Kup Akcje Tesla: Jak je kupić w 2026? Gdzie? Wykres i Notowania

Tesla shares are very popular among investors. No wonder. Tesla is the undisputed leader in the electric car industry.

It is headed by Elon Musk , one of the most influential entrepreneurs in the world. His Twitter profile is followed by almost 79 million users. The businessman’s statements have repeatedly had a direct impact on the prices of TSLA shares .

The company’s share price remains high. In January 2021, it was just over $880 . Currently (March 2022), one share costs around $945 .

The company has ambitious plans for further development in the automotive and sustainable energy sectors. There is no indication that its leadership position is in danger. So is it worth investing in Tesla stock? Where is the best place to buy it? What does the future hold for Elon Musk’s company? You will find answers to these and other questions in the article below.

How to buy Tesla stock in four steps?

- Create an account on eToro .

- Verification: send a scan of your ID and confirm your address.

- Make a deposit into your investment account.

- Buy Tesla stock.

Top Stock Exchanges 2026

[stocks_table id=”22″]

Where to buy Tesla stock? List of trusted stock brokers

You can buy Tesla shares through a brokerage house or stock broker. The choice of investment platforms on the market is very large. The decision on which one to open an account on is not the easiest.

Below is our list of verified and regulated stock brokers. Check out their offer and buy Tesla shares from your chosen provider.

1. AvaTrade

For newbies, the AvaTrade GO app and the easily accessible web version of the platform are a great place to start. Both provide an intuitive trading environment.

Experienced traders will certainly appreciate the advanced capabilities offered by MetaTrader 4 and MetaTrader 5.

With AvaTrade you can trade a variety of asset classes, from stocks and cryptocurrencies to other instruments, with no additional fees or commissions.

You can fund your account using a variety of payment methods , including bank transfers and credit cards. The minimum deposit is just $100. This makes AvaTrade accessible to a wide range of investors.

Security is a key aspect of AvaTrade’s operations. This is confirmed by numerous licenses in various jurisdictions around the world. The broker has also received prestigious awards and distinctions, such as “Most Trusted Broker 2023”.

All this builds AvaTrade’s solid reputation as a trusted investment partner.

Pros:

Cons:

2. Pepperstone

Pepperstone is an Australian broker, known worldwide. The platform has been operating since 2010, and trading on it is supervised by seven regulatory bodies, including the three highest financial authorities: the British Financial Conduct Authority (FCA), the German BaFin and the Australian Securities and Investments Commission (ASIC).

The service entices investors with low spreads, high leverage, and efficient transaction handling. Users also praise the wide range of financial instruments, including currency pairs, indices, raw materials, commodities, and stocks.

Both experienced and novice investors can benefit from the broker’s services. Due to this diversity, the platform offers two types of accounts: Razor and Standard.

On the Standard account, commissions are included in the spread. For experienced and professional traders, the Razor account is available. There is also a DEMO account option for those who are just trying out trading instruments.

Interestingly, the platform also offers a special account for users who cannot accept or pay swaps.

Although Pepperstone does not require a minimum deposit, the creators of the platform recommend a deposit of $200. Another interesting fact is that the broker offers investors a choice of 5 trading platforms: MetaTrader4, MetaTrader5, cTrader, WebTrader and SmartTrader.

The service does not charge a commission for depositing or withdrawing funds from an account, nor does it charge a commission for inactivity on the account.

Pros:

Cons:

3. eToro

The broker directs its services primarily to novice investors. The trading platform is intuitive and easy to use. You will find educational materials on investing , among other things .

eToro offers access to thousands of global markets . You can invest in stocks, ETFs, and CFDs , among others . The broker allows trading using leverage.

Leveraged trading carries high risk.

Some companies’ shares, like Tesla, are very expensive. Not everyone can afford to buy them. With eToro, you don’t have to buy full shares – you can buy a fraction of them . This way, you can invest in highly valued companies, even if you have little money (read how to buy shares ).

Find out opinions about eToro !

Pros:

Cons:

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

4. XTB

XTB is a Polish broker operating on the market for almost 20 years . Since 2005, it has been subject to KNF regulations, which is an important guarantee of transaction security.

XTB impresses with the number of instruments it supports – it offers over 3,000 shares from 16 major stock exchanges around the world.

Beginner investors will enjoy the rich educational base in the form of courses available from the xStation application . And speaking of the application itself, users praise its ease of use above all. It is worth mentioning that this is an original solution of the platform’s creators , who decided not to follow the crowd and develop their own application instead of using popular platforms such as MetaTrader.

The xStation platform is available in desktop and mobile versions.

Among the main advantages of the platform are low commissions or even their absence . Up to a monthly turnover of EUR 100,000 we will not pay a commission, and above this amount a fee of only 0.2% (min. EUR 10) will be charged. The minimum transaction value is only PLN/EUR/USD 10!

Users can choose from 3 types of accounts on the XTB platform : Standard, Experienced Client and Professional Client. Beginners can also start with a Practice Account and risk-free see how they like their trading adventure.

The intuitive investment platform also has an additional feature in the form of a company scanner. Traders will also appreciate free access to real-time quotes and professional customer service in Polish, available 24 hours a day, 5 days a week.

Pros:

Cons:

5. Alvexo

The broker offers more than 450 financial instruments from various markets , and the minimum deposit is EUR 500.

Since you are dealing with a CFD broker, you will also have access to leverage and short positions . This means you can earn more, but you also face greater risk.

Interestingly, Alvexo also offers copy trading signals . They will allow you to benefit from the experience of other investors and earn money from it.

Finally, it is worth adding that the broker is safe because it is regulated by CySEC and FS A.

Pros:

Cons:

6. Libertex

The Libertex platform was founded in 1997. It is currently used by over 2.2 million users in many countries around the world.

Libertex offers access to CFDs on stocks, ETFs and cryptocurrencies (find out more about the best CFD platforms ). It allows you to use leverage.

The Libertex platform is easy to use. It is great for both beginners and experienced traders. At Libertex you will find many useful educational materials about investing in financial markets.

The broker provides access to advanced trading features and technical analysis tools via the MT4 platform.

The minimum deposit is only €100. The broker is regulated by CySEC and FSCA.

Learn more about Libertex !

Pros:

Cons:

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Tesla Stock Analysis

Before you decide to buy Tesla stock, do some research. Learn about the company’s history and business profile. Track the stock’s performance to date and look at expert forecasts. This will give you the knowledge to help you make a sound investment decision .

Thinking about an alternative investment? Read:

Below we discuss the most important aspects to consider before purchasing shares.

Tesla Highlights

In 2010, it debuted on the New York Stock Exchange NASDAQ. The price per share was then $17. Since then, its quotations have grown significantly .

Tesla designs and manufactures electric vehicles, solar panels, and energy storage batteries .

The CEO and one of the founders of Tesla is Elon Musk.

The company has been widely covered in the media. In 2021, the world was informed that Tesla would accept payments in bitcoin. However, the payment method was later disabled due to the negative impact of bitcoin on the environment. This decision was also widely commented on.

Tesla shares last made headlines in November 2021, when their price reached a record high of $1,222 .

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Share price

Tesla’s stock price has been rising steadily since its stock market debut in 2010. In the first decade, Tesla’s stock price did not exceed $70 . At the end of 2019, growth accelerated significantly. In January 2021, Tesla’s stock price reached a record high of $880 , only to fall to $600 shortly afterwards .

In the period from March to August, the price fluctuated between $597 and $680 . From the second half of August, the rate began to rise systematically. On November 1, 2021, the price of TSLA reached a record level of $1,222 .

A few days later, it dropped to $1,033 . Since then, Tesla’s share price has been falling. It currently trades at around $945 per share .

Fundamental analysis

In the second quarter of 2021, Tesla reported record quarterly net income of $1.1 billion. It was a whopping 813% higher than the income in the second quarter of 2020.

The company is developing very dynamically . Its goal is to increase production by 50% each year . There are many indications that it will be achieved. Interest in electric cars and green energy production is still growing, which is conducive to the company’s development.

Currently, Tesla is one of the most successful companies in the world . It is a leader in the automotive industry .

Dividends

Tesla has never paid dividends. It plans to use all future profits to fund further growth.

It does not anticipate paying dividends to its shareholders in the near future.

Forecast for the future

Price forecasts for Tesla shares are not clear. According to analysts, the average share price in 2022 will be $ 776 . The highest predicted level is $ 1,591 , and the lowest is $ 67 .

This large discrepancy is due to Tesla’s share price fluctuations over the past two years. The price is so volatile that it is difficult to predict how it will behave in the future .

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Buy Tesla shares on eToro

Buying Tesla stock is very easy. All you need to do is follow four simple steps. Below we discuss the process of buying stocks using the eToro platform as an example.

Before you make your first investment on eToro, you need to create an account. To do this, go to the broker’s website and register . Create a new account from scratch or log in using your Facebook, Google or Apple ID profile.

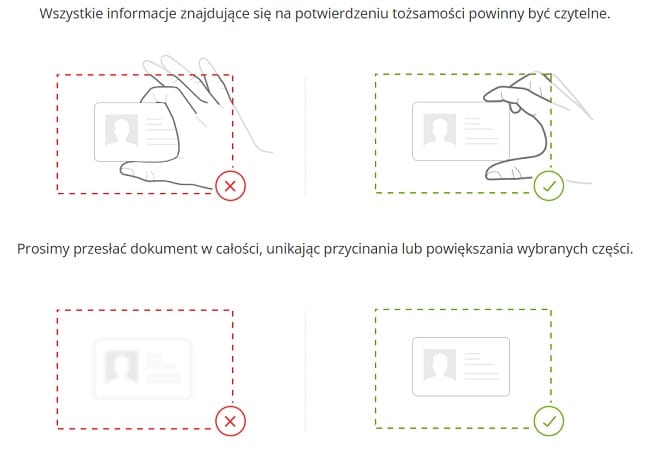

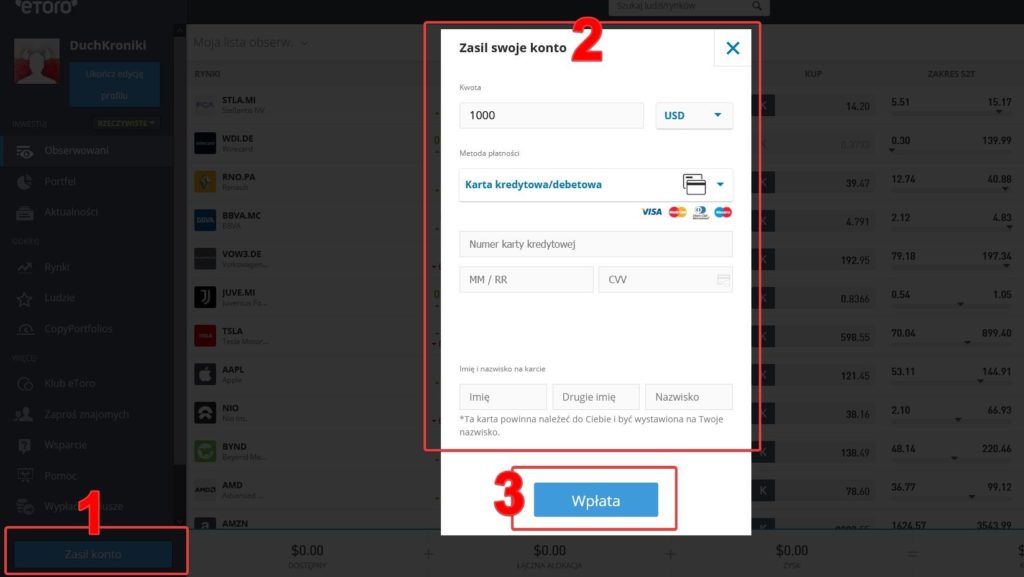

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees. The next step is identity verification. The procedure is intended to ensure investor safety and prevent crime. To confirm your data, send a scan of your identity document (ID card, passport or driving license) and a document confirming your address (e.g. bank statement). After positive verification, top up your account. You can deposit using credit and debit cards, bank transfers, and e-wallets. Click the “Deposit Funds” button in the lower left corner of the dashboard. Select a payment method and enter the transaction details. Depending on the payment method you choose, the funds will appear in your account immediately or within a few days. Already have funds in your account? Proceed to purchase shares. Search for Tesla shares in the list of available assets and click the “Trade” button. Enter the transaction details and confirm the order.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.Step 1: Create an account

Step 2: Verify your identity

Step 3: Pay your deposit

Step 4: Buy Tesla Stock

Is Tesla stock worth buying? Summary

Although Tesla is successful and its shares are valued very highly, buying them involves risk . The company has been improving its financial results year after year . However, analysts believe that its future is still uncertain .

Experts point to Tesla’s huge market capitalization and talk about the so-called Internet bubble.

Want to invest in Tesla and believe in its potential? Try to avoid too much TSLA stock in your portfolio. Most Tesla predictions advise caution .

Remember that in addition to its great successes, the company has also experienced setbacks. Looking for a safer investment? Check out how to buy Amazon stock !

Tesla’s stock price is greatly influenced by Elon Musk. The businessman is very active on social media, especially Twitter. One wrong statement can cause the company’s stock price to rise or fall dramatically.

Risk not putting you off? Buy Tesla stocks with a trusted stock broker like eToro.

eToro – The best platform to buy Tesla stocks

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQ – Frequently Asked Questions

On which stock exchange is Tesla listed?

Where can I buy Tesla shares?

Does Tesla pay dividends?

Where is Tesla headquartered?