Como comprar ações da Tesla no Brasil – 0% de Comissões!

Tesla is no longer just a car company, but a brand that has grown far beyond that, so if you are one of those investors who want to know how to buy Tesla shares, keep an eye on this article .

The Palo Alto-based company doesn’t just make electric cars, it’s also a producer of energy storage systems aimed at integrating renewable energy solutions into homes and businesses.

Tesla is also one of the most talked about companies in the world and consequently it is increasingly exciting to follow its share price, but also exciting to invest in.

If you want to buy Tesla shares and don’t know where to start, this guide is perfect for you. We’ll explain how to buy Tesla shares in Brazil and suggest the best brokers that offer Tesla shares.

Additionally, we will also analyze Tesla’s history and future prospects to help you decide whether it is the right time to buy or sell Tesla shares.

How to Buy Tesla Stock – Step by Step Guide 2026

To start buying Tesla shares you need to follow these steps below:

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

Step 1: Find a Stock Broker in Brazil that Offers Tesla Shares

As Tesla shares are currently one of the hottest assets in the world, you will find several stock brokers in Brazil that offer the purchase and sale of these shares.

With that in mind, you need to find a licensed broker that will allow you to buy Tesla stock, however, you may want to look for one with low trading commissions and a solid trading platform.

To help you find the ideal broker to meet your needs, we have compiled a list below of the best regulated securities brokers operating in Brazil.

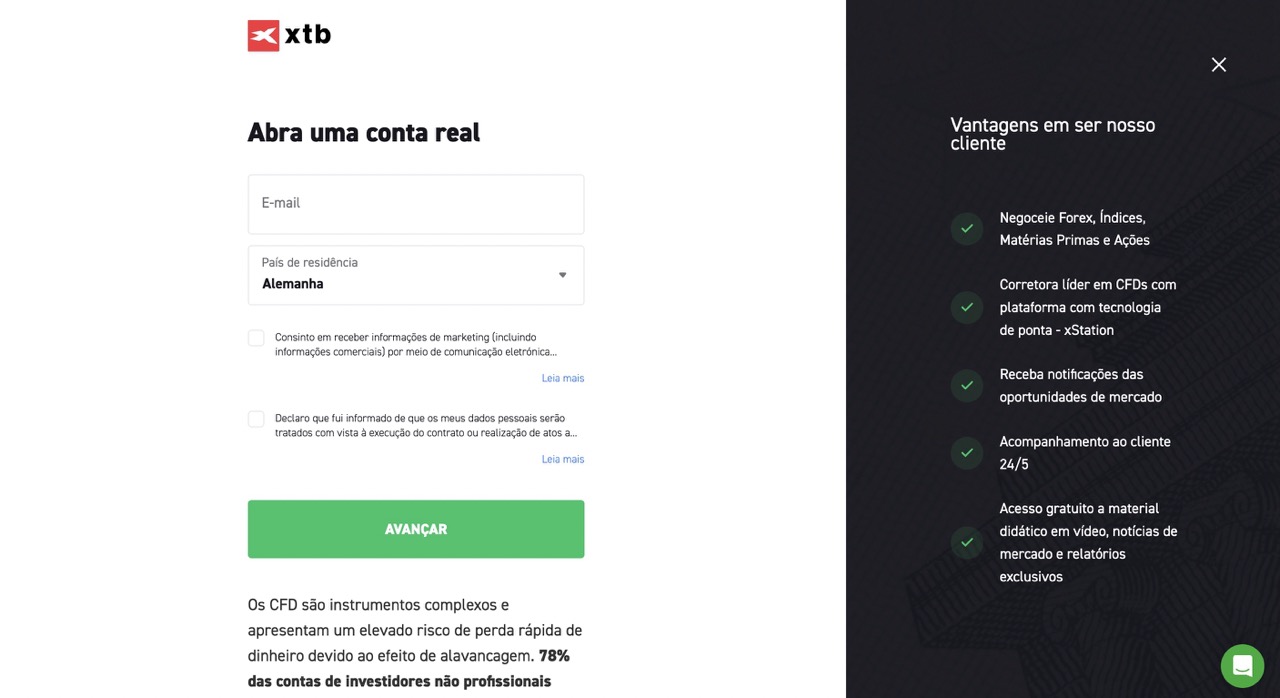

1. xtb – The widest range of assets to invest in

Given this, it is clear that xtb’s biggest differentiator is its ability to be a one-stop shop for investors who value diversification. And this is extremely important, since diversification is your best weapon against the natural volatility of the markets.

At xtb you can create your account for free and start trading in less than 30 minutes. The whole process is quick and easy. The broker is also easy to use, which is great for beginner investors.

Something we cannot fail to highlight is the educational tab on the xtb website, as through the platform’s educational content you can acquire valuable knowledge that will help you on your journey as an investor.

xtb fees:

Commission

0% on purchases up to 100 thousand EUR per month

Deposit Fee

Free

Withdrawal Fee

Free for withdrawals over 100 USD

Inactivity Fee

10 EUR after one year of inactivity

Pros:

Cons:

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.

2. AXI – Excellent broker to buy Tesla shares

The platform is intuitive and dynamic, as well as being very user-friendly. You can test the technology and investment methods with a demo account. You can also take advantage of the broker's other advantages, such as learning opportunities, 24-hour support, and various income possibilities.

Axi has a long history of global success since 2007. In Brazil, the broker is starting to expand and gain notoriety. Based on the quality of the broker, it should not be long before more investors notice the possibilities provided by Axi, especially since it is a global award-winner. At the moment, Axi offers two different accounts.

AXI Fees:

| Axi Standard Account | Axi Pro Account | |

| Entrance fee | No entry fee | No entry fee |

| Commission | Commission-free trading for all transactions | US$7 dollars in some types of investments |

| Withdrawal fee | There is no withdrawal fee | There is no withdrawal fee |

Pros:

Cons:

Your capital is at risk.

3. Libertex – Zero Spread Stock CFD Broker

For stock investments, commissions range from 0% to 0.5%, depending on the trading instrument. However, with some specific account types, it is possible to obtain a 50% discount on all commissions.

Additionally, Libertex lets you know how to buy Tesla stocks and other emerging stocks in the cannabis sector, electric vehicle sector, and many others. Additionally, they have a wide range of cryptocurrencies that you can trade as well.

The broker also offers some useful educational tools, including courses, a blog and a few webinars. You can also trade via the globally popular MetaTrader 4 platform, as well as the broker’s own feature-rich web platform.

Libertex also ensures peace of mind and security with authorization and regulation provided by CySEC.

Libertex Fees:

Commission

0% - 0.5% on shares

Deposit Fee

Free

Withdrawal Fee

1 EUR by debit/credit card, 1% by Neteller, free by Skrill

Inactivity Fee

10 EUR after 180 days of inactivity

Pros:

Cons:

Your capital is at risk.

Step 2: Study Tesla Stock

Tesla stock has seen tremendous growth over the past few years, but that doesn't mean you should buy Tesla stock right away. The company continues to grow rapidly, but at the same time, some analysts and investors believe the stock is overvalued.

To make an informed decision, it’s important to conduct your own research and research before making any investment. Throughout this article, we’ll cover the key information you need to know about this company, including Tesla’s history, its stock price history, and the company’s future outlook.

What is the Value of Tesla Stock? Tesla Stock Price History

Tesla was founded in 2003 by a group of engineers, shortly after General Motors discontinued production of its electric vehicle. The company builds electric and clean energy vehicles, as well as producing energy storage batteries for home grids and solar energy products such as photovoltaic panels.

Tesla's eccentric CEO Elon Musk joined the company in 2004 after investing $6.3 million in Tesla stock during a Series A round of funding. The company eventually went public in June 2010, raising $226 million in its IPO (initial public offering), when it offered 13.3 million shares at a price of $17 per share.

Since then, Tesla's stock price has seen meteoric growth, reaching its peak value of $900 per share in 2021. On August 11, 2020, Tesla announced a Five-for-One Stock Split , which was implemented on August 31.

For those unfamiliar with the term, a stock split is a decision made by company management to increase the number of shares, making more shares available at a lower price.

Between August 11 and August 31, Tesla's stock price increased by 81%, but on September 8, Tesla's stock price fell by 21%, marking the worst day in the company's history. After this drop, the price rose again and reached its peak value at the end of the year.

It should be noted that Tesla's stock split doesn't change much, but it can be a bit confusing anyway. Earnings per share calculations for the company change based on the new stock price, and you may need to adjust the new prices to the pre- split value .

For example, looking at Tesla's full price history, the stock price on IPO day is $3.84, adjusted for the 5-1 split .

Tesla Stock Dividend Information

Tesla has never declared dividend payments to its shareholders. The company is completely transparent about its intentions, mentioning on its official website that it does not anticipate paying any cash dividends in the future, all in the interest of preserving the company's growth momentum.

Should I Buy Tesla Stock?

Many people place their hopes and trust in Tesla’s cutting-edge technology and innovative vision. Of course, Tesla investors look beyond the immediate future, and some even see a strong similarity to Apple.

We can debate whether this is just a financial bubble or not, but there are certainly some key factors that give Tesla the competitive advantage it has achieved thus far.

First and foremost, this company is a global leader in the production of electric vehicles. Last year, Tesla became the world’s largest electric vehicle manufacturer based on sales volume, surpassing the numbers achieved by Chinese company BYD. Globally, Tesla delivered between 367,000 and 368,000 electric vehicles in 2019.

Another important factor to consider when analyzing Tesla is the amount of data the company collects. Tesla electric cars are constantly recording and collecting data, using cameras and other navigation tools to store as much data as possible while you are driving.

This data is incredibly valuable and, according to McKinsey & Company, could be worth $750 billion annually. Finally, Tesla doesn’t just sell electric vehicles.

Tesla’s Supercharger stations are the fastest and most efficient way to recharge electric vehicles on the market today, and the new battery modules are expected to have lifespans of 300,000 and 500,000 miles (~500,000 km and ~800,000 km). Additionally, Tesla provides sustainable energy products such as solar roofs and solar panels.

Step 3: Open an Account and Deposit Funds

If you’re ready to buy Tesla stock in Brazil, you’ll first need to open an online trading account with a broker. To help you get started, we’ll walk you through the process of registering with our recommended broker, XTB. To create a CFD trading account with XTB, you must visit the broker’s website and click on the “Start Trading” button in the bottom left corner of the homepage. You will then be redirected to the registration page, with a form where you will need to create a username and password, and enter some personal information, including your full name, email, date of birth, nationality and tax number. In the next step, you will need to confirm your identity by uploading a copy of your national driver’s license or passport, as well as a recent utility bill or bank statement that proves your address. This information is required because XTB is a regulated broker. After your account is approved, you can then deposit funds. There is no minimum deposit at XTB. Therefore, you can make your deposit using the following payment methods supported by XTB: Now that your account has been funded and approved, you are ready to buy Tesla shares. On the XTB dashboard, enter Tesla or TSLA into the search box at the top of the screen, then click on the first result displayed. Next, XTB will present the Tesla stock page. On this page, you can find useful information about the quote and the company, including news, statistics, an interactive chart, and analysis tools. Once you are ready to place a buy order, navigate to and click on the “Trade” button. You will now be presented with an order (investment/position) form where you must enter the amount you wish to invest in Tesla shares. Next, click on the “Open Trade” button. Remember that XTB allows fractional trading, meaning you can invest any amount above $50 in Tesla shares. Note: If you wish to purchase Tesla shares after standard market hours (9:30am to 5:00pm EST), you will need to click the “Set Order” button. Your Tesla shares will be purchased when the market opens again. In 2020, Tesla shares rose more than 743%. Even after this incredible surge, analysts remained bullish (speculating on a rise in value) despite concerns caused by the Covid-19 pandemic and market turmoil. However, short interest (the number of shares sold short, yet to close) remains at 22% as of this writing, making Tesla the first company ever with $20 billion bet against its appreciation. This is a phenomenon known as a short squeeze , which refers to the total number of open short positions for a given financial asset. Consequently, the battle between buyers and sellers can intensify, causing a substantial drop in value. Tesla stock is definitely a dangerous financial instrument and may be overvalued at its current price of around $660.00. The stock split has created a surge of interest in Tesla stock, as investors are receiving five shares for one, and the stock is being promoted to the S&P 500 index. Tesla is completely different from other companies, and its shares are one of the most popular assets among individual investors. Although Tesla’s share price may fluctuate over the next few days, from a long-term investment perspective, buying seems more advisable than selling. The easiest way to short sell your Tesla shares is to use an account with a top stock broker that offers CFD trading, such as XTB. To do this, you need to register a free online trading account, log in to the trading dashboard, select Tesla stocks and place a short sell order. This means that if the market goes down, you will profit from the decline in the share price. This is a great feature of Tesla CFD trading , as it is a derivative of the Tesla share price. Fortunately, with XTB you can trade Tesla CFDs and you also have the option of buying the shares directly, all 100% commission-free!

Step 4: Buy Tesla Shares

Tesla Stock – Buy or Sell?

How to Sell Tesla Stock

In short, Tesla investors’ outlook will become clearer in the coming days and weeks. Tesla has much more room to grow, both in terms of profitability and its stock price. Of course, a large number of analysts are viewing the recent decline as a favorable investment opportunity. However, Tesla is certainly extremely volatile and unpredictable, so if you can’t handle the swings and volatility, this may not be the right investment for you. On the other hand, many investors claim that Tesla is the best “buy and forget” investment currently on the market, so it would be one of the best stocks to buy for long-term investments. Just click the link below to get started!

75% das contas de pequenos investidores perdem dinheiro ao negociar CFDs com este provedor.Conclusion

XTB – Buy Tesla Shares in Brazil Commission-Free

FAQs

What index is Tesla listed on?

Does Tesla pay dividends?

What is the minimum amount of Tesla shares I can buy?

Is Tesla a component of the stock market indices?