Investice do akcií – online příručka pro začátečníky

Investing in stocks is perhaps the most common type of investment. In our easy-to-understand online guide for beginners, we’ll give you all the advice you need. We’ll talk about how to choose an approved and regulated broker, what fees to expect, how to place your first trade, and give you tips on choosing the right stocks.

Investing in stocks

[/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

[stocks_table id="24"]

How to invest in stocks - choosing the right broker

Before you make your first stock investments, you need to choose a top broker – this is an absolute must-have. To help you out, we’ve listed the top Czech brokers below with a full breakdown of their fees and features. You can even test out the amount you plan to invest and the number of trades to see how much each broker will cost you!

Investing in stocks - a step-by-step guide for the year 2026

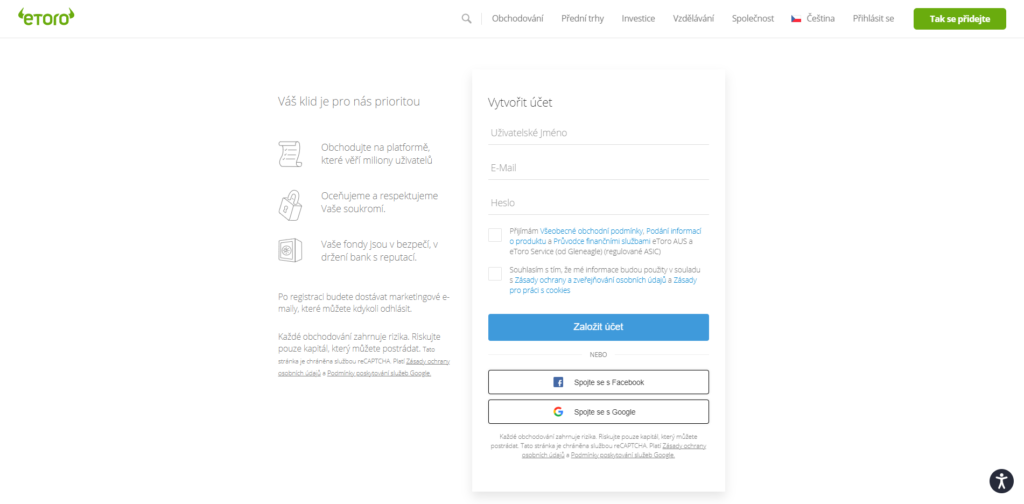

This step-by-step guide on how to buy stocks is based on our recommended regulated broker eToro , although the process is similar for most brokers. If you are happy with all the information on this page, you can register using the form below.

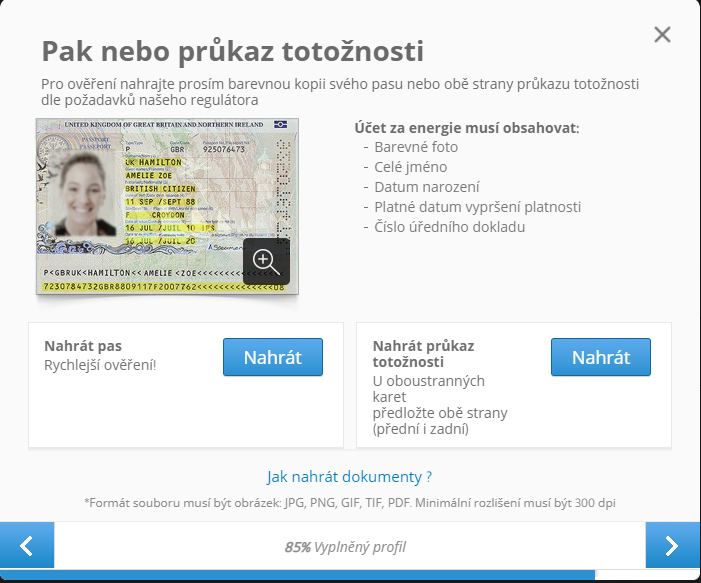

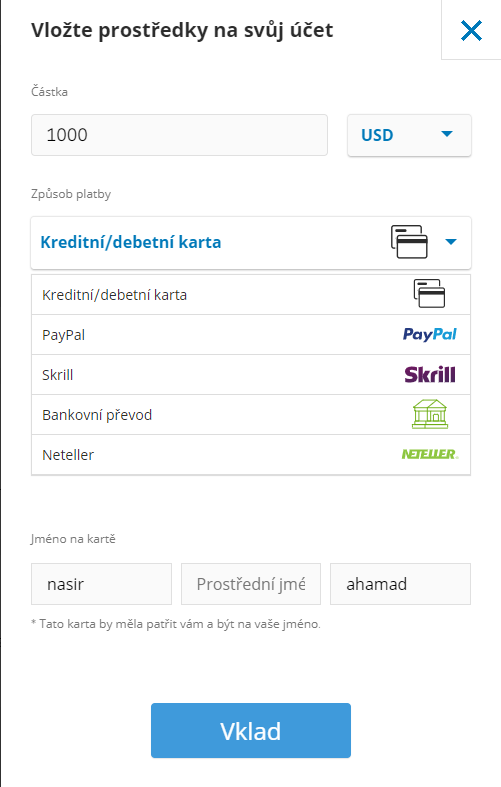

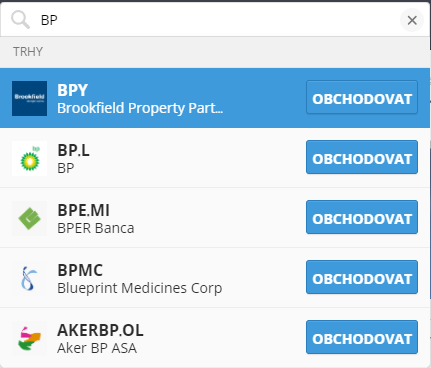

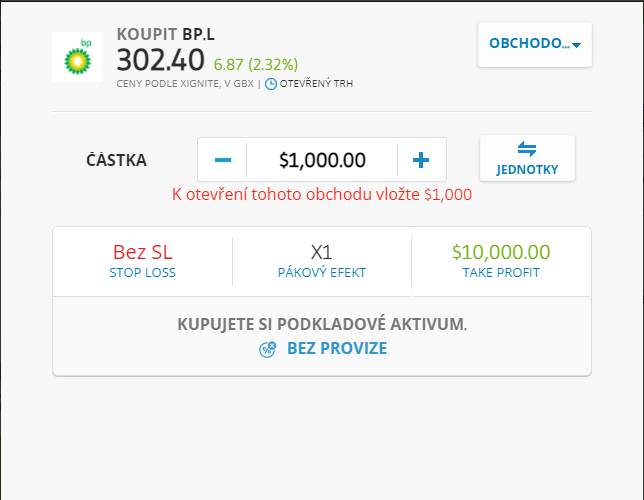

1. Open an eToro account today To create an account, eToro will ask you to provide a range of personal information – for example: You will also need to choose a username and a strong password. You can deposit up to $2,000 without uploading ID. However, if you want to deposit more, you will need to verify your account as eToro is regulated by the Financial Conduct Authority. Simply upload a photo of your passport or driver’s license. You will also need to upload proof that the information on your ID is real. This could be a bank statement or utility bill. Once you upload your documents, eToro should be able to verify them within a few minutes. At eToro you must meet a minimum deposit amount of $200 (approximately CZK 4,700). Supported payment methods are debit/credit cards, bank transfers, and e-wallets such as PayPal, Neteller, and Skrill. As we briefly mentioned earlier, all deposits on eToro will be converted to US dollars for a 0.5% fee. This gives you instant access to over a dozen financial markets – both in the Czech Republic and abroad. Once you have funded your eToro account, you are within reach of your first ever stock investment. In our example, we will show you buying shares in BP. So, we will type BP into the search box at the top of the screen and then click TRADE. If you have not yet decided which shares you want to buy, click on the TRADE MARKETS button and browse the list of tradable stocks on eToro. In order to invest in the shares of our chosen company, we first need to set up a buy order. As you can see in the screenshot below, the current market price of BP is 302.40 GBX – and this will change almost every second. However, we need to enter the amount we want to invest in US dollars. In our case, we are buying 1,000 USD worth of BP shares. Note: We are buying the underlying asset directly. That is, we are buying real shares, not a derivative derived from shares such as a CFD .

3. Deposit funds

4. Buy stocks

Learn the basics of investing in stocks

To complete the stock investment process, we simply click OPEN TRADE. Within seconds, our order will be executed, meaning we have just bought BP shares, with no fees. Done You have just learned how to invest in stocks in just four easy steps!

The way stock trading works today, you can buy thousands of global stocks with the click of a button. All you need is an account with a reliable online broker .

The best part is that there are now hundreds of brokers competing for you. That's why fees and spreads have never been more advantageous. In fact, there are even Czech stock platforms that allow you to buy stocks without any transaction costs.

It's important to learn not only how to invest in stocks, but also to master the basics of how stocks actually work. By learning the basics, you have the best chance of avoiding unnecessary, but costly, mistakes. Tip: Once you buy any shares in a company, they are required to send you a certificate within two months.

What are shares?

If a company decides to start publicly trading its shares, it means that it will be listed (quoted) on a stock exchange. This allows ordinary investors to buy their shares. By buying a share, you will own a share of the company you are investing in - proportional to the number of shares you hold. As a shareholder of the company, you will be entitled to a number of benefits - depending on the shares you invest in.

The value of a stock is determined by market forces. In other words, if there are more buyers than sellers, the price of the stock will increase. If that happens, the value of your investment will follow.

If there are more sellers than buyers, it has the opposite effect – meaning the value of your shares will fall.

Sale of shares

First of all, you will be entitled to dividends and voting rights at general meetings. You can sell your shares at any time during normal trading hours. The amount you receive back in cash will depend on the number of shares you hold and the current share price of the company. When buying your first share, we recommend that you bookmark our terminology page.

How much money can you make by investing in stocks?

If you want to find out how much you can theoretically earn if you decide to invest in stocks, try our handy investment calculator. Remember that stocks have an average historical return of around 10% per year. Which in the vast majority of cases always beats inflation, so you can effectively protect your money from depreciation.

How to make money on stocks:

There are three ways – capital gains, regular income in the form of dividends, and compound growth.

1. Capital gains

If the value of your shares is higher than the price you originally paid, these are capital gains.

For example:

- Let's say you buy 1,000 shares of Facebook at $200 per share.

- This means your total investment is $200,000.

- Five years later, Facebook shares are priced at $400 per share.

- You are happy with your profits, so you decide to sell the shares.

- You earned $200 on one share, which with 1,000 shares means a profit of $400,000. So in relative terms, the return on capital is 100%.

2. Dividends (current yield)

There are countless dividend stocks on the market. So you have the opportunity to get additional income in the form of dividends. In their most basic form, dividends allow large companies to share their profits with shareholders. Investing in stocks that pay dividends is therefore a great attraction. You are sure to get your dividend. Especially when it comes to established dividend stocks like Apple shares .

By investing in shares, you are entitled to a share of the company's profits. The specific dividend income you receive will vary depending on how well the company is doing. Not all joint-stock companies pay dividends. Those that do pay dividends send payments once a quarter. However, for example, dividends are paid once a year for Czech stocks.

This is how dividend stocks work:

- Let's say you hold 500 shares of HSBC.

- The company pays dividends every three months.

- This time HSBC announces a dividend payment of 7%.

- This amounts to £0.28 per share.

- You hold 500 shares, so you get a total of £140 (£0.28 x 500 shares).

The best thing about dividends is that you receive them on top of your capital gains. The ideal situation is one where your investments are in stocks that give you both capital and dividend income. The funny thing is that dividend stocks are less volatile than non-dividend stocks, which are called “growth” stocks.

Growth stocks benefit from reinvesting their profits – companies keep them and use them for innovation, expansion of production, research, etc. While dividend-paying companies simply take a slice of the pie and give it to investors. Therefore, they do not have as many resources to further expand their business.

However, it is not true that growth companies cannot repay their shareholders in any way. It is common practice for joint-stock companies to carry out so-called share buybacks. In layman's terms, they buy their shares from the market with their profits. This reduces the available supply on the market, so their price can increase much more easily. Then the return on capital is even higher. That is why share buybacks and dividends are equated. The effect is the same - a return for the investor.

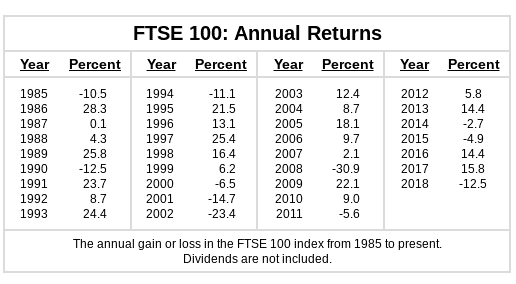

Although historical performance is never a reliable indicator of future results, below you can find the average annual return of the FTSE 100 over the past 25 years. If you would like to replicate these returns, you will need to invest in an ETF or mutual fund that tracks the FTSE 100.

3. Compound growth

Rather than simply paying out capital gains or dividend income, many investors seek to reinvest the income from their assets. The logical goal of this strategy is to generate even more income.

This is called compound growth, or you may also come across compound interest. By holding a stock for the long term and continually reinvesting capital gains, you can achieve the compounding effect, which essentially gives you additional profits on top of your previous profits.

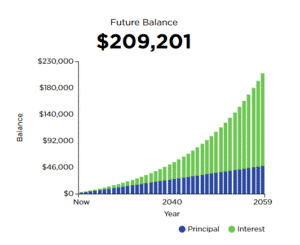

For a better idea, we attach the following graph and a specific example with numbers:

- You invest $110 per month in an asset that has a 6% return and you have reinvested your profit.

- If you did this for 10 years, you invested $13,200 and have $18,915.

- If you did this for 20 years, you invested $25,200 and have $50,640.

- If you did this for 40 years, you invested $49,200 and have $209,201.

The reason why your investment in stocks grows at this rate is simple. Your investment in stocks carries profits that you reinvest. So you earn interest on your regular monthly contributions + reinvestment of profits. So you have a cumulative return.

This type of stock investment requires patience, as initial profits are naturally small, but in the long run it is a financial seventh wonder of the world. Therefore, it is generally not recommended to withdraw your dividend profits in any way, but it is wiser to reinvest them.

Of course, you have to factor in stock price fluctuations, inflation, and fees, but if you follow this simple rule, compound interest can be one of the best ways to grow your wealth.

What to consider before buying company shares

Although stock markets have historically performed well, this is not the case for all companies. On the contrary, many companies in the Czech Republic and abroad are now worth only a fraction of their previous highs. This is especially the case for major British banks - companies such as HSBC and Deutsche Bank never really recovered from the financial crisis of 2008.

With that in mind, below are some useful stock tips that will help you mitigate the risks of your first stock investment.

Tip #1: Diversify as much as possible

In short, diversification is the opposite of betting everything on one card. This means that instead of investing in one or two companies, a well-diversified portfolio should contain dozens, if not hundreds, of different stocks. Not only that, but you will also invest in companies from several sectors. This ensures that you do not invest all your funds in just one segment. Why is this important? There are market segments that grow almost to the sky in an economic boom. But when a recession comes, they go down first and hardest. That is why it is a good idea to invest in sectors that do not grow as much in an economic boom, but maintain their value during a recession.

For example, let's say you have $5,000 to invest in the stock market.

- An inexperienced investor could use the entire $5,000 to invest in a single stock company.

- However, a smart investor will buy shares in 100 different companies for $50 each. These companies would also be from different sectors of the economy.

Tip #2: Start with small amounts

Once you decide to invest in stocks, you need to be very honest with yourself. Honest in the sense that you don't overestimate your abilities. But it's not advisable to underestimate yourself either. In any case, it's wise to start with smaller amounts. Most regulated brokers require a minimum deposit of a few hundred dollars. That's a few thousand crowns in our currency. Which is not such a huge amount these days. Of course, you don't have to invest the entire deposit in one stock. You can divide your investment.

Platforms like eToro allow for minimum investments in stocks of $50. This allows you to start with really small amounts and gradually build your confidence and gain new experience.

Tip #3: Learn how to analyze stocks

As you begin to master the first steps of investing in stocks, it is also important to learn how to analyze the market environment. By this we do not mean anything as complicated as in-depth technical and fundamental analysis or reading charts. Just make sure you are constantly aware of key market developments that could affect the value of your investment.

- For example, let's say you invested £3,000 in Royal Mail.

- If Royal Mail announces that it plans to cut hundreds of jobs, how do you think this will affect the share price?

- Undoubtedly, such negative news would lead to a mass sell-off by shareholders.

- Immediately after that, the value of the shares will drop.

- This means that if you sold the stock immediately after the news was announced, you would have the best chance of minimizing your losses and getting back as much as possible.

Additional tip: It's worth signing up for alerts on a news site like Yahoo!. The finance tab lets you add companies you're invested in to your portfolio, and then you can choose to receive real-time alerts when important news releases are released. For more tips on stocks and how to sell them, check out our guide to the best stocks to buy.

But let's give some examples of widely used fundamental stock analysis methods that you will often encounter:

- Price-to-Earnings Ratio: The price-to-earnings (P/E) ratio examines the relationship between a stock’s market price and its earnings per share. This allows investors to determine whether a stock is undervalued or overvalued. Simply divide the current market price of the stock by the company’s annual earnings per share to get the ratio. While there are many other variables to consider, major U.S. stock exchanges have an average price-to-earnings ratio of between 13 and 15.

- Debt to Equity Ratio: The debt to equity ratio examines how much debt a company has in relation to its equity. Simply put, it tells you whether a company has too much debt. When calculated, the ratio comes out to be between 0 and 1 - the higher the number, the more debt (relative to the amount of equity). When using the debt to equity ratio, you need to evaluate the type of industry the company operates in, as it is common knowledge that some industries have more debt than others (for example, construction companies).

There are, of course, many other methods used by experienced investors.

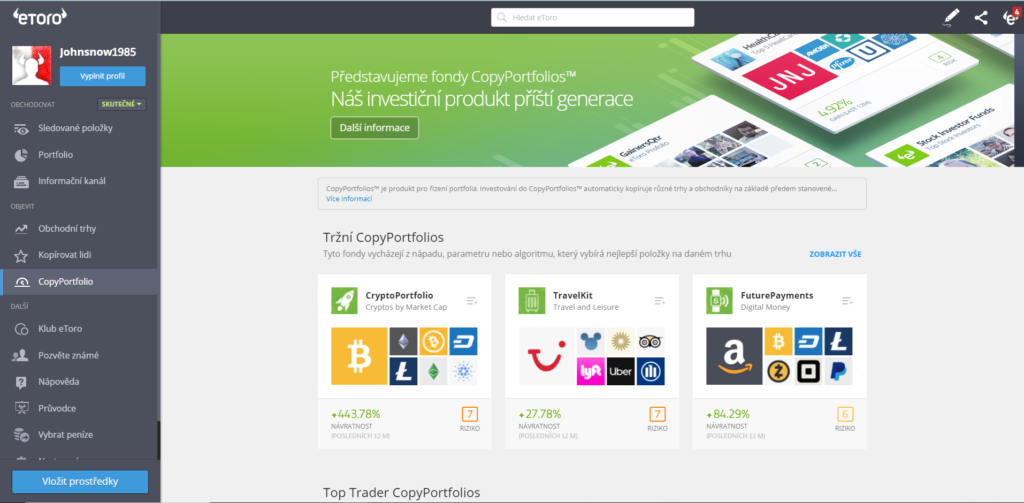

Tip #4: Consider Copying Traders

If you have almost no knowledge about the stock market. You have no idea how stocks work. In that case, you might consider building a portfolio by copying other traders . Beginner-friendly platforms like eToro allow you to copy the trades of experienced investors.

This includes not only their current portfolio but also any investment related to it. The best part is that you can check the trader’s reputation before investing any money. Copying traders essentially allows you to invest in stocks without having to do anything, making the mechanism very popular among new investors.

How to choose a broker for investing in stocks

Now you know how to invest in stocks, but do you have a reliable broker that suits your investment preferences? There are many brokers out there, and they all differ in terms of tradable assets, fees, and features. So, you need to spend some time researching different platforms before signing up.

Some of the most important factors to look out for are:

Regulation by the Financial Conduct Authority

The first and most important point you need to consider when choosing a stock broker is whether or not they are regulated by the Financial Conduct Authority (FCA) or another regulator such as CySEC, ASIC and others. This will ensure that you can buy, sell and trade stocks in a safe environment.

For example:

- All FCA regulated brokers are required to go through a long and drawn-out application process before they can legally start accepting traders.

- The platform's accounting must be audited by the FCA every quarter.

- All client funds must be held in segregated bank accounts. This protection is essential because it prevents the broker from using your invested funds to cover its own working capital.

- Separate bank accounts also mean that if the broker were to run into financial trouble, your money would be tied up.

In other words, never sign up for a stock trading platform unless it has an important regulatory license from the FCA!

Payment methods

Once you have evaluated a broker, find out what forms of payment they accept. In the vast majority of cases, Czech stock trading platforms will accept debit/credit cards and bank transfers. The latter option is more suitable for larger deposits of funds.

Depending on the broker, it can take 1 to 3 business days for the funds to be credited to your account. If you make an instant bank transfer, they can be credited within two hours.

Brokers like eToro also accept e-wallets: Skrill, Neteller, and also the most practical PayPal.

What stocks can you buy in the Czech Republic?

As we briefly noted earlier, there are tens of thousands of listed companies on dozens of exchanges. Crucially, the specific markets you have access to will depend on the broker you sign up with. For example, between eToro and Plus500, you will be able to buy, sell and trade over 10,000 different companies.

This includes companies listed on the following exchanges:

- London Stock Exchange (UK)

- Alternative Investment Market (UK)

- NASDAQ (USA)

- New York Stock Exchange (US)

- Tokyo Stock Exchange (Japan)

- Hong Kong Stock Exchange (Hong Kong)

- and many, many more!

It is best to choose a broker that offers both Czech and international markets, as this will give you the best possible chance of diversifying your risk. For example, eToro allows you to buy shares from 17 different global stock markets.

Where to buy stocks – the best Czech stock trading platforms of the year 2026

Finding the time to research all the important details about a broker can be challenging. Below, you will find the best stock trading platforms that meet a number of necessary requirements and can act as investment managers for your stocks. These brokers have a vital regulatory license from the Financial Conduct Authority, support for debit/credit cards and bank accounts, and the ability to buy and sell shares of both domestic and international companies.

1. eToro – the best broker in the Czech Republic

On eToro, you can invest in, for example, UK blue chip stocks such as Tesco, BT and Rolls Royce, as well as the best technology ETFs. Or perhaps you want to invest in growth US technology stocks such as Amazon, Apple and Tesla.

If you want to trade stock CFDs , where leverage of up to 1:5 is available, you will have to pay a small fee known as a spread. You can find out more about the differences between buying physical shares and trading stock CFDs here .

eToro is also licensed in Australia (ASIC) and Cyprus (CySEC), so the platform is regulated from multiple sides.

Opening an investment account takes just a few minutes. The platform allows you to deposit funds with a Czech debit/credit card, bank account, or e-wallet, but you must meet a minimum deposit of $200 (approximately $4,700).

Once your deposit is credited by your broker, it will be automatically converted to US dollars. For a small fee of 0.5%. This allows you to access international markets without having to worry about exchange rates. If you wish to deposit a larger amount of money, eToro requires verification.

The platform supports large investments – up to £40,000 per card transaction and no limits on bank transfers – which would qualify you for a VIP account and a chance at a face-to-face meeting at their London headquarters.

Another advantage of the eToro platform is its copy trader feature, which gives you the chance to copy successful investors in stocks and build similar portfolios. However, this feature comes with additional fees. You can find a more detailed overview in our eToro review.

Advantages:

Disadvantages:

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

2. Plus500 – a trading platform for trading stock CFDs without commission

Plus500 also allows you to use leverage on your stock CFD trades in the same way that it allows you to use leverage on other instruments. With a maximum leverage of 1:5 for retail clients (and higher across other asset classes), a £200 deposit would allow for a maximum trade size of £1,000. Using Plus500 to trade stock CFDs also gives you the option to choose a buy or sell order. This means you can speculate on how the price will go up and down. This is something you won’t be able to do with a traditional broker.

As for the basics, not only is the parent company listed on the London Stock Exchange as a PLC, but Plus500UK Ltd is authorised and regulated by the FCA (#509909). You can open an account with Plus500 in minutes and deposit funds using a Czech debit/credit card, bank account or PayPal. You will need to meet a minimum deposit of £100.

Advantages:

Disadvantages:

76,4% retailových investorů je při obchodování na této stránce ztrátových.

3. Libertex – broker with stock CFDs and zero spreads

With Libertex you can trade global stocks, currencies, commodities, cryptocurrencies, indices and more via CFDs. They also provide key stocks in popular sectors, such as cannabis stocks, which some brokers are still reluctant to offer.

When trading stocks, the commission ranges from 0% to 0.5%, but with some account types you can get a 50% discount, all with zero spreads!

Libertex fees:

| Commission | 0–0.5% of the share |

| Deposit fee | Free |

| Withdrawal fee | 1 EUR for credit/debit card, 1% for Neteller, free for Skrill |

| Inactivity fees | 10 EUR after 180 days |

Advantages:

Disadvantages:

73,77 % účtů drobných investorů ztrácí peníze při obchodování CFD s tímto poskytovatelem.

5. AvaTrade – Wide range of stock trading accounts

With AvaTrade, users have access to a wide selection of different trading platforms and account types. Including spread betting, options trading, CFD trading, and swap-free Islamic accounts for the MetaTrader 4 and MetaTrader 5 trading platforms.

Through the AvaTrade platform, you can not only trade stock CFDs, but also have access to over 1,250 global markets including global stocks, commodities, indices, currencies and cryptocurrencies.

Even better, you can trade 100% commission-free with a broker that is regulated in six different jurisdictions!

AvaTrade Fees:

| Commission | 0% |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | Yes, $50 after 3 consecutive months of non-use |

Advantages:

Disadvantages:

71 % účtů drobných investorů přichází o peníze při obchodování s CFD s tímto poskytovatelem.

What are the advantages and disadvantages of investing in stocks?

Advantages:

Disadvantages:

The process of buying shares in the Czech Republic has changed considerably over the past decade. You no longer have to call a traditional broker to place your buy and sell orders. Instead, you simply choose a regulated online stock trading platform, deposit some money with your Czech debit/credit card, and then choose which shares you want to buy. We recommend trying eToro because of its FCA regulation.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.How to invest in stocks – the verdict

eToro – investing in stocks

Frequently asked questions

Can you invest in foreign companies?

What Czech payment methods can I use to buy stocks online?

What fees will I pay when investing in stocks?

How can I buy shares listed on AIM?