Handel na Rynku Forex (Twój kraj) – Kompletny Przewodnik po Handlu na Rynku Forex w 2026

Surely, you have heard about Forex investing – the Forex market is one of the largest financial markets in the world. Every day, currencies worth over 5 trillion euros are traded there!

If you are considering entering and investing in the foreign exchange market, this beginner’s guide to Forex covers everything you need to know.

We explain in detail how Forex trading works in (Your country), highlight the benefits of Forex trading, and offer strategies and tips to help you get started.

Additionally, we will review the five best Forex brokers (your country) so you can start your online currency trading adventure today.

How to Start Trading Forex – How It Works

To start investing in the Forex Market , follow these steps:

[/letter]

eToro to platforma inwestycyjna obejmująca wiele aktywów. Wartość Twoich inwestycji może rosnąć lub spadać. Twój kapitał jest zagrożony.

How Forex Trading Works - What is Forex Trading

If you have ever exchanged euros for dollars, pounds or another currency while on holiday, you have indirectly participated in forex trading.

However, when we talk about foreign exchange trading in (your country) we are referring specifically to the exchange of currencies in order to make a profit through fluctuations in their value.

One of the most exciting parts of Forex trading is the fact that it is a global market.

This is a big difference compared to stock trading, where individual transactions typically involve only shares of companies based in a given country.

The currency market is also gigantic - more than 5 trillion euros worth of currencies are traded there every day.

The size of this market is dictated by the fact that it is essential not only for the Forex investor, but also for the circulation of the world economy.

For example, if you want to buy clothes made in Italy, you will pay the importing company in pounds, and they will in turn pay the Italian manufacturer in euros.

Currencies are also constantly exchanged by major banks around the world.

The FX Trading market (your country) is open 24 hours a day, five days a week - from 10pm Sunday to 10pm Friday.

When trading on the foreign exchange market, there is no centralized transaction as is the case with buying stocks.

Instead, the buy position is placed on a global computer network and may be brokered by a Forex Broker (your country) or a global broker, bank or any other person trading on the global network.

Since online Forex trading takes place all over the world, the market can become very active at any time of the day.

Currency Pairs for Forex Trading

One of the basic things that every beginner should know about Forex trading (Your Country) is that the value of one currency is always intertwined with the value of all others.

This is another important difference that distinguishes this market from buying stocks.

The pound has no predetermined value. The value of the pound is calculated in relation to, for example, the dollar or the euro.

The value of the pound can increase against the dollar or the euro by different amounts, or it can increase against the dollar and decrease against the euro at the same time.

Therefore, all transactions made in the Forex (Your Country) market are made through currency pairs. There are three types of currency pairs in the online Forex market:

Main Couples

In the foreign exchange market, there are seven major currency pairs, all of which are related to the US dollar:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven major currency pairs account for the majority of daily Forex trades in (your country) and around the world.

If you want to learn Forex for beginners, you should start by investing in these major currency pairs because they are always available for buying and selling and usually have lower fees associated with them, compared to less popular currency pairs.

Secondary Pairs

There are over 20 different minor currency pairs. Typically, each of these pairs consists of currencies other than the US dollar (USD) that are part of the major pairs, or are pairs with the US dollar and other world currencies.

For example, JPY/AUD and GBP/EUR are considered minor currency pairs.

Exotics

Exotics, refer to currency pairs that are traded less frequently. For example, JPY/ZAR and EUR/HUF are considered exotic pairs in the online Forex market.

Exotic pairs can be quite illiquid – meaning that few people buy or sell them often – so these pairs are generally best for Forex traders with advanced knowledge.

Reasons to Invest in Forex in (your country)

The currency market has several features that make Forex trading particularly suitable for beginners. Let’s look at some of the best reasons to invest in Forex trading (Your Country) in 2021.

Availability

For many investors, the main aspect that attracts them to the Forex trading market is its incredible accessibility.

Few other markets allow you to log in at any time and start investing immediately.

However, since the Forex trading market operates 24 hours a day, this is possible.

There are also no restrictions on the type of currency you can invest in, especially compared to the stock market - where most brokerages only offer stocks from one or two countries.

Moreover, you do not need a large capital to start trading Forex (in your country) today.

Some of the best Forex brokers only require deposits of between €50 and €100 to open a real Forex trading account.

Therefore, you can start buying and selling currency pairs with just a small initial investment.

Financial Liquidity

Due to the high volume of currencies traded daily, finding a buyer for the currency you are trying to sell is virtually guaranteed at any time of the day.

This concept is known as liquidity - there is a constant flow of currency pairs around the world.

Liquidity is a good thing because it means you are less likely to get stuck in an investment, unable to sell your position when you want.

High liquidity is also important as it helps keep the price of your Forex transaction low. Later in this article, we will discuss in detail the costs of Forex transactions and how illiquidity affects them.

Buying and Selling in Currency Trading

Another interesting element of Forex trading is the ability to bet on the value of any currency falling (against another currency) just as easily as predicting its value rising.

When you short sell a currency, you profit from its devaluation.

This allows you more flexibility in hedging your Forex trading positions and creating more complex trading strategies.

Forex Leverage Trading (in your country)

A key aspect of trading the foreign exchange market (in your country) is the ability to use leverage in your transactions (investments).

By using leverage, you can get a loan from your Forex broker to increase the effective value of your investment.

For example, if you open a position with a leverage of 1:10, you can open a market position worth €1,000 with only €100 in your live Forex trading account.

The advantage of using leverage is that your profits will be multiplied.

Let’s say you buy GBP/EUR with a leverage of 1:10. If the euro rises by 1% against the pound, the value of your position will increase by 10%.

By using leverage, you can make significant profits with small fluctuations in the value of a currency pair.

In addition, it is possible to invest in several Forex trading pairs in order to hedge your positions, as a small investment is enough to open large positions.

Forex Transaction Costs (in your country)

Instead of charging a flat fee of a few euros per investment, most Forex brokers in (your country) charge a spread.

The spread is the difference between the amount you can buy a currency pair for and its potential selling value at the same time.

Spreads vary by currency pair and broker, ranging from 0.05% to 1% or more. Generally speaking, the tightest spreads can be found on major currency pairs, while the tightest spreads can be found on exotic pairs.

We should point out that if you trade Forex using leverage, you will likely incur additional fees.

Most brokers charge overnight interest - so-called swap fees - if you hold a leveraged position after 10pm (GMT), despite the fact that the FX market "never sleeps".

Therefore, if you are using leverage in your online forex trading, it is best to only keep positions open for a few hours at a time.

Forex Trading Risks (in your country)

Investing in the Forex market - like any type of investment - carries some risk.

There is always a chance that something will go wrong with your investment, causing your position to be devalued. If that happens, you can always sell the position at a loss.

Alternatively, you could hold the position in the hope that the value will rise again - although there is no guarantee that it will - and you could simply take a bigger loss.

It is important to never forget that the use of leverage increases the risks in online Forex trading.

First, any losses are multiplied.

Just as a 1% increase in the value of any currency pair means a return of 10%, in the case of a position with 1:10 leverage, a 1% decrease also means a 10% devaluation of the position.

Furthermore, using leverage involves borrowing capital from the FX broker (in your country) you are using.

Most Forex brokers require more money in your account than the value of the position, in case the position starts to lose value.

Therefore, you may be forced to quickly add money to your account, risking that the brokerage firm will automatically sell your position at a loss.

Given these additional risks, if you are a beginner Forex trader, you should take an extremely cautious approach to using leverage.

Popular Forex Trading Strategies

If you want to ensure you have a chance of making money trading Forex, having a sound and effective strategy is absolutely essential.

There are as many Forex trading strategies as there are Forex traders - each Forex trader must develop their own personalized strategy, tailored to their goals, risk tolerance, and trading style.

The process takes time and practice, which is why we recommend that you start your Forex journey with a demo account to find out what works for you.

With this in mind, let's look at three day trading strategies you can try.

Forex Scalping

Scalping is a short-term trading strategy that involves buying and selling a specific currency pair during the day.

The goal of scalping is to profit from minimal price fluctuations that occur within just a few seconds or minutes.

Scalpers (people who use this strategy) closely monitor technical indicators to identify potential entry and exit points.

The price fluctuations that occur in scalping are small, so the profits from any single investment can only be a fraction of a percent.

However, with enough successful trades throughout the day, these small wins can result in significant profits.

Forex Swing Trading

Swing Trading is a medium-term Forex strategy.

Typically, traders using this strategy look for momentum indicators in the value of a given currency pair.

Ideally, you should open a position after a strong reversal, when the value starts to rise or fall with high trading volume.

Keep the position open as long as the currency pair is showing a solid trend in a particular direction and sell it as soon as the trend begins to unwind.

Aggressive swing traders are then able to speculate on a trend in the opposite direction if one occurs.

Trading on the Forex Market Using News

Much of the volatility found in Forex trading is caused by news.

Global events, politics, weather, trade agreements and financial reports can cause values to fluctuate in either direction.

An effective forex trading strategy involves following the news to predict the appreciation or devaluation of a given currency in the short or long term.

You should then open an investment position based on this news and your analysis.

Automate Your Forex Trading

Many intermediate to advanced Forex traders choose to automate their online Forex trading.

Automating your trading reduces the amount of work required in day trading and also removes the psychological element that often makes decision-making difficult.

There are two main methods that can be used to automate Forex trading - Forex signals and automated Forex robots.

Forex Trading Signals

Forex Signals are sets of technical and fundamental news indicators. With FX Signals, you receive a notification on your computer or smartphone when a specific set of parameters is observed in the market.

For example, when several indicators line up, you can receive a notification on your phone with information about the currency pair, the current price, and potential entry and exit points.

Forex signals can be created manually or use artificial intelligence to improve their effectiveness over time.

It is also possible to purchase signals created by Forex trading professionals through a broker or other online trading platform.

Forex Robots

Forex robots represent the next level in trading signals, fully automating your investments.

These robots use Forex signals not only to identify and alert the user to potential trading opportunities, but also to automatically invest on the user's behalf.

Trading robots can operate 24/7, which makes them particularly suitable for automated Forex trading.

Forex Trading Tips

Forex trading (in your country) is accessible, but it is important to be sure of what you are doing before you start.

So let’s take a look at five tips you can use to prepare yourself to enter the forex market.

1 - Take a Free Forex Trading Course

Our guide is a great starting point for learning the Forex market for beginners in Polish.

However, before you invest your money in the Forex market, it is a great idea to enroll in a Forex investing course.

Free, high-quality Forex courses can be found through a broker or other professional online services.

2 - Read the Best Forex Trading Books

Professional traders have invested years of their lives to perfect their forex strategies and techniques. By reading this book, you can learn some of their most useful tricks.

We recommend " Forex for Beginners: What You Need to Know to Get Started, and Everything in Between " by Anna Coulling and " How to Make a Living Trading Foreign Currencies: Guaranteed Income for Life " by Courtney Smith.

3 - Try a Forex Demo Account

Another great way to ease your way into the world of forex trading is to start with a demo account.

With a Forex demo account, you can freely practice on the broker's platform, access real-time price data, and monitor your trading results over time without risking real money.

4 - Start with Small Projects

When you decide to start trading with a real account, it is advisable to start with small investments.

Focus on just one or two currency pairs instead of trying to invest in everything at once.

Additionally, try to invest with no leverage or with a minimal level of leverage to limit your risk.

5 - Use stop loss function

One of the best practices that you can use to limit your risk when trading FX is to use a stop loss . By using a stop loss, your broker will automatically sell your position if its value falls below a set level.

Stop loss is especially important in currency trading because the market remains active 24/7, making it impossible to constantly monitor your positions.

Best Forex Trading Platforms (in your country)

To start Forex trading in (your country) you need a secure Forex trading platform.

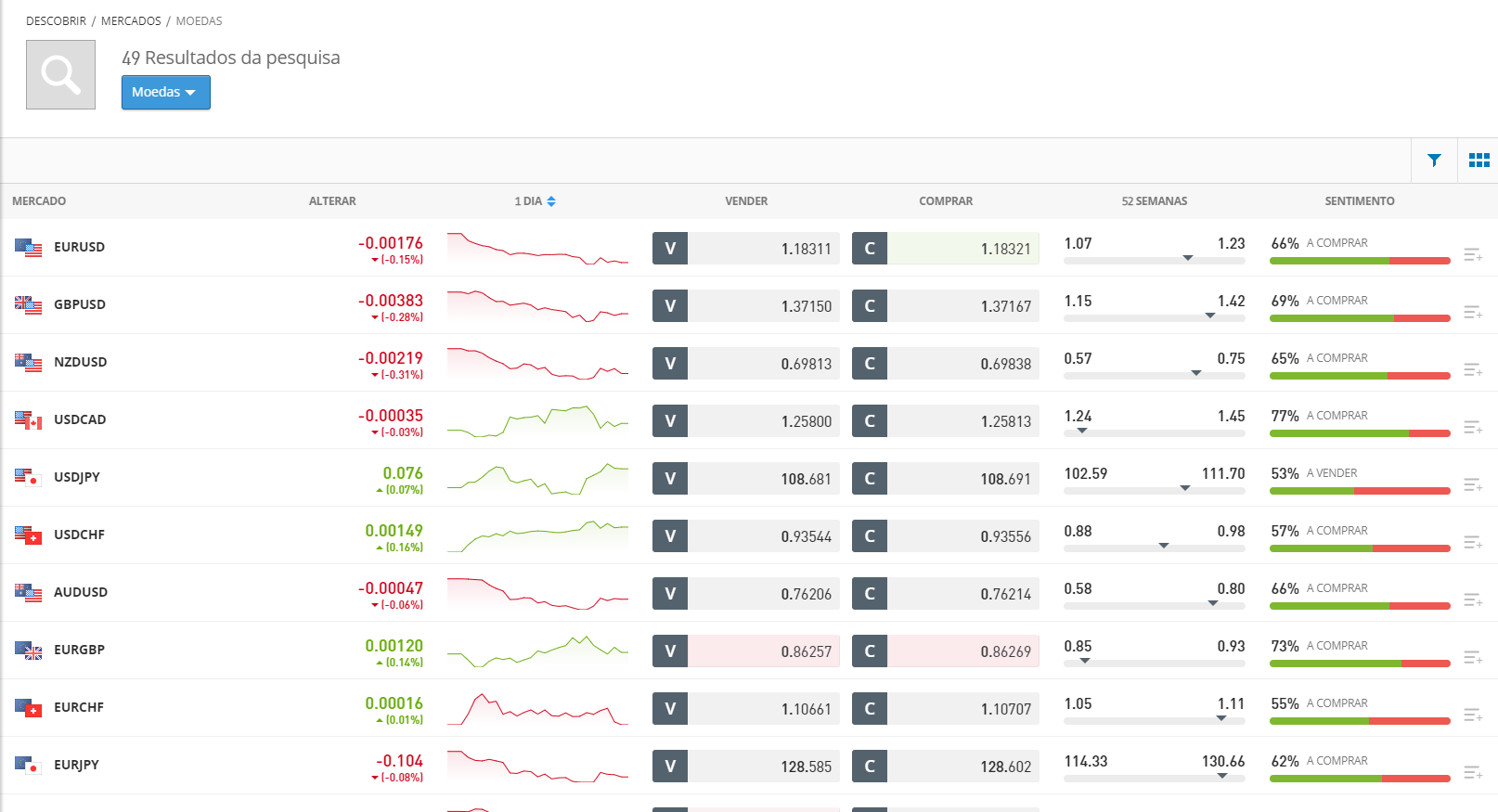

Look for a service that offers low spreads, high leverage, and access to a wide range of currency pairs. Below are four of our favorite platforms:

1 - eToro - The Best Forex Trading Platform in Poland

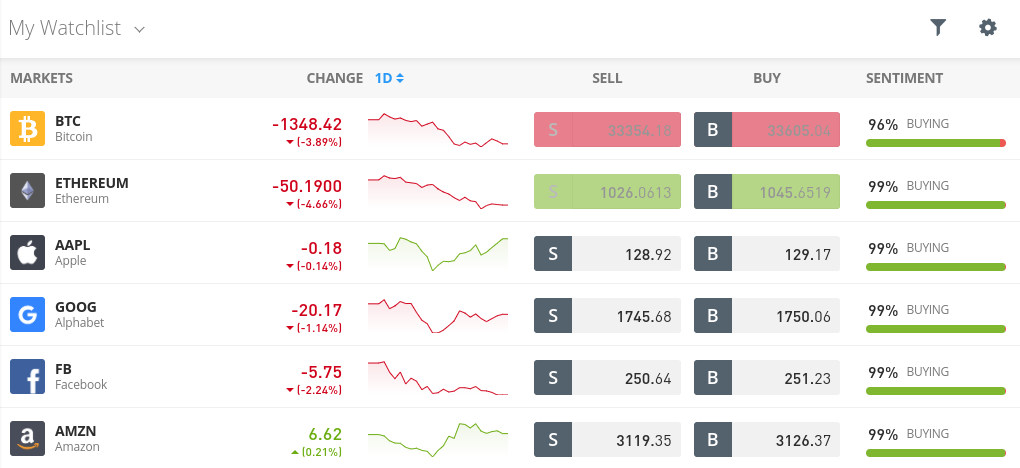

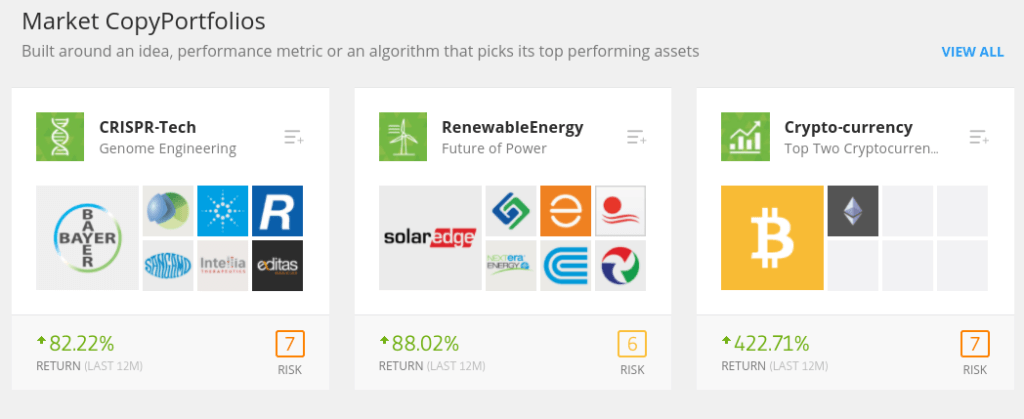

This Forex broker has a social trading network through which you can interact with thousands of traders from all over the world.

With this feature, you can check which currency pairs are being bought by others, with the ability to start conversations and analyze market sentiment.

Additionally, you can set up the Copy Trading option to automatically copy the positions of experienced and proficient traders.

eToro also offers powerful charting with dozens of integrated technical analyses.

You can also monitor news through the platform, making it easy to find out about important events. The lack of technical analysis capabilities for charts is the only issue with the eToro platform.

Forex trading at eToro is completely commission-free, and you can find tight spreads of just 0.008% on most major currency pairs.

eToro does charge some account fees, including withdrawal fees, but they are relatively low and easy to avoid.

We also like the fact that it is possible to invest in major currency pairs with a leverage of 1:30.

Advantages:

Defects:

eToro to platforma inwestycyjna obejmująca wiele aktywów. Wartość Twoich inwestycji może rosnąć lub spadać. Twój kapitał jest zagrożony.

2. XTB – Polish broker with a wide range of forex trading offers

You can count on access to over 3,000 financial assets. You will also benefit from 10:1 leverage, and spreads start from just 0.1 pips.

XTB's strong point is its proprietary trading platform, xStation 5 , which offers professional analysis tools. At the same time, it is easy to use. There are more facilities for beginners, such as educational materials or a demo account with a virtual balance.

XTB offers a variety of payment methods, including debit and credit cards and e-wallets . If you have any problems, you can count on helpful customer support 24/5.

Importantly, there is no minimum deposit on XTB, so you can start your forex adventure without investing large amounts.

Advantages:

Defects:

3. Pepperstone – Safe Forex Broker

The Standard account offers fee-free trading with spreads starting at 0.6 pips . The Razor account offers spreads of 0 pips and a lot fee of $3.50.

What’s more, Pepperstone offers a choice of several reputable platforms, including MT4 and MT5. Another advantage is the wide range of payment methods – from traditional bank transfers, through credit and debit cards, to e-wallets like Skrill and PayPal.

There are also options for beginners. After registering, you will have access to a demo account where you can try out different trading strategies. In addition, Pepperstone provides educational materials and helpful analyses.

Active investors will appreciate the loyalty program with discounts and priority customer service.

Advantages:

Defects:

4 - Libertex - Forex Broker Trading Without Spreads

Typically, brokers make their money on the spread between the bid and ask price and other commissions associated with buying and selling.

At Libertex, traders pay a small commission on buys and sells, with no spreads. You can also trade currencies using CFDs – meaning potential profits as markets rise and fall.

There is a wide range of account types to choose from, with the VIP+ account offering a 50% discount on all commissions and many additional trading features.

The broker also provides its own fully-featured web platform, ready with sentiment indicators, live news and other features.

Advantages:

Defects:

85% inwestorów detalicznych traci pieniądze, handlując kontraktami CFD u tego dostawcy.

Getting Started Trading on FX - eToro Poland

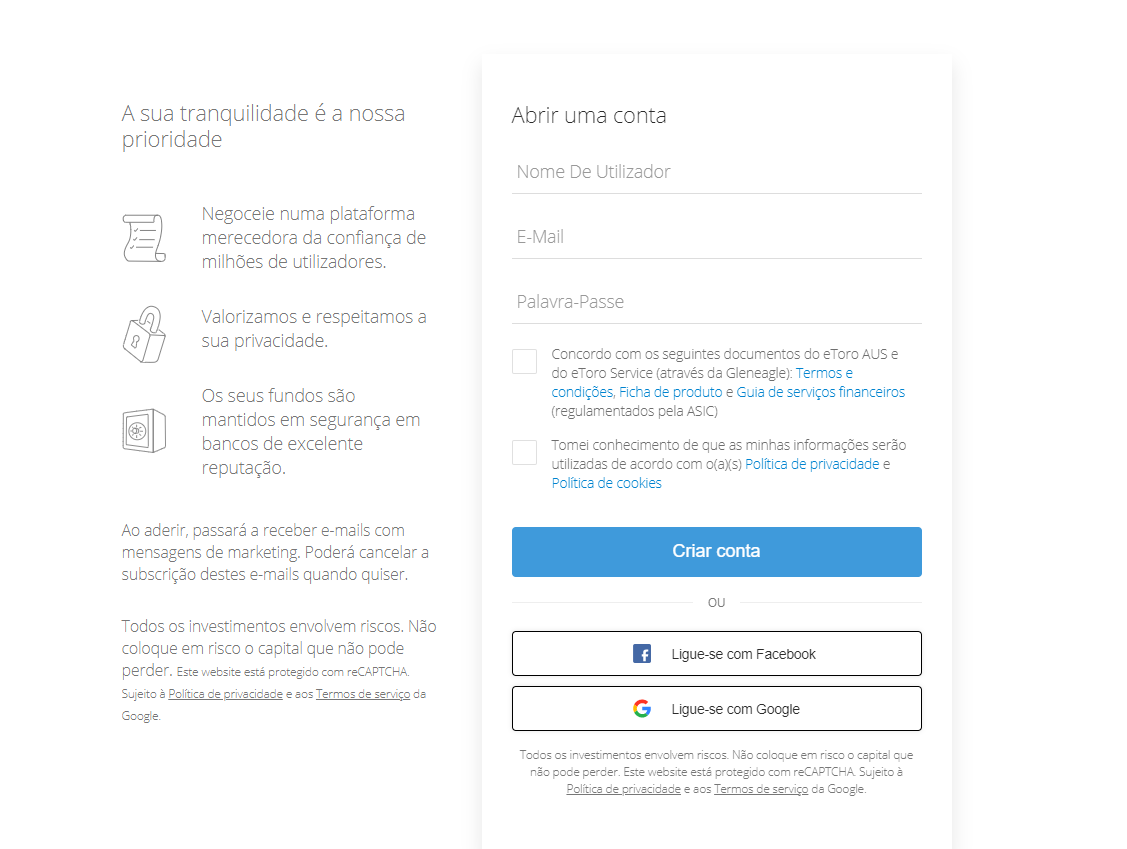

Ready to start your Forex journey online? We'll show you how to open your first Forex position on eToro.

Visit the eToro homepage and click “Join Now” to open a new account You’ll need to provide a new username and password, as well as some personal information: such as your name, date of birth, email address, and phone number. Aby zachować zgodność z przepisami rządowymi, eToro wymaga również weryfikacji Twojej tożsamości. Miej przy sobie kopię prawa jazdy, karty obywatela lub paszportu, a także kopię każdej ostatniej faktury lub wyciągu bankowego, które potwierdzają Twój adres zamieszkania. Teraz nadszedł czas, aby zasilić swój rachunek. eToro akceptuje szeroki zakres opcji płatności, w tym karty debetowe lub kredytowe, e-portfele lub przelewy bankowe. Podczas pierwszej wpłaty na Twój rachunek, minimalna kwota wpłaty wynosi 140 EUR.. Mając zasilony rachunek, jesteś gotowy do otwarcia swojej pierwszej transakcji na rynku Forex. Wyszukaj parę walutową, taką jak “GBP/EUR” na pulpicie nawigacyjnym eToro, a następnie kliknij “Handel”, gdy pojawi się w menu, w celu otwarcia nowej pozycji. W formularzu handlowym, określ kwotę, którą chcesz zainwestować (minimalna kwota to €50) i wybierz czy chcesz kupić czy sprzedać parę walutową. Jeśli chcesz zastosować dźwignię finansową do swojego handlu lub ustawić zlecenie stop loss, możesz ustawić te opcje w tym samym menu. Po skonfigurowaniu transakcji, kliknij “Handel” ponownie, aby zakończyć inwestycję handlową na platformie Forex. Handel na rynku Forex daje Ci dostęp do globalnego rynku o ogromnych ruchach, aktywnego 24 godziny na dobę. Poprzez handel na rynku Forex można spekulować na cenie jednej waluty w stosunku do drugiej. Rynek walutowy jest szeroko dostępny, ze względu na swój globalny charakter, i wymaga jedynie niewielkiej inwestycji początkowej. Jeśli jesteś gotowy do inwestowania na rynku Forex (w Twoim kraju) - załóż konto eToro już dziś. Wystarczy kliknąć poniższy przycisk, aby rozpocząć! Step 1: Open a Forex Trading Account

Krok 2: Wpłata Srodków Finansowych

Krok 3: Otwórz Pozycję Rynkową

Podsumowanie - Przewodnik po Inwestowaniu na Rynku Forex w 2021

eToro - Najlepsza Platforma Transakcyjna Rynku Forex w Polsce

Najczęściej Zadawane Pytania

Forex Trading - How Does It Work in Practice?

What are pips in Forex online trading?

How do margins work in leveraged Forex trading?

Is Forex trading suitable for Muslims?

What is the best Forex trading app for your smartphone?

Is Forex trading profitable?