Kup Akcje Amazon: Jak je kupić w 2026? Gdzie? Czy Warto? Wykres

Despite the first signs of a bear market in many global markets, are Amazon shares still a good investment? Well, no one needs to be convinced of the strength of the American giant – just look at the charts.

If someone invested in Amazon shares in 2019, they could enjoy profits exceeding 110% in 2021, which means they would double their capital. However, if someone did it even earlier, they earned much more.

Today’s Amazon is still a solid company, and its fundamental analysis hasn’t changed. It’s still a “blue chip,” a safe and profitable investment.

You too can benefit from the development of your business. What’s more, you can do it without any additional fees and from the comfort of your own home. How? You can read about it in detail in the article.

How to Buy Amazon Stocks? A Quick Guide

Want to jump right into investing? Then here are four simple steps to owning Amazon stock — no unnecessary descriptions, just the facts.

- Open an account with eToro – eToro broker is a trading platform that allows you to invest in stocks. To open an account, simply go to the official eToro website and click the “Join Now” button.

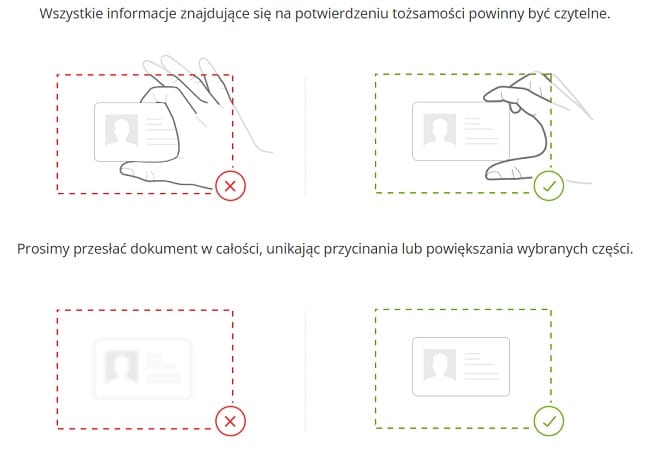

- Upload a scan of your ID – As required by law, eToro will ask you to confirm your identity and place of residence. To do this, send the broker scans of the relevant documents.

- Make a deposit – You can fund your investment account using a variety of transfer methods, so you shouldn’t have any problems with that.

- Buy Amazon shares – type “Amazon” or “AMZN” in the broker’s search engine. Then click on the company’s shares and in the new window select the trade option. Enter the amount of money you want to invest and then buy the asset.

However, if you want to learn more about what online brokerage services are or how to buy Amazon shares and whether it is worth it at all, read on.

Best Stock Market Platforms 2026

[stocks_table id=”22″]

Where to buy Amazon stock? Broker Ranking

Before you invest, choose an intermediary who will allow you to do so. Think carefully, because it is on him that such matters as:

- total investment cost,

- convenience of trading,

- available payment methods.

To make your choice easier, we have prepared a short ranking of brokers valued in the industry and by users below.

1. AvaTrade

The broker specializes in CFD instruments. It offers stocks, forex, commodities, indices, bonds, ETFs and many others.

What’s more, AvaTrade stands out for its commission-free trading with very competitive spreads. This makes it attractive to a wide range of investors.

Leverage of up to 400:1 is available for retail traders, allowing you to increase your potential profits, but it also comes with greater risk.

AvaTrade is especially appreciated by experienced traders, thanks to the advanced tools and features it offers.

Advanced chart analysis , supported by dozens of technical and economic indicators, allows for precise planning of trading strategies. In addition, access to MT4 and MT5 platforms further expands trading possibilities.

The process of opening an account with AvaTrade is quick and hassle-free. The minimum first deposit is just $100.

The platform accepts a variety of payment methods , including debit/credit cards and e-wallets, with no additional deposit fees.

Pros:

Cons:

2. Pepperstone

Pepperstone is considered one of the best brokers on the market . It is dedicated mainly to investors interested in trading stocks. It has good reviews from customers, and the broker itself has won many awards.

High transparency of transactions is guaranteed by directing orders to liquidity providers. This minimizes potential conflicts of interest.

Pepperstone offers high-quality customer service and access to fast technologies. Additionally, the broker provides freedom and flexibility of trading, processing transactions for an average of $8.3 billion daily , operating actively in over 170 countries.

It is a platform worth recommending to investors who want to trade stocks in a solid and transparent environment .

Pros: Cons:

3. eToro

It is used by over 20 million investors from around the world.

With eToro you can invest in stocks traditionally as well as through CFDs , which allow you to trade with leverage.

It is also worth mentioning the copy trading function . With it, you can copy the trades of successful traders with one click.

Find out opinions about eToro !

Pros:

Cons:

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

4. XTB

XTB is a good option for anyone interested in investing in stocks and ETFs . This broker does not charge commissions for trading these instruments, and its easy operation means that investors of all experience levels will find their place here.

Optimal risk management is facilitated by access to 16 different exchanges worldwide. This helps to diversify your portfolio.

The market valuation of XTB is PLN 3.83 million , which makes it an experienced broker with a stable financial situation.

Beginners can use the demo account option and test out the various options and features of the platform before depositing their own money. This helps in finding optimal investment strategies and minimizing risk at a later stage.

Pros:

Cons:

4. Alvexo

In addition to a wide range of assets, it also offers additional services, such as trading signals for copy trading .

Thanks to them, you will earn from the experience of other investors .

It is also significant that you will gain access to 2 trading platforms : the proprietary one and MetaTrader 4.

Finally, it is worth adding that Alvexo is subject to CySEC and FSA regulations .

Pros:

Cons:

5. Libertex

Moreover, it operates under the supervision of CySEC , so trading through it is safe.

Although the broker charges a small commission on trading, you will not find any spreads with it , which is often cheaper. In addition, in addition to its proprietary platform, it provides users with MetaTrader 4 .

Learn more about Libertex !

Pros:

Cons:

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Is Amazon stock worth buying?

Amazon stock is worth buying, as confirmed by many financial market analysis firms, including JP Morgan and Morgan Stanley. The company still has a lot of room to grow, which bodes well for the future.

The coronavirus pandemic has been a boon for the e-commerce giant, as a shift toward more home-based living has made its services even more useful. That’s why, unlike many industries, Amazon has thrived during this period .

In addition, in many places (e.g. India), experts still see untapped potential for the company. Amazon can continue to expand its influence in many corners of the world.

In addition, there is a chance that Amazon will sign a JEDI contract (worth $10 billion) with the United States Department of Defense. According to official information, the winner will be announced in the second quarter of 2022.

In short, Amazon is still a very good investment . The company continues to come up with new innovative services and products, which makes it easier to maintain the upward trend in the stock market. For now, there is no indication that the company will stop generating profits.

However, do not forget that investment decisions (especially ill-considered ones) always involve relatively high risk.

How does Amazon develop its services?

Amazon has built a business with a market capitalization of over a trillion dollars, and yet it continues to grow and diversify its services. Here are some ways in which we and experts believe the company can continue to grow.

Here they are:

- Indian e-commerce market — Amazon wants to expand into this territory because of its total sales, only 1.6% of buyers come from India (compared to 15% from China). The Indian retail market is expected to reach $200 billion by 2025, and some of that money could end up in Amazon’s pocket;

- E-pharmaceuticals market — Jeff Bezos’ company bought PillPack, an online pharmaceutical company, in 2018. Experts believe that this market will grow by about $100 billion in the near future, which Amazon can benefit from;

- Amazon Prime subscribers – Amazon’s premium subscribers regularly renew their subscriptions, and there are over 150 million of them. They get services like next-day delivery, unlimited music streaming, Prime Video, and access to Amazon Fresh and Whole Foods. It’s no wonder that the number of paid subscribers is growing;

- Buying the Metro-Goldwyn-Mayer film studio — Amazon intends to significantly expand its influence in the streaming service with this move. The purchase cost $8.45 billion, making it the company’s second-largest expenditure since acquiring the Whole Foods chain for $13.7 billion;

- Amazon Web Services (AWL) – Amazon’s cloud service already has millions of users worldwide because it is characterized by lower costs, greater productivity and flexibility, and is also growing very quickly.

In addition to the above, we can mention such sectors of Amazon’s business as Kindle e-book, Kindle Fire Tablet, Echo speaker and other technological devices, Amazon Music and Prime Video for music, series and movies, Amazon Game Studios for games, and many others.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

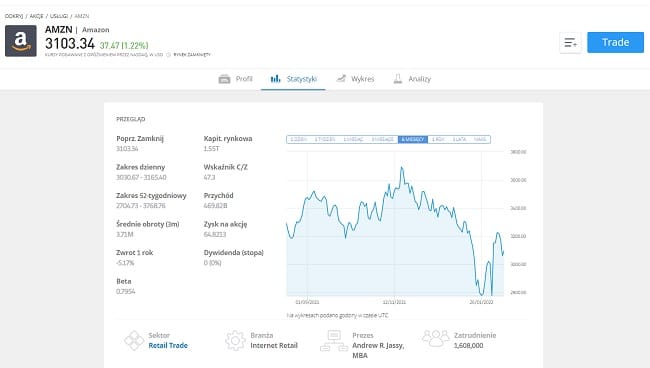

Current Amazon share price

Amazon shares, like most global markets, were hit hard by declines in late January 2022. However, the good news is that the e-commerce giant quickly made up for its losses .

After a brief bear market that stalled at $2,776 , traders entered the market and quickly pushed the price above $3,228 . As of the writing of this article, Amazon’s share price is hovering around $3,180 .

Price History and Future Forecasts

The company was founded by Jeff Bezos in 1994 under the name Amazon.com, Inc. It started as an online bookstore.

After initial success on the market, Amazon shares went public in 1997. Listed on the NASDAQ under the symbol AMZN, the company continued to grow. Today, it enjoys one of the largest market capitalizations on the American stock exchanges.

At the time of the initial public sale, Amazon shares were worth $18 . Compared to the highest market price ($3,731), they have since increased in value by more than 20,500% !

However, even compared to the 2020 price, the company has brought investors a huge profit. We are talking about an increase of around 30% .

Can we expect a further bull run in Amazon shares?

Amazon stock forecasts for the coming months

According to CNN Bussiness experts, the forecast for Amazon shares for the next 12 months is very positive. More than forty market analysts predict an average price of $4,224 .

The most optimistic forecast says that the company’s shares will reach a value of up to USD 5,500 .

On the other hand, extremely pessimistic predictions speak of a price of USD 3,775 .

If the average forecasts come true and Amazon’s share price actually reaches $4,224, it would be an increase of more than 33% from its current price level .

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

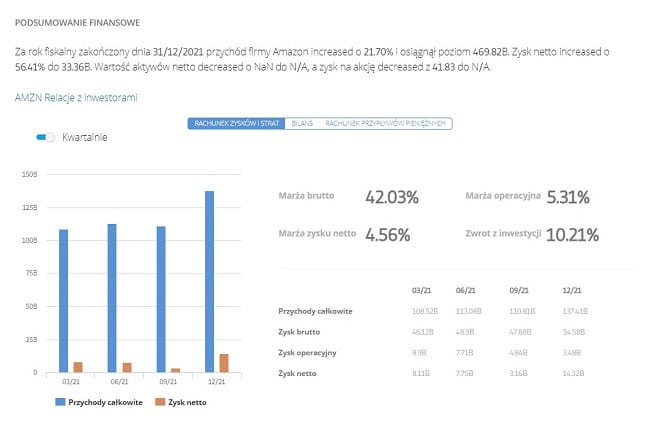

Is a good end to Q4 2021 a signal to buy Amazon shares?

Amazon received positive reviews from Wall Street analysts after the company reported better-than-expected earnings in its fourth-quarter 2021 earnings report.

The report says that average earnings per share came in at $27.75 , which is a much better result than the $3.61 expected . This is due to the fact that the company managed labor and supply costs more effectively than analysts had forecast. It also noted gains from its cloud computing services and advertising.

Meanwhile, overall revenue for the quarter came in at $137.4 billion , slightly below expectations of $137.7 billion . Despite the small difference, the news sent the stock price down 13.5% (though the company quickly recovered).

Of note here is Amazon Web Services, the company’s cloud services unit, which posted revenue of $17.8 billion, beating the $17.4 billion analysts had predicted.

How to Buy Amazon Stocks on eToro? Step-by-Step Guide

Are you just starting out with investing and don’t know exactly what to do? Then read the guide below. It will take you step by step from registration to buying Amazon shares.

Go to the broker’s official website and click the “Join Now” button. You will be taken to a simple form where you need to fill in 3 fields: Do this, accept the broker’s terms and conditions and privacy policy, and finally create an account. You can also register a bit faster using your Google or Facebook account.

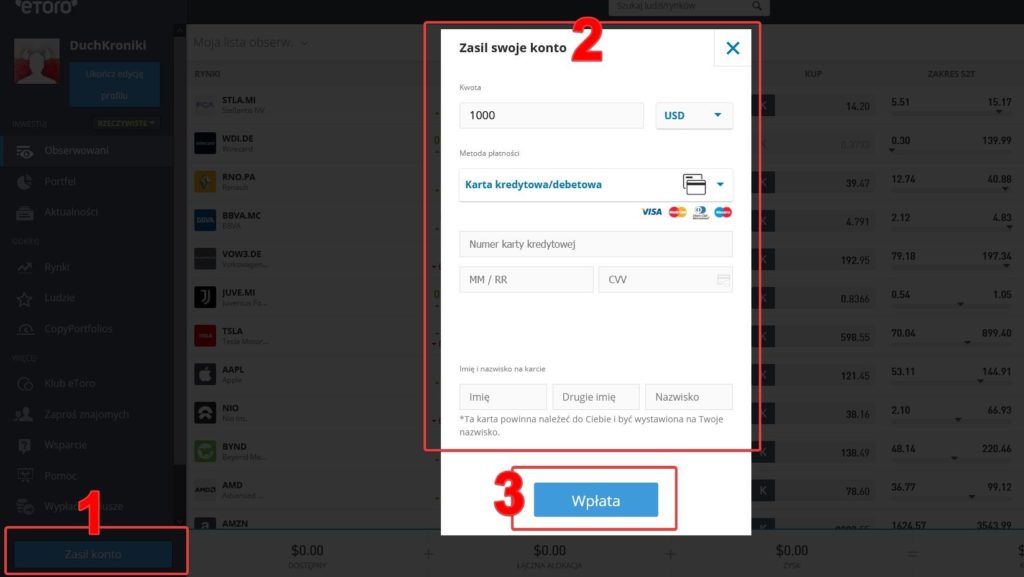

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees. As eToro is a legal broker, it has a legal obligation to verify the identity of its users. Therefore, after registering, send scans of your ID and a document that proves your place of residence (e.g. a recent bank account) to the platform. In addition, there is a short survey waiting for you that will test your knowledge of the stock market. Once you have activated your account, fund it with funds to invest. However, keep in mind that the minimum initial deposit at eToro is $100 . The transfer itself is very simple and fast. In addition, you have many payment methods at your disposal: At eToro, you have two options when it comes to stock trading: The main difference is that CFDs do not make you the owner of the asset. To buy Amazon stock, simply search for the company name on your broker’s platform and click on the appropriate box. You’ll be taken to a new tab where you’ll find more detailed information about the asset. Familiarize yourself with it, then start trading. A new window will appear, where you will set the investment details (including its amount, financial leverage, etc.). Select the options that interest you and finally buy the shares.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.Step 1: Sign up

Step 2: Verify your account

Step 3: Pay your deposit

Step 4: Buy company shares

Amazon and Dividends

How balanced the payouts are says a lot about the quality of a dividend company. When the percentage of a company’s income that investors receive in dividends becomes too high, there is cause for concern.

If payout ratios reach 100%, it is a signal that the company is using financial reserves or loans to pay dividends to shareholders.

This usually ends with dividends either being reduced or stopped .

The second way to identify a good dividend stock is whether the company is growing its customer base . If so, that’s a sign that customers value the company’s services and products.

As a result, revenue and net profits increase. In other words, a strong, dedicated customer base acts as a catalyst for sustainable growth and dividend payments.

How does the above relate to Amazon?

Well, surprisingly, the e-commerce giant is not currently paying dividends to shareholders . However, having said that, it is worth noting that based on the two conditions above, Amazon has a lot of potential in this regard. In the future, it could become one of the best dividend companies on the market.

For now, the company is reinvesting its net profits into further developing its business, which has seen sales and customer engagement rise dramatically during the pandemic. Social distancing and lockdowns have simply led consumers to shop more online.

Over the past three years, Amazon has spent about US$60 billion on real estate, hiring more workers and other projects.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Summary

You already know where and how to buy Amazon stocks and what the company has to offer. It is still an attractive investment because we are talking about a company known all over the world that has almost dominated the e-commerce market. It is no wonder that it is considered a relatively safe investment among investors.

Those who have been with Amazon from the beginning are now looking at 6-digit percentage gains . However, the company continues to grow, as evidenced by the fact that it recorded its highest historical value in July 2021. Market analysts predict that we can expect further successes and impressive market achievements from it in the coming months. This is confirmed by over 25 million active users from around the world.

Read also:

- How to buy pharmaceutical stocks?

- How to buy Gamestop stock ? Is it worth it?

Buy Amazon Stocks on eToro

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQ – Frequently Asked Questions

What are CFDs?

How much will I pay for Amazon stock?

How much money do I need to start investing?

Is Amazon a good investment?