eToro: Opinie 2026 o Brokerze | Czy Warto Założyć Konto? Opłaty, Podatek, Wersja Demo

How is it that when the majority of retail investor accounts lose money , a select few generate significant profits ? Do they have a good strategy? Experience? Or maybe just a stroke of luck?

With eToro, you don’t have to think about it – what matters is that you can earn money along with these chosen few .

How?

With a copy trading feature that you won’t find anywhere else in such an extensive form. The eToro broker offers the world’s largest social trading platform. It is currently used by over 20 million users.

If you want to join them, you’ve come to the right place. In this article, we take a closer look at the broker and see what (apart from copy trading) it has to offer.

eToro – the best broker 2026

[stocks_table id=”24″]

eToro – what is it?

How did the platform gain popularity in such a short time?

Its functionalities have certainly contributed to this and are truly valuable compared to the competition.

The first is social trading . It turns eToro broker into the “Facebook for investors.”

On the platform, you can talk to other traders, post, reply to threads, and even like comments. In other words, you have an open door to discussing different investment ideas.

The second interesting feature you will find on the eToro platform is copy trading, mentioned in the introduction.

It gives you the ability to copy trades of successful traders, allowing you to earn with them. Before you choose any, you can check detailed statistics about their achievements to date.

The result is that you will have a platform where you can invest in over 2,000 different assets , from currencies to stocks and commodities. In addition, you will find both asset trading and CFDs on offer.

Security is also at a high level. eToro operates under the supervision of CySEC (Cyprus Securities and Exchange Commission), and is also subject to ASIC (Australian Securities and Exchange Commission) and FCA (British Financial Conduct Authority).

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro Advantages and Disadvantages

Before we get into the detailed review, let us briefly outline the pros and cons of the broker.

For:

Cons:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

What will you invest in with eToro?

At eToro, you can invest in stocks, indices, ETFs, currencies, and commodities . It is worth noting that some of these assets (stocks, ETFs) can also be purchased in the traditional sense of the word. In addition, the entire brokerage offer is available in the form of CFD contracts.

These are derivative instruments that provide access to financial leverage, increasing potential profits.

However, keep in mind that the risk of loss is also increased. Most retail investor accounts lose money when trading CFDs due to the use of leverage.

Forex Trading

Forex is the largest financial market in the world, with a trading volume that exceeds $6 trillion per day. Of course, eToro provides access to it.

On the broker’s platform, you will find 49 currency pairs from the Forex market. Trading is based on CFD contracts (also check our ranking of CFD brokers and platforms ).

As for leverage, it is 1:30 for popular pairs and 1:20 for others . Forex transactions are not subject to commission. The broker earns on the spread. Its size depends on the pair – usually, the more exotic, the greater the difference between the bid and ask price.

Read more about the forex platform here.

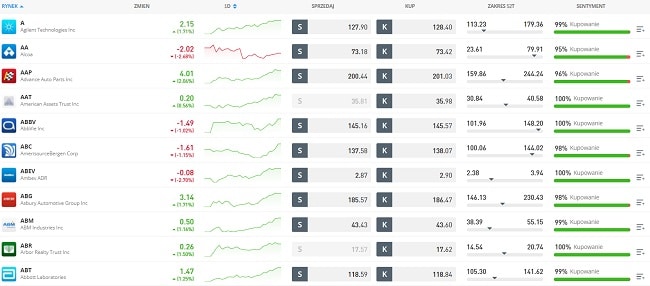

Stock Trading

The eToro platform gives you access to 17 global stock markets . You can trade on each of them during their opening hours.

Moreover, with shares you will buy the actual asset without price speculations as is the case with CFDs.

This means that if you buy shares without leverage, you will own them. As a result, you do not incur additional costs of holding the position overnight and you will be entitled to dividends .

For small investors, the fractional investment option will be equally important. At eToro, you don’t have to buy the entire share, just a fraction of it – the minimum transaction size in this sector is $50.

This is very helpful in the case of particularly expensive companies (eg one share of Amazon normally costs over $3,000).

Read how the best stock exchange platform works !

Index Trading

If individual stocks aren’t enough for you, choose indices. At eToro, you can choose from 13 of them , including the American SPX500 and the Chinese China50.

Trading is done exclusively using CFDs, meaning you have long and short positions and leverage. The latter is a maximum of 1:10 . Additionally (due to how CFDs work) there is an overnight holding fee.

It is worth adding here that eToro has an extensive training section for indices trading. You will learn what to look for in each of them, what affects the price and what the current investor demographics look like.

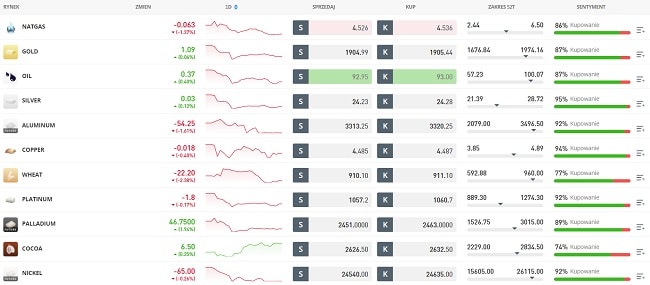

Trade in raw materials

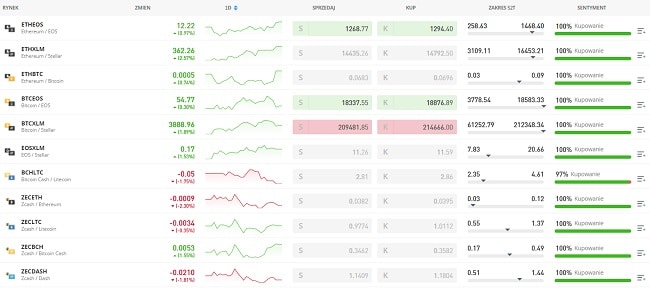

The range of commodities on eToro is extensive, with 31 markets to choose from . They are divided into three main categories:

- precious metals,

- energy resources,

- agricultural products.

Trading is done via CFDs with leverage of up to 1:20 for gold and (usually) 1:10 for others .

Here you will also find an extensive training section where you can learn about the history and details of a given raw material.

ETF Trading

The eToro investment platform also offers ETFs. They are considered relatively safe investments because they consist of different assets.

Therefore, when you invest in an ETF, you automatically diversify your portfolio.

At eToro, you can choose from over 250. Some are based on indices, others on commodities, and still others on different types of stocks.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro Fees

We already know what you will be trading on the eToro platform. Now let’s see under what conditions. Below we have prepared a detailed description of all the costs that are associated with using the broker’s services.

Transaction fees

As we mentioned, trading on eToro is commission-free for ETFs. No matter which ETF you trade, you won’t pay a penny to execute your trade.

Spreads

The eToro platform, like most brokers in the industry, has spreads that are dependent on the asset in question. Spreads, or the difference between the bid and ask price.

Usually, in the case of popular assets, the spread is very low (eg for shares listed on NASDAQ it is on average 0.2%). However, in less popular markets the rate differences will increase.

Deposits and withdrawals

When it comes to depositing funds into your trading account, they are free. However, keep in mind that the base currency of your eToro account is the US dollar , so you will not miss out on currency conversion costs.

However, for withdrawals, a fixed fee of USD 5 applies . The value does not change, regardless of the method or amount transferred.

Inactivity Fee

Like most brokers, eToro also has an inactivity fee. It is $10 per month . It only kicks in after 12 months of inactivity . Furthermore, if you have some assets in your portfolio or your trading account is empty, you don’t have to worry about this fee.

Position holding fee

This type of fee only applies if you are trading CFDs and holding a position overnight. This is because of the leverage. Since you are trading on margin, you can compare the fee to interest.

Their amount depends on several factors:

- transaction amounts,

- traded assets,

- leverage level.

eToro will tell you the exact amount you will pay. There will be no hidden fees.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro Account Key Features

Now that you know what and for how much you can buy at eToro, it’s time to check out the broker’s most important features. Here they are:

- social trading (writing posts, talking to other traders, following your favorite investors);

- copy trading (copying the portfolio of other traders);

- analytical tools (only basic charts, but access to decent fundamental analysis);

- free demo account (it is unlimited and contains 100 thousand virtual USD, allows you to test all the platform functions without the risk of losing real money);

- mobile application (enables convenient trading on a smartphone or tablet).

eToro – User Reviews

In order to provide you with the most objective information about the broker’s services, we have presented below some user reviews that we have taken from the Trustpilot website.

Here is the first one:

This user’s opinion is valuable primarily because he has 2 years of experience with the platform. As you can see, he is happy with both it and the customer service.

Let’s check another one:

Another satisfied customer who confirms what we wrote in the review. The online platform is easy to use, transparent and cheap.

Finally, let’s analyze the negative feedback:

eToro clearly lists all costs associated with using the platform. You can check them on the broker’s website.

Also check out our ranking of trading platforms ! Learn about Libertex opinions .

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

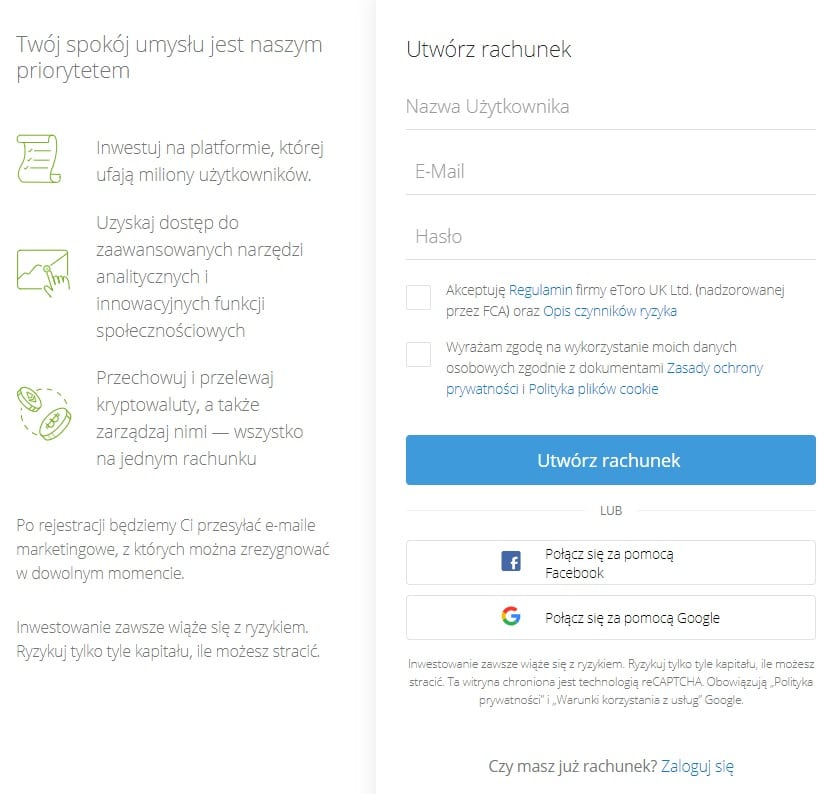

How to Start Trading on eToro? Guide

Want to try eToro for yourself? It couldn’t be easier! You only need a few minutes to go from registration to trading on the exchange.

You will do it even faster if you use the short guide we have prepared for you.

On the official eToro website, you will find the “Join Now” button. Click it and you will be taken to a short registration form. It consists of three fields: Fill them out, then accept the broker’s regulations and privacy policy. Confirm everything, and the registration will be complete. If you want to speed up the process, choose to register using your Google or Facebook account.

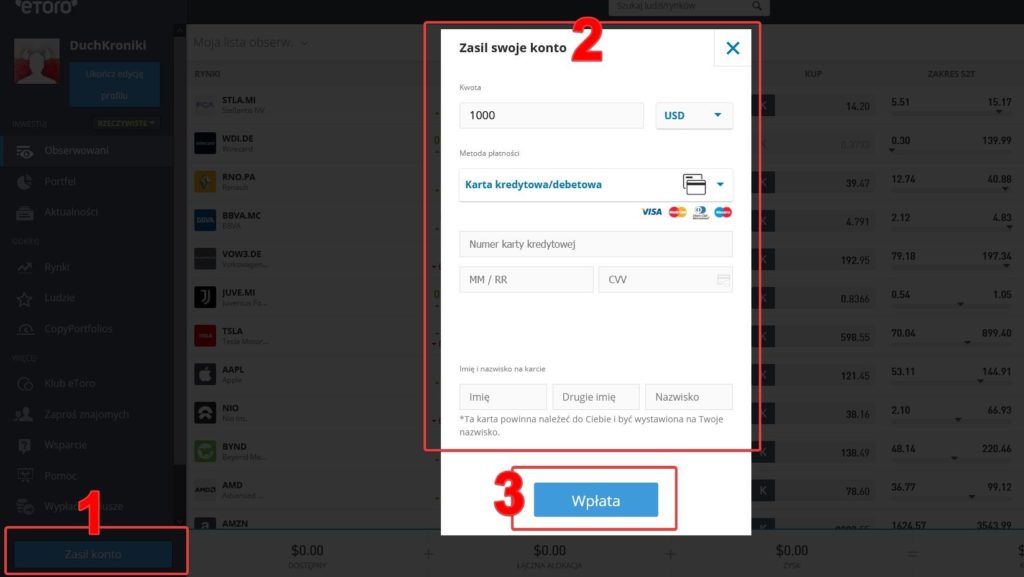

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. As the eToro broker operates under the supervision of state institutions, it must comply with legal regulations. One of them is the verification of the identity of retail clients. To fully activate your account, send the broker scans of your ID and a document confirming your place of residence (eg a current bank statement). Once eToro has verified your account, it will notify you. Before you start trading, fund your account. However, keep in mind that eToro has a minimum initial deposit of $200 . This means that your first transfer to your trading account cannot be less than this amount. On the investment platform, select the “Deposit funds” option. In the new window, enter the transfer amount and then select the transfer method. Once the money is in your account, start trading . Choose the assets you are interested in from the general list or enter a specific name in the broker search engine. Then click on the selected financial instrument. You will be taken to a new tab where you will find detailed information about the asset. Once you have read it, click the “Act” button. A window will appear where you can specify the transaction details, i.e.: Finally, confirm your choice and you will take your position on the market.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.Step 1: Registration

Step 2: Account verification

Step 3: Deposit

Step 4: Trade

Is eToro safe?

Wondering if the platform is safe? Absolutely. Security is one of the most important things to check before you sign up with a broker.

eToro is regulated by three financial authorities:

- British Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC).

The capital invested on the platform is protected at all times. The broker keeps it in separate bank accounts. It does not use your funds for its own operational purposes.

Due to the broker’s regulations, each new user goes through the KYC (Know Your Customer) process. To confirm their identity, they send a scan of a document confirming their place of residence and an identity card, driving license or passport.

Please note that CFDs are complex financial instruments. Most retail investor accounts lose money due to leveraged trading. Before taking a risk, make sure you understand how CFDs work.

Summary

The review presents a broker that is available to beginner investors, offers trading, and also gives the opportunity to earn on the experience of others. It is no wonder that it is already used by over 20 million users.

That is why we have no choice but to recommend eToro to anyone looking for a convenient and safe broker. Especially since the platform is available in Polish.

Trade on eToro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQ – Frequently Asked Questions

What is the minimum initial deposit at eToro?

Is eToro a scam?

How does eToro make money?

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ