Como Investir em ações no Brasil – Guia online para iniciantes

Are you in Brazil and looking for financial guidance on how to invest in stocks in the country? In this beginner’s guide, we will provide you with all the information you need to start investing in stocks in Brazil. In addition, we will discuss the best options for authorized and regulated brokers. We will also detail the associated fees, explain how to open your first trading position and even offer tips for selecting the best stocks.

Investing in Stocks

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

How to invest in stocks – choosing the best broker

Before buying your shares, it is crucial to choose a safe and competent broker. In this article, we will list the best brokers available in Brazil, with a detailed analysis of their fees and features.

How to Invest in Stocks – Step by Step Guide 2026

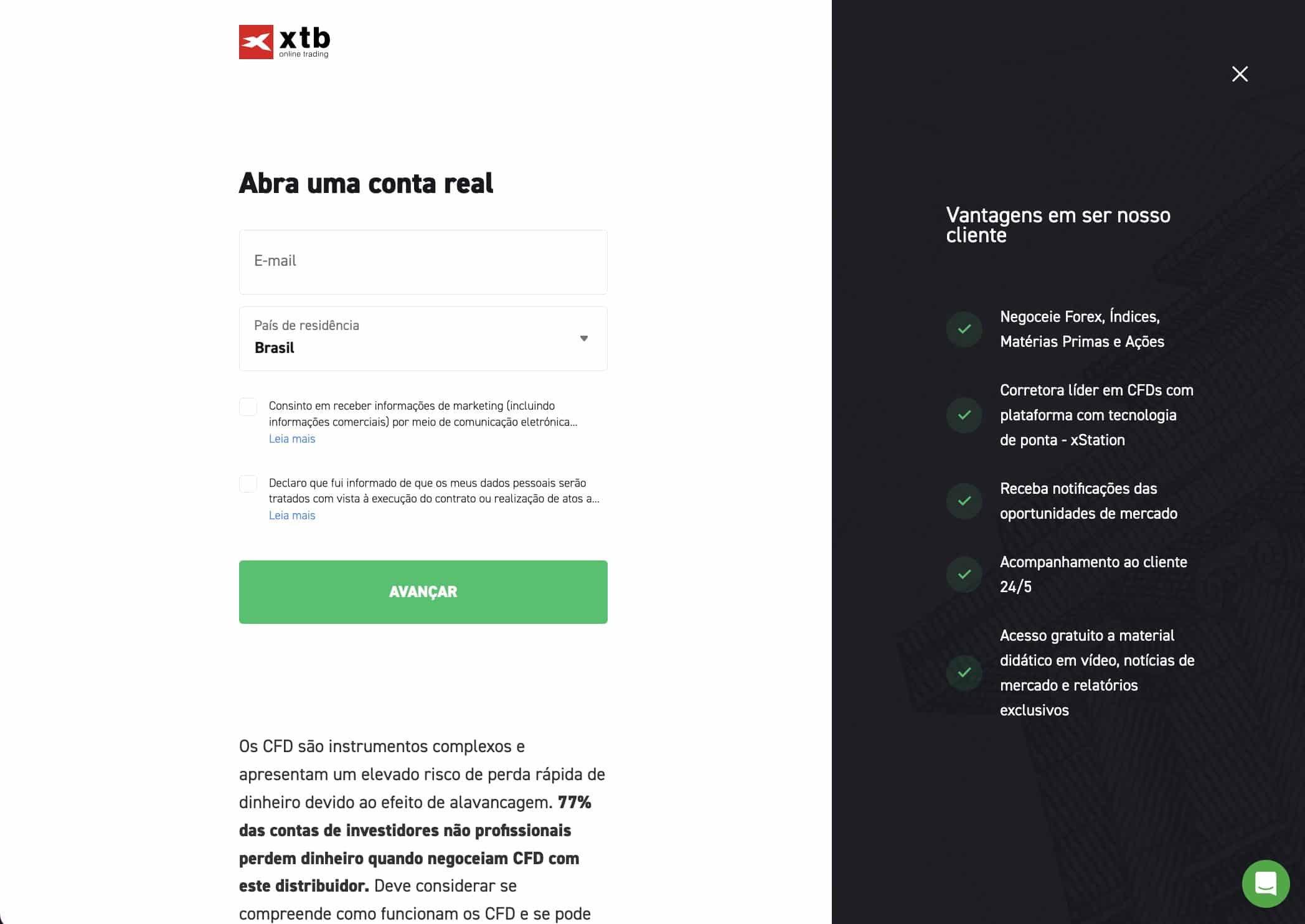

First of all, this step-by-step guide on how to buy stocks is based on our recommended and regulated broker, XTB, although the process is similar across most brokers. You can create your account by following the instructions below once you are comfortable with all the information provided in this article.

Here are the simplified steps to open an account with XTB and start investing in stocks:1. Open an Account with XTB

2. Submit your identification documents (ID)

3. Deposit funds

4. Start investing in stocks

Learn the basics of investing in stocks in Brazil

To complete the investment process, simply click on “OPEN TRADE”. In just a few seconds, your order will be executed, meaning you have purchased BP shares without paying any commissions. With these four simple steps, you have learned how to invest in stocks in Brazil.

Due to the current way stock trading operates in Brazil, you can buy thousands of shares globally with just one click. All you need is an account with a trusted and regulated online broker.

What are shares?

When a company decides to go public, it is listed on a stock exchange. This allows ordinary investors to buy “shares” in the company, becoming owners of a proportional share of the company based on the number of shares they own. As a result, the value of the shares is determined by market forces: if there are more buyers than sellers, the share price will rise, thus increasing the value of your investment. As a shareholder, you are entitled to a number of perks and benefits, including dividends and voting at annual general meetings.

Sell shares

In addition to benefits like receiving dividends, you can also sell your shares at any time during regular market hours. The amount you receive will depend on the number of shares you own and the company’s current stock price.

How much money can you make by investing in stocks?

If you want to calculate the potential profits from learning how to invest in stocks in Brazil, you can use a convenient investment calculator. Historically, stocks have averaged annual returns of around 6% to 7%.

How to make money by investing in stocks:

You can achieve financial success by investing in stocks in three distinct ways – capital gains, dividends, and compound annual growth rate.

- Capital gains: If the value of your shares is higher than the original purchase price, you make a ‘capital gain’. For example, if you buy 1000 BP shares at 350p per share and then sell them at 450p per share, you make a capital gain.

- Dividends : In the same vein, you can also make money from stocks through dividends, which are payments of profits from companies to shareholders. Dividends are distributed periodically, usually every 3 to 6 months, and the amount depends on the company’s financial performance.

- Compound Annual Growth Rate : Finally, by reinvesting profits over time, you can use the effect of compound interest to increase your earnings.

What to Consider Before Investing in Any Company’s Stock

While markets have performed well in the past, this is not always the case for all companies. In fact, many companies, both domestically and abroad, are now worth only a fraction of their past peak value. This is particularly evident in the UK banking sector, with entities such as HSBC and Natwest never fully recovering from the 2008 financial crisis.

Tip 1: Diversify as much as you can

Diversification is the opposite of putting all your money in one place. Instead of investing in just one or two companies, a diversified portfolio allows you to own shares in dozens or hundreds of different companies across a variety of industries. For example, if you have $5,000 to invest in stocks:

- An inexperienced investor may spend all of his capital on shares of a single company.

- An experienced investor will probably buy shares of 100 different companies, at R$50 each, covering different sectors.

Tip 2: Start with small investments

If you’re new to investing in stocks in Brazil, it may be wise to start with smaller investments first. Most regulated brokerages in Brazil require a minimum investment amount, usually between R$100 and R$200. However, you don’t have to invest all of your money in a single position.

Tip 3: Learn to analyze stocks

When you’re learning how to invest in stocks, it’s also important to learn how to analyze stocks. This way, you don’t have to perform complex technical analysis or read charts. Instead, you can stay informed about significant market developments that could affect the value of your investments.

For example, if you have £3,000 invested in Royal Mail and the company announces plans to lay off hundreds of employees, how do you think this news will affect the share price?

Negative news, however, like this example, usually results in more selling by investors, which causes the value of the stock to decrease. Therefore, selling your shares immediately after receiving unfavorable news can help minimize losses.

It’s also a good idea to sign up for a news alert service, such as Yahoo! Finance, which allows you to add the companies you’ve invested in to your portfolio and receive real-time alerts about relevant news.

Finally, there are other fundamental analysis methods used by experienced investors. If you are an independent investor, you can learn more about how to select the best stocks.

Tip 4: Consider copy trading

So, if you don’t have any experience in the stock market, it might be a good idea to consider copy trading, where you can copy the trades of experienced traders. This way, you can also assess the credentials of the trader before investing your own money. Copy trading allows you to invest in stocks without much effort, which is popular among new investors.

How to choose a broker in Brazil to invest in stocks

So now that you know how to invest in stocks, it’s important to choose a reliable broker that can meet your needs. There are several brokers available, each with different tradable assets, fees, and features. Here are some important factors to consider:

Regulation by the Financial Conduct Authority

Before signing up with any stockbroker, check that they are licensed and regulated by the Financial Conduct Authority ( FCA ) or other regulators. This ensures that you can buy, sell and trade shares in a safe environment.

Payment methods

Check the payment methods accepted by the broker. Most accept debit/credit cards and bank transfers. Additionally, some brokers accept e-wallets such as Skrill, Neteller, and PayPal.

Diversity of actions

Check which markets and stocks are available through the broker. Choose a broker that offers access to a wide range of companies and markets, allowing you to diversify your investments.

Fees and commissions

Evaluate the fees and commissions charged by the broker. Some brokers do not charge trading fees or annual fees, making money through spreads or conversion rates.

Now that you know how to invest in stocks and what to consider when choosing a broker, you can start your investment journey with confidence. Always remember to do thorough research before making any major financial decisions.

What stocks can I invest in in Brazil?

Following on from what was mentioned earlier, there are tens of thousands of companies publicly listed on various stock exchanges. It is important to note that the specific markets you will have access to will depend on the broker you choose.

This includes companies listed on the following exchanges:

- London Stock Exchange (United Kingdom)

- Alternative Investment Market (UK)

- NASDAQ (USA)

- New York Stock Exchange (USA)

- Tokyo Stock Exchange (Japan)

- Hong Kong Stock Exchange (Hong Kong)

- And many, many more!

It is recommended to select a broker that covers both national and international markets, expanding your ability to diversify your investments and reduce risks. XTB, for example, allows you to buy shares in 17 different markets.

Fees and commissions

There are several associated fees and commissions that you should consider when searching for a broker, including trading commissions, annual account fees, and withdrawal fees.

On the other hand, the good news is that some stock trading platforms in Brazil allow you to buy stocks without charging any trading fees or annual fees. Instead, these services generate revenue through “spreads” or one-time conversion fees when you make your first deposit.

Where to Invest in Stocks – The Best Stock Trading Platforms in Brazil for 2026

Taking the time to evaluate all the details of a broker can be challenging. In the following section, you will find a selection of the best share trading accounts that meet several minimum requirements and can act as investment managers for your shares. Some of these requirements include the all-important Financial Conduct Authority (FCA) license, support for debit/credit card and bank transfer deposits, as well as the ability to buy and sell shares of domestic and international companies.

1. XTB — Broker for trading stocks, ETFs, Forex CFDs and more

Above all, XTB’s flagship is the Forex market, which is the global exchange for trading currencies such as the dollar, yen, peso and real, for example. However, any type of investor can benefit from the platform, as you can use it to invest in a wide range of asset classes.

Take advantage and register to buy shares (whole or fractional) with zero fees.

XTB Fees:

| Commission | Free on shares up to 100,000 euros per month. |

| Deposit fee | Free |

| Withdrawal fee | Free for withdrawals over 100 USD |

Pros:

Cons:

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

2. Axi - An excellent option for Brazilians who want to invest in stocks

Axi also offers a full range of products and services. On the platform, investors can invest in Forex, day trade, invest in commodities, cryptocurrencies, and more. All of this contributes to the diversification of their investments and increases their profit potential.

Additionally, Axi offers highly competitive fees and commissions. This is one of the main advantages of Axi, as some brokers tend to have high associated fees and variable commissions. Axi also offers investment planning and commitment to your investments for the future. Investors can set up a demo account and test out all the features. After that, it is simply a matter of choosing the best account type for your investment.

AXI Fees:

| Axi Standard Account | Axi Pro Account | |

| Entrance fee | No entry fee | No entry fee |

| Commission | Commission-free trading for all transactions | US$7 dollars in some types of investments |

| Withdrawal fee | There is no withdrawal fee | There is no withdrawal fee |

Pros:

Cons:

Your capital is at risk.

3. Libertex – CFD Broker with Zero Spreads

As a result, with Libertex, you can trade via CFDs on global markets, currencies, commodities, cryptocurrencies, indices , and other financial instruments. The broker offers important stocks in unique popular sectors, such as shares of companies in the cannabis industry, which some brokers are not comfortable with.

When investing in stocks, the commission varies between 0% and 0.5%, but some account types receive a 50% discount, and all this without spreads!

Libertex Fees:

| Commission | 0%-0.5% for stocks |

| Deposit fee | Free |

| Withdrawal fee | 1 EUR via debit/credit card, 1% via Neteller, free via Skrill |

| Inactivity rate | 10 EUR after 180 days of inactivity |

Pros:

Cons:

Your capital is at risk.

What are the pros and cons of investing in stocks?

Pros:

Cons:

Above all, the process of investing in stocks in Brazil has undergone significant changes in the last decade. It is no longer necessary to contact a traditional broker by phone to buy or sell shares. Instead, you simply choose a regulated and licensed online trading platform, make a deposit with your debit/credit card and select the shares you wish to purchase. As a result, our team recommends XTB, due to its FCA regulation and zero commissions.

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor. Warning: Investing in stocks involves substantial risk of financial loss and is not suitable for all investors. You should carefully consider your investment objectives, level of experience, and risk tolerance before deciding to buy stocks. Most importantly, you should not invest money that you cannot afford to lose.How to Invest in Stocks – Conclusion

XTB – Invest in Stocks Without Commissions

FAQs

Is it possible to invest in foreign companies?

What are the supported payment methods for buying shares online?

What are the fees associated with investing in shares?

How can I buy shares in companies listed on AIM (the UK Alternative Investment Market)?