Melhor Corretora Forex Brasil – Best Forex Broker 2026

If you intend to trade in the forex market from the comfort of your home – you need to register with a Forex broker in Brazil.

However, there are hundreds of Forex brokers active in this space, so you need to take some time to find the broker that best suits your needs.

This research should include a minimum number of requirements, such as low commissions and fees, availability of tradable currency pairs, and a satisfactory number of chart reading tools. Of course, you should also make sure that the broker is regulated.

But don’t worry, because in this guide we’ll set you on the right track by evaluating the best Forex broker for 2026 . We’ll also explore the various features you need to compare between different Forex brokers.

How to start with a Forex Broker in Brazil – Step by Step

To get started with a Forex broker you need to follow these steps below:

Best Forex Brokers Brazil 2026

If you want to read all about the best Forex brokers in detail , keep reading this guide. But if you are just looking for a summary of the best brokers currently available on the market, check out the following list:

- xtb – Europe’s leading Forex broker with a wide range of assets

- AXI – Great Forex Broker Option

- Markets.com – Forex broker with powerful market analysis tools

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

What is a Forex Broker anyway ?

In short, a Forex broker is an intermediary platform that allows you to trade in the foreign exchange market. Just like a typical stock broker, the platform in question requires you to register an account and deposit some funds.

Once you complete your registration, you will be able to invest in currency pairs with just one click. When you place an order (position), it needs to be matched by another user on the platform.

This is because a Forex broker is merely a place to match orders between buyers and sellers.

For example:

- Let’s say you want to place a buy order on GBP/USD

- Want to invest $1,000 at the buy price of 1.2760

- For your trade to be executed, someone needs to place a sell order.

- This sell order must cover the invested amount of $1,000 as well as the price of 1.2760

Once you open your position with a Forex broker, there will always be a winner and a loser. In other words, if you make $100 profit on your trade (investment), in theory, someone had to lose $100.

Regardless of the direction of the markets, a Forex broker guarantees your profits. This is because brokers charge something known as a “spread,” which is the difference between the buying and selling price of a given currency pair.

In addition to brokering buy and sell orders, the best Forex brokers should also:

- Verify the identity of all traders (investors) to ensure compliance with anti-money laundering laws;

- Process deposits and withdrawals;

- Ensure that trading conditions are the same as those implemented in the real-world Forex market;

- Offer trading advantages such as leverage and margin;

- Provide technical analysis tools and functionalities;

- Provide educational resources; and

- Provide the best customer support service.

Crucially, with so many Forex brokers active in this market, recognizing the best platform to sign up with can be difficult. For this reason, you need to invest some time in finding the right broker for your needs.

Best Forex Brokers in Brazil 2026

As mentioned earlier, there are hundreds of forex brokers competing for your money. This is fantastic for you as a trader, as brokers are forced to be increasingly competitive.

This means lower fees and commissions, as well as creating a wider range of tradable currency pairs. To save you countless hours of research, in this article you will find a selection of the best Forex brokers in 2026.

[stocks_table id=”16″]

1. xtb – Europe’s leading Forex broker with a wide range of assets

And few are as good at this as xtb. Proof of this are the various awards that the broker has already won, such as the best forex broker of 2021 and 2022.

The quality of the platform’s application has also earned xtb awards, as has its CFD trading structure.

Given these credentials, you must be curious to know how to open an account with xtb and start investing in it. The best thing is that the account is free and deposits are also fee-free, so don’t waste any time.

In addition to everything that has been presented, we must highlight the immense offer of different assets, therefore, at xtb you can create a complete investment portfolio, from volatile cryptocurrencies, to blue chip stocks, including currencies on the Forex market and complementing with ETFs.

With a portfolio like this, you will hardly see your assets decrease much, regardless of the bad phases of the market, because a diversified portfolio is your greatest protection against the dreaded “bear markets”.

Not to say that everything is rosy at xtb, the platform is a little lacking in terms of spread, which is slightly above the competition’s average when you use the Standard account.

xtb fees:

| Commission | 0% for purchasing shares up to 100 thousand per month |

| Deposit Fee | Free |

| Withdrawal Fee | Free for withdrawals of 100USD or more |

| Inactivity Fee | $10 per month after 12 months of inactivity |

Pros:

Cons:

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

2. AXI – Great Forex Broker Option

Axi's interactive and technological portal offers the possibility of learning more about the market through courses and training. In addition, this broker has the best rates on the market, making your Forex investments yield more. Not to mention the many awards received by the broker, which has been successful in the market since 2007.

At Axi, you can set up a demo account and then choose the best account type for you. At the moment, investors can choose from two different account types, both with very attractive rates.

AXI Fees:

| Axi Standard Account | Axi Pro Account | |

| Entrance fee | No entry fee | No entry fee |

| Commission | Commission-free trading for all transactions | US$7 dollars in some types of investments |

| Withdrawal fee | There is no withdrawal fee | There is no withdrawal fee |

Pros:

Cons:

Your capital is at risk.

3. Markets.com – Forex broker with powerful market analysis tools

To get started with Markets.com, you need to open an account, a quick and easy registration process that takes around 15 minutes. The company follows strict verification procedures as required by the European Economic Area (EEA) to ensure the security of funds and regulatory compliance.

In terms of fees, Markets.com does not charge any fees for opening an account or for depositing or withdrawing funds. However, the financial service provider used to transfer funds may charge transaction fees. The broker also offers fee reimbursement for deposits over $2,500. Transaction fees are included in the spread, which is floating and may vary depending on market conditions.

Markets.com offers several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely used by traders. Mobile apps are also available for trading on Android and iOS devices.

The broker offers a wide range of assets, including currencies, cryptocurrencies, stocks, commodities, bonds, stock indices and ETFs, allowing investors to diversify their portfolios.

Markets.com Fees and Costs

Minimum deposit

US$100

CFDs

Variable

Account fee

There is no

Deposit Fee

There is no

Inactivity rate

R$10.00/month

Pros:

Cons:

Your capital is at risk.

How to Choose the Best Reliable Forex Broker

Now that you have had the opportunity to evaluate the best Forex brokers in Brazil , you need to know what to look for when selecting a suitable platform.

It is always advisable to research a broker in more detail before opening an account. Alternatively, you may choose a forex broker mentioned in this article and wish to further investigate them.

With that in mind, below are the most important features to consider when selecting a Forex broker that suits your needs.

Regulation - Best Regulated Forex Broker

Just like when investing in stocks on the stock market , the best first step you can take is to make sure that the Forex broker has the approval of reputable regulatory bodies. Depending on the regulator, such as the FCA, CySEC, ASIC, FSA and others, this ensures that:

- All client funds are held in segregated bank accounts. This means that your money is held in a separate bank account from the brokerage firm’s operating capital.

- All new registered accounts are verified. This ensures that the platform complies with anti-money laundering laws.

- The broker is audited regularly.

- Your data is kept secure and managed only by responsible and authorized individuals.

- The risks involved in Forex trading are clearly expressed to all clients.

In the vast majority of cases, if a Forex broker is licensed, you will be able to find its license number at the bottom of its website. However, if this is not the case, it is advisable to look at the regulatory agency’s registry to be 100% sure.

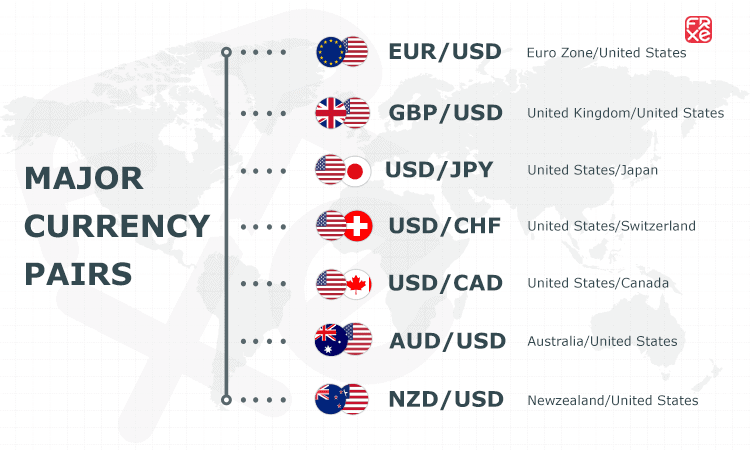

Currency Pairs

Next, you need to explore the number of currency pairs available for trading. This number can range from just a few dozen to over a hundred.

In most cases, you will find that the broker offers the majority of major and minor pairs. This is because these pairs are the most traded and are considered liquid pairs in the Forex Trading market .

These pairs also feature tighter spreads and less volatility, making them ideal pairs for beginner traders.

On the other extreme, exotic pairs are much more volatile and have higher spreads. Since the risks are higher, it is possible to obtain much higher profit margins as well.

Considering this feature, it is best to avoid exotic pairs if you are a beginner. However, if you have a specific pair that you want to trade, make sure that the broker supports that pair before creating your account.

Forex Broker Fees

Of course, fees play a big role in your choice of the best Forex broker in Brazil. The associated fees will reduce your potential trading profits, so it is advisable to look for the lowest fees.

Considering the complexity of the fees applied by each Forex broker, we have detailed below the most common fees that you need to evaluate before registering your account.

Commission in Forex Trading

This is the most important fee. Crucially, if you have selected a broker that charges a trading commission , you will need to pay it every time you place an order.

For example:

- If you have to pay a 0.5% commission “per side”, this means paying 0.5% when you enter the trade, and again when you close your position.

- Therefore, on an initial investment of $1,000, your entry fee would be equal to $5.

- If you close your position when it is worth $1,200, you must pay a commission of $6 again.

The good news is that the best Forex brokers we recommend on this page offer their services commission-free. However, this is not the case with all platforms in the industry, so do your research before opening an account.

Forex Broker Spreads

The spread is simply the difference between the buying and selling price of a currency pair. As we have already pointed out, the respective Forex broker always guarantees your profit .

When evaluating whether a particular broker is competitive in this department, it is advisable to stick to platforms that offer a spread of less than 1 pip on major and minor currency pairs. Any higher than this means you are paying too much.

Maintenance Fees

You should also explore the different maintenance fees that apply. These may include:

- Deposit and Withdrawal Fees: Some online Forex brokers charge a fee whenever you make a deposit and/or withdrawal. This fee is sometimes fixed, or expressed as a percentage.

- Currency Conversion Fees: Some Forex brokers charge a currency conversion fee. This fee is applied because your currency pair trades are likely to be denominated in a different currency than the deposited currency.

- Inactivity Fee: This particular fee is charged when you do not use your Forex trading account for a certain number of months. For example, if you do not place any trades for 12 months, you may be charged a fee of $10. Your account will be charged $10 every month that you do not initiate any orders, or until your account balance is depleted.

As you can see from the list above, there are several factors to consider when selecting a Forex broker. For this reason, the research process is extremely important.

Leverage at Forex Brokers

In fact, if you use a broker licensed by major jurisdictions such as the FCA , CySEC or ASIC , your leverage limits will remain constant across all brokers.

This is because platforms are required to comply with the laws implemented by the European Securities Markets Authority (ESMA). In short, this means that you can trade on major currency pairs (e.g. EUR/USD) with a leverage limit of 1:30.

Therefore, an investment of $100 allows for a position worth up to $3,000. When trading minor pairs (such as EUR/GBP) or exotic pairs (such as EUR/TRY), your leverage limit is 1:20.

The only way to get higher leverage limits is to prove to the Forex broker that you are a professional trader. If this is the case, you can often get limits higher than 1:200.

Forex Broker Trading Tools

If you think you can make money in the Forex markets without using trading tools, think again. How else would you be able to determine the likely direction of a particular currency pair’s value?

If you don't use these tools, you will be entirely dependent on luck. That's why all experienced traders make full use of technical indicators .

These include 50-day and 200-day moving averages, Bollinger bands, MACD, relative strength index, and many others. In addition to technical indicators, you should opt for a Forex broker that provides chart reading tools.

User Experience

If you are new to the world of online forex trading, you need to ensure that your broker offers an accessible and user-friendly user experience.

This includes all parameters from the very beginning, such as the account opening and deposit process, as well as the availability of your preferred currency pair. Of course, the trading process and chart analysis should also be intuitive and consistent.

Research and Education

The best Forex brokers in Brazil provide a comprehensive research department. This can include live webinars, market insights, real-time fundamental news, and in-depth expert analysis.

When it comes to educational resources, it is always helpful when brokers provide accessible guides that explain the main terms used in the Forex market. For example, the broker may provide guides on how to develop and implement a trading strategy or create a risk management system.

Payment Methods

If you intend to trade currency pairs with real money, you need to deposit funds into your account using the payment method that suits you best.

Most of the best Forex brokers in Brazil, including the ones we’ve mentioned on this page, support deposits via debit and credit cards, as well as bank transfers. Sometimes, e-wallets are also an option, including Paypal, Skrill, or Neteller.

Forex Broker Customer Support

The customer support department is often undervalued by beginner traders. We prefer it when the best Forex brokers in Brazil offer 24/7 customer support . This way, you never lose access to assistance, night or day.

In terms of support channels , the easiest way to get in touch is via live chat. Email is also an option, although the response will not be immediate. Alternatively, your Forex broker may offer a dedicated telephone support line.

If this is the case, we prefer toll-free numbers. This way, you can receive all the help you need over the phone, without any associated costs.

Best Forex Brokers for Beginners

If you are looking for the best forex brokers for beginners, it is advisable to select a platform that allows you to trade with ease.

There shouldn’t be too many overbearing features, nor should it be difficult to navigate the broker’s website. With this in mind, the most intuitive Forex broker for traders in Brazil is undoubtedly XTB.

The platform tailors its services to beginner traders, meaning that you don’t need any prior experience to get started.

Additionally, XTB offers the option to trade on a demo account. In short, this means that you can practice your trading with a demo account worth $100,000 .

The demo platform provides the same experience as trading with real money, which is crucial to understanding how the markets work before risking your own capital.

Broker for Trading Forex Options

Some of the online brokers allow you to trade in Forex “options” .

For those unfamiliar with this term, options are extremely complex financial derivatives that allow traders to speculate on the future value of a given asset by investing a small amount.

If the prediction is correct, traders make money.

The best part is that there is no limit to the amount you can earn, as your profits depend on the distance between the “call/put” price (buy or sell) of your options contract and the price displayed at the time the contract was closed.

If your speculation is incorrect, on the other hand, you simply lose the entire amount invested to execute the contract.

If you are new to Forex, we suggest you stay away from options, as they are more suited to traders who truly understand these sophisticated financial products.

How to Start a Forex Broker in Brazil

Now that you’ve had the opportunity to learn about the best Forex brokers active on the market – as well as what you need to consider when selecting a suitable platform – let’s show you how to get started with your trading account today.

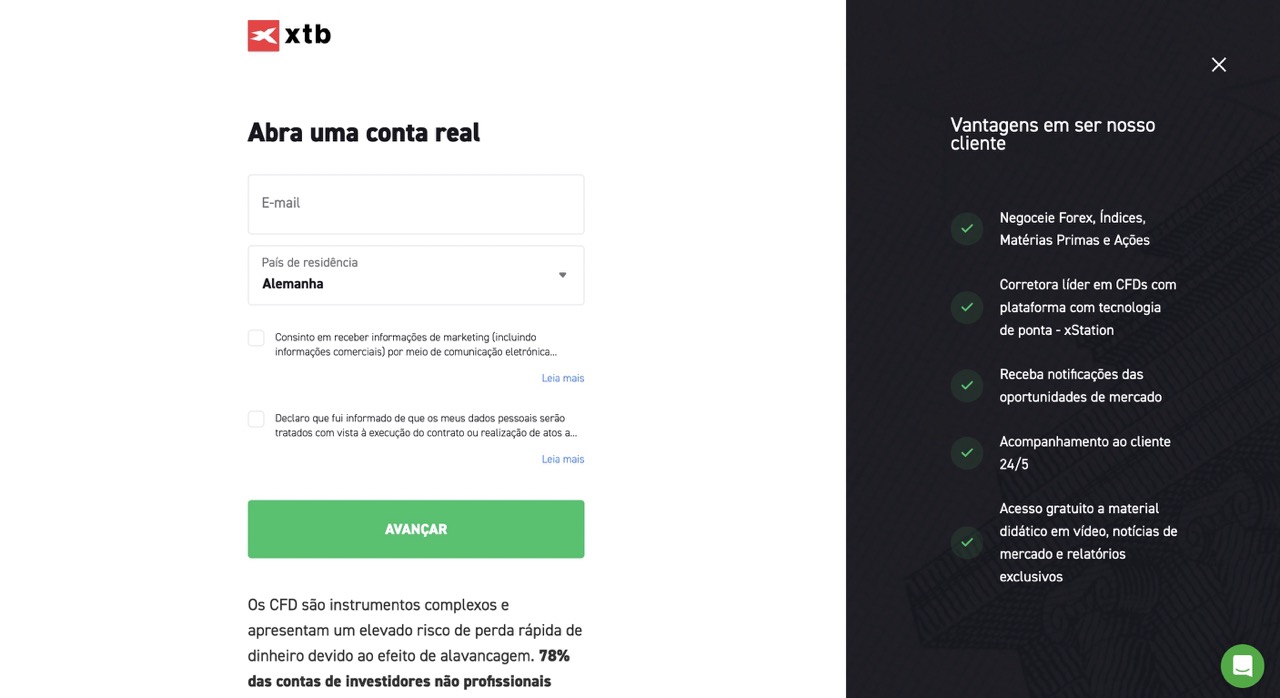

Although the registration process is similar on most of the best Forex broker platforms, the following guide is based on XTB, which is our selection as the best trading platform in Brazil.

All Forex brokers in Brazil require account registration and identity verification . To get started, visit the XTB website. On the registration page, you must enter your personal details, such as your full name, address, date of birth, social security number, contact details, username and password. In terms of ID, XTB requests two documents. These include a passport or national driving license (proof of identity) and a recent bank statement or invoice (proof of residence). Next, you need to deposit some funds. There is no minimum deposit at XTB. Supported payment methods include debit cards, credit cards, Paypal, Klarna, and bank transfer. Apart from bank transfer, all funds will be deposited into your account immediately. After funding your account, you can click on the “ Trading Markets ” button, which you will find on the left side of the page. Then, click on “ Currencies ”. As depicted in the following image, you will be presented with a long list of currency pairs that you can trade on XTB. After selecting your preferred pair, you need to click on the “Trade” button. An order box will open for the selected currency pair, then select a buy or sell order . What you need to know: Once you open your position, it will remain active until the stop-loss or take-profit order is triggered, or until you close it manually.Step 1: Open an Account and Submit an ID

Step 2: Deposit Funds to the Forex Broker

Step 3: Do Forex Trading

Online trading in the forex market needs to be mediated by a Forex broker. There are several brokers active in this segment of the financial markets, so there is a suitable platform for any need. After reading our guide in full, you should have a solid understanding of what the best Forex brokers in 2026 have to offer . All of the platforms we cover are ideal for brokering commission-free trades, with numerous currency pairs available and a fantastic selection of payment methods. But the main thing is that all these brokers are licensed. In the end, xtb stands out as the best Forex broker currently on the market.

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.Conclusion – What is the Best Forex Broker in Brazil?

XTB – Best Forex Broker Brazil

Frequently Asked Questions

How do Forex brokers make money?

How does a Forex broker work in Brazil?

Is an FX broker always regulated?

What is the most traded currency pair at the best Forex brokers?

How do I deposit funds into my Forex Brazil online broker account?