Příručka pro intradenní obchodování 2026

Online trading has made it easier than ever to make a living in the Czech Republic by day trading . When you day trade, you buy and sell assets with the goal of closing all your positions by the end of the day. You can day trade cryptocurrencies, stocks, options, funds, forex, and more.

Day trading can be rewarding, but it can also be very challenging. In this guide, we’ll explain intraday trading for beginners and explore day trading strategies and tips to help you get started. We’ll also show you the five best brokers to start day trading with in the UK and show you how to make your first day trade.

Best intraday trading platforms for the year 2026

Below you will find a list of the best platforms for intraday trading. You can scroll down to read a full review of each platform to see which one suits your personal trading goals!

[/blade]

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

[stocks_table id="24"]

What is intraday trading ?

Day trading is the act of buying and selling financial instruments within a single day. You might buy a stock or option in the morning and then sell it a few hours later before the end of the trading day. Whether you hold it for a few minutes or a few hours, one of the principles of day trading is that you should close all of your positions by the end of the day.

Because the time frame for holding positions is so short, most day trading strategies focus on many small profits. For example, you might place dozens of trades in a single day, each of which will only make around one or two percent. However, place enough winning trades, and these profits can add up to a large amount over time.

Další důležitou věcí, kterou je potřeba mít na paměti při intradenním obchodování, je to, že je nesmírně důležitá minimalizace vašich ztrát. Nemusíte vydělat každým obchodem, ale musíte zabránit tomu, aby jediná prohra pokazila zisky za celý den. Z tohoto důvodu se denní obchodníci hodně spoléhají na nástroje řízení rizik, jako je opuštění pozice při ztrátě (stop loss).

Jednou ze vzrušujících věcí na denním obchodování je, že to lze provést s širokou škálou různých aktiv. Podívejme se blíže na některé typy aktiv, které denní obchodníci upřednostňují.

Intradenní obchodování s akciemi

Nákup a prodej akcií je jedním z nejběžnějších způsobů, jak se zapojit do denního obchodování.

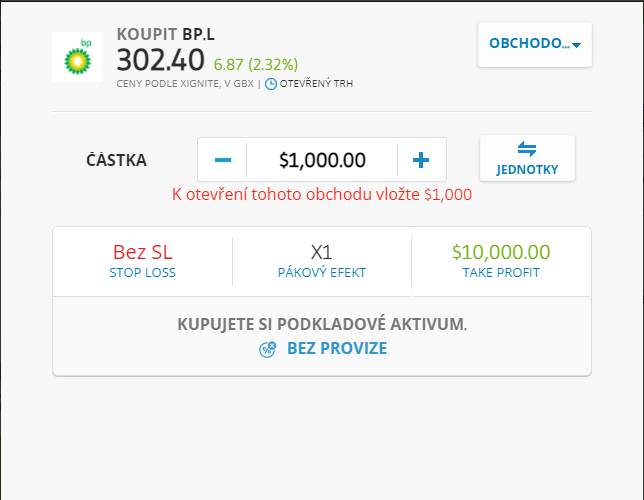

Můžete nakupovat akcie velkých společností, jako je BP, nebo se podívat na mezinárodní obchodování se společnostmi jako jsou Amazon a Facebook.

Můžete také vyzkoušet denní obchodování s centovými akciemi. Centové akcie jsou obvykle extrémně volatilní, což z nich dělá hlavní cíle pro krátkodobé obchodování. Jen se ujistěte, že víte, do čeho jdete když obchodujete s těmito akciemi, protože nepodléhají stejným předpisům jako blue chips akcie (velké společnosti, které mají vysokou váhu na akciovém trhu)

Při denním obchodování s akciemi hledejte významné události, jako jsou oznámení společností a zprávy o zisku, které pravděpodobně způsobí velké výkyvy cen akcií. Denní obchodování v ČR není ani tak o nalezení podhodnocených akcií nebo růstových akcií, když to srovnáme s dlouhodobým investováním. Cílem je spíše odhalit krátkodobé cenové změny, ke kterým dochází během obchodního dne.

Intradenní obchodování s ETF

Intradenní obchodování s ETF (fondy obchodovanými na burze) může být obtížné, protože tyto fondy jsou obvykle méně volatilní než akcie jednotlivých společností. Koneckonců, cena jednoho ETF je ovlivněna desítkami nebo stovkami cenových změn, které se mohou vzájemně ovlivňovat.

Některé ETF však mají velké výkyvy na základě zpráv. Například ETF, které je zaměřené na technologie, může náhle vzrůst v reakci na pozitivní zprávu o příjmech Netflixu nebo regulační vítězství pro toto odvětví. ETF, které je specifické pro jednotlivé země, může také reagovat na zprávy, což je pro denní obchodníky možnost zisku.

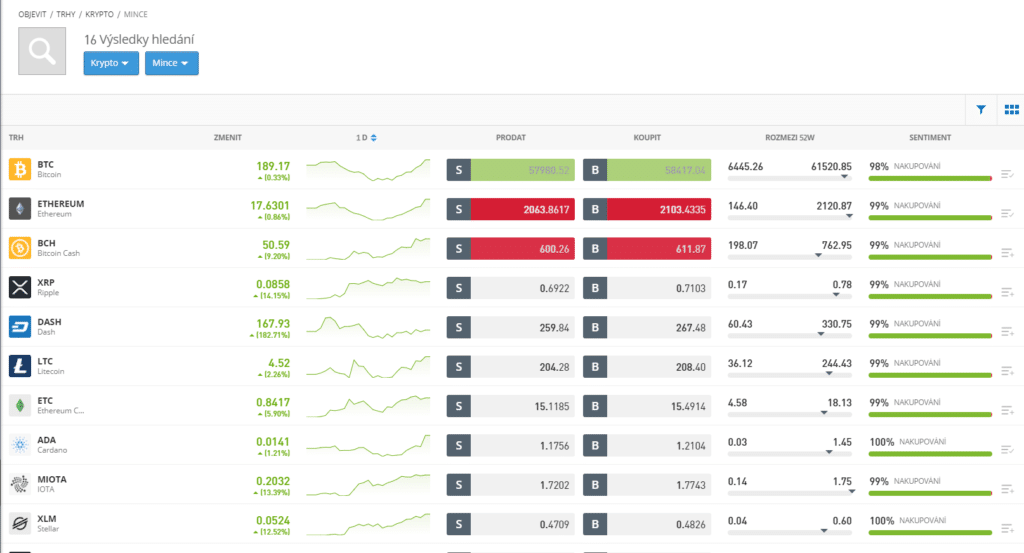

Intradenní obchodování s kryptoměnami

Kryptoměny jsou pro obchodníky relativně nové, ale špičkové mince, jako je Bitcoin, se rychle staly populárními mezi českými denními obchodníky. Digitální mince zažívají mnohem větší volatilitu než tradiční měny a cena může prudce vyletět nebo náhle klesnout jen na základě fám. Buďte opatrní při obchodování s méně známými kryptoměnami, protože podléhají mnoha stejným podvodným schématům jako centové akcie.

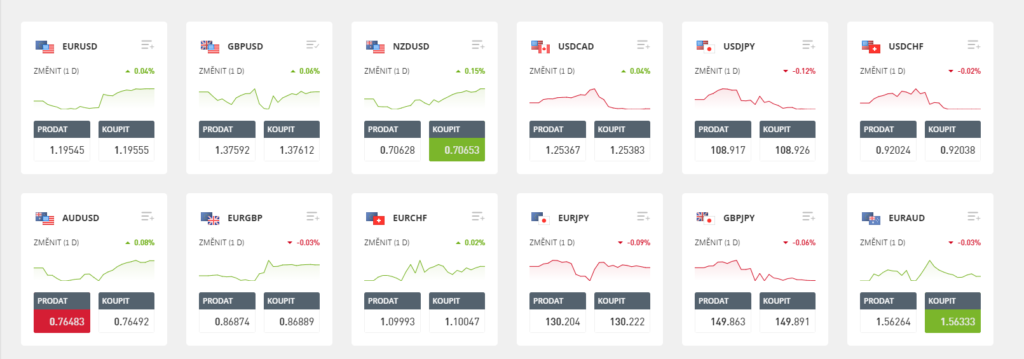

Intradenní obchodování na forexu

Forex trading is another popular destination for day traders. The forex market operates 24 hours a day, five days a week, so you can trade forex outside of standard Czech market hours.

This is ideal for novice traders who want to trade in the morning before work or in the evening after work.

There are several other advantages to day trading forex. Most forex brokers in the Czech Republic offer leverage, which allows you to multiply your profits when there are small price changes. In addition, you can use forex signals and forex robots to take the worry out of trading.

Day trading options

Day trading options is a bit complicated because the value of the options depends on both time and the price of the underlying asset. However, options open up a whole new world of day trading strategies because you can be in profit even when the market is moving sideways. Make sure you hold highly liquid options because you can hold options that no one wants to buy.

Advantages of intraday trading in the Czech Republic

Why start day trading in the Czech Republic instead of medium or long-term investing? The type of trading that is best for you ultimately depends on your financial goals and how much effort you are willing to put into trading. However, day trading has some clear advantages.

Adding profits to your account

The number one advantage of day trading is that your account balance builds up quickly. You can trade all the money in your account multiple times in a single day, as opposed to investing once a year for the long term.

Even if you only make 1% profit per day, that's more than a 30% return after a month of trading. As the money in your account grows, you can potentially take on bigger bets and compound your returns even more.

This is why day trading can be more lucrative than long-term investing, if done correctly. If you add 1% to £100 each day by day trading, after a year of trading your portfolio would be worth £3,700. If you earn, say, a 10% annual return by investing in 100 FTSE shares , you would only have £110 at the end of the year.

Minimizing the risk of holding assets overnight

Another important aspect of day trading is that it minimizes or eliminates the risk of holding assets overnight. Especially in the stock market, prices can jump up or down overnight in response to news. Holding positions overnight exposes you to these price jumps and there is nothing you can do about it because you cannot exit the position outside of market hours.

Day trading is exciting

For many traders, day trading is simply exciting. It requires a unique combination of strategy, focus, cunning, and determination. This is the part of trading that makes day trading especially exciting for beginners. Few things are as exciting as putting your money at risk every day and getting instant feedback on whether your trade was good or bad.

Define your own goals

While day trading is a significant time commitment, it also allows you to set your own goals to a certain extent. You can choose the time you trade and decide whether you want to spend two hours or eight hours trading each day.

If you use day trading to supplement your income, you can even set a limit on how many day trades you want to make or what kind of return you want. Once you reach your goal, you have the rest of the day off.

Intraday trading strategy

It is essential to approach day trading with a clearly defined strategy. There are hundreds of popular day trading strategies, many of which suit different types of traders or work towards different trading goals. To help you choose a strategy, let's take a closer look at three of the most popular day trading methods.

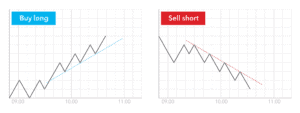

1. Trading on growth

One of the easiest day trading strategies for beginners is to trade when the asset is rising. With this style of trading, you simply ride the price trends that occur throughout the day. For example, if the price of a stock or currency is rising, buy it. As soon as the price starts to fall, sell your position.

When trading when the price is rising, it is important to use momentum indicators such as MACD and RSI. In general, it is better to sell sooner rather than later - you want to focus on profits rather than holding too long and risking a trend reversal.

2. Scalping

Scalping is a very short-term trading strategy that involves buying and selling within seconds to minutes. The goal is to make many small, profitable trades throughout the day. Each trade may only yield a profit of, say, 0.1%, but if you make a dozen of these trades in one day, the profits add up.

Scalpers often have the same strategies as when trading when the price is rising, trying to capitalize on short-term trends. It is important to limit your losses when scalping. One big loss can leave you in the red at the end of the day.

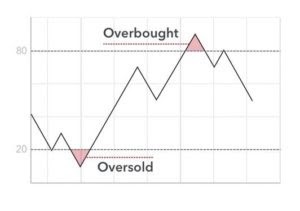

3. Overbought and oversold trading

Many day traders buy and sell assets based on whether they are overbought or oversold relative to recent market conditions. Overbought and oversold levels are typically defined by technical indicators such as RSI and Chaikin Money Flow.

When an asset is oversold, buy it – and then sell it once it is no longer oversold according to the indicators you are using.

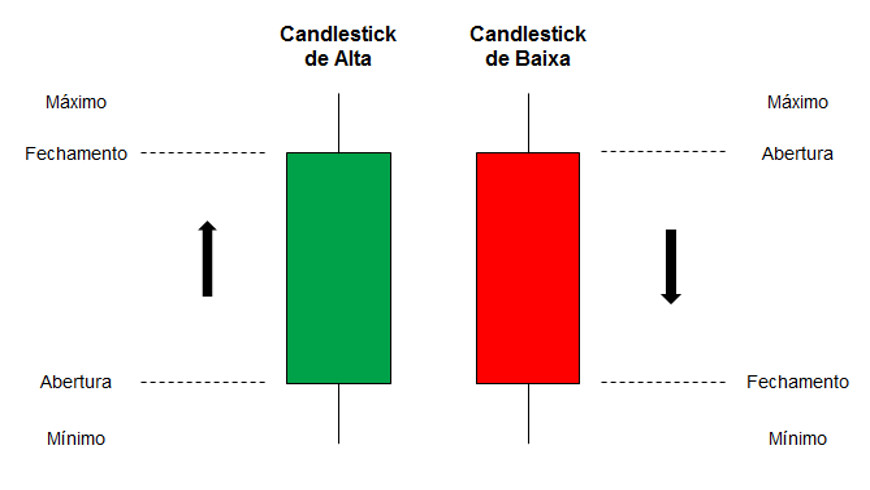

How to read a candlestick chart for intraday trading

The candlestick chart is the most common tool that traders use to analyze price movements.

A candle has two parts, a box and a wick. The box shows the opening and closing prices of the time interval – the opening price is at the bottom if the price is rising, or at the top if the price is falling. The wick shows the low and high for that time interval.

Candlesticks often show price data per minute. However, you can also look at candles that last one second, 15 minutes, or an hour. Many charting platforms have green candles when the price is going up and red candles when the price is going down.

Swing trading vs. intraday trading

Swing trading and day trading share many common strategies. However, while day trading involves making multiple trades per day and exiting all positions by the end of the day, swing trading takes place over a period of several days to several weeks. While day trading requires a lot of time, swing trading does not require as much time.

It is possible to participate in both day trading and swing trading at the same time. However, you will need to look for different opportunities that correspond to different time frames, even if you are using one strategy.

Day Trading Software

Most traders will receive trading software from their broker. The tools and features your day trading software includes may vary, but generally you will need access to advanced candlestick charting with a variety of technical indicators and drawing tools. Many day traders also monitor breaking news, social media, stock scanners, and price alerts within their trading software.

One important thing to consider when choosing day trading software is whether you can create your own indicators. You may not need this feature when you are starting out, but the ability to create a personalized trading strategy can be important as you become more day trading in the CR over time.

Risks of intraday trading

Day trading is inherently risky, like any form of trading or investing. There is always a chance that your trade will not work out, in which case you could be forced to sell the asset at a loss.

However, day trading in the Czech Republic is somewhat riskier than other types of trading in that you are constantly having to make decisions. There may not be much time during the trading day to think about how things are going. Since day trading positions are often opened with leverage, there is also the possibility that sudden changes in the price of the asset can lead to a significant loss in the value of your position.

Day trading taxes

Figuring out how to pay taxes on day trading in the Czech Republic can be a bit confusing. In any case, there is no set tax rate on day trading profits. Your tax depends more on whether day trading is your primary income and what type of instrument you use when day trading.

Best books on intraday trading

If you want to learn more about day trading, there are plenty of good books on the subject. Here are a few we recommend diving into if you want to get started with day trading:

- "Trading in the Zone" by Mark Douglas

- "Technical Analysis of Financial Markets" by John J. Murphy

- "How to Day Trade: A Detailed Guide to Day Trading Strategies, Risk Management, and Trader Psychology" by Ross Cameron

- "Start Day Trading Now: A Quick and Easy Introduction to Managing Risk While Making Money" by Michael Sincere

Intraday Trading Tips

Successful day trading takes time, practice, and dedication. Here are five tips to help you get started:

1.Try the day trading simulator

The best place to start your day trading career is with a demo account. A day trading simulator gives you the opportunity to familiarize yourself with your day trading platform and test out strategies before risking real money. Ideally, you should be making profits in the simulator before moving on to real trading.

2. Consider day trading courses

One of the best ways to quickly improve your day trading skills in the Czech Republic is to take a course. Many brokers and professional traders offer online day trading courses where you can learn new strategies, get tips and advice from other traders, and practice analyzing price movements.

3. Always watch the news

Day traders should always keep an eye on the news feeds because news is the reason for volatility. Turning on news alerts is a good way to ensure that you react as quickly as possible to price changes, whether you want to exit a trade or have the opportunity to get into the market before everyone else.

4. Focus on one strategy and one market

Rather than spreading your money across multiple sectors, it's a good idea to master one strategy and one market. Focus on being consistently profitable before you start exploring other strategies or trying to trade multiple markets in a single day.

5. Know when to exit the market on a given day

Sometimes the market is slow or things just don't go according to plan. Rather than taking loss after loss on one of these bad days, it's just better to step away from the computer. The market will be here tomorrow too and you'll come back refreshed and rested.

Best platforms for intraday trading 2026

Finding the right broker for day trading is incredibly important. Your broker controls everything from the fees you pay, what assets you can trade, to what trading platform you can use. To help you choose the best broker, let's take a look at five of our favorite Czech day trading brokers:

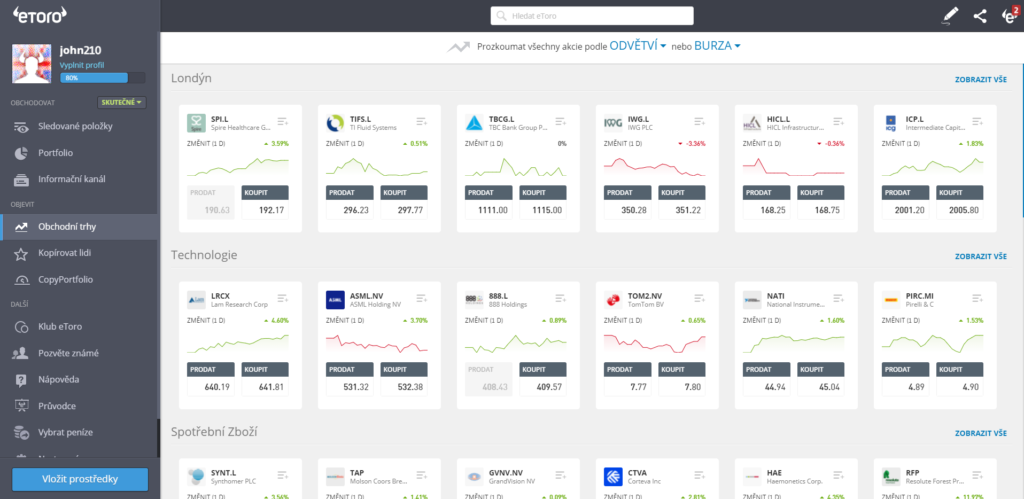

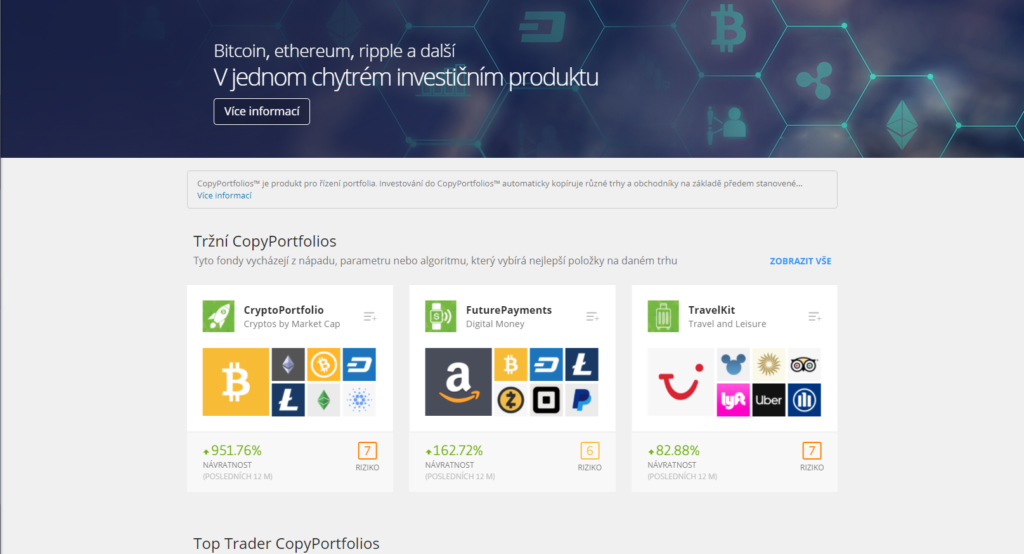

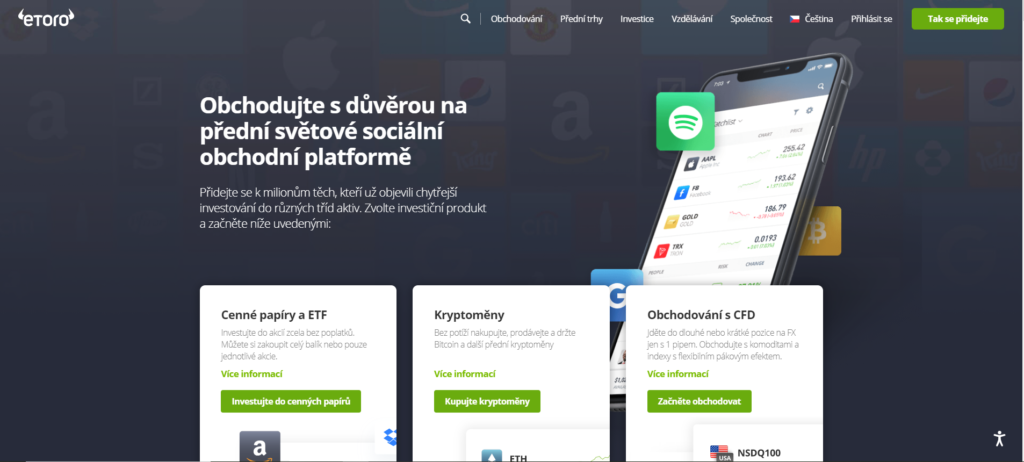

1. eToro – Overall best platform for intraday trading in the Czech Republic

One of the neat things about eToro is that it has a built-in social trading network.

You can connect with other traders to exchange ideas or start a discussion about day trading strategies. eToro also supports copy trading, so you don't have to worry about your portfolio.

The eToro trading platform is perfect for day trading. While you can't create your own indicators, the charting interface comes with nearly 100 tools. eToro also offers a handy mobile trading app and a news feed.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

2. XTB – Regulated intraday trading broker with over two decades of history

XTB is one of the most sought-after intraday trading platforms for several reasons. For example, it offers a wide range of assets, from cryptocurrencies to stocks. Not only for advanced users, but also for less experienced ones. In third-party reviews, favorable opinions about XTB prevail due to the ease of use of the platform.

In addition, XTB broker also has a very good customer service. It is easy to contact and responds without waiting, so any problems are resolved almost immediately. This is one of the main reasons why users from all over the world rate XTB broker positively.

XTB is a broker where you can buy stocks, ETFs and CFDs. Users have access to more than 2,000 stocks, 300 ETFs such as iShares JP Morgan USD EM UCITS or iShares S&P 500 EUR Hedged UCITS, 71 forex pairs, 35 indices, 50 cryptocurrencies and 26 commodities with spreads starting from 0.8 pips.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

3. Pepperstone - A safe and licensed broker suitable not only for intraday trading

Pepperstone is a top CFD and forex trading broker that boasts a large number

Pepperstone also offers traders a range of trading platforms that have been designed to suit traders' experience and preferences. These include MetaTrader 4, MetaTrader 5, cTrader, TradingView and Pepperstone's own WebTrader, each with its own unique features and benefits. For example, MetaTrader 4 (MT4) is a widely used and free trading platform that is known for its advanced charting tools, technical indicators and trading signals. Although it is an older version, many traders still prefer MT4 over the newer MetaTrader 5. TradingView is an equally interesting platform, which is an innovative trading platform that not only integrates advanced charts, but also market analysis and social features. It also allows traders to share their ideas, learn from other more experienced traders or even collaborate in a community environment.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

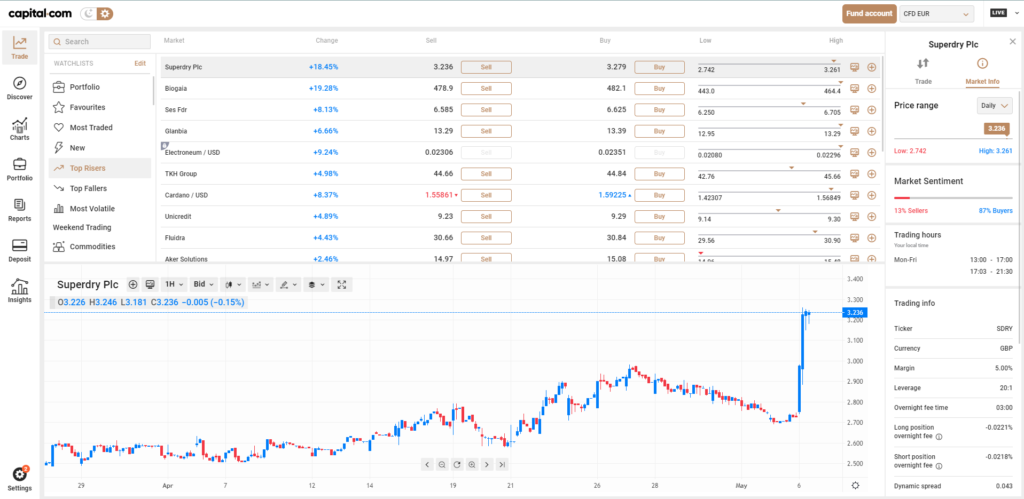

4. Capital.com – New CFD broker with reviews

Capital.com excels in how it uses artificial intelligence to improve your trading. This trading platform automatically analyzes your trades to identify actionable patterns. For example, you may be more successful when you hold positions for longer periods of time or vice versa when you hold assets for only a short period of time or with a specific trading strategy. In addition, Capital.com's artificial intelligence can help you find trading opportunities.

The algorithm automatically scans the markets every morning for potential setups. It's like having a built-in scanner that learns from past market activity and improves over time. Trading with Capital.com is 100% commission-free, and the broker's spreads are roughly the same as other platforms. You can trade UK and US stocks, dozens of forex pairs, commodities and more.

Advantages

Disadvantages

83.45% retailových investorů je při obchodování na této stránce ztrátových.

5. Libertex - Day Trading Broker with Zero Spreads

This means that you can make quick trading decisions based on the price you see on their chart. You only pay a small commission for buying and selling. The broker also offers its own proprietary web trading platform as well as the world's most popular day trading platform – MetaTrader 4. You can trade multiple asset classes using CFDs, including cryptocurrencies, stocks, forex and more.

Advantages

Disadvantages

73,77 % účtů drobných investorů ztrácí peníze při obchodování CFD s tímto poskytovatelem.

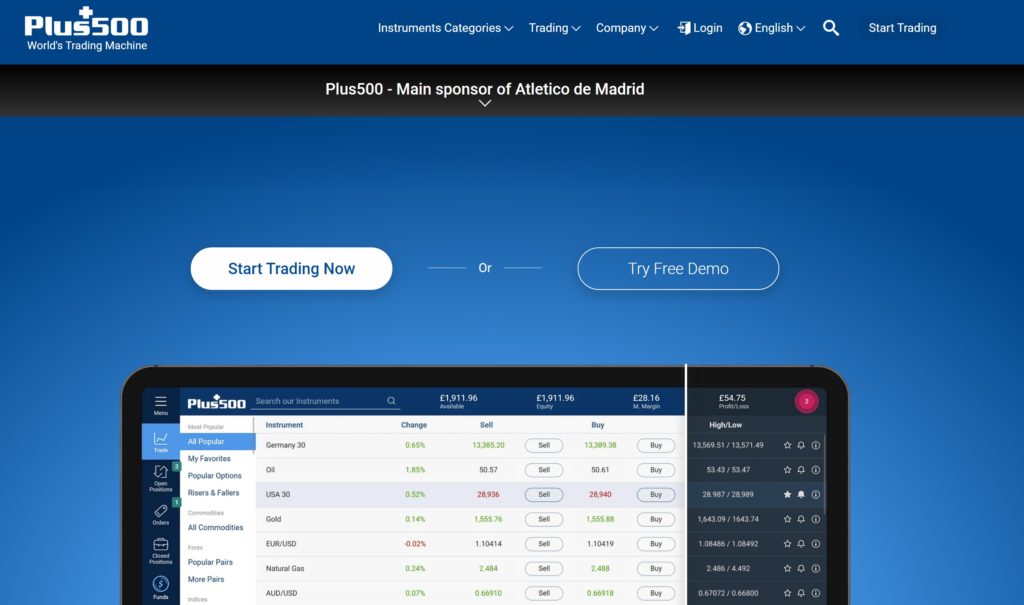

6. Plus500 – Day Trading Broker with Low Spreads

An easy-to-use day trading platform with over 90 technical indicators included. You also have access to dozens of drawing tools. Note, however, that you cannot create your own studies or forex signals with this platform. One of the things we like most about Plus500 is that it offers advanced price alerts. You can set a price for any asset and then an alert will be sent to your smartphone when the asset reaches that price. This makes it easy to stay on top of the market even when you are away from your computer.

Advantages

Disadvantages

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

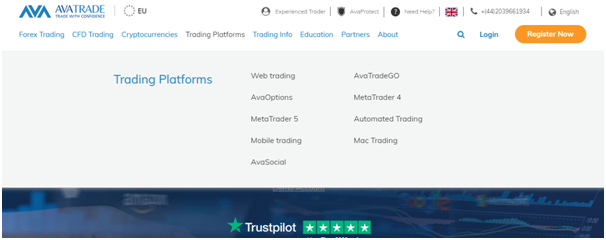

7. AvaTrade - Day Trading Broker with MT4/MT5

The MetaTrader 4 and MetaTrader 5 trading platforms are considered good day trading platforms for forex, stocks and cryptocurrency traders. AvaTrade offers both of these platforms for desktop download, mobile trading and browser trading. With the MetaTrader platform, you have access to trading features with just one click and can trade even while you are on the chart.

If you want to communicate with other traders, you can do so using the FCA-regulated AvaSocial trading app. In addition, you can trade commission-free, with only spreads and swaps. The broker also provides a high level of security for your funds, as it is regulated in six jurisdictions around the world.

Advantages

Disadvantages

71 % účtů drobných investorů přichází o peníze při obchodování s CFD s tímto poskytovatelem.

Intraday Trading - Advantages and Disadvantages

Advantages

Disadvantages

How to start intraday trading

If you're ready to start day trading, we'll walk you through the process. For this demo, we'll use eToro because it offers commission-free trading of stocks, forex, cryptocurrencies, etc. It also offers an advanced day trading platform.

To start day trading, you will need to open a new trading account. On the eToro homepage, click on the “Join Now” button and then create a new username and password. You will also need to enter your personal information and verify your identity to comply with government regulations.

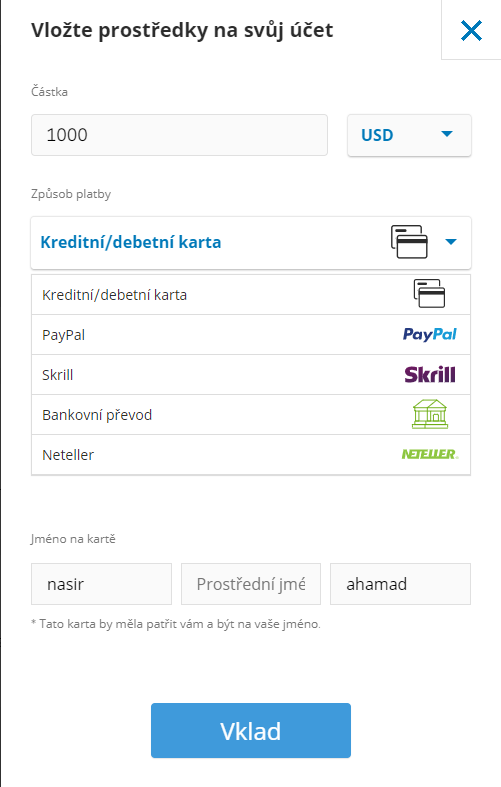

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. You will need to deposit funds into your new account before you can open a trade. eToro requires a minimum deposit of £150 and accepts a wide range of payment methods, including debit or credit card, e-wallet and bank transfer.

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty. Now you are ready to day trade. Use the tools that eToro offers to find a potential trade. Then search for a stock, forex pair or cryptocurrency in the search bar at the top of the page. Click the “Trade” button to open the order form. Enter the amount of money you want to trade (minimum $50) in your order. You can also specify whether you want to use leverage and decide when to close a trade when you are in the red (stop loss) or when to take profits. We recommend using a stop loss when day trading to prevent one trade from ruining your entire day’s profits. Once your order is ready, click “Trade” and place your first trade. You can sell your position later in the day. Just make sure you sell your order before the end of the trading day to close your position.Step 1: Open a new trading account

Step 2: Deposit money into your account

Step 3: Open your first intraday trade

Conclusion

Day trading requires hard work, determination, and focus to be profitable. However, when done correctly, day trading in the Czech Republic can be an exciting and potentially lucrative form of trading. You can trade almost any market, and there are plenty of strategies you can use or adapt. Are you ready to start day trading? Register with eToro today and open your first trade!

eToro – The best intraday trading platform in the Czech Republic

{etoroCFDrisk} % retailových investorů došlo ke vzniku ztráty.

FAQ

Can you make a living day trading?

How does day trading work?

What is the best app for day trading?

What is the day trading rule?

How much money do you need to start day trading?

How to scan stocks for day trading?