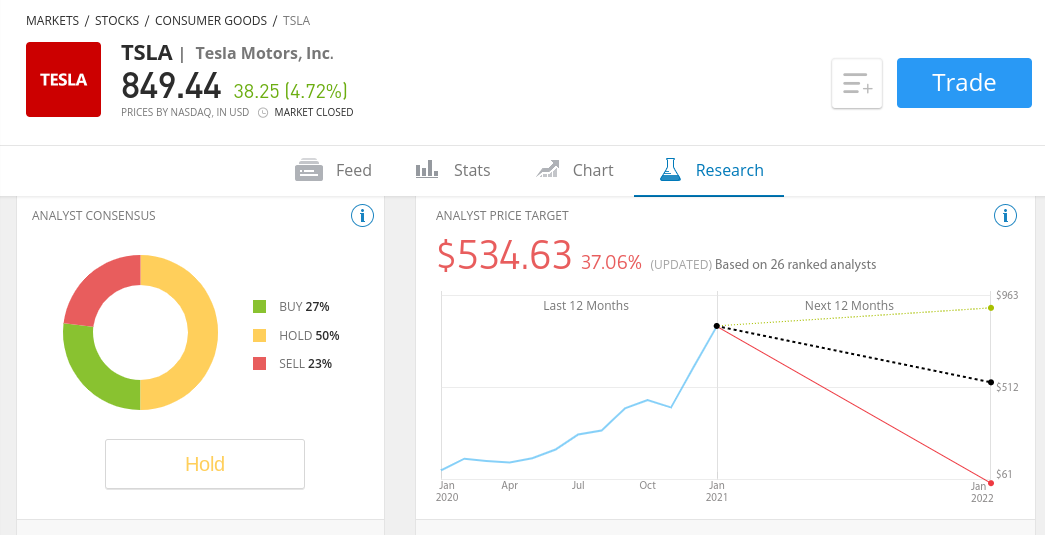

Training, research and analysis

We've found that the best online trading platforms in the online space are improving significantly by offering a comprehensive training service. This allows you to learn the basics of buying and selling financial instruments without the need for an external provider.

Some of the most useful training materials offered by top-rated trading platforms include:

- Guides and blogs on the main trading conditions

- Webinars

- Podcasts

- E-Books

- Mini-course

In addition to educational resources, we find that the best online trading platforms also offer numerous research and analysis tools. The former includes real-time financial news, trading information, and market sentiment analysis. When it comes to analysis, the best online trading platforms offer advanced chart reading tools, such as technical indicators.

User experience

If you're looking to trade online for the very first time, you need to make sure you choose a provider that offers a seamless user experience. While this isn't usually an issue when using the provider's main website, the end-to-end experience can be very challenging when it comes to its trading app .

Past performance is not a guarantee of future results.

After all, if you're into mobile investing, you'll have to enter buy and sell positions on a small screen. Therefore, it's essential to check how easy the app is to navigate. This includes not only finding assets and performing research, but also entering and exiting orders, checking your portfolio value, and depositing/withdrawing funds.

The good news is that, in most cases, the best trading platforms design apps for both iOS and Android devices. In other words, the app will have been built from the ground up and, crucially, optimized specifically for your operating system. If the trading platform in question offers demo accounts, you can test them out yourself without risking any money.

Payment methods

You'll need to add funds to your trading account before you can buy and sell assets from the comfort of your home, so it's important to check which payment methods the provider accepts.

In most cases, you'll be able to transfer funds from your personal bank account. While some platforms allow you to do this instantly, others require 1-2 business days to process the payment. That's why it's worth considering a trading platform that also offers debit/credit cards—as the payment is almost always added directly to your account.

If you use our top-notch trading platform eToro, you'll be able to deposit funds not only with Visa and MasterCard, but also with e-wallets like Neteller and Skrill.

Customer Service

There can be a huge disparity in the level of customer service offered by your chosen trading platform. Some providers, for example, only allow you to get help via email or an online support ticket. These platforms should be avoided, as it often takes several days to receive a response.

Instead, stick to trading platforms that offer real-time customer support. The best method of contact is live chat, although phone support is also popular.

You should also inquire about the customer support team's business days and hours. Most platforms don't offer weekly support, as the vast majority of financial markets are closed. Support is generally available 24/5.

Mobile trading

Being able to trade on the go is very convenient since you can take your smartphone with you everywhere. As you know, time is money, and the best trading opportunities don't come sooner. Therefore, whether a French trading platform offers a mobile app is one of the features you should consider. Thanks to mobile trading, you can place orders even when you're stuck in traffic. Furthermore, mobile trading gives you the opportunity to benefit from market fluctuations in a very short period of time. Therefore, no matter what trading strategy you use, mobile trading will be beneficial to you.

Platforms that also offer cryptocurrencies

Cryptocurrencies have become assets just as sought-after as stocks or Forex . Indeed, crypto trading allows you to take advantage of the volatility of this rapidly expanding digital currency market. Some of the best trading platforms listed on our site give you the opportunity to trade cryptocurrencies. You can buy cryptocurrencies and hold them in wallets or speculate on their price fluctuations through CFDs.

Therefore, investing in cryptocurrencies requires some knowledge of the industry and the help of a reliable trading platform. If you follow the news, you'll know that new cryptocurrencies are constantly emerging. This surely makes you wonder which cryptocurrency to invest in in 2023. To find the answer to this question, you must first do some research.

Furthermore, the best cryptocurrency to buy in 2023 isn't necessarily the one that was most popular in 2022. Indeed, you can also look at the best crypto presales to find projects that are truly worth it. On the other hand, you can search for the most promising cryptocurrencies to invest in. Regardless, if you want to invest for the long term, you must do so on a reliable trading platform. In addition, there are trading robots on the market that allow you to trade cryptocurrencies automatically, which is also an option you can take advantage of.

All things considered, you should always remember that it's crucial to only invest amounts you can afford. Indeed, the volatility of the cryptocurrency market is a double-edged sword. Just as it can make you win big, there's also the possibility of losing big. Therefore, when trading cryptocurrencies, you must be prepared for all eventualities.

How to Open an Online Trading Account in 2026

So far, this guide has reviewed a selection of the best online trading platforms. We've also explained the many important factors you should consider before choosing a provider.

To conclude, we'll now guide you through the process of setting up a trading platform. To do this, we've chosen to demonstrate the necessary steps using leading provider eToro.

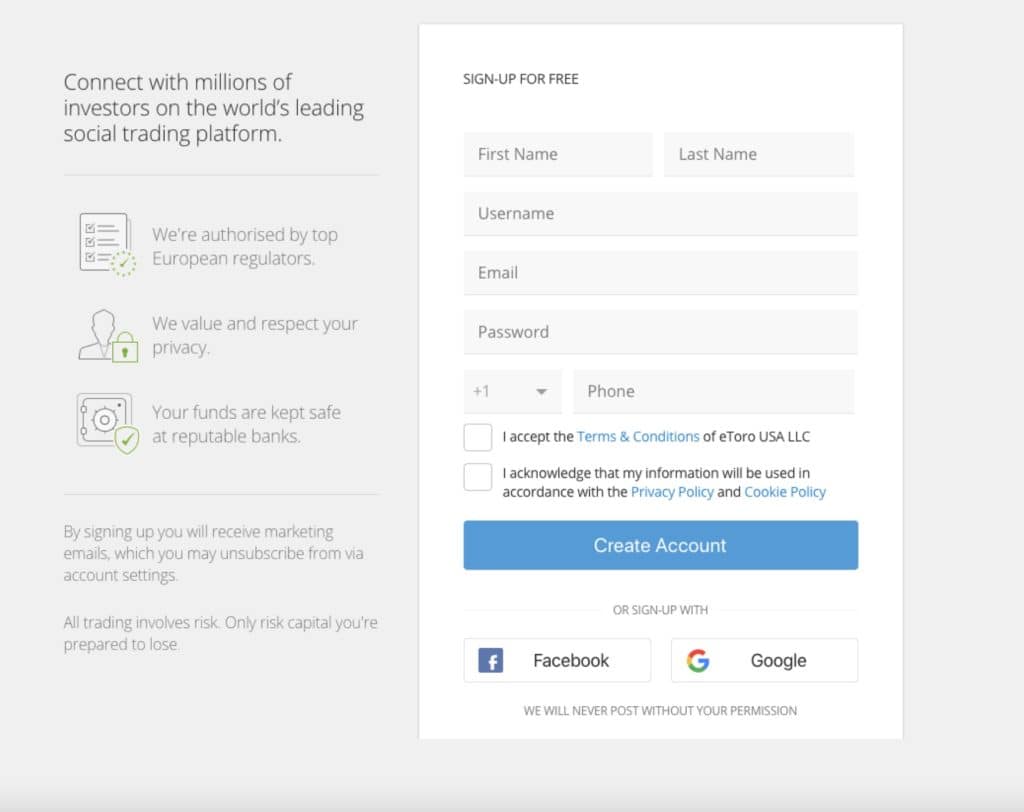

Step 1: Open an account and upload your identity document

Whichever trading platform you decide to join, you'll need to start by opening an account. With eToro, this can be done in just a few minutes.

To get started, head over to the eToro website and click the "Register" button. You'll then be prompted to enter your personal information, such as your full name, nationality, address, and date of birth. The trading platform also requires your email address and phone number.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

Step 2: Confirmation of identity

eToro is not only regulated by the FCA, CySEC, and ASIC, but it is also legally required to verify your identity before you can make a withdrawal. With this in mind, it's best to quickly get the verification step out of the way now.

You just need to upload a clear copy of the following two documents:

- Valid passport or driver's license

- Utility bill or bank statement (issued within the last 3 months)

In most cases, eToro will automatically validate the documents - so your account should be verified instantly.

Step 3: Deposit Funds

Now it's time to find your newly created eToro trading account.

You can choose from several convenient payment methods, including:

- Debit cards

- Credit cards

- Electronic wallets (Skrill, or Neteller)

- Bank transfer

The minimum deposit is $100.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.

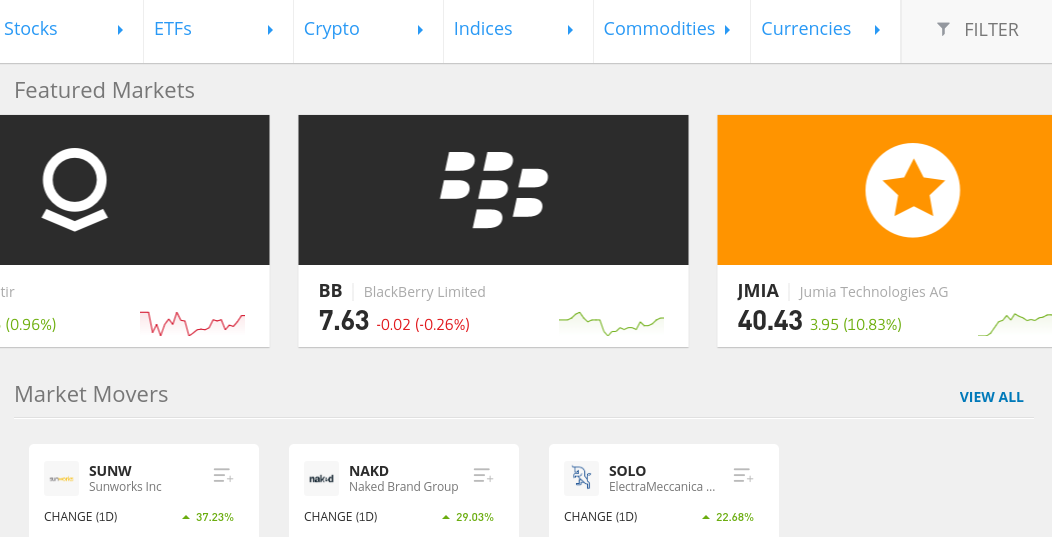

Step 4: Navigate Supported Trading Markets

Now that you've funded your eToro account, it's time to search for the asset you want to trade. If you know which market you're interested in, simply search for it.

Past performance is not a guarantee of future results.

If you want to see which assets are supported, click the "Trading Markets" button. You'll then see the asset classes you can trade—such as stocks, cryptocurrencies, ETFs, forex, and commodities.

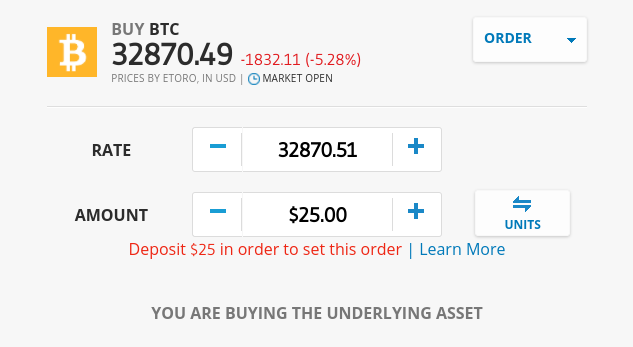

Step 5: Place an order

Now that you know what asset you want to trade, you need to place an order. In our example below, we are looking to trade bitcoins .

Past performance is not a guarantee of future results.

As you can see, we've entered our $25 stake in the "Amount" box. If you want to place a stop-loss and/or take-profit order, enter your price targets.

Once you are ready to place your order, click the “ Open Position ” button.

Conclusion - The Best Trading Platform in France 2026

In total, there are hundreds of trading platforms to choose from today. With this in mind, you should do plenty of research to ensure you find a provider that meets your needs.

While some of you may be looking to focus primarily on low fees, others may be looking for a platform that offers a specific market or asset class.

Ultimately, we found that Avatrade ticks all the right boxes for what you should look for in an online trading platform. It's a heavily regulated broker, offering thousands of markets.

{etoroCFDrisk} % des comptes d'investisseurs particuliers perdent de l'argent lorsqu'ils négocient des CFD avec ce fournisseur. Vous devez vous demander si vous pouvez vous permettre de prendre le risque élevé de perdre votre argent. Vous ne perdrez jamais plus que le montant investi dans chaque position.