Forex handel in Nederland – Complete gids voor FX handel 2026

Of course you have heard of Forex trading – the Forex market is one of the largest financial markets in the world. Over €4.4 trillion worth of currencies are traded every day!

If you’re considering getting into the currency market and investing, this beginners guide to Forex trading covers everything you need to know.

We explain in depth how Forex trading works in the Netherlands, highlight the benefits of Forex trading and offer strategies and tips to help you get started.

Additionally, we will review five of the best Forex trading Netherlands brokers to start your journey in online FX trading today.

How to Start Forex Trading – Forex Trading and How it Works

Now to start Forex trading you need to follow the steps below:

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

Forex Trading and How it Works – What is Forex Trading?

If you have ever exchanged euros for dollars, pounds or any other currency while on holiday, you have indirectly participated in Forex trading.

But when we talk about FX Trading in the Netherlands we specifically mean the exchange of currencies with the aim of taking advantage of the fluctuations in their value.

One of the most exciting elements of Forex trading is the fact that the market is global.

This is a major difference from stock trading, where individual transactions usually only involve shares of companies based in a particular country.

The FX market is also huge, with over €4.4 trillion worth of currencies traded daily.

The size of this market is dictated by the fact that it is vital not only for a Forex trader but also for the circulation of the global economy.

For example, if you want to buy clothes made in Italy, you pay the import company in pounds, which in turn pays the Italian manufacturer in euros.

Currencies are also constantly being changed by major banks around the world.

The FX trading Netherlands market operates 24 hours a day, five days a week – from 10pm on Sunday to 10pm on Friday.

When trading in the currency market, there is no centralized transaction like when buying stocks.

Instead, a buying position is placed on a global computer network and can be brokered by a Forex trading in the Netherlands or global broker, a bank or other individual trading on the global network.

Since online Forex trading takes place all over the world, the market can become very active at any time of the day.

Forex trading currency pairs

One of the fundamental things that every beginner about Forex trading Netherlands must know is that the value of one currency is always intertwined with the value of all others.

This is another important difference that sets this market apart from buying stocks.

The pound has no predetermined value. The value of the pound is calculated against, say, the dollar or the euro.

The value of the pound can rise against the dollar or the euro by different amounts, or rise against the dollar and fall against the euro at the same time.

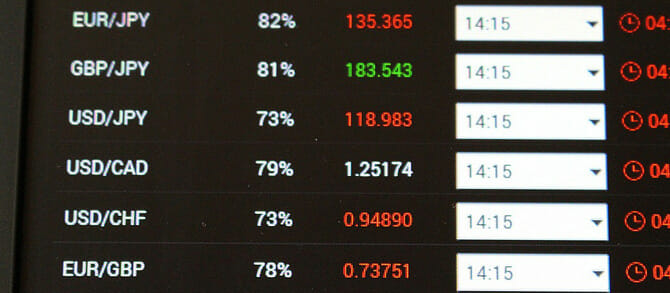

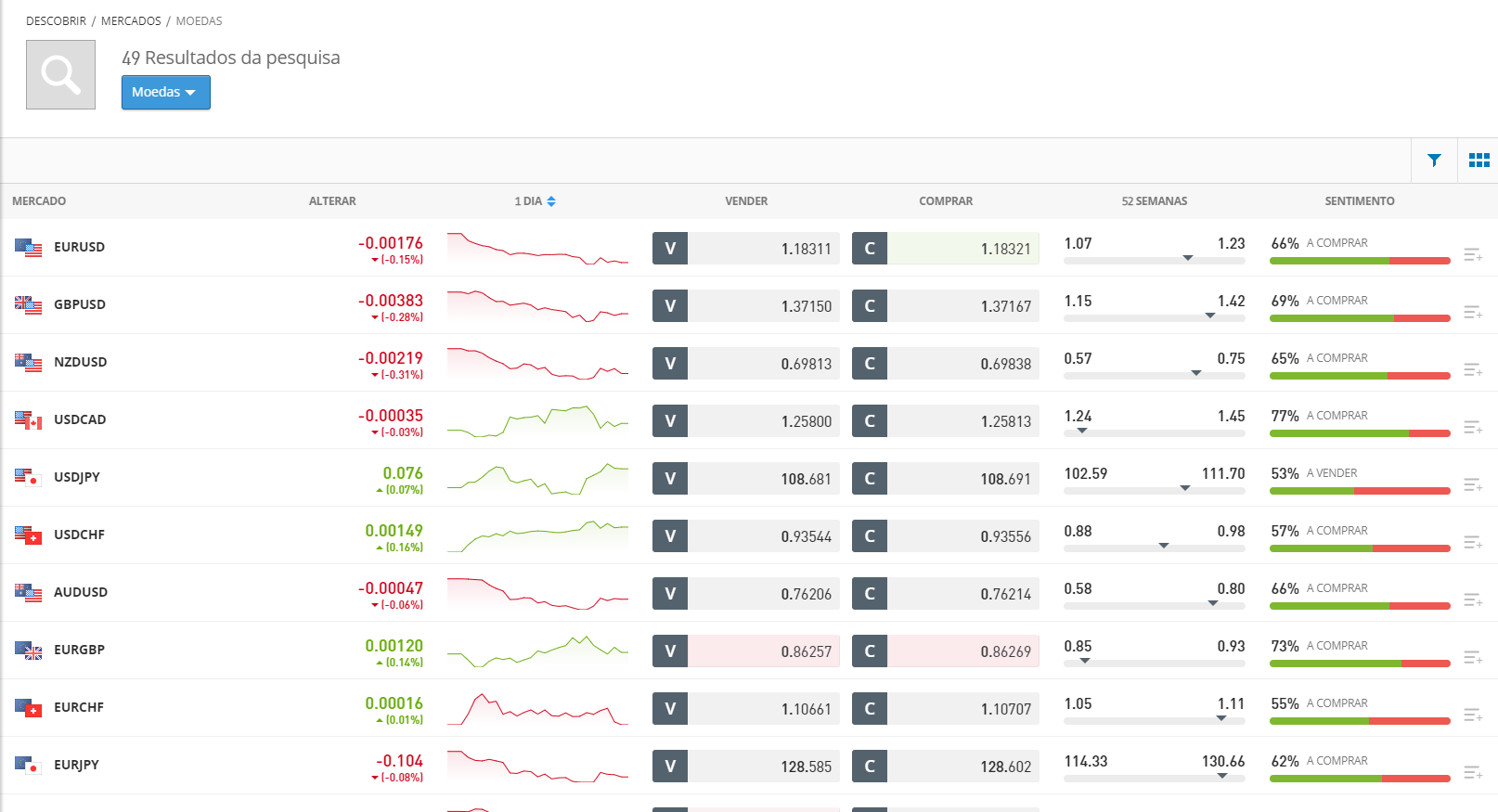

Therefore, all transactions in Forex trading Netherlands take place via currency pairs. There are three types of online Forex currency pairs:

Main pairs

There are seven major currency pairs in the FX market – all of which are linked to the US dollar:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven major pairs comprise the majority of transactions made daily in Forex trading, in the Netherlands and around the world.

If you want to learn Forex for beginners, start by trading these major currency pairs, as they are always available to buy and sell, and typically have lower fees than less common currency pairs.

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

Secondary pairs

There are over 20 different secondary FX currency pairs. Typically, each of these pairs consists of currencies other than the US dollar (USD) that are major pairs, or they form pairs with the USD and other world currencies.

For example, JPY/AUD and GBP/EUR are considered secondary currency pairs.

Exotics

Exotics are less frequently traded currency pairs. For example, JPY/ZAR and EUR/HUF are considered exotic pairs in the online Forex trading market.

Exotic pairs can be quite illiquid – that is, there aren’t many people buying or selling frequently – so these pairs are generally best suited to Forex traders with advanced knowledge.

Reasons to invest in Forex trading in the Netherlands

The currency market has several characteristics that make Forex trading particularly suitable for beginners. Let’s take a look at some of the best reasons to invest in Forex trading Netherlands in 2026 .

Accessibility

For many traders, the main aspect that attracts them to the Forex trading market is its extreme accessibility.

There are few other markets where you can log in at any time and start investing right away.

But since the Forex trading market operates 24 hours a day, this is possible.

There are also few restrictions on the types of currencies you can invest in, especially compared to the stock market – where most brokers only offer stocks from one or two countries.

Moreover, you do not need a lot of capital to start Forex trading Netherlands today.

Several of the top Forex trading brokers only require deposits of around $50 (€44.25) to $100 (€88.50) to create a real Forex trading account.

Therefore, it is possible to start buying and selling currency pairs with a small initial investment.

Liquidity

Due to the large volume of currencies traded daily, finding a buyer for the currency you are trying to sell at any time of the day is virtually guaranteed.

This concept is known as liquidity – there is a constant flow of currency pairs around the world.

Liquidity is a beneficial aspect because it means you are less likely to be locked into a particular investment, unable to sell your position when you want to.

High liquidity is also important because it helps keep the price of your Forex trading at a low level. We will go into detail about the costs of Forex trading and how they are affected by liquidity.

Buying and selling in FX trading

Another interesting element of Forex trading is the ability to bet on the fall in value of one currency (against another) just as easily as predicting its rise.

When you short sell a particular currency , you profit from its devaluation.

This gives you more flexibility to secure your Forex trading positions and create more complex trading strategies.

Forex trading with leverage Netherlands

A crucial aspect of trading FX Netherlands is the ability to execute your transactions (investments) with leverage.

Leverage allows you to get a loan from your Forex broker to increase the effective value of your investment.

For example, if you open a position with 1:10 leverage, you can open a market position of $1,000 (€885) with only $100 (€88.50) in your real Forex trading account.

The advantage of using leverage is the multiplication of your profits.

Let’s say you buy GBP/USD with a leverage of 1:10. If the dollar increases in value against the pound by 1%, the value of your position increases by 10%.

Leverage allows you to make significant profits from small fluctuations in the value of the currency pair.

Moreover, it is possible to invest in different Forex trading pairs to hedge your positions, as you only need a small investment to open large positions.

Forex trading costs Netherlands

One of the best features of Forex trading in the Netherlands is that it is almost always commission-free.

Instead of charging a fixed rate of a few euros per investment, most Forex brokers in the Netherlands charge a spread.

The spread is the difference between the amount for which you can buy a currency pair and its possible sale value at the same time.

Spreads vary by currency pair and broker, from 0.05% to 1% or more. In general, you will find the tightest spreads on major currency pairs and the highest spreads on exotic pairs.

We should point out that if you trade Forex with leverage, you will likely have to pay additional fees.

Most brokers charge an overnight interest rate – called swap fees – if you hold a leveraged position after 10pm (GMT), even though the currency market “never sleeps”.

Therefore, if you use leverage in your online Forex trading, it is better to keep your positions open for only a few hours at a time.

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

Risks of Forex trading in the Netherlands

There is always a chance that something will go wrong with your investment, causing your position to decrease in value. Should this happen, you can always sell your position at a loss.

You can also hold the position in the hope that the value will rise again – there is no guarantee that this will happen – but you may just suffer a greater loss.

It is important to never forget that using leverage increases your risk when trading Forex online.

First, any losses are multiplied.

Just as a 1% increase in the value of a currency pair means a return of 10%, in a position with 1:10 leverage, a 1% decrease also means a 10% devaluation of your position.

Furthermore, using leverage implies that you are borrowing capital from the FX Netherlands broker you are using.

Most Forex brokers require more money in your account than your position, in case the position starts to lose value.

Therefore, you may be forced to quickly add money to your account, with the risk that the brokerage will automatically sell your position at a loss.

Given these additional risks, as a novice Forex trader you should be extremely careful when using leverage.

Popular Forex Trading Strategies

If you want to ensure your chance of making money with Forex Trading – having a sensible and effective strategy is absolutely vital.

There are as many Forex trading strategies as there are Forex traders – each FX trader (investor) must develop their own personal strategy that suits their goals, risk tolerance and trading style.

This process takes time and practice, so we recommend starting your Forex trading journey with a demo account to find out what works for you.

With this in mind, let’s look at three day trading strategies you can try.

Scalping Forex trading

Scalping is a short-term trading strategy where you buy and sell a specific currency pair throughout the day.

The goal of scalping is to profit from minimal price fluctuations that occur in just a few seconds or minutes.

Scalpers (adherents of this strategy) closely monitor technical indicators to identify potential entry and exit points.

The price fluctuations in scalping are small, so the return on any individual investment can only correspond to a fraction of a percentile.

But with enough successful investments throughout the day, these small wins can lead to significant profits.

Swing trading in Forex

Swing trading is a medium-term Forex strategy.

Typically, traders following this strategy look for indicators of momentum in the value of a particular currency pair.

Ideally, you would enter your position after a strong reversal, when the value starts to rise or fall on a large transaction volume.

Keep the position open as long as the currency pair shows a strong trend in a certain direction, and sell as soon as the trend starts to weaken.

Aggressive swing traders can then speculate on a trend in the opposite direction, should it occur.

FX trading with news

Much of the volatility seen in Forex trading is caused by news.

Global events, politics, weather, trade agreements, and financial news can cause value fluctuations in either direction.

A powerful Forex trading strategy involves following the news to predict the appreciation, or devaluation, of a particular currency in the short or long term.

Then open an investment position based on the news and your analysis.

Automate your Forex trading

Many intermediate and advanced level Forex traders choose to automate their Forex trading online.

Automating your trades reduces the workload that comes with day trading – in addition to removing the psychological element that often complicates decision making.

There are two main methods you can use to automate Forex trading – Forex signals and automated Forex robots.

Forex trading signals

Forex signals are sets of technical and fundamental news indicators. With FX signals, you will receive an alert on your computer or smartphone every time a certain set of parameters is observed in the market.

For example, if several indicators align, you can receive an alert on your phone with information about the currency pair involved, the current price, and possible entry and exit points.

Forex signals can be created manually, or use artificial intelligence to improve their effectiveness over time.

It is also possible to purchase signals created by Forex trading professionals through your broker or another online trading platform.

Forex robots

Forex robots represent the next level in terms of trading signals, completely automating your investments.

These robots use Forex signals not only to detect and alert you to potential trading opportunities, but also to automatically trade on your behalf.

Trading robots can operate 24/7, making them particularly suitable for automated Forex trading.

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

Forex Trading Tips

Forex trading Netherlands is affordable, but it is important that you know exactly what you are doing before you start.

So let’s look at five tips you can use to prepare for the currency market.

1 – Take a free Forex trading course

Our guide is a great starting point to learn Forex for beginners in Dutch.

However, before you invest your money in the forex market, taking a forex trading course is a fantastic idea.

You can find high quality free Forex courses through your broker, or through other professional online services.

2 – Read the best books on Forex trading

Professional traders have invested years of their lives to hone their strategies and techniques in the forex market. By reading a book, it is possible to learn some of their most useful tricks.

We recommend ‘ Forex for Beginners: What You Need to Know to Get Started, and Everything in Between’ by Anna Coulling and ‘How to Make Money Trading Foreign Exchange : A Guaranteed Income for Life ‘ by Courtney Smith.

3 – Try a Forex Demo Account

Another great way to ease your entry into the world of FX trading is to start with a demo account.

A Forex demo account allows you to practice freely on your broker’s platform, access real-time price data, and track your trading performance over time without risking real money.

4 – Start Small

If you decide to trade with a real account, it is advisable to start with small investments only.

Focus on just one or two currency pairs rather than trying to invest in everything at once.

Additionally, try to invest without leverage or with only minimal leverage levels to limit your risk.

5 – Use the stop loss (loss limit)

One of the best methods you can use to limit your risk when trading FX is to use the stop loss function. With a stop loss, your broker will automatically sell your position if the value drops past the set level.

Stop losses are especially important in currency trading because the market remains active 24/7, making it impossible to constantly monitor your positions.

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

The best forex trading platforms in the Netherlands

To start investing in Forex in the Netherlands, you need a secure Forex trading platform.

Look for a service that offers low spreads, high leverage, and access to a wide range of currency pairs. Here are four of our favorite platforms:

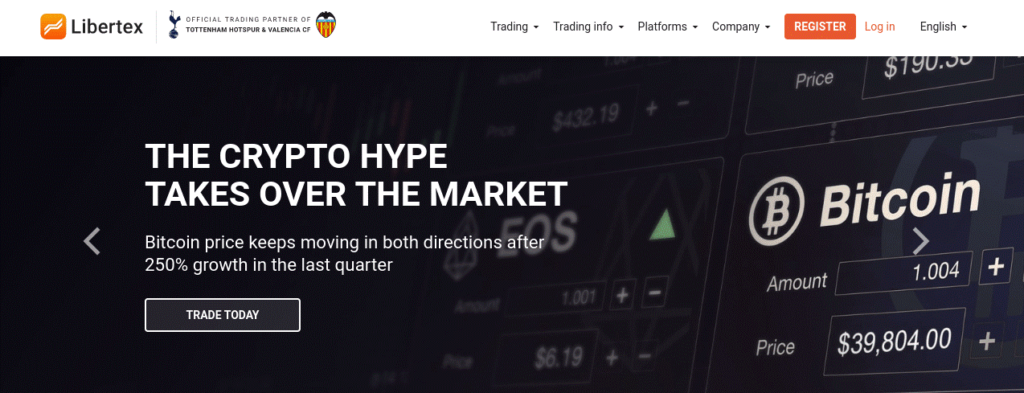

1 – Libertex – Forex broker trading without spreads

Typically, brokers make money from the difference between the buy and sell price, as well as any other commissions associated with buying and selling.

With Libertex, traders pay a small commission when buying and selling, with no spreads. Plus, you can trade currencies using CFDs – meaning potential profits as markets rise and fall.

There is a wide choice of account types, with a VIP+ account offering 50% off all commissions and many additional trading options.

The broker also offers its own fully-featured web platform, prepared with sentiment indicators, live news and other features.

Advantages:

Disadvantages:

85% of retail investor accounts lose money when trading CFDs with this provider.

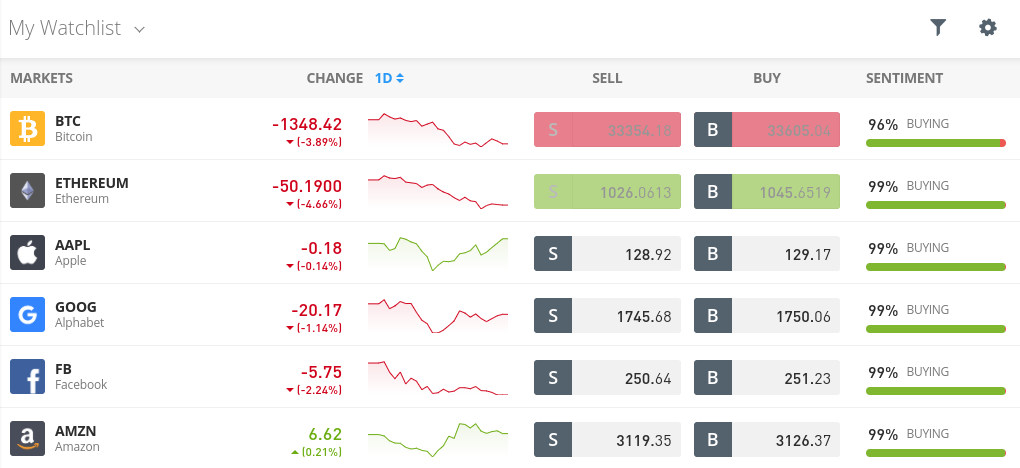

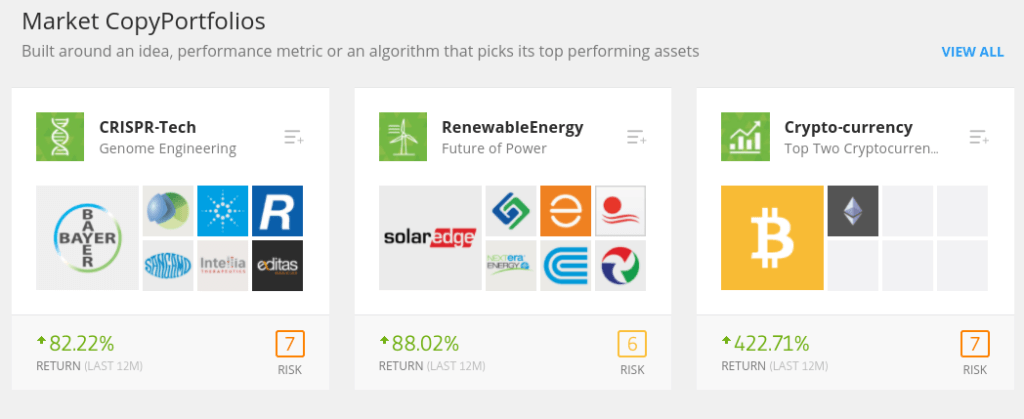

2 - eToro - The best Forex trading platform in the Netherlands

This Forex broker has a social trading network, where you can communicate with thousands of traders around the world.

This feature allows you to see the currency pairs being bought by others, with the ability to start conversations and analyze market sentiment.

Additionally, you can set the Copy Trading option to automatically copy the positions of experienced and expert traders.

eToro also offers powerful charts with dozens of integrated technical studies.

You can also follow the news via the platform, making it easy to stay up to date with important developments. The inability to do technical chart analysis is the only problem with the eToro platform.

eToro does charge some account fees, including withdrawal fees, but these are relatively cheap and easy to avoid.

We also love that you can trade major currency pairs with a leverage of 1:30.

Advantages:

Disadvantages:

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

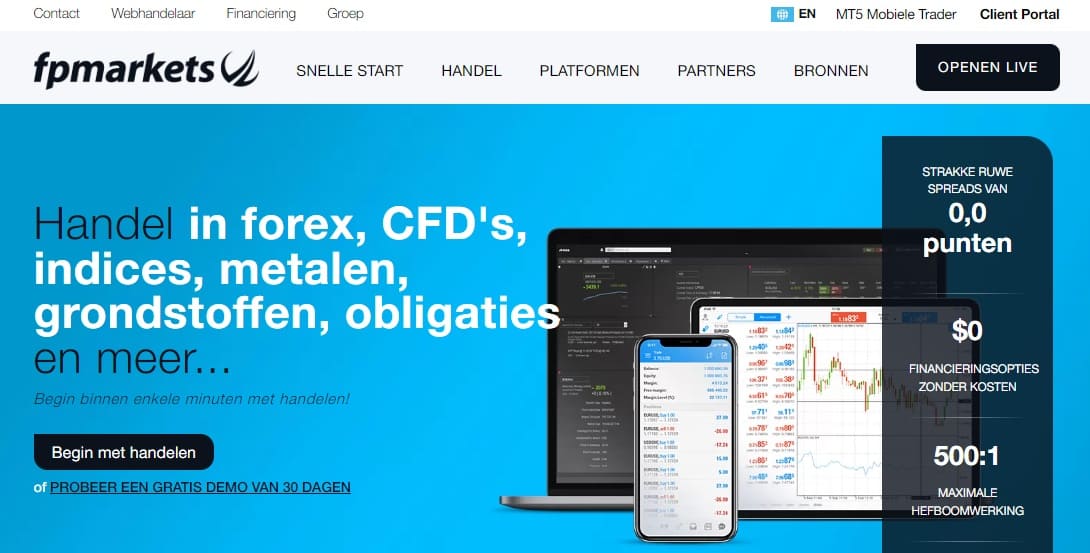

3 - FP Markets - a broker with a wide range of financial instruments

FP Markets users get access to over 10,000 CFD products , which will satisfy any trader looking for variety. In addition, clients can choose between a standard account with 1 pip spreads and no commission, or a ‘raw’ account with a commission of EUR 3 per lot and zero spread.

FP Markets also offers several trading platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView . This allows traders to take advantage of a number of advanced analytical tools and an intuitive interface.

The broker also offers solid educational support through FP Markets Academy, which is especially beneficial for beginner traders. A demo account is also a big plus, allowing you to test the platform and your skills risk-free.

In addition, the broker also offers customer support that is available 24/7.

Advantages:

Disadvantages:

4 - Quantum AI - Best Forex Trading Platform in the Netherlands

All Forex transactions on the Quantum AI platform are 100% commission-free. You also pay no fees for transactions. The first deposit is €220, which you can transfer from your bank account or pay with a credit or debit card.

Quantum AI is not regulated, but that is because it is a completely new software on the market. But all of Quantum AI's different partners are. This means that all of your trading

is done in a safe and secure way

You can easily access your account on a computer or download the application on your mobile phone. To use the app you must have an iPhone or an Android device.

Advantages:

Disadvantages:

Your capital is at stake.

5 - AvaTrade - Forex trading broker with different account types

AvaTrade is a broker that offers a wide variety of account types.

This includes CFD trading accounts, Option trading and Swap-free accounts. Using a broker that offers such a wide variety is great for staying flexible in different market conditions.

The broker also offers a wide choice of trading platforms, including MetaTrader 4, MetaTrader 5, AvaOptions, AvaSocial, and AvaTradeGO.

Under these platforms you can perform algorithmic trading, Option trading, social trading and Copy Trading on any desktop, web and mobile device.

You can trade on over 1,250 global markets, including all major, minor and exotic currency pairs, commission-free.

Additionally, you can rest easy knowing that AvaTrade is regulated in six jurisdictions, including the CBI, ASIC, FSA, FSCA, FRSE, and BVI FSC.

Advantages:

Disadvantages:

Your capital is at stake.

Getting Started with FX Trading - eToro Netherlands

Ready to start your journey into online Forex trading? Let us show you how to open your first market position on eToro.

Visit the eToro homepage and click “Join Now” to open a new account. You will need to enter a new username and password, as well as some personal information: such as your name, date of birth, email address and phone number. To comply with government regulations, eToro also requires verification of your identity. Bring a copy of your driver’s license or passport, along with a copy of a recent bill or bank statement proving your address. Now it’s time to fund your account. eToro accepts a wide range of payment options, including debit or credit cards, e-wallets, or bank transfers. When making your first deposit into your account, the minimum deposit amount is $140 (€167.1). With your funded account, you are ready to open your first Forex trade on the market. Find a currency pair, such as ‘GBP/USD’ in the eToro dashboard, then click on “Trade” when it appears in the menu to open a new position. On the transaction form, enter the amount you want to invest (the minimum amount is $50 (€44.26)) and choose whether you want to buy or sell the currency pair. If you want to apply leverage to your trade or set a stop loss , you can set these options in the same menu. Once your trade is set up, click “Trade” again to complete your Forex trading investment in the platform.Step 1: Open a Forex trading account

Step 2: Deposit money

Step 3: Open a market position

Conclusion - FX Trading Guide 2026

Forex trading gives you access to a global market with immense movement, which operates 24 hours a day.

Forex trading allows you to speculate on the price of one currency against another. The currency market is widely accessible due to its global nature, and requires only a small initial investment.

If you are ready to invest in Forex trading in the Netherlands - create your eToro account today. Click the button below to get started!

eToro - The best Forex trading platform in the Netherlands

{etoroCFDrisk} % van de accounts van particuliere beleggers verliest geld bij het handelen in CFD's met deze aanbieder. Je moet overwegen of je het je kunt veroorloven om het hoge risico te nemen om je geld te verliezen.

Frequently Asked Questions

Forex trading - How does it work in practice?

What are pips in online Forex trading?

How do margins work in leveraged Forex trading?

Is Forex trading considered suitable for Muslims?

What is the best Forex trading app for smartphone?

Is Forex trading profitable?