Recenzja Libertex 2026: Opinie Na Forum, Demo, Wypłaty | Jak Zarabiać?

Are you wondering whether Libertex will work as an intermediary in trading on global stock exchanges? Then take the time to read the article… So that during the investment it does not turn out that the broker does not meet your expectations.

There is nothing worse than investing your money in a platform whose limitations do not allow you to trade the way you want.

Therefore, below you will find the necessary information about Libertex : opinions of independent users, the number of assets available on offer, the amount of commission, the analytical capabilities of the platform and much, much more.

Read the article and the Libertex broker will have no secrets from you.

Libertex – the best broker 2026

[stocks_table id=”25″]

What is Libertex?

The experience he gained allowed him to refine his offer to such an extent that he attracted over 2 million users from around the world – both amateurs and professional investors.

Libertex is used by clients from over 100 different countries, who gain access to over 250 financial instruments through the broker .

Unlike its competitors, Libertex’s offering is simple and meticulously crafted. After all, the broker focuses on trading CFDs from just over 200 markets. You’ll find a curated selection of stocks, cryptocurrencies, indices, ETFs, commodities, and Forex.

In addition, you have financial leverage at your disposal, thanks to which you can invest more than your capital. This way, you increase your potential win, but the same applies to a possible loss.

Libertex provides a leverage of 1:30 . This means that a capital of 100 EUR gives you an investment potential of up to 3000 EUR.

If you are interested in higher leverage, know that at Libertex it is only available for professional accounts.

Finally, it is worth looking at the trading platforms that you will find with a broker. You can choose from three:

- author’s (Libertex),

- MetaTrader4,

- MetaTrader5.

The first one will work best for beginner traders who are looking for an accessible interface without any complicated functionalities.

The next two are ideal for advanced traders, as they offer a wealth of analytical tools, fully customizable charts, and even the option of automated trading.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Advantages and disadvantages of Libertex

Like any online trading platform, Libertex has its strengths and weaknesses. Below you will find them all in an easy-to-follow list.

Advantages:

Defects:

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

How to Start Trading at Libertex? Guide

If this is your first time logging into a trading platform and you need help, read on. We have prepared a short guide that will take you from the registration process to making your first transaction.

As you will soon see, the whole thing is very simple and will take you a few minutes at most .

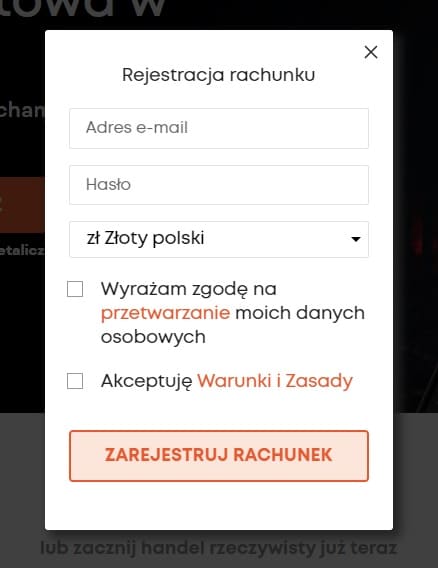

On the official Libertex website, you will notice an orange “Register” button. Click it and a new window with a registration form will appear. As you will probably notice, it is very short, consisting of only two fields: Fill them out, then indicate that you have read the broker’s terms and conditions and privacy policy. Finally, click the “Register an account” button.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy. After registration, deposit your initial capital into your account. Remember that Libertex has a minimum deposit of EUR 100. This means that the first transfer to your account cannot be less than this amount. Once the money is in the account, the broker will ask you for documents that confirm your identity . This means proof of identity (e.g. ID card or passport) and proof of residence (e.g. a recent bank statement). Such a request results from the fact that the Libertex broker is bound by legal regulations . And the Anti-Money Laundering Act requires it to verify the identity of its clients. This process takes a maximum of 3 days. After that time, your account should be fully active. On the Libertex trading platform, find the financial instrument you are interested in and choose to buy or sell. A new window will appear where you can set the transaction details : Finally, confirm your selection and you’re done! However, before you start trading, make sure you understand how CFDs work (read more about CFD platforms here ). Most retail investor accounts lose money when trading them because of leverage. So only invest what you can afford to risk .

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.Step 1: Create an account

Step 2: Pay your deposit

Step 3: Verify your account

Step 4: Start Trading

What can you trade at Libertex?

Know that trading in Libertex is significantly different from traditional investments. You do not become the owner of a given asset, you only speculate on the future change in its price. This is exactly what CFDs, or contracts for difference , are all about – they are derivatives of real assets.

This has its advantages because you gain access to several additional opportunities that you will not find in traditional investments.

The first is the option to take a long or short position . The first is a buy position, which allows you to make money on price increases. The second is a sell position, which you take if you believe the asset’s price will fall. This allows you to make money on both price increases and decreases.

Another of the additional options is the aforementioned leverage . It allows you to invest much more than your deposit. However, proceed with caution. Most retail investor accounts lose money when trading CFDs because of leverage.

Now that we have the basics explained, let’s move on to the Libertex broker’s offer.

Forex Trading

Many Forex traders choose Libertex because the broker offers access to a large selection of currency pairs. These include majors, minors, and many exotics.

There are over 50 of them in total.

The minimum transaction volume is 10 EUR and the available leverage is 1:30 or 1:20 (depending on the selected pair). In addition, you can connect your Libertex account to the MetaTrader 4 or 5 platform.

Check out the ranking of the best FOREX platforms !

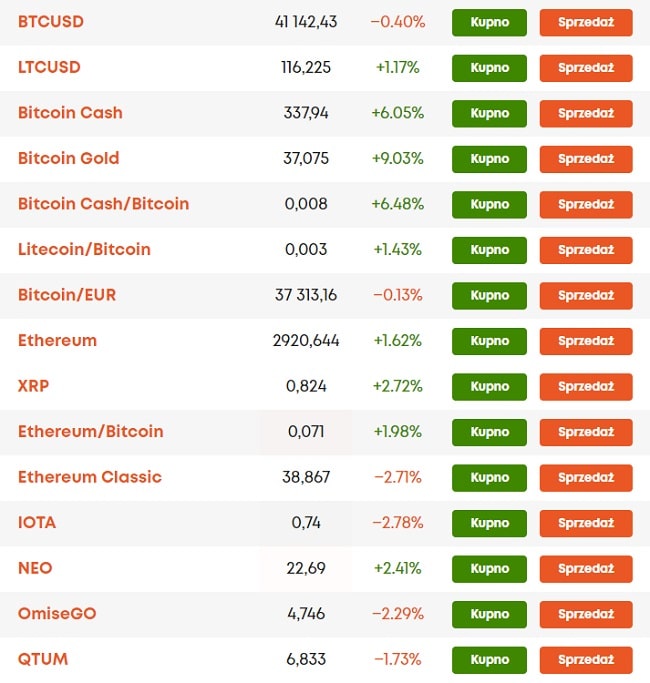

Cryptocurrency Trading

Cryptocurrency fans will also find something for themselves at Libertex, as the broker offers over 50 crypto-crypto and crypto-fiat pairs . Thanks to this, you can trade digital assets against each other and traditional currencies.

What’s more, cryptocurrency CFDs have the advantage that you don’t actually buy the cryptocurrencies yourself. This allows you to earn without the worries of storing them in cold or hot wallets.

Stock Trading

When it comes to company shares, Libertex gives you access to a selection of 50 assets that are the most liquid and volatile. These include shares from the US stock exchanges, as well as from Europe and Latin America.

As we mentioned, when you trade CFDs, you are not buying the actual stock. Instead, you are accessing the market on a speculative basis, trying to predict whether the price will rise or fall.

For example: in Libertex you can invest in Apple (APPL) shares with a maximum leverage of 1:5. Dividends are also included. This means that if you have a long position, the dividend income will be added to your account. However, in the case of a short position, it will be deducted (read more about exchange platforms ).

You can review the stock offer either in its entirety or based on individual categories. You have several of the latter to choose from:

- medical marijuana,

- raw materials,

- industry,

- technologies,

- finances,

- consumer services,

- luxury services,

- telecommunication,

- consumer goods,

- energy,

- health care,

- automotive industry.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Trade in raw materials

Libertex also offers CFDs on commodities, giving you access to the three main branches of this market: metals, agricultural products, and oil and gas . Below are the assets available in these categories:

- metals: copper, palladium, platinum, silver, gold;

- Oil and Gas: Brent Crude Oil, Light Sweet Crude Oil, WTI Crude Oil, Heating Oil, Henry Hub Natural Gas;

- agricultural products: cocoa, coffee, corn, soy, sugar, wheat.

As with other markets, the transaction commission depends on the specific asset .

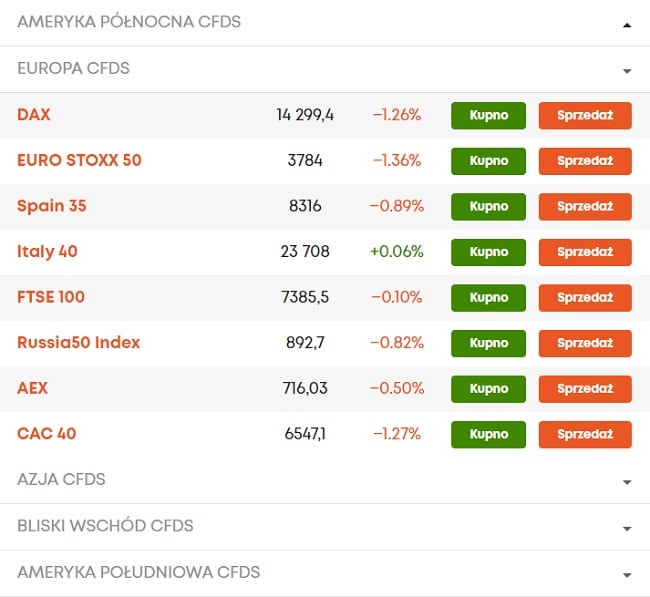

Stock Index Trading

Indices act as a measure of the price movement of a basket of shares from a single stock exchange, such as the London Stock Exchange. For example, the FTSE 100 Index measures the price movement of the 100 largest companies that make up the London Stock Exchange.

As a result, index trading gives traders full access to a national economy or sector with a single investment.

What’s more, CFDs allow you to speculate on the price of a particular market without having to buy it. Indices are a very popular way to trade because they are very liquid . They also tend to be open for longer periods of time compared to other markets, giving you more opportunities to make money.

In Libertex you will find European, American and Asian indices . These are:

- S&P 500 — measures the performance of the 500 largest companies in the U.S.;

- NASDAQ 100 — tracks the price of the 100 largest non-financial companies in the US;

- DAX — measures the performance of the 30 largest companies listed on the Frankfurt Stock Exchange;

- Hang Seng Index —monitors the prices of the largest companies on the Hong Kong Stock Exchange;

- Nikkei 225 – Tracks the prices of the 225 largest companies listed on the Tokyo Stock Exchange.

ETF Trading

ETF derivatives are an effective way to speculate on short-term price movements in a particular sector or industry .

When you trade ETF CFDs, you can use leverage (up to 1:5) to gain full exposure to the fund in question, meaning that your deposit only needs to cover a fraction of its value.

However, remember that this option also has its drawbacks, as it increases the potential for monetary losses . This is due to the fact that the broker calculates wins and losses based on the size of the position, not the underlying capital.

With Libertex you will gain access to the following ETFs:

- iShares Core US Aggregate Bond ETF,

- iShares MSCI Germany ETF,

- iShares MSCI United Kingdom ETF,

- iShares MSCI Mexico ETF,

- iShares MSCI Brazil ETF,

- iShares China Large-Cap ETF,

- iShares Core S&P Mid-Cap ETF,

- iShares Latin America 40 ETF,

- SPDR S&P 500 ETF Trust,

- Vanguard FTSE Europe ETF.

Options Trading

In simple terms, options trading comes down to two types of orders: Call and Put . You place the first one when you think the asset price will rise. You place the second one when you think the asset price will fall.

Buying and selling options usually gives you access to a larger market exposure than other instruments. This allows traders to open larger positions at a lower cost. At Libertex, the leverage for options is a maximum of 1:5, which for example allows you to open a position worth 500 EUR with just 100 EUR.

The offer includes CFD options on:

- bitcoin,

- Brent crude oil,

- DAX,

- S&P500,

- gold (XAU/USD).

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Libertex – Transaction Commission and Other Fees

Now that you know what you can trade with Libertex broker, let’s see how much their services cost.

Zero spreads

Libertex stands out from the competition in that it does not impose its own spreads . This is a truly unique feature that you will not find with many CFD brokers. Typically, these types of platforms make money on spreads, but advertise zero commission.

Recall that the spread is the difference between the buy and sell price of an asset. This means that if the spread is 0.5%, you only break even after making a 0.5% profit.

Therefore, the solution present in Libertex bodes well for your future earnings.

Transaction commission

Unfortunately, no trading platform offers its services for free. Therefore, instead of spreads, Libertex earns on transaction commissions. Their amount varies from 0% to 1.623% depending on the selected asset.

The exact transaction cost can be found on the broker’s website with CFD characteristics or in the trading terminal after clicking on a given financial instrument.

For example, when it comes to Forex trading on the EUR/USD pair, you will pay a commission of 0.011%.

Keep in mind that while most CFD platforms offer commission-free trading, they do have a spread. In the case of Libertex, the situation is different. The broker does not impose spreads on assets, but earns money from a low commission – and even that is not always the case.

You can trade some financial instruments at Libertex without any fees. For example, options are available without spreads and commissions.

Other fees

In addition to the costs directly related to transactions, CFD brokers also have other fees. Libertex is no exception.

The first of these fees is the overnight holding fee . This is because CFDs are complex instruments and involve financial leverage, which works somewhat like credit. For example, the overnight holding rate for Apple shares is 0.0302% (buy position) or 0.0254% (sell position).

Another fee is for inactivity. If a user has been inactive (has not traded, has not had any open positions, has not withdrawn or deposited money) for 180 days, Libertex will start charging them 10 EUR per month for maintaining their account.

Libertex and ease of use

If you are new to stock trading, Libertex is a good choice. You can trade CFDs via the broker’s proprietary trading platform (a mobile app is also available) or choose the advanced option, which is the MetaTrader 4 or 5 platform.

The registration process is quick and simple , as is depositing money into your investment account.

You can browse available financial instruments in one catalog or choose one of the available categories, which make searching easier. You also have a search engine at your disposal, where you can manually enter the name of the assets you are interested in. A list of favorites is also useful , where you can add your most frequently traded financial instruments.

As for the transaction process itself, it is as intuitive as possible . All you have to do is click on the asset, set the transaction amount and leverage, and finally choose the buy or sell option.

To sum up, Libertex provides a platform that is friendly to both beginners and advanced investors .

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Broker functionalities

Below we outline what Libertex has to offer in terms of charts, market analysis tools and additional features.

MetaTrader Platform

As we have already mentioned, with Libertex you will gain access to additional trading platforms, which are the older and newer versions of MetaTrader.

Experienced traders should be familiar with this name. MetaTrader is a separate investment platform designed by MetaQuotes. It gives you access to a wealth of analytical tools, a fully customizable trading terminal, and the ability to trade with automated robots .

Therefore, if you are interested in advanced trading, the MetaTrader platform will meet your expectations.

Libertex Platform

Are you just starting out and looking for a simple, convenient platform for trading on the stock exchange? Then limit yourself to the proprietary Libertex platform. With its help, you can buy or sell your favorite assets in just a few clicks.

However, that doesn’t mean you won’t find other opportunities here.

The charts are fully customizable , with time intervals ranging from 1 second to 1 month. And when it comes to technical analysis tools, you have over 40 different indicators at your disposal , which are divided into three categories:

- trend indicators,

- oscillators,

- volatility indicators.

You can also compare different assets on one chart. Just click the “compare” button at the top of the screen and type in the name of the financial instrument. There are also drawing tools.

Libertex charts are great for beginners because each one shows market sentiment and includes an open position button. This allows you to enter a trade without having to change tabs or close the chart window.

In addition, Libertex users receive access to trading signals provided by the renowned company Trading Central.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Libertex Mobile App

Like most brokers, Libertex also provides its clients with a mobile trading app that is compatible with both iOS and Android . This means that you can buy and sell CFDs with zero spreads and find the best trading opportunities from your smartphone or tablet.

An alternative is the MetaTrader 4 or 5 mobile application, which you can also download to your phone.

What makes the mobile trading platform stand out? It mirrors all the functionalities of the desktop version, meaning it allows you to:

- trading in financial instruments;

- control of your own portfolio;

- price chart analysis;

- using trading signals.

An additional and very useful feature is price alerts and notifications . You can easily set them up in the mobile app, so you won’t miss any opportunity to earn money.

You simply set an alarm to notify you of important events on the stock market (e.g. price increases to a specific level). This way, you avoid having to spend hours in front of the screen and monitor price movements. If what you are waiting for happens, the app will notify you via push notification.

Types of accounts in Libertex

At Libertex you have two types of accounts at your disposal: demo and live trading .

The demo account allows you to trade with fictitious money on an artificial market image. The account has a virtual 50,000 EUR that you can use to test the platform’s capabilities.

This is a great solution for beginner investors because they can practice and get acquainted with the specifics of online trading without any risk.

Once you have tested everything, you can move to a live account. You can do this with a single click. The button in the upper right corner of the trading platform is responsible for switching between accounts.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Payment methods at Libertex

At Libertex you will find a wide selection of payment methods, including:

- bank transfer,

- credit/debit card,

- PayPal,

- Skrill,

- Neteller.

There are no deposit fees , and the transfer in most cases reaches the investment account immediately (only a bank transfer may take a little longer).

As for withdrawals, they are free to use via PayPal and Skrill. However, there are small fees for cards, bank transfers and Neteller.

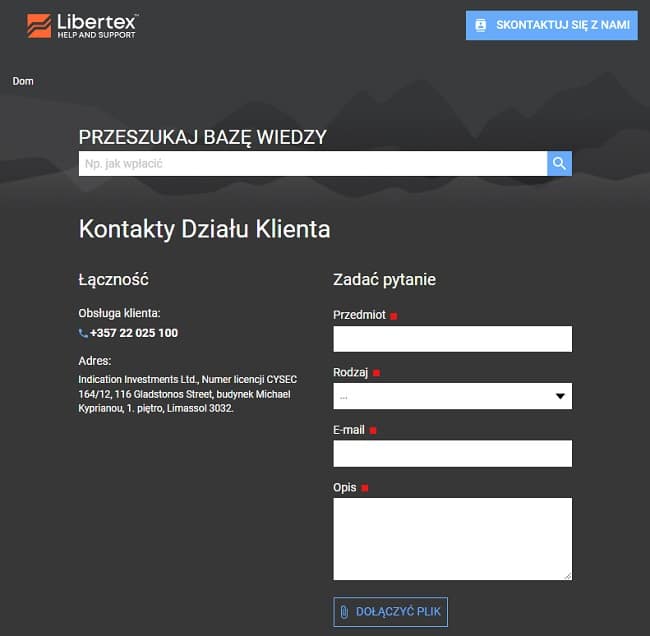

Customer service and forms of contact

Not everyone pays attention to it, but it doesn’t change the fact that customer service plays a very important role on every trading platform. After all, each of us can sometimes come across a problem that we won’t be able to solve on our own. That’s why (contrary to appearances) customer service is not intended only for beginner investors.

What does it look like in Libertex?

Well, the broker provides several ways to contact their employees. These are:

- e-mail,

- phone,

- live chat,

- Whatsapp,

- Facebook Messenger.

What’s more, the broker’s website has a useful FAQ section , as well as educational materials, the latest market news and an economic calendar . All of this will help you develop your investment skills.

For those who are just starting their adventure with online trading, Libertex has even prepared a 3-hour course that introduces the basics of using the platform and taking positions on the market.

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Is Libertex a safe CFD broker?

The Libertex trading platform belongs to Indication Investments Ltd., a Cypriot investment firm regulated by CySEC . It has a CIF license number 164/12.

In addition, in South Africa the service provider operates under the name Libertex Pty. The company is regulated by the local financial regulator and has license number 47381 .

This gives you the assurance that the CFD broker is operating legally.

In addition, on the platform itself, security is provided by two-step verification when logging in . You can do it either via SMS or using Google Authenticator.

You don’t have to worry about protecting your funds either. As Libertex is regulated by CySEC, it is required to keep client capital in separate bank accounts. In addition, each investor has a security of EUR 20,000 in case the company goes bankrupt.

Summary

The reviews show that Libertex will be an ideal choice for anyone interested in trading CFDs with no spreads and low commissions .

With several trading platforms available, both beginners and advanced investors will find something for themselves with the broker. Especially since Libertex has over 20 years of experience on the market and is a winner of many industry awards.

For Polish traders, an additional advantage will be the fact that the broker is available in Polish and also allows trading in Polish zloty.

Libertex – trading platform with zero spreads and low commissions

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

FAQ – Frequently Asked Questions

Is Libertex free?

Is Libertex trustworthy?

How much money do I need to trade with Libertex?